The eHealth Market was valued at USD 77.43 Bn in 2023 and is expected to reach USD 1580.33 Bn by 2030, at a CAGR of 22.7 percent during the forecast period.eHealth Market Overview

eHealth, i.e. electronic health, is the use of information and communication technologies (ICT) in the healthcare industry. It encompasses a broad range of technologies, systems, and services that leverage digital platforms to enhance the delivery of healthcare services, improve efficiency, and facilitate better patient care. eHealth aims to enhance the efficiency, quality, and accessibility of healthcare services by leveraging technology to streamline processes, improve communication among healthcare professionals, and empower patients to actively participate in their healthcare. The adoption of eHealth solutions has the potential to transform the healthcare landscape, making it more patient-centered, cost-effective, and data-driven. The global eHealth market had been steadily expanding, driven by factors such as the digitization of healthcare processes, the growing prevalence of chronic diseases, and the need for improved healthcare efficiency. The COVID-19 pandemic further accelerated the adoption of eHealth solutions, particularly telemedicine, as remote healthcare became crucial in maintaining healthcare services while minimizing physical contact. Healthcare organizations were investing in analytics solutions to derive insights from large datasets. Data analytics played a vital role in population health management, personalized medicine, and improving overall healthcare outcomes. The eHealth industry has investments, both from traditional healthcare companies and tech firms. Mergers and acquisitions were common as companies sought to strengthen their portfolios and expand their reach in the digital healthcare space.To know about the Research Methodology:-Request Free Sample Repor

eHealth Market Dynamics

Technological Advancements in healthcare industry to boost the eHealth Market growth Rapid advancements in information technology have paved the way for sophisticated eHealth solutions. The availability of high-speed internet, improved connectivity, and the evolution of digital platforms has facilitated the seamless integration of technology into various aspects of healthcare. Telemedicine has emerged as a key driver for the eHealth market. The increasing demand for remote healthcare services, especially during the COVID-19 pandemic, has accelerated the adoption of telemedicine, which significantly boosts the eHealth Market growth. Virtual consultations, remote monitoring, and telehealth platforms offer convenient and accessible healthcare options, reducing the need for physical visits to healthcare facilities. The rising prevalence of chronic diseases globally has necessitated a shift towards more proactive and continuous healthcare management. eHealth solutions, such as remote patient monitoring and mobile health apps, enable patients and healthcare providers to monitor and manage chronic conditions effectively, leading to improved outcomes and reduced healthcare costs. Aging populations in many parts of the world have heightened the demand for healthcare services. eHealth technologies support the delivery of care to elderly individuals, promoting independent living through remote monitoring, medication management, and telehealth interventions. Governments worldwide have recognized the potential of eHealth in improving healthcare accessibility, efficiency, and overall outcomes. Supportive policies, incentives, and regulatory frameworks have encouraged healthcare organizations to invest in and adopt digital health solutions. The transition from paper-based health records to electronic health records (EHR) is a significant driver for eHealth market. EHR systems enhance information accessibility, care coordination, and data sharing among healthcare providers, leading to more informed and collaborative patient care. Increasing consumer awareness and demand for digital health tools and services have influenced the adoption of eHealth solutions. Patients seek convenient ways to access healthcare services, manage their health information, and actively participate in their care through mobile health apps and patient portals. Healthcare organizations are leveraging data analytics to derive valuable insights from large datasets. Analytics tools enable predictive modeling, personalized medicine, and population health management, contributing to more informed decision-making and improved patient outcomes. Data Security and Privacy Concerns to limit the eHealth Market growth Challenges in the eHealth sector is the protection of sensitive patient data. The digital nature of health records and the exchange of medical information over networks make eHealth systems susceptible to cyber threats. Concerns regarding data breaches, unauthorized access, and the misuse of health data hinder the adoption of eHealth solutions, which is expected to limit the eHealth Market growth. The lack of standardized protocols and interoperability among different eHealth systems poses a significant challenge. Incompatibility between electronic health record (EHR) systems, telemedicine platforms, and other digital health tools restrains seamless data exchange, collaboration among healthcare providers, and the realization of a comprehensive patient health record. The healthcare industry has historically been slow to adopt new technologies due to factors such as resistance to change, concerns about disruption, and the need for extensive training. Convincing healthcare professionals to transition from traditional practices to digital platforms is significant challenge and limits the eHealth Market growth. Implementation and maintenance costs associated with eHealth solutions is barrier for healthcare organizations, especially smaller clinics and facilities with limited budgets. The initial investment in technology, staff training, and ongoing support is challenging for some stakeholders. Integrating eHealth solutions into existing healthcare workflows is complex and time-consuming and significantly restrains the eHealth Market growth. Resistance from healthcare professionals who perceive these technologies as disruptive to their established routines impede successful implementation. Ethical considerations surrounding the use of eHealth technologies, such as the responsible handling of patient data, the appropriate use of artificial intelligence in healthcare decision-making, and issues related to consent, require careful attention. Legal and ethical challenges create uncertainties that impact the adoption of eHealth solutions.eHealth Market Segment Analysis

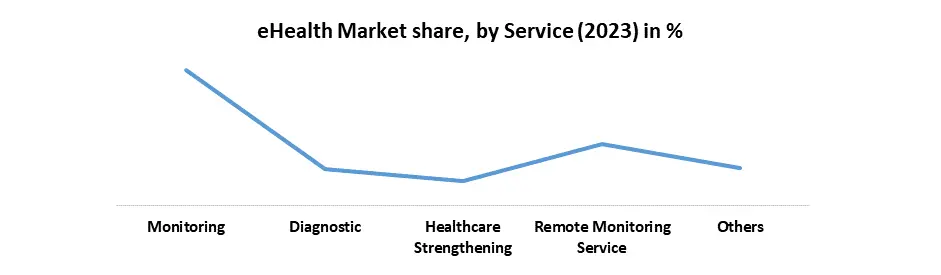

Based on Product, the market is segmented into Big Data for Health, Electronic Health Record, Health Information System, mHealth, and Telemedicine. mHealth segment dominated the market in 2023 and is expected to hold the largest eHealth Market share over the forecast period. mHealth is a significant segment within the broader eHealth market that focuses on the use of mobile devices and wireless technologies to deliver healthcare services, information, and communication. This segment encompasses a wide range of applications, services, and devices designed to enhance health outcomes, improve patient engagement, and provide healthcare professionals with tools to deliver more efficient and accessible care. mHealth apps are software applications designed to run on mobile devices such as smartphones and tablets. These apps cover a diverse range of functionalities, including health monitoring, medication reminders, fitness tracking, mental health support, and chronic disease management, which boosts the eHealth Market growth. Wearables are devices that are worn on the body, often in the form of smartwatches, fitness trackers, or other wearable sensors. These devices collect and monitor health-related data, such as heart rate, activity levels, sleep patterns, and more. The data is synchronized with mobile apps to provide users and healthcare providers with real-time insights. mHealth brings healthcare services and information to the fingertips of users, promoting accessibility and convenience. Patients access healthcare resources and communicate with providers from virtually anywhere, which significantly boost the eHealth industry growth. mHealth plays a crucial role in global health initiatives, especially in regions with limited access to traditional healthcare infrastructure. Mobile technologies are leveraged to deliver healthcare services, education, and resources to underserved populations.Based on Services, the market is segmented into Monitoring, Diagnostic, Healthcare Strengthening, and Others. Monitoring segment dominated the market in 2023 and is expected to hold the largest eHealth Market share over the forecast period. The monitoring segment in the eHealth market refers to the use of various technologies and tools to continuously track and assess health-related parameters. This segment encompasses a wide range of monitoring solutions that enable healthcare providers, patients, and other stakeholders to gather real-time data, make informed decisions, and respond promptly to changes in health conditions, which significantly contribute for the growth of eHealth Market. The monitoring segment plays a crucial role in preventive care, chronic disease management, and overall healthcare optimization. Remote Patient Monitoring involves the use of technology to collect and transmit health data from individuals in one location to healthcare providers in another. This is particularly valuable for managing chronic conditions such as diabetes, hypertension, and heart disease. Patients use wearable devices, sensors, or other monitoring tools to track vital signs, activity levels, and other relevant health metrics. The collected data is then transmitted to healthcare professionals remotely monitor and adjust treatment plans as needed.

eHealth Market Regional Insight

Government Support and Policies to boost North America eHealth Market growth North America dominated the market in 2023 and is expected to hold the largest eHealth Market share over the forecast period. Governments in North America, both at the federal and state levels, have been supportive of eHealth initiatives. Policies that promote the use of electronic health records (EHR), telemedicine, and other digital health solutions have been implemented, facilitating the integration of technology into healthcare delivery. North America is at that forefront of technological advancements. The region's well-developed IT infrastructure, widespread access to high-speed internet, and the presence of tech-savvy populations create a conducive environment for the adoption of eHealth technologies, which is expected to boost eHealth Market growth.There is a growing demand among North American consumers for digital health tools and services. Patients seek convenient ways to access healthcare, manage their health information, and engage with healthcare providers through mobile health apps, telemedicine, and patient portals. The push for modernizing healthcare systems in North America has led to increased adoption of EHR systems, health information exchange (HIE) platforms, and other digital health solutions. These technologies aim to improve care coordination, reduce administrative burdens, and enhance overall healthcare efficiency. North America is a hub for healthcare research and innovation. The presence of leading academic institutions, research organizations, and technology companies contributes to the development of cutting-edge eHealth solutions, including advanced diagnostics, digital therapeutics, and AI-powered healthcare applications, and boosts the eHealth industry growth.

eHealth Market Scope: Inquire before buying

Global eHealth Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 377.43 Bn. Forecast Period 2024 to 2030 CAGR: 22.7% Market Size in 2030: US $ 1580.33 Bn. Segments Covered: By Product Big Data for Health Electronic Health Record Health Information System mHealth Telemedicine By Service Monitoring Diagnostic Healthcare Strengthening Remote Monitoring Service Others By End User Healthcare Provider Payers Healthcare Consumers Pharmacies Others Global eHealth Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)eHealth Services Providers include:

North America: 1. Cerner Corporation (United States) 2. Epic Systems Corporation (United States) 3. Allscripts Healthcare Solutions, Inc. (United States) 4. McKesson Corporation (United States) 5. Athenahealth (United States) Europe: 1. Siemens Healthineers AG (Germany) 2. Philips Healthcare (Netherlands) 3. CompuGroup Medical SE (Germany) 4. Agfa-Gevaert Group (Belgium) 5. Dedalus Group (Italy) Asia-Pacific: 1. Tencent Healthcare (China) 2. Alibaba Health Information Technology Limited (China) 3. Novartis International AG (Switzerland, but significant presence in Asia-Pacific) 4. NEC Corporation (Japan) 5. Samsung Healthcare (South Korea) Latin America: 1. InterSystems Corporation (United States, but with a presence in Latin America) 2. Pixeon (Brazil) 3. TOTVS S.A. (Brazil) Middle East and Africa: 1. DrFirst (United States, but with a presence in the Middle East) 2. Cerner Middle East (United Arab Emirates) 3. InterSystems Corporation (United States, but with a presence in Africa) Global/Various Regions: 1. IBM Watson Health (United States) 2. GE Healthcare (United Kingdom) 3. Medtronic plc (Ireland) 4. Health Catalyst (United States)Frequently asked Questions:

1. What is eHealth? Answer: eHealth, or electronic health, refers to the use of information and communication technologies (ICT) in the healthcare industry. It involves a range of digital platforms and services aimed at improving healthcare delivery, efficiency, and patient care. 2. How do technological advancements contribute to eHealth market growth? Answer: Rapid advancements in information technology, high-speed internet availability, and improved connectivity have facilitated the integration of sophisticated eHealth solutions. Telemedicine, virtual consultations, and remote monitoring have become key drivers for eHealth market growth. 3. Which region dominates the eHealth market, and why? Answer: North America dominated the eHealth market in 2023, driven by government support, well-developed IT infrastructure, widespread access to high-speed internet, and a tech-savvy population. The region is a hub for technological advancements and healthcare innovation. 4. Why is data security a concern in the eHealth sector? Answer: The digital nature of health records and the exchange of medical information over networks make eHealth systems susceptible to cyber threats. Concerns about data breaches and unauthorized access hinder the adoption of eHealth solutions. 5. Why are governments supporting eHealth initiatives? Answer: Governments recognize the potential of eHealth in improving healthcare accessibility, efficiency, and outcomes. Supportive policies, incentives, and regulatory frameworks encourage healthcare organizations to invest in digital health solutions, including the transition from paper-based to electronic health records.

1. eHealth Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. eHealth Market: Dynamics 2.1. eHealth Market Trends by Region 2.1.1. North America eHealth Market Trends 2.1.2. Europe eHealth Market Trends 2.1.3. Asia Pacific eHealth Market Trends 2.1.4. Middle East and Africa eHealth Market Trends 2.1.5. South America eHealth Market Trends 2.2. eHealth Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America eHealth Market Drivers 2.2.1.2. North America eHealth Market Restraints 2.2.1.3. North America eHealth Market Opportunities 2.2.1.4. North America eHealth Market Challenges 2.2.2. Europe 2.2.2.1. Europe eHealth Market Drivers 2.2.2.2. Europe eHealth Market Restraints 2.2.2.3. Europe eHealth Market Opportunities 2.2.2.4. Europe eHealth Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific eHealth Market Drivers 2.2.3.2. Asia Pacific eHealth Market Restraints 2.2.3.3. Asia Pacific eHealth Market Opportunities 2.2.3.4. Asia Pacific eHealth Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa eHealth Market Drivers 2.2.4.2. Middle East and Africa eHealth Market Restraints 2.2.4.3. Middle East and Africa eHealth Market Opportunities 2.2.4.4. Middle East and Africa eHealth Market Challenges 2.2.5. South America 2.2.5.1. South America eHealth Market Drivers 2.2.5.2. South America eHealth Market Restraints 2.2.5.3. South America eHealth Market Opportunities 2.2.5.4. South America eHealth Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For eHealth Industry 2.8. Analysis of Government Schemes and Initiatives For eHealth Industry 2.9. eHealth Market Trade Analysis 2.10. The Global Pandemic Impact on eHealth Market 3. eHealth Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. eHealth Market Size and Forecast, by Product (2023-2030) 3.1.1. Big Data for Health 3.1.2. Electronic Health Record 3.1.3. Health Information System 3.1.4. mHealth 3.1.5. Telemedicine 3.2. eHealth Market Size and Forecast, by Service (2023-2030) 3.2.1. Monitoring 3.2.2. Diagnostic 3.2.3. Healthcare Strengthening 3.2.4. Others 3.3. eHealth Market Size and Forecast, by End User (2023-2030) 3.3.1. Providers 3.3.2. Insurers 3.3.3. Government 3.3.4. Healthcare Consumers 3.4. eHealth Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America eHealth Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America eHealth Market Size and Forecast, by Product (2023-2030) 4.1.1. Big Data for Health 4.1.2. Electronic Health Record 4.1.3. Health Information System 4.1.4. mHealth 4.1.5. Telemedicine 4.2. North America eHealth Market Size and Forecast, by Service (2023-2030) 4.2.1. Monitoring 4.2.2. Diagnostic 4.2.3. Healthcare Strengthening 4.2.4. Others 4.3. North America eHealth Market Size and Forecast, by End User (2023-2030) 4.3.1. Providers 4.3.2. Insurers 4.3.3. Government 4.3.4. Healthcare Consumers 4.4. North America eHealth Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States eHealth Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Big Data for Health 4.4.1.1.2. Electronic Health Record 4.4.1.1.3. Health Information System 4.4.1.1.4. mHealth 4.4.1.1.5. Telemedicine 4.4.1.2. United States eHealth Market Size and Forecast, by Service (2023-2030) 4.4.1.2.1. Monitoring 4.4.1.2.2. Diagnostic 4.4.1.2.3. Healthcare Strengthening 4.4.1.2.4. Others 4.4.1.3. United States eHealth Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Providers 4.4.1.3.2. Insurers 4.4.1.3.3. Government 4.4.1.3.4. Healthcare Consumers 4.4.2. Canada 4.4.2.1. Canada eHealth Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Big Data for Health 4.4.2.1.2. Electronic Health Record 4.4.2.1.3. Health Information System 4.4.2.1.4. mHealth 4.4.2.1.5. Telemedicine 4.4.2.2. Canada eHealth Market Size and Forecast, by Service (2023-2030) 4.4.2.2.1. Monitoring 4.4.2.2.2. Diagnostic 4.4.2.2.3. Healthcare Strengthening 4.4.2.2.4. Others 4.4.2.3. Canada eHealth Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Providers 4.4.2.3.2. Insurers 4.4.2.3.3. Government 4.4.2.3.4. Healthcare Consumers 4.4.3. Mexico 4.4.3.1. Mexico eHealth Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Big Data for Health 4.4.3.1.2. Electronic Health Record 4.4.3.1.3. Health Information System 4.4.3.1.4. mHealth 4.4.3.1.5. Telemedicine 4.4.3.2. Mexico eHealth Market Size and Forecast, by Service (2023-2030) 4.4.3.2.1. Monitoring 4.4.3.2.2. Diagnostic 4.4.3.2.3. Healthcare Strengthening 4.4.3.2.4. Others 4.4.3.3. Mexico eHealth Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Providers 4.4.3.3.2. Insurers 4.4.3.3.3. Government 4.4.3.3.4. Healthcare Consumers 5. Europe eHealth Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe eHealth Market Size and Forecast, by Product (2023-2030) 5.2. Europe eHealth Market Size and Forecast, by Service (2023-2030) 5.3. Europe eHealth Market Size and Forecast, by End User (2023-2030) 5.4. Europe eHealth Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom eHealth Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom eHealth Market Size and Forecast, by Service (2023-2030) 5.4.1.3. United Kingdom eHealth Market Size and Forecast, by End User(2023-2030) 5.4.2. France 5.4.2.1. France eHealth Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France eHealth Market Size and Forecast, by Service (2023-2030) 5.4.2.3. France eHealth Market Size and Forecast, by End User(2023-2030) 5.4.3. Germany 5.4.3.1. Germany eHealth Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany eHealth Market Size and Forecast, by Service (2023-2030) 5.4.3.3. Germany eHealth Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy eHealth Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy eHealth Market Size and Forecast, by Service (2023-2030) 5.4.4.3. Italy eHealth Market Size and Forecast, by End User(2023-2030) 5.4.5. Spain 5.4.5.1. Spain eHealth Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain eHealth Market Size and Forecast, by Service (2023-2030) 5.4.5.3. Spain eHealth Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden eHealth Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden eHealth Market Size and Forecast, by Service (2023-2030) 5.4.6.3. Sweden eHealth Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria eHealth Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria eHealth Market Size and Forecast, by Service (2023-2030) 5.4.7.3. Austria eHealth Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe eHealth Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe eHealth Market Size and Forecast, by Service (2023-2030) 5.4.8.3. Rest of Europe eHealth Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific eHealth Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific eHealth Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific eHealth Market Size and Forecast, by Service (2023-2030) 6.3. Asia Pacific eHealth Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific eHealth Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China eHealth Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China eHealth Market Size and Forecast, by Service (2023-2030) 6.4.1.3. China eHealth Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea eHealth Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea eHealth Market Size and Forecast, by Service (2023-2030) 6.4.2.3. S Korea eHealth Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan eHealth Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan eHealth Market Size and Forecast, by Service (2023-2030) 6.4.3.3. Japan eHealth Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India eHealth Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India eHealth Market Size and Forecast, by Service (2023-2030) 6.4.4.3. India eHealth Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia eHealth Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia eHealth Market Size and Forecast, by Service (2023-2030) 6.4.5.3. Australia eHealth Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia eHealth Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia eHealth Market Size and Forecast, by Service (2023-2030) 6.4.6.3. Indonesia eHealth Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia eHealth Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia eHealth Market Size and Forecast, by Service (2023-2030) 6.4.7.3. Malaysia eHealth Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam eHealth Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam eHealth Market Size and Forecast, by Service (2023-2030) 6.4.8.3. Vietnam eHealth Market Size and Forecast, by End User(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan eHealth Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan eHealth Market Size and Forecast, by Service (2023-2030) 6.4.9.3. Taiwan eHealth Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific eHealth Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific eHealth Market Size and Forecast, by Service (2023-2030) 6.4.10.3. Rest of Asia Pacific eHealth Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa eHealth Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa eHealth Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa eHealth Market Size and Forecast, by Service (2023-2030) 7.3. Middle East and Africa eHealth Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa eHealth Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa eHealth Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa eHealth Market Size and Forecast, by Service (2023-2030) 7.4.1.3. South Africa eHealth Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC eHealth Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC eHealth Market Size and Forecast, by Service (2023-2030) 7.4.2.3. GCC eHealth Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria eHealth Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria eHealth Market Size and Forecast, by Service (2023-2030) 7.4.3.3. Nigeria eHealth Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A eHealth Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A eHealth Market Size and Forecast, by Service (2023-2030) 7.4.4.3. Rest of ME&A eHealth Market Size and Forecast, by End User (2023-2030) 8. South America eHealth Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America eHealth Market Size and Forecast, by Product (2023-2030) 8.2. South America eHealth Market Size and Forecast, by Service (2023-2030) 8.3. South America eHealth Market Size and Forecast, by End User(2023-2030) 8.4. South America eHealth Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil eHealth Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil eHealth Market Size and Forecast, by Service (2023-2030) 8.4.1.3. Brazil eHealth Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina eHealth Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina eHealth Market Size and Forecast, by Service (2023-2030) 8.4.2.3. Argentina eHealth Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America eHealth Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America eHealth Market Size and Forecast, by Service (2023-2030) 8.4.3.3. Rest Of South America eHealth Market Size and Forecast, by End User (2023-2030) 9. Global eHealth Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading eHealth Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cerner Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Epic Systems Corporation (United States) 10.3. Allscripts Healthcare Solutions, Inc. (United States) 10.4. McKesson Corporation (United States) 10.5. Athenahealth (United States) 10.6. Siemens Healthineers AG (Germany) 10.7. Philips Healthcare (Netherlands) 10.8. CompuGroup Medical SE (Germany) 10.9. Agfa-Gevaert Group (Belgium) 10.10. Dedalus Group (Italy) 10.11. Tencent Healthcare (China) 10.12. Alibaba Health Information Technology Limited (China) 10.13. Novartis International AG (Switzerland, but significant presence in Asia-Pacific) 10.14. NEC Corporation (Japan) 10.15. Samsung Healthcare (South Korea) 10.16. InterSystems Corporation (United States, but with a presence in Latin America) 10.17. Pixeon (Brazil) 10.18. TOTVS S.A. (Brazil) 10.19. DrFirst (United States, but with a presence in the Middle East) 10.20. Cerner Middle East (United Arab Emirates) 10.21. InterSystems Corporation (United States, but with a presence in Africa) 10.22. IBM Watson Health (United States) 10.23. GE Healthcare (United Kingdom) 10.24. Medtronic plc (Ireland) 10.25. Health Catalyst (United States) 11. Key Findings 12. Industry Recommendations 13. eHealth Market: Research Methodology 14. Terms and Glossary