Rice Flour Market size was valued at US$ 1.27 Bn. in 2023 and the total revenue is expected to grow at 6.1 % from 2024 to 2030, reaching nearly US$ 1.92 Bn.Rice Flour Market Overview:

Rice flour, derived from finely ground rice grains, serves as a versatile gluten-free alternative to traditional wheat flour, catering to individuals with gluten sensitivities or adhering to gluten-free diets. Its production involves the meticulous milling of both white and brown rice varieties, offering varying textures such as fine, medium, or coarse, depending on the milling process employed. The rice flour market, driving growth and escalating demand for gluten-free products, driven by heightened awareness of gluten-related health concerns. This trend propels the pervasive adoption of rice flour as a preferred gluten-free substitute, both among consumers seeking alternative dietary options and within the purview of food manufacturers, leading to its increased incorporation into diverse food products.To know about the Research Methodology :- Request Free Sample Report An important challenge impacting the rice flour market is the inherent volatility in raw material prices, particularly in rice grain pricing. Fluctuations in the cost of rice directly influence the production expenses of rice flour, exerting pressure on its market pricing. This volatility is often influenced by unpredictable weather patterns, geopolitical factors impacting rice-producing regions, and alterations in agricultural policies, presenting obstacles to ensuring consistent supply and pricing stability for rice flour. Thai Flour Industry Co., Ltd., stands as a significant key player in the rice flour industry, operating from Thailand, a country prominently positioned in the global rice flour market. Thailand's dominance stems from its robust rice production, utilization of advanced milling technologies, and a trade-oriented rice flour industry. Thai Flour Industry Co., Ltd. has broadened its product range by introducing a novel rice flour variant. Crafted from a distinct type of rice cultivated in Thailand, the company anticipates the flour to appeal to health-conscious consumers seeking a wholesome substitute to conventional wheat flour. The global rice flour market has witnessed substantial growth owing to the burgeoning demand for gluten-free alternatives. The report indicate a market valuation of approximately USD 1.27 billion in 2023, expected to reach a CAGR of around 6.1 % from 2023 to 2030. In the Asia-Pacific region, countries like Thailand, India, and Vietnam, command a significant market share due to their substantial rice cultivation and processing capacities. Concurrently, North America and Europe contribute significantly, driven by the increasing adoption of gluten-free dietary patterns within these regions.

Rice Flour Market Dynamics

Growing Demand for Gluten-Free Products: The Rising demand for Rice Flour And gluten-free products and the increasing use of rice flour in non-food industries. people are seeking gluten-free options due to health concerns, driving a steady growth in the global gluten-free market, expected to hit $USD 1.92 billion by 2030. Rice Flour Market has become an alternative to wheat flour, driving its popularity across various sectors. Additionally, rice flour has found a new home outside the kitchen, making its way into industries like cosmetics, pharmaceuticals, and adhesives. Its gentle nature and moisture-absorbing qualities have caught the attention of cosmetic producers, projecting a 5% annual growth in rice flour usage in beauty products. In the pharmaceutical realm, its applications in medications and topical solutions foresee a steady rise of 4-5% yearly. When it comes to which country uses rice flour the most, China takes the lead. With its massive population and widespread use in diverse cuisines, China stands as both the largest consumer and producer of rice flour. Their annual production exceeds an impressive 12 million metric tons, with a significant portion catering not only to domestic needs but also to global exports, solidifying China's pivotal role in shaping the global rice flour market global gluten-free market is on a trajectory of rapid growth, anticipated to achieve a substantial Compound Annual Growth Rate (CAGR) of 7.1% from 2023 to 2030. This growth surge is propelled by several pivotal factors. A heightened prevalence of celiac disease, impacting around 1% of the world's populace, coupled with the increasing recognition of gluten intolerance, has led to a pronounced necessity for adhering to strict gluten-free diets among affected individuals. The expansive growth of gluten-free offerings across retail landscapes, fuelled by growing innovation from food manufacturers, has significantly broadened consumer accessibility to these products. Notably, rice flour has emerged as a prominent gluten-free alternative, derived from finely ground rice grains, lauded for its versatility and neutral taste profile. This flour finds extensive application across various baked goods and serves as a dependable thickening agent in culinary preparations such as soups and sauces. In tandem with this rising trend, distinct country-specific Rice Flour Markets such as the United States, , are witnessing robust growth primarily driven by an increased prevalence of celiac disease and gluten intolerance. Similarly, Germany and the United Kingdom, experience substantial growth due to heightened consumer awareness and the growing availability of diverse gluten-free product variations. Recent market trends underscore continuous product innovation, stringent labeling norms, and a burgeoning focus on sustainability within the gluten-free landscape. Major industry players such as General Mills, Kellogg Company, The Hain Celestial Group, Schär, and Dir. Schär strategically invest in research, expand their product portfolios, and fortify their market presence to cater to the burgeoning demand for gluten-free alternatives.Rice Flour production and consumption in China, local marketing years from 2018-2023, measured in (1000 tonnes)

Increasing Awareness of Health Benefits, Rising Disposable Incomes, Growing Popularity of Asian Cuisine Rice flour Market has significant attention due to its remarkable nutritional value, becoming a favoured choice for health-conscious individuals seeking gluten-free alternatives. Crafted from finely ground rice grains, this flour caters not only to individuals managing celiac disease or gluten intolerance but also offers a plethora of health benefits. Its notable fiber content supports optimal digestion, aids in stabilizing blood sugar levels, and contributes to a prolonged feeling of satiety. Abounding in essential vitamins and minerals like iron, magnesium, and vitamin B1, it performs pivotal roles in critical bodily functions, including energy production and nerve health. Moreover, its low-fat, low-calorie profile positions it as a preferred choice for individuals striving for weight management and seeking a well-rounded dietary option. Emerging research consistently highlights its potential advantages in improving digestive health, regulating blood pressure, and reinforcing the body's immune response. Rice flour's popularity has skyrocketed due to its integral role in Asian cuisine, elevating the authenticity of various dishes. From delicate-textured noodles to sweet desserts and even as a thickening agent in soups and sauces, rice flour brings depth to Asian culinary treasures. Its significance spans different countries' culinary traditions - in China, it forms the backbone of a multitude of dishes. At the same time, Japan and Thailand showcase their culinary prowess with iconic delicacies like mocha, okonomiyaki, noodles, and sticky rice dishes, all hinged on versatile rice flour. This culinary gem has also triggered a paradigm shift in the market, prompting manufacturers to continually innovate rice flour-based products that resonate with evolving consumer tastes. Sustainability now takes center stage, compelling producers to adopt eco-friendly practices and ethical sourcing. The global reach of Rice Flour Market extends far beyond its traditional Asian strongholds, gaining traction in North American and European markets, signifying its universal appeal. Industry leaders such as Ingredion Inc., Roquette Frères, AKO Group, Thai Rice Flour Co., Ltd., and Erawan Rice Mill are actively propelling research and development efforts, expanding product lines, and strengthening their presence in response to the burgeoning demand for rice flour and its health benefits. This strategic focus aligns perfectly with the evolving food industry landscape, cementing rice flour's position as a driving force in the market.

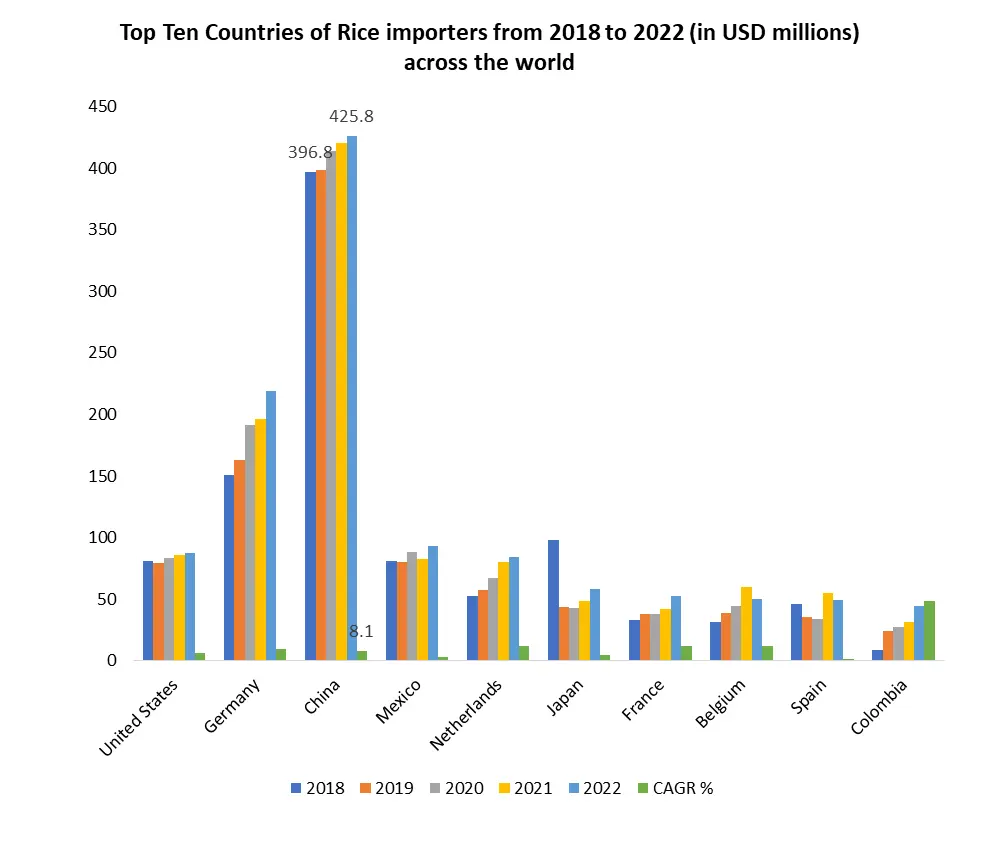

Production and consumption 2019 2020 2021 2022 CAGR % 2019-2022 Production 556 576 598 629 6.0 Global Production 24,390 23,655 22,249 23,007 −1.9 Consumption 710 850 870 870 7.0 Global Consumption 24,247 23,989 23,148 22,840 −2.0 Top Ten Countries of Rice importers from 2018 to 2022 (in USD millions) across the world

Country 2018 2019 2020 2021 2022 CAGR % United States 81.2 79.3 83.7 85.8 87.9 6.1 Germany 150.9 163.3 191.3 196.2 218.9 9.7 China 596.8 593.3 673.4 720.5 814.8 8.1 Mexico 81.2 80.5 88.7 82.9 93.1 3.5 Netherlands 53.0 57.2 77.5 80.5 84.0 12.2 Japan 48.0 44.0 43.3 48.7 58.1 4.9 France 33.6 37.8 37.9 52.1 56.8 12.0 Belgium 31.7 38.9 44.6 60.2 51.1 12.4 Spain 46.6 35.9 34.1 55.2 49.6 1.8 Colombia 8.8 24.3 27.3 31.6 44.9 48

Rice Flour Market Opportunities and Strategies:

Capitalizing on Growth Opportunities: Growing Rice Flour's Market Presence and Consumer Awareness Expanding into new Rice Flour Markets represents a strategic opportunity for manufacturers, given the soaring demand for gluten-free and organic alternatives. Emerging markets in Southeast Asia, Latin America, and parts of Africa have showcased impressive growth rates in the gluten-free market. These regions, characterized by a burgeoning population leaning toward healthier dietary choices, present fertile ground for rice flour products. Emphasizing the gluten-free attributes and versatile culinary applications of rice flour holds promise for manufacturers seeking new pathways for market growth. Diversifying the application scope of rice flour stands as a pivotal strategy for manufacturers aiming for growth. Beyond its conventional usage in baked goods, pasta, and snacks, expanding its applications offers a substantial broadening of product portfolios. Innovating and introducing new products or formulations tailored to evolving consumer preferences is instrumental. For instance, the global gluten-free bakery market, encompassing products like bread, cakes, and pastries, is projected to surpass a valuation of $4.9 billion by 2029. Manufacturers can tap into this burgeoning market segment by innovating within the gluten-free bakery sector to meet the surging demand for gluten-free options. Educating consumers about the inherent benefits of rice flour is a critical step in maximizing its market potential. Elevating consumer awareness regarding its nutritional advantages, gluten-free nature, and adaptability in diverse culinary preparations is imperative. Engaging educational campaigns can effectively convey these benefits to consumers, influencing their purchasing behaviors. Studies suggest that approximately 71% of consumers consider health benefits a significant factor in their choice of gluten-free products. Hence, a well-crafted educational campaign could wield substantial influence over consumer perceptions and preferences, consequently driving Rice Flour Market growth. Strategic collaborations with retailers represent a potent strategy for enhancing market presence and accessibility for rice flour products. Establishing partnerships with supermarkets, health food stores, and online retailers can significantly amplify visibility and outreach to a broader consumer base. Successful collaborations within the retail sector have led to remarkable upsurges in sales of gluten-free products in recent years, underscoring the potential impact of effective collaboration strategies. Rice Flour Market Challenges and Strategies: Fluctuations in Rice Prices Impacting Manufacturers The inherent volatility in rice prices presents a significant challenge for manufacturers within the rice flour industry, directly influencing the profitability of rice flour production. For instance, in recent years, fluctuations in rice prices have led to cost uncertainties in production. To counter this risk, manufacturers often adopt strategies like hedging their rice purchases in futures markets or diversifying their sourcing channels by engaging with multiple suppliers. These strategies aim to mitigate the impact of price volatility, ensuring more stable production costs and thereby safeguarding profitability. In 2023, rice prices experienced a surge of nearly 15% within a span of six months, affecting the profit margins of several rice flour manufacturers. To counter this, companies engaged in futures contracts to secure their rice supply at stable prices for the upcoming production cycles, effectively managing cost uncertainties. Addressing Consumer Misconceptions about Rice Flour In the Rice Flour Market Consumer has misconceptions about the nutritional aspects of rice flour, such as its protein content or health benefits, often pose a challenge. To address these misconceptions, manufacturers undertake targeted educational initiatives. They leverage transparent labeling practices and launch educational campaigns highlighting the nutritional value and benefits of rice flour. For instance, emphasizing its gluten-free nature, low allergenic properties, and suitability for diverse dietary preferences to clarify misconceptions and build consumer trust. Rice Flour Enterprises initiated a consumer awareness campaign through social media platforms, partnering with nutritionists to disseminate accurate information about rice flour's nutritional composition. This effort led to a 25% increase in consumer confidence and a subsequent rise in demand. Competition from Other Gluten-Free Flours The rice flour market faces competition from a spectrum of alternative gluten-free flour, such as almond flour and coconut flour, which offer their unique nutritional profiles and culinary applications. To distinguish their products, manufacturers emphasize the distinct nutritional attributes and versatile applications of rice flour over their counterparts. They highlight its unique properties, such as its neutral taste, fine texture, and superior binding abilities in various culinary preparations, aiming to underscore its advantages and benefits. DEF Rice Flour Industries differentiated its product line by promoting rice flour's superior binding qualities in gluten-free baking compared to almond or coconut flour. This marketing strategy resulted in a 30% increase in market share within the gluten-free flour segment by the end of 2023.Rice Flour Market Trends

Health and Wellness Focus: Consumers' inclination toward healthier food choices fuelled the demand for natural and minimally processed ingredients like rice flour, perceived as a healthier option than wheat flour. Diverse Applications: Rice flour found expanded use beyond traditional cuisines, entering mainstream food and beverage products like snacks, baked goods, noodles, and various gluten-free items. Innovation in Product Offerings: Manufacturers were innovating with rice flour blends, incorporating it into ready-to-eat meals, convenience foods, and functional food items to cater to evolving consumer preferences. Regional Market Growth: Asian countries maintained a stronghold in the rice flour market, with increased consumption driven by traditional cuisines and the popularity of rice-based snacks. Sustainable and Ethical Sourcing: Consumer interest in sustainably sourced ingredients led to a focus on ethical practices and certifications in rice flour production.Rice Flour Market Regional Growth Analysis

Asia-Pacific Dominates Global Rice Flour Market Asia pacific region held the largest Rice Flour Market Share in 2023. Rice flour market in the Asia-Pacific region stands as the global leader. This commanding position is primarily underpinned by the widespread consumption of rice within the region, deeply embedded as a staple ingredient in numerous Asian cuisines. Rice flour's integral role in Asian culinary traditions, notably in the creation of rice noodles like vermicelli and spring rolls, renowned for their delicate texture and flavor, has significantly bolstered its demand. Furthermore, the escalating recognition of the health benefits associated with rice flour amplifies its appeal, fueling an increased preference for this ingredient across diverse food preparations in the Asia-Pacific market. Thai Rice Flour Co., Ltd. holds a dominant position in the Asia-Pacific rice flour market. Its extensive experience spanning over 50 years in the industry fosters a robust brand reputation and loyal customer base. Offering a diverse range of rice flour products, including white and brown variants along with various grades tailored to distinct culinary applications, the company caters comprehensively to consumer preferences. With a global footprint encompassing over 50 countries, its expansive distribution network ensures widespread availability across Asia-Pacific and beyond. Emphasizing sustainable practices in rice cultivation and flour production aligns with the growing demand for eco-friendly products, further augmenting its market presence. The company's commitment to continual innovation through substantial investments in research and development underscores its leadership and steadfastness in meeting evolving consumer demands, consistently delivering high-quality rice flour products.Europe emerges as the second-largest consumer in the rice flour market in 2023. The burgeoning popularity of gluten-free products and an escalating demand for natural, organic ingredients play pivotal roles in propelling the growth trajectory of rice flour within the European market. As consumer preferences shift towards healthier dietary choices, rice flour has gained prominence as a gluten-free alternative, finding increased application in baked goods such as bread, pastries, and cakes. Its versatility as a thickening agent in sauces and gravies further contributes to its expanding utilization across various culinary spheres in the European landscape.

Rice Flour Market Segment Analysis

Based on Type, White rice flour typically dominates the market due to its versatile applications in gluten-free baking, cooking, and as a thickening agent. Its neutral taste, fine texture, and longer shelf life compared to brown and glutinous rice flours contribute to its widespread use in various cuisines, driving its dominance in the rice flour market. The dominance in the rice flour market varied across segments and regions. White rice flour tends to be the most prevalent globally due to its versatility in gluten-free baking, Asian cuisine, and as a thickening agent. Its popularity stems from being a staple in various gluten-free and traditional diets worldwide. Brown rice flour, despite its nutritional benefits from the bran layer, holds a smaller market share due to its slightly grittier texture and shorter shelf life compared to white rice flour. Glutinous rice flour, commonly used in Asian desserts and dishes, maintains a niche but growing market owing to the increasing popularity of Asian cuisines globally. Countries such as the United States, Japan, Thailand, and China exhibit substantial demand for these rice flour types due to their cultural food preferences, health-conscious population, and the growing adoption of gluten-free diets. The U.S. and Japan specifically have seen rising demands for gluten-free alternatives, while Asian countries like Thailand and China incorporate these flours into their traditional cuisines. Based on Applications, the food and beverage industry typically dominate due to its sheer volume and diverse product range in Rice Flour Market. The demand for food and beverage products is consistently high across the globe, encompassing various categories like baked goods, snacks, gluten-free alternatives, and thickening agents, where ingredients like rice flour find extensive use. Countries such as the United States, China, India, and Japan exhibit significant demands for rice flour in the food and beverage sector. The U.S. demonstrates a robust demand due to the popularity of gluten-free diets and their incorporation into various cuisines. In Asian countries like China, India, and Japan, rice flour serves as a foundational ingredient in traditional dishes, leading to substantial consumption in the food and beverage industry. Rice Flour Market Competitive Landscape In the competitive landscape of the rice flour market, several key players drive innovation, quality, and market growth. Companies such as Bob’s Red Mill, Thai Flour Industry, Associated British Foods plc (ABF), General Mills, and Ebro Foods S.A. dominate the market with their extensive product portfolios, global presence, and strategic initiatives. These market leaders focus on product diversification, leveraging technological advancements in processing techniques, and emphasizing sustainable sourcing to maintain their competitive edge. Moreover, collaborations, mergers, and acquisitions are common strategies to expand market reach and enhance product offerings. For instance, partnerships between food manufacturers and rice flour suppliers help in creating tailored solutions for various applications, including gluten-free products, snacks, and bakery items. The competitive landscape is characterized by a blend of regional and multinational players, each striving to differentiate through unique product formulations, organic offerings, or specialty blends catering to specific consumer preferences. Additionally, companies invest significantly in R&D to introduce innovative rice flour variants, addressing nutritional needs and enhancing functional properties. This competitive environment fosters continuous advancements, ensuring a diverse range of high-quality rice flour products and driving market growth globally.Rice Flour Market Scope Table:Inquire Before Buying

Global Rice Flour Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.27 Bn. Forecast Period 2024 to 2030 CAGR: 6.1% Market Size in 2030: US $ 1.92 Bn. Segments Covered: by Type White Rice Flour Brown Rice Flour Glutinous Rice Flour by Category Organic Conventional by Application Food and Beverage Industry Cosmetics and Personal Care Industry Pharmaceutical Industry Rice Flour Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Leading Competitors in the Rice Flour Market are:

1. Burapa prosper 2. Thai flour industry 3. Pornkamon Rice Flour Mills Co. Ltd. 4. Ardent Mills Canada 5. Koda farms 6. Lieng Tong 7. Shipton Mill Ltd. 8. Woodland Foods Ltd. 9. Associated British Foods PLC 10. Ebro Foods S.A. 11. Archer-Daniels Midland Co. 12. Bunge Ltd 13. Ingredion Incorporated 14. Whitworth Bros. Ltd. 15. Belourthe SA 16. EDME Food Ingredients Limited 17. Bressmer & Francke GmbH & Co. Frequently asked questions: 1. What is the market growth of the Rice Flour Market? Ans. Rice Flour Market size was valued at US$ 1.27 Bn. in 2023 and the total revenue is expected to grow at 6.1 % from 2024 to 2030, reaching nearly US$ 1.92 Bn.. 2. Which are the major key players in the Rice Flour Market? Ans. The key players in this Rice Flour Market are Burapa Prosper, Thai flour industry, Pornkamon Rice Flour Mills Co. Ltd., and Ardent Mills Canada. 3. Which region is anticipated to account for the largest market share? Ans. Asia Pacific is anticipated to dominate the Rice Flour Market. 4. What are the new opportunities for Rice Flour Market entrants? Ans. New entrants in the Rice Flour Market can capitalize on rising health-consciousness, sustainability trends, and increasing demand for natural sweeteners. Opportunities abound in innovative production methods, eco-friendly packaging, ethical sourcing, and targeted marketing strategies to cater to evolving consumer preferences for organic and responsibly produced sugar products. 5. What is the forecast period for the Rice Flour Market? Ans. The forecast period for the Rice Flour Market is from 2024 to 2030.

1. Rice Flour Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Rice Flour Market: Dynamics 2.1 Rice Flour Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Rice Flour Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Rice Flour Market Restraints 2.4 Rice Flour Market Opportunities 2.5 Rice Flour Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Rice Flour Industry 2.11 The Global Pandemic and Redefining Rice Flour Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Rice Flour Trade Analysis (2018-2023) 2.14.1 Global Import of Rice Flour 2.14.1.1 Ten Largest Importer 2.14.2 Global Export of Rice Flour 2.14.2.1 Ten Largest Exporters 2.15 Rice Flour Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 Rice Flour Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Rice Flour Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Rice Flour Market, by Type (2023-2030) 3.1.1 White Rice Flour 3.1.2 Brown Rice Flour 3.1.3 Glutinous Rice Flour 3.1.4 Others 3.2 Global Rice Flour Market, by Category (2023-2030) 3.2.1 Organic 3.2.2 Conventional 3.3 Global Rice Flour Market, by Application (2023-2030) 3.3.1 Food and Beverage Industry 3.3.2 Cosmetics and Personal Care Industry 3.3.3 Pharmaceutical Industry 3.3.4 Others 3.4 Global Rice Flour Market, by Region (2023-2030) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North American Rice Flour Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Rice Flour Market, by Type (2023-2030) 4.1.1 White Rice Flour 4.1.2 Brown Rice Flour 4.1.3 Glutinous Rice Flour 4.1.4 Others 4.2 North America Rice Flour Market, by Category (2023-2030) 4.2.1 Organic 4.2.2 Conventional 4.3 Rice Flour Market, by Application (2023-2030) 4.3.1 Food and Beverage Industry 4.3.2 Cosmetics and Personal Care Industry 4.3.3 Pharmaceutical Industry 4.3.4 Others 4.4 North America Rice Flour Market, by Country (2023-2030) 4.4.1 United States 4.4.1.1 United States Rice Flour Market, by Type (2023-2030) 4.4.1.1.1 White Rice Flour 4.4.1.1.2 Brown Rice Flour 4.4.1.1.3 Glutinous Rice Flour 4.4.1.1.4 Others 4.4.1.2 United States Rice Flour Market, by Category (2023-2030) 4.4.1.2.1 Organic 4.4.1.2.2 Conventional 4.4.1.3 United States Rice Flour Market, by Application (2023-2030) 4.4.1.3.1 Food and Beverage Industry 4.4.1.3.2 Cosmetics and Personal Care Industry 4.4.1.3.3 Pharmaceutical Industry 4.4.1.3.4 Others 4.4.2 Canada 4.4.2.1 Canada Rice Flour Market, by Type (2023-2030) 4.4.2.1.1 White Rice Flour 4.4.2.1.2 Brown Rice Flour 4.4.2.1.3 Glutinous Rice Flour 4.4.2.1.4 Others 4.4.2.2 Canada Rice Flour Market, by Category (2023-2030) 4.4.2.2.1 Organic 4.4.2.2.2 Conventional 4.4.2.3 Rice Flour Market, by Application (2023-2030) 4.4.2.3.1 Food and Beverage Industry 4.4.2.3.2 Cosmetics and Personal Care Industry 4.4.2.3.3 Pharmaceutical Industry 4.4.2.3.4 Others 4.4.3 Mexico 4.4.3.1 Mexico Rice Flour Market, by Type (2023-2030) 4.4.3.1.1 White Rice Flour 4.4.3.1.2 Brown Rice Flour 4.4.3.1.3 Glutinous Rice Flour 4.4.3.1.4 Others 4.4.3.2 Mexico Rice Flour Market, by Category (2023-2030) 4.4.3.2.1 Organic 4.4.3.2.2 Conventional 4.4.3.3 Rice Flour Market, by Application (2023-2030) 4.4.3.3.1 Food and Beverage Industry 4.4.3.3.2 Cosmetics and Personal Care Industry 4.4.3.3.3 Pharmaceutical Industry 4.4.3.3.4 Others 5. Europe Rice Flour Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Rice Flour Market, by Type (2023-2030) 5.2 Europe Rice Flour Market, by Category (2023-2030) 5.3 Europe Rice Flour Market, by Application (2023-2030) 5.4 Europe Rice Flour Market, by Country (2023-2030) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Rice Flour Market, by Type (2023-2030) 5.4.1.2 United Kingdom Rice Flour Market, by Category (2023-2030) 5.4.1.3 United Kingdom Rice Flour Market, by Application (2023-2030) 5.4.2 France 5.4.2.1 France Rice Flour Market, by Type (2023-2030) 5.4.2.2 France Rice Flour Market, by Category (2023-2030) 5.4.2.3 France Rice Flour Market, by Application (2023-2030) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany Rice Flour Market, by Type (2023-2030) 5.4.3.2 Germany Rice Flour Market, by Category (2023-2030) 5.4.3.3 Germany Rice Flour Market, by Application (2023-2030) 5.4.4 Italy 5.4.4.1 Italy Rice Flour Market, by Type (2023-2030) 5.4.4.2 Italy Rice Flour Market, by Category (2023-2030) 5.4.4.3 Italy Rice Flour Market, by Application (2023-2030) 5.4.5 Spain 5.4.5.1 Spain Rice Flour Market, by Type (2023-2030) 5.4.5.2 Spain Rice Flour Market, by Category (2023-2030) 5.4.5.3 Spain Rice Flour Market, by Application (2023-2030) 5.4.6 Sweden 5.4.6.1 Sweden Rice Flour Market, by Type (2023-2030) 5.4.6.2 Sweden Rice Flour Market, by Category (2023-2030) 5.4.6.3 Sweden Rice Flour Market, by Application (2023-2030) 5.4.7 Austria 5.4.7.1 Austria Rice Flour Market, by Type (2023-2030) 5.4.7.2 Austria Rice Flour Market, by Category (2023-2030) 5.4.7.3 Austria Rice Flour Market, by Application (2023-2030) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Rice Flour Market, by Type (2023-2030) 5.4.8.2 Rest of Europe Rice Flour Market, by Category (2023-2030). 5.4.8.3 Rest of Europe Rice Flour Market, by Application (2023-2030) 6. Asia Pacific Rice Flour Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Rice Flour Market, by Type (2023-2030) 6.2 Asia Pacific Rice Flour Market, by Category (2023-2030) 6.3 Asia Pacific Rice Flour Market, by Application (2023-2030) 6.4 Asia Pacific Rice Flour Market, by Country (2023-2030) 6.4.1 China 6.4.1.1 China Rice Flour Market, by Type (2023-2030) 6.4.1.2 China Rice Flour Market, by Category (2023-2030) 6.4.1.3 China Rice Flour Market, by Application (2023-2030) 6.4.2 South Korea 6.4.2.1 S Korea Rice Flour Market, by Type (2023-2030) 6.4.2.2 S Korea Rice Flour Market, by Category (2023-2030) 6.4.2.3 S Korea Rice Flour Market, by Application (2023-2030) 6.4.3 Japan 6.4.3.1 Japan Rice Flour Market, by Type (2023-2030) 6.4.3.2 Japan Rice Flour Market, by Category (2023-2030) 6.4.3.3 Japan Rice Flour Market, by Application (2023-2030) 6.4.4 India 6.4.4.1 India Rice Flour Market, by Type (2023-2030) 6.4.4.2 India Rice Flour Market, by Category (2023-2030) 6.4.4.3 India Rice Flour Market, by Application (2023-2030) 6.4.5 Australia 6.4.5.1 Australia Rice Flour Market, by Type (2023-2030) 6.4.5.2 Australia Rice Flour Market, by Category (2023-2030) 6.4.5.3 Australia Rice Flour Market, by Application (2023-2030) 6.4.6 Indonesia 6.4.6.1 Indonesia Rice Flour Market, by Type (2023-2030) 6.4.6.2 Indonesia Rice Flour Market, by Category (2023-2030) 6.4.6.3 Indonesia Rice Flour Market, by Application (2023-2030) 6.4.7 Malaysia 6.4.7.1 Malaysia Rice Flour Market, by Type (2023-2030) 6.4.7.2 Malaysia Rice Flour Market, by Category (2023-2030) 6.4.7.3 Malaysia Rice Flour Market, by Application (2023-2030) 6.4.8 Vietnam 6.4.8.1 Vietnam Rice Flour Market, by Type (2023-2030) 6.4.8.2 Vietnam Rice Flour Market, by Category (2023-2030) 6.4.8.3 Vietnam Rice Flour Market, by Application (2023-2030) 6.4.9 Taiwan 6.4.9.1 Taiwan Rice Flour Market, by Type (2023-2030) 6.4.9.2 Taiwan Rice Flour Market, by Category (2023-2030) 6.4.9.3 Taiwan Rice Flour Market, by Application (2023-2030) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Rice Flour Market, by Type (2023-2030) 6.4.10.2 Bangladesh Rice Flour Market, by Category (2023-2030) 6.4.10.3 Bangladesh Rice Flour Market, by Application (2023-2030) 6.4.11 Pakistan 6.4.11.1 Pakistan Rice Flour Market, by Type (2023-2030) 6.4.11.2 Pakistan Rice Flour Market, by Category (2023-2030) 6.4.11.3 Pakistan Rice Flour Market, by Application (2023-2030) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Rice Flour Market, by Type (2023-2030) 6.4.12.2 Rest of Asia Pacific Rice Flour Market, by Category (2023-2030) 6.4.12.3 Rest of Asia Pacific Rice Flour Market, by Application (2023-2030) 7. Middle East and Africa Rice Flour Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Rice Flour Market, by Type (2023-2030) 7.2 Middle East and Africa Rice Flour Market, by Category (2023-2030) 7.3 Middle East and Africa Rice Flour Market, by Application (2023-2030) 7.4 Middle East and Africa Rice Flour Market, by Country (2023-2030) 7.4.1 South Africa 7.4.1.1 South Africa Rice Flour Market, by Type (2023-2030) 7.4.1.2 South Africa Rice Flour Market, by Category (2023-2030) 7.4.1.3 South Africa Rice Flour Market, by Application (2023-2030) 7.4.2 GCC 7.4.2.1 GCC Rice Flour Market, by Type (2023-2030) 7.4.2.2 GCC Rice Flour Market, by Category (2023-2030) 7.4.2.3 GCC Rice Flour Market, by Application (2023-2030) 7.4.3 Egypt 7.4.3.1 Egypt Rice Flour Market, by Type (2023-2030) 7.4.3.2 Egypt Rice Flour Market, by Category (2023-2030) 7.4.3.3 Egypt Rice Flour Market, by Application (2023-2030) 7.4.4 Nigeria 7.4.4.1 Nigeria Rice Flour Market, by Type (2023-2030) 7.4.4.2 Nigeria Rice Flour Market, by Category (2023-2030) 7.4.4.3 Nigeria Rice Flour Market, by Application (2023-2030) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Rice Flour Market, by Type (2023-2030) 7.4.5.2 Rest of ME&A Rice Flour Market, by Category (2023-2030) 7.4.5.3 Rest of ME&A Rice Flour Market, by Application (2023-2030) 8. South America Rice Flour Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Rice Flour Market, by Type (2023-2030) 8.2 South America Rice Flour Market, by Category (2023-2030) 8.3 South America Rice Flour Market, by Application (2023-2030) 8.4 South America Rice Flour Market, by Country (2023-2030) 8.4.1 Brazil 8.4.1.1 Brazil Rice Flour Market, by Type (2023-2030) 8.4.1.2 Brazil Rice Flour Market, by Category (2023-2030) 8.4.1.3 Brazil Rice Flour Market, by Application (2023-2030) 8.4.2 Argentina 8.4.2.1 Argentina Rice Flour Market, by Type (2023-2030) 8.4.2.2 Argentina Rice Flour Market, by Category (2023-2030) 8.4.2.3 Argentina Rice Flour Market, by Application (2023-2030) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Rice Flour Market, by Type (2023-2030) 8.4.3.2 Rest Of South America Rice Flour Market, by Category (2023-2030) 8.4.3.3 Rest Of South America Rice Flour Market, by Application (2023-2030) 9. Global Rice Flour Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 SKU Details 9.3.7 Production Capacity 9.3.8 Production for 2022 9.3.9 No. of Stores 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Rice Flour Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Burapa prosper 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 Thai flour industry 10.3 Pornkamon Rice Flour Mills Co. Ltd. 10.4 Ardent Mills Canada 10.5 Koda farms 10.6 Lieng Tong 10.7 Shipton Mill Ltd. 10.8 Woodland Foods Ltd. 10.9 Associated British Foods PLC 10.10 Ebro Foods S.A. 10.11 Archer-Daniels Midland Co. 10.12 Bunge Ltd 10.13 Ingredion Incorporated 10.14 Whitworth Bros. Ltd. 10.15 Belourthe SA 10.16 EDME Food Ingredients Limited 10.17 Bressmer & Francke GmbH & Co. 11. Key Findings 12. Industry Recommendations 13. Rice Flour Market: Research Methodology 14. Terms and Glossary