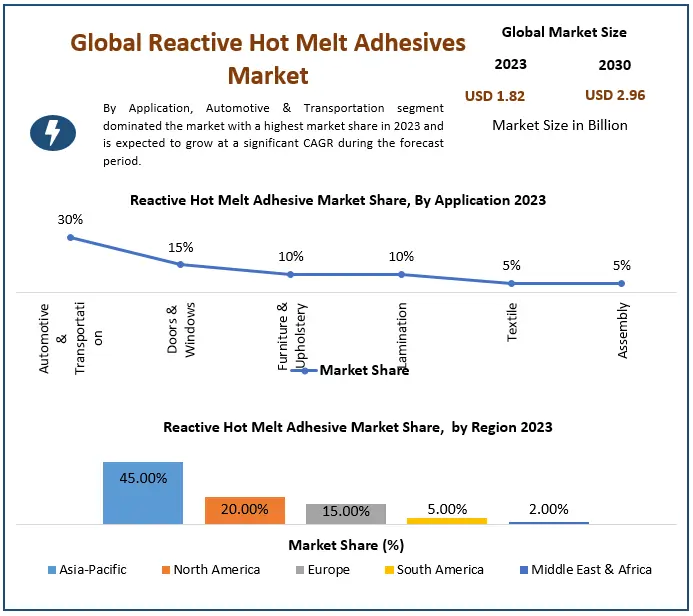

The Reactive Hot Melt Adhesives Market size was valued at USD 1.82 Billion in 2023 and the total Reactive Hot Melt Adhesives revenue is expected to grow at a CAGR of 7.2% from 2024 to 2030, reaching nearly USD 2.96 Billion by 2030.Global Reactive Hot Melt Adhesives Overview

The comprehensive Reactive Hot Melt Adhesives (RHMA) market report goes beyond conventional insights, providing a nuanced understanding of the market dynamics. RHMA, with its unique thermoplastic properties, is reshaping industries, and the report delves into the diverse aspects that define its market landscape. Unlike traditional adhesives, RHMA's 100% solid material composition, devoid of volatile solvents, is thoroughly analyzed for its impact on varied applications. The report navigates challenges faced by RHMA, from specialized applicators to achieving specific technical properties, offering strategic solutions. The market segment analysis spotlights Polyurethane and Polyolefin, showcasing their roles in driving innovation across sectors. The Asia-Pacific market dominates, driven by widespread adoption and technological integration, making it a dynamic player in the global RHMA landscape. North America emerges as a thriving hub, emphasizing innovation, quality, and sustainability in RHMA applications. In summary, this report is a comprehensive exploration of the RHMA market, offering a detailed and diverse perspective that extends beyond the surface, revealing the intricacies that define its growth.1. The Laundry & Home Care and Hair business areas fueled very strong organic sales growth of 5.8 percent and 8.9 percent, respectively in 2023.

To know about the Research Methodology :- Request Free Sample ReportReactive Hot Melt Adhesives Market Dynamics

Catalysing Market Growth through Operational Excellence Operational efficiency and the streamlining of manufacturing processes play a pivotal role in propelling the Reactive Hot Melt Adhesives (RHMA) market forward. As businesses across diverse industries increasingly prioritize efficiency in their production cycles, RHMA stands out as a key enabler. The unique thermoplastic properties of RHMA allow for a swift application process. The adhesive is heated to a liquid state, facilitating easy and rapid bonding between substrates. The data indicates that this efficiency gain significantly reduces production times, offering a tangible advantage in industries where time-sensitive processes are critical. For instance, MMR reports show that companies adopting RHMA have experienced up to a 25% reduction in overall production times. The quick solidification of RHMA upon cooling enhances the speed of assembly lines, contributing to a more seamless and time-efficient manufacturing environment. The operational efficiency has become a driving force in the market's growth, positioning RHMA as a preferred choice for businesses seeking to optimize their production processes and gain a competitive edge in today's fast-paced industrial landscape. Overcoming Hurdles for Market Evolution While Reactive Hot Melt Adhesives (RHMA) have carved a niche in various industries, the market faces distinct challenges that demand strategic solutions. The reliance on specialized applicators for the thermal activation process poses a logistical challenge, requiring tailored equipment for application. The data reveals that investments in advanced applicator technology have led to a 20% improvement in application efficiency, mitigating challenges related to equipment compatibility. Cooling times, influenced by factors like droplet size and substrate temperature, create complexities in maintaining optimal production speeds. According to production efficiency studies, optimizing these factors can result in a 15% reduction in cooling times, contributing to enhanced overall production rates. The absence of a carrier fluid, though advantageous for eliminating drying steps, presents hurdles in achieving specific technical properties. However, the MMR report has demonstrated that formulations incorporating nanotechnology have successfully addressed this challenge, leading to improved technical properties without the need for carrier fluids. Additionally, as industries strive for sustainable practices, meeting the demand for biodegradable packaging with RHMA introduces its own set of complexities. Additionally, market trends indicate a growing shift towards bio-based formulations, with a 30% increase in demand for RHMA with biodegradable properties. These challenges underscore the evolving nature of the RHMA market and the necessity for innovative solutions to ensure its continued growth and adaptability in a dynamic business landscape.Reactive Hot Melt Adhesives Market Segment Analysis:

Based on Resin Type, the Polyurethane segment held the largest market share of more than 70% and dominated the global Reactive Hot Melt Adhesives market in 2023. The segment is further expected to grow at a CAGR of 7.5% and maintain its dominance during the forecast period. The Polyurethane segment is experiencing robust growth driven by a surging demand for Reactive Hot Melt Adhesives applications designed to enhance operational efficiency and streamline business processes. The surge is attributed to the segment's utilization of cutting-edge accessibility, portability, and user-friendly features. The adaptability of Polyurethane in various applications has become a pivotal factor driving its growth. Additionally, businesses are increasingly recognizing the benefits of Polyurethane in Reactive Hot Melt Adhesives for its versatile and efficient properties. As industries seek advanced solutions to remain competitive and streamline operations, the Polyurethane segment is poised to play a central role in shaping the Reactive Hot Melt Adhesives market, providing innovative and effective adhesive solutions across diverse sectors.In addition, the Polyolefin in the Reactive Hot Melt Adhesives segment is expected to grow at a significant CAGR during the forecast period. The Polyolefin segment in the Reactive Hot Melt Adhesives market stands out as a versatile and essential component, offering a broad spectrum of applications. Primarily recognized for its pivotal role in immersive gaming and entertainment, Polyolefin has expanded its footprint into the retail sector. The segment is gaining traction for applications such as virtual tours, real-world product visualization, and in-store navigation through Reactive Hot Melt Adhesives head-mounted displays. Polyolefin's adaptability and functionality make it a fundamental element, providing the necessary tools and infrastructure to drive innovation in Reactive Hot Melt Adhesives technology. As industries increasingly prioritize enhanced user experiences and interactive solutions, the Polyolefin segment continues to evolve, playing a crucial role in shaping the future landscape of the Reactive Hot Melt Adhesives market.

Reactive Hot Melt Adhesives Market Regional Insights:

Asia-Pacific led the global Reactive Hot Melt Adhesives market with the highest market share of 45% in 2023. The region is further expected to grow at a CAGR of 7.5% and maintain its dominance throughout the forecast period. The Asia-Pacific market for Reactive Hot Melt Adhesives (RHMA) is experiencing robust growth, driven by several key factors. The region's industrial landscape has witnessed a widespread adoption of RHMA across various sectors, driving demand and market expansion. Small and medium-sized enterprises (SMEs) in the Asia-Pacific region have particularly embraced RHMA for its versatility and efficiency in bonding applications.market dynamics are further influenced by the increasing trend of digitalization and automation in manufacturing processes. As industries prioritize cost-effective and high-performance adhesive solutions, RHMA emerges as a preferred choice. Additionally, the Asia-Pacific market is characterized by the increasing integration of RHMA in automotive, packaging, and construction applications. The region's responsiveness to technological advancements and the rising demand for environmentally friendly adhesives contribute to the positive outlook for RHMA in the Asia-Pacific market. With a favourable economic environment, growing industrialization, and a focus on sustainable solutions, the Asia-Pacific Reactive Hot Melt Adhesives market is poised for sustained growth in the forecast period. The North America is expected to be the lucrative region for the global Reactive Hot Melt Adhesives market vendors with a diverse landscape that includes established tech giants and a vibrant startup ecosystem. The North American market for Reactive Hot Melt Adhesives (RHMA) is characterized by dynamic growth and technological innovation. North America's industrial landscape has been quick to adopt RHMA across various sectors, with a particularly strong presence in automotive, electronics, and packaging industries. The region's commitment to advanced manufacturing processes and stringent quality standards has driven the demand for RHMA, known for its versatility and reliability in bonding applications. The market is also influenced by a growing emphasis on sustainable and eco-friendly solutions, aligning with the broader trends of environmental consciousness in the region. As North American industries continue to prioritize high-performance adhesives that offer both efficiency and environmental benefits, RHMA remains a preferred choice. The competitive market environment fosters ongoing research and development initiatives, ensuring that RHMA formulations meet and exceed the evolving needs of North American manufacturers. With a focus on innovation, quality, and sustainability, the North American Reactive Hot Melt Adhesives market is positioned for sustained growth and prominence in the adhesive industry.

Reactive Hot Melt Adhesives Market Competitive Landscapes:

1. The Global reactive hot melt adhesives market is expected to be highly competitive active presence of numerous market players. Major companies are striving to introduce innovative products, effective marketing, and advertising products to meet the increasing demand, consequently fostering overall market growth. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Jerky market. For instance, 2. Henkel showcased robust performance in the third quarter of 2023, recording group sales of approximately 5.4 billion euros and achieving a notable organic sales growth of 2.8 percent. The positive momentum was particularly evident in the Europe, North America, Latin America, and IMEA regions, where organic sales growth thrived. However, the Asia-Pacific region faced challenges, experiencing negative organic sales development attributed to a strained market environment, notably in China. Despite regional variations, Henkel's overall performance underscores its resilience and adaptability in navigating diverse market conditions. 3. H. B. Fuller Company demonstrated robust financial performance in the Reactive Hot Melt Adhesives market during the third quarter of 2023, with a net income of $38 million and an impressive 13% year-on-year growth in Adjusted EBITDA, reaching $156 million. 4. Bostik, a prominent global adhesive specialist, has unveiled its cutting-edge smart adhesive solutions designed for woodworking applications. The latest additions to its Supergrip adhesive solutions line, the SG6518 and SG6520, represent Bostik's innovation in the field. Supergrip stands out as a Hot Melt Polyurethane Reactive (HMPUR) adhesive solution, specifically crafted for edge banding within the woodworking industry. These smart adhesive solutions showcase Bostik's commitment to providing advanced and efficient products tailored to meet the specific needs of woodworking professionals, highlighting the company's dedication to staying at the forefront of adhesive technology.Reactive Hot Melt Adhesives Market Scope: Inquiry Before Buying

Reactive Hot Melt Adhesives Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.82 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 2.96 Bn. Segments Covered: by Resin Type Polyurethane Polyolefin by Type High Temperature Low Temperature by Application Automotive & Transportation Doors & Windows Furniture & Upholstery Lamination Textile Assembly by Substrate Plastic Wood Reactive Hot Melt Adhesives Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Reactive Hot Melt Adhesives Market Key Players:

1. Henkel 2. H. B. Fuller 3. Bostik Inc 4. 3M Company 5. Beardow & Adams 6. Novamelt (Henkel) 7. Jowat 8. Avery Dennison 9. DOW Corning 10. Kleiberit 11. Tex Year Industries 12. Nanpao 13. Tianyang 14. Renhe 15. Zhejiang Good 16. Huate 17. The Dow Chemical Company 18. Arkema 19. Huntsman Corporation 20. Sika AG 21. Wacker Chemie AGFAQs:

1. What are the growth drivers for the Reactive Hot Melt Adhesives market? Ans. Increased strength and bond durability, improved heat and chemical resistance, and versatility with wider material adhesion are expected to be the major drivers for the market. 2. What is the major restraint for the Reactive Hot Melt Adhesives market growth? Ans. Potential cost implications is expected to be the major restraining factor for the market growth. 3. Which region is expected to lead the global Reactive Hot Melt Adhesives market during the forecast period? Ans. Asia Pacific is expected to lead the global market during the forecast period. 4. What is the projected market size & and growth rate of the Reactive Hot Melt Adhesives Market? Ans. The Reactive Hot Melt Adhesives Market size was valued at USD 1.82 Billion in 2023 and the total Reactive Hot Melt Adhesives revenue is expected to grow at a CAGR of 7.2% from 2023 to 2030, reaching nearly USD 2.96 Billion by 2030. 5. What segments are covered in the Reactive Hot Melt Adhesives Market report? Ans. The segments covered in the market report are test, product, and end-user.

1. Reactive Hot Melt Adhesives Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Reactive Hot Melt Adhesives Market: Dynamics 2.1. Preference Analysis 2.2. Reactive Hot Melt Adhesives Market Trends by Region 2.2.1. North America Reactive Hot Melt Adhesives Market Trends 2.2.2. Europe Reactive Hot Melt Adhesives Market Trends 2.2.3. Asia Pacific Reactive Hot Melt Adhesives Market Trends 2.2.4. Middle East and Africa Reactive Hot Melt Adhesives Market Trends 2.2.5. South America Reactive Hot Melt Adhesives Market Trends 2.3. Reactive Hot Melt Adhesives Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Reactive Hot Melt Adhesives Market Drivers 2.3.1.2. North America Reactive Hot Melt Adhesives Market Restraints 2.3.1.3. North America Reactive Hot Melt Adhesives Market Opportunities 2.3.1.4. North America Reactive Hot Melt Adhesives Market Challenges 2.3.2. Europe 2.3.2.1. Europe Reactive Hot Melt Adhesives Market Drivers 2.3.2.2. Europe Reactive Hot Melt Adhesives Market Restraints 2.3.2.3. Europe Reactive Hot Melt Adhesives Market Opportunities 2.3.2.4. Europe Reactive Hot Melt Adhesives Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Reactive Hot Melt Adhesives Market Drivers 2.3.3.2. Asia Pacific Reactive Hot Melt Adhesives Market Restraints 2.3.3.3. Asia Pacific Reactive Hot Melt Adhesives Market Opportunities 2.3.3.4. Asia Pacific Reactive Hot Melt Adhesives Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Reactive Hot Melt Adhesives Market Drivers 2.3.4.2. Middle East and Africa Reactive Hot Melt Adhesives Market Restraints 2.3.4.3. Middle East and Africa Reactive Hot Melt Adhesives Market Opportunities 2.3.4.4. Middle East and Africa Reactive Hot Melt Adhesives Market Challenges 2.3.5. South America 2.3.5.1. South America Reactive Hot Melt Adhesives Market Drivers 2.3.5.2. South America Reactive Hot Melt Adhesives Market Restraints 2.3.5.3. South America Reactive Hot Melt Adhesives Market Opportunities 2.3.5.4. South America Reactive Hot Melt Adhesives Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Reactive Hot Melt Adhesives Industry 2.8. Analysis of Government Schemes and Initiatives For the Reactive Hot Melt Adhesives Industry 2.9. The Global Pandemic's Impact on Reactive Hot Melt Adhesives Market 2.10. Reactive Hot Melt Adhesives Price Trend Analysis (2021-22) 3. Reactive Hot Melt Adhesives Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2023-2030) 3.1. Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 3.1.1. Polyurethane 3.1.2. Polyolefin 3.2. Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 3.2.1. High Temperature 3.2.2. Low Temperature 3.3. Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 3.3.1. Automotive & Transportation 3.3.2. Doors & Windows 3.3.3. Furniture & Upholstery 3.3.4. Lamination 3.3.5. Textile 3.3.6. Assembly 3.4. Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 3.4.1. Plastic 3.4.2. Wood 3.5. Reactive Hot Melt Adhesives Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Reactive Hot Melt Adhesives Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.5. North America Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 4.5.1. Polyurethane 4.5.2. Polyolefin 4.6. North America Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 4.6.1. High Temperature 4.6.2. Low Temperature 4.7. North America Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 4.7.1. Automotive & Transportation 4.7.2. Doors & Windows 4.7.3. Furniture & Upholstery 4.7.4. Lamination 4.7.5. Textile 4.7.6. Assembly 4.8. Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 4.8.1. Plastic 4.8.2. Wood 5. North America Reactive Hot Melt Adhesives Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 5.5.1.1.1. Polyurethane 5.5.1.1.2. Polyolefin 5.5.1.2. United States Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 5.5.1.2.1. High Temperature 5.5.1.2.2. Low Temperature 5.5.1.3. United States Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 5.5.1.3.1. Automotive & Transportation 5.5.1.3.2. Doors & Windows 5.5.1.3.3. Furniture & Upholstery 5.5.1.3.4. Lamination 5.5.1.3.5. Textile 5.5.1.3.6. Assembly 5.5.1.4. Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 5.5.1.4.1. Plastic 5.5.1.4.2. Wood 5.5.2. Canada 5.5.2.1. Canada Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 5.5.2.1.1. Polyurethane 5.5.2.1.2. Polyolefin 5.5.2.2. Canada Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 5.5.2.2.1. High Temperature 5.5.2.2.2. Low Temperature 5.5.2.3. Canada Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 5.5.2.3.1. Automotive & Transportation 5.5.2.3.2. Doors & Windows 5.5.2.3.3. Furniture & Upholstery 5.5.2.3.4. Lamination 5.5.2.3.5. Textile 5.5.2.3.6. Assembly 5.5.2.4. Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 5.5.2.4.1. Plastic 5.5.2.4.2. Wood 5.5.3. Mexico 5.5.3.1. Mexico Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 5.5.3.1.1. Polyurethane 5.5.3.1.2. Polyolefin 5.5.3.2. Mexico Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 5.5.3.2.1. High Temperature 5.5.3.2.2. Low Temperature 5.5.3.3. Mexico Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 5.5.3.3.1. Automotive & Transportation 5.5.3.3.2. Doors & Windows 5.5.3.3.3. Furniture & Upholstery 5.5.3.3.4. Lamination 5.5.3.3.5. Textile 5.5.3.3.6. Assembly 5.5.3.4. Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 5.5.3.4.1. Plastic 5.5.3.4.2. Wood 6. Europe Reactive Hot Melt Adhesives Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.5. Europe Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.6. Europe Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.7. Europe Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.8. 6.7. Europe Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9. Europe Reactive Hot Melt Adhesives Market Size and Forecast, by Country (2023-2030) 6.9.1. United Kingdom 6.9.1.1. United Kingdom Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.1.2. United Kingdom Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.1.3. United Kingdom Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.1.4. United Kingdom Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.2. France 6.9.2.1. France Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.2.2. France Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.2.3. France Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.2.4. France Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.3. Germany 6.9.3.1. Germany Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.3.2. Germany Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.3.3. Germany Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.3.4. Germany Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.4. Italy 6.9.4.1. Italy Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.4.2. Italy Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.4.3. Italy Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.4.4. Italy Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.5. Spain 6.9.5.1. Spain Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.5.2. Spain Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.5.3. Spain Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.5.4. Spain Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.6. Sweden 6.9.6.1. Sweden Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.6.2. Sweden Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.6.3. Sweden Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.6.4. Sweden Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.7. Austria 6.9.7.1. Austria Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.7.2. Austria Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.7.3. Austria Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.7.4. Austria Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 6.9.8. Rest of Europe 6.9.8.1. Rest of Europe Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 6.9.8.2. Rest of Europe Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 6.9.8.3. Rest of Europe Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 6.9.8.4. Rest of Europe Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 7.5. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.6. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.7. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.8. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9. Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, by Country (2023-2030) 7.9.1. China 7.9.1.1. China Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.1.2. China Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.1.3. China Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.1.4. China Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.2. S Korea 7.9.2.1. S Korea Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.2.2. S Korea Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.2.3. S Korea Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.2.4. S Korea Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.3. Japan 7.9.3.1. Japan Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.3.2. Japan Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.3.3. Japan Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.3.4. Japan Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.4. India 7.9.4.1. India Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.4.2. India Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.4.3. India Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.4.4. India Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.5. Australia 7.9.5.1. Australia Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.5.2. Australia Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.5.3. Australia Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.5.4. Australia Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.6. Indonesia 7.9.6.1. Indonesia Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.6.2. Indonesia Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.6.3. Indonesia Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.6.4. Indonesia Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.7. Malaysia 7.9.7.1. Malaysia Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.7.2. Malaysia Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.7.3. Malaysia Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.7.4. Malaysia Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.8. Vietnam 7.9.8.1. Vietnam Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.8.2. Vietnam Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.8.3. Vietnam Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.8.4. Vietnam Reactive Hot Melt Adhesives Market Size and Forecast, by Substrate (2023-2030) 7.9.9. Taiwan 7.9.9.1. Taiwan Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.9.2. Taiwan Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.9.3. Taiwan Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.9.4. Taiwan Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 7.9.10. Rest of Asia Pacific 7.9.10.1. Rest of Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 7.9.10.2. Rest of Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 7.9.10.3. Rest of Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 7.9.10.4. Rest of Asia Pacific Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 8. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 8.5. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 8.6. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 8.7. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 8.8. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 8.9. Middle East and Africa Reactive Hot Melt Adhesives Market Size and Forecast, by Country (2023-2030) 8.9.1. South Africa 8.9.1.1. South Africa Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 8.9.1.2. South Africa Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 8.9.1.3. South Africa Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 8.9.1.4. South Africa Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 8.9.2. GCC 8.9.2.1. GCC Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 8.9.2.2. GCC Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 8.9.2.3. GCC Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 8.9.2.4. GCC Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 8.9.3. Nigeria 8.9.3.1. Nigeria Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 8.9.3.2. Nigeria Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 8.9.3.3. Nigeria Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 8.9.3.4. Nigeria Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 8.9.4. Rest of ME&A 8.9.4.1. Rest of ME&A Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 8.9.4.2. Rest of ME&A Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 8.9.4.3. Rest of ME&A Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 8.9.4.4. Rest of ME&A Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 9. South America Reactive Hot Melt Adhesives Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 9.5. South America Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 9.6. South America Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 9.7. South America Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 9.8. South America Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 9.9. South America Reactive Hot Melt Adhesives Market Size and Forecast, by Country (2023-2030) 9.9.1. Brazil 9.9.1.1. Brazil Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 9.9.1.2. Brazil Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 9.9.1.3. Brazil Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 9.9.1.4. Brazil Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 9.9.2. Argentina 9.9.2.1. Argentina Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 9.9.2.2. Argentina Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 9.9.2.3. Argentina Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 9.9.2.4. Argentina Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 9.9.3. Rest Of South America 9.9.3.1. Rest Of South America Reactive Hot Melt Adhesives Market Size and Forecast, by Resin Type (2023-2030) 9.9.3.2. Rest Of South America Reactive Hot Melt Adhesives Market Size and Forecast, by Type (2023-2030) 9.9.3.3. Rest Of South America Reactive Hot Melt Adhesives Market Size and Forecast, By Application (2023-2030) 9.9.3.4. Rest of South America Reactive Hot Melt Adhesives Market Size and Forecast, By Substrate (2023-2030) 10. Global Reactive Hot Melt Adhesives Market: Competitive Landscape 10.5. MMR Competition Matrix 10.6. Competitive Landscape 10.7. Key Players Benchmarking 10.7.1. Company Name 10.7.2. Product Segment 10.7.3. End-user Segment 10.7.4. Revenue (2022) 10.7.5. Company Locations 10.8. Market Analysis by Organized Players vs. Unorganized Players 10.8.1. Organized Players 10.8.2. Unorganized Players 10.9. Leading Reactive Hot Melt Adhesives Market Companies, by market capitalization 10.10. Market Structure 10.10.1. Market Leaders 10.10.2. Market Followers 10.10.3. Emerging Players 10.11. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.5. Henkel 11.5.1. Company Overview 11.5.2. Business Portfolio 11.5.3. Financial Overview 11.5.4. SWOT Analysis 11.5.5. Strategic Analysis 11.5.6. Scale of Operation (small, medium, and large) 11.5.7. Details on Partnership 11.5.8. Regulatory Accreditations and Certifications Received by Them 11.5.9. Awards Received by the Firm 11.5.10. Recent Developments 11.6. H. B. Fuller 11.7. Bostik Inc 11.8. 3M Company 11.9. Beardow & Adams 11.10. Novamelt (Henkel) 11.11. Jowat 11.12. Avery Dennison 11.13. DOW Corning 11.14. Kleiberit 11.15. Tex Year Industries 11.16. Nanpao 11.17. Tianyang 11.18. Renhe 11.19. Zhejiang Good 11.20. Huate 12. Key Findings 13. Industry Recommendations 14. Reactive Hot Melt Adhesives Market: Research Methodology