The Bunker Fuel Market size was valued at USD 36.20 Billion in 2023 and the total Bunker Fuel revenue is expected to grow at a CAGR of 6.9 % from 2024 to 2030, reaching nearly USD 69.12 Billion by 2030.Bunker Fuel Market Overview:

The Bunker Fuel market stands as a critical sector within the global maritime industry, serving as the primary source of power for various ships and vessels. Bunker fuel, a key component in the bunkering ecosystem, plays a pivotal role in facilitating international trade, seaborne tourism, and the transportation of goods across vast maritime routes. The Bunker Fuel market is influenced by several dynamic factors that contribute to its growth and evolution. Growing maritime trade, rising seaborne tourism, and the globalization of supply chains are among the primary drivers propelling the demand for bunker fuel. As economies, particularly in emerging regions, undergo industrialization and trade expansion, the need for efficient shipping services amplifies, consequently boosting the demand within the Bunker Fuel market.To know about the Research Methodology:-Request Free Sample Report Though, the market grapples with various challenges, including stringent environmental regulations aiming to curb emissions, particularly sulfur oxides (SOx) and nitrogen oxides (NOx). Compliance with these regulations necessitates costly modifications or the adoption of alternative, cleaner fuels, impacting the overall market landscape. The transition to cleaner energy sources represents a significant shift in the Bunker Fuel market. The global impetus towards sustainability encourages the exploration of alternative fuels and propulsion systems, challenging the dominance of traditional bunker fuels. This transformative trend shapes the long-term demand outlook for conventional bunker fuel market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Bunker Fuel Market. Bunker Fuel Market Competitive landscape

Bunker Fuel Market Dynamics

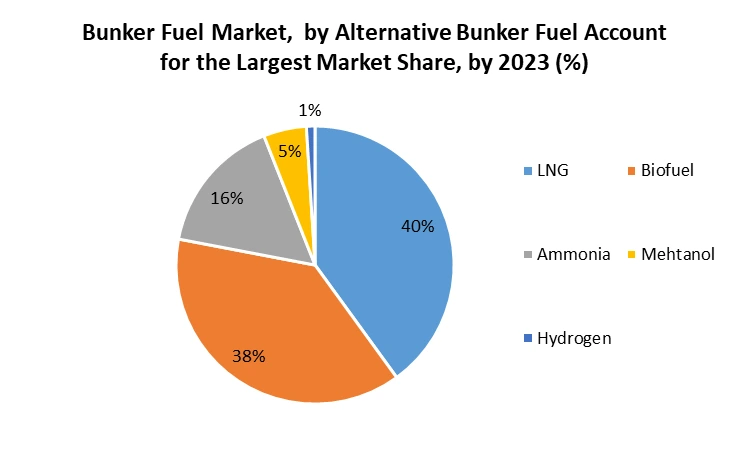

Growing Maritime Trade and Emerging Economies and Industrialization Driving the Bunker Fuel Market The Bunker Fuel Market witnesses robust growth due to the escalating volume of global maritime trade, presenting immense market potential. The expansion of international shipping operations directly correlates with an increased demand for bunker fuel, which serves as the primary power source for vessels navigating the world's oceans and waterways. The market thrives on the indispensable role bunker fuel plays in sustaining and facilitating the growing movement of goods and commodities across maritime trade routes, solidifying its significant market share. The market receives a substantial boost from the thriving cruise industry and the burgeoning popularity of seaborne tourism, contributing to its market penetration. Cruise ships and passenger vessels heavily rely on bunker fuel to propel their maritime journeys. As the demand for luxurious and adventurous cruise experiences continues to rise, the consumption of bunker fuel follows suit, affirming its role in shaping emerging trends within the seaborne tourism sector. Economic advancement in emerging economies becomes a catalyst for the Bunker Fuel Market, unlocking new opportunities. The ongoing process of industrialization and increased trade activities in these emerging regions significantly contributes to the demand for shipping services, driving a parallel increase in the consumption of bunker fuel. This underscores the market's role in supporting the economic development of emerging nations and highlights its potential to capitalize on industrialization trends. The Bunker Fuel Market experiences propulsion through the globalization of supply chains, positioning itself as a key player. The imperative for efficient and cost-effective shipping solutions in a globally interconnected market amplifies the demand for bunker fuel, making it a crucial component of international trade. Acting as the lifeblood of global commerce, bunker fuel ensures the seamless movement of goods across expansive supply chains, solidifying its strategic importance and pricing analysis. Stringent Environmental Regulations and Volatility in Oil Prices Restraining the Bunker Fuel Market The Bunker Fuel Market faces headwinds due to stringent environmental regulations targeting emissions, particularly sulfur oxides (SOx) and nitrogen oxides (NOx), posing challenges to market innovation. Compliance with these regulations necessitates costly fuel modifications or the adoption of alternative fuels, impacting operational norms and fuel choices. The market contends with the need for eco-friendly practices to align with evolving environmental standards and faces the fluctuation of compliance costs. Bunker fuel prices, intricately linked to fluctuations in crude oil prices, introduce an element of unpredictability and risk for the market. Volatile oil prices can lead to sudden and unpredictable spikes in operational costs for shipping companies, thereby affecting their overall profitability. The market remains susceptible to the inherent uncertainties associated with the global oil market, making pricing analysis and strategic decision-making critical for stakeholders. The global movement toward cleaner and sustainable energy sources poses a formidable challenge to traditional bunker fuels, prompting industry players to explore innovative solutions. The maritime industry's exploration of alternative fuels and propulsion systems reflects a strategic shift that could impact the long-term demand for conventional bunker fuel. The market grapples with the need to adapt to a changing energy landscape while navigating the evolving preferences for environmentally friendly alternatives, highlighting the necessity for continuous innovation in the industry. The Bunker Fuel Market encounters disruptions stemming from the impact of the COVID-19 pandemic on global trade and shipping activities, emphasizing the need for market adaptability. The temporary decline in bunker fuel demand, coupled with economic uncertainties and fluctuating shipping patterns, underscores the market's vulnerability to external shocks. Ongoing recovery efforts continue to shape the market's trajectory in the aftermath of pandemic-induced challenges, emphasizing the importance of identifying new opportunities amidst market fluctuations. Ongoing advancements in vessel design and propulsion technologies present both opportunities and challenges for the Bunker Fuel Market, driving industry innovation. While these innovations aim to enhance fuel efficiency, subsequently reducing overall bunker fuel consumption, they also introduce a transformative trend. The market grapples with the need to embrace these advancements for environmental sustainability while considering the potential constraints on traditional bunker fuel demand posed by more efficient vessel technologies. Navigating these technological advancements becomes crucial for maintaining market share and capitalizing on emerging trends.

Bunker Fuel Market Segment Analysis

Type: Historically, HSFO has held a substantial share in the bunker fuel market, but its dominance is diminishing due to environmental regulations favoring lower Sulfur alternatives. The segment is currently undergoing a significant decline, driven by the International Maritime Organization's (IMO) regulations mandating a reduction in Sulfur content, leading to a shift towards low Sulfur alternatives. LSFO has emerged as a dominant segment propelled by environmental concerns and stringent regulatory requirements. The increasing adoption of LSFO is fuelled by the imperative for regulatory compliance, meeting the Sulfur content limits set by the IMO. This positions LSFO as a major player in the transitioning bunker fuel market. MGO, with its lower Sulfur content compared to HSFO, occupies a niche market catering primarily to vessels preferring cleaner fuels. Its popularity is pronounced in regions with stricter emission standards, positioning MGO as a key player in specific geographical areas or for vessels with stringent emission requirements. The others category introduces a diverse range of specialty fuels and blends tailored to specific vessel requirements or market niches. Ongoing research and development activities play a pivotal role in introducing innovative fuel types within this category, addressing specific needs and compliance requirements. Commercial Distributor: Oil majors maintain a dominant position in the bunker fuel distribution market, leveraging their extensive infrastructure and global presence. These companies offer a wide spectrum of bunker fuel types, providing comprehensive solutions to meet the diverse needs of shipping companies globally. Large independent distributors have expanded their market share, providing a competitive alternative to oil majors. They often concentrate on specific regions or markets, providing flexibility and customized services to cater to the evolving demands of shipping companies. Small independent distributors play a crucial role in serving local markets and niche segments with their specialized knowledge. Their agility and ability to provide personalized services make them essential for certain regions or specialized shipping operations. Application: Bunker fuels for container vessels constitute a major market segment due to the substantial volume of global container shipping. The focus in this segment is on providing bunker fuels that not only comply with emission standards but also enhance fuel efficiency for container ships. Bulk carriers maintain a consistent demand for bunker fuels, emphasizing fuel quality and compliance with international regulations. Economic factors influencing global trade patterns directly impact the demand for bunker fuels in this segment. Bunker fuels for oil tankers are tailored to meet specialized requirements, with a focus on safety, stability, and compliance with stringent regulations. The demand patterns in this segment are intricately connected to the dynamics of the global oil trade landscape. Bunker fuel for general cargo vessels requires versatility to accommodate a diverse range of cargoes and routes. The emphasis is on providing bunker fuels that strike a balance between efficiency and compliance with environmental regulations. Bunker fuels for chemical tankers must meet stringent standards to ensure the safe transportation of hazardous materials. Compliance with international regulations governing the transport of chemicals is a critical factor in this segment. Fishing vessels have unique bunker fuel requirements, prioritizing considerations such as fuel stability, storage, and environmental sustainability. The demand in this segment may vary based on regional fishing activities and specific regulatory frameworks. Bunker fuels for gas tankers need to meet specific requirements for the transportation of liquefied natural gas (LNG) or other gases. Safety considerations and fuel efficiency take precedence in this segment, given the nature of the cargo. The others category encompasses various vessel types with specific bunker fuel requirements. Bunker fuel providers tailor their offerings to meet the unique needs of vessels falling within this diverse category.Bunker Fuel Market Regional Analysis

The North American region plays a pivotal role in the Bunker Fuel Market, characterized by a robust maritime industry and extensive trade networks. The region experiences steady growth, driven by the flourishing shipping activities along the Atlantic and Pacific coasts. Major ports in the United States and Canada contribute significantly to the demand for bunker fuel, making North America a major player in the market's regional segment. The stringent environmental regulations in this region also influence the market dynamics, prompting the exploration of cleaner fuel options and technological innovations. North America's commitment to sustainable practices shapes the Bunker Fuel Market's future trajectory, making it an influential and evolving segment. The Bunker Fuel Market witnesses notable regional growth in the U.S., Canada, and Mexico, with a substantial market share in these countries. The Asia Pacific stands out as a dynamic and rapidly growing market for bunker fuel, fuelled by the expansive economies of countries like China, Japan, and South Korea. The region's strategic location as a global trade hub contributes to the escalating demand for bunker fuel, particularly in key ports such as Singapore and Shanghai. The burgeoning manufacturing sector, rising seaborne trade, and the increasing popularity of seaborne tourism drive the market's potential in the Asia Pacific. The adoption of advanced technologies and a proactive approach to align with international maritime standards position Asia Pacific as a booming segment, presenting lucrative opportunities for market penetration and expansion. The Bunker Fuel Market holds a substantial regional share in Brazil and experiences significant market share in China and Indonesia. Europe distinguishes itself as a mature and technologically advanced market for bunker fuel, marked by a strong emphasis on sustainability and energy efficiency. The region's well-established maritime infrastructure and significant ports contribute to the steady demand for bunker fuel. Europe is a major segment in the Bunker Fuel Market, characterized by the dominance of major oil companies and a focus on meeting stringent environmental standards. The regional segment is witnessing a shift toward cleaner energy sources and innovative propulsion systems, reflecting Europe's commitment to reducing emissions and embracing green practices. The Bunker Fuel Market in Europe represents a major share, reflecting stability, innovation, and adaptation to evolving industry trends. The Bunker Fuel Market demonstrates notable regional growth in Germany and France. The Middle East and Africa showcase a distinctive market landscape for bunker fuel, influenced by economic diversification and infrastructure development. The region experiences unique market dynamics with a particular focus on catering to the needs of the oil and gas industry, maritime trade, and emerging seaborne tourism. Major bunkering hubs in the Middle East, including the UAE and Saudi Arabia, contribute significantly to the market's regional segment. The expansion of the hospitality sector, driven by tourism and economic diversification efforts, presents opportunities for bunker fuel suppliers. The market in the Middle East and Africa is characterized by a mix of established trade routes and emerging maritime activities, making it a region with significant potential for market share growth and strategic partnerships. The Bunker Fuel Market holds substantial potential in the Middle East and Africa, driven by regional key players and diverse growth factors.Bunker Fuel Market Competitive Landscape: Minerva Bunkering, a global bunker fuel market player, has successfully launched its bunkering service in the Suez Canal and Egyptian Ports. Having completed ten deliveries in Egypt, the company stands as a major bunker fuel market share holder, and providing substantial cost savings to vessels awaiting transit convoys. With a focus on flexibility, Minerva leverages its significant physical logistics assets, including a 150k DWT floating storage unit (MV Cronus) and five modern bunkering tankers. Minerva's strategic significance in Egypt is highlighted by its licensing to operate in Suez Canal waiting anchorages and 12 Egyptian ports, making it a leading key player in the region. In close collaboration with authorities such as the Ministry of Petroleum, Suez Canal Authority, and relevant port authorities, Minerva aims to empower customers by lowering their total cost of bunkers procurement. Utilizing its extensive cargo sourcing network, Minerva provides VLSFO, HSFO, and MGO to vessels in the region, establishing itself as a bunker fuel prominent manufacturer. The company's contributions to the international shipping community in Egyptian ports position it as a key player in the bunker Fuel market. As well, Minerva Bunkering's partnership with rise-x.io to establish ADP Clear Pte. Ltd. in Singapore showcases its commitment to driving digitalization and efficiency in the marine fuel market. Combining Minerva's Advanced Delivery Platform (ADP) with rise-x.io's DIANA Ecosystem Operating Platform, the collaboration aims to offer end-to-end bunkering solutions in a digital ecosystem. Minerva's ADP, with integrated hardware and software, provides real-time insights into bunkering operations, solidifying its position as a bunker fuel market leading key player in the digitalization landscape. In a strategic move towards sustainability, Minerva Bunkering has entered into a global collaboration agreement with Renewable Energy Group, Inc. (REG) and Bunker Holding Group. The collaboration focuses on advancing Bunker Fuel use in the U.S. and EU marine markets, showcasing Minerva's commitment to reducing greenhouse gas emissions. This collaboration underlines Minerva's role as a major bunker fuel market share holder, actively contributing to the transition of the shipping industry to sustainable bio-based diesel. Also, Bunker Holding, another major bunker fuel market share holder, collaborates with NeoGreen Hydrogen Corp., signing a Memorandum of Understanding to operate in the green ammonia and synthetic fuels sector. This strategic move aligns with the EU's FuelEU Maritime regulations and expected IMO regulations, positioning Bunker Holding as a key player in addressing the bunker fuel industry's transition to a low-carbon future. As Minerva Bunkering continues to expand its services and collaborations, the company remains a forefront global bunker fuel market player, emphasizing innovation, sustainability, and efficiency in the ever-evolving marine fuel sector.

Bunker Fuel Markets Scope: Inquire before buying

Global Bunker Fuel Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 36.20 Bn. Forecast Period 2024 to 2030 CAGR: 6.9% Market Size in 2030: US $ 69.12 Bn. Segments Covered: by Type High Sulfur Fuel Oil Low Sulfur Fuel Oil Marine Gasoil Others by Commercial Distributor Oil Majors Large Independent Distributor Small Independent Distributor by Application Container Bulk Carrier Oil Tanker General Cargo Chemical Tanker Fishing Vessels Gas Tanker Others Bunker Fuel Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bunker Fuel Market Key Players:

Major Global Key Players: 1. Shell (Singapore) 2. Bunker Holding A/S (Denmark) Leading Key Players in North America: 1. Aegean Marine Petroleum Network Inc. (United States) 2. BP PLC (United Kingdom) 3. World Fuel Services (United States) 4. Exxon Mobil (United States) Market Follower key Players in Europe: 1. Chemoil Energy Ltd. (United Kingdom) 2. Gazprom Neft PJSC (Russia) 3. AC Bunker Fuels Ltd. (United Kingdom) 4. KPI Bridge Oil A/S (Denmark) 5. Royal Dutch Shell PLC (Netherlands) 6. Total Marine Fuel (France) 7. Bright Oil (United Kingdom) 8. Lukoil-Bunker (Russia) 9. Alliance Oil Company (Sweden) Prominent Key player Asia Pacific: 1. Bomin Bunker Oil Corp. (Singapore) 2. China Marine Bunker (China) 3. Bunker Holding (Singapore) 4. Sinopec (China) 5. GAC (United Arab Emirates) 6. China Changjiang Bunke (China) 7. Southern Pec (Singapore) 8. Shanghai Lonyer Fuels (China) FAQ’s: 1. What is the Bunker Fuel Market? Ans: The Bunker Fuel Market refers to the global industry involved in the production, distribution, and sale of fuel to power ships and vessels. It plays a crucial role in maritime transportation. 2. What types of fuels are used in the Bunker Fuel Market? Ans: Common fuels include IFO 380, IFO 180, MGO, and MDO. IFO (Intermediate Fuel Oil) and MGO/MDO (Marine Gas Oil/Marine Diesel Oil) are primary choices for various vessels. 3. What drives the demand for bunker fuel? Ans: Growing maritime trade, rising seaborne tourism, emerging economies, and the globalization of supply chains are key drivers fueling demand in the Bunker Fuel Market. 4. How does the market cope with environmental regulations? Ans: Stringent environmental regulations pose challenges, requiring compliance with emission standards. This often involves costly fuel modifications or the adoption of alternative, cleaner fuels. 5. What impacts bunker fuel prices? Ans: Bunker fuel prices are closely tied to crude oil prices. Volatility in oil prices can lead to unpredictable and increased operational costs for shipping companies.

1. Bunker Fuel Market: Research Methodology 2. Bunker Fuel Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Bunker Fuel Market: Dynamics 3.1. Bunker Fuel Market Trends by Region 3.1.1. North America Bunker Fuel Market Trends 3.1.2. Europe Bunker Fuel Market Trends 3.1.3. Asia Pacific Bunker Fuel Market Trends 3.1.4. Middle East and Africa Bunker Fuel Market Trends 3.1.5. South America Bunker Fuel Market Trends 3.2. Bunker Fuel Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Bunker Fuel Market Drivers 3.2.1.2. North America Bunker Fuel Market Restraints 3.2.1.3. North America Bunker Fuel Market Opportunities 3.2.1.4. North America Bunker Fuel Market Challenges 3.2.2. Europe 3.2.2.1. Europe Bunker Fuel Market Drivers 3.2.2.2. Europe Bunker Fuel Market Restraints 3.2.2.3. Europe Bunker Fuel Market Opportunities 3.2.2.4. Europe Bunker Fuel Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Bunker Fuel Market Drivers 3.2.3.2. Asia Pacific Bunker Fuel Market Restraints 3.2.3.3. Asia Pacific Bunker Fuel Market Opportunities 3.2.3.4. Asia Pacific Bunker Fuel Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Bunker Fuel Market Drivers 3.2.4.2. Middle East and Africa Bunker Fuel Market Restraints 3.2.4.3. Middle East and Africa Bunker Fuel Market Opportunities 3.2.4.4. Middle East and Africa Bunker Fuel Market Challenges 3.2.5. South America 3.2.5.1. South America Bunker Fuel Market Drivers 3.2.5.2. South America Bunker Fuel Market Restraints 3.2.5.3. South America Bunker Fuel Market Opportunities 3.2.5.4. South America Bunker Fuel Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Bunker Fuel Market 3.8. Analysis of Government Schemes and Initiatives For Bunker Fuel Market 3.9. The Global Pandemic Impact on Bunker Fuel Market 4. Bunker Fuel Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Bunker Fuel Market Size and Forecast, By Type (2023-2030) 4.1.1. High Sulfur Fuel Oil 4.1.2. Low Sulfur Fuel Oil 4.1.3. Marine Gasoil 4.1.4. Others 4.2. Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 4.2.1. Oil Majors 4.2.2. Large Independent Distributor 4.2.3. Small Independent Distributor 4.3. Bunker Fuel Market Size and Forecast, By Application (2023-2030) 4.3.1. Container 4.3.2. Bulk Carrier 4.3.3. Oil Tanker 4.3.4. General Cargo 4.3.5. Chemical Tanker 4.3.6. Fishing Vessels 4.3.7. Gas Tanker 4.3.8. Others 4.4. Bunker Fuel Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Bunker Fuel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Bunker Fuel Market Size and Forecast, By Type (2023-2030) 5.1.1. High Sulfur Fuel Oil 5.1.2. Low Sulfur Fuel Oil 5.1.3. Marine Gasoil 5.1.4. Others 5.2. North America Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 5.2.1. Oil Majors 5.2.2. Large Independent Distributor 5.2.3. Small Independent Distributor 5.3. North America Bunker Fuel Market Size and Forecast, By Application (2023-2030) 5.3.1. Container 5.3.2. Bulk Carrier 5.3.3. Oil Tanker 5.3.4. General Cargo 5.3.5. Chemical Tanker 5.3.6. Fishing Vessels 5.3.7. Gas Tanker 5.3.8. Others 5.4. North America Bunker Fuel Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Bunker Fuel Market Size and Forecast, By Type (2023-2030) 5.4.1.1.1. High Sulfur Fuel Oil 5.4.1.1.2. Low Sulfur Fuel Oil 5.4.1.1.3. Marine Gasoil 5.4.1.1.4. Others 5.4.1.2. United States Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 5.4.1.2.1. Oil Majors 5.4.1.2.2. Large Independent Distributor 5.4.1.2.3. Small Independent Distributor 5.4.1.3. United States Bunker Fuel Market Size and Forecast, By Application (2023-2030) 5.4.1.3.1. Container 5.4.1.3.2. Bulk Carrier 5.4.1.3.3. Oil Tanker 5.4.1.3.4. General Cargo 5.4.1.3.5. Chemical Tanker 5.4.1.3.6. Fishing Vessels 5.4.1.3.7. Gas Tanker 5.4.1.3.8. Others 5.4.2. Canada 5.4.2.1. Canada Bunker Fuel Market Size and Forecast, By Type (2023-2030) 5.4.2.1.1. High Sulfur Fuel Oil 5.4.2.1.2. Low Sulfur Fuel Oil 5.4.2.1.3. Marine Gasoil 5.4.2.1.4. Others 5.4.2.2. Canada Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 5.4.2.2.1. Oil Majors 5.4.2.2.2. Large Independent Distributor 5.4.2.2.3. Small Independent Distributor 5.4.2.3. Canada Bunker Fuel Market Size and Forecast, By Application (2023-2030) 5.4.2.3.1. Container 5.4.2.3.2. Bulk Carrier 5.4.2.3.3. Oil Tanker 5.4.2.3.4. General Cargo 5.4.2.3.5. Chemical Tanker 5.4.2.3.6. Fishing Vessels 5.4.2.3.7. Gas Tanker 5.4.2.3.8. Others 5.4.3. Mexico 5.4.3.1. Mexico Bunker Fuel Market Size and Forecast, By Type (2023-2030) 5.4.3.1.1. High Sulfur Fuel Oil 5.4.3.1.2. Low Sulfur Fuel Oil 5.4.3.1.3. Marine Gasoil 5.4.3.1.4. Others 5.4.3.2. Mexico Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 5.4.3.2.1. Oil Majors 5.4.3.2.2. Large Independent Distributor 5.4.3.2.3. Small Independent Distributor 5.4.3.3. Mexico Bunker Fuel Market Size and Forecast, By Application (2023-2030) 5.4.3.3.1. Container 5.4.3.3.2. Bulk Carrier 5.4.3.3.3. Oil Tanker 5.4.3.3.4. General Cargo 5.4.3.3.5. Chemical Tanker 5.4.3.3.6. Fishing Vessels 5.4.3.3.7. Gas Tanker 5.4.3.3.8. Others 6. Europe Bunker Fuel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.2. Europe Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.3. Europe Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4. Europe Bunker Fuel Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.1.2. United Kingdom Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.1.3. United Kingdom Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.2. France 6.4.2.1. France Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.2.2. France Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.2.3. France Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.3.2. Germany Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.3.3. Germany Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.4.2. Italy Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.4.3. Italy Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.5.2. Spain Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.5.3. Spain Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.6.2. Sweden Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.6.3. Sweden Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.7.2. Austria Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.7.3. Austria Bunker Fuel Market Size and Forecast, By Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Bunker Fuel Market Size and Forecast, By Type (2023-2030) 6.4.8.2. Rest of Europe Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 6.4.8.3. Rest of Europe Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Bunker Fuel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.2. Asia Pacific Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.3. Asia Pacific Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4. Asia Pacific Bunker Fuel Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.1.2. China Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.1.3. China Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.2.2. S Korea Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.2.3. S Korea Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.3.2. Japan Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.3.3. Japan Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.4. India 7.4.4.1. India Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.4.2. India Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.4.3. India Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.5.2. Australia Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.5.3. Australia Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.6.2. Indonesia Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.6.3. Indonesia Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.7.2. Malaysia Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.7.3. Malaysia Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.8.2. Vietnam Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.8.3. Vietnam Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.9.2. Taiwan Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.9.3. Taiwan Bunker Fuel Market Size and Forecast, By Application (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Bunker Fuel Market Size and Forecast, By Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 7.4.10.3. Rest of Asia Pacific Bunker Fuel Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Bunker Fuel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Bunker Fuel Market Size and Forecast, By Type (2023-2030) 8.2. Middle East and Africa Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 8.3. Middle East and Africa Bunker Fuel Market Size and Forecast, By Application (2023-2030) 8.4. Middle East and Africa Bunker Fuel Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Bunker Fuel Market Size and Forecast, By Type (2023-2030) 8.4.1.2. South Africa Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 8.4.1.3. South Africa Bunker Fuel Market Size and Forecast, By Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Bunker Fuel Market Size and Forecast, By Type (2023-2030) 8.4.2.2. GCC Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 8.4.2.3. GCC Bunker Fuel Market Size and Forecast, By Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Bunker Fuel Market Size and Forecast, By Type (2023-2030) 8.4.3.2. Nigeria Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 8.4.3.3. Nigeria Bunker Fuel Market Size and Forecast, By Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Bunker Fuel Market Size and Forecast, By Type (2023-2030) 8.4.4.2. Rest of ME&A Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 8.4.4.3. Rest of ME&A Bunker Fuel Market Size and Forecast, By Application (2023-2030) 9. South America Bunker Fuel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Bunker Fuel Market Size and Forecast, By Type (2023-2030) 9.2. South America Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 9.3. South America Bunker Fuel Market Size and Forecast, By Application (2023-2030) 9.4. South America Bunker Fuel Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Bunker Fuel Market Size and Forecast, By Type (2023-2030) 9.4.1.2. Brazil Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 9.4.1.3. Brazil Bunker Fuel Market Size and Forecast, By Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Bunker Fuel Market Size and Forecast, By Type (2023-2030) 9.4.2.2. Argentina Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 9.4.2.3. Argentina Bunker Fuel Market Size and Forecast, By Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Bunker Fuel Market Size and Forecast, By Type (2023-2030) 9.4.3.2. Rest Of South America Bunker Fuel Market Size and Forecast, By Commercial Distributor (2023-2030) 9.4.3.3. Rest Of South America Bunker Fuel Market Size and Forecast, By Application (2023-2030) 10. Global Bunker Fuel Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Bunker Fuel Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Aegean Marine Petroleum Network Inc. (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. BP PLC (United Kingdom) 11.3. World Fuel Services (United States) 11.4. Exxon Mobil (United States) 11.5. Bunker Holding A/S (Denmark) 11.6. Chemoil Energy Ltd. (United Kingdom) 11.7. Gazprom Neft PJSC (Russia) 11.8. AC Bunker Fuels Ltd. (United Kingdom) 11.9. KPI Bridge Oil A/S (Denmark) 11.10. Royal Dutch Shell PLC (Netherlands) 11.11. Total Marine Fuel (France) 11.12. Bright Oil (United Kingdom) 11.13. Lukoil-Bunker (Russia) 11.14. Alliance Oil Company (Sweden) 11.15. Bomin Bunker Oil Corp. (Singapore) 11.16. Shell (Singapore) 11.17. China Marine Bunker (China) 11.18. Bunker Holding (Singapore) 11.19. Sinopec (China) 11.20. GAC (United Arab Emirates) 11.21. China Changjiang Bunke (China) 11.22. Southern Pec (Singapore) 11.23. Shanghai Lonyer Fuels (China) 12. Key Findings 13. Industry Recommendations