Polycarbonate Market was valued at USD 14.17 Billion in 2023, and expected to reach USD 20.50 Billion by 2030, growing at a CAGR of 5.41 % during the forecast period (2024-2030) Polycarbonate, thanks to its superior material characteristics, such as heat resistance, strength-to-weight ratio, and chemical stability, is increasingly being used to replace traditional materials, including bronze, stainless steel, cast iron, and ceramics in the automotive industry. The increased demand for polycarbonate in the automotive industry is expected to drive the growth of polycarbonate market during the forecast period. Lightweight plastics are in high demand in the automotive industry due to their competitive pricing, high performance, style, reliability, strength, and safety. Plastic components weigh almost 50% lesser than similar components made from other materials, thus, providing 25%-35% improvement in fuel efficiency, which is a key factor in the automotive and transportation industry. Every 10% reduction in vehicle weight is estimated to result in a 5% to 7% reduction in fuel usage. In the automotive industry, polycarbonates allow energy absorption, weight reduction, shock absorption for bumpers, restriction of explosion risks in fuel tanks, seat belts, airbags, door and seat assemblies, subsystems, bumpers, under-bonnet components, exterior trim, and several other applications. This is expected to drive the growth of the polycarbonate market. Currently, to manufacture a typical 4-wheel vehicle, 10 kg of polycarbonate is used in various forms. Polycarbonates are used in manufacturing of sunroofs, window panes, entryway handles, inner lenses, door handles, headlight bezels, internal focal points, and radiator flame broils. Moreover, polycarbonate offers added advantages to manufacturers, which include no corrosion, noise-reduction, and low wear and tear, along with resultant increased component and vehicle life. Therefore, they have gradually become an integral part of the automotive industry. With polycarbonates expected to replace conventional materials in the automotive industry, their usage is expected to increase at a rapid pace during the forecast period. Furthermore, the increasing demand for the automotive sector, due to low interest rates and rising disposable incomes, may positively impact the polycarbonate market during the forecast period.To know about the Research Methodology:-Request Free Sample Report

Market Share Analysis of Key Competitors:

The global polycarbonate market is consolidated, with the top five companies accounted for almost 80% of the global production capacity in 2017. A majority of the production of polycarbonate is based in the Asia-Pacific and European regions. Covestro AG leads the polycarbonate market, with a little over 29% of the total production capacity. The company has sales representatives’ offices all across North America, Europe, and Asia-Pacific, which helps the company achieve the leading position in the global polycarbonate market. SABIC, Mitsubishi Engineering Plastics, Lotte Chemical Corporation, and Teijin Limited are the other major manufacturers of polycarbonate. All the major manufacturers are looking for capacity expansions during the forecast period, to further extend their reach to lucrative end-user markets. The other prominent manufacturers include LG Chem, Trinseo, Idemitsu Kosan, and Chi Mei Corporation. Covestro AG, being the largest global manufacturer of polycarbonate, is primarily focusing on expanding its production capacities to strengthen its position during the forecast period. To cater to the growing electronics, healthcare, and automotive industries in China and other Asian countries, the company has expansion strategy to increase its total production of polycarbonate and also to maintain its top position in the polycarbonate market. Other methods, such as recycling process technology, are also being adopted by the company to recycle the saltwater obtained at the production site, to produce chlorine and sodium hydroxide, which can be further used as raw materials for polycarbonate production. Through such processes, Covestro is emphasizing on the inclusion of eco-friendly, as well as energy efficient methods in the production lines.Growing Demand of Polycarbonate in Construction Industry: Polycarbonates are a high-performing thermoplastics which are highly suitable in building and construction applications. Polycarbonate material possesses properties, such as lightweight, high optical clarity, durability, excellent thermal stability, high-impact and high-heat resistance, high transparency, cold formability, and also possess excellent flammability resistance, making it one of the most used plastic types in construction applications. Polycarbonate sheets are used as a substitute for glass in a variety of skylight and window applications. They are also used as opaque cladding panels, barrel vaults, canopies, translucent walls, facades and signage, sports stadium roofs, louvers, and roof domes. Hence, due to such factors, the polycarbonate market is expected to witness a rise, during the forecast period.

Increasing Popularity of Polycarbonate against Conventional Materials: The material used for the applications where translucent and transparent solutions are desired is mainly glass. But it has its own drawbacks, such as fragility, difficulties in installation, and poor thermal efficiency among others. Polycarbonate materials are known for addressing these disadvantages of glass and other plastic materials. The main advantages of using polycarbonates are thermal insulation and low expertise for the installation, which is driving the growth of polycarbonate market. When compared to glass, polycarbonate sheets can be extruded in various thicknesses to improve structural integrity and higher thermal efficiency. One of the major advantages of polycarbonate sheets as compared to other materials is its ability to bend. The application of polycarbonate materials has highly increased in greenhouses and has almost replaced the conventional glass in the recent years. In Europe, countries, such as Germany, the Netherlands, Spain, and France, have larger areas for greenhouse cultivation. Europe has around 25% of the global commercial greenhouse market. The increasing popularity of polycarbonates, thanks to their advantages over other conventional materials (which include glass and other plastics), is expected to drive the polycarbonate market, during the forecast period.

Volatility in Raw Material Prices to Restraint Polycarbonate Market:

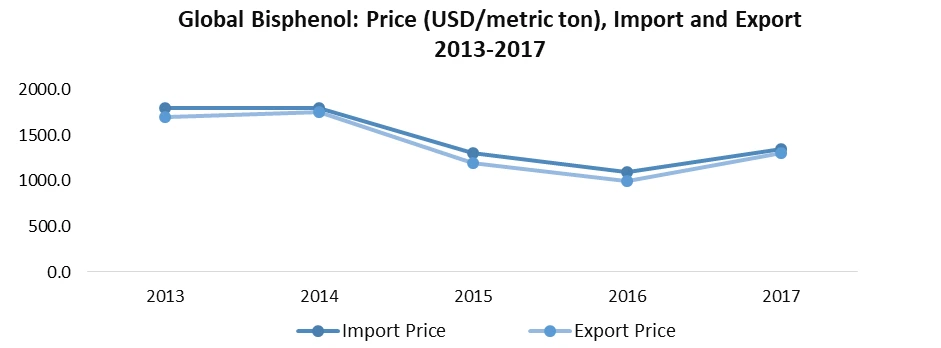

The primary raw materials for polycarbonate are Bisphenol-A (BPA) and phosgene(COCl2). The prices of these raw materials have witnessed volatility in the past few years, which, in turn, affected the demand for polycarbonates. Moreover, this affects and increases the pressure on profit margins of the polycarbonate resin manufacturers, as the raw materials required are generally purchased in bulk on a contract basis. Hence, the instability of raw material prices affects the polycarbonate market manufacturers. Fluctuations in the global economy have made it more difficult to balance supply and demand in the short-term, resulting in volatile raw material prices. The ability to accurately forecast and manage raw material pricing can become a competitive advantage for companies that can do it well. While critically important, the need to manage the prices constantly can get in the way of executing long-term objectives, such as the creation of well-defined organic growth programs. Raw material prices and sourcing are ongoing issues for any manufacturer, while shortages lead to price volatility, which is not desirable for anyone. Price volatility for some raw materials, along with product availability, is compelling formulators and manufacturers to look at alternative technologies for the roofing materials. Thus, volatile raw materials prices are expected to hinder the global polycarbonate market growth during the forecast period.

Sheets/Films to Dominate Product Type Segment in the Polycarbonate Market

Polycarbonate sheets and films are high-quality materials, which are increasingly being used for advanced applications. They are currently replacing glass, toughened glass, and polyethylene membrane, as they offer a perfect combination of lightweight, high-impact strength, light transmission, frame-resistance, UV protection, anti-drop properties, as well as better aesthetic appearance. This is expected to increase the demand for polycarbonate sheets and films, further driving the growth of polycarbonate market during the forecast period. Currently, the electrical and electronics industry is the largest end-user segment for polycarbonate films in applications, such as lighting applications, printed circuit boards, battery packs, labels and overlays, LED/LCD displays, and others. However, in polycarbonate market product type, polycarbonate sheets and films is expected to witness maximum growth in the automotive industry. Additionally, polycarbonate sheets are widely used to construct greenhouses, as they are resistant to heat, sunlight, snow, and rain, enabling them to last for many years without fading or discolouring. Electricals and Electronics to Dominate Application Segment in the Polycarbonate Market The electrical and electronics industry is the biggest end-user segment for the polycarbonate market, accounted for more than 47.42% (in terms of volume) share of the polycarbonate market in 2018. China is the largest consumer of polycarbonate, with approximately half of the demand (in terms of volume) coming from the electrical and electronics sector in the country. Electrical and electronics producers are gradually moving from high-cost to low-cost manufacturing locations. China is a strong, favourable market for electronics producers, owing to the country’s low labour cost and flexible policies. The demand for spike temperature resistance, high service temperature, ductility and toughness in thin sections, and non-flammability features in the material being used in electrical and electronics has further increased the demand for polycarbonate, since it is capitalized on its collective safety features. Further, polycarbonate materials fulfil quality and safety requirements, such as heat resistance and electrical insulation. This is expected to drive the demand for polycarbonate in electrical and electronics industry, further driving the growth of the polycarbonate market. China is Expected to hold the Largest Polycarbonate Market Share in Asia Pacific Region Despite the volatile growth in the real estate sector, the significant development of rail and road infrastructure by the Chinese government to withstand the growing industrial and service sectors have resulted in a significant growth of the Chinese construction industry, in the recent years. As the construction industry is dominated by the state-owned enterprises, the increased government spending is boosting the industry in the country. The demand for polycarbonate has also been witnessed from the Chinese automotive sector, which drove the growth of polycarbonate market in the country. China is by far the largest automotive manufacturer in the world since 2009, with the current share of production over 29%. In 2017, the Chinese automotive industry recorded a growth of 3.19% and reached a total of 29,015,434 units. China is currently spending only about 3% of the global healthcare spending to address healthcare needs of 22% of the world’s total population. To reduce this gap, China is investing heavily in their domestic healthcare sector. In 2017, the Chinese government increased its per capita subsidy for Basic Medical Insurance (BMI) from RMB 420 to RMB 450. This increase will result in the growth of healthcare expenditure, and in turn is expected to increase the production of healthcare products on the whole. Hence, with the growth in the electrical and electronics, construction and building, healthcare, and automotive sectors in the country, the demand for polycarbonate is expected to increase in the country, further driving the growth of polycarbonate market during the forecast period.Polycarbonate Market Scope: Inquire before buying

Global Polycarbonate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2017 to 2023 Market Size in 2023: US $ 14.17 Bn. Forecast Period 2024 to 2030 CAGR: 5.41% Market Size in 2030: US $ 20.50 Bn. Segments Covered: by Product Sheets/Films Fibers Blends Tubes and Other Product Types by Grade Injection Molding Extrusion Others by Application Automotive and Transportation Electricals and Electronics Construction Applications Medical Other Applications Polycarbonate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Polycarbonate Market, Key Players are:

1. Mitsubishi Engineering Plastics Corporation 2. SABIC 3. Covestro AG 4. Ningbo Zhetie Daphoon Chemical Co. Ltd 5. Chi Mei Corporation 6. LOTTE Chemical Corporation 7. EXOLON Group GmbH 8. Trinseo SA 9. Formosa Chemicals & Fibre Corp. 10. LG Chem 11. Teijin Limited 12. Samyang Corporation 13. Idemitsu Kosan Corporation Limited 14. Centroplast Engineering Plastics GmbH 15. Bayer Material Science AG 16. Royal DSM 17. Asahi Kasei Chemical Corporation Frequently Asked Questions: 1] Which region is expected to hold the largest market share in the global Polycarbonate Market? Ans. The Asia Pacific region is expected to hold the largest market share in the Polycarbonate Market during the forecast period. 2] What are the major key players of the global Polycarbonate Market? Ans. The major key players of the global Polycarbonate Market are Mitsubishi Engineering Plastics Corporation, SABIC, Covestro AG, Ningbo Zhetie Daphoon Chemical Co. Ltd, Chi Mei Corporation, LOTTE Chemical Corporation, among others. 3] What factors are expected to drive the growth of the global Polycarbonate Market? Ans. Growing demand in construction industry and increasing popularity of polycarbonate against conventional materials are the major factors expected to drive the growth of the global Polycarbonate Market during the forecast period. 4] What factors are expected to restraint the growth of the global Polycarbonate Market? Ans. Volatility in raw material prices is the major factor expected to restraint the growth of the global Polycarbonate Market during the forecast period. 3] Which product type segment is expected to dominate the global Polycarbonate Market? Ans. The sheets/films segment is expected to dominate the global Polycarbonate Market during the forecast period.

1. Polycarbonate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polycarbonate Market: Dynamics 2.1. Polycarbonate Market Trends by Region 2.1.1. North America Polycarbonate Market Trends 2.1.2. Europe Polycarbonate Market Trends 2.1.3. Asia Pacific Polycarbonate Market Trends 2.1.4. Middle East and Africa Polycarbonate Market Trends 2.1.5. South America Polycarbonate Market Trends 2.2. Polycarbonate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polycarbonate Market Drivers 2.2.1.2. North America Polycarbonate Market Restraints 2.2.1.3. North America Polycarbonate Market Opportunities 2.2.1.4. North America Polycarbonate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polycarbonate Market Drivers 2.2.2.2. Europe Polycarbonate Market Restraints 2.2.2.3. Europe Polycarbonate Market Opportunities 2.2.2.4. Europe Polycarbonate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polycarbonate Market Drivers 2.2.3.2. Asia Pacific Polycarbonate Market Restraints 2.2.3.3. Asia Pacific Polycarbonate Market Opportunities 2.2.3.4. Asia Pacific Polycarbonate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polycarbonate Market Drivers 2.2.4.2. Middle East and Africa Polycarbonate Market Restraints 2.2.4.3. Middle East and Africa Polycarbonate Market Opportunities 2.2.4.4. Middle East and Africa Polycarbonate Market Challenges 2.2.5. South America 2.2.5.1. South America Polycarbonate Market Drivers 2.2.5.2. South America Polycarbonate Market Restraints 2.2.5.3. South America Polycarbonate Market Opportunities 2.2.5.4. South America Polycarbonate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Polycarbonate Industry 2.8. Analysis of Government Schemes and Initiatives For Polycarbonate Industry 2.9. Polycarbonate Market price trend Analysis (2023-24) 2.10. Polycarbonate Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Polycarbonate 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Polycarbonate 2.11. Polycarbonate Production Analysis 2.12. The Global Pandemic Impact on Polycarbonate Market 3. Polycarbonate Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2023-2030 3.1. Polycarbonate Market Size and Forecast, by Product (2023-2030) 3.1.1. Sheets/Films 3.1.2. Fibers 3.1.3. Blends 3.1.4. Tubes and Other Product Types 3.2. Polycarbonate Market Size and Forecast, by Grade (2023-2030) 3.2.1. Injection Molding 3.2.2. Extrusion 3.2.3. Others 3.3. Polycarbonate Market Size and Forecast, by Application (2023-2030) 3.3.1. Automotive and Transportation 3.3.2. Electricals and Electronics 3.3.3. Construction Applications 3.3.4. Medical 3.3.5. Other Applications 3.4. Polycarbonate Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Polycarbonate Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 4.1. North America Polycarbonate Market Size and Forecast, by Product (2023-2030) 4.1.1. Sheets/Films 4.1.2. Fibers 4.1.3. Blends 4.1.4. Tubes and Other Product Types 4.2. North America Polycarbonate Market Size and Forecast, by Grade (2023-2030) 4.2.1. Injection Molding 4.2.2. Extrusion 4.2.3. Others 4.3. North America Polycarbonate Market Size and Forecast, by Application (2023-2030) 4.3.1. Automotive and Transportation 4.3.2. Electricals and Electronics 4.3.3. Construction Applications 4.3.4. Medical 4.3.5. Other Applications 4.4. North America Polycarbonate Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Polycarbonate Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Sheets/Films 4.4.1.1.2. Fibers 4.4.1.1.3. Blends 4.4.1.1.4. Tubes and Other Product Types 4.4.1.2. United States Polycarbonate Market Size and Forecast, by Grade (2023-2030) 4.4.1.2.1. Injection Molding 4.4.1.2.2. Extrusion 4.4.1.2.3. Others 4.4.1.3. United States Polycarbonate Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Automotive and Transportation 4.4.1.3.2. Electricals and Electronics 4.4.1.3.3. Construction Applications 4.4.1.3.4. Medical 4.4.1.3.5. Other Applications 4.4.2. Canada 4.4.2.1. Canada Polycarbonate Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Sheets/Films 4.4.2.1.2. Fibers 4.4.2.1.3. Blends 4.4.2.1.4. Tubes and Other Product Types 4.4.2.2. Canada Polycarbonate Market Size and Forecast, by Grade (2023-2030) 4.4.2.2.1. Injection Molding 4.4.2.2.2. Extrusion 4.4.2.2.3. Others 4.4.2.3. Canada Polycarbonate Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Automotive and Transportation 4.4.2.3.2. Electricals and Electronics 4.4.2.3.3. Construction Applications 4.4.2.3.4. Medical 4.4.2.3.5. Other Applications 4.4.3. Mexico 4.4.3.1. Mexico Polycarbonate Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Sheets/Films 4.4.3.1.2. Fibers 4.4.3.1.3. Blends 4.4.3.1.4. Tubes and Other Product Types 4.4.3.2. Mexico Polycarbonate Market Size and Forecast, by Grade (2023-2030) 4.4.3.2.1. Injection Molding 4.4.3.2.2. Extrusion 4.4.3.2.3. Others 4.4.3.3. Mexico Polycarbonate Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Automotive and Transportation 4.4.3.3.2. Electricals and Electronics 4.4.3.3.3. Construction Applications 4.4.3.3.4. Medical 4.4.3.3.5. Other Applications 5. Europe Polycarbonate Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 5.1. Europe Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.2. Europe Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.3. Europe Polycarbonate Market Size and Forecast, by Application (2023-2030) 5.4. Europe Polycarbonate Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.1.3. United Kingdom Polycarbonate Market Size and Forecast, by Application(2023-2030) 5.4.2. France 5.4.2.1. France Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.2.3. France Polycarbonate Market Size and Forecast, by Application(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.3.3. Germany Polycarbonate Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.4.3. Italy Polycarbonate Market Size and Forecast, by Application(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.5.3. Spain Polycarbonate Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.6.3. Sweden Polycarbonate Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.7.3. Austria Polycarbonate Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Polycarbonate Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Polycarbonate Market Size and Forecast, by Grade (2023-2030) 5.4.8.3. Rest of Europe Polycarbonate Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Polycarbonate Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 6.1. Asia Pacific Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.3. Asia Pacific Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Polycarbonate Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.1.3. China Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.2.3. S Korea Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.3.3. Japan Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.4.3. India Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.5.3. Australia Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.6.3. Indonesia Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.7.3. Malaysia Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.8.3. Vietnam Polycarbonate Market Size and Forecast, by Application(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.9.3. Taiwan Polycarbonate Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Polycarbonate Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Polycarbonate Market Size and Forecast, by Grade (2023-2030) 6.4.10.3. Rest of Asia Pacific Polycarbonate Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Polycarbonate Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 7.1. Middle East and Africa Polycarbonate Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Polycarbonate Market Size and Forecast, by Grade (2023-2030) 7.3. Middle East and Africa Polycarbonate Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Polycarbonate Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Polycarbonate Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Polycarbonate Market Size and Forecast, by Grade (2023-2030) 7.4.1.3. South Africa Polycarbonate Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Polycarbonate Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Polycarbonate Market Size and Forecast, by Grade (2023-2030) 7.4.2.3. GCC Polycarbonate Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Polycarbonate Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Polycarbonate Market Size and Forecast, by Grade (2023-2030) 7.4.3.3. Nigeria Polycarbonate Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Polycarbonate Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Polycarbonate Market Size and Forecast, by Grade (2023-2030) 7.4.4.3. Rest of ME&A Polycarbonate Market Size and Forecast, by Application (2023-2030) 8. South America Polycarbonate Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 8.1. South America Polycarbonate Market Size and Forecast, by Product (2023-2030) 8.2. South America Polycarbonate Market Size and Forecast, by Grade (2023-2030) 8.3. South America Polycarbonate Market Size and Forecast, by Application(2023-2030) 8.4. South America Polycarbonate Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Polycarbonate Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Polycarbonate Market Size and Forecast, by Grade (2023-2030) 8.4.1.3. Brazil Polycarbonate Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Polycarbonate Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Polycarbonate Market Size and Forecast, by Grade (2023-2030) 8.4.2.3. Argentina Polycarbonate Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Polycarbonate Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Polycarbonate Market Size and Forecast, by Grade (2023-2030) 8.4.3.3. Rest Of South America Polycarbonate Market Size and Forecast, by Application (2023-2030) 9. Global Polycarbonate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Production of 2023 9.3.6. Company Locations 9.4. Leading Polycarbonate Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Polycarbonate Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Mitsubishi Engineering Plastics Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SABIC 10.3. Covestro AG 10.4. Ningbo Zhetie Daphoon Chemical Co. Ltd 10.5. Chi Mei Corporation 10.6. LOTTE Chemical Corporation 10.7. EXOLON Group GmbH 10.8. Trinseo SA 10.9. Formosa Chemicals & Fibre Corp. 10.10. LG Chem 10.11. Teijin Limited 10.12. Samyang Corporation 10.13. Idemitsu Kosan Corporation Limited 10.14. Centroplast Engineering Plastics GmbH 10.15. Bayer Material Science AG 10.16. Royal DSM 10.17. Asahi Kasei Chemical Corporation 11. Key Findings 12. Industry Recommendations 13. Polycarbonate Market: Research Methodology 14. Terms and Glossary