Protein Bar Market size was valued at USD 4.77 Bn in 2023 and is expected to reach USD 7.28 Bn by 2030, at a CAGR of 6.5 percent during the forecast period (2024-2030).Protein Bar Market Overview:

The protein bar industry has been experiencing substantial growth, primarily due to the increasing awareness of health and fitness among consumers. The demand for convenient and nutritious snacking options has significantly contributed to the popularity of protein bars, particularly among athletes, fitness enthusiasts, and individuals seeking on-the-go snacks. Consumers are now more mindful of their nutritional intake, leading to a surge in the consumption of protein-rich foods for weight management and muscle recovery purposes. The protein bar market offers a diverse range of product types, including whey, plant-based, energy, meal replacement, and specialty bars, catering to various dietary preferences. These bars are made available to consumers through multiple distribution channels, such as supermarkets, convenience stores, health and wellness outlets, online platforms, and fitness centers. The rise of e-commerce has played a pivotal role in enhancing accessibility to protein bars.To know about the Research Methodology :- Request Free Sample Report The competitive landscape of the protein bar market is highly dynamic, with established brands and new players striving to capture market share. Key Protein Bar companies operating in this market include Quest Nutrition, Clif Bar & Company, PowerBar, Kind LLC, RXBAR, and Grenade. However, manufacturers face challenges, including intense competition, sourcing quality ingredients, ensuring product integrity, and meeting the growing demand for healthier and sustainable options. Despite these challenges, the protein bar market is projected to continue its expansion as consumers increasingly prioritize their health and fitness goals. The market growth will be driven by product innovations, targeted marketing strategies, and the ability to meet the specific dietary requirements of consumers. Protein Bar Market Competitive Landscapes:

Protein Bar Market Dynamics:

Protein Bar Market: Drivers The protein bar market has experienced significant growth due to various driving factors. Increasing health and fitness awareness among consumers has led to a higher demand for convenient and nutritious snacking options, such as protein bars. The market has also been driven by busy and on-the-go lifestyles, where protein bars provide a quick and portable source of protein. The rise in sports and fitness activities has further contributed to the demand for protein bars among athletes and fitness enthusiasts. Consumers' preference for healthy snacks has led them to choose protein bars as a healthier alternative to traditional snacks. The market offers a wide range of flavors and formulations, including options that cater to specific dietary needs, attracting a diverse consumer base. Effective marketing and branding efforts, as well as the growth of e-commerce and online retail, have increased the accessibility and awareness of protein bars. Additionally, the increasing trend towards vegan and plant-based diets has prompted the introduction of plant-based protein bars. These factors collectively drive the growth of the protein bar market as consumers prioritize their health, convenience, and personalized nutrition choices. Protein Bar Market: Opportunities The report covers key findings, including the Protein Bar potential for innovation in product formulations through the introduction of new flavors, textures, and ingredients, thereby enhancing the overall consumer experience. The report also emphasizes the untapped Protein Bar potential of targeting niche consumer segments, such as seniors or children, who have specific nutritional requirements. The report also highlights the favorable landscape of emerging markets, where increasing disposable incomes and a growing health-conscious population drive the demand for protein bars. It also underscores the importance of leveraging online retail and direct-to-consumer sales channels, allowing manufacturers to achieve global reach and provide personalized engagement to customers. Incorporating functional ingredients and promoting health claims are identified as crucial strategies to cater to consumers seeking enhanced benefits from protein bars. The report emphasizes the significance of collaborations with fitness centers, influencers, and sports teams in amplifying brand visibility and credibility. Furthermore, the report stresses the importance of embracing sustainable packaging solutions to address consumer concerns about the environment, thereby enhancing brand reputation. Lastly, the report highlights the Protein Bar potential for market expansion through partnerships with the foodservice sector, including cafes, restaurants, and meal delivery services. Protein Bar Market: Restraints & Challenges The protein bar market is facing significant challenges that could potentially hinder its growth and profitability. Intense competition among numerous established and emerging brands creates a need for manufacturers to differentiate themselves through pricing, marketing, and product innovation. In addition, sourcing high-quality ingredients while maintaining competitive prices and establishing strong supplier relationships is critical. Meeting increasing consumer demands for healthier options, including cleaner labels and reduced sugar content, may require investment in research and development and reformulation efforts. Proper storage and distribution logistics are essential to maintain the quality and shelf life of protein bars. Furthermore, complying with complex regulations and labeling requirements across different jurisdictions is necessary to avoid penalties and protect brand reputation. Educating consumers about the nutritional value and benefits of protein bars and dispelling misconceptions is crucial, along with balancing production costs while meeting consumer demands for affordability and quality. Environmental sustainability concerns require developing eco-friendly packaging and practices, despite potential added costs. Protein Bar Market Trends: The protein bar market is experiencing several trends. The report highlights the increasing demand for plant-based protein bars, clean label products, high protein with low sugar content, functional ingredients, and personalized nutrition. The popularity of plant-based protein bars is attributed to the growing preference for sustainable and vegan-friendly products, with pea protein, soy protein, and hemp protein being the preferred ingredients. Consumers are also interested in clean label protein bars that use natural ingredients without artificial additives. There is a growing demand for high protein bars with low sugar content, which provides sustained energy and muscle recovery after workouts. Functional ingredients like probiotics, fiber, and vitamins are being added to protein bars to provide additional health benefits. Personalized nutrition is also gaining traction, with brands offering customizable protein bars to cater to individual needs.Protein Bar Market Segment Analysis:

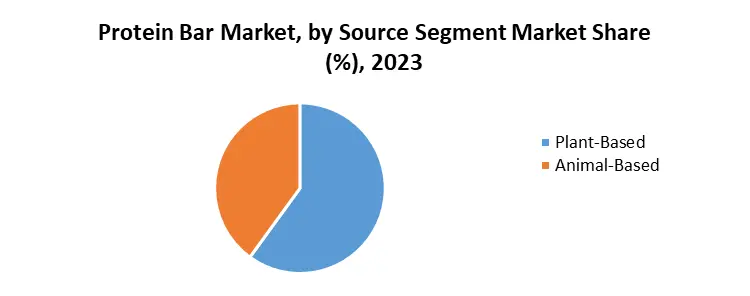

The protein bar market is segmented based on various factors such as type, distribution channel, source and region. This segmentation helps protein bar brands cater to specific dietary requirements, reach their target audience effectively, and target different consumer segments based on their budget and preferences. The primary consumers of protein bars are athletes, fitness enthusiasts, and people with active lifestyles, but there is also a growing demand for protein bars as a healthy snack option among the general population. The market segmentation provides valuable insights into consumer behavior and preferences, allowing brands to develop products and marketing strategies that appeal to their target audience. Furthermore, geographical region-based segmentation enables brands to focus their marketing and product development efforts in specific regions based on demand and consumer preferences. These insights and segmentation strategies are discussed in detail in the protein bar industry report by Maximize Market Research.

Protein Bar Market Regional Insights:

The protein bar market analysis reveals notable regional variations in consumer preferences, market dynamics, and growth prospects. In North America, the largest market, an extensive range of protein bar options such as high-protein, low-sugar, and organic variants cater to health-conscious consumers. Europe highlights the significance of natural ingredients, functional benefits, and sustainable packaging. The Asia Pacific region experiences rapid growth due to factors like rising incomes, urbanization, and evolving lifestyles. South America emerges as an upcoming market, where consumers show a preference for natural and plant-based protein bars, leveraging the region's biodiversity. The Middle East and Africa exhibit steady growth supported by increasing health and wellness awareness, higher disposable incomes, and a growing presence of fitness centers. Report provides detailed insights into these regional dynamics, covering consumer preferences, market trends, and growth opportunities. The report emphasizes the need for manufacturers to adapt their strategies to local tastes, preferences, and cultural nuances. Additionally, understanding and complying with regulatory requirements are crucial for success in each region. By effectively targeting specific consumer segments and tailoring their products accordingly, protein bar manufacturers can establish a strong market presence and leverage the growth Protein Bar potential within each region. Protein Bar Market Competitive Landscape: Report on the protein bar market reveals a highly competitive landscape. Established brands such as Quest Nutrition, Clif Bar, RXBAR, and KIND Snacks dominate the market with their strong presence. The report also highlights the entry of new players who bring innovation through unique flavors and packaging. Health and fitness brands like Optimum Nutrition and MusclePharm leverage their expertise and existing customer base to promote protein bars. Private label and store brands offer competitively priced options, while online retailers such as Amazon provide convenience and a wide variety of choices. Regional and local players cater to specific geographic areas and niche markets, leveraging their understanding of local preferences. Collaborations with fitness centers, influencers, and sports teams help enhance brand visibility. The report emphasizes the importance of constant innovation, product differentiation, and effective marketing strategies focusing on taste, nutritional value, ingredient quality, and packaging. Strong distribution networks and continuous product development are identified as crucial factors for success in this competitive market.Protein Bar Market Scope: Inquire before buying

Protein Bar Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.77 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 7.28 Bn. Segments Covered: by Source Plant-Based Animal-Based by Type Sports Nutrition Bars Meal Replacement Bars Others by Distribution Channel Mass Merchandisers Specialty Stores Convenience Stores Online Channels Others Protein Bar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Protein Bar Market, Key Players are

1. Quest Nutrition (United States) 2. Clif Bar (United States) 3. RXBAR (United States) 4. KIND Snacks (United States) 5. Optimum Nutrition(United States) 6. MusclePharm (United States) 7. BSN (United States) 8. Larabar (United States) 9. Premier Protein (United States) 10. PowerBar (United States) 11. ProBar (United States) 12. Grenade (United Kingdom) 13. Lenny & Larry's (United States) 14. MET-Rx (United States) 15. ProSupps (United States) 16. ISS Research (United States) 17. Pure Protein (United States) 18. Power Crunch (United States) 19. Myprotein (United Kingdom) 20. GoMacro (United States) 21. NuGo Nutrition (United States) 22. Think! (United States) 23. Oatmega (United States) 24. Rise Bar (United States) 25. Gatorade (United States) 26. RX Foods (United States) 27. Universal Nutrition (United States) FAQs 1. What is the forecast market size of the Market by 2030? Ans: The market size of the Protein Bar Market by 2030 is expected to reach USD 6.43 Billion 2. What is the growth rate of Global Protein Bar Market? Ans: The Global Protein Bar Market is growing at a CAGR of 6.5% during forecasting period 2024-2030 3. Who are the key players in Global Protein Bar Market? Ans: Quest Nutrition (USA), Clif Bar (USA), RXBAR (USA), KIND Snacks (USA), Atkins Nutritionals (USA), Grenade (UK), Premier Nutrition Corporation (USA), Optimum Nutrition (USA), MusclePharm (USA), BSN (USA), The Kellogg Company (USA), General Mills, Inc. (USA), Hormel Foods Corporation (USA), Mars, Incorporated (USA), Kellogg's Company (USA), The Hershey Company (USA), PowerBar (USA), ThinkThin, LLC (USA), MuscleTech (Canada) 4. What is the study period of Protein Bar Market? Ans: The Global Protein Bar Market is studied from 2023 to 2030 5. What was the market size of the Market in 2023? Ans: The market size of the Protein Bar Market in 2023 was valued at USD 4.77 Billion.

1. Protein Bar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Protein Bar Market: Dynamics 2.1. Protein Bar Market Trends by Region 2.1.1. North America Protein Bar Market Trends 2.1.2. Europe Protein Bar Market Trends 2.1.3. Asia Pacific Protein Bar Market Trends 2.1.4. Middle East and Africa Protein Bar Market Trends 2.1.5. South America Protein Bar Market Trends 2.2. Protein Bar Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Protein Bar Market Drivers 2.2.1.2. North America Protein Bar Market Restraints 2.2.1.3. North America Protein Bar Market Opportunities 2.2.1.4. North America Protein Bar Market Challenges 2.2.2. Europe 2.2.2.1. Europe Protein Bar Market Drivers 2.2.2.2. Europe Protein Bar Market Restraints 2.2.2.3. Europe Protein Bar Market Opportunities 2.2.2.4. Europe Protein Bar Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Protein Bar Market Drivers 2.2.3.2. Asia Pacific Protein Bar Market Restraints 2.2.3.3. Asia Pacific Protein Bar Market Opportunities 2.2.3.4. Asia Pacific Protein Bar Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Protein Bar Market Drivers 2.2.4.2. Middle East and Africa Protein Bar Market Restraints 2.2.4.3. Middle East and Africa Protein Bar Market Opportunities 2.2.4.4. Middle East and Africa Protein Bar Market Challenges 2.2.5. South America 2.2.5.1. South America Protein Bar Market Drivers 2.2.5.2. South America Protein Bar Market Restraints 2.2.5.3. South America Protein Bar Market Opportunities 2.2.5.4. South America Protein Bar Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Protein Bar Industry 2.8. Analysis of Government Schemes and Initiatives For Protein Bar Industry 2.9. Protein Bar Market Trade Analysis 2.10. The Global Pandemic Impact on Protein Bar Market 3. Protein Bar Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Protein Bar Market Size and Forecast, by source (2023-2030) 3.1.1. Plant-Based 3.1.2. Animal-Based 3.2. Protein Bar Market Size and Forecast, by Type (2023-2030) 3.2.1. Sports Nutrition Bars 3.2.2. Meal Replacement Bars 3.2.3. Others 3.3. Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Mass Merchandisers 3.3.2. Specialty Stores 3.3.3. Convenience Stores 3.3.4. Online Channels 3.3.5. Others 3.4. Protein Bar Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Protein Bar Market Size and Forecast, by source (2023-2030) 4.1.1. Plant-Based 4.1.2. Animal-Based 4.2. North America Protein Bar Market Size and Forecast, by Type (2023-2030) 4.2.1. Sports Nutrition Bars 4.2.2. Meal Replacement Bars 4.2.3. Others 4.3. North America Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Mass Merchandisers 4.3.2. Specialty Stores 4.3.3. Convenience Stores 4.3.4. Online Channels 4.3.5. Others 4.4. North America Protein Bar Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Protein Bar Market Size and Forecast, by source (2023-2030) 4.4.1.1.1. Plant-Based 4.4.1.1.2. Animal-Based 4.4.1.2. United States Protein Bar Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Sports Nutrition Bars 4.4.1.2.2. Meal Replacement Bars 4.4.1.2.3. Others 4.4.1.3. United States Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Mass Merchandisers 4.4.1.3.2. Specialty Stores 4.4.1.3.3. Convenience Stores 4.4.1.3.4. Online Channels 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Protein Bar Market Size and Forecast, by source (2023-2030) 4.4.2.1.1. Plant-Based 4.4.2.1.2. Animal-Based 4.4.2.2. Canada Protein Bar Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Sports Nutrition Bars 4.4.2.2.2. Meal Replacement Bars 4.4.2.2.3. Others 4.4.2.3. Canada Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Mass Merchandisers 4.4.2.3.2. Specialty Stores 4.4.2.3.3. Convenience Stores 4.4.2.3.4. Online Channels 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Protein Bar Market Size and Forecast, by source (2023-2030) 4.4.3.1.1. Plant-Based 4.4.3.1.2. Animal-Based 4.4.3.2. Mexico Protein Bar Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Sports Nutrition Bars 4.4.3.2.2. Meal Replacement Bars 4.4.3.2.3. Others 4.4.3.3. Mexico Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Mass Merchandisers 4.4.3.3.2. Specialty Stores 4.4.3.3.3. Convenience Stores 4.4.3.3.4. Online Channels 4.4.3.3.5. Others 5. Europe Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Protein Bar Market Size and Forecast, by source (2023-2030) 5.2. Europe Protein Bar Market Size and Forecast, by Type (2023-2030) 5.3. Europe Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Protein Bar Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.1.2. United Kingdom Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.2.2. France Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.3.2. Germany Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.4.2. Italy Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.5.2. Spain Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.6.2. Sweden Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.7.2. Austria Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Protein Bar Market Size and Forecast, by source (2023-2030) 5.4.8.2. Rest of Europe Protein Bar Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Protein Bar Market Size and Forecast, by source (2023-2030) 6.2. Asia Pacific Protein Bar Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Protein Bar Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.1.2. China Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.2.2. S Korea Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.3.2. Japan Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.4.2. India Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.5.2. Australia Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.6.2. Indonesia Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.7.2. Malaysia Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.8.2. Vietnam Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.9.2. Taiwan Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Protein Bar Market Size and Forecast, by source (2023-2030) 6.4.10.2. Rest of Asia Pacific Protein Bar Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Protein Bar Market Size and Forecast, by source (2023-2030) 7.2. Middle East and Africa Protein Bar Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Protein Bar Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Protein Bar Market Size and Forecast, by source (2023-2030) 7.4.1.2. South Africa Protein Bar Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Protein Bar Market Size and Forecast, by source (2023-2030) 7.4.2.2. GCC Protein Bar Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Protein Bar Market Size and Forecast, by source (2023-2030) 7.4.3.2. Nigeria Protein Bar Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Protein Bar Market Size and Forecast, by source (2023-2030) 7.4.4.2. Rest of ME&A Protein Bar Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Protein Bar Market Size and Forecast, by source (2023-2030) 8.2. South America Protein Bar Market Size and Forecast, by Type (2023-2030) 8.3. South America Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Protein Bar Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Protein Bar Market Size and Forecast, by source (2023-2030) 8.4.1.2. Brazil Protein Bar Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Protein Bar Market Size and Forecast, by source (2023-2030) 8.4.2.2. Argentina Protein Bar Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Protein Bar Market Size and Forecast, by source (2023-2030) 8.4.3.2. Rest Of South America Protein Bar Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America Protein Bar Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Protein Bar Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Protein Bar Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Quest Nutrition (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Clif Bar (United States) 10.3. RXBAR (United States) 10.4. KIND Snacks (United States) 10.5. Optimum Nutrition(United States) 10.6. MusclePharm (United States) 10.7. BSN (United States) 10.8. Larabar (United States) 10.9. Premier Protein (United States) 10.10. PowerBar (United States) 10.11. ProBar (United States) 10.12. Grenade (United Kingdom) 10.13. Lenny & Larry's (United States) 10.14. MET-Rx (United States) 10.15. ProSupps (United States) 10.16. ISS Research (United States) 10.17. Pure Protein (United States) 10.18. Power Crunch (United States) 10.19. Myprotein (United Kingdom) 10.20. GoMacro (United States) 10.21. NuGo Nutrition (United States) 10.22. Think! (United States) 10.23. Oatmega (United States) 10.24. Rise Bar (United States) 10.25. Gatorade (United States) 10.26. RX Foods (United States) 10.27. Universal Nutrition (United States) 11. Key Findings 12. Industry Recommendations 13. Protein Bar Market: Research Methodology 14. Terms and Glossary