The Premium Chocolate Market size was valued at USD 36.38 Billion in 2024 and the total Premium Chocolate revenue is expected to grow at a CAGR of 9.4% from 2025 to 2032, reaching nearly USD 74.65 Billion.Premium Chocolate Market Overview

Premium chocolate refers to a category of high-quality chocolates that are made with premium ingredients, meticulous craftsmanship, and innovative flavors chocolates. Chocolates often have higher cocoa ingredients and are crafted with precision to deliver a truly exceptional taste experience. 1.Companies are launching innovative products to capitalize on customers' demands. For instance, in October , Lindt expanded its dairy-free range in the US market with vegan versions of the popular Lindor truffles. As per the brand’s claim, the chocolate is available in two varieties: oat milk and dark oat milk 2.Nestlé has announced an agreement with Advent International to acquire a majority stake in Grupo CRM, a premium chocolate player in Brazil. 3.The two leading brands in Brazil, Nestlé with its milky chocolate, and Garoto with its strong cocoa flavor, are experiencing increased interest from consumers. Chocolates have an image of being an exotic luxury food, generally based on brand and packaging. Premium chocolate manufacturers have established flagship boutique stores that enable them to provide a more premium product experience through formulating unique flavors, using a certain technique in producing chocolate, in-house production, personalization of product and gift packaging, seasonal or event specialty range, and delivery services. With the increasing demand for premium chocolates, there are new emerging distribution channels for premium chocolates. Some companies choose to distribute their products through traditional retail channels such as supermarkets and convenience stores, while others focus on direct-to-consumer sales through online channels. Europe and North America are the largest markets for premium chocolate, though it is also growing in Asia Pacific.To know about the Research Methodology :- Request Free Sample Report

Premium Chocolate Market Dynamics

Driving Forces in the Premium Chocolate Market Consumers are encouraged to purchase premium chocolates owing to taste and health benefits, especially dark chocolate, considered an affordable indulgence. The increased consumer demand for the ingredients, taste, packaging, and gifting tradition has propelled the market growth. Surged market demand for plant-based products is creating opportunities for start-ups across globally, which also contributes to sustainability goals. The premium chocolate market is accelerating digitalization, using data and technology to unlock efficiencies of growth opportunities. Increased rapid shifts in consumer behavior by amplifying digital-centric businesses and scaling digital capabilities as well as artificial intelligence and remote assistance are allowing to be more agile and flexible in chocolate manufacturing. Additionally, increased growth in gifting chocolates in big basket sizes has led to market growth. Various regions are witnessing growth driven by the intensifying middle class, and increased disposable income, which has spurred growth of cocoa grinding capacity. The Premium market is dynamic and evolving as chocolate makers are continuously innovating and developing their products using modern technology or diverse ingredients to appeal to and suit the demand as consumers are willing to pay more for new and artistic gift ideas increasing market growth.Constraints in the Premium Chocolate Market The key factor that hinders the market growth is large fluctuations in the prices of cocoa due to increases in various circumstances such as environmental change etc. To maintain the prices of premium chocolates it is challenging for manufacturers to keep steady prices. Premium chocolate uses premium ingredients, traditional production techniques, and premium packaging, it is substantially more expensive than mass-produced chocolate. Particularly in regions where consumers are price-sensitive, the high price point has restrained the market growth. Premium Chocolate is supplied through specialty shops and internet retailers, premium chocolate is frequently harder to come by than mass-produced chocolates. The rising introduction of premium lines by mass-produced chocolate firms may put pressure on the market share of key player premium chocolate brands.

Premium Chocolate Market Segment Analysis

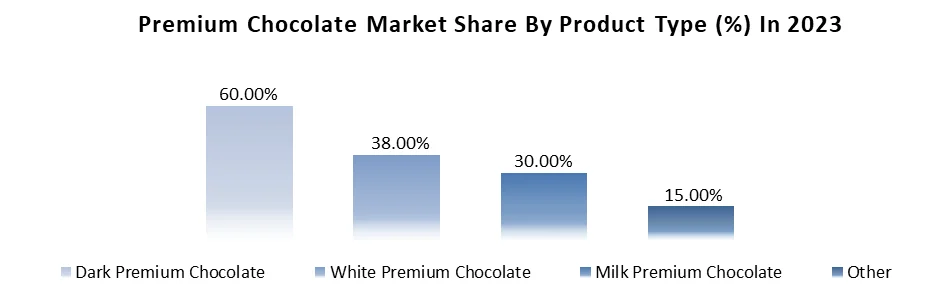

Based on Product Type, the Dark Chocolate segment holds the majority share of 60% with increasing CAGR of 9.56%. A growing market for premium chocolates which are low in fat and have antioxidant potential resulted in demand for chocolates in hypermarkets. Dark chocolate accounts for over 40% of total chocolate sales in various regions. Sustainable production by using a proprietary innovation to create a dark chocolate made entirely from cocoa fruit, reducing waste by using cocoa pulp as a natural sweetener. The rising consumer health concerns have led to the changing inclination from conventional milk chocolates towards premium dark chocolates. Increased awareness of the benefits of dark chocolate has raised the demand in the market. Surging dark chocolates infused with various superfoods such as berries, nuts, and spices have gained consumer traction. Europe holds a significant share of 43.09% in the Dark chocolate segment with a growing CAGR of 9.45% during the forecast years, owing to the wide range of chocolate availability of various premium brands catering to diverse consumer preferences. Increased awareness of premium chocolate brands has led to an increase in demand for chocolates in market growth.

Premium Chocolate Market Regional Insights

Europe holds the highest number of shares accounting for 45% market share with a growing CAGR of 9.60%. The increase in the demand for ultrafine cocoa beans and premium packaging of gifts has increased the market popularity which drives the Europe market. The need for organic, vegan, sugar-free, and gluten-free premium chocolates is driving the market growth in the region. The rise in Demand for gourmet cocoa is growing rapidly in Europe, as gourmet chocolate uses super and premium beans, and traditional premium chocolate uses regular and low-fine beans. The key factor that influences the market is the increasing popularity of dark chocolate with unique flavor combination chocolates. Increases in E-commerce have significantly boosted the market thanks to the substantial growth of online retailers which provide a convenient platform for product showcasing allowing brands to connect broader customer base.Germany holds the largest share of 35% in Europe premium chocolate followed by France, the United Kingdom, Switzerland, etc. owing to an increase in demand for domestic and international premium brands. Italy is a major player in the global chocolate market, holding a significant share of the international scene and ranking highly among the world's top exporters. The surge in high levels of production specialization of Italian companies and the competitive advantage provided by the Made in Italy brand has propelled the market growth in the region.

Premium Chocolate Market Competitive Landscape

In February 2023, Morinaga Nutritional Foods, Inc. (a subsidiary) announced the acquisition of Turtle Island Foods Holdings, Inc. Turtle Island Foods is a manufacturer of plant-based food products. As a result of this acquisition, Turtle Islands Foods will become a subsidiary of Morinaga Nutritional Foods, Inc. This will create an opportunity to develop nutritional chocolates for the premium chocolate market. In June 2023: Lindt and Sprungli launched a chocolate bar under One for One in the Canadian market. As per the brand’s claim, the One for One line is distinctly packaged with a modern look that sets the bars apart from other Lindt classics and features three flavors, including One for One Milk Chocolate Bar, One for One Milk Chocolate Hazelnut Bar, and One for One Milk Chocolate Salted Caramel Bar. In October 2023: Lindt expanded its dairy-free range in the US market with vegan versions of the famous Lindor truffles. As per the brand’s claim, the chocolate is available in two varieties: oat milk and dark oat milk. In December 2023: Lindt partnered with German cocoa-free chocolate brand ChoViva to expand its popular Hello range with a limited edition vegan soft and creamy Hazelnut Bar.Premium Chocolate Market Scope: Inquire before buying

Global Premium Chocolate Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 36.38 Bn. Forecast Period 2025 to 2032 CAGR: 9.4% Market Size in 2032: USD 74.65 Bn. Segments Covered: by Product Type Dark Chocolate Milk Chocolate White Chocolate by Distribution Channel Supermarkets and Hypermarkets Convenience Stores Specialty Stores Online Stores Premium Chocolate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Premium Chocolate Market Key Players:

1. Lindt & Sprüngli 2. Ferrero Group 3. Mondelez International (Cadbury) 4. The Hershey Company 5. Mars, Incorporated 6. Nestlé SA 7. Godiva Chocolatier 8. Ghirardelli Chocolate Company 9. Patchi 10. Russell Stover Chocolates 11. Valrhona 12. Guylian 13. Neuhaus 14. Green & Black's 15. Toblerone 16. Ferrero Rocher 17. Leonidas 18. Kinder Chocolate 19. Lindt Excellence Frequently Asked Questions: 1] What was the Global Premium Chocolate Market size in 2024? Ans: The Global Premium Chocolate Market size was USD 36.38 Billion in 2024. 2] What segments are covered in the Premium Chocolate Market report? Ans. The segments covered in the Premium Chocolate Market report are based on Product type and Distribution type. 3] Which region is expected to hold the highest share in the Global Premium Chocolate Market? Ans. The European region is expected to hold the highest share of the Premium Chocolate Market. 4] What are the growth drivers for the Premium Chocolate market? Ans. Increased in customer demand for luxury gifts, etc. is expected to be the major driver for the Premium Chocolate market. 5] What is the forecast period for the Premium Chocolate Market? Ans. The forecast period for the Premium Chocolate Market is 2025-2032.

1. Premium Chocolate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Premium Chocolate Market: Dynamics 2.1. Premium Chocolate Market Trends by Region 2.1.1. North America Premium Chocolate Market Trends 2.1.2. Europe Premium Chocolate Market Trends 2.1.3. Asia Pacific Premium Chocolate Market Trends 2.1.4. Middle East and Africa Premium Chocolate Market Trends 2.1.5. South America Premium Chocolate Market Trends 2.1.6. Preference Analysis 2.2. Premium Chocolate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Premium Chocolate Market Drivers 2.2.1.2. North America Premium Chocolate Market Restraints 2.2.1.3. North America Premium Chocolate Market Opportunities 2.2.1.4. North America Premium Chocolate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Premium Chocolate Market Drivers 2.2.2.2. Europe Premium Chocolate Market Restraints 2.2.2.3. Europe Premium Chocolate Market Opportunities 2.2.2.4. Europe Premium Chocolate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Premium Chocolate Market Drivers 2.2.3.2. Asia Pacific Premium Chocolate Market Restraints 2.2.3.3. Asia Pacific Premium Chocolate Market Opportunities 2.2.3.4. Asia Pacific Premium Chocolate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Premium Chocolate Market Drivers 2.2.4.2. Middle East and Africa Premium Chocolate Market Restraints 2.2.4.3. Middle East and Africa Premium Chocolate Market Opportunities 2.2.4.4. Middle East and Africa Premium Chocolate Market Challenges 2.2.5. South America 2.2.5.1. South America Premium Chocolate Market Drivers 2.2.5.2. South America Premium Chocolate Market Restraints 2.2.5.3. South America Premium Chocolate Market Opportunities 2.2.5.4. South America Premium Chocolate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For Premium Chocolate Market 2.7. Analysis of Government Schemes and Initiatives For Premium Chocolate Industry 3. Premium Chocolate Market: Global Market Size and Forecast by Segmentation (by Value) (2024-2032) 3.1. Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Dark Chocolate 3.1.2. Milk Chocolate 3.1.3. White Chocolate 3.2. Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 3.2.1. Supermarkets and Hypermarkets 3.2.2. Convenience Stores 3.2.3. Specialty Stores 3.2.4. Online Stores 3.3. Premium Chocolate Market Size and Forecast, by Region (2024-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Premium Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. North America Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Dark Chocolate 4.1.2. Milk Chocolate 4.1.3. White Chocolate 4.2. North America Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 4.2.1. Supermarkets and Hypermarkets 4.2.2. Convenience Stores 4.2.3. Specialty Stores 4.2.4. Online Stores 4.3. North America Premium Chocolate Market Size and Forecast, by Country (2024-2032) 4.3.1. United States 4.3.1.1. United States Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 4.3.1.1.1. Dark Chocolate 4.3.1.1.2. Milk Chocolate 4.3.1.1.3. White Chocolate 4.3.1.2. United States Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1.2.1. Supermarkets and Hypermarkets 4.3.1.2.2. Convenience Stores 4.3.1.2.3. Specialty Stores 4.3.1.2.4. Online Stores 4.3.2. Canada 4.3.2.1. Canada Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 4.3.2.1.1. Dark Chocolate 4.3.2.1.2. Milk Chocolate 4.3.2.1.3. White Chocolate 4.3.2.2. Canada Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.2.2.1. Supermarkets and Hypermarkets 4.3.2.2.2. Convenience Stores 4.3.2.2.3. Specialty Stores 4.3.2.2.4. Online Stores 4.3.3. Mexico 4.3.3.1. Mexico Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 4.3.3.1.1. Dark Chocolate 4.3.3.1.2. Milk Chocolate 4.3.3.1.3. White Chocolate 4.3.3.2. Mexico Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.3.2.1. Supermarkets and Hypermarkets 4.3.3.2.2. Convenience Stores 4.3.3.2.3. Specialty Stores 4.3.3.2.4. Online Stores 5. Europe Premium Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. Europe Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3. Europe Premium Chocolate Market Size and Forecast, by Country (2024-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.1.2. United Kingdom Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.2. France 5.3.2.1. France Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.2.2. France Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.3. Germany 5.3.3.1. Germany Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.3.2. Germany Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.4. Italy 5.3.4.1. Italy Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.4.2. Italy Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.5. Spain 5.3.5.1. Spain Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.5.2. Spain Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.6. Sweden 5.3.6.1. Sweden Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.6.2. Sweden Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.7. Austria 5.3.7.1. Austria Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.7.2. Austria Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 5.3.8.2. Rest of Europe Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6. Asia Pacific Premium Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Asia Pacific Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3. Asia Pacific Premium Chocolate Market Size and Forecast, by Country (2024-2032) 6.3.1. China 6.3.1.1. China Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.1.2. China Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.2. S Korea 6.3.2.1. S Korea Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.2.2. S Korea Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.3. Japan 6.3.3.1. Japan Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.3.2. Japan Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.4. India 6.3.4.1. India Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.4.2. India Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.5. Australia 6.3.5.1. Australia Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.5.2. Australia Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.6.2. Indonesia Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.7.2. Malaysia Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.8.2. Vietnam Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.9.2. Taiwan Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 6.3.10.2. Rest of Asia Pacific Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 7. Middle East and Africa Premium Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Middle East and Africa Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 7.3. Middle East and Africa Premium Chocolate Market Size and Forecast, by Country (2024-2032) 7.3.1. South Africa 7.3.1.1. South Africa Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 7.3.1.2. South Africa Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.2. GCC 7.3.2.1. GCC Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 7.3.2.2. GCC Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 7.3.3.2. Nigeria Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 7.3.4.2. Rest of ME&A Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 8. South America Premium Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. South America Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 8.3. South America Premium Chocolate Market Size and Forecast, by Country (2024-2032) 8.3.1. Brazil 8.3.1.1. Brazil Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 8.3.1.2. Brazil Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.2. Argentina 8.3.2.1. Argentina Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 8.3.2.2. Argentina Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Premium Chocolate Market Size and Forecast, by Product Type (2024-2032) 8.3.3.2. Rest Of South America Premium Chocolate Market Size and Forecast, by Distribution Channel (2024-2032) 9. Global Premium Chocolate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Premium Chocolate Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Lindt & Sprüngli 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ferrero Group 10.3. Mondelez International (Cadbury) 10.4. The Hershey Company 10.5. Mars, Incorporated 10.6. Nestlé SA 10.7. Godiva Chocolatier 10.8. Ghirardelli Chocolate Company 10.9. Patchi 10.10. Russell Stover Chocolates 10.11. Valrhona 10.12. Guylian 10.13. Neuhaus 10.14. Green & Black's 10.15. Toblerone 10.16. Ferrero Rocher 10.17. Leonidas 10.18. Kinder Chocolate 10.19. Lindt Excellence 11. Key Findings 12. Industry Recommendations 13. Premium Chocolate Market: Research Methodology