Power Module Packaging Market size was valued at USD 1.86 Bn in 2023 and Power Module Packaging Market revenue is expected to reach USD 3.58 Bn by 2030, at a CAGR of 9.79% over the forecast period.Power Module Packaging Market Overview

The global Power Module Packaging market refers to the industry involved in packaging and assembling power semiconductor modules used in various applications such as power electronics renewable energy systems electric vehicles and more. The market include technologies that enhance the thermal management, electrical connectivity and protection for these modules factors giving growth include the increasing demand for advanced packaging solutions and expansion of industries like electric mobility and renewable energy. The market is expanded to continue evolving with advancement in semiconductor Power Module Packaging materials and packaging techniques.To know about the Research Methodology :- Request Free Sample Report

Power Module Packaging Market Dynamics

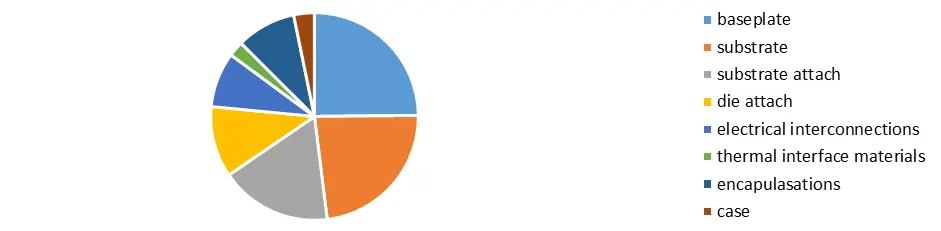

Increasing demand for power electronics devices is the expected to drive the Market growth over the forecast period. The growing demand for electric vehicles across the globe is expected to drive the global power electronics market. Various vehicle components such as windshield wiper control, interior lighting, ignition switches, and power steering utilize power electronics. Power module packaging technologies play a crucial role in managing the electric energy of electric vehicles. Therefore, the rapidly growing electric vehicle industry is expected to result in the increase in demand for the Automotive Power Module Packaging during the forecast period. Moreover, the rising concerns regarding the environment have compelled governments across nations to control vehicle emissions. The power electronics are increasingly used across various energy conversion and use applications. The rapidly growing demand for power-efficient devices across the end-user verticals is significantly boosting the demand for High-Density Power Packaging. The increasing demand for automation technologies and the emergence of industry are the major factors that drive the growth of the power electronics market. The rising adoption of automated assembly lines and industrial robots is a significant market driver. Moreover, more powerful electronics applications are deploying power modules instead of discrete components to increase performance and reduce losses. Power module substrate materials play a crucial role in the design and assembly of these modules, ensuring their reliability and efficiency. Manufacturers must master power module assembly to fuel innovation in the packaging design. Legal and Regulatory Challenges to Restraint the Power Module Packaging market growth Legal and regulatory challenges pose restraints on the growth of the power module packaging market. The packaging challenges associated with high-speed switching, thermal management, high-temperature operation, and high-voltage isolation are significant. Recent advances in technologies addressing these limitations are summarized, offering insights into improving power electronics packaging. Reducing inductance Reducing inductance requires making the equivalent loop areas converted by traces as small as possible. The best way to do this is to place the ground plane for critical traces directly above the layer containing your ground plane.Power Module Packaging Trends

Increasing focus on renewable energy module packaging to drive the market growth According to the international renewable energy agency in 2022 global renewable generation capacity amounted to 2351 GW. It showed an increase of 7.9% compared to last year. Wind and solar energy accounted with capacities of 564 GW and 486 GW respectively. As power module in renewables are used in wind turbine inverters, photovoltaic inverters, and micro inverters, they are expected to witness an increased adoption. Power module in PV enables the control system to get power from the solar panels directly and ensure reliable operations. Thus, the growing adoption of solar power is likely to drive the demand for power modules. In turn, this is driving the power module packaging demand.in 2018 sierra club and sun power partnered to help create a sustainable future. This alliance between sun power and sierra club further helped the sierra club overall efforts to advance climate solutions and move us towards 100% renewable energy.Power Module Packaging Market Forecast In 2023 (in Million)

Power Module Packaging Market Segment Analysis

Based on Application: The market was divided into Food, Beverage, Healthcare, Cosmetics, Industrial and Others. The industrial segment held the largest Power Module Packaging Market share of around 39% in 2023. In the industrial sector, the power module packaging is used in wide range of applications such as packaging of electronic components, machinery, and industrial equipment. The Food segment is expected to grow during the forecast period due to the increasing demand for sustainable and efficient packaging solutions. This has also led the innovation in the segment with a focus on reducing food wastage and enhancing food safety.Power Module Packaging Market by Regional analysis

Asia Pacific Power Module Packaging Market dominated the global market with 43% of the share in 2023 and is expected to witness robust growth during the forecast period. The increasing adoption of electric vehicles (EVs) across the region is one of the primary drivers of the regional market growth. Power module packaging technologies are instrumental in powertrain and battery management systems of electric vehicles, which is highly contributing to better energy utilization and extended battery life. The region is also increasing its focus on renewable energy sources, such as solar and wind power, which is boosting the demand for power modules. These modules are majorly used in renewable energy inverters. This allows for the efficient conversion of renewable energy into usable electricity.Power Module Packaging Market Competitive Landscape

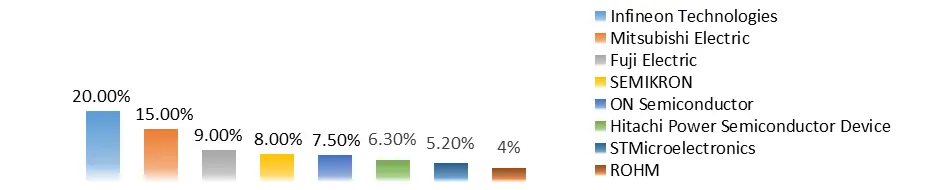

The competitive analysis includes the Market size, growth rate and key trends in the Power Module Packaging industry. The report provides information about the Power Module Packaging Key companies, such as their size, share, and geographic presence. In Power Module Packaging market consist new and emerging companies like danfoss, semikron, Toshiba, Fuli electric co.ltd. and Amcor plc. As per the study, the market is competitive. STMicroelectronics has recently introduced the ACEPACK DMT-32 family of silicon carbide (SiC) power modules in a convenient 32-pin, dual-inline, molded, through-hole package for automotive applications.Power Module Packaging Market Share of Key Players (%) in 2023

Power Module Packaging Market Scope : Inquire Before Buying

Power Module Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.86 Bn. Forecast Period 2024 to 2030 CAGR: 9.79% Market Size in 2030: US $ 3.58 Bn. Segments Covered: by Material Paper and Paperboard Rigid Plastic Flexible Metal Glass Others by Function Cushioning Blocking and Bracing Void Fill Insulation Wrapping Others by Application Food Beverage Healthcare Cosmetics Industrial Others Power Module Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Power Module Packaging Key Players

1. huhtamaki 2. Smurfit kappa group plc 3. Amcor plc 4. International paper 5. Ds smith 6. Sealed air 7. Pro Pac packaging limited 8. Storopack hans reichenecker gmbh 9. Sonoco products company 10. Pregis llc 11. Fuli electric co.ltd. 12. Infineon technologies ag 13. Hitachi ltd. 14. Mitsubishi technologies ag 15. Vincotech 16. Toshiba 17. On semiconductor 18. Stmicroelectronics 19. Semikron 20. Danfoss 21. STMicroelectronics Frequently Asked Questions: 1] What is the growth rate of the Global Power Module Packaging market? Ans. The Global Power Module Packaging Market is growing at a significant rate of 9.79 % over the forecast period. 2] Which region is expected to dominate the Global Power Module Packaging Market? Ans. Asia Pacific region is expected to dominate the Global Power Module Packaging Market over the forecast period. 3] What is the expected Global Market size by 20230? Ans. The market size of the Global Market is expected to reach USD 3.58 Bn by 2030. 4] Who are the top players in the Global Market? Ans. The major key players in the Global Market are, Amcor technologies, Toshiba, fuji electric and hitachi. 5] Which factors are expected to drive the Global Market growth by 2030? Ans. Increasing demand for power electronics devices is the expected to drive the Market growth over the forecast period (2024-2030).

1. Power Module Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Power Module Packaging Market: Dynamics 2.1. Power Module Packaging Market Trends by Region 2.1.1. Global Power Module Packaging Market Trends 2.1.2. North America Power Module Packaging Market Trends 2.1.3. Europe Power Module Packaging Market Trends 2.1.4. Asia Pacific Power Module Packaging Market Trends 2.1.5. Middle East and Africa Power Module Packaging Market Trends 2.1.6. South America Power Module Packaging Market Trends 2.2. Power Module Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Power Module Packaging Market Drivers 2.2.1.2. North America Power Module Packaging Market Restraints 2.2.1.3. North America Power Module Packaging Market Opportunities 2.2.1.4. North America Power Module Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Power Module Packaging Market Drivers 2.2.2.2. Europe Power Module Packaging Market Restraints 2.2.2.3. Europe Power Module Packaging Market Opportunities 2.2.2.4. Europe Power Module Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Power Module Packaging Market Drivers 2.2.3.2. Asia Pacific Power Module Packaging Market Restraints 2.2.3.3. Asia Pacific Power Module Packaging Market Opportunities 2.2.3.4. Asia Pacific Power Module Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Power Module Packaging Market Drivers 2.2.4.2. Middle East and Africa Power Module Packaging Market Restraints 2.2.4.3. Middle East and Africa Power Module Packaging Market Opportunities 2.2.4.4. Middle East and Africa Power Module Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Power Module Packaging Market Drivers 2.2.5.2. South America Power Module Packaging Market Restraints 2.2.5.3. South America Power Module Packaging Market Opportunities 2.2.5.4. South America Power Module Packaging Market Challenges 2.3. PORTER’s Five Functions Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For the Power Module Packaging Industry 2.8. Analysis of Government Schemes and Initiatives For the Power Module Packaging Industry 2.9. The Global Pandemic Impact on the Power Module Packaging Market 3. Power Module Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Power Module Packaging Market Size and Forecast, by Material (2023-2030) 3.1.1. Paper and paperboard 3.1.2. Rigid plastic 3.1.3. Flexible 3.1.4. Metal 3.1.5. Glass 3.1.6. Others 3.2. Power Module Packaging Market Size and Forecast, by Function (2023-2030) 3.2.1. Cushioning 3.2.2. Blocking and Bracing 3.2.3. Void fill 3.2.4. Insulation 3.2.5. Wrapping 3.2.6. Others 3.3. Power Module Packaging Market Size and Forecast, by Application (2023-2030) 3.3.1. Food 3.3.2. Beverage 3.3.3. Healthcare 3.3.4. Cosmetics 3.3.5. Industrial 3.3.6. Others 3.4. Power Module Packaging Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Power Module Packaging Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 4.1. North America Power Module Packaging Market Size and Forecast, by Material (2023-2030) 4.1.1. Paper and paperboard 4.1.2. Rigid plastic 4.1.3. Flexible 4.1.4. Metal 4.1.5. Glass 4.1.6. Others 4.2. North America Power Module Packaging Market Size and Forecast, by Function (2023-2030) 4.2.1. Cushioning 4.2.2. Blocking and Bracing 4.2.3. Void fill 4.2.4. Insulation 4.2.5. Wrapping 4.2.6. Others 4.3. North America Power Module Packaging Market Size and Forecast, by Application (2023-2030) 4.3.1. Food 4.3.2. Beverage 4.3.3. Healthcare 4.3.4. Cosmetics 4.3.5. Industrial 4.3.6. Others 4.4. North America Power Module Packaging Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Power Module Packaging Market Size and Forecast, by Material (2023-2030) 4.4.1.1.1. Paper and paperboard 4.4.1.1.2. Rigid plastic 4.4.1.1.3. Flexible 4.4.1.1.4. Metal 4.4.1.1.5. Glass 4.4.1.1.6. Others 4.4.1.2. United States Power Module Packaging Market Size and Forecast, by Function (2023-2030) 4.4.1.2.1. Cushioning 4.4.1.2.2. Blocking and Bracing 4.4.1.2.3. Void fill 4.4.1.2.4. Insulation 4.4.1.2.5. Wrapping 4.4.1.2.6. Others 4.4.1.3. United States Power Module Packaging Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Food 4.4.1.3.2. Beverage 4.4.1.3.3. Healthcare 4.4.1.3.4. Cosmetics 4.4.1.3.5. Industrial 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Power Module Packaging Market Size and Forecast, by Material (2023-2030) 4.4.2.1.1. Paper and paperboard 4.4.2.1.2. Rigid plastic 4.4.2.1.3. Flexible 4.4.2.1.4. Metal 4.4.2.1.5. Glass 4.4.2.1.6. Others 4.4.2.2. Canada Power Module Packaging Market Size and Forecast, by Function (2023-2030) 4.4.2.2.1. Cushioning 4.4.2.2.2. Blocking and Bracing 4.4.2.2.3. Void fill 4.4.2.2.4. Insulation 4.4.2.2.5. Wrapping 4.4.2.2.6. Others 4.4.2.3. Canada Power Module Packaging Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Food 4.4.2.3.2. Beverage 4.4.2.3.3. Healthcare 4.4.2.3.4. Cosmetics 4.4.2.3.5. Industrial 4.4.2.3.6. Others 4.4.2.4. Mexico 4.4.2.5. Mexico Power Module Packaging Market Size and Forecast, by Material (2023-2030) 4.4.2.5.1. Paper and paperboard 4.4.2.5.2. Rigid plastic 4.4.2.5.3. Flexible 4.4.2.5.4. Metal 4.4.2.5.5. Glass 4.4.2.5.6. Others 4.4.2.6. Mexico Power Module Packaging Market Size and Forecast, by Function (2023-2030) 4.4.2.6.1. Cushioning 4.4.2.6.2. Blocking and Bracing 4.4.2.6.3. Void fill 4.4.2.6.4. Insulation 4.4.2.6.5. Wrapping 4.4.2.6.6. Others 4.4.2.7. Mexico Power Module Packaging Market Size and Forecast, by Application (2023-2030) 4.4.2.7.1. Food 4.4.2.7.2. Beverage 4.4.2.7.3. Healthcare 4.4.2.7.4. Cosmetics 4.4.2.7.5. Industrial 4.4.2.7.6. Others 5. Europe Power Module Packaging Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 5.1. Europe Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.2. Europe Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.3. Europe Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4. Europe Power Module Packaging Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.1.2. United Kingdom Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.1.3. United Kingdom Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.2.2. France Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.2.3. France Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.3.2. Germany Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.3.3. Germany Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.4.2. Italy Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.4.3. Italy Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.5.2. Spain Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.5.3. Spain Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.6.2. Sweden Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.6.3. Sweden Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.7.2. Austria Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.7.3. Austria Power Module Packaging Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Power Module Packaging Market Size and Forecast, by Material (2023-2030) 5.4.8.2. Rest of Europe Power Module Packaging Market Size and Forecast, by Function (2023-2030) 5.4.8.3. Rest of Europe Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Power Module Packaging Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 6.1. Asia Pacific Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.2. Asia Pacific Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.3. Asia Pacific Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Power Module Packaging Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.1.2. China Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.1.3. China Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.2.2. S Korea Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.2.3. S Korea Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.3.2. Japan Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.3.3. Japan Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.4.2. India Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.4.3. India Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.5.2. Australia Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.5.3. Australia Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.6.2. Indonesia Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.6.3. Indonesia Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.7.2. Malaysia Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.7.3. Malaysia Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.8.2. Vietnam Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.8.3. Vietnam Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.9.2. Taiwan Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.9.3. Taiwan Power Module Packaging Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Power Module Packaging Market Size and Forecast, by Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Power Module Packaging Market Size and Forecast, by Function (2023-2030) 6.4.10.3. Rest of Asia Pacific Power Module Packaging Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Power Module Packaging Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030 7.1. Middle East and Africa Power Module Packaging Market Size and Forecast, by Material (2023-2030) 7.2. Middle East and Africa Power Module Packaging Market Size and Forecast, by Function (2023-2030) 7.3. Middle East and Africa Power Module Packaging Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Power Module Packaging Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Power Module Packaging Market Size and Forecast, by Material (2023-2030) 7.4.1.2. South Africa Power Module Packaging Market Size and Forecast, by Function (2023-2030) 7.4.1.3. South Africa Power Module Packaging Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Power Module Packaging Market Size and Forecast, by Material (2023-2030) 7.4.2.2. GCC Power Module Packaging Market Size and Forecast, by Function (2023-2030) 7.4.2.3. GCC Power Module Packaging Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Power Module Packaging Market Size and Forecast, by Material (2023-2030) 7.4.3.2. Nigeria Power Module Packaging Market Size and Forecast, by Function (2023-2030) 7.4.3.3. Nigeria Power Module Packaging Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Power Module Packaging Market Size and Forecast, by Material (2023-2030) 7.4.4.2. Rest of ME&A Power Module Packaging Market Size and Forecast, by Function (2023-2030) 7.4.4.3. Rest of ME&A Power Module Packaging Market Size and Forecast, by Application (2023-2030) 8. South America Power Module Packaging Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030 8.1. South America Power Module Packaging Market Size and Forecast, by Material (2023-2030) 8.2. South America Power Module Packaging Market Size and Forecast, by Function (2023-2030) 8.3. South America Power Module Packaging Market Size and Forecast, by Application (2023-2030) 8.4. South America Power Module Packaging Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Power Module Packaging Market Size and Forecast, by Material (2023-2030) 8.4.1.2. Brazil Power Module Packaging Market Size and Forecast, by Function (2023-2030) 8.4.1.3. Brazil Power Module Packaging Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Power Module Packaging Market Size and Forecast, by Material (2023-2030) 8.4.2.2. Argentina Power Module Packaging Market Size and Forecast, by Function (2023-2030) 8.4.2.3. Argentina Power Module Packaging Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Power Module Packaging Market Size and Forecast, by Material (2023-2030) 8.4.3.2. Rest Of South America Power Module Packaging Market Size and Forecast, by Function (2023-2030) 8.4.3.3. Rest Of South America Power Module Packaging Market Size and Forecast, by Application (2023-2030) 9. Global Power Module Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Leading Power Module Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. huhtamaki 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Smurfit kappa group plc 10.3. Amcor plc 10.4. International paper 10.5. Ds smith 10.6. Sealed air 10.7. Pro Pac packaging limited 10.8. Storopack hans reichenecker gmbh 10.9. Sonoco products company 10.10. Pregis llc 10.11. Fuli electric co.ltd. 10.12. Infineon technologies ag 10.13. Hitachi ltd. 10.14. Mitsubishi technologies ag 10.15. Vincotech 10.16. Toshiba 10.17. On semiconductor 10.18. Stmicroelectronics 10.19. Semikron 10.20. Danfoss 11. Key Findings 12. Industry Recommendations 13. Power Module Packaging Market: Research Methodology 14. Terms and Glossary