Potting Compound Market size was valued at US$ 3.47 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 3.9% from 2022 to 2029, reaching nearly US$ 4.54 Bn.Potting Compound Market Overview:

Potting Compound Market is expected to reach US$ 4.54 Bn. by 2029. The potting compound is used to protect a gadget from moisture and to insulate it electrically. Both manual and automated meter-mix-dispensing (MMD) machines can be used for the potting process. This report focuses on the different segments of the Potting Compound market (Resin Type, Curing Technology, Application, End User, and Region). This report examines the major market players and regions in depth (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It's a thorough examination of today's quick advances in a variety of sectors. Facts and figures, visualisations, and presentations are utilised to demonstrate the core data analysis from 2017 through 2022. The market drivers, restraints, opportunities, and challenges for Potting Compound are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the Potting Compound market.To know about the Research Methodology:-Request Free Sample Report

Potting Compound Market Dynamics:

The aircraft industry's increasing requirement for potting Potting compounds come in a wide variety of chemistries, allowing for their usage with various substrates, over a range of working temperatures, and to deliver maximum performance under various environmental circumstances. In the aerospace industry, potting compounds are favoured because they increase mechanical strength and offer vibration and shock resistance. Additionally, potting materials shield metal from corrosion caused by moisture, temperature cycling, dust, and chemicals. To meet specific aerospace requirements like low coefficient of thermal expansion, low stress, cryogenic serviceability, ultra-low moisture absorption, special flow properties, high glass transition temperature, low outgassing, and high purity, epoxy, silicone, polyurethane, polysulfide, and UV cure systems are also available. Because of these qualities, potting compounds are frequently utilised in aerospace applications, which is expected to drive market growth for potting compounds during the forecast period. Heat generation's effects on potting chemicals Making sure that electrical circuits function as expected for an extended period of time is getting harder due to the growing demand for ever-increasing production rates at reduced unit prices. Due to excessive heat build-up and electrical interference, delicate materials, densely packed printed circuit boards (PCBs), constricting packaging, and extremely demanding service conditions have the potential to cause greater failure rates. Smaller and more powerful electronic designs need higher operating temperatures to function. They must be able to effectively dissipate the heat if they are to maintain a long service life and high dependability. Fragile parts are fried as a result of the curing reaction's heat. Additionally, a printed circuit board has parts that, when potted, generate a lot of heat and cause issues. Therefore, issues with heat generation in PCBs and other electronic circuits will continue to provide challenges for the potting compound market during the forecast period.Potting Compound Market Segment Analysis:

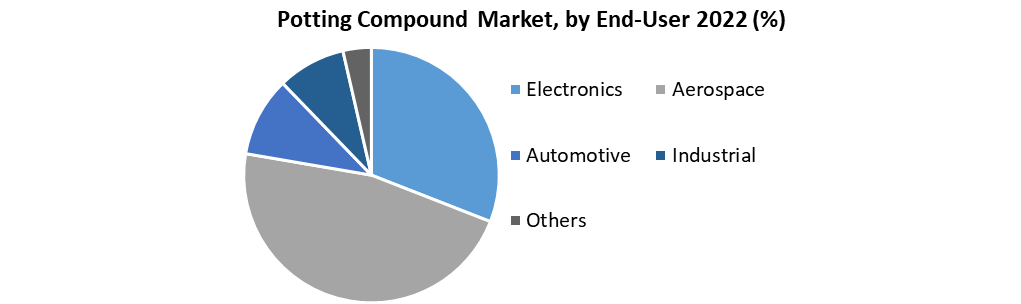

The Potting Compound Market is segmented by Resin Type, Curing Technology, Application, and End User. Based on the Resin Type, the market is segmented into Epoxy, Polyurethane, Silicone, Polyester, Polyamide, Polyolefin, and Acrylics. Epoxy segment is expected to hold the largest market share of xx% by 2029. The potting compound market uses epoxy extensively. Epoxy resins are the most often used potting substance. This compound is a wonderful option for outdoor applications since it generally has superior adhesion, high-temperature tolerance, chemical resistance, higher stiffness, modulus, and tensile strength, and very good resistance to moisture. Epoxies are frequently used in potting transformers and switches because of their high dielectric characteristics. Since they are frequently robust, long-lasting, and exhibit minimal cure shrinkage, epoxy resin is the major thermosetting plastic utilised in electronics applications. These factors are expected to help epoxy grow in the market during the forecast period. Based on the End User, the market is segmented into Electronics, Aerospace, Automotive, Industrial, and Others. Electronics segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. The world is becoming more and more digital due to the proliferation of high-performance electronics and cutting-edge sensor technologies. This necessitates more effective safeguards against a variety of environmental impacts for these delicate electrical components and sensors. To provide superior dielectric characteristics, electrical insulation, thermal conductivity, thermal shock resistance, mechanical strength, adhesion, hardness, cure speed, and chemical resistance, potting is used in electronic applications to reduce internal stress. As a result, the market is expected to increase significantly during the forecast period.

Potting Compound Market Regional Insights:

Asia Pacific region is expected to dominate the Potting Compound Market during the forecast period 2023-2029. Asia Pacific region is expected to hold the largest market share of xx% by 2029. The usage of potting compounds in electronics and electrical applications is rising significantly in countries in this region, including China, India, Japan, South Korea, and Malaysia. The consumer electronics and transportation industries in Asia-Pacific are driving most of this growth. Additionally, the rapid industrial development in the Asia-Pacific region is ferociously driving up demand for potting compounding in electrical and electronic applications. The Electronics and Computer Software Promotion Council (ESC) was established, according to the India Brand Equity Foundation, to offer a forum for India's IT & electronics industry. With exports to more than 200 nations, ESC has effectively guided India's exports of software and electronics. The International Energy Administration also claims that China's electronics industry has been a significant factor in the country's GDP growth. With about 150 million workers and more than five times as many electronics manufacturers and suppliers as Japan, it has the largest electronics ecosystem and supply chain in the world. The objective of the report is to present a comprehensive analysis of the Global Potting Compound Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Potting Compound Market dynamic and structure by analyzing the market segments and projecting the Global Potting Compound Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Potting Compound Market make the report investor’s guide.Potting Compound Market Scope:Inquire before buying

Potting Compound Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3.47 Bn. Forecast Period 2023 to 2029 CAGR: 3.9% Market Size in 2029: US $ 4.54 Bn. Segments Covered: by Resin Type • Epoxy • Polyurethane • Silicone • Polyester • Polyamide • Polyolefin • Acrylics by Curing Technology • UV Curing • Thermal Curing • Room Temperature Curing by Application •Electrical • Electronics by End-User •Electronics • Aerospace • Automotive • Industrial • Others Potting Compound Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Potting Compound Market Key Players

• Henkel AG & Co. KGaA • The 3M Company • MG Chemicals • ELANTAS GmbH • ALPAS Srl • Dymax Corporation • Aremco Products, Inc. • DowDuPont Inc • HItach Chemical LLC • WEVO-CHEMIE GmbH • Huntsman Advanced Materials • Wacker-Chemie • Master Bond, Inc. • Lord Corporation • RBC Industries, Inc. • Shanghai Sepna Chemical Technology Co. Ltd. Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Potting Compound Market? Ans. Asia Pacific is expected to hold the highest share in the Potting Compound Market. 2] Who are the top key players in the Potting Compound Market? Ans. Henkel AG & Co. KGaA, The 3M Company, MG Chemicals, ELANTAS GmbH, ALPAS Srl, and Dymax Corporation are the top key players in the Potting Compound Market. 3] Which segment is expected to hold the largest market share in the Potting Compound Market by 2029? Ans. Epoxy segment is expected to hold the largest market share in the Potting Compound Market by 2029. 4] What is the market size of the Potting Compound Market by 2029? Ans. The market size of the Potting Compound Market is expected to reach US $4.54 Bn. by 2029. 5] What was the market size of the Potting Compound Market in 2022? Ans. The market size of the Potting Compound Market was worth US $3.47 Bn. in 2022.

1. Global Potting Compound Market: Research Methodology 2. Global Potting Compound Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to the Global Potting Compound Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Potting Compound Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Potting Compound Market Segmentation 4.1 Global Potting Compound Market, by Resin Type (2022-2029) • Epoxy • Polyurethane • Silicone • Polyester • Polyamide • Polyolefin • Acrylics 4.2 Global Potting Compound Market, by Curing Technology (2022-2029) • UV Curing • Thermal Curing • Room Temperature Curing 4.3 Global Potting Compound Market, by Application (2022-2029) • Electrical • Electronics 4.4 Global Potting Compound Market, by End User (2022-2029) • Electronics • Aerospace • Automotive • Industrial • Others 5. North America Potting Compound Market (2022-2029) 5.1 North America Potting Compound Market, by Resin Type (2022-2029) • Epoxy • Polyurethane • Silicone • Polyester • Polyamide • Polyolefin • Acrylics 5.2 North America Potting Compound Market, by Curing Technology (2022-2029) • UV Curing • Thermal Curing • Room Temperature Curing 5.3 North America Potting Compound Market, by Application (2022-2029) • Electrical • Electronics 5.4 North America Potting Compound Market, by End User (2022-2029) • Electronics • Aerospace • Automotive • Industrial • Others 5.5 North America Potting Compound Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Potting Compound Market (2022-2029) 6.1. Europe Potting Compound Market, by Resin Type (2022-2029) 6.2. Europe Potting Compound Market, by Curing Technology (2022-2029) 6.3. Europe Potting Compound Market, by Application (2022-2029) 6.4. Europe Potting Compound Market, by End User (2022-2029) 6.5. Europe Potting Compound Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Potting Compound Market (2022-2029) 7.1. Asia Pacific Potting Compound Market, by Resin Type (2022-2029) 7.2. Asia Pacific Potting Compound Market, by Curing Technology (2022-2029) 7.3. Asia Pacific Potting Compound Market, by Application (2022-2029) 7.4. Asia Pacific Potting Compound Market, by End User (2022-2029) 7.5. Asia Pacific Potting Compound Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. South America Potting Compound Market (2022-2029) 8.1. South America Potting Compound Market, by Resin Type (2022-2029) 8.2. South America Potting Compound Market, by Curing Technology (2022-2029) 8.3. South America Potting Compound Market, by Application (2022-2029) 8.4. South America Potting Compound Market, by End User (2022-2029) 8.5. South America Potting Compound Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 9. Middle East and Africa Potting Compound Market (2022-2029) 9.1. Middle East and Africa Potting Compound Market, by Resin Type (2022-2029) 9.2. Middle East and Africa Potting Compound Market, by Curing Technology (2022-2029) 9.3. Middle East and Africa Potting Compound Market, by Application (2022-2029) 9.4. Middle East and Africa Potting Compound Market, by End User (2022-2029) 9.5. Middle East and Africa Potting Compound Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 10. Company Profile: Key players 10.1 Henkel AG & Co. KGaA 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 The 3M Company 10.3 MG Chemicals 10.4 ELANTAS GmbH 10.5 ALPAS Srl 10.6 Dymax Corporation 10.7 Aremco Products, Inc. 10.8 DowDuPont Inc 10.9 HItach Chemical LLC 10.10 WEVO-CHEMIE GmbH 10.11 Huntsman Advanced Materials 10.12 Wacker-Chemie 10.13 Master Bond, Inc. 10.14 Lord Corporation 10.15 RBC Industries, Inc. 10.16 Shanghai Sepna Chemical Technology Co. Ltd.