The Pickles Market size was valued at USD 11.80 Bn in 2023 and is expected to reach USD 15.22 Bn by 2030, at a CAGR of 3.7 %.Overview of the Pickles Market

Pickles are crafted through the immersion of cucumbers and assorted vegetables in a brine solution comprising vinegar, salt, and various spices. Vinegar serves a dual purpose in preserving the pickles and imparting a subtle sour flavor. The addition of sugars or alternative sweeteners can introduce a sweet element to the pickles, while the incorporation of ingredients such as dill weed, cinnamon, allspice, cloves, garlic, and black pepper contributes to the creation of distinct and diverse flavors. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Pickles Market.To know about the Research Methodology :- Request Free Sample Report

Pickles Market Dynamics

Growing Consumer Demand for Convenience Foods with Globalization and Cultural Exchange are driving the Pickles Market The pervasive trend toward busier lifestyles and an increasing need for on-the-go snacks is a key driver in the pickles market. Consumers, seeking convenient food options, are drawn to pickles as a quick and easily accessible choice. The ready-to-eat nature of pickles positions them as a favored snack, aligning seamlessly with the demands of those seeking convenience in their daily lives. This trend is evident in the popularity of homemade pickles in India, reflecting a cultural affinity for convenient and flavourful snack options. A discerning health-conscious consumer base is propelling the demand for pickles made with natural ingredients, minimal additives, and low preservatives. In response, pickles with organic, non-GMO, and probiotic-rich formulations are gaining notable traction among health-oriented individuals. This shift reflects a growing awareness of the impact of dietary choices on overall well-being. American pickles, known for their emphasis on quality and health-conscious ingredients, are particularly well-received in this evolving market. Ongoing innovation within the pickle industry is characterized by the introduction of exotic spices, unique vegetable combinations, and creative brine solutions. This diversification caters to adventurous eaters actively seeking novel taste experiences. The market is evolving beyond traditional offerings, with consumers embracing a broader range of pickle flavors and profiles. Innovations such as those seen in Jampani Pickles, known for their inventive combinations and South Asian pickle influences, exemplify the industry's commitment to culinary diversity. The globalization of food preferences has fostered a cross-cultural acceptance of diverse pickling traditions. Consumers are increasingly open to exploring and embracing pickles inspired by different cuisines. This openness contributes significantly to the expansion of the global pickle market, as culinary diversity becomes a driving force in shaping consumer preferences. The demand for various types of pickles is particularly evident in the pickles market demand in Asian countries, showcasing a fusion of traditional and international flavors.Fig.1. Production of Cucumbers in (tons) Per Country 202 Increasing Demand for Health-Focused Pickles with Rising E-commerce and Direct-to-Consumer Channels bolstering opportunities in the Pickles Market Addressing the demand for healthier options, manufacturers can seize the opportunity to develop pickles with added health benefits. This may involve incorporating probiotics for gut health or creating options with reduced sodium content. Marketing campaigns highlighting these health-focused features can effectively appeal to a growing segment of health-conscious consumers. The market penetration of health-focused pickles in North America underscores the potential for meeting evolving consumer preferences. The rise of online platforms presents a substantial avenue for pickle manufacturers to broaden their audience reach. Leveraging e-commerce allows for the implementation of exclusive online promotions, subscription services, and unique bundles. This capitalizes on the convenience and accessibility of online shopping, offering consumers a seamless experience while expanding market presence. The demand and supply dynamics for pickles market in the United States, Mexico, and Canada are particularly influenced by the accessibility and efficiency of e-commerce channels. A significant opportunity lies in the expansion of product portfolios, where companies can tap into niche markets by introducing specialized pickle products. These may include organic, artisanal, or gourmet varieties that not only attract consumers seeking unique flavors but also allow for premium pricing strategies, positioning pickles as a distinctive and premium snack option. The growth potential of the pickles market in South America exemplifies the opportunity for companies to cater to diverse regional tastes and preferences. Collaborating with restaurants, chefs, or other food producers presents a strategic avenue for innovation in the pickle market. Such partnerships can lead to the creation of unique and innovative pickle products. Limited-edition collaborations or co-branded offerings have the potential to generate buzz and attract a diverse customer base seeking distinctive and premium pickle options. The pickles market share in United States, Japan, China, Indonesia, and France is influenced by collaborations that bring together culinary expertise and consumer preferences. High Salt Content Concerns and Supply Chain Disruptions are the Dominating Challenges in the Pickles Market While salt is a traditional and essential ingredient in pickling, the escalating concern about high sodium intake and its impact on health poses a significant restraint. Manufacturers can address this challenge by developing low-sodium or salt-alternative pickles to meet the preferences of health-conscious consumers and align with evolving dietary trends. Regulatory compliance in the pickles market potential in Europe is particularly stringent concerning salt content, adding an additional layer of restraint for manufacturers. Dependence on a stable supply chain for fresh vegetables and spices is a potential challenge. Weather-related disruptions, geopolitical issues, or unforeseen events can impact the availability and cost of raw materials. Developing contingency plans and building resilient supply chains are crucial steps in mitigating risks associated with potential supply chain disruptions. The pickles market growth in the United States, Mexico, and Canada is particularly vulnerable to supply chain disruptions, emphasizing the need for strategic planning. Overcoming the persistent perception of pickles as unhealthy, often due to preservatives or high salt content, requires strategic communication. Clear labelling, comprehensive nutritional information, and marketing efforts emphasizing natural ingredients are essential in reshaping consumer perceptions and fostering a more positive image of pickles in the context of a balanced diet. Consumer behaviour trends in the pickles market emphasize the need for transparent communication to address concerns and reshape perceptions. Adhering to stringent food safety and labelling regulations represents a constant challenge for pickle manufacturers. Keeping abreast of evolving regulatory standards, investing in robust quality control measures, and fostering a culture of compliance within the industry are essential for navigating the regulatory landscape effectively. This commitment ensures that pickles meet the highest standards of safety and quality, instilling consumer confidence in the product. Regulatory compliance is particularly emphasized in the pickles market share in Germany, Japan, China, Indonesia, and France, where adherence to strict standards is essential for market presence and consumer trust.

Production of Cucumbers (Food Processing) Rank Country Production (tons) 1 China 54,315,900 2 Turkey 1,754,613 3 Iran (Islamic Republic of) 1,570,078 4 Russian Federation 1,068,000 5 Ukraine 1,044,300 6 Spain 754,400 7 United States of America 747,610 8 Mexico 637,395 9 Egypt 631,129 10 Uzbekistan 607,397

Pickles Market Segment Analysis

Type: Revered for their unique dill-infused flavor, Dill Pickles hold an esteemed position in the market. Beyond their tangy and slightly sour taste, these classic pickles stand as a culinary cornerstone, satisfying consumers seeking the authentic and traditional experience of homemade pickles. Crafted with meticulous precision for those with a sweet tooth, Sweet Pickles embody a delightful blend of sweetness and tanginess, crafting a flavor profile that resonates with the indulgence of American pickles. This variant caters to discerning palates seeking a nuanced and satisfying taste. Carving a distinct niche, Candied Pickles introduce a subtle touch of sweetness to the pickle spectrum. Tailored for consumers yearning for a more indulgent and gourmet pickle experience, this variant aligns seamlessly with the evolving consumer behaviour trends emphasizing uniqueness and premium offerings. Embracing bold and vibrant flavors, Spicy Pickles cater to the adventurous taste buds that seek a kick of heat in culinary choices. This variant stands as a testament to ongoing innovation and the increasing demand for diverse pickle types, offering a zesty and flavourful option. A harmonious amalgamation of various vegetables and spices, Mixed Pickles present a dynamic and diverse taste experience. Within a single jar, this variant combines different textures and flavors, showcasing a continuous innovation trend in the pickles industry, appealing to those with an appreciation for culinary variety. Infused with a distinctive South Asian flair, Chow Chow pickles represent a fusion of vegetables and pickling spices. This variant appeals to consumers seeking regional authenticity, contributing significantly to the global diversity of pickle offerings, especially in Asian countries.Flavour: With a sugary note, Sweet-flavoured pickles cater to consumers desiring a harmonious balance between sweetness and acidity. This variant adds a delightful and nuanced sweetness to the pickle landscape, responding to the demand for sweet vegetable pickles in diverse and evolving markets. Anchored in traditional tastes, Salty Pickles focus on the savory aspect, providing a classic and straightforward flavor profile. This variant resonates with consumers appreciating the timeless and savory essence of pickled foods, showcasing the enduring appeal of salty pickles across various regions. Emphasizing tanginess, Sour-flavoured pickles appeal to those who relish the puckering sensation associated with pickled foods. This variant adds a refreshing and zesty dimension to the pickle market, aligning with South Asian pickle preferences and reflecting global consumer behaviour trends. Sales Channels: As major retail hubs, supermarkets and hypermarkets play a pivotal role in the pickles market. These establishments offer a diverse range of options to consumers, meeting the intricate dynamics of demand and supply for pickles in a convenient and comprehensive shopping environment. American pickles, with their diverse flavors, secure ample shelf space in these retail giants, contributing to their accessibility. Addressing the needs of on-the-go consumers, convenience stores contribute significantly to the accessibility of pickles. These outlets make pickles available for quick and easy purchase, aligning with the fast-paced consumer behaviour trends in the pickles market, where convenience is a key consideration. Enriching the diversity of the pickles market, specialty and local retailers offer unique and artisanal pickle varieties. Brands like Jampani Pickles, renowned for their South Asian influence, may find a niche in these outlets, contributing to the gourmet aspects of the industry and appealing to specific consumer preferences. The rise of e-commerce has left an indelible mark on the pickles market, providing a platform for consumers to explore and purchase a wide range of pickles from the comfort of their homes. Online stores enhance accessibility and broaden consumer choices, reflecting the evolving landscape of retail in various countries. This category encompasses various niche outlets, including farmers' markets, specialty food stores, and foodservice establishments. The others category further contributes to the overall accessibility and availability of pickles in the market. These outlets cater to specific preferences, showcasing the diverse types of pickles available and their potential in South America, providing a nuanced and specialized purchasing experience.

Pickles Market Regional Analysis

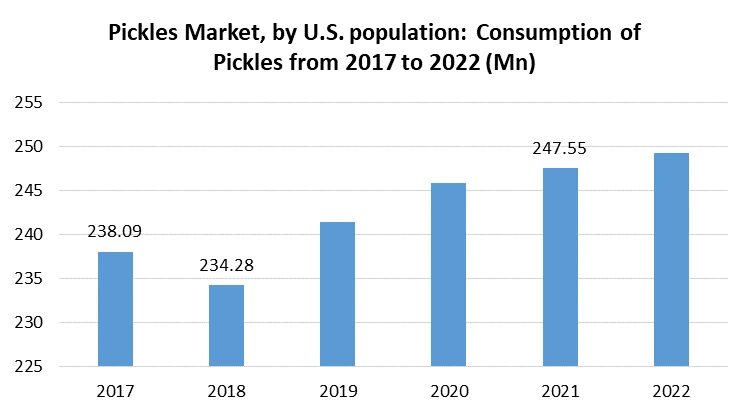

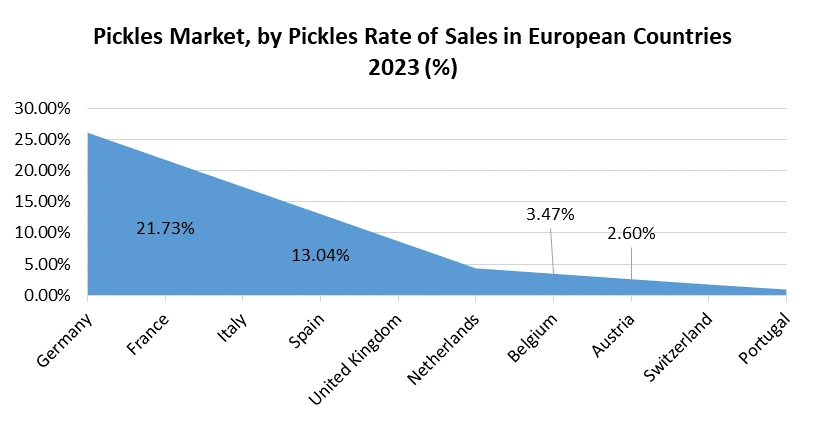

The pickles market in North America has a rich historical evolution deeply intertwined with cultural influences. Christopher Columbus introduced pickles during his voyages, a practice that later evolved into a significant culinary tradition. In the United States, the market witnessed the rise of diverse pickling practices, notably with Jewish immigrants introducing kosher dill pickles in the late 19th and early 20th centuries. The American pickles market, influenced by historical roots dating back to Christopher Columbus, has evolved into a diverse landscape. Dutch farmers in 1659 initiated pickling cucumbers in Brooklyn, New York, while Jewish communities played a pivotal role in popularizing kosher dill pickles during the late 19th and early 20th centuries. This rich culinary tradition transformed pickles into a profitable business, sold from barrels in Jewish shops, showcasing the adaptability of American pickles over time. The adaptability of pickles to diverse tastes and preferences is evident in their incorporation into the American diet. Consumer behaviour trends in the North American pickles market showcase a preference for innovation and variety. The demand and supply dynamics for pickles continue to be robust, with a growing interest in unique flavors and types. The market penetration in North America highlights the widespread availability and consumption of pickles, contributing to their status as a versatile and beloved food item. The pickles market in North America presents growth opportunities, with specific segments gaining prominence. Dill pickles, sweet pickles, and innovative flavors cater to diverse consumer preferences. The segmentation analysis emphasizes the importance of sales channels, including supermarkets, convenience stores, and online platforms, as key drivers of market growth. Europe boasts a diverse and rich culinary heritage, reflected in the varied pickling traditions across the continent. In Germany, for instance, pickles have deep-rooted cultural significance, contributing to the global pickles market. Regional variations in pickling techniques and flavors showcase the adaptability of pickles to local tastes. The pickles market share in Germany, along with other European countries such as France, reflects the widespread consumption of this versatile food item. Consumer preferences lean towards traditional flavors, but there is also a growing interest in innovative types of pickles. The market potential in Europe remains high, driven by the continuous demand for pickles as a popular condiment. The economic factors influencing the pickle market in Europe include factors like disposable income and lifestyle changes. The regional competitive landscape is characterized by a mix of international and local players, each contributing to the market's diversity. The presence of various types of pickles, from classic dill to regional specialties, adds to the competitive dynamics. In the Asia Pacific Region, pickles are foundational in every household, weaving into the fabric of the country's culinary identity. With over 1000 diverse pickle recipes, pickling techniques vary regionally, showcasing the versatility of vegetable pickles. Each type reflects strong regional footprints, aligning with local tastes and preferences, making pickles a universal accompaniment to meals across the country. The Indian pickle market thrives domestically and internationally, with scalable business models meeting diverse demands. From homemade pickles to commercial enterprises like Jampani Pickles, the industry caters to varied preferences. Adherence to food standards like FSSAI and ISI establishes a reputation, contributing to the global quality standard of Indian pickles and fostering export demand. Asian Countries pickles resonate globally, finding favor in countries like Saudi Arabia, America, Australia, Europe, and Russia. The diverse regional flavors of Indian pickles contribute to their global popularity. As life becomes more fast-paced, the demand for ready-made quality products with a homemade touch rises, positioning Indian pickles to fulfil this need across different societal segments.

Pickles Market Competitive Landscape

The competitive landscape of the pickles market undergoes a comprehensive analysis of market rivalry, highlighting the intense competition among industry players. This rivalry assessment offers insights into the market dynamics, elucidating the strategies employed by competitors to gain a competitive edge. Competitor benchmarking stands as a critical component in the pickles market, enabling industry players to assess their performance against key competitors. This process involves a thorough comparison of metrics, encompassing market share, product offerings, and consumer satisfaction, to identify strengths and areas for improvement. In another development, ADF Foods has acquired Elena's Food Specialities, a US-based manufacturer and marketer of organic and natural products, recognized for its leadership in protein-based Mexican foods in the natural and organic category. The acquisition includes all significant assets and certain liabilities of Elena's for an agreed consideration. ADF Foods' Managing Director, Bimal Thakkar, emphasized that this strategic move aligns with ADF's pursuit of inorganic growth, expanding both the product portfolio and distribution network. Elena's, with its robust distribution network in the US mainstream markets and popular brands like PJ's Organics and Nate's, complements ADF Foods' growth strategy. ADF Foods' acquisition of Elena's Food Specialities marks a strategic move in the company's pursuit of inorganic growth. Elena's, a US-based manufacturer and marketer specializing in organic and natural products, particularly protein-based Mexican foods, is known for popular brands like PJ's Organics and Nate's. The acquisition involves the purchase of significant assets and certain liabilities of Elena's by ADF Foods. Bimal Thakkar, the Managing Director of ADF Foods, emphasized that this strategic step aligns with the company's broader growth strategy. By incorporating Elena's into its portfolio, ADF Foods aims to diversify its product offerings and expand its distribution network. Elena's has a robust presence in the US mainstream markets, which, coupled with its recognized brands, enhances ADF Foods' market presence. On a larger scale, this acquisition reflects the broader trends in the food industry, where companies seek to strengthen their positions by diversifying product lines and acquiring brands with established market recognition. The emphasis on organic and natural products aligns with evolving consumer preferences for healthier and sustainable food options. Furthermore, Conagra Brands has announced its acquisition of Pinnacle Foods for USD 10.9 billion in cash and stock. The boards of directors of both companies have unanimously approved the definitive agreement. Pinnacle Foods shareholders will receive USD 43.11 per share in cash and 0.6494 shares of Conagra Brands common stock for each share of Pinnacle Foods held. This acquisition is valued at approximately USD 10.9 billion, including Pinnacle Foods' outstanding net debt.The competitive landscape in the pickles market, as illustrated by these strategic acquisitions, demands continual assessment and strategic adaptation. Industry players can navigate this competitive intensity effectively through processes such as competitor benchmarking, strategy reviews, and impact analyses, ensuring a robust and resilient market position.

Pickles Market Scope Table: Inquire Before Buying

Global Pickles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2029 Historical Data: 2018 to 2023 Market Size in 2023: US $ 11.80 Bn. Forecast Period 2024 to 2030 CAGR: 3.7% Market Size in 2030: US $ 15.22 Bn. Segments Covered: by Type Dill pickles Sweet pickles Candied pickles Spicy pickles Mixed pickles Chow Chow by Flavour Sweet Salty Sour by Packaging Type Bottles and Jars Pouches Others by Sales Channel Supermarkets and Hypermarkets Convenience stores Independent retailers Online Stores Others Pickles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Pickles Market

1. ADF Foods (India) 2. Conagra Brands, Inc. (United States) 3. Pinnacle Foods Inc.(United States) 4. Kraft Heinz(United States) 5. Del Monte Foods(United States) 6. Mt Olive Pickles(United States) 7. Kraft Heinz, Inc.(United States) 8. Mothers Recipe(India) 9. MTR Foods(India) 10. Nilon’s Enterprises Pvt. Ltd(India) 11. Mitoku Company Limited(Japan) 12. Angel CamachoSpain) 13. Freestone Pickles(Australia) 14. REITZEL INDIA P LTD.(India) Frequently Asked Questions and Answers about Pickles Market 1. What factors contribute to the growth of the pickles market? Ans: The pickles market is fuelled by factors such as diverse consumer preferences, health benefits, and the adaptability of pickles to various global cuisines. 2. Which regions are significant players in the global pickles market? Ans: North America, Europe, and Asia, especially India, play key roles in the global pickles market, with unique regional variations and traditions. 3. What are the major types of pickles dominating the market? Ans: Dill pickles, sweet pickles, spicy pickles, and South Asian pickles are among the prominent types, offering diverse flavor profiles to cater to consumer preferences. 4. How does the competitive landscape look in the pickles market? Ans: The pickles market is characterized by intense rivalry, benchmarking against competitors, and strategic positioning, with major players from the United States and India leading the industry. 5. What is the global market potential for pickles? Ans: The global pickles market is projected to surpass USD 15.22 billion by 2030, indicating substantial opportunities and sustained consumer demand.

1. Pickles Market: Research Methodology 2. Pickles Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Pickles Market: Dynamics 3.1. Pickles Market Trends by Region 3.1.1. Global Pickles Market Trends 3.1.2. North America Pickles Market Trends 3.1.3. Europe Pickles Market Trends 3.1.4. Asia Pacific Pickles Market Trends 3.1.5. Middle East and Africa Pickles Market Trends 3.1.6. South America Pickles Market Trends 3.2. Pickles Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Pickles Market Drivers 3.2.1.2. North America Pickles Market Restraints 3.2.1.3. North America Pickles Market Opportunities 3.2.1.4. North America Pickles Market Challenges 3.2.2. Europe 3.2.2.1. Europe Pickles Market Drivers 3.2.2.2. Europe Pickles Market Restraints 3.2.2.3. Europe Pickles Market Opportunities 3.2.2.4. Europe Pickles Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Pickles Market Drivers 3.2.3.2. Asia Pacific Pickles Market Restraints 3.2.3.3. Asia Pacific Pickles Market Opportunities 3.2.3.4. Asia Pacific Pickles Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Pickles Market Drivers 3.2.4.2. Middle East and Africa Pickles Market Restraints 3.2.4.3. Middle East and Africa Pickles Market Opportunities 3.2.4.4. Middle East and Africa Pickles Market Challenges 3.2.5. South America 3.2.5.1. South America Pickles Market Drivers 3.2.5.2. South America Pickles Market Restraints 3.2.5.3. South America Pickles Market Opportunities 3.2.5.4. South America Pickles Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Pickles Market 3.7. Analysis of Government Schemes and Initiatives For Pickles Market 3.8. The Global Pandemic Impact on Pickles Market 4. Pickles Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Pickles Market Size and Forecast, by Type (2023-2030) 4.1.1. Dill pickles 4.1.2. Sweet pickles 4.1.3. Candied pickles 4.1.4. Spicy pickles 4.1.5. Mixed pickles 4.1.6. Chow Chow 4.2. Pickles Market Size and Forecast, by Flavour (2023-2030) 4.2.1. Sweet 4.2.2. Salty 4.2.3. Sour 4.3. Pickles Market Size and Forecast, by Packaging Types (2023-2030) 4.3.1. Bottles and Jars 4.3.2. Pouches 4.3.3. Others 4.4. Pickles Market Size and Forecast, by Sales Channel (2023-2030) 4.4.1. Supermarkets and Hypermarkets 4.4.2. Convenience stores 4.4.3. Independent retailers 4.4.4. Online Stores 4.4.5. Others 4.5. Pickles Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Pickles Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. North America Pickles Market Size and Forecast, by Type (2023-2030) 5.1.1. Dill pickles 5.1.2. Sweet pickles 5.1.3. Candied pickles 5.1.4. Spicy pickles 5.1.5. Mixed pickles 5.1.6. Chow Chow 5.2. North America Pickles Market Size and Forecast, by Flavour (2023-2030) 5.2.1. Sweet 5.2.2. Salty 5.2.3. Sour 5.3. North America Pickles Market Size and Forecast, by Packaging Types (2023-2030) 5.3.1. Bottles and Jars 5.3.2. Pouches 5.3.3. Others 5.4. North America Pickles Market Size and Forecast, by Sales Channel (2023-2030) 5.4.1. Supermarkets and Hypermarkets 5.4.2. Convenience stores 5.4.3. Independent retailers 5.4.4. Online Stores 5.4.5. Others 5.5. North America Pickles Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Pickles Market Size and Forecast, by Type (2023-2030) 5.5.1.1.1. Dill pickles 5.5.1.1.2. Sweet pickles 5.5.1.1.3. Candied pickles 5.5.1.1.4. Spicy pickles 5.5.1.1.5. Mixed pickles 5.5.1.1.6. Chow Chow 5.5.1.2. United States Pickles Market Size and Forecast, by Flavour (2023-2030) 5.5.1.2.1. Sweet 5.5.1.2.2. Salty 5.5.1.2.3. Sour 5.5.1.3. United States Pickles Market Size and Forecast, by Packaging Types (2023-2030) 5.5.1.3.1. Bottles and Jars 5.5.1.3.2. Pouches 5.5.1.3.3. Others 5.5.1.4. United States Pickles Market Size and Forecast, by Sales Channel (2023-2030) 5.5.1.4.1. Supermarkets and Hypermarkets 5.5.1.4.2. Convenience stores 5.5.1.4.3. Independent retailers 5.5.1.4.4. Online Stores 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Pickles Market Size and Forecast, by Type (2023-2030) 5.5.2.1.1. Dill pickles 5.5.2.1.2. Sweet pickles 5.5.2.1.3. Candied pickles 5.5.2.1.4. Spicy pickles 5.5.2.1.5. Mixed pickles 5.5.2.1.6. Chow Chow 5.5.2.2. Canada Pickles Market Size and Forecast, by Flavour (2023-2030) 5.5.2.2.1. Sweet 5.5.2.2.2. Salty 5.5.2.2.3. Sour 5.5.2.3. Canada Pickles Market Size and Forecast, by Packaging Types (2023-2030) 5.5.2.3.1. Bottles and Jars 5.5.2.3.2. Pouches 5.5.2.3.3. Others 5.5.2.4. Canada Pickles Market Size and Forecast, by Sales Channel (2023-2030) 5.5.2.4.1. Supermarkets and Hypermarkets 5.5.2.4.2. Convenience stores 5.5.2.4.3. Independent retailers 5.5.2.4.4. Online Stores 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Pickles Market Size and Forecast, by Type (2023-2030) 5.5.3.1.1. Dill pickles 5.5.3.1.2. Sweet pickles 5.5.3.1.3. Candied pickles 5.5.3.1.4. Spicy pickles 5.5.3.1.5. Mixed pickles 5.5.3.1.6. Chow Chow 5.5.3.2. Mexico Pickles Market Size and Forecast, by Flavour (2023-2030) 5.5.3.2.1. Sweet 5.5.3.2.2. Salty 5.5.3.2.3. Sour 5.5.3.3. Mexico Pickles Market Size and Forecast, by Packaging Types (2023-2030) 5.5.3.3.1. Bottles and Jars 5.5.3.3.2. Pouches 5.5.3.3.3. Others 5.5.3.4. Mexico Pickles Market Size and Forecast, by Sales Channel (2023-2030) 5.5.3.4.1. Supermarkets and Hypermarkets 5.5.3.4.2. Convenience stores 5.5.3.4.3. Independent retailers 5.5.3.4.4. Online Stores 5.5.3.4.5. Others 6. Europe Pickles Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Europe Pickles Market Size and Forecast, by Type (2023-2030) 6.2. Europe Pickles Market Size and Forecast, by Flavour (2023-2030) 6.3. Europe Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.4. Europe Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5. Europe Pickles Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Pickles Market Size and Forecast, by Type (2023-2030) 6.5.1.2. United Kingdom Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.1.3. United Kingdom Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.1.4. United Kingdom Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.2. France 6.5.2.1. France Pickles Market Size and Forecast, by Type (2023-2030) 6.5.2.2. France Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.2.3. France Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.2.4. France Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Pickles Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Germany Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.3.3. Germany Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.3.4. Germany Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Pickles Market Size and Forecast, by Type (2023-2030) 6.5.4.2. Italy Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.4.3. Italy Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.4.4. Italy Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Pickles Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Spain Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.5.3. Spain Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.5.4. Spain Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Pickles Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Sweden Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.6.3. Sweden Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.6.4. Sweden Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Pickles Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Austria Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.7.3. Austria Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.7.4. Austria Pickles Market Size and Forecast, by Sales Channel (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Pickles Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Rest of Europe Pickles Market Size and Forecast, by Flavour (2023-2030) 6.5.8.3. Rest of Europe Pickles Market Size and Forecast, by Packaging Types (2023-2030) 6.5.8.4. Rest of Europe Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7. Asia Pacific Pickles Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Pickles Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Pickles Market Size and Forecast, by Flavour (2023-2030) 7.3. Asia Pacific Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.4. Asia Pacific Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5. Asia Pacific Pickles Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Pickles Market Size and Forecast, by Type (2023-2030) 7.5.1.2. China Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.1.3. China Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.1.4. China Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Pickles Market Size and Forecast, by Type (2023-2030) 7.5.2.2. S Korea Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.2.3. S Korea Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.2.4. S Korea Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Pickles Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Japan Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.3.3. Japan Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.3.4. Japan Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.4. India 7.5.4.1. India Pickles Market Size and Forecast, by Type (2023-2030) 7.5.4.2. India Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.4.3. India Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.4.4. India Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Pickles Market Size and Forecast, by Type (2023-2030) 7.5.5.2. Australia Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.5.3. Australia Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.5.4. Australia Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Pickles Market Size and Forecast, by Type (2023-2030) 7.5.6.2. Indonesia Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.6.3. Indonesia Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.6.4. Indonesia Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Pickles Market Size and Forecast, by Type (2023-2030) 7.5.7.2. Malaysia Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.7.3. Malaysia Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.7.4. Malaysia Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Pickles Market Size and Forecast, by Type (2023-2030) 7.5.8.2. Vietnam Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.8.3. Vietnam Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.8.4. Vietnam Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Pickles Market Size and Forecast, by Type (2023-2030) 7.5.9.2. Taiwan Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.9.3. Taiwan Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.9.4. Taiwan Pickles Market Size and Forecast, by Sales Channel (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Pickles Market Size and Forecast, by Type (2023-2030) 7.5.10.2. Rest of Asia Pacific Pickles Market Size and Forecast, by Flavour (2023-2030) 7.5.10.3. Rest of Asia Pacific Pickles Market Size and Forecast, by Packaging Types (2023-2030) 7.5.10.4. Rest of Asia Pacific Pickles Market Size and Forecast, by Sales Channel (2023-2030) 8. Middle East and Africa Pickles Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Pickles Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Pickles Market Size and Forecast, by Flavour (2023-2030) 8.3. Middle East and Africa Pickles Market Size and Forecast, by Packaging Types (2023-2030) 8.4. Middle East and Africa Pickles Market Size and Forecast, by Sales Channel (2023-2030) 8.5. Middle East and Africa Pickles Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Pickles Market Size and Forecast, by Type (2023-2030) 8.5.1.2. South Africa Pickles Market Size and Forecast, by Flavour (2023-2030) 8.5.1.3. South Africa Pickles Market Size and Forecast, by Packaging Types (2023-2030) 8.5.1.4. South Africa Pickles Market Size and Forecast, by Sales Channel (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Pickles Market Size and Forecast, by Type (2023-2030) 8.5.2.2. GCC Pickles Market Size and Forecast, by Flavour (2023-2030) 8.5.2.3. GCC Pickles Market Size and Forecast, by Packaging Types (2023-2030) 8.5.2.4. GCC Pickles Market Size and Forecast, by Sales Channel (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Pickles Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Nigeria Pickles Market Size and Forecast, by Flavour (2023-2030) 8.5.3.3. Nigeria Pickles Market Size and Forecast, by Packaging Types (2023-2030) 8.5.3.4. Nigeria Pickles Market Size and Forecast, by Sales Channel (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Pickles Market Size and Forecast, by Type (2023-2030) 8.5.4.2. Rest of ME&A Pickles Market Size and Forecast, by Flavour (2023-2030) 8.5.4.3. Rest of ME&A Pickles Market Size and Forecast, by Packaging Types (2023-2030) 8.5.4.4. Rest of ME&A Pickles Market Size and Forecast, by Sales Channel (2023-2030) 9. South America Pickles Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 9.1. South America Pickles Market Size and Forecast, by Type (2023-2030) 9.2. South America Pickles Market Size and Forecast, by Flavour (2023-2030) 9.3. South America Pickles Market Size and Forecast, by Packaging Types (2023-2030) 9.4. South America Pickles Market Size and Forecast, by Sales Channel (2023-2030) 9.5. South America Pickles Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Pickles Market Size and Forecast, by Type (2023-2030) 9.5.1.2. Brazil Pickles Market Size and Forecast, by Flavour (2023-2030) 9.5.1.3. Brazil Pickles Market Size and Forecast, by Packaging Types (2023-2030) 9.5.1.4. Brazil Pickles Market Size and Forecast, by Sales Channel (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Pickles Market Size and Forecast, by Type (2023-2030) 9.5.2.2. Argentina Pickles Market Size and Forecast, by Flavour (2023-2030) 9.5.2.3. Argentina Pickles Market Size and Forecast, by Packaging Types (2023-2030) 9.5.2.4. Argentina Pickles Market Size and Forecast, by Sales Channel (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Pickles Market Size and Forecast, by Type (2023-2030) 9.5.3.2. Rest Of South America Pickles Market Size and Forecast, by Flavour (2023-2030) 9.5.3.3. Rest Of South America Pickles Market Size and Forecast, by Packaging Types (2023-2030) 9.5.3.4. Rest Of South America Pickles Market Size and Forecast, by Sales Channel (2023-2030) 10. Global Pickles Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Pickles Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. ADF Foods(India) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Conagra Brands, Inc.(United States) 11.3. Pinnacle Foods Inc.(United States) 11.4. Kraft Heinz(United States) 11.5. Del Monte Foods(United States) 11.6. Mt Olive Pickles(United States) 11.7. Kraft Heinz, Inc.(United States) 11.8. Mothers Recipe(India) 11.9. MTR Foods(India) 11.10.Nilon’s Enterprises Pvt. Ltd(India) 11.11.Mitoku Company Limited(Japan) 11.12.Angel CamachoSpain) 11.13.Freestone Pickles(Australia) 11.14.REITZEL INDIA P LTD.(India) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary