Global Pharmaceutical Gelatin Market size was valued at USD 1.26 Bn in 2023 and Pharmaceutical Gelatin Market revenue is expected to reach USD 1.82 Bn by 2030, at a CAGR of 5.4 % over the forecast period (2024-2030)Pharmaceutical Gelatin Market Overview

Gelatin is a natural, water-soluble protein that is transparent and colorless. It is obtained through the controlled and partial hydrolysis of collagen from animal skin, bone, and tissue. The collagen itself is a fibrous protein that is composed of three intertwined polypeptide chains. In vivo, collagen is generally white and opaque, with unbranched fibrils embedded in a matrix of mucopolysaccharides and other proteins. Used for capsules, tablets, and more, the many benefits of gelatin include its ability to protect active pharmaceutical ingredients (APIs) excellent bioavailability, and the potential for modified release. Gelatin meets both consumer and production needs, which makes it an ideal ingredient for the pharma industry. The Gelatin has been used for many year in pharmaceutical formulation cell culture and tissue engineering account for its excellent biocompatibility, ease of processing and availability at low cost.To know about the Research Methodology :- Request Free Sample Report

Pharmaceutical Gelatin Market Dynamics

Rising demand for gelatin-based medical devices to drive the Market Growth The pharmaceutical Gelatin Market has increased in the popularity of medical devices made from gelatin. The reason for this surge in demand is due to Gelatin’s special qualities. It is a natural protein derived from collagen, which makes it very compatible with our bodies and can be broken down naturally. This makes it a great material for various medical uses. Gelatin can be easily turned into different forms like films, sponges, and coatings, making it suitable for wound dressings, stopping bleeding, and delivering medicines. Additionally, these gelatin-based devices stick well to tissues and cause minimal inflammation, which helps in faster healing and fewer complications. As scientists and doctors continue to explore its potential, the demand for these gelatin-based medical devices is expected to keep growing, making a positive impact on healthcare and patient recovery. Increasing use of technology in the production of gelatin to boost the market demand In recent years, there has been a noticeable increase in the adoption of technology in various industries, and the production of gelatin is no exception. This technological shift is bringing about several significant benefits to gelatin manufacturers. The combination of advanced technology, the gelatin production process has become more efficient, resulting in reduced costs and improved quality. Automation and modern machinery have made it possible to have precise control over every step of gelatin extraction and purification, leading to a higher-quality and purer end product. Additionally, the use of technology has opened up new possibilities for extracting gelatin from alternative sources, making it more accessible and sustainable. As technology continues to advance, we can expect even more improvements in the gelatin industry, meeting the growing demand and finding diverse applications for this valuable protein material. Growing demand for vegan and vegetarian products drives the market growth The increasing demand for vegan and vegetarian products is also impacting the Pharmaceutical Gelatin Market. As more consumers seek alternatives to animal-derived gelatin, the pharmaceutical industry is exploring plant-based substitutes to cater to this growing trend. Plant-based gelling agents, such as agar-agar and carrageenan, are gaining traction in pharmaceutical applications, enabling manufacturers to develop vegan-friendly medications and supplements. Industry analysts predict significant growth in the global plant-based pharmaceutical gelatin market, with projections indicating a market size of $xxx million by 2025, and a CAGR of xx% during the forecast period. These figures demonstrate the rising market potential for plant-based gelling agents in the pharmaceutical sector as the demand for vegan and vegetarian options continues to surge.

Trends in Pharmaceutical Gelatin Market

The increasing demand for hard and soft Gelatin capsules The increasing demand for hard and soft Gelatin capsules can be attributed to their convenience, ease of swallowing, precise dosing, and ability to mask unpleasant tastes or odors of medications. They are widely used in the pharmaceutical and nutraceutical industries for oral drug delivery, driving their popularity and market growth. Advanced Gelatin Formulations Technological advancements in Gelatin processing and formulation were leading to the development of advanced Gelatin types. These formulations offered improved functionalities, such as enhanced stability, controlled drug release, and tailored properties to suit specific pharmaceutical applications. Customization for Niche Applications The pharmaceutical industry was witnessing a trend of customization and niche applications. Manufacturers were tailoring Gelatin properties to suit specific drug formulations, delivery methods, and patient needs, which led to increased demand for specialized Gelatin types.Pharmaceutical Gelatin Market Restraint and Challenges

The increasing cost of raw materials The pharmaceutical Gelatin market is facing a challenge due to the rising cost of raw materials. As the demand for Gelatin increases in pharmaceutical and nutraceutical applications, sourcing animal-derived collagen becomes more expensive. This cost escalation can impact Gelatin manufacturers' profitability and may lead to price increases for Gelatin-based products, posing a challenge for the industry to maintain competitive pricing and cost-effective production. The rising competition from synthetic alternatives The pharmaceutical Gelatin market is experiencing increased competition from synthetic alternatives. As advancements in technology and research continue, synthetic Gelatin substitutes are being developed, offering similar functionalities without the reliance on animal-derived sources. This growing competition challenges traditional Gelatin manufacturers to innovate, improve product offerings, and address consumer preferences for sustainable and animal-free options to stay competitive in the market.Pharmaceutical Gelatin Market Regional Analysis

North America is the largest market for pharmaceutical gelatin, accounting for a share of approximately 37% in 2023. In the pharmaceutical Gelatin market, owing to the increasing prevalence of chronic diseases such as osteoarthritis, cancer, and others. Also market drives the growth due to the presence of major key players in the region. These players are involved in acquisitions, business expansions, and strategic collaborations. In January 2022, darling ingredients (US) collaborated with the teriyaki institute for biomedical innovation focused on biomedical innovation. The growth of the market in North America is being driven by the increasing demand for hard and soft gelatin capsules in the United States and Canada. The United States is the largest market for pharmaceutical gelatin in North America, followed by Canada. Europe is the second largest market for pharmaceutical gelatin, accounting for a share of approximately 28% in 2023. The growth of the market in Europe is being driven by the increasing demand for gelatin-based medical devices in Germany, France, and Italy. Germany is the largest market for pharmaceutical gelatin in Europe, followed by France and Italy.Pharmaceutical Gelatin Market Segment Analysis

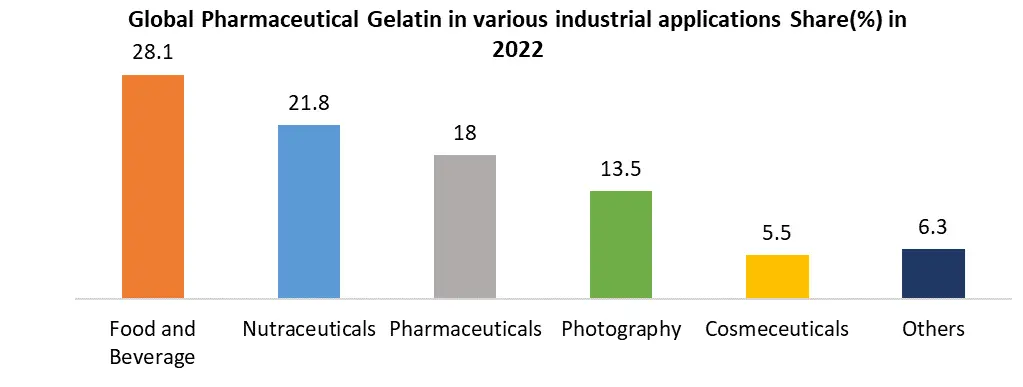

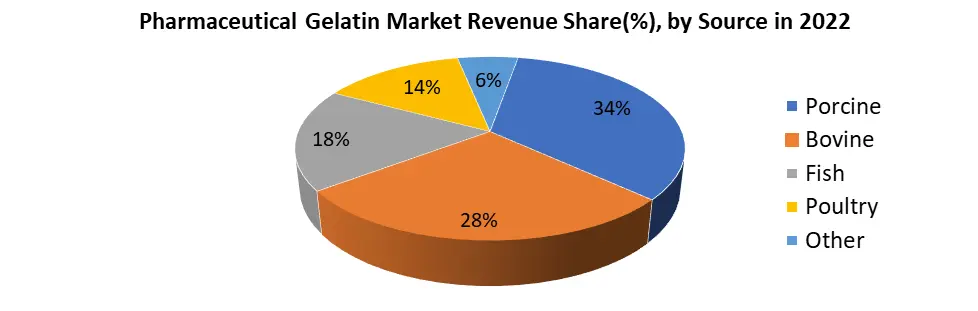

Based on the Source, In the pharmaceutical Gelatin Market segment is categorized into Porcine, Bovine, Fish, and Poultry and others among these segments the porcine segment held the largest share in 2023. Due to the Increasing use of food, drugs, and supplements in the pharmaceutical industry. The advancements in drug delivery technology caused the evolvement of new excipients as novel dosage forms to fulfill specific functions which directly or indirectly influence the extent and or rate of drug release. This in return enrages the development of new and modified excipient sources to continue to emerge for better drug delivery performance Due to a tremendous increase in demand, there is an expectation of a drop in the supply of raw materials derived from the hides of bovine or porcine, which makes up to 90% of the Gelatin source. Porcine-based raw materials are one of the biggest sources of Gelatin within the Gelatin industry. However, due to the European Union’s changes to pig farming laws in early, the price of Gelatin-based products is expected to increase by 5% because of shortages of porcine skin as well as bovine bones. This is because the farmers would have to spend more on housing the livestock The development of alternative Gelatin sources provides market opportunities for the industry. Demands in halal Gelatin have created a strong influence in this sector. It is expected that the halal food and pharmaceutical industries would grow at about 12% of the total global trade in agro-food and pharmaceutical products. This growing market is basically due to the projected Muslim population of about 30% of the world’s population by 2025. Different types of Gelatin raw Materials Gelatin is basically sourced from different biopolymer raw materials such as indicated below.

Pharmaceutical Gelatin Market Competitive Landscape

The pharmaceutical Gelatin market is highly competitive, driven by numerous key players vying for market share. Established pharmaceutical companies, such as Gelita AG, Rousselot, Capsugel (now part of Lonza Group), and Nitta Gelatin Inc., dominate the industry with their extensive product portfolios and strong global presence. These market leaders continuously invest in research and development to introduce innovative Gelatin-based products for various pharmaceutical applications. Additionally, emerging players, like Weishardt Group and Sterling Gelatin, are striving to carve out their niche by offering specialized Gelatin solutions and fostering strategic partnerships with pharmaceutical manufacturers to expand their market reach.Gelita AG, the global market leader in the production of Gelatin and collagen peptides, has had several recent developments. In July 2022, the company opened a Biotech Hub in Frankfurt am Main, Germany. The Biotech Hub is focused on the development of new products and technologies using biotechnology. In December 2022, Gelita AG has launched a new line of pharmaceutical Gelatin called GELITA® RXL, which is designed to have improved stability and dissolution. The company is also working on developing new Gelatin-based excipients for use in pharmaceutical applications and investing in research into the use of Gelatin in new medical applications, such as wound dressings and implants. These developments demonstrate Gelita AG's commitment to innovation and its continuous efforts to find new ways to use Gelatin in the medical field.

Pharmaceutical Gelatin Market Scope: Inquire before buying

Pharmaceutical Gelatin Market by Region North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)

Pharmaceutical Gelatin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.26 Bn. Forecast Period 2024 to 2030 CAGR: 5.4% Market Size in 2030: US $ 1.82 Bn. Segments Covered: by Application Hard Capsules Soft Capsules Tablets Microencapsulation Others by Source Porcine Bovine Fish Poultry by End User Pharmaceutical Companies Nutraceutical Companies Research Institutes Pharmaceutical Gelatin Market key players include

1. Gelita AG (Germany) 2. Rousselot (Irving, Texas) 3. Nitta Gelatin Inc (India) 4. PB Gelatins (China) 5. Weishardt Group (France) 6. Capsugel Belgium NV (Bornem, Belgium) 7. Sterling Gelatin (India) 8. India Gelatin & Chemicals Ltd (India) 9. Tessenderlo Group (Belgium) 10. Darling Ingredients Inc (Texas) 11. Junca Gelatins S.L (Spain) 12. Norland Products Inc (U.S) 13. Catalent Pharma Solutions (U.S) 14. Gelken Gelatin Co., Ltd (China) 15. Trobas Gelatin B.V (Netherlands) 16. Ewald-Gelatin GmbH (Germany) 17. Lapi Gelatin S.p.A.(Toscana) 18. Gelco SA (Colombia) 19. Qinghai Gelatin Company Ltd (China) Frequently Asked Questions: 1] What is the growth rate of the Global Pharmaceutical Gelatin Market? Ans. The Global Pharmaceutical Gelatin Market is growing at a significant rate of 5.4% over the forecast period. 2] Which region is expected to dominate the Global Pharmaceutical Gelatin Market? Ans. North American region is expected to dominate the Pharmaceutical Gelatin Market over the forecast period. 3] What is the expected Global Pharmaceutical Gelatin Market size by 2030? Ans. The market size of the Pharmaceutical Gelatin Market is expected to reach USD 1.82 Bn by 2030. 4] Who are the top players in the Global Pharmaceutical Gelatin Industry? Ans. The major key players in the Global Pharmaceutical Gelatin Market are Gelita AG (Germany), Rousselot (Irving, Texas), Nitta Gelatin Inc (India), PB Gelatins (China) 5] Which factors are expected to drive the Global Pharmaceutical Gelatin Market growth by 2030? Ans. Growing demand for vegan and vegetarian products drives the market growth over the forecast period (2024-2030).

1. Pharmaceutical Gelatin Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pharmaceutical Gelatin Market: Dynamics 2.1. Pharmaceutical Gelatin Market Trends by Region 2.1.1. North America Pharmaceutical Gelatin Market Trends 2.1.2. Europe Pharmaceutical Gelatin Market Trends 2.1.3. Asia Pacific Pharmaceutical Gelatin Market Trends 2.1.4. Middle East and Africa Pharmaceutical Gelatin Market Trends 2.1.5. South America Pharmaceutical Gelatin Market Trends 2.2. Pharmaceutical Gelatin Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pharmaceutical Gelatin Market Drivers 2.2.1.2. North America Pharmaceutical Gelatin Market Restraints 2.2.1.3. North America Pharmaceutical Gelatin Market Opportunities 2.2.1.4. North America Pharmaceutical Gelatin Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pharmaceutical Gelatin Market Drivers 2.2.2.2. Europe Pharmaceutical Gelatin Market Restraints 2.2.2.3. Europe Pharmaceutical Gelatin Market Opportunities 2.2.2.4. Europe Pharmaceutical Gelatin Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pharmaceutical Gelatin Market Drivers 2.2.3.2. Asia Pacific Pharmaceutical Gelatin Market Restraints 2.2.3.3. Asia Pacific Pharmaceutical Gelatin Market Opportunities 2.2.3.4. Asia Pacific Pharmaceutical Gelatin Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pharmaceutical Gelatin Market Drivers 2.2.4.2. Middle East and Africa Pharmaceutical Gelatin Market Restraints 2.2.4.3. Middle East and Africa Pharmaceutical Gelatin Market Opportunities 2.2.4.4. Middle East and Africa Pharmaceutical Gelatin Market Challenges 2.2.5. South America 2.2.5.1. South America Pharmaceutical Gelatin Market Drivers 2.2.5.2. South America Pharmaceutical Gelatin Market Restraints 2.2.5.3. South America Pharmaceutical Gelatin Market Opportunities 2.2.5.4. South America Pharmaceutical Gelatin Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pharmaceutical Gelatin Industry 2.8. Analysis of Government Schemes and Initiatives For Pharmaceutical Gelatin Industry 2.9. Pharmaceutical Gelatin Market Trade Analysis 2.10. The Global Pandemic Impact on Pharmaceutical Gelatin Market 3. Pharmaceutical Gelatin Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 3.1.1. Hard Capsules 3.1.2. Soft Capsules 3.1.3. Tablets 3.1.4. Microencapsulation 3.1.5. Others 3.2. Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 3.2.1. Porcine 3.2.2. Bovine 3.2.3. Fish 3.2.4. Poultry 3.3. Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 3.3.1. Pharmaceutical Companies 3.3.2. Nutraceutical Companies 3.3.3. Research Institutes 3.4. Pharmaceutical Gelatin Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Pharmaceutical Gelatin Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 4.1.1. Hard Capsules 4.1.2. Soft Capsules 4.1.3. Tablets 4.1.4. Microencapsulation 4.1.5. Others 4.2. North America Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 4.2.1. Porcine 4.2.2. Bovine 4.2.3. Fish 4.2.4. Poultry 4.3. North America Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 4.3.1. Pharmaceutical Companies 4.3.2. Nutraceutical Companies 4.3.3. Research Institutes 4.4. North America Pharmaceutical Gelatin Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 4.4.1.1.1. Hard Capsules 4.4.1.1.2. Soft Capsules 4.4.1.1.3. Tablets 4.4.1.1.4. Microencapsulation 4.4.1.1.5. Others 4.4.1.2. United States Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 4.4.1.2.1. Porcine 4.4.1.2.2. Bovine 4.4.1.2.3. Fish 4.4.1.2.4. Poultry 4.4.1.3. United States Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Pharmaceutical Companies 4.4.1.3.2. Nutraceutical Companies 4.4.1.3.3. Research Institutes 4.4.2. Canada 4.4.2.1. Canada Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 4.4.2.1.1. Hard Capsules 4.4.2.1.2. Soft Capsules 4.4.2.1.3. Tablets 4.4.2.1.4. Microencapsulation 4.4.2.1.5. Others 4.4.2.2. Canada Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 4.4.2.2.1. Porcine 4.4.2.2.2. Bovine 4.4.2.2.3. Fish 4.4.2.2.4. Poultry 4.4.2.3. Canada Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Pharmaceutical Companies 4.4.2.3.2. Nutraceutical Companies 4.4.2.3.3. Research Institutes 4.4.3. Mexico 4.4.3.1. Mexico Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 4.4.3.1.1. Hard Capsules 4.4.3.1.2. Soft Capsules 4.4.3.1.3. Tablets 4.4.3.1.4. Microencapsulation 4.4.3.1.5. Others 4.4.3.2. Mexico Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 4.4.3.2.1. Porcine 4.4.3.2.2. Bovine 4.4.3.2.3. Fish 4.4.3.2.4. Poultry 4.4.3.3. Mexico Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Pharmaceutical Companies 4.4.3.3.2. Nutraceutical Companies 4.4.3.3.3. Research Institutes 5. Europe Pharmaceutical Gelatin Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.2. Europe Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.3. Europe Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 5.4. Europe Pharmaceutical Gelatin Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.1.2. United Kingdom Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.1.3. United Kingdom Pharmaceutical Gelatin Market Size and Forecast, by End User(2023-2030) 5.4.2. France 5.4.2.1. France Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.2.2. France Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.2.3. France Pharmaceutical Gelatin Market Size and Forecast, by End User(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.3.2. Germany Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.3.3. Germany Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.4.2. Italy Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.4.3. Italy Pharmaceutical Gelatin Market Size and Forecast, by End User(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.5.2. Spain Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.5.3. Spain Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.6.2. Sweden Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.6.3. Sweden Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.7.2. Austria Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.7.3. Austria Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 5.4.8.2. Rest of Europe Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 5.4.8.3. Rest of Europe Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Pharmaceutical Gelatin Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.3. Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.1.2. China Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.1.3. China Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.2.2. S Korea Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.2.3. S Korea Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.3.2. Japan Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.3.3. Japan Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.4.2. India Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.4.3. India Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.5.2. Australia Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.5.3. Australia Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.6.2. Indonesia Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.6.3. Indonesia Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.7.2. Malaysia Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.7.3. Malaysia Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.8.2. Vietnam Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.8.3. Vietnam Pharmaceutical Gelatin Market Size and Forecast, by End User(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.9.2. Taiwan Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.9.3. Taiwan Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 6.4.10.2. Rest of Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 6.4.10.3. Rest of Asia Pacific Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Pharmaceutical Gelatin Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 7.3. Middle East and Africa Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Pharmaceutical Gelatin Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 7.4.1.2. South Africa Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 7.4.1.3. South Africa Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 7.4.2.2. GCC Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 7.4.2.3. GCC Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 7.4.3.2. Nigeria Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 7.4.3.3. Nigeria Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 7.4.4.2. Rest of ME&A Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 7.4.4.3. Rest of ME&A Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 8. South America Pharmaceutical Gelatin Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 8.2. South America Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 8.3. South America Pharmaceutical Gelatin Market Size and Forecast, by End User(2023-2030) 8.4. South America Pharmaceutical Gelatin Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 8.4.1.2. Brazil Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 8.4.1.3. Brazil Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 8.4.2.2. Argentina Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 8.4.2.3. Argentina Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Pharmaceutical Gelatin Market Size and Forecast, by Application (2023-2030) 8.4.3.2. Rest Of South America Pharmaceutical Gelatin Market Size and Forecast, by Source (2023-2030) 8.4.3.3. Rest Of South America Pharmaceutical Gelatin Market Size and Forecast, by End User (2023-2030) 9. Global Pharmaceutical Gelatin Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Pharmaceutical Gelatin Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gelita AG (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Rousselot (Irving, Texas) 10.3. Nitta Gelatin Inc (India) 10.4. PB Gelatins (China) 10.5. Weishardt Group (France) 10.6. Capsugel Belgium NV (Bornem, Belgium) 10.7. Sterling Gelatin (India) 10.8. India Gelatin & Chemicals Ltd (India) 10.9. Tessenderlo Group (Belgium) 10.10. Darling Ingredients Inc (Texas) 10.11. Junca Gelatins S.L (Spain) 10.12. Norland Products Inc (U.S) 10.13. Catalent Pharma Solutions (U.S) 10.14. Gelken Gelatin Co., Ltd (China) 10.15. Trobas Gelatin B.V (Netherlands) 10.16. Ewald-Gelatin GmbH (Germany) 10.17. Lapi Gelatin S.p.A.(Toscana) 10.18. Gelco SA (Colombia) 10.19. Qinghai Gelatin Company Ltd (China) 11. Key Findings 12. Industry Recommendations 13. Pharmaceutical Gelatin Market: Research Methodology 14. Terms and Glossary