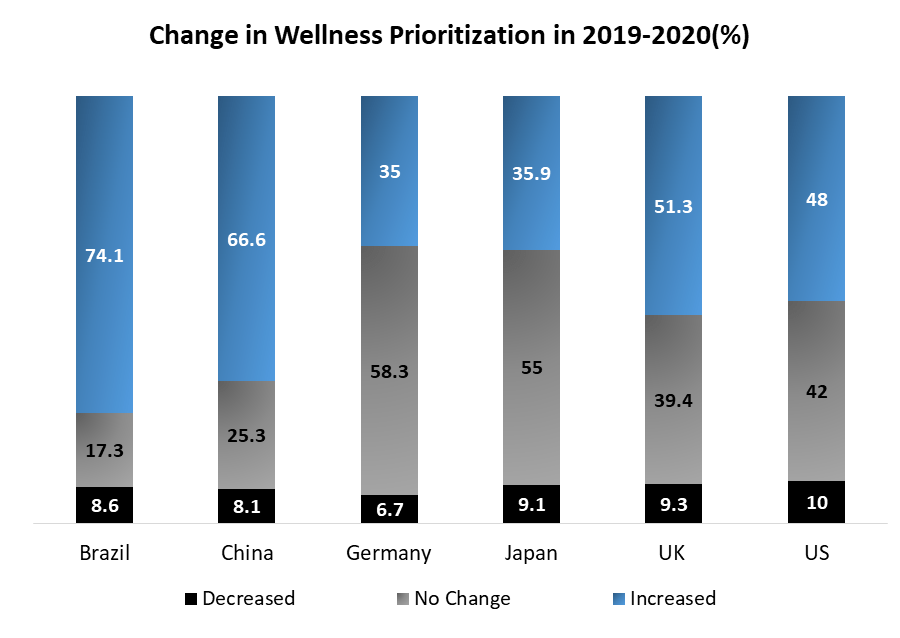

Consumer wellness-related trends have been gaining traction over time. Overall, these developments affect industry players across the board, from traditional consumer healthcare to fitness and nutrition to beauty, clothes, and retail. When used appropriately, several tactics can assist businesses in meeting consumer demands and capitalizing on the industry's rapid expansion.

To know about the Research Methodology :- Request Free Sample Report

1. Natural/clean products Natural/clean items are popular in various categories, including skincare, cosmetics, multivitamins, subscription food services, and sleep aids. The magnitude of the change is remarkable. Natural/clean items are overwhelmingly preferred by consumers, partichttps://www.maximizemarketresearch.com/inquiry-before-buying/139206/ularly in Brazil and China. In the case of nutritional supplements, consumers worldwide responded that if they had to pick between more natural supplements and more effective supplements, they would select the more natural choice of 50 %. Similarly, consumers prefer the more natural selection over the more effective option by 38% when it comes to skincare. Companies may want to consider this method. Players have more potential to introduce natural or wellness-oriented items or to acquire natural/clean product lines, as part of your development roadmap. In fashion, items are created with organic/natural materials and sustainability in mind; in consumer health, natural/clean cosmetic products; and in retail, marketing with an eye to products that resonate as authentically natural. Zarbee's Naturals aimed to provide a solution for parents looking for natural cures for their children; Sephora's private-label brand has developed clean cosmetics products and dramatically increased its pure makeup presence in its stores. 2. More personalization While privacy remains a concern for many respondents, many (especially in Brazil and China) are willing to trade privacy for customization. Moreover, a large majority of consumers around the world feel personalization is more important now than it was two years ago. More than 85% of customers in the United States, the United Kingdom, and Germany prefer personalization is as important as it was before. A potential strategy for companies can be to develop individualized marketing capabilities to target the specific consumer categories who are most likely to be interested in your products, with content and narrative tailored to them. Incorporate personalized or semi-personalized offerings into your product roadmap.

Consumer trends in Wellness Market :Inquiry Before Buying

3. Digital transformation is the Future The transition to digital channels is unfolding at a "decade in days" pace. The shift will be permanent: over the next several years, the majority of consumer categories expect e-commerce to grow faster than conventional channels. Certain product categories, such as fortified foods, multivitamins, and skincare, continue to be predominantly sold through brick-and-mortar establishments. Other new product categories, such as fitness wearables, are nearly exclusively based on the internet. Consumers in China spend the most money on wellness online, followed by Japanese consumers, and then consumers in Europe, the United States, and Brazil. A potential strategy for companies, to meet customers where they are, provide seamless omnichannel and digital services. Consider constructing a supply chain, package sizes, marketing, and other e-commerce-specific features in addition to channel partner partnerships. Use a holistic web strategy to design app-enabled features that keep customers engaged throughout the ecosystem, such as gyms. 4. The rise of services Services have become an increasingly important aspect of the wellness business, with more and more experiences becoming accessible as options. Consumers are migrating toward services that address physical and mental health requirements, and these trends are seen across countries (for instance, personal trainers, nutritionists, and counseling services). Products continue to be a stable and important portion of the industry, accounting for nearly 70% of self-reported consumer wellness spending worldwide. A potential strategy for companies can be diagnostics or coaching services that support a direct link to the consumer could be considered by consumer healthcare enterprises. One startup teamed up with a telemedicine provider to launch an app that allows parents to connect with healthcare providers for their children via video chat. Offerings such as connected gadgets and virtual communities’ products and services other than gyms and training equipment could be considered by fitness corporations. Peloton's service offering has evolved to include subscriptions for its fitness app, in-person studios, and live virtual courses, allowing it to reach customers who do not own Peloton workout equipment. As the popularity of home workouts grew during the COVID-19 epidemic, the company's sales rose in 2020. 5. Category lines continue to blur Companies are evaluating how to play across the health and wellness categories and channels in light of the aforementioned trends. It's vital to figure out which parts of the market are willing to let these corporations expand their brands. The majority of consumers say they don't want a single solution or brand to help them with all aspects of wellness, implying that tailored expansions are a better strategy for businesses. A potential strategy for companies will be asses M&A prospects in the wellness ecosystem to acquire access to more categories. It is critical to verify that each acquisition has a clear strategic justification and makes sense in light of the acquirer's existing equity, skill set, and competencies while using this technique. A well-defined and executed programmatic M&A strategy can assist develop resiliency and generating excess returns to shareholders over time if those parts are in place. Lululemon’s acquisition of Mirror, provided them with a digital offering to complement its core fitness-apparel business. Through studios and community-based workshops, it has also experimented with nutrition, mindfulness, and exercise offerings in stores. These actions appear to be consistent with the company's brand messaging.

1) Which trends are affecting the wellness industry? 2) Has personalization become a new trend or necessity in the market? 3) What strategies are companies using in wellness market? 4) Which strategies to adapt to thrive in the wellness market? 5) Is demand for natural products taking the industry forward? 6) Which markets are open for the players to expand? 7) Which M&A strategy to adopt assisting is developing resiliency? 8) Products or Services which to focus on in the wellness market? 9) What are strategies to meet targeted consumers? 10) How digitization is helping to grow in wellness industry?