Global Pet Supplements Market size was valued at USD 3.4 Bn. in 2022 and the total Pet Supplements revenue is expected to grow by 5.9 % from 2023 to 2029, reaching nearly USD 5.08 Bn.Pet Supplements Market Overview:

Pet supplements are designed specifically to improve pets' health and well-being, offering a diverse range of vitamins, minerals, and dietary supplements. The pet supplements market is growing rapidly, and there is a strong emphasis on customizing dietary supplements, vitamins, and minerals to enhance the health of pets, in addition to providing quality therapies to support their physical and mental health. A growing number of pet owners are actively seeking methods to enhance the quality of life for their cherished companions as pet health awareness and the trend of treating pets like family members continue to grow.In recent times, significant advancements by key players in the market driving the market growth. For instance, Virbac introduced Tramvetol, an injectable solution developed to address acute and chronic pain in dogs. This particular development underscores the market's commitment to tackling specific health concerns prevalent among pets, such endeavours serve as drivers for the growth of the Pet Supplements Market. Pet Supplements Market Scope and Research Methodology The Pet Supplements Market report represents innovation, policy support, increased competition, and environmental concerns by global and local players holding the Pet Supplements Market in different countries. The report covered Market structure by comparative analysis of key players, and market followers, which makes this report insightful to the Pet Supplements Outlook. The Pet Supplements Market report aims to outlook the market size based on segments, regional distribution and industry competition. The bottom-up approach has been used to estimate and forecast market size and market growth. The report provides a detailed examination of the key players in the Pet Supplements industry, including revenue. The report covers the global, regional and local level analysis of the Pet Supplements Market with the factors restraining, driving and challenging the market growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Pet Supplements Market Dynamics:

Pet Supplements Market Drivers Increasing Ownership and Humanization of Pets Driving the Market Growth The global pet supplement market is expected growth due to the rising rate of pet adoption worldwide. Factors such as personal choices and medical reasons contribute to the increasing number of people opting for pets. For instance, individuals who choose not to have biological children may voluntarily adopt pets, and individuals or couples who are unable to conceive for medical reasons also opt for pet companionship. The trend of pet humanization significantly influences the purchasing decisions of pet dietary supplement products. The notion of treating pets as family members, resembling children, has gained popularity, leading pet owners to seek products that are similar to those they use for themselves. This trend of pet humanization has received significant attention in mainstream media in recent years. pet owners are more inclined to increase their annual expenditure on pet dietary supplements. A recent survey conducted by the American Pet Products Association (APPA) in 2021 reported that 51% of consumers purchase premium pet food, 33% provide their pets with vitamins and supplements, 21% cook specifically for their pets, and 18% have some form of pet medical insurance, demonstrating the spending behaviour of consumers on pet dietary products. This consumer trend of pet humanization, coupled with the growing incidence of health issues in pets, is expected to create ample opportunities for pet dietary supplements in the foreseeable future. Pet Supplements Market Restraint Lack Of Awareness About Pet Supplements Hinders the Market Growth One of the main restraining factors in the growth pet supplement market is the lack of awareness about pet supplements across the globe. Many pet owners believe that if the pet is healthy, it does not require supplements. In addition to this, pet parents assume that “complete and balanced” pet foods address all animals’ physiological needs. This misconception acts as one of the biggest barriers in the pet supplement industry. For instance, certain breeds of dogs may be prone to joint problems, but their owners might not realize that joint supplements containing ingredients like glucosamine and chondroitin can help alleviate these issues. Another aspect of this lack of awareness is the doubt or confusion surrounding the effectiveness and safety of pet supplements. Some pet owners may question whether these products actually deliver the claimed benefits or worry about potential side effects. Without proper awareness and education, they may hesitate to incorporate supplements into their pets' routines, and this will hinder the Pet Supplements Market. Pet Supplements market opportunities: Product Innovation and E-Commerce Expansion Present Significant Growth Opportunities Increasing demand for specialized and effective pet supplements offers an opportunity to companies for developing innovative products that fulfil the evolving needs and preferences of pet owners. This can include the introduction of new formulations, improved delivery methods, and novel ingredients to enhance the efficacy and appeal of pet supplements. For example, companies can focus on developing supplements specifically designed for certain breeds, life stages, or health conditions of pets. This targeted approach allows pet owners to choose supplements that address their pets' specific requirements more accurately. The expansion of e-commerce platforms provides a broader reach and convenience for pet owners to access a wide range of pet supplements. Online marketplaces and dedicated pet supply websites enable consumers to explore and compare different products, read reviews, and make informed purchasing decisions from the comfort of their homes. This digital landscape also facilitates direct communication between pet owners and manufacturers, allowing for personalized recommendations and guidance based on specific pet needs. An example of this growth opportunity is the emergence of subscription-based models for pet supplements. Companies offer customized subscription services where pet owners receive regular deliveries of supplements based on their pets' needs and preferences. This not only ensures a steady revenue stream for businesses but also provides convenience and peace of mind to pet owners, eliminating the hassle of reordering and ensuring a consistent supply of supplements for their pets. Product innovation and e-commerce expansion open up promising growth opportunities in the pet supplements market.Pet Supplements Market Segment Analysis:

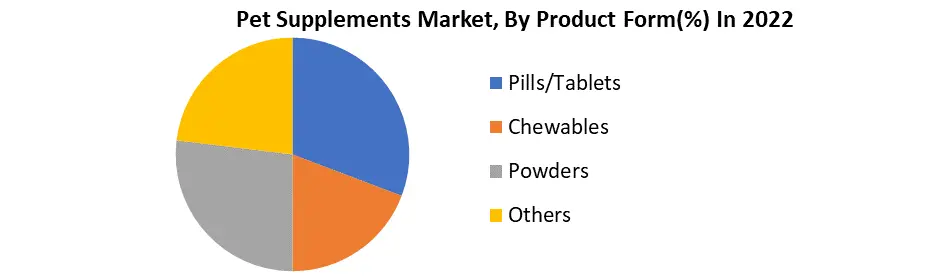

Based on Product Form, Chewable supplements emerged as the dominant force in the market in 2022, being the preferred form of supplementation. Numerous pets, including cats and dogs, encounter challenges when swallowing tablets or capsules, or they simply dislike the sensation. In such cases, chewable supplements prove to be an ideal option since animals naturally tend to chew their food, thereby propelling the growth of this segment. The powder form of supplements is expected to exhibit a higher compound annual growth rate (CAGR) during the forecast period. Powder-based supplements offer advantages such as swift absorption, ease of consumption, and the convenience of being effortlessly mixed into various foods and beverages. These factors are anticipated to augment product visibility among pet owners and drive the demand for powder-based supplements in the market. Key industry players, like NOW Foods, present a diverse range of powder-based products. For instance, NOW Foods specializes in providing pet supplements in powder form that are specifically formulated to promote cardiovascular health in both cats and dogs.

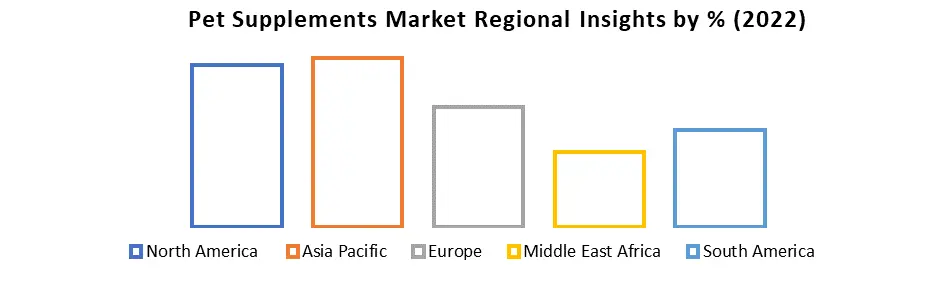

Pet Supplements Market Regional Insights:

North America dominated the pet supplements market in 2022 and is expected to continue its dominance by 2029. The growth in North America is driven by the increase in pet ownership and the rise in spending on pet care, including pet insurance. Also, the presence of market leaders in the region such as Zesty Paws and Virbac has expanded in the region which drives the market growth. In the Asia Pacific, the pet supplement market is expected to grow at a high growth rate during the forecast period. Owners in this region are increasingly recognizing the benefits of supplements in meeting their pets' health requirements. The growing population of domesticated animals, particularly in China and Australia, is driving the demand for pet supplements. Europe is another significant market for pet supplements, with countries like France and Germany witnessing steady growth in pet ownership. The region has a large number of pet owners and manufacturing facilities, ensuring the availability of pet supplements. Germany, in particular, is experiencing notable growth due to the increasing number of millennials and Gen Z population adopting pets. The pet supplement market shows promising growth across Middle East Africa and South America regions driven by factors such as pet ownership trends, increased awareness, and the desire to provide better care for pets.

Competitive Landscape:

The pet supplements market is highly competitive, with several key players operating on a global scale. The competitive landscape is characterized by a mix of established companies and emerging players. Key market players include Nutramax Laboratories, Zoetis Inc., Vetoquinol S.A., Nestlé Purina PetCare, and Bayer AG, among others. These companies compete based on product innovation, brand recognition, distribution networks, and strategic partnerships. Mars Petcare is making its foray into the supplements category with the introduction of Pedigree Multivitamins in March 2023. This new product line offers three variants of soft chews specifically developed to meet the essential requirements of pets, aiming to bolster immunity, support healthy digestion, and provide joint care. Similarly, in March 2022, Virbac launched two Veterinary HPM wet diets to aid in the prevention and management of feline lower urinary tract disease (FLUTD), a significant health concern in cats. Additionally, in February 2022, Virbac unveiled its first line of pet food, Veterinary HPM Pet Nutrition, tailored for spayed and neutered animals. This product range includes two cat foods and four dog foods, featuring six different formulas that are customized to cater to the needs of pets based on their age and size.Pet Supplements Market Scope: Inquire before buying

Global Pet Supplements Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.4 Bn. Forecast Period 2023 to 2029 CAGR: 5.9% Market Size in 2029: US $ 5.08 Bn. Segments Covered: by Pet Type Dogs Cats Ruminants Others by Product Form Pills/Tablets Chewables Powders Others by Application Skin & Coat Hip & Joint Digestive Health Others by Distribution Channel Online Offline Pet Supplements Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pet Supplements Market Key Players

1. Ark Naturals 2. Bayer AG 3. Bayer Animal Health 4. Ceva Santé Animale 5. Church & Dwight Co. Inc. 6. Dechra Pharmaceuticals 7. Food Science Corporation 8. Hill's Pet Nutrition 9. Kemin Industries 10. Mars Petcare Inc. 11. Merck Animal Health 12. Nestlé Purina PetCare 13. NOW Foods 14. Nutramax Laboratories, Inc. 15. NutriScience Innovations LLC 16. Pet Honesty 17. PetAg Inc. 18. PetLife Pharmaceuticals Inc. 19. PetMed Express Inc. 20. Virbac Group 21. Zesty Paws 22. Zoetis Inc. Frequently Asked Questions: 1] What segments are covered in the Global Pet Supplements Market report? Ans. The segments covered in the Pet Supplements Market report are based on Pet Type, Product Form, Distribution Channel, Application and Region. 2] Which region is expected to hold the highest share of the Global Pet Supplements Market? Ans. The Asia Pacific region is expected to hold the highest share of the Pet Supplements Market. 3] What is the market size of the Global Pet Supplements Market by 2029? Ans. The market size of the Pet Supplements Market by 2029 is expected to reach US$ 5.08 Bn. 4] What is the forecast period for the Global Pet Supplements Market? Ans. The forecast period for the Pet Supplements Market is 2022-2029. 5] What was the market size of the Global Pet Supplements Market in 2022? Ans. The market size of the Pet Supplements Market in 2022 was valued at US$ 3.4 Bn.

Table of Content: 1. Pet Supplements Market: Research Methodology 2. Pet Supplements Market: Executive Summary 3. Pet Supplements Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Pet Supplements Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Pet Supplements Market: Segmentation (by Value USD and Volume Units) 5.1. Pet Supplements Market, by Pet Type (2022-2029) 5.1.1. Dogs 5.1.2. Cats 5.1.3. Ruminants 5.1.4. Others 5.2. Pet Supplements Market, by Product Form (2022-2029) 5.2.1. Pills/Tablets 5.2.2. Chewables 5.2.3. Powders 5.2.4. Others 5.3. Pet Supplements Market, by Distribution Channel (2022-2029) 5.3.1. Online 5.3.2. Offline 5.4. Pet Supplements Market, by Application (2022-2029) 5.4.1. Skin & Coat 5.4.2. Hip & Joint 5.4.3. Digestive Health 5.4.4. Others 5.5. Pet Supplements Market, by region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Pet Supplements Market (by Value USD and Volume Units) 6.1. North America Pet Supplements Market, by Pet Type (2022-2029) 6.1.1. Dogs 6.1.2. Cats 6.1.3. Ruminants 6.1.4. Others 6.2. North America Pet Supplements Market, by Product Form (2022-2029) 6.2.1. Pills/Tablets 6.2.2. Chewables 6.2.3. Powders 6.2.4. Others 6.3. North America Pet Supplements Market, by Distribution Channel (2022-2029) 6.3.1. Online 6.3.2. Offline 6.4. North America Pet Supplements Market, by Application (2022-2029) 6.4.1. Skin & Coat 6.4.2. Hip & Joint 6.4.3. Digestive Health 6.4.4. Others 6.5. North America Pet Supplements Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Pet Supplements Market (by Value USD and Volume Units) 7.1. Europe Pet Supplements Market, by Pet Type (2022-2029) 7.2. Europe Pet Supplements Market, by Product Form (2022-2029) 7.3. Europe Pet Supplements Market, by Distribution Channel (2022-2029) 7.4. Europe Pet Supplements Market, by Application (2022-2029) 7.5. Europe Pet Supplements Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Pet Supplements Market (by Value USD and Volume Units) 8.1. Asia Pacific Pet Supplements Market, by Pet Type (2022-2029) 8.2. Asia Pacific Pet Supplements Market, by Product Form (2022-2029) 8.3. Asia Pacific Pet Supplements Market, by Distribution Channel (2022-2029) 8.4. Asia Pacific Pet Supplements Market, by Application (2022-2029) 8.5. Asia Pacific Pet Supplements Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Pet Supplements Market (by Value USD and Volume Units) 9.1. Middle East and Africa Pet Supplements Market, by Pet Type (2022-2029) 9.2. Middle East and Africa Pet Supplements Market, by Product Form (2022-2029) 9.3. Middle East and Africa Pet Supplements Market, by Distribution Channel (2022-2029) 9.4. Middle East and Africa Pet Supplements Market, by Application (2022-2029) 9.5. Middle East and Africa Pet Supplements Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Pet Supplements Market (by Value USD and Volume Units) 10.1. South America Pet Supplements Market, by Pet Type (2022-2029) 10.2. South America Pet Supplements Market, by Product Form (2022-2029) 10.3. South America Pet Supplements Market, by Distribution Channel (2022-2029) 10.4. South America Pet Supplements Market, by Application (2022-2029) 10.5. South America Pet Supplements Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Ark Naturals 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Bayer AG 11.3. Bayer Animal Health 11.4. Ceva Santé Animale 11.5. Church & Dwight Co. Inc. 11.6. Dechra Pharmaceuticals 11.7. Food Science Corporation 11.8. Hill's Pet Nutrition 11.9. Kemin Industries 11.10. Mars Petcare Inc. 11.11. Merck Animal Health 11.12. Nestlé Purina PetCare 11.13. NOW Foods 11.14. Nutramax Laboratories, Inc. 11.15. NutriScience Innovations LLC 11.16. Pet Honesty 11.17. PetAg Inc. 11.18. PetLife Pharmaceuticals Inc. 11.19. PetMed Express Inc. 11.20. Virbac Group 11.21. Zesty Paws 11.22. ZoetisInc 12. Key Findings 13. Industry Recommendation