Global Organic Drinks Market size was valued at USD 25.47 Bn in 2022 and is expected to reach USD 36.13 Bn by 2029, at a CAGR of 5.12 %Organic Drinks Market Overview

Organic drinks refer to beverages made from ingredients that are grown without the use of synthetic pesticides, herbicides, or genetically modified organisms (GMOs). These beverages are produced using organic farming practices, emphasizing the use of natural fertilizers and sustainable agricultural methods. Organic drinks include a wide range of beverages, including organic juices, teas, coffees, sodas, and functional beverages. The Organic Drinks Market is currently undergoing a dynamic transformation, fueled by a confluence of consumer trends and industry innovations. The surge in consumer demand for organic beverages is driven by a growing awareness of health and environmental concerns. This paradigm shift is pushing market players to adopt innovative strategies, such as the incorporation of unique superfood ingredients and the development of functional beverages that offer both health benefits and a delightful taste experience. Additionally, the market is witnessing a rise in sustainable packaging solutions, aligning with the eco-conscious preferences of today's consumers. As technological advancements play a crucial role in supply chain optimization and quality control, analytics-driven approaches are becoming paramount for market players to stay competitive. The landscape is also marked by an influx of niche players, introducing novel flavors and brewing techniques, further diversifying the organic drinks segment. Also, the Organic Drinks industry is poised for continued growth, driven by a blend of health consciousness, environmental sustainability, and innovative product offerings. Austria Juice is a prominent player in the organic beverage industry, offering a diverse range of products that cater to the growing demand for organic and natural drinks in the innovative and sustainable sector. The organic market has witnessed substantial growth globally, with Europe and the USA emerging as the largest markets for organic food and drinks or beverages. The COVID-19 pandemic has further heightened consumer awareness of the connection between nutrition and health, leading to increased interest in products with a "health image," including organic options.To know about the Research Methodology :- Request Free Sample Report

Organic Drinks Market Dynamics: Drivers, Restraints, Opportunities and Trends

The Surge of Health-Conscious Consumers to Drive the Organic Drinks Market Growth In the dynamic landscape of consumer preferences, the surge of health-conscious individuals is emerging as a pivotal driver for the organic drinks market. The paradigm shift in consumer behavior, accentuated by the global pandemic, has ignited a profound recalibration toward holistic well-being. Health-conscious consumers, marked by a desire for meaningful, purposeful living, are meticulously scrutinizing product choices beyond brand recognition. This new breed of consumers delves into the origins of products, demanding transparency in sourcing, and manufacturing processes, and a commitment to sustainability. Companies championing social responsibility initiatives are gaining prominence, resonating with the growing concerns around environmental impact. Across all retail sectors, consumers are increasingly expecting businesses to actively contribute to their health and well-being journey. This extends beyond producing clean and sustainable products to offering altruistic benefits that contribute to social or environmental causes. The environmental consciousness is especially pronounced as consumers prioritize the health of the planet alongside their personal well-being. The health and wellness industry is undergoing a transformative phase, with a diverse range of influencing factors shaping consumer journeys. Beyond profitability, the future of health-focused products is poised to revolve around people, the planet, and a sense of purpose. The organic drinks companies recognize the holistic significance of health and wellness for consumers. The changing landscape necessitates a flexible yet focused approach, challenging conventional definitions of health and wellness. Maintaining a personal touch in the digital age while delivering quality, affordable, and altruistic products is paramount. For Example, unveiling health consciousness trends in Australia is an impact on Industries. In the ever-evolving landscape of consumer behavior, health consciousness has emerged as a critical factor shaping market dynamics in Australia. According to MMR study the IBIS World report delves into an insightful analysis, presenting a comprehensive index of health indicators, including alcohol and tobacco consumption, dietary habits, obesity rates, and participation in physical activities. The health consciousness index, serves as a barometer for the nation's evolving health priorities. Recent trends indicate a 0.8% annualized growth in health consciousness from 2018-2022, reflecting a heightened awareness of personal well-being. Looking ahead to 2023-24, a 0.1% increase is anticipated, propelled by a decline in smoking rates and a shift towards non-alcoholic beverage options. However, challenges loom, with an expected rise in obesity levels, particularly among the aging population. Industries are significantly influenced by these health trends. For instance, the Bread and Cake retail industry faces a 4.5% revenue growth threat as health-conscious consumers opt for low-carb and sugar-free diets. Similarly, Gyms and Fitness Centres witness a 3.7% decline due to increased health consciousness prompting more individuals to exercise independently. As health becomes an omnipresent concern, companies must align strategies with this paradigm shift, ensuring offerings resonate with health-conscious consumers who prioritize products contributing to personal well-being.The Global Reach of Organic Lifestyle Trends to Drive the Market Growth The globalization of organic trends is a pivotal driver fueling the growth of the organic drinks market. As global health movements and environmental awareness campaigns gain momentum, consumers worldwide are embracing organic lifestyles. Social media platforms serve as powerful catalysts, facilitating the exchange of information and fostering a collective consciousness towards health and sustainability. This interconnected global community ensures that the demand for organic beverages transcends geographical boundaries. The shared commitment to cleaner, more ethical consumption creates a broader market footprint, presenting abundant opportunities for growth in the organic drinks sector. As consumers across the globe prioritize wellness and sustainability, the organic drinks market continues to flourish on a truly international scale. A notable trend is the growth of organic offerings in alcoholic drinks and is expected to create a lucrative opportunity for the alcoholic drinks manufacturers for market growth. Cider based on 100% organic ingredients, with unique flavors and health-promoting additives, has become increasingly popular. With an alcohol content of around 5%, these light alcoholic beverages cater to consumers' preferences for light and fruity refreshments. The home mixing trend, accelerated by the pandemic and closure of bars, has led to the development of organic basic products for mixed drinks, including Organic Cola, Organic Tonic, Organic Berry, Organic Bitter Orange, Organic Bitter Lemon, and Organic Ginger Ale. Tea, too, is experiencing a resurgence, with consumers opting for pure, plant-based ingredients with health benefits. As organic becomes more mainstream, tea is gaining traction in the beverage market.

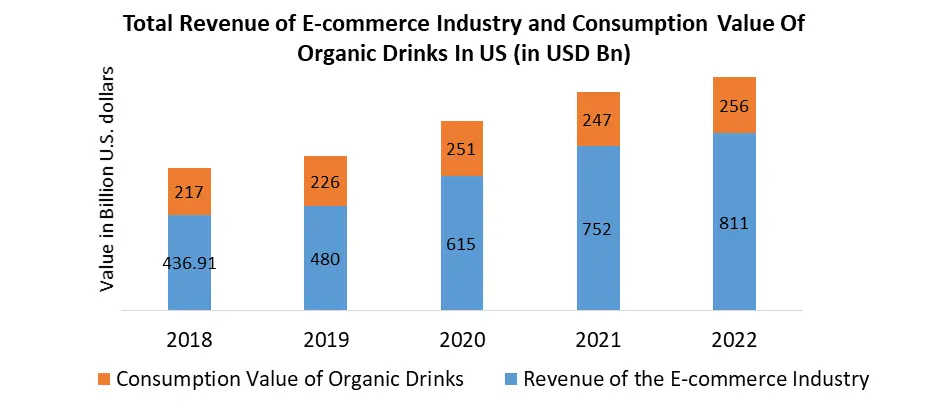

Organic products in India represent far less than 1.0% of global value demand, with a per capita expenditure of just US$0.08 in 2021. However, with the rise in demand for organic products in categories such as tea and organic juice, and consumers becoming increasingly aware of the advantages of consuming organic food, India represents a promising market over the coming years. The Digital Revolution Reshaping E-Commerce The evolution of digitalization has profoundly impacted the e-commerce landscape, transcending geographical and linguistic barriers. Big data, machine learning, and artificial intelligence have ushered in a new era of personalized shopping experiences, providing consumers with tailored product recommendations. Emphasizing product optimization and leveraging the enormous popularity of mobile shopping, the e-commerce sector is set to reach unprecedented heights, with an anticipated $728 billion in the mobile retail sector by 2025. The integration of augmented reality further enhances customer engagement and brand loyalty. As businesses embark on the journey of digital transformation, a strategic focus on customer-centricity, infrastructure robustness, and advanced analytics is crucial for sustainable growth in the Organic Drinks Market.

Organic Drinks Market Segment Analysis

The global Organic Drinks Market is segmented into product type, source, packaging type, consumer demographic, distribution channel and region. On the basis of region, the market is divided into major sectors such as North America, Europe, APAC, Middle East and Africa and South America. By Product Type, The product type segmentation in the organic drinks market encompasses a diverse range, including organic juices, teas, coffees, and functional beverages. Organic juices, with their natural sweetness and health benefits, appeal to health-conscious consumers. In 2022, the organic juices segment held the largest market share. The European Union's fruit juice and nectars consumption totaled 9.2 billion liters in 2020, revealing a 1.1% decline, a slight improvement from the previous year. Despite challenges like consumer concerns over sugar content and volatile raw material prices, segments like chilled and not-from-concentrate showed resilience, recording growth in most EU markets. Premiumization played a pivotal role, with consumers increasingly opting for perceived healthier and natural options, driving the popularity of cold-pressed, organic, Fair Trade, and vegan offerings. While traditional breakfast habits decline, the industry adapts by exploring on-the-go consumption avenues through smaller-sized premium packs. Overall, innovation, premiumization, and adapting to changing lifestyles are key drivers shaping the EU fruit juice market. Various kinds of organic fruit juice offer different medical advantages, for example, avocado juice supports characteristic vitality in the body; watermelon juice keeps the body hydrated and improves digestion; papaya juice caters to sound assimilation; lemon juice battles viral contaminations; and pineapple juice diminishes cholesterol levels”.Europe is the largest Organic Drinks Market for fruit juices in the world, representing 55% of the total world imports. The import continues to grow, in spite of the decreasing consumption of retailpacked juices. This is because imported juices are increasingly used as ingredients in different types of beverages. Large importing and consuming markets such as Belgium, the Netherlands, France, Germany and the United Kingdom continue to offer opportunities for exporters from developing countries. The best opportunities can be found in the high-value segments of not-from-concentrate (NFC) or organic juices, superfruit juices and the use of fruit juices as ingredients in soft-drink “detox” beverages. Exports to Europe are generally done as semifinished products (bulk tanks, drums, containers), packing of consumer products is done by European bottling companies. On the other hand, organic teas and coffees, often sourced sustainably, cater to those seeking a comforting and eco-friendly beverage experience. The functional beverage segment is witnessing notable growth, with innovative formulations featuring superfoods and adaptogens, meeting the demand for beverages that offer both taste and health benefits. By Packaging Type, The packaging type plays a crucial role in addressing environmental concerns within the organic drinks market. Sustainable packaging, such as biodegradable materials and recyclable containers, is gaining traction. Consumers are aligning their choices with eco-friendly options, prompting industry players to invest in innovative, planet-friendly packaging solutions that resonate with the overall ethos of organic and sustainable living. Based on the distribution channel, the retail store dominated the largest Organic Drinks Market share in 2022. The distribution channel segment encompasses where consumers purchase organic drinks, whether through traditional brick-and-mortar retailers, e-commerce platforms, or specialty health stores. The rise of e-commerce has notably influenced consumer behavior, providing convenient access to a wide variety of organic drinks. Understanding the preferences of consumers regarding where and how they shop is crucial for market players to optimize their distribution strategies.

Organic Drinks Market Regional Analysis

In Europe and North America, organic juices, particularly 100% juice, have been described as the new "growth machine" in the market. In 2022, Europe dominated the largest Organic Drinks Market share. The surge in interest in organic products during health crises can be attributed to consumers seeking disease prevention and improved nutrition. In Europe, the Organic Drinks manufacturers mirrors the rich tapestry of cultural and taste preferences among consumers. Countries like Germany and the United Kingdom are experiencing a notable uptick in the consumption of organic sodas, kombuchas, and plant-based milk alternatives. European consumers are distinctive in their prioritization of eco-friendly packaging and a strong inclination toward locally sourced ingredients, reflecting a broader commitment to sustainability. Organic produce has seen growing support among European consumers at a time of increasing concerns for wellbeing, health and the environment. In the European Union, the market for organic juices and nectars is significant, with Germany, France, the UK, and Spain leading in consumption. Germany holds the largest market share with XX million liters consumed in 2022, boasting the highest per capita consumption in the EU at 29.7 liters. For instance, the German fruit juice market has shown diversity, with high-quality fruit juice specialties, including organic options, gaining market share. Organic juices, especially orange juice, have seen increased volume, emphasizing consumer preferences for regionalist, organic, and reusable products. The European trend leans toward manufacturer brands, representing 58% of the market, with Germany, the UK, and Spain aligning with this pattern. Packaging preferences vary, with cardboard dominating at 62.8%, especially in Spain, while German consumers prefer plastic containers in 51.4% of cases. Orange remains the favored flavor, representing 38% of the market volume, with distinct preferences in each country. French consumers prioritize healthy and organic products, while Germans lean toward local and fair-trade items. British consumers value local purchases, sustainability, and simpler products with minimal packaging. In Spain, emerging market niches for eco and bio products, especially in the juice sector, are gaining traction, reflecting a growing interest in healthy and sustainable choices. In North America, the surge in demand for organic beverages is closely tied to a health-conscious lifestyle adopted by consumers. This shift is notably visible in the increased popularity of organic juices, teas, and functional drinks. In 2022, North America held second largest market share. The region's emphasis on clean labels and sustainable practices has further fueled this trend. Notably, in the United States and Canada, the organic movement has evolved beyond a mere dietary choice, becoming a symbol of environmental responsibility and personal well-being. The Asia Pacific region stands out as a dynamic and rapidly growing market for Organic Drinks, driven by an increasing awareness of health and wellness. Nations such as Japan and Australia are witnessing a surge in the demand for organic green teas and functional beverages. In emerging markets like India and China, the preference for organic fruit juices and herbal concoctions is on the rise, underscoring a broader shift toward healthier beverage choices in these populous countries. The trend reflects a blend of traditional practices and a contemporary focus on well-being. The Growing population and consumer shifting preference for organic drinks trend is expected to influence the regional market growth during the forecast period.Competitive Landscape

The competitive landscape of the organic drinks market is dynamic and multifaceted, featuring key players that contribute to the industry's growth and innovation. Austria Juice, a notable contender, distinguishes itself with an extensive range of organic juices, while Suja Life, LLC. is recognized for its commitment to cold-pressed organic beverages. Evolution Fresh, Honest Tea, and Lakewood Organic add further dimensions to the competitive mix. Evolution Fresh, a subsidiary of Starbucks, focuses on cold-pressed juices, aligning with evolving consumer preferences. Honest Tea, known for its organic iced teas, emphasizes transparency and sustainability. Lakewood Organic, a family-owned company, specializes in pure and premium organic juices. As consumer awareness of organic choices continues to rise, the industry is likely to witness further dynamism, with new entrants and evolving strategies shaping the market.Organic Drinks Market Scope: Inquiry Before Buying

Organic Drinks Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 25.47 Bn. Forecast Period 2023 to 2029 CAGR: 5.12% Market Size in 2029: US $ 36.13 Bn. Segments Covered: by Product Type Juices Tea and Coffee Soft drinks Alcoholic Beverages Others by Source Organic Fruits Organic Vegetables by Packaging Type Bottles Cans Cartons by Consumer Demographic Age Group Income Level Income by Distribution Channel Retail Stores Online Retailing Food Service Organic Drinks Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Organic Drinks Key Players are:

1. Austria Juice 2. Suja Life, LLC. 3. Organic Valley 4. The Coca-Cola Company 5. Evolution Fresh 6. Honest Tea 7. Lakewood Organic 8. Uncle Matt's Organic 9. R.W. Knudsen Family 10. Bolthouse Farms, Inc. 11. Numi Organic Tea 12. Hain Celestial Group, Inc. 13. ABC Fine Wine & Spirits 14. Greenbar Distillery 15. Juniper Green Organic Gin 16. Organic Nation 17. Tru Organic Spirits 18. Prairie Organic SpiritsFrequently Asked Questions:

1] What is the growth rate of the Global Organic Drinks Market? Ans. The Global Organic Drinks Market is growing at a significant rate of 5.12 % during the forecast period. 2] Which region is expected to dominate the Global Organic Drinks Market? Ans. Europe is expected to dominate the Organic Drinks Market during the forecast period. 3] What is the expected Global Organic Drinks Market size by 2029? Ans. The Organic Drinks Market size is expected to reach USD 36.13 Bn by 2029. 4] Which are the top players in the Global Organic Drinks Market? Ans. The major top players in the Global Organic Drinks Market are The Coca-Cola Company, Evolution Fresh, Honest Tea and others. 5] What are the factors driving the Global Organic Drinks Market growth? Ans. Consumers are increasingly concerned about their health is the primary driver for market growth and is expected to drive the market during the forecast period 6] Which is the leading country for the sale of Organic Drinks in 2022? Ans. Germany is the leading country for the sale of organic drinks in 2022.

1. Organic Drinks Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Organic Drinks Market: Dynamics 2.1. Organic Drinks Market Trends by Region 2.1.1. Global Organic Drinks Market Trends 2.1.2. North America Organic Drinks Market Trends 2.1.3. Europe Organic Drinks Market Trends 2.1.4. Asia Pacific Organic Drinks Market Trends 2.1.5. Middle East and Africa Organic Drinks Market Trends 2.1.6. South America Organic Drinks Market Trends 2.1.7. Preference Analysis 2.2. Organic Drinks Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Organic Drinks Market Drivers 2.2.1.2. North America Organic Drinks Market Restraints 2.2.1.3. North America Organic Drinks Market Opportunities 2.2.1.4. North America Organic Drinks Market Challenges 2.2.2. Europe 2.2.2.1. Europe Organic Drinks Market Drivers 2.2.2.2. Europe Organic Drinks Market Restraints 2.2.2.3. Europe Organic Drinks Market Opportunities 2.2.2.4. Europe Organic Drinks Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Organic Drinks Market Drivers 2.2.3.2. Asia Pacific Organic Drinks Market Restraints 2.2.3.3. Asia Pacific Organic Drinks Market Opportunities 2.2.3.4. Asia Pacific Organic Drinks Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Organic Drinks Market Drivers 2.2.4.2. Middle East and Africa Organic Drinks Market Restraints 2.2.4.3. Middle East and Africa Organic Drinks Market Opportunities 2.2.4.4. Middle East and Africa Organic Drinks Market Challenges 2.2.5. South America 2.2.5.1. South America Organic Drinks Market Drivers 2.2.5.2. South America Organic Drinks Market Restraints 2.2.5.3. South America Organic Drinks Market Opportunities 2.2.5.4. South America Organic Drinks Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For the Organic Drinks Industry 2.9. Analysis of Government Schemes and Initiatives For Organic Drinks Industry 2.10. The Global Pandemic Impact on Organic Drinks Market 2.11. Organic Drinks Price Trend Analysis (2021-22) 2.12. Global Organic Drinks Market Trade Analysis (2017-2022) 2.12.1. Global Import of Organic Drinks 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Organic Drinks 2.12.3. Ten Largest Exporter 3. Organic Drinks Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 3.1.1. Juices 3.1.2. Tea and Coffee 3.1.3. Soft drinks 3.1.4. Alcoholic Beverages 3.1.5. Others 3.2. Organic Drinks Market Size and Forecast, by Source (2022-2029) 3.2.1. Organic Fruits 3.2.2. Organic Vegetables 3.3. Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 3.3.1. Bottles 3.3.2. Cans 3.3.3. Cartons 3.4. Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 3.4.1. Age Group 3.4.2. Income Level 3.4.3. Income 3.5. Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 3.5.1. Retail Stores 3.5.2. Online Retailing 3.5.3. Food Service 3.6. Organic Drinks Market Size and Forecast, by Region (2022-2029) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Organic Drinks Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Juices 4.1.2. Tea and Coffee 4.1.3. Soft drinks 4.1.4. Alcoholic Beverages 4.1.5. Others 4.2. North America Organic Drinks Market Size and Forecast, by Source (2022-2029) 4.2.1. Organic Fruits 4.2.2. Organic Vegetables 4.3. North America Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 4.3.1. Bottles 4.3.2. Cans 4.3.3. Cartons 4.4. North America Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 4.4.1. Age Group 4.4.2. Income Level 4.4.3. Income 4.5. North America Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1. Retail Stores 4.5.2. Online Retailing 4.5.3. Food Service 4.6. Organic Drinks Market Size and Forecast, by Country (2022-2029) 4.6.1. United States 4.6.1.1. United States Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 4.6.1.1.1. Juices 4.6.1.1.2. Tea and Coffee 4.6.1.1.3. Soft drinks 4.6.1.1.4. Alcoholic Beverages 4.6.1.1.5. Others 4.6.1.2. United States Organic Drinks Market Size and Forecast, by Source (2022-2029) 4.6.1.2.1. Organic Fruits 4.6.1.2.2. Organic Vegetables 4.6.1.3. United States Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 4.6.1.3.1. Bottles 4.6.1.3.2. Cans 4.6.1.3.3. Cartons 4.6.1.4. United States Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 4.6.1.4.1. Age Group 4.6.1.4.2. Income Level 4.6.1.4.3. Income 4.6.1.5. United States Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.1.5.1. Retail Stores 4.6.1.5.2. Online Retailing 4.6.1.5.3. Food Service 4.6.2. Canada 4.6.2.1. Canada Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 4.6.2.1.1. Juices 4.6.2.1.2. Tea and Coffee 4.6.2.1.3. Soft drinks 4.6.2.1.4. Alcoholic Beverages 4.6.2.1.5. Others 4.6.2.2. Canada Organic Drinks Market Size and Forecast, by Source (2022-2029) 4.6.2.2.1. Organic Fruits 4.6.2.2.2. Organic Vegetables 4.6.2.3. Canada Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 4.6.2.3.1. Bottles 4.6.2.3.2. Cans 4.6.2.3.3. Cartons 4.6.2.4. Canada Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 4.6.2.4.1. Age Group 4.6.2.4.2. Income Level 4.6.2.4.3. Income 4.6.2.5. Canada Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.2.5.1. Retail Stores 4.6.2.5.2. Online Retailing 4.6.2.5.3. Food Service 4.6.3. Mexico 4.6.3.1. Mexico Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 4.6.3.1.1. Juices 4.6.3.1.2. Tea and Coffee 4.6.3.1.3. Soft drinks 4.6.3.1.4. Alcoholic Beverages 4.6.3.1.5. Others 4.6.3.2. Mexico Organic Drinks Market Size and Forecast, by Source (2022-2029) 4.6.3.2.1. Organic Fruits 4.6.3.2.2. Organic Vegetables 4.6.3.3. Mexico Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 4.6.3.3.1. Bottles 4.6.3.3.2. Cans 4.6.3.3.3. Cartons 4.6.3.4. Mexico Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 4.6.3.4.1. Age Group 4.6.3.4.2. Income Level 4.6.3.4.3. Income 4.6.3.5. Mexico Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.3.5.1. Retail Stores 4.6.3.5.2. Online Retailing 4.6.3.5.3. Food Service 5. Europe Organic Drinks Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.2. Europe Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.3. Europe Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.4. Europe Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.5. Europe Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6. Europe Organic Drinks Market Size and Forecast, by Country (2022-2029) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.1.2. United Kingdom Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.1.3. United Kingdom Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.1.4. United Kingdom Organic Drinks Market Size and Forecast, by Consumer Demographic(2022-2029) 5.6.1.5. United Kingdom Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.2. France 5.6.2.1. France Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.2.2. France Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.2.3. France Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.2.4. France Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.2.5. France Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.3. Germany 5.6.3.1. Germany Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.3.2. Germany Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.3.3. Germany Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.3.4. Germany Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.3.5. Germany Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.4. Italy 5.6.4.1. Italy Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.4.2. Italy Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.4.3. Italy Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.4.4. Italy Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.4.5. Italy Organic Drinks Market Size and Forecast, Pdff (2022-2029) 5.6.5. Spain 5.6.5.1. Spain Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.5.2. Spain Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.5.3. Spain Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.5.4. Spain Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.5.5. Spain Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.6. Sweden 5.6.6.1. Sweden Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.6.2. Sweden Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.6.3. Sweden Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.6.4. Sweden Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.6.5. Sweden Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.7. Austria 5.6.7.1. Austria Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.7.2. Austria Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.7.3. Austria Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.7.4. Austria Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.7.5. Austria Organic Drinks Market Size and Forecast, by Distribution Channel(2022-2029) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 5.6.8.2. Rest of Europe Organic Drinks Market Size and Forecast, by Source (2022-2029) 5.6.8.3. Rest of Europe Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 5.6.8.4. Rest of Europe Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 5.6.8.5. Rest of Europe Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Organic Drinks Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.2. Asia Pacific Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.3. Asia Pacific Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.4. Asia Pacific Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.5. Asia Pacific Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6. Asia Pacific Organic Drinks Market Size and Forecast, by Country (2022-2029) 6.6.1. China 6.6.1.1. China Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.1.2. China Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.1.3. China Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.1.4. China Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.1.5. China Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.2. S Korea 6.6.2.1. S Korea Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.2.2. S Korea Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.2.3. S Korea Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.2.4. S Korea Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.2.5. S Korea Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.3. Japan 6.6.3.1. Japan Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.3.2. Japan Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.3.3. Japan Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.3.4. Japan Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.3.5. Japan Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.4. India 6.6.4.1. India Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.4.2. India Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.4.3. India Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.4.4. India Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.4.5. India Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.5. Australia 6.6.5.1. Australia Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.5.2. Australia Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.5.3. Australia Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.5.4. Australia Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.5.5. Australia Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.6. Indonesia 6.6.6.1. Indonesia Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.6.2. Indonesia Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.6.3. Indonesia Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.6.4. Indonesia Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.6.5. Indonesia Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.7. Malaysia 6.6.7.1. Malaysia Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.7.2. Malaysia Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.7.3. Malaysia Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.7.4. Malaysia Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.7.5. Malaysia Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.8. Vietnam 6.6.8.1. Vietnam Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.8.2. Vietnam Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.8.3. Vietnam Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.8.4. Vietnam Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.8.5. Vietnam Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.8.6. Vietnam Organic Drinks Market Size and Forecast, by Consumer Demographic(2022-2029) 6.6.9. Taiwan 6.6.9.1. Taiwan Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.9.2. Taiwan Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.9.3. Taiwan Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.9.4. Taiwan Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.9.5. Taiwan Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 6.6.10.2. Rest of Asia Pacific Organic Drinks Market Size and Forecast, by Source (2022-2029) 6.6.10.3. Rest of Asia Pacific Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 6.6.10.4. Rest of Asia Pacific Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 6.6.10.5. Rest of Asia Pacific Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Organic Drinks Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Middle East and Africa Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 7.2. Middle East and Africa Organic Drinks Market Size and Forecast, by Source (2022-2029) 7.3. Middle East and Africa Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 7.4. Middle East and Africa Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 7.5. Middle East and Africa Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 7.6. Middle East and Africa Organic Drinks Market Size and Forecast, by Country (2022-2029) 7.6.1. South Africa 7.6.1.1. South Africa Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 7.6.1.2. South Africa Organic Drinks Market Size and Forecast, by Source (2022-2029) 7.6.1.3. South Africa Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 7.6.1.4. South Africa Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 7.6.1.5. South Africa Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.2. GCC 7.6.2.1. GCC Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 7.6.2.2. GCC Organic Drinks Market Size and Forecast, by Source (2022-2029) 7.6.2.3. GCC Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 7.6.2.4. GCC Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 7.6.2.5. GCC Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.3. Nigeria 7.6.3.1. Nigeria Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 7.6.3.2. Nigeria Organic Drinks Market Size and Forecast, by Source (2022-2029) 7.6.3.3. Nigeria Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 7.6.3.4. Nigeria Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 7.6.3.5. Nigeria Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 7.6.4.2. Rest of ME&A Organic Drinks Market Size and Forecast, by Source (2022-2029) 7.6.4.3. Rest of ME&A Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 7.6.4.4. Rest of ME&A Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 7.6.4.5. Rest of ME&A Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Organic Drinks Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. South America Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 8.2. South America Organic Drinks Market Size and Forecast, by Source (2022-2029) 8.3. South America Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 8.4. South America Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 8.5. South America Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 8.6. Middle East and Africa Organic Drinks Market Size and Forecast, by Country (2022-2029) 8.6.1. Brazil 8.6.1.1. Brazil Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 8.6.1.2. Brazil Organic Drinks Market Size and Forecast, by Source (2022-2029) 8.6.1.3. Brazil Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) Brazil Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 8.6.1.4. Brazil Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.2. Argentina 8.6.2.1. Argentina Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 8.6.2.2. Argentina Organic Drinks Market Size and Forecast, by Source (2022-2029) 8.6.2.3. Argentina Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 8.6.2.4. Argentina Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 8.6.2.5. Argentina Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Organic Drinks Market Size and Forecast, by Product Type (2022-2029) 8.6.3.2. Rest Of South America Organic Drinks Market Size and Forecast, by Source (2022-2029) 8.6.3.3. Rest Of South America Organic Drinks Market Size and Forecast, by Packaging Type (2022-2029) 8.6.3.4. Rest Of South America Organic Drinks Market Size and Forecast, by Consumer Demographic (2022-2029) 8.6.3.5. Rest Of South America Organic Drinks Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Organic Drinks Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. Production for 2022 9.3.7. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Organic Drinks Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Austria Juice 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Suja Life, LLC. 10.3. Organic Valley 10.4. The Coca-Cola Company 10.5. Evolution Fresh 10.6. Honest Tea 10.7. Lakewood Organic 10.8. Uncle Matt's Organic 10.9. R.W. Knudsen Family 10.10. Bolthouse Farms, Inc. 10.11. Numi Organic Tea 10.12. Hain Celestial Group, Inc. 10.13. ABC Fine Wine & Spirits 10.14. Greenbar Distillery 10.15. Juniper Green Organic Gin 10.16. Organic Nation 10.17. Tru Organic Spirits 10.18. Prairie Organic Spirits 11. Key Findings 12. Industry Recommendations 13. Organic Drinks Market: Research Methodology