The Organic Cheese Market size was valued at USD 8.32 Billion in 2022 and the total Organic Cheese revenue is expected to grow at a CAGR of 6.86% from 2023 to 2029, reaching nearly USD 13.24 billion By 2029. Organic Cheese is the most pure and healthy option in the diet compared to its conventional counterparts. It's produced from milk obtained through organic farming practices, excluding synthetic pesticides, antibiotics, and growth hormones. The demand for organic cheese has witnessed a rapid surge in recent years all across the world. Consumers increasingly prioritize healthier and sustainable food choices, driving the demand for organic products. The appeal of organic cheese lies in its assurance of reduced exposure to toxins and pesticides commonly linked with conventional farming methods.To know about the Research Methodology :- Request Free Sample Report Moreover, the growing awareness of the environmental impact of food production has led consumers to seek products that support eco-friendly and ethical farming practices. Additionally, the rise in small dairy farmers transitioning to organic practices has expanded the availability of organic cheese varieties, offering unique flavors and textures that resonate with consumers seeking diverse culinary experiences. The increasing demand for organic cheese not only aligns with health-conscious consumer preferences but also supports sustainable farming methods, contributing to the revitalization of farms and local economies. As a result, the organic cheese market is experiencing robust growth, driven by shifting consumer preferences towards healthier, ethically sourced food options. From traditional varieties like cheddar and mozzarella to innovative specialty flavors and artisanal creations, organic cheese producers continuously diversify their product lines to meet consumer demands. This factor is further supporting the organic cheese market growth. The commitment of small-scale dairy farmers to adopt organic farming practices is further expected to be the major factor driving the organic cheese industry. Their shift towards sustainable methods contributes to increased organic milk production, ensuring a steady supply for cheese production. The United States is expected to be the lucrative region for organic cheese manufacturers during the forecast period. Evolving consumer preferences towards healthier and sustainably produced food options are expected to increase the sales of organic cheese in the country and increase the United States organic cheese market size.

Organic Cheese Market Dynamics:

Increasing Consumer Consciousness About Health And Well-Being The increasing consumer awareness about health and well-being is expected to be the major factor driving the global organic cheese market. As more individuals prioritize healthier dietary choices, there's a notable shift towards organic cheese due to its perceived health benefits and natural production methods. For instance, in the United States, the organic food sector has been witnessing steady growth, with organic dairy, including cheese, gaining popularity among health-conscious consumers. According to the MMR analysis, the organic dairy sector experienced a significant upsurge, with sales reaching more than 8 billion in 2022, reflecting the increasing demand for organic dairy products, including cheese. Similarly, in European countries like Germany and France, where organic food consumption has increased rapidly, the demand for organic cheese has surged significantly. Thanks to consumers' preference for products free from synthetic additives and produced using environmentally friendly practices. Reports from the European Commission showcase a consistent increase in organic food consumption across various European nations, indicating a parallel rise in the demand for organic cheese. Consumers are increasingly opting for organic cheese as it's perceived to be free from synthetic pesticides, growth hormones, and antibiotics. This growing health-conscious mindset is influencing purchasing decisions, contributing to the growth of the organic cheese market globally. As a result, manufacturers and retailers are responding by expanding their organic cheese offerings, capitalizing on this trend, and meeting the evolving demands of health-conscious consumers.Organic Cheese Buyer’s Profile

Increasing Adoption Of Organic Cheese In Emerging Economies The increasing adoption of organic cheese in emerging economies presents a significant growth opportunity for organic cheese manufacturers during the forecast period. As these economies experience rising urbanization, evolving consumer preferences, and heightened awareness about healthier food choices, there's a notable shift towards organic products, including cheese. For instance, in countries like Brazil and China, the demand for organic food products has been steadily rising. Brazil's organic food market witnessed substantial growth in recent years, with consumers showing a growing preference for organic dairy products, including cheese. Similarly, in China, as consumer awareness about food safety and quality intensifies, there's an emerging trend toward organic dairy products, contributing to the organic cheese market's potential growth. These emerging economies present untapped markets where organic cheese manufacturers capitalize on the growing consumer interest in healthier and environmentally friendly options. The increasing disposable incomes in these regions are enabling consumers to prioritize premium-quality food products, including organically produced cheese, further increasing the product demand, and thereby driving the organic cheese market size. Moreover, government initiatives and regulations supporting organic farming practices and certifications are bolstering the organic food sector's growth in these emerging economies. For instance, India's National Programme for Organic Production (NPOP) and various certification schemes are fostering the growth of the organic food industry, creating favorable conditions for the expansion of organic cheese consumption. Mexico's government has taken significant steps to promote organic agriculture through initiatives like the National Service for Agro-Alimentary Public Services (SENASICA). SENASICA has implemented programs to encourage organic farming practices and support certification processes for organic products, including dairy items like cheese. This commitment to fostering organic agriculture creates an enabling environment for the growth of the organic food industry, stimulating increased consumption of organic cheese among consumers seeking healthier and sustainably produced dairy options. Brazil has unveiled its National Plan for Organic Production and Agroecology (PLANAPO) to foster organic farming practices. This initiative, launched in recent years, aims to promote sustainable agriculture, provide financial support, and establish regulations to facilitate organic production. PLANAPO supports organic farmers and processors, encouraging the expansion of the organic food industry, including the production and consumption of organic cheese. As these emerging economies undergo demographic and socio-economic shifts, the inclination towards organic cheese as a healthier and premium dairy option is expected to offer lucrative growth opportunities for organic cheese manufacturers, contributing to the overall growth of the organic cheese market on a global scale.

Strong Competition with Conventional Products Strong competition with conventional products acts as a major barrier to the global organic cheese market growth. Conventional cheese offerings often dominate the market due to their lower production costs, extensive availability, and established consumer familiarity. For instance, in the United States, conventional cheese products, widely available in supermarkets and retail outlets at competitive prices, significantly outpace the market share compared to organic cheese. According to the MMR analysis, conventional cheese held a substantial share of over 70% in the U.S. cheese market, while organic cheese accounted for a smaller segment due to higher pricing and limited availability. Similarly, in European countries like Germany and the United Kingdom, traditional cheeses produced through conventional methods have a stronghold in the market. Their lower prices and easier accessibility compared to organic alternatives make them a preferred choice for consumers, impacting the organic cheese market penetration. This robust competition from conventional cheese products poses challenges for organic cheese manufacturers aiming to expand their market presence. The price differential between organic and conventional cheeses, coupled with the wider availability of traditional options, often deters consumers from opting for organic alternatives. Additionally, the strong brand loyalty and familiarity associated with conventional cheeses further hinder the organic cheese market growth.

Organic Cheese Market Segment Analysis:

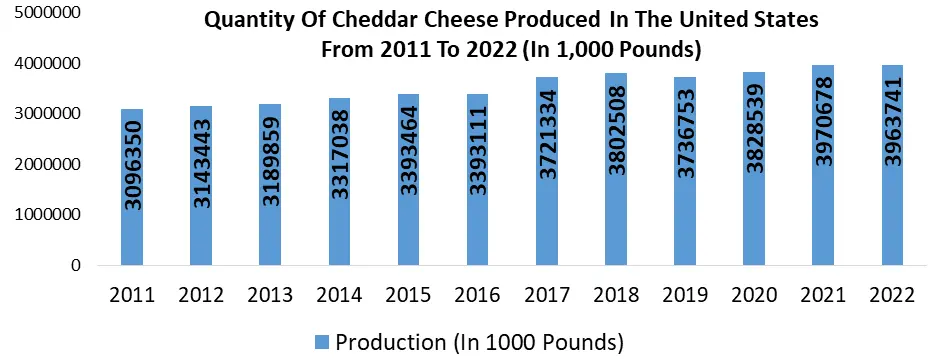

Based on Product Type, the Cheddar segment held the largest market share of about 36.78% in the global organic cheese market in 2022. According to the MMR analysis, the segment is further expected to grow at a CAGR of 6.12% during the forecast period. Cheddar's versatile application caters to diverse consumer preferences, reflecting across age groups, ethnicities, and different socio-economic backgrounds. Despite the emerging interest in specialty and pizza cheeses, Cheddar maintains a significant portion of the regular consumption rate among cheese consumers, propelling per capita cheese consumption to double over the past decade, thereby supporting the segment growth.

Cheddar Cheese Process Overview

The surge in demand for Cheddar cheese is supported by its remarkable adaptability and versatile appeal, resonating with a vast spectrum of culinary preferences. This increasing popularity stems from its ability to seamlessly integrate into diverse dishes, ranging from everyday snacks to complex culinary creations like burgers, sandwiches, and pasta. What makes Cheddar particularly sought after is its wide-ranging flavor profile, transitioning from a mild, creamy taste to intricate, nutty nuances as it matures. This diversity allows consumers to select flavors that align with their individual preferences, contributing significantly to its sustained allure. Moreover, Cheddar's acclaim transcends geographical boundaries, enjoying global recognition and appreciation across continents. Its availability in various formats, facilitated by modern manufacturing methods, caters to evolving consumer needs. From traditional large loaves to easily manageable rectangular blocks, Cheddar's accessibility in the market has bolstered its widespread consumption. The cheese's presence in an array of retail outlets, spanning supermarkets, specialty stores, and online platforms, further amplifies its accessibility, enabling consumers to procure it with ease.

Additionally, the burgeoning awareness surrounding healthier dietary choices has propelled the demand for Cheddar produced organically or with health-oriented attributes, further increasing the organic cheese market growth. This appeal to health-conscious consumers has significantly contributed to its uptake, especially within the organic cheese market segment. Furthermore, Cheddar's adaptability to emerging food trends and its incorporation into fusion cuisines and innovative culinary applications have played a pivotal role in maintaining its relevance and desirability among consumers seeking diverse gastronomic experiences. The optimization of Cheddar cheese to align with consumer sensory expectations poses a significant challenge and opportunity for manufacturers. Understanding and refining the cheese's flavor profile to resonate more strongly with consumer preferences remains a crucial focus for producers seeking sustained profitability. Traditional methods of grading and judging in the dairy industry, while useful for quality control, might not wholly reflect consumer acceptance. A shift towards more informative grading systems, rooted in positive attributes and consumer demands, becomes imperative for enhancing consumer acceptance and consumption of Cheddar cheese. Besides that, the Mozzarella cheese segment is expected to grow at a rapid CAGR and offer lucrative growth opportunities for organic cheese manufacturers all across the world during the forecast period. The rising popularity and increasing consumer demand is expected to be the primary factor driving the segment growth. Its versatile nature and adaptable characteristics make it a sought-after choice not only in traditional dishes but also in contemporary culinary trends, such as pizzas, salads, sandwiches, and various global cuisines. This versatility positions Mozzarella as a cheese of choice across a diverse range of culinary applications, contributing significantly to its rapid growth.

Furthermore, the shifting consumer preferences towards healthier and natural food options have further propelled the organic Mozzarella segment, increasing the organic cheese market size. With consumers increasingly valuing organic products due to health and environmental considerations, organic Mozzarella cheese is expected to witness heightened demand during the forecast period. This demand surge aligns with the broader trend of consumers seeking sustainably sourced and environmentally friendly food choices. Capitalizing on the expanding consumer preference for organic options and the versatile appeal of Mozzarella, the manufacturers are poised to meet the burgeoning market demand during the forecast period.

Organic Cheese Market Regional Insights:

EU dominated the global organic cheese market with the highest market share of over 40% in 2022. The region is expected to grow at a CAGR of 6.45% during the forecast period and maintain its dominance by 2029. Organic dairy sales have increased in many EU countries in recent years and the offer has been enriched with new products, especially for cheeses, thus supporting the European organic cheese market. In many European cities, cheese is more than just a cuisine. Germany, Denmark, and Sweden have been major producers of organic cheeses in recent years. France, known globally for its cheese heritage, boasts an impressive array of over 400 cheese varieties. It remains a quintessential destination for cheese enthusiasts.Paris offers a diverse range of Brie selections, while the Loire Valley is renowned for its exceptional goat cheeses. The Midi Pyrenees region stands out for producing the esteemed Roquefort, made exclusively from ewes' milk sourced from the Causses limestone cliffs. Spanish cheeses are revered for their intense flavors and varied textures. Zamorano, a notable hard sheep's milk cheese with a distinct nutty profile, is a must-try in the Castile-Leon region. Additionally, Torta del Casal, a creamy farm cheese, and the robust Cabrales blue cheese complement Spain's cheese-making prowess. Switzerland, adorned with small country villages housing cheese factories and farmhouses, prides itself on its craftsmanship. Gruyere, originating from Fribourg, entices with its buttery, sweet, and nutty essence. Emmental Cheese, with its iconic holes, showcases a nutty and buttery flavor, drawing enthusiasts to the Emmental Valley in Bern. Italian cheese makers are revered globally for their stringent quality standards and consistent taste. Pecorino, prevalent across central and southern Tuscany, offers a delectable hard cheese experience akin to sharp parmesan flavors. Castelmagno, a semi-firm cheese from Piedmont, presents a journey from mild blue flavors to intense spiciness with aging, providing a diverse tasting experience at Castelmagno factories. Thus, these all countries have been significant players in the organic cheese market due to their strong cheese-making traditions and consumer demand for high-quality, natural products. This factor supports the organic cheese market and increases the regional market share.

The Top 10 Cheese Producers In The European Union In 2022

In addition, the rising consumer consciousness regarding health, environmental impact, and animal welfare has propelled the demand for organic cheese across Europe. This demand surge aligns with the European Union's stringent regulations, ensuring that organic cheeses meet specific standards in farming techniques, animal feed, and the exclusion of synthetic additives or pesticides.

European Country Cheese Production (tonnes) in 2022 Germany 2,334,000 France 1,909,000 Italy 1,359,000 Netherlands 973,580 Poland 925,740 Spain 538,210 Denmark 466,500 Ireland 282,500 Greece 242,860 Austria 222,660 Other Cheese Producers Countries In The European Union In 2022

Europe's diverse cheese culture, spanning from classic varieties like French Camembert to specialized artisanal options, caters to an array of palates within the organic cheese market. Accessibility has increased through multiple avenues, including supermarkets, specialty stores, farmers' markets, and the digital sphere, allowing broader consumer reach and choice. European cheese producers are amplifying their commitment to sustainable and traditional farming practices, resonating profoundly with consumers seeking eco-friendly products. This emphasis on sustainability not only aligns with consumer values but also contributes to the overall appeal and marketability of organic cheeses within the region. Organic Cheese Market Competitive Landscapes: Several organic cheese manufacturers are focused on enhancing and expanding their core business through the launch of additional efficient products in order to keep up with conventional cheese sales. Several organic cheese firms are broadening their product portfolios beyond traditional cheese varieties. For instance, Companies like Organic Valley have expanded their offerings to include an array of organic cheese types, ranging from cheddar and mozzarella to specialty flavors like smoked gouda or pepper jack. By diversifying their product lines, these firms aim to cater to diverse consumer preferences and expand their market reach. Producers are further concentrating on introducing new flavors and variations within cream cheese, a segment witnessing notable innovation. Brands such as Stonyfield Farm, under the Danone umbrella, have launched organic cream cheese products infused with diverse flavors like herbs, spices, or fruit blends. This strategic focus on flavor innovation within cream cheese aligns with changing consumer tastes, enhancing product appeal and market competitiveness. Recognizing the demand for convenient, on-the-go snack options, companies are creating organic cheese snack packs. Brands like Horizon Organic (part of Danone) have introduced portable organic cheese snack packs, combining cheese with complementary items like nuts, crackers, or dried fruits. These snack packs cater to consumers seeking healthy, convenient snacking choices, thereby tapping into a growing market segment. In addition, the market players increasingly adopt various approaches including strategic alliances and acquisitions, product innovation, and expanding market reach to increase market share. For instance, In June 2021, Danone, a major player in the dairy industry, acquired Follow Your Heart, a US-based plant-based food company. Although focused on plant-based products, this acquisition reflects Danone's strategic move to diversify its portfolio, catering to evolving consumer preferences for healthier and sustainable food choices. Such expansions often influence the company's approach to dairy and cheese segments, including organic options. In March 2021, Dalter Alimentari Spa introduced a novel cheese product: cheese matchsticks, a specialized slice designed to meet the needs of food manufacturing and food service industries. This product serves as a versatile ingredient in prepared meals, instant salads, soups, sauces, and even fillings and stuffing, catering to diverse culinary applications. By August 2020, Glanbia completed the acquisition of Foodarom (Germany), bolstering its expertise in flavors and nutritional solutions. This strategic acquisition significantly enhanced Glanbia's capabilities in catering to evolving consumer preferences and expanding its offerings in the flavors segment. These strategic endeavors underscore the organic cheese industry's commitment to diversifying product lines, innovating within segments, and adopting strategic partnerships to compete effectively in the market landscape. As consumer preferences evolve, these proactive strategies position organic cheese manufacturers for sustained growth and competitiveness in the dairy market.

Other European Country Cheese Production (tonnes) in 2022 Czechia 175,030 Belgium 119,680 Romania 102,790 Bulgaria 97,600 Lithuania 93,980 Organic Cheese Market Scope: Inquire Before Buying

Global Organic Cheese Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 8.32 Bn. Forecast Period 2023 to 2029 CAGR: 6.86% Market Size in 2029: US $ 13.24 Bn. Segments Covered: by Product Type Cheddar Mozzarella Parmesan Feta Blue Cheese Gouda Others by Forms Cubes & Blocks Slices Spreads or Dips Crumbles Other Forms by Distribution Channel Offline Hypermarket/Supermarket Grocery Stores Others Online store E-commerce Platforms Company Owned Websites Organic Cheese Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Organic Cheese Market Key Players

1. Purity Foods, Inc. 2. Organic Valley. 3. Eden Foods, Inc. 4. Fonterra Co-operative Group Limited 5. Aurora Organic Dairy Corp. 6. The Kroger Co. 7. Danone 8. Groupe Lactalis S.A. 9. Kerry Group Plc. 10. The WhiteWave Foods Company 11. Emmi 12. Sargento Foods Inc. 13. BelGioioso Cheese Inc. 14. Organic Creamery 15. Norseland 16. Thise Dairy 17. Murray's Cheese 18. Savencia Fromage & Dairy 19. Sierra Nevada Cheese Co. 20. Velvet Creek CheeseFAQs:

1. What are the growth drivers for the Organic Cheese market? Ans. Increasing Health Awareness, Rising Environmental Concerns, Shifting Consumer Preferences, etc. are expected to be the major drivers for the Organic Cheese market. 2. What is the major restraint for the Organic Cheese market growth? Ans. Strong Competition with Conventional Products is expected to be the major restraining factor for the Organic Cheese market growth. 3. Which region is expected to lead the global Organic Cheese market during the forecast period? Ans. Europe is expected to lead the global Organic Cheese market during the forecast period. 4. What is the projected market size & and growth rate of the Organic Cheese Market? Ans. The Organic Cheese Market size was valued at USD 8.32 Billion in 2022 and the total Organic Cheese revenue is expected to grow at a CAGR of 6.86% from 2023 to 2029, reaching nearly USD 13.24 Billion By 2029. 5. What segments are covered in the Organic Cheese Market report? Ans. The segments covered in the Organic Cheese market report are Product Type, Form, Distribution Channel, and Region.

1. Organic Cheese Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Organic Cheese Market: Dynamics 2.1. Preference Analysis 2.2. Organic Cheese Market Trends by Region 2.2.1. North America Organic Cheese Market Trends 2.2.2. Europe Organic Cheese Market Trends 2.2.3. Asia Pacific Organic Cheese Market Trends 2.2.4. Middle East and Africa Organic Cheese Market Trends 2.2.5. South America Organic Cheese Market Trends 2.3. Organic Cheese Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Organic Cheese Market Drivers 2.3.1.2. North America Organic Cheese Market Restraints 2.3.1.3. North America Organic Cheese Market Opportunities 2.3.1.4. North America Organic Cheese Market Challenges 2.3.2. Europe 2.3.2.1. Europe Organic Cheese Market Drivers 2.3.2.2. Europe Organic Cheese Market Restraints 2.3.2.3. Europe Organic Cheese Market Opportunities 2.3.2.4. Europe Organic Cheese Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Organic Cheese Market Drivers 2.3.3.2. Asia Pacific Organic Cheese Market Restraints 2.3.3.3. Asia Pacific Organic Cheese Market Opportunities 2.3.3.4. Asia Pacific Organic Cheese Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Organic Cheese Market Drivers 2.3.4.2. Middle East and Africa Organic Cheese Market Restraints 2.3.4.3. Middle East and Africa Organic Cheese Market Opportunities 2.3.4.4. Middle East and Africa Organic Cheese Market Challenges 2.3.5. South America 2.3.5.1. South America Organic Cheese Market Drivers 2.3.5.2. South America Organic Cheese Market Restraints 2.3.5.3. South America Organic Cheese Market Opportunities 2.3.5.4. South America Organic Cheese Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Value Chain - Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For Organic Cheese Industry 2.9. Analysis of Government Schemes and Initiatives For Organic Cheese Industry 2.10. The Global Pandemic's Impact on Organic Cheese Market 2.11. Organic Cheese Price Trend Analysis (2021-22) 3. Organic Cheese Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 3.1. Organic Cheese Market Size and Forecast, by Product (2022-2029) 3.1.1. Cheddar 3.1.2. Mozzarella 3.1.3. Parmesan 3.1.4. Feta 3.1.5. Blue Cheese 3.1.6. Gouda 3.1.7. Others 3.2. Organic Cheese Market Size and Forecast, by Form (2022-2029) 3.2.1. Cubes & Blocks 3.2.2. Slices 3.2.3. Spreads or Dips 3.2.4. Crumbles 3.2.5. Other Forms 3.3. Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Offline 3.3.1.1. Hypermarket/Supermarket 3.3.1.2. Grocery Stores 3.3.1.3. Others 3.3.2. Online store 3.3.2.1. E-commerce Platforms 3.3.2.2. Company Owned Websites 3.4. Organic Cheese Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Organic Cheese Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Organic Cheese Market Size and Forecast, by Product (2022-2029) 4.1.1. Cheddar 4.1.2. Mozzarella 4.1.3. Parmesan 4.1.4. Feta 4.1.5. Blue Cheese 4.1.6. Gouda 4.1.7. Others 4.2. North America Organic Cheese Market Size and Forecast, by Form (2022-2029) 4.2.1. Cubes & Blocks 4.2.2. Slices 4.2.3. Spreads or Dips 4.2.4. Crumbles 4.2.5. Other Forms 4.3. North America Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Offline 4.3.1.1. Hypermarket/Supermarket 4.3.1.2. Grocery Stores 4.3.1.3. Others 4.3.2. Online store 4.3.2.1. E-commerce Platforms 4.3.2.2. Company Owned Websites 4.4. North America Organic Cheese Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Organic Cheese Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Cheddar 4.4.1.1.2. Mozzarella 4.4.1.1.3. Parmesan 4.4.1.1.4. Feta 4.4.1.1.5. Blue Cheese 4.4.1.1.6. Gouda 4.4.1.1.7. Others 4.4.1.2. United States Organic Cheese Market Size and Forecast, by Form (2022-2029) 4.4.1.2.1. Cubes & Blocks 4.4.1.2.2. Slices 4.4.1.2.3. Spreads or Dips 4.4.1.2.4. Crumbles 4.4.1.2.5. Other Forms 4.4.1.3. United States Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Offline 4.4.1.3.1.1. Hypermarket/Supermarket 4.4.1.3.1.2. Grocery Stores 4.4.1.3.1.3. Others 4.4.1.3.2. Online store 4.4.1.3.2.1. E-commerce Platforms 4.4.1.3.2.2. Company Owned Websites 4.4.2. Canada 4.4.2.1. Canada Organic Cheese Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Cheddar 4.4.2.1.2. Mozzarella 4.4.2.1.3. Parmesan 4.4.2.1.4. Feta 4.4.2.1.5. Blue Cheese 4.4.2.1.6. Gouda 4.4.2.1.7. Others 4.4.2.2. Canada Organic Cheese Market Size and Forecast, by Form (2022-2029) 4.4.2.2.1. Cubes & Blocks 4.4.2.2.2. Slices 4.4.2.2.3. Spreads or Dips 4.4.2.2.4. Crumbles 4.4.2.2.5. Other Forms 4.4.2.3. Canada Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Offline 4.4.2.3.1.1. Hypermarket/Supermarket 4.4.2.3.1.2. Grocery Stores 4.4.2.3.1.3. Others 4.4.2.3.2. Online store 4.4.2.3.2.1. E-commerce Platforms 4.4.2.3.2.2. Company Owned Websites 4.4.3. Mexico 4.4.3.1. Mexico Organic Cheese Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Cheddar 4.4.3.1.2. Mozzarella 4.4.3.1.3. Parmesan 4.4.3.1.4. Feta 4.4.3.1.5. Blue Cheese 4.4.3.1.6. Gouda 4.4.3.1.7. Others 4.4.3.2. Mexico Organic Cheese Market Size and Forecast, by Form (2022-2029) 4.4.3.2.1. Cubes & Blocks 4.4.3.2.2. Slices 4.4.3.2.3. Spreads or Dips 4.4.3.2.4. Crumbles 4.4.3.2.5. Other Forms 4.4.3.3. Mexico Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Offline 4.4.3.3.1.1. Hypermarket/Supermarket 4.4.3.3.1.2. Grocery Stores 4.4.3.3.1.3. Others 4.4.3.3.2. Online store 4.4.3.3.2.1. E-commerce Platforms 4.4.3.3.2.2. Company Owned Websites 5. Europe Organic Cheese Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.2. Europe Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.3. Europe Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Organic Cheese Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.1.3. United Kingdom Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.2.3. France Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.3.3. Germany Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.4.3. Italy Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.5.3. Spain Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.6.3. Sweden Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.7.3. Austria Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Organic Cheese Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Organic Cheese Market Size and Forecast, by Form (2022-2029) 5.4.8.3. Rest of Europe Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Organic Cheese Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.3. Asia Pacific Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Organic Cheese Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.1.3. China Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.2.3. S Korea Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.3.3. Japan Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.4.3. India Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.5.3. Australia Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.6.3. Indonesia Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.7.3. Malaysia Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.8.3. Vietnam Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8.4. Vietnam Organic Cheese Market Size and Forecast, by Industry Vertical(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.9.3. Taiwan Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Organic Cheese Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Organic Cheese Market Size and Forecast, by Form (2022-2029) 6.4.10.3. Rest of Asia Pacific Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Organic Cheese Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Organic Cheese Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Organic Cheese Market Size and Forecast, by Form (2022-2029) 7.3. Middle East and Africa Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Organic Cheese Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Organic Cheese Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Organic Cheese Market Size and Forecast, by Form (2022-2029) 7.4.1.3. South Africa Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Organic Cheese Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Organic Cheese Market Size and Forecast, by Form (2022-2029) 7.4.2.3. GCC Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Organic Cheese Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Organic Cheese Market Size and Forecast, by Form (2022-2029) 7.4.3.3. Nigeria Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Organic Cheese Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Organic Cheese Market Size and Forecast, by Form (2022-2029) 7.4.4.3. Rest of ME&A Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Organic Cheese Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. South America Organic Cheese Market Size and Forecast, by Product (2022-2029) 8.2. South America Organic Cheese Market Size and Forecast, by Form (2022-2029) 8.3. South America Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. South America Organic Cheese Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Organic Cheese Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Organic Cheese Market Size and Forecast, by Form (2022-2029) 8.4.1.3. Brazil Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Organic Cheese Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Organic Cheese Market Size and Forecast, by Form (2022-2029) 8.4.2.3. Argentina Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Organic Cheese Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Organic Cheese Market Size and Forecast, by Form (2022-2029) 8.4.3.3. Rest Of South America Organic Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Organic Cheese Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Organic Cheese Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Purity Foods, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Organic Valley. 10.3. Eden Foods, Inc. 10.4. Fonterra Co-operative Group Limited 10.5. Aurora Organic Dairy Corp. 10.6. The Kroger Co. 10.7. Danone 10.8. Groupe Lactalis S.A. 10.9. Kerry Group Plc. 10.10. The WhiteWave Foods Company 10.11. Emmi 10.12. Sargento Foods Inc. 10.13. BelGioioso Cheese Inc. 10.14. Organic Creamery 10.15. Norseland 10.16. Thise Dairy 10.17. Murray's Cheese 10.18. Savencia Fromage & Dairy 10.19. Sierra Nevada Cheese Co. 10.20. Velvet Creek Cheese 11. Key Findings 12. Industry Recommendations 13. Organic Cheese Market: Research Methodology