Global Maple Syrup Market size was valued at USD 634.2 Mn in 2023 and is expected to reach USD 976.6 Mn by 2030, at a CAGR of 5.6 %.Maple Syrup Market Overview:

Maple syrup is used as a coating for several bakery products such as French toast, cakes, waffles, pancakes, and bread rolls. It is used in preparing various food products such as vegetables, baked fruits, hot cereals, sausages, fresh donuts, and ice cream. There is a rise in the demand in the maple syrup market for the food topping and flavouring, Owing to these factors the market is expected to grow during the forecast period.To know about the Research Methodology :- Request Free Sample Report One major driver of the maple syrup market is the growing consumer demand for natural sweeteners. This trend significantly impacts the market, especially in regions like North America, particularly the United States and Canada. The cultural significance of maple syrup in these areas has fuelled an increased desire for authentic and natural sweetening options. Organizations like the Vermont Maple Sugar Makers' Association are actively promoting the surge in consumer demand for natural sweeteners through press releases, emphasizing the superior quality and authenticity of locally produced maple syrup. In Europe, where health-conscious consumers in countries like Germany and France contribute to the market's growth by seeking healthier alternatives to refined sugars. European health agencies endorsing maple syrup as a healthier option further amplify its adoption in various food applications. This overarching demand for natural sweeteners steers the maple syrup market and shapes consumer preferences toward more authentic and health-conscious choices. Quebec Maple Syrup Producers (QMSP) stand as pivotal players in the global maple syrup market, wielding influence with their control over 70% of production. Their strategic reserve guarantees a stable supply, and a robust commitment to sustainability is evident in stringent tapping regulations and significant research investments. Their recent announcement of record sales for the renowned "Purely Quebec" brand underscores the strength of their brand recognition and resonates with consumer preferences for top-quality syrup. QMSP's dominance is rooted in being a production powerhouse, leveraging Quebec's ideal climate and expansive maple forests. Their commitment to sustainability, showcased through strict tapping regulations and substantial investments in research, establishes QMSP as a leader in ensuring long-term resource availability. This dominance is further fortified by their robust marketing strategies, exemplified by impactful branding campaigns like "Purely Quebec" and strategic reserve initiatives, solidifying QMSP's pivotal role in shaping the dynamics of the maple syrup market.

Maple Syrup Market Dynamics

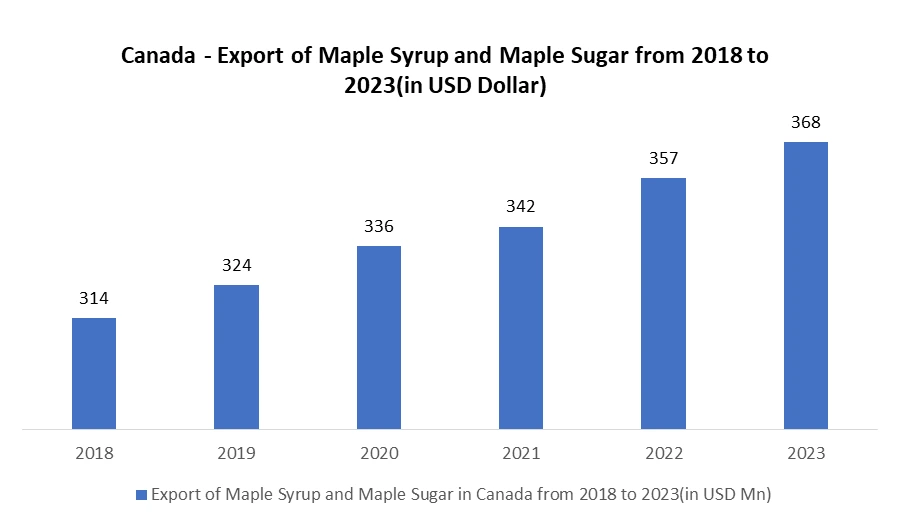

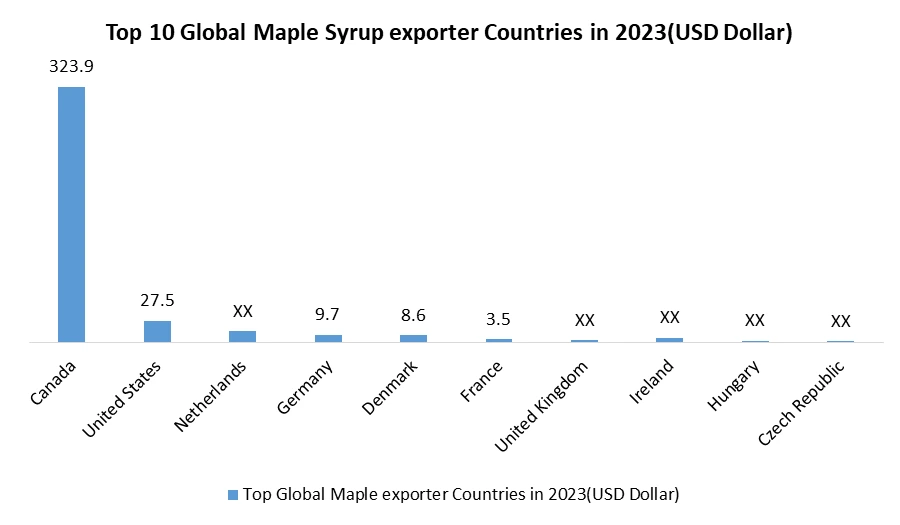

Maple Syrup Market Driver Increasing Health Consciousness and rising Popularity of Organic and Sustainable Products driving the Maple Syrup Market Growth Australian retailers, partnerships with eco-friendly maple syrup producers, showcasing their commitment to offering sustainable choices. The demand for organic maple syrup in Australia and New Zealand, aligns with the region's strong focus on sustainability. This reflects a broader consumer trend towards eco-conscious and ethically sourced products, elevating the importance of sustainability in the maple syrup market, Health & Wellness orchestrates a symphony of sweetness and purity that resonates globally. The organic crescendo, with a commanding 60% market share, is particularly striking in North America, the US, and Canada. This surge is mirrored in Europe, where France and Germany contribute to a 30% market share, driven by regulations promoting natural ingredients. Purity takes center stage with Grade A maple syrup, captivating health-conscious individuals with its unadulterated taste. Initiatives like the Green Maple program in Quebec ensure ethical sourcing and sustainable tapping practices, creating a sustainability harmony that resonates with eco-conscious consumers. Beyond breakfast, health-conscious consumers compose new notes, integrating maple syrup into diverse culinary ventures for natural sweetness and complex flavors. The Quebec Maple Syrup Producers' record sales of their sustainably sourced syrup brand stand as a testament to the commercial success achievable through ethical and environmentally friendly practices. Health-conscious consumers in Europe, particularly in Germany and France, actively contribute to the growth of the maple syrup market. European health agencies endorse maple syrup as a healthier alternative, sparking increased adoption in diverse food applications, as highlighted in a press release. This driver reflects a global shift toward healthier eating habits, with maple syrup emerging as a natural and wholesome sweetening option. Growing Consumer Demand for Natural Sweeteners and Expanding Application Scope in Food and Beverages Culinary Exploration, leads the maple syrup market into sweet adventures beyond traditional breakfast fare. Chefs are composing bold new tunes, incorporating maple syrup into savory glazes, salad dressings, and sauces, challenging its breakfast-centric image. Canadian chefs stand at the forefront of this culinary exploration, showcasing maple syrup's versatility in unexpected ways. Consumer demand for new experiences has fuelled the popularity of infused and flavored syrups globally, with the Asia-Pacific region showing particular interest in innovative options like cinnamon maple or maple chili. Global culinary collaborations, exemplified by chefs like David McMillan in Canada, create an international buzz, expanding maple syrup's reach and sparking culinary curiosity. Fine dining restaurants increasingly feature maple syrup in signature dishes, elevating its perception beyond a breakfast staple. A major food company's introduction of a new line of maple-infused cookies using Canadian syrup underscores the growing use of maple syrup in processed foods, driven by consumer demand for unique flavors. The culinary exploration driver not only diversifies maple syrup applications but also fosters innovation and global collaborations in the culinary landscape. The rising consumer demand for natural sweeteners serves as a prominent driver in the maple syrup market. With an emphasis on health and wellness, consumers increasingly opt for natural alternatives, propelling the sales of organic maple syrup. This trend is particularly pronounced in North America, specifically the United States and Canada, where maple syrup holds cultural significance. Health-conscious consumers are drawn to maple syrup's purity, choosing it over refined sugars, and its versatility, extending its use beyond traditional breakfast applications. Maple syrup demand in the United States and Canada is deeply rooted in cultural significance. The Vermont Maple Sugar Makers' Association amplifies this trend, emphasizing the superior quality and authenticity of Vermont-produced maple syrup in a press release. Consumers increasingly opt for natural sweeteners, with maple syrup gaining prominence as a preferred and authentic choice. Global Trade Agreements Impacting Maple Syrup Exports, Technological Advancements in Maple Production driving the market growth Global trade agreements significantly impact maple syrup exports, particularly in Canada. These agreements facilitate market access and contribute to the growth of the maple industry. Canadian maple syrup associations commend such trade agreements for promoting exports, providing economic benefits, and enhancing the competitiveness of the maple syrup sector on a global scale. Canadian maple syrup exports experience a substantial boost through international trade agreements that facilitate Maple Syrup Market access and enhance the industry's global standing. Canadian Maple Syrup associations commend these trade agreements in press releases, acknowledging their significant contribution to economic growth. This driver highlights the interconnectedness of the maple syrup market with global trade dynamics, showcasing the industry's reliance on international collaborations for sustained success. The United States, a key player in the industry, channels significant investments into technological advancements that drive innovation in maple syrup production processes. Leading U.S. maple syrup producers, through press releases, announce the adoption of cutting-edge technologies to enhance efficiency and product quality. This technological leap emphasizes the industry's commitment to staying at the forefront of innovation and meeting evolving consumer demands.

Maple Syrup Market Restraint and Challenges

Supply and Production Constraints The limited geographical distribution of sugar maples confines large-scale production to specific zones in North America and Europe. Seasonality and weather dependence, with sap flow restricted to a few spring months, introduce unpredictability. Labor-intensive tapping methods contribute to production costs and scalability limitations. Market and Consumer Factors Price fluctuations, arising from seasonality and yield unpredictability, may dissuade cost-conscious consumers. Competition from synthetic sweeteners poses a challenge, despite maple syrup's natural appeal. Limited awareness and usage in some regions constrain Maple Syrup Market potential. Regulation and Environmental Concerns Balancing high demand with sustainable tapping practices is crucial for long-term maple resource availability. Strict quality control measures and adherence to food safety regulations add complexity. Environmental impact from transportation and packaging raises sustainability challenges in Maple Syrup Market. Strategies to Overcome Restraints Investing in R&D for efficient tapping methods and alternative sources addresses supply limitations. Promoting diverse culinary applications expands Maple Syrup Market's reach, while emphasizing sustainability and ethical sourcing appeals to environmentally conscious consumers. Building brand loyalty through unique qualities and storytelling differentiates producers.Maple Syrup Market Regional Analysis

North America held the largest Maple syrup Market share in 2023, In Canada's Quebec and Ontario provinces, where temperatures and vast maple forests align perfectly, sugar maples thrive, contributing to the majority of the world's maple syrup production. Drawing from centuries-old wisdom of Indigenous communities like the Anishinaabeg, sustainable tapping practices lay the foundation for today's methods. With a robust infrastructure, including processing facilities, storage warehouses, and distribution networks, the efficient production of high-quality syrup has become a reality. North America's maple syrup dominance is more than just headlines; it's a blend of favorable climate, strong traditions, constant innovation, and recent developments, solidifying its position as the undeniable maple syrup king. With Canada and the United States leading the way, the numbers tell a sweet story North America contributes to over 80% of the global maple syrup production, truly making it the syrup heartland. Enter iconic brands like Canada's Quebec Maple Syrup Producers' Federation and Vermont Maple Syrup, which have cultivated trust and loyalty among consumers, associating North American Maple Syrup Market with authenticity and superior quality. This liquid gold isn't just a condiment; it's deeply ingrained in North American heritage, featured prominently in traditional cuisines and cultural celebrations, creating emotional connections and driving demand. Strategic marketing campaigns highlight the unique flavors and culinary versatility of North American maple syrup, appealing to diverse consumer preferences. Sustainable practices, such as controlled tapping and biodiversity preservation, ensure the long-term availability of maple resources while technological advancements, like automation in tapping systems, enhance efficiency and reduce labor costs. Experiments with infused syrups, maple-based spirits, and culinary applications beyond breakfast further diversify the Maple Syrup Market. Recent developments showcase the industry's resilience, with Quebec refilling its Strategic Reserve in 2023 to ensure supply stability during potential fluctuations. Increased collaborations with Indigenous communities underscore a commitment to ethical and sustainable harvesting practices. Investments in research on maple tree health and sap production, particularly under changing climate conditions, aim to secure the future of this sweet industry. Europe is developing a growing appetite for golden nectar, with heightened demand for premium maple syrup observed, in Germany, France, and the UK. European companies are diversifying the Maple Syrup Market by exploring innovative maple-infused products like ice cream, baked goods, and alcoholic beverages. The focus on authenticity and traceability is evident, with European consumers valuing transparency, leading producers to offer maple syrup with clear traceability and sought-after certifications like Protected Geographical Indication (PGI). Recent developments include the introduction of an organic maple syrup brand by French food giant Danone and the EU granting PGI status to German maple syrup from the Black Forest region. In the UK, Waitrose has entered a partnership with a Canadian maple syrup producer to ensure a sustainable and consistent supply of high-quality syrup. While North America continues to dominate the market, with Canada controlling 80% of the $1.4 billion industry, Europe's market is expanding rapidly, projected to reach $0.5 billion by 2027, growing at a notable CAGR of 6.5%. The future beckons with both regions focusing on sustainability, traceability, and diversification, ensuring a sweet global maple syrup market ahead.

Maple Syrup Market Segment Analysis

By Type, in the Maple syrup market type segment is categorised into Black Maple and Sugar Maple. Among these segments sugar maple held the largest market share with 67.34% in 2023 due to the Sugar Maple offers a sweet spot for flavor, delivering the classic, sought-after maple taste with a delicate balance of sweetness and complexity. Its sap is a sugar powerhouse, boasting the highest sugar content at around 8%, resulting in higher yields and a more cost-effective production process. The Sugar Maple's production prowess extends to a wider range of climates compared to Red or Black Maple, making it accessible for cultivation in more regions. its versatility reigns supreme, as Sugar Maple syrup seamlessly integrates into various applications, from breakfast staples to diverse culinary creations. In contrast, while Red and Black Maple contribute unique flavor profiles and cater to niche markets, their lower sugar content, limited growth range, and less versatile taste profile position them behind the indisputable Sugar Maple. In essence, Sugar Maple's winning combination of deliciousness, efficiency, and adaptability solidifies its throne as the undisputed king of the maple syrup market. By Application, The Food and Beverages category stands as the undisputed leader in the maple syrup market, commanding a substantial 55.23% market share, showcasing its pervasive influence. This dominance is grounded in the cherished tradition of enjoying maple syrup on breakfast classics like pancakes, waffles, and French toast, a cultural mainstay in North America and Europe. The versatility of maple syrup takes center stage as it transcends traditional breakfast fare, making its way into various food and beverage applications across diverse regions, from drizzling on oatmeal and yogurt to enhancing the flavors of smoothies and cocktails. Culinary trends highlight the expanding use of maple syrup in savory dishes like roasted vegetables and meat glazes, elevating its presence beyond conventional breakfast applications. While segments like Bakery and Confectionary hold promise with a 15% market share, Flavor Enhancer and Dairy face fiercer competition at approximately 5% each. Key industry keywords such as organic maple syrup, Grade A syrup, sustainability, and innovation play pivotal roles in shaping consumer preferences and driving growth. Understanding these dominating segments and key trends empowers market players to devise effective strategies, align with evolving consumer demands, and unlock growth opportunities in this dynamic and vibrant industry. In essence, the crown of maple syrup market dominance resides firmly on the plate of Food and Beverages, propelled by classic breakfast usage, cross-regional adaptability, and culinary ingenuity. While other segments show potential, the current maple syrup reign continues to revolve around the breakfast table.End-User, In the Maple Syrup Market End-User segment is categorized into Retail Stores, Supermarkets/Hypermarkets, Convenience Stores, and Others. Among these segments, Retail held the largest revenue share in the market securing a substantial 50% market share in 2023, predominantly fueled by its extensive accessibility and consumer appeal. These stores, prevalent across North America, notably in the United States and Canada, offer widespread access to maple syrup, positioning it as a pantry essential. The segment's dominance stems from consumers' preference for the convenience of obtaining maple syrup during routine shopping trips, influencing not only Retail Stores but also Supermarkets/Hypermarkets and Convenience Stores. This dominance extends seamlessly across regions, aligning with the cultural significance of maple syrup in North American cuisine. While Supermarkets/Hypermarkets and Convenience Stores play vital roles, the Retail Stores segment leads with its broad accessibility, catering to diverse purchasing habits and resonating with regional preferences. Maple Syrup Market contains differents ranges of organic maple syrup, Grade A syrup, sustainability, and innovation are pivotal, in shaping consumer choices and steering industry growth.

Maple Syrup Market Scope: Inquire before buying

Global Maple Syrup Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 634.2 Mn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 976.6 Mn. Segments Covered: by Type Black Maple Sugar Maple Red Maple by Application Food and Beverages Bakery and Confectionary Flavor Enhancer Dairy by End User Retail Stores Supermarkets/Hypermarkets Convenience Store Others Maple Syrup Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Maple Syrup Key players

North America 1. B&G Foods. (United States) 2. Federation of Quebec Maple Syrup Producer (Canada) 3. J.M. Smucker Company: (United States) 4. Ontario Maple Syrup Producers Association (Canada) 5. New Hampshire Maple Producers Association, Inc (United States) 6. New York State Maple Producers Association (United States) 7. Pennsylvania Maple Association (United States) 8. Michigan Maple Syrup Association (United States) 9. Thompson's Maple Products (United States) 10. Bascom Family Farms (United States) 11. H.J. Heinz Company (United States) 12. Vermont Maple Sugar Makers (United States) 13. La Ferme du Mont-Crosin (Canada) 14. La Sucrerie du Lac – (Canada ) 15. Jeju Island Maple – (South Korea) Europe 1. Verival AG (Switzerland) 2. Acertys Group (France) 3. Probst GmbH & Co. KG (Germany) 4. Albert M. Spieth GmbH & Co. (Germany) 5. Trentino-Alto Adige (Italy) Asia-Pacific 1. Meguro Seika Co., Ltd. ( Japan ) 2. Maple Acres (Japan ) 3. Maple Craft (South Korea) 4. MapleStory (South Korea) Frequently Asked Questions: 1] What is the growth rate of the Global Maple Syrup Market? Ans. The Global Maple Syrup Market is growing at a significant rate of 5.6 % during the forecast period. 2] Which region is expected to dominate the Global Maple Syrup Market? Ans. APAC is expected to dominate the Maple Syrup Market during the forecast period. 3] What is the expected Global Maple Syrup Market size by 2030? Ans. The Maple Syrup Market size is expected to reach USD 976.6 Mn by 2030. 4] Which are the top players in the Global Maple Syrup Market? Ans. The major top players in the Global Maple Syrup Market are Epiroc, Atlas Copco, Komatsu and others. 5] What are the factors driving the Global Maple Syrup Market growth? Ans. The growth of huge construction activities and mining projects is expected to drive the Maple Syrup Market growth. 6] Which country held the largest Global Maple Syrup Market share in 2023? Ans. The United States held the largest Maple Syrup Market share in 2023.

1. Maple Syrup Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Maple Syrup Market: Dynamics 2.1. Maple Syrup Market Trends by Region 2.1.1. North America Maple Syrup Market Trends 2.1.2. Europe Maple Syrup Market Trends 2.1.3. Asia Pacific Maple Syrup Market Trends 2.1.4. Middle East and Africa Maple Syrup Market Trends 2.1.5. South America Maple Syrup Market Trends 2.2. Maple Syrup Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Maple Syrup Market Drivers 2.2.1.2. North America Maple Syrup Market Restraints 2.2.1.3. North America Maple Syrup Market Opportunities 2.2.1.4. North America Maple Syrup Market Challenges 2.2.2. Europe 2.2.2.1. Europe Maple Syrup Market Drivers 2.2.2.2. Europe Maple Syrup Market Restraints 2.2.2.3. Europe Maple Syrup Market Opportunities 2.2.2.4. Europe Maple Syrup Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Maple Syrup Market Drivers 2.2.3.2. Asia Pacific Maple Syrup Market Restraints 2.2.3.3. Asia Pacific Maple Syrup Market Opportunities 2.2.3.4. Asia Pacific Maple Syrup Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Maple Syrup Market Drivers 2.2.4.2. Middle East and Africa Maple Syrup Market Restraints 2.2.4.3. Middle East and Africa Maple Syrup Market Opportunities 2.2.4.4. Middle East and Africa Maple Syrup Market Challenges 2.2.5. South America 2.2.5.1. South America Maple Syrup Market Drivers 2.2.5.2. South America Maple Syrup Market Restraints 2.2.5.3. South America Maple Syrup Market Opportunities 2.2.5.4. South America Maple Syrup Market Challenges 2.3. PORTER’s Five Products Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Maple Syrup Industry 2.7. Analysis of Government Schemes and Initiatives For the Maple Syrup Industry 2.8. The Global Pandemic Impact on the Maple Syrup Market 3. Maple Syrup Market: Global Market Size and Forecast (by Value) (2023-2030) 3.1. Maple Syrup Market Size and Forecast, by type (2023-2030) 3.1.1. Black Maple 3.1.2. Sugar Maple 3.1.3. Red Maple 3.2. Maple Syrup Market Size and Forecast, by Application (2023-2030) 3.2.1. Food and Beverages 3.2.2. Bakery and Confectionary 3.2.3. Flavor Enhancer 3.2.4. Dairy 3.3. Maple Syrup Market Size and Forecast, by End-User (2023-2030) 3.3.1. Retail Stores 3.3.2. Supermarkets/Hypermarkets 3.3.3. Convenience Store 3.3.4. Others 3.4. Maple Syrup Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Maple Syrup Market Size and Forecast (by Value in USD Million) (2023-2030) 4.1. North America Maple Syrup Market Size and Forecast, by Type (2023-2030) 4.1.1. Black Maple 4.1.2. Sugar Maple 4.1.3. Red Maple 4.2. North America Maple Syrup Market Size and Forecast, by Application (2023-2030) 4.2.1. Food and Beverages 4.2.2. Bakery and Confectionary 4.2.3. Flavor Enhancer 4.2.4. Dairy 4.3. North America Maple Syrup Market Size and Forecast, by End-User (2023-2030) 4.3.1. Retail Stores 4.3.2. Supermarkets/Hypermarkets 4.3.3. Convenience Store 4.3.4. Others 4.4. North America Maple Syrup Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Maple Syrup Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Black Maple 4.4.1.1.2. Sugar Maple 4.4.1.1.3. Red Maple 4.4.1.2. United States Maple Syrup Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Food and Beverages 4.4.1.2.2. Bakery and Confectionary 4.4.1.2.3. Flavor Enhancer 4.4.1.2.4. Dairy 4.4.1.3. United States Maple Syrup Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Retail Stores 4.4.1.3.2. Supermarkets/Hypermarkets 4.4.1.3.3. Convenience Store 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Maple Syrup Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Black Maple 4.4.2.1.2. Sugar Maple 4.4.2.1.3. Red Maple 4.4.2.2. Canada Maple Syrup Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Food and Beverages 4.4.2.2.2. Bakery and Confectionary 4.4.2.2.3. Flavor Enhancer 4.4.2.2.4. Dairy 4.4.2.3. Canada Maple Syrup Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Retail Stores 4.4.2.3.2. Supermarkets/Hypermarkets 4.4.2.3.3. Convenience Store 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Maple Syrup Market Size and Forecast, by type (2023-2030) 4.4.3.1.1. Black Maple 4.4.3.1.2. Sugar Maple 4.4.3.1.3. Red Maple 4.4.3.2. Mexico Maple Syrup Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Food and Beverages 4.4.3.2.2. Bakery and Confectionary 4.4.3.2.3. Flavor Enhancer 4.4.3.2.4. Dairy 4.4.3.3. Mexico Maple Syrup Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Retail Stores 4.4.3.3.2. Supermarkets/Hypermarkets 4.4.3.3.3. Convenience Store 4.4.3.3.4. Others 5. Europe Maple Syrup Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. Europe Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.2. Europe Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.3. Europe Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Maple Syrup Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Maple Syrup Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Maple Syrup Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Maple Syrup Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Maple Syrup Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Maple Syrup Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Maple Syrup Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Maple Syrup Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Maple Syrup Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Maple Syrup Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Maple Syrup Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Maple Syrup Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Maple Syrup Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Maple Syrup Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Maple Syrup Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Maple Syrup Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Maple Syrup Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Maple Syrup Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Maple Syrup Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Maple Syrup Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Maple Syrup Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Maple Syrup Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Maple Syrup Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Maple Syrup Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Maple Syrup Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Maple Syrup Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Maple Syrup Market Size and Forecast, by End-User (2023-2030) 8. South America Maple Syrup Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. South America Maple Syrup Market Size and Forecast, by Type (2023-2030) 8.2. South America Maple Syrup Market Size and Forecast, by Application (2023-2030) 8.3. South America Maple Syrup Market Size and Forecast, by End-User (2023-2030) 8.4. South America Maple Syrup Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Maple Syrup Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Maple Syrup Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Maple Syrup Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Maple Syrup Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Maple Syrup Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Maple Syrup Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Maple Syrup Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Maple Syrup Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Maple Syrup Market Size and Forecast, by End-User (2023-2030) 9. Global Maple Syrup Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Maple Syrup Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. B&G Foods: (United States). 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. Federation of Quebec Maple Syrup Producer: (Canada) 10.3. J.M. Smucker Company: (United States) 10.4. Ontario Maple Syrup Producers Association: (Canada) 10.5. New Hampshire Maple Producers Association, Inc.: (United States) 10.6. New York State Maple Producers Association: (United States) 10.7. Pennsylvania Maple Association: (United States) 10.8. Michigan Maple Syrup Association: (United States) 10.9. Thompson's Maple Products: (United States) 10.10. Bascom Family Farms: (United States) 10.11. H.J. Heinz Company: (United States) 10.12. Vermont Maple Sugar Makers: (United States) 10.13. La Sucrerie du Lac – (Canada ) 10.14. Jeju Island Maple – (South Korea) 10.15. Verival AG (Switzerland) 10.16. Acertys Group (France) 10.17. Probst GmbH & Co. KG (Germany) 10.18. Albert M. Spieth GmbH & Co. (Germany) 10.19. Trentino-Alto Adige (Italy) 10.20. Meguro Seika Co., Ltd. (Japan ) 10.21. Maple Acres (Japan ) 10.22. Maple Craft (South Korea) 10.23. MapleStory (South Korea) 11. Key Findings 12. Industry Recommendations 13. Maple Syrup Market: Research Methodology 14. Terms and Glossary