Global Oolong Tea Market size was valued at USD 440 Thousand in 2022 and is expected to reach USD 570 Thousand by 2029, at a CAGR of 3.6%.Oolong Tea Market Overview

Oolong tea, an embodiment of ancient Chinese tea culture, holds a distinct position straddling the realms of green and black tea. Its allure lies not only in its nuanced flavor but also in the potential health benefits attributed to its processing nuances. This exquisite tea emerges from the leaves of the Camellia sinensis plant, a lineage shared with both green and black teas. Oolong’s magic lies in its intricate processing of partial oxidation a critical phase that defines its taste spectrum. Ranging from a mere 8% to a significant 80% oxidation, the transformation orchestrated by tea artisans orchestrates a delicate balance within the diverse spectrum of the Oolong Tea Market. It strikes a balance between the crispness of green tea and the robustness akin to black tea. The result is a tapestry of flavors and aromas, from floral and herbaceous notes to the depth of woody undertones, offering a sensory journey with every sip. The origins of Oolong tea shrouded in folklore and historical intrigue, add to its mystique within the vibrant Oolong Tea Market. Legends suggest its name, wulong or black dragon, stemmed from its leaves' resemblance to the mythical Chinese dragon. Other tales attribute its discovery to a serendipitous mishap by a distracted tea farmer, enriching the narrative surrounding this beloved tea variety. Chinese oolongs, nurtured in the rugged, elevated terrains, bear the hallmark of their environment a bold, robust flavor. In contrast, Taiwanese variations, with lower oxidation levels, showcase a lighter, more verdant demeanor. The allure of oolong transcends borders; it finds expression in diverse terroirs worldwide. From India’s distinctive offerings to Japan's nuanced brews and New Zealand’s innovative twists, each locale infuses its oolong with unique environmental characteristics and artisanal techniques. The craftsmanship behind oolong production involves a symphony of factors tea plant varieties, terroir influences, and the meticulous post-picking artistry culminating in a beverage that not only captures the essence of its origin but also presents a myriad of flavors and textures, each a testament to the intricate dance of nature and human ingenuity. As Oolong tea continues its enchantment, captivating tea aficionados globally, its adaptability, distinct flavors, and brewing finesse stand as a tribute to the artistry and innovation thriving within the dynamic Oolong Tea Market.To know about the Research Methodology :- Request Free Sample Report

Oolong Tea Market Trend

Premiumization and Elevation of the Tea-Drinking Experience People crave top-notch goods and exclusive experiences, valuing authenticity, craft, and diverse tastes. Seeking both quality and novelty, they're drawn to unique flavors. With health a top concern, beverages now deliver taste and wellness. This shift celebrates genuine, skillfully made products that tantalize taste buds and offer potential health boosts. It's about savoring authenticity, craftsmanship, and flavor while embracing healthier choices like Oolong tea. Oolong tea, known for its potential health properties, becomes an attractive choice, especially when marketed as a premium, high-quality product. There's a resurgence of interest in traditional practices and rituals, including tea ceremonies. This cultural trend emphasizes the art of tea brewing and the appreciation of teas with unique characteristics, encouraging the premiumization of tea experiences. Amidst a competitive Oolong Tea Market, tea producers and retailers seek ways to stand out. Offering premium, rare, or single-origin Oolong teas allows companies to differentiate themselves, appealing to a niche market of discerning consumers willing to pay a premium for quality. In some regions, increasing affluence and disposable income enable consumers to allocate more spending toward premium and higher-priced items, including luxury food and beverages like specialty Oolong teas. With globalization and the accessibility of information, consumers are more knowledgeable about different tea varieties, their origins, and their unique characteristics. This knowledge encourages exploration and demand for exclusive and high-quality teas. Social media platforms and influencer culture play a role in promoting premium products and experiences. Influencers often highlight specialty teas, fostering curiosity and interest among their followers and this helps to boost the Oolong Tea industry.Oolong Tea Market Dynamics

Health and Wellness Trend to Boost Market Growth The ascent of Oolong Tea within the market stems from its health-promoting properties, turning it into a potent elixir sought after by health-conscious consumers worldwide. As a semi-oxidized tea, Oolong Tea harbors a spectrum of antioxidants akin to those found in green and black teas, shielding cells from aging, lifestyle, and environmental-induced damage. Its fortified appeal lies in the multifaceted health benefits attributed to these antioxidants and other nutrients, positioning it as a functional beverage. The infusion of polyphenols in Oolong Tea showcases promising potential in mitigating various health concerns, igniting interest and driving Oolong Tea Market expansion. These antioxidants exhibit robust effects, spanning from supporting diabetes management by regulating blood sugar levels and insulin resistance to fostering heart health by aiding in triglyceride breakdown and cholesterol reduction. Oolong Tea’s role in weight management, stimulating fat burning and boosting metabolism positions it as an ally in the quest for healthy living. The tea's richness in L-theanine, an amino acid, amplifies its appeal by presenting cognitive support, enhancing brain activity, reducing stress, and potentially safeguarding against neurodegenerative diseases. Additionally, the nutrient profile of Oolong Tea, boasting essential vitamins, minerals, and fluoride content comparable to dental recommendations, adds to its allure, depicting it as a holistic health-enhancing brew. The Oolong Tea market surge propelled by Oolong Tea's health halo transcends mere nutritional composition, extending into the realm of research-backed benefits. Studies exploring the correlation between Oolong Tea consumption and various health aspects affirm its market-driving potential. Its influence in mitigating heart disease risk, showcased in research observing lowered cholesterol levels among regular Oolong Tea consumers, establishes it as a heart-healthy choice. The tea's impact on weight management further solidifies its market ascendancy, with studies showcasing its efficacy in curbing abdominal fat gain and aiding weight loss, stimulating interest among health-conscious consumers seeking holistic approaches to wellness. Oolong Tea's potential role in cancer prevention, particularly in reducing the risk of head, neck, or ovarian cancers according to select studies, adds a layer of intrigue to its health profile, propelling its market surge. Oolong Tea's Varied Flavors Drive Artisanal Tea Market Growth The surge in the artisanal tea market owes much of its momentum to the diverse and intricate flavors offered by Oolong tea. This enigmatic beverage, nestled between green and black teas, is celebrated for its nuanced taste profile, captivating aroma, and the complex craftsmanship involved in its production. The multifaceted flavors of Oolong tea not only tantalize the taste buds but also serve as a cornerstone for the exponential growth of this Oolong Tea Market segment. Oolong tea, with its roots entrenched in Chinese tradition, undergoes a semi-oxidation process, setting it apart from the unoxidized green teas and the fully oxidized black teas. This unique production method allows for a spectrum of flavors, ranging from floral and fruity to woody and roasted, depending on factors like oxidation levels, terroir, and processing techniques. The diversity in taste is akin to the richness found in fine wines, appealing to connoisseurs seeking distinct and complex sensory experiences. The terroir, encompassing the soil, climate, and altitude, significantly influences Oolong tea's flavor profile. For instance, teas grown in the high-altitude regions of Taiwan yield a different taste compared to those from the Fujian province of China. The high elevation cultivates a slower growth rate for tea plants, resulting in leaves with concentrated flavors, often noted for their floral and creamy notes. The meticulous crafting methods employed by skilled artisans contribute to the allure of Oolong tea. The art of withering, oxidation, shaping, and firing the leaves demands expertise and precision, ensuring the development of specific flavors and aromas. Whether it's the tightly rolled ball-like appearance of Tieguanyin or the long, twisted leaves of Da Hong Pao, each Oolong tea variety offers a distinctive taste adventure. The spectrum of Oolong flavors provides versatility in consumption, provides a wide array of preferences. Lighter, greener Oolongs with minimal oxidation exude floral and grassy notes, appealing to those fond of delicate teas. On the other end, heavily oxidized Oolongs present deeper, roasted flavors reminiscent of nuts and caramel, attracting enthusiasts seeking a more robust tea experience. This versatility fosters a broad consumer base, accommodating both traditionalists and those exploring innovative taste profiles which boost Oolong Tea Market growth. Limited availability of certain high-quality or rare varieties to Hamper Oolong Tea Market Growth Limited availability often leads to scarcity of specific high-quality or rare Oolong teas. This scarcity drives up prices, making these teas inaccessible to a larger consumer base, impacting affordability. Consumer interest in unique and premium Oolong teas surpasses the supply. When certain varieties are in high demand but have limited production capacity due to factors including specific growing conditions or traditional cultivation methods, meeting this demand becomes a challenge and this impede the Oolong Tea Market growth. As the demand for high-quality Oolong teas grows, competition among buyers intensifies. This creates situations where certain buyers, such as tea shops or distributors, struggle to secure enough stock of these specialized teas, impacting their offerings to consumers. Factors such as weather changes, natural disasters, or geopolitical issues in tea-producing regions disrupt the supply chain. This inconsistency affects the availability of these rare teas, making it stimulating for retailers or sellers to maintain a consistent inventory. The limited availability of these premium teas hinders market growth potential. If consumers' desires for these specialized teas remain unmet due to scarcity, it restricts the overall expansion and evolution of the Oolong Tea market.Oolong Tea Market Segment Analysis

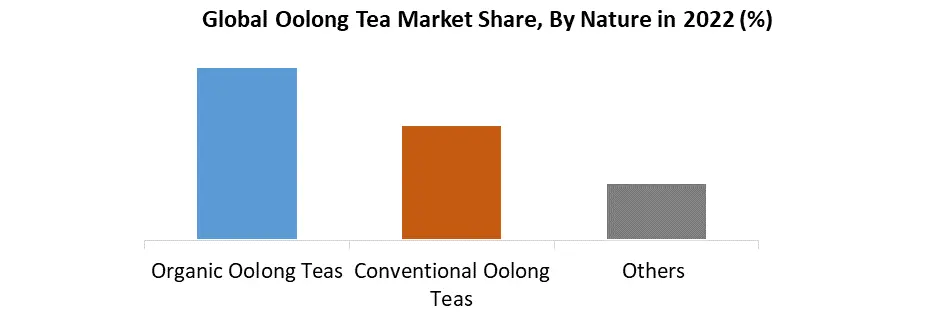

Based on Product Type, the market is segmented into Moderately Oxidized Oolongs, Lightly Oxidized Oolongs, Heavily Oxidized Oolongs and Partially Oxidized or Bai Hao Oolong. Moderately Oxidized Oolongs dominated the Oolong Tea Market in 2022. Moderately oxidized Oolongs, such as Tie Guan Yin, offer a balanced and versatile flavor spectrum. They present floral, fruity, and roasted notes, appealing to a wide range of consumer tastes within a single category. This category caters to both seasoned tea enthusiasts and newcomers to Oolong teas. Its diverse flavor profile attracts consumers seeking a variety of taste experiences without leaning too heavily toward intensely roasted or lightly floral teas. Certain varieties within this category, like Tie Guan Yin, hold cultural significance and popularity, particularly in Chinese tea culture. Their historical background and traditional production methods contribute to their prominence. Moderately oxidized Oolongs often strike a balance between traditional and contemporary preferences. Their popularity among tea enthusiasts and their market demand contribute to their dominance within the broader Oolong tea market. These teas have gained recognition and popularity not just within their regions of origin but also in the global market. They're often readily available and marketed due to their widespread appeal. Moderately oxidized Oolongs offer a processing range that allows for a variety of craftsmanship techniques. This adaptability in processing methods allows for innovation and experimentation, keeping the market vibrant and engaging.Based on Nature, the market is segmented into Organic Oolong Teas, Conventional Oolong Teas and Others. Organic Oolong Teas is expected to dominate the Oolong Tea Market during the forecast period. Increasing consumer awareness and a growing emphasis on health and wellness have led to a surge in demand for organic products. Organic Oolong Teas, cultivated without synthetic pesticides, herbicides, or fertilizers, align with these health-conscious preferences. Consumers are increasingly concerned about environmental sustainability and the impact of agricultural practices on the planet. Organic farming methods prioritize biodiversity, soil health, and conservation, resonating with consumers seeking eco-friendly choices. Organic certification ensures adherence to strict cultivation standards, guaranteeing a purer product free from synthetic additives. This assurance of quality appeals to discerning consumers seeking clean, untainted teas. Organic certifications provide transparency in the tea's sourcing and production methods, fostering consumer trust. This transparency in the supply chain resonates with those seeking more information about the origins and practices behind their teas which furl the Oolong Tea Market growth. Organic Oolong Teas often occupy a premium market segment due to their perceived higher quality and ethical cultivation methods. This positioning attracts consumers willing to pay a premium for perceived health benefits and superior taste profiles. As consumers become more mindful of what they consume, there's a shift towards organic products across various segments, including beverages such as tea. This change in preference contributes to the rising dominance of Organic Oolong Teas.

Oolong Tea Market Regional Insights

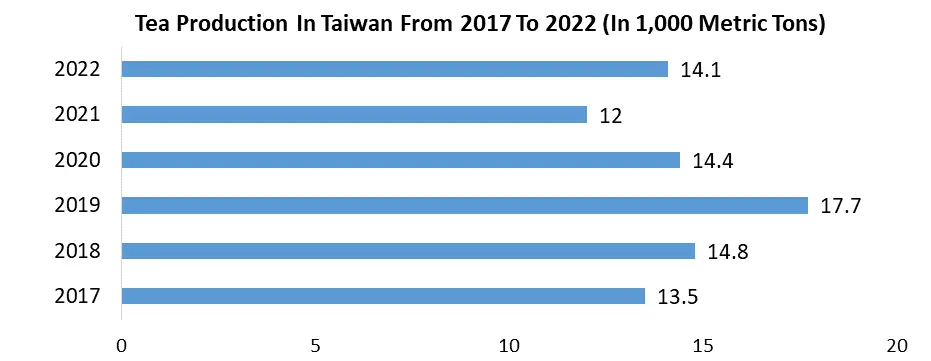

Asia Pacific dominated the largest Oolong Tea Market share in 2022 and is expected to continue its dominance over the forecast period. Nestled within the Asia Pacific, Taiwan's mountainous landscapes and China's diverse terrains create a perfect symphony for cultivating Oolong tea. Each region boasts unique microclimates and elevations, offering an ideal canvas for crafting a myriad of Oolong varieties with distinct flavors and aromas. The artistry and centuries-old expertise in tea cultivation and processing in these regions are unparalleled. From meticulous hand-picking of tea leaves to precise oxidization and roasting techniques, the craftsmanship behind each cup of Oolong tea is a testament to generations of dedication and skill. Oolong tea production runs deep in the cultural essence of these regions. It's not merely about the tea; it's a cherished heritage, a lifestyle intertwined with tradition and legacy. The tea ceremonies, traditions, and reverence for the craft add an enchanting allure to the Oolong tea experience. The Asia Pacific's Oolong tea spectrum is a treasure trove of flavors. From the floral notes of Alishan Oolong to the complex, nuanced taste of Tie Guan Yin, each sip tells a story of the region's rich tea culture, inviting enthusiasts to explore a world of diverse tastes. These teas have earned global recognition for their quality, commanding admiration and high prices in international markets. Connoisseurs and tea aficionados worldwide seek out these premium Oolong teas for their unparalleled excellence. While rooted in tradition, the Asia Pacific region continually innovates, blending traditional methods with modern techniques. This blend of innovation and heritage keeps the Oolong tea industry vibrant and relevant in today's ever-evolving Oolong Tea Market. Taiwan boasts renowned tea production, notably excelling in Oolong tea. Its picturesque landscapes and high-altitude regions, like Ali Shan, nurture exceptional Oolongs. Taiwan's tea industry thrives on meticulous craftsmanship, elevating Oolong teas to global acclaim for their floral aromas, creamy textures, and exquisite flavors.

Oolong Tea Market Competitive Landscape

In the Oolong Tea market, a multitude of players exists across global, regional, and local tiers. This landscape assesses key companies, their sizes, strengths, weaknesses, barriers, and threats. It scrutinizes competitive rivals' influence, potential market entrants, customer dynamics, supplier relationships, and the impact of substitute products. Understanding these facets is pivotal for gauging profitability in the Oolong Tea industry. Some of the key players are Bigelow Tea, R. Twining and Company Limited, Teas and Thes (China) Ltd, Ceylon Organic Spices, Arbor Teas, The Republic of Tea, Dilmah Ceylon Tea Company PLC, Harney & Sons Fine Teas, Mighty Leaf Tea, Tata Consumer Products, ITO EN INC and others. Numerous companies have engaged in research and development endeavors to expand their product portfolios and provide for the growing demands within the Oolong Tea Market. Bigelow Tea expanded its oolong tea offerings in 2022. It offers a total of 16 different oolong teas, including new varieties such as Peach Blossom Oolong and Honey Ginger Oolong. In addition, the company has also been working to improve its sustainability practices by using recycled materials in its packaging and reducing its carbon footprint. • Bigelow Tea launched several new oolong teas in 2022, including Peach Blossom Oolong, Honey Ginger Oolong, and Classic Oolong. These new teas were designed to appeal to a wider range of consumers and to meet the demand for flavor-infused oolong teas.Oolong Tea Market Scope: Inquiry Before Buying

Oolong Tea Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 440 Thousand. Forecast Period 2023 to 2029 CAGR: 3.6% Market Size in 2029: US $ 570 Thousand. Segments Covered: by Product Type Moderately Oxidized Oolongs Lightly Oxidized Oolongs Heavily Oxidized Oolongs Partially Oxidized or Bai Hao Oolong by Form Loose-Leaf Oolong Tea Oolong Tea Bags Oolong Tea Powders Oolong Tea Extracts or Concentrates Others by Nature Organic Oolong Teas Conventional Oolong Teas Others by Distribution Channel Retail Stores Online Retail Others Oolong Tea Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Oolong Tea Key Players

1. Bigelow Tea 2. R. Twining and Company Limited 3. Teas and Thes Ltd 4. Ceylon Organic Spices 5. Arbor Teas 6. The Republic of Tea 7. Dilmah Ceylon Tea Company PLC 8. Harney & Sons Fine Teas 9. Mighty Leaf Tea 10. Tata Consumer Products 11. ITO EN (North America) INC 12. COFCO 13. The HPS Tea Company 14. International Coffee & Tea, LLC 15. Harada Seicha 16. generation tea 17. Choice Organics 18. Starbucks Corporation 19. TETLEYFrequently Asked Questions:

1] What is the growth rate of the Global Oolong Tea Market? Ans. The Global Oolong Tea Market is growing at a significant rate of 3.7% during the forecast period. 2] Which region is expected to dominate the Global Oolong Tea Market? Ans. Asia Pacific is expected to dominate the Oolong Tea Market during the forecast period. 3] What is the expected Global Oolong Tea Market size by 2029? Ans. The Oolong Tea Market size is expected to reach USD 570 Thousand by 2029. 4] Which are the top players in the Global Oolong Tea Market? Ans. The major top players in the Global Oolong Tea Market are Bigelow Tea, R. Twining and Company Limited, Teas and Thes Ltd, Ceylon Organic Spices, Arbor Teas, The Republic of Tea, Dilmah Ceylon Tea Company PLC, Harney & Sons Fine Teas, Mighty Leaf Tea, Tata Consumer Products, ITO EN INC and others. 5] What are the factors driving the Global Oolong Tea Market growth? Ans. Oolong tea's varied flavors and health and wellness trends of the Oolong tea are expected to drive market growth during the forecast period.

1. Oolong Tea Market: Research Methodology 2. Oolong Tea Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Oolong Tea Market: Dynamics 3.1 Oolong Tea Market Trends by Region 3.1.1 North America Oolong Tea Market Trends 3.1.2 Europe Oolong Tea Market Trends 3.1.3 Asia Pacific Oolong Tea Market Trends 3.1.4 Middle East and Africa Oolong Tea Market Trends 3.1.5 South America Oolong Tea Market Trends 3.2 Oolong Tea Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Oolong Tea Market Drivers 3.2.1.2 North America Oolong Tea Market Restraints 3.2.1.3 North America Oolong Tea Market Opportunities 3.2.1.4 North America Oolong Tea Market Challenges 3.2.2 Europe 3.2.2.1 Europe Oolong Tea Market Drivers 3.2.2.2 Europe Oolong Tea Market Restraints 3.2.2.3 Europe Oolong Tea Market Opportunities 3.2.2.4 Europe Oolong Tea Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Oolong Tea Market Drivers 3.2.3.2 Asia Pacific Oolong Tea Market Restraints 3.2.3.3 Asia Pacific Oolong Tea Market Opportunities 3.2.3.4 Asia Pacific Oolong Tea Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Oolong Tea Market Drivers 3.2.4.2 Middle East and Africa Oolong Tea Market Restraints 3.2.4.3 Middle East and Africa Oolong Tea Market Opportunities 3.2.4.4 Middle East and Africa Oolong Tea Market Challenges 3.2.5 South America 3.2.5.1 South America Oolong Tea Market Drivers 3.2.5.2 South America Oolong Tea Market Restraints 3.2.5.3 South America Oolong Tea Market Opportunities 3.2.5.4 South America Oolong Tea Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Oolong Tea Industry 3.7 The Global Pandemic and Redefining of The Oolong Tea Industry Landscape 3.8 Technological Road Map 4. Global Oolong Tea Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 4.1 Global Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 4.1.1 Moderately Oxidized Oolongs 4.1.2 Lightly Oxidized Oolongs 4.1.3 Heavily Oxidized Oolongs 4.1.4 Partially Oxidized or Bai Hao Oolong 4.2 Global Oolong Tea Market Size and Forecast, by Form (2022-2029) 4.2.1 Loose-Leaf Oolong Tea 4.2.2 Oolong Tea Bags 4.2.3 Oolong Tea Powders 4.2.4 Oolong Tea Extracts or Concentrates 4.2.5 Others 4.3 Global Oolong Tea Market Size and Forecast, by Nature (2022-2029) 4.3.1 Organic Oolong Teas 4.3.2 Conventional Oolong Teas 4.3.3 Others 4.4 Global Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1 Retail Stores 4.4.2 Online Retail 4.4.3 Others 4.5 Global Oolong Tea Market Size and Forecast, by Region (2022-2029) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Oolong Tea Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 5.1 North America Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 5.1.1 Moderately Oxidized Oolongs 5.1.2 Lightly Oxidized Oolongs 5.1.3 Heavily Oxidized Oolongs 5.1.4 Partially Oxidized or Bai Hao Oolong 5.2 North America Oolong Tea Market Size and Forecast, by Form (2022-2029) 5.2.1 Loose-Leaf Oolong Tea 5.2.2 Oolong Tea Bags 5.2.3 Oolong Tea Powders 5.2.4 Oolong Tea Extracts or Concentrates 5.2.5 Others 5.3 North America Oolong Tea Market Size and Forecast, by Nature (2022-2029) 5.3.1 Organic Oolong Teas 5.3.2 Conventional Oolong Teas 5.3.3 Others 5.4 North America Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1 Retail Stores 5.4.2 Online Retail 5.4.3 Others 5.5 North America Oolong Tea Market Size and Forecast, by Country (2022-2029) 5.5.1 United States 5.5.1.1 United States Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 5.5.1.1.1 Moderately Oxidized Oolongs 5.5.1.1.2 Lightly Oxidized Oolongs 5.5.1.1.3 Heavily Oxidized Oolongs 5.5.1.1.4 Partially Oxidized or Bai Hao Oolong 5.5.1.2 United States Oolong Tea Market Size and Forecast, by Form (2022-2029) 5.5.1.2.1 Loose-Leaf Oolong Tea 5.5.1.2.2 Oolong Tea Bags 5.5.1.2.3 Oolong Tea Powders 5.5.1.2.4 Oolong Tea Extracts or Concentrates 5.5.1.2.5 Others 5.5.1.3 United States Oolong Tea Market Size and Forecast, by Nature (2022-2029) 5.5.1.3.1 Organic Oolong Teas 5.5.1.3.2 Conventional Oolong Teas 5.5.1.3.3 Others 5.5.1.4 United States Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.1.4.1 Retail Stores 5.5.1.4.2 Online Retail 5.5.1.4.3 Others 5.5.2 Canada 5.5.2.1 Canada Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 5.5.2.1.1 Moderately Oxidized Oolongs 5.5.2.1.2 Lightly Oxidized Oolongs 5.5.2.1.3 Heavily Oxidized Oolongs 5.5.2.1.4 Partially Oxidized or Bai Hao Oolong 5.5.2.2 Canada Oolong Tea Market Size and Forecast, by Form (2022-2029) 5.5.2.2.1 Loose-Leaf Oolong Tea 5.5.2.2.2 Oolong Tea Bags 5.5.2.2.3 Oolong Tea Powders 5.5.2.2.4 Oolong Tea Extracts or Concentrates 5.5.2.2.5 Others 5.5.2.3 Canada Oolong Tea Market Size and Forecast, by Nature (2022-2029) 5.5.2.3.1 Organic Oolong Teas 5.5.2.3.2 Conventional Oolong Teas 5.5.2.3.3 Others 5.5.2.4 Canada Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2.4.1 Retail Stores 5.5.2.4.2 Online Retail 5.5.2.4.3 Others 5.5.3 Mexico 5.5.3.1 Mexico Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 5.5.3.1.1 Moderately Oxidized Oolongs 5.5.3.1.2 Lightly Oxidized Oolongs 5.5.3.1.3 Heavily Oxidized Oolongs 5.5.3.1.4 Partially Oxidized or Bai Hao Oolong 5.5.3.2 Mexico Oolong Tea Market Size and Forecast, by Form (2022-2029) 5.5.3.2.1 Loose-Leaf Oolong Tea 5.5.3.2.2 Oolong Tea Bags 5.5.3.2.3 Oolong Tea Powders 5.5.3.2.4 Oolong Tea Extracts or Concentrates 5.5.3.2.5 Others 5.5.3.3 Mexico Oolong Tea Market Size and Forecast, by Nature (2022-2029) 5.5.3.3.1 Organic Oolong Teas 5.5.3.3.2 Conventional Oolong Teas 5.5.3.3.3 Others 5.5.3.4 Mexico Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3.4.1 Retail Stores 5.5.3.4.2 Online Retail 5.5.3.4.3 Others 6. Europe Oolong Tea Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 6.1 Europe Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.2 Europe Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.3 Europe Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.4 Europe Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029 6.5 Europe Oolong Tea Market Size and Forecast, by Country (2022-2029) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.1.2 United Kingdom Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.1.3 United Kingdom Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.1.4 United Kingdom Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2 France 6.5.2.1 France Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.2.2 France Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.2.3 France Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.2.4 France Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3 Germany 6.5.3.1 Germany Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.3.2 Germany Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.3.3 Germany Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.3.4 Germany Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4 Italy 6.5.4.1 Italy Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.4.2 Italy Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.4.3 Italy Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.4.4 Italy Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5 Spain 6.5.5.1 Spain Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.5.2 Spain Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.5.3 Spain Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.5.4 Spain Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6 Sweden 6.5.6.1 Sweden Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.6.2 Sweden Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.6.3 Sweden Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.6.4 Sweden Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7 Austria 6.5.7.1 Austria Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.7.2 Austria Oolong Tea Market Size and Forecast, by Form (2022-2029) 6.5.7.3 Austria Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.7.4 Austria Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 6.5.8.2 Rest of Europe Oolong Tea Market Size and Forecast, by Form (2022-2029). 6.5.8.3 Rest of Europe Oolong Tea Market Size and Forecast, by Nature (2022-2029) 6.5.8.4 Rest of Europe Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7. Asia Pacific Oolong Tea Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 7.1 Asia Pacific Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.2 Asia Pacific Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.3 Asia Pacific Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.4 Asia Pacific Oolong Tea Market Size and Forecast, by Distribution Channel (2022- 7.5 Asia Pacific Oolong Tea Market Size and Forecast, by Country (2022-2029) 7.5.1 China 7.5.1.1 China Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.1.2 China Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.1.3 China Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.1.4 China Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2 South Korea 7.5.2.1 S Korea Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.2.2 S Korea Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.2.3 S Korea Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.2.4 S Korea Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3 Japan 7.5.3.1 Japan Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.3.2 Japan Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.3.3 Japan Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.3.4 Japan Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4 India 7.5.4.1 India Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.4.2 India Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.4.3 India Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.4.4 India Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.5 Australia 7.5.5.1 Australia Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.5.2 Australia Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.5.3 Australia Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.5.4 Australia Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.6 Indonesia 7.5.6.1 Indonesia Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.6.2 Indonesia Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.6.3 Indonesia Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.6.4 Indonesia Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.7 Malaysia 7.5.7.1 Malaysia Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.7.2 Malaysia Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.7.3 Malaysia Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.7.4 Malaysia Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.8 Vietnam 7.5.8.1 Vietnam Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.8.2 Vietnam Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.8.3 Vietnam Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.8.4 Vietnam Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.9 Taiwan 7.5.9.1 Taiwan Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.9.2 Taiwan Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.9.3 Taiwan Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.9.4 Taiwan Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.10.2 Bangladesh Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.10.3 Bangladesh Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.10.4 Bangladesh Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.11 Pakistan 7.5.11.1 Pakistan Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.11.2 Pakistan Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.11.3 Pakistan Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.11.4 Pakistan Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 7.5.12.2 Rest of Asia Pacific Oolong Tea Market Size and Forecast, by Form (2022-2029) 7.5.12.3 Rest of Asia Pacific Oolong Tea Market Size and Forecast, by Nature (2022-2029) 7.5.12.4 Rest of Asia Pacific Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8. Middle East and Africa Oolong Tea Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 8.1 Middle East and Africa Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.2 Middle East and Africa Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.3 Middle East and Africa Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.4 Middle East and Africa Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8.5 Middle East and Africa Oolong Tea Market Size and Forecast, by Country (2022-2029) 8.5.1 South Africa 8.5.1.1 South Africa Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.5.1.2 South Africa Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.5.1.3 South Africa Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.5.1.4 South Africa Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2 GCC 8.5.2.1 GCC Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.5.2.2 GCC Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.5.2.3 GCC Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.5.2.4 GCC Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3 Egypt 8.5.3.1 Egypt Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.5.3.2 Egypt Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.5.3.3 Egypt Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.5.3.4 Egypt Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.4 Nigeria 8.5.4.1 Nigeria Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.5.4.2 Nigeria Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.5.4.3 Nigeria Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.5.4.4 Nigeria Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 8.5.5.2 Rest of ME&A Oolong Tea Market Size and Forecast, by Form (2022-2029) 8.5.5.3 Rest of ME&A Oolong Tea Market Size and Forecast, by Nature (2022-2029) 8.5.5.4 Rest of ME&A Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 9. South America Oolong Tea Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 9.1 South America Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 9.2 South America Oolong Tea Market Size and Forecast, by Form (2022-2029) 9.3 South America Oolong Tea Market Size and Forecast, by Nature (2022-2029) 9.4 South America Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 9.5 South America Oolong Tea Market Size and Forecast, by Country (2022-2029) 9.5.1 Brazil 9.5.1.1 Brazil Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 9.5.1.2 Brazil Oolong Tea Market Size and Forecast, by Form (2022-2029) 9.5.1.3 Brazil Oolong Tea Market Size and Forecast, by Nature (2022-2029) 9.5.1.4 Brazil Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 9.5.2 Argentina 9.5.2.1 Argentina Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 9.5.2.2 Argentina Oolong Tea Market Size and Forecast, by Form (2022-2029) 9.5.2.3 Argentina Oolong Tea Market Size and Forecast, by Nature (2022-2029) 9.5.2.4 Argentina Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Oolong Tea Market Size and Forecast, by Product Type (2022-2029) 9.5.3.2 Rest Of South America Oolong Tea Market Size and Forecast, by Form (2022-2029) 9.5.3.3 Rest Of South America Oolong Tea Market Size and Forecast, by Nature (2022-2029) 9.5.3.4 Rest Of South America Oolong Tea Market Size and Forecast, by Distribution Channel (2022-2029) 10. Global Oolong Tea Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Oolong Tea Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Bigelow Tea 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Bigelow Tea 11.3 R. Twining and Company Limited 11.4 Teas and Thes Ltd 11.5 Ceylon Organic Spices 11.6 Arbor Teas 11.7 The Republic of Tea 11.8 Dilmah Ceylon Tea Company PLC 11.9 Harney & Sons Fine Teas 11.10 Mighty Leaf Tea 11.11 Tata Consumer Products 11.12 ITO EN INC 11.13 COFCO 11.14 The HPS Tea Company 11.15 International Coffee & Tea, LLC 11.16 Harada Seicha 11.17 generation tea 11.18 Choice Organics 11.19 Starbucks Corporation 11.20 TETLEY 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary