Germany Artificial Meat Market size is expected to reach nearly US$ 874.6 Mn by 2026 with the CAGR of 95.9% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Germany Artificial Meat Market Overview:

Artificial meat products have enhanced significantly since they were 1st introduced to the market, & have in current years become more attractive to an extensive customer base. However, perfections in taste & texture are still needed since these characteristics are main drivers behind purchase decisions. While it is correct that artificial meat products have always existed, taste & price have long been seen as obstructions to purchase by vegetarians & -vegans. While these products have become much more attractive, there is still a need to further advance taste & texture.Germany Artificial Meat Market Dynamics:

Growing awareness of the aids of a plant-based focused diet, along with the element that most key retailers have rapidly expanded their shelf space & private-label ranges with new plant-based products, underscores the development in the segment. Numerous restaurants, casual dining venues, & fast-food chains now have devoted ‘meat-free’ options on their menu, as the acceptance of artificial meat products endures to increase.Sample size for artificial meat eaters and reducers across the different country:

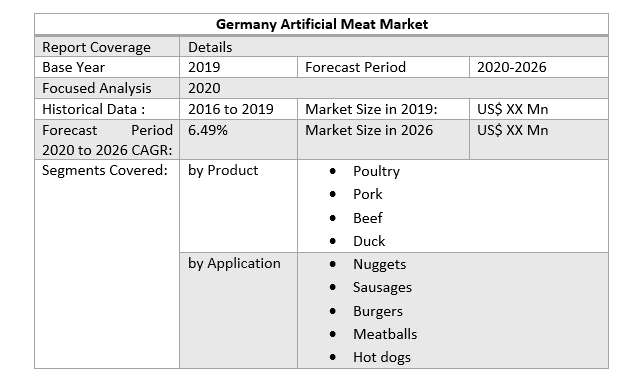

Given the detail that the number of respondents following an artificial meat consumption is higher than the number of reducers, our report sample has a much higher amount of informed customers than the overall population these customers have already bought different artificial meat products & can thus make a more informed assessment of the offerings on supermarket shelves. As an effect, food producers & retailers can profit from the experiences of customers already active in the artificial meat segment, in order to shape their product portfolio. The global meat & dairy market is presently experiencing extraordinary levels of competition & disruption, driven mostly by the development of viable artificial meat alternatives through many categories. The days when artificial meat were niche customer categories & occupied limited shelf space are long gone. Firms are now investing deeply in acquiring & creating new products & brands in order to take benefit of the rising customer demand for artificial meat products. A robust increase in artificial meat consumption was witnessed through Europe, with different nations showing diverse rates, & with customer responses being fairly mixed. This growth reflects a culturally diverse Europe which is finding ways to adapt traditional cuisines to the rising number of individuals who are eating more artificial meat. Each of the 9 countries looked at has its own culture, cuisine, & attitude towards the new & the diverse. As each country in Europe is unique, so are its artificial meat eaters & their customer behavior’s. MMR has collected illustrative data on how these nations, which establish some of the most intriguing & energetic artificial meat markets in Europe, are taking up this important shift in food consumption in different ways. In spite of the enhanced availability of artificial meat, the MMR survey results show that the supply side & the industry is still in a relatively initial stage in terms of market penetration, & there is thus substantial room for additional development. It is anticipated that the industry’s total reach will rise during the forecast period owing to new product growths & increasing customer demand. The demand for artificial meat products in Germany endures to expand, as can be seen by the growing value of sales in the segment. It should be eminent that this might be a replication of the relative wealth of the average German buyer, as cost is often a main barrier to buying artificial meat owing to the best price attached to many products. The report covers Poultry, Pork, Beef, Duck with detailed analysis Germany Artificial Meat Market industry with the classifications of the market on the, Product, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled fifteen key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.

Scope of the Germany Artificial Meat Market: Inquire before buying

Germany Artificial Meat Market Key Players

• MosaMeat • Just, Inc • SuperMeat • Aleph Farms Ltd • Finless Foods Inc • Integriculture • Balletic Foods • Future Meat Technologies Ltd • Avant Meats Company Limited • Higher Steaks • Appleton Meats • Fork & Goode • Biofood Systems LTD • Mission Barns • BlueNalu, Inc. • Mutable

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Germany Artificial Meat Market Size, by Market Value (US$ Mn) 3.1. Germany Market Segmentation 3.2. Germany Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the Artificial Meat Market 3.4. Geographical Snapshot of the Artificial Meat Market, By Manufacturer share 4. Germany Artificial Meat Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Germany Artificial Meat Market 5. Supply Side and Demand Side Indicators 6. Germany Artificial Meat Market Analysis and Forecast, 2019-2026 6.1. Germany Artificial Meat Market Size & Y-o-Y Growth Analysis. 7. Germany Artificial Meat Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 7.1.1. Poultry 7.1.2. Pork 7.1.3. Beef 7.1.4. Duck 7.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.2.1. Nuggets 7.2.2. Sausages 7.2.3. Burgers 7.2.4. Meatballs 7.2.5. Hot dogs 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the Germany Artificial Meat Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. MosaMeat. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. Just, Inc 8.3.3. SuperMeat 8.3.4. Aleph Farms Ltd 8.3.5. Finless Foods Inc 8.3.6. Integriculture 8.3.7. Balletic Foods 8.3.8. Future Meat Technologies Ltd 8.3.9. Avant Meats Company Limited 8.3.10. Higher Steaks 8.3.11. Appleton Meats 8.3.12. Fork & Goode 8.3.13. Biofood Systems LTD 8.3.14. Mission Barns 8.3.15. BlueNalu, Inc. 8.3.16. Mutable 8.3.17. Seafuture Sustainable Biotech 8.3.18. Shiok Meats 8.3.19. Wild Type 8.3.20. Lab farm Foods 8.3.21. Kiran Meats 8.3.22. Cubiq Foods 8.3.23. Cell Farm FOOD Tech 8.3.24. Granjua Celular S.A. 9. Primary Key Insights