North America Telematics Market was valued at USD 2.24 Bn in 2023 and is expected to reach USD 6.89 Bn by 2030, at a CAGR of 17.43 % during the forecast period.North America Telematics Market Overview

The North America automotive telematics market, particularly in the United States, is experiencing robust growth driven by the increasing role of connected cars and the integration of Cellular Vehicle-to-Everything (C-V2X) technologies. This growth is supported by a surge in demand for fleet management solutions and an increased interest in luxury vehicles equipped with advanced infotainment systems. As a result, the market sees an uptick in innovative telematics Provider Types spanning safety, security, navigation, and fleet management, highlighting a need for enhanced security solutions due to the unique challenges posed by proprietary telematics protocols. Key players such as Verizon Communications are pivotal, with offerings like Verizon Connect that optimize fleet operations and enhance vehicle connectivity, positioning the market for continued expansion and technological integration.To know about the Research Methodology :- Request Free Sample Report

North America Telematics Market Dynamics

Rising consumer demand for advanced infotainment and safety features fuels growth in telematics market. The increasing consumer preference for connected vehicles is significantly driving the growth of the automotive telematics market in North America, fueled by the integration of advanced infotainment systems, real-time navigation, and robust safety features. Infotainment systems like Tesla's interactive touchscreen and Ford's SYNC offer extensive entertainment options, smartphone integration, and internet connectivity, enhancing user engagement and convenience. Furthermore, navigation systems utilized by manufacturers such as General Motors leverage GPS and cellular data to provide live traffic updates and road condition alerts, optimizing routes and improving driving efficiency. Safety is also a critical component, with systems such as General Motors’ OnStar offering automatic emergency braking, crash response, and emergency services, significantly enhancing vehicle safety. Additionally, the shift towards connected vehicles is bolstered by regulatory support from bodies like the National Highway Traffic Safety Administration (NHTSA), which mandates the inclusion of telematics features to uplift safety standards. This regulatory push, combined with consumer demand for more connected, convenient, and safe driving experiences, is reshaping the automotive landscape, prompting manufacturers to continuously innovate and integrate cutting-edge technologies. This dynamic is increasing the North America telematics market, steering it towards a future dominated by more connected, intelligent, and autonomous vehicles. Telematics transforms North American fleet management Telematics is playing a crucial role in transforming fleet management by enhancing operational efficiency, reducing costs, and improving safety. By employing GPS technology, telematics solutions provide fleet operators with real-time data on vehicle locations, which is vital for optimizing logistics and ensuring timely deliveries. Additionally, these systems monitor driver behaviour, capturing data on speed, braking, and acceleration to help identify unsafe driving habits and facilitate targeted training programs. This not only enhances safety but also contributes to significant reductions in fuel consumption and maintenance costs by curbing aggressive driving. Moreover, in a regulatory environment as stringent as North America's, telematics assists in complying with laws regarding hours of service, electronic logging devices (ELD), and maintenance records, helping fleets avoid penalties while fostering a culture of compliance and safety. Telematics is indispensable in modern fleet management in North America, driving smarter, safer, and more cost-effective operations. Increased adoption of telematics solutions are poised to significantly impact the North America telematics market The evolution of telematics solutions is driven by rapid technological advancements, particularly in connectivity and data analytics. These systems, combining telecommunications and informatics, leverage emerging technologies such as IoT for seamless data collection from sensors in assets and vehicles. Integration with 5G ensures faster data transmission, while AI and ML enable predictive maintenance and optimization. These advancements drive significant growth in the telematics market as organizations recognize the value in reducing costs and improving productivity. With continuous innovation and increasing adoption, telematics solutions are set to become even more integral in shaping connected operations and smart enterprises. Regulatory compliance and efficiency improvements are set to propel the growth of the North American Telematics Market. The North America Telematics Market is experiencing significant positive impacts driven by various factors outlined in the provided paragraph. The implementation of regulatory mandates, notably the Electronic Logging Device (ELD) mandate, has propelled the widespread adoption of telematics solutions across sectors such as retail, parcel delivery, logistics, transport, and F&B. This mandate, particularly stringent for Hazmat-placarded vehicles in the petroleum and chemicals industry, has resulted in near-full penetration, around 99%, of telematics solutions in these fleets. Such regulatory requirements create a compelling incentive for fleet operators to integrate telematics systems, thereby fostering North America telematics market growth. Additionally, the high adoption rates among fleet owners in sectors like retail, parcel delivery, logistics, and F&B signify a growing recognition of the benefits of telematics in enhancing fleet efficiency and management. With a significant percentage of fleets now equipped with telematics, there is a notable improvement in overall operational efficiency, safety, and productivity. Moreover, the expected (CAGRs) of telematics adoption in the F&B haulage industry in North America indicate a robust upward trend in the market. The increasing demand for trailer telematics, especially for monitoring trailer status and temperature management, is a significant driver of this growth. As industries continue to acknowledge the value of telematics in improving operational visibility, compliance, and cost-effectiveness, the North America Telematics Market is poised for further growth and innovation during the forecast period.North America Telematics Market Segment Analysis

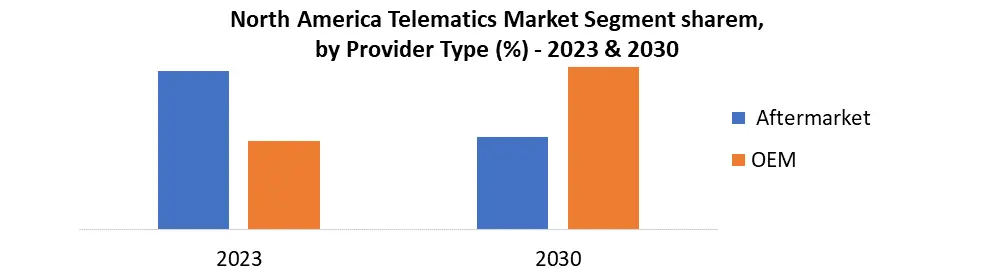

Based on Type, The Services segment in the North America Telematics Market is poised for significant growth due to rising demand for value-added services like data analytics and consulting to maximize telematics benefits. Customized solutions tailored to different sectors are driving adoption, alongside increased complexity requiring ongoing support services. Additionally, companies recognizing the strategic value of telematics data are fuelling demand for advanced services such as predictive analytics and fleet optimization, further boosting segment growth. Based on Provider Type, the market is segmented by Aftermarket, OEM. The Aftermarket segment dominates the North America Telematics Market primarily due to its flexibility and compatibility with a wide range of vehicles, making it accessible to a broader customer base. It's perceived as cost-effective, especially for smaller fleet operators or individual vehicle owners. Additionally, aftermarket providers often specialize in niche areas or offer innovative features not available through OEM solutions, attracting customers seeking specific functionalities or customization options. The competitive landscape of the aftermarket segment, with multiple providers offering various products and services, drives innovation and market growth, ultimately contributing to its maximum share in the North America Telematics Market.

North America Telematics Market Country Insight

The rising adoption of insurance telematics policies, particularly in North America, is reshaping the telematics market in several key ways. The expected growth from 16.8 million in 2023 to 29.2 million policies by 2027 signifies a growing demand for telematics solutions, driving market growth. Dominance of US-based insurers like Progressive and Canadian insurers underscores their pivotal role in driving adoption. Regional shifts towards aftermarket black boxes and mobile Provider Types, along with the integration of OEM telematics data into usage-based insurance programs, reflect evolving preferences and technological advancements. Involvement of various players across the telematics value chain, including automotive OEMs and technology companies, signifies a diverse ecosystem fostering innovation and data exchange. Furthermore, aftermarket telematics providers continue to play a crucial role in offering end-to-end solutions and expanding the reach of insurance telematics programs. As a result, this trend towards insurance telematics adoption, coupled with technological advancements and industry collaboration, is driving significant transformation and growth in the North American telematics market. Fleet Telematics Installed Base and Penetration, North America, Europe, and Australia, 2020As the demand for mobile resource productivity and efficiency enhancements surged, the telematics industry experienced rapid growth, witnessing higher than expected demand for OEM-embedded telematics, asset tracking, and video telematics solutions. In North America and Europe alone, approximately 750,000 new OEM telematics subscriptions were absorbed, while North America subscriptions for video telematics reached a total of 1.7 million. Notably, asset tracking solutions catering to assets with sub-$1,000 book value emerged as one of the fastest-growing market segments for Fleet Complete and the broader telematics industry in 2020. Amidst this growth, 2020 also marked a period of significant transformation in the North America fleet telematics industry, characterized by tectonic shifts in business models. Berg Insight's study on the video telematics market underscores the significant impact of camera integration on fleet telematics, particularly in North America, where the market is over three times larger than Europe's. With an estimated 4.9 million active video telematics systems in North America by 2023, growing to 11.7 million by 2028, the region sees substantial growth potential. In Europe, a similar trend is observed, with an estimated 1.4 million units in 2023, projected to reach 3.1 million by 2028. The market is supported by a diverse range of players, from specialists in video telematics solutions to general fleet telematics providers and hardware suppliers. Leading companies like Streamax, Lytx, and Samsara drive innovation, fostering competition and further advancement in the North American telematics industry.

North America Europe Australia Installed Base 10.1-12.3 million 9.6-11.5 million 1-1.1 million Percentage Penetration 31-38% 21-23% 19-22% North America Telematics Market Scope: Inquiry Before Buying

North America Telematics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.24 Bn. Forecast Period 2024 to 2030 CAGR: 17.43% Market Size in 2030: US $ 6.89 Bn. Segments Covered: by Provider Type Aftermarket OEM by Type Solution Services by Country United States Canada Mexico Leading North America Telematics Key Players include:

1. CelluTrak - in Canada 2. GM Fleet - United States 3. Trimble - United States 4. CTrack - South Africa 5. FleetBoard - Germany 6. PTC, Inc. - United States 7. Masternaut Limited - United Kingdom 8. Trimble Inc. - United States 9. OCTO Telematics Ltd. - Italy 10. Inseego Corporation - United States 11. ZONAR SYSTEMS, INC. - United States 12. Verizon Telematics, Inc. - United States 13. Infineon - Germany 14. Mix Telematics International Ltd. - South AfricaFrequently asked Questions:

1. What is the growth rate of North America North America Telematics Market? Ans: The North America North America Telematics Market is growing at a CAGR of 17.43% during forecasting period 2024-2030. 2. What is scope of the North America North America Telematics Market report? Ans: North America North America Telematics Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Who are the key players in North America North America Telematics Market? Ans: The important key players in the North America North America Telematics Market are – CelluTrak - in Canada, GM Fleet , Trimble , CTrack , FleetBoard , PTC, Inc. , Masternaut Limited , Trimble Inc. OCTO Telematics Ltd, Inseego Corporation and ZONAR SYSTEMS, INC. 4. What is the study period of this market? Ans: The North America Telematics Market is studied from 2023 to 2030.

1. North America Telematics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. North America North America Telematics Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. Revenue (2023) 2.3.4. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. North America Telematics Market: Dynamics 3.1. North America Telematics Market Trends 3.2. North America Telematics Market Dynamics 3.2.1. North America Telematics Market Drivers 3.2.2. North America Telematics Market Restraints 3.2.3. North America Telematics Market Opportunities 3.2.4. North America Telematics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 4. North America Telematics Market: North America Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Telematics Market Size and Forecast, By Provider Type (2023-2030) 4.1.1. Aftermarket 4.1.2. OEM 4.2. North America Telematics Market Size and Forecast, By Type (2023-2030) 4.2.1. Solution 4.2.2. Services 4.3. North America North America Telematics Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States North America Telematics Market Size and Forecast, By Provider Type (2023-2030) 4.3.1.1.1. Aftermarket 4.3.1.1.2. OEM 4.3.1.2. United States North America Telematics Market Size and Forecast, By Type (2023-2030) 4.3.1.2.1. Solution 4.3.1.2.2. Services 4.3.2. Canada 4.3.2.1. Canada North America Telematics Market Size and Forecast, By Provider Type (2023-2030) 4.3.2.1.1. Aftermarket 4.3.2.1.2. OEM 4.3.2.2. Canada North America Telematics Market Size and Forecast, By Type (2023-2030) 4.3.2.2.1. Solution 4.3.2.2.2. Services 4.3.3. Mexico 4.3.3.1. Mexico North America Telematics Market Size and Forecast, By Provider Type (2023-2030) 4.3.3.1.1. Aftermarket 4.3.3.1.2. OEM 4.3.3.2. Mexico North America Telematics Market Size and Forecast, By Type (2023-2030) 4.3.3.2.1. Solution 4.3.3.2.2. Services 5. Company Profile: Key Players 5.1. CelluTrak - in Canada. 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. GM Fleet - United States 5.3. Trimble - United States 5.4. CTrack - South Africa 5.5. FleetBoard - Germany 5.6. PTC, Inc. - United States 5.7. Masternaut Limited - United Kingdom 5.8. Trimble Inc. - United States 5.9. OCTO Telematics Ltd. - Italy 5.10. Inseego Corporation - United States 5.11. ZONAR SYSTEMS, INC. - United States 5.12. Verizon Telematics, Inc. - United States 5.13. Infineon - Germany 5.14. Mix Telematics International Ltd. - South Africa 6. Key Findings 7. Analyst Recommendations 8. North America Telematics Market: Research Methodology