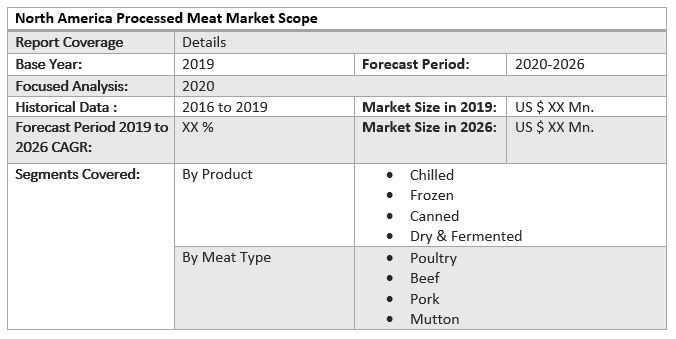

North America Processed Meat Market size is expected to reach nearly US$ 9645.5 Mn by 2026 with the CAGR of 4.1% during the forecast period.North America Processed Meat Market Overview

The region's growing meat production sectors are projected to boost market demand. Similarly, the growing number of major participants and meat snack types are projected to boost the global growth of the processed meat market. The growing awareness of pet health is also driving up the demand for processed meat. The processed meat market is expected to develop over the projected period due to increased urbanization and an increase in the number of working professionals. Because of changing consumer lifestyles and growing urbanization, which impacts consumer purchase patterns, the US market is anticipated to rise steadily throughout the forecast period. According to the United States Department of Agriculture (USDA), the United States was the leading consumer of meat in 2019 and is anticipated to maintain its lead throughout the projection period. Consumers' increased knowledge of the benefits of eating protein-rich foods is driving the industry forward. Similarly, manufacturers are coming out with novel goods to attract the demographics. The demand for protein is increasing as consumers become more aware of the need of eating high-nutritional foods. The fast-paced lifestyles of these people in developed areas of the country have resulted in a preference shift among the working class for processed items over conventional ones. Also, with a rising gym-going population in the United States, Canada, and Mexico, the need for meat protein has increased substantially.North America Processed Meat Market Segmentation Analysis

By Product, The chilled products segment accounted for the largest revenue share of more than 65.0% in 2020. The preference for chilled products is more among consumers as they possess long shelf life and can be cooked with as the requirement. Similarly, the demand for canned products is growing due to the increasing inclination towards ready-to-eat food. These products can be stored at ambient temperature, which provides high-quality protein-rich food. The frozen product segment is expected to register the fastest growth at a CAGR of 4.4% during the forecast period. The extended shelf life of these items influences customer purchasing decisions. Meatballs, chicken nuggets, beef patties, fillets, and chicken breast are some of the most popular frozen items purchased by customers. The dried and fermented segment is projected to develop significantly during the forecast period due to the ease with which novel tastes and textures of dry and fermented goods are adopted. Today's market offers a large range of dried and fermented goods, including dry ham, pepperoni, salami, and chorizo. Companies provide a variety of dried and fermented meats that have consistent color, consistency, flavor, and look. By Meat Type, The beef segment accounted for the largest revenue share of more than 36.0% in 2020. This segment is likely to be driven by grass-fed beef products due to their high nutritional value. Frozen boneless ground beef is one of the most popular processed beef items among customers. The pork segment held a substantial revenue share in 2020. The advent of meat processing systems has allowed pork to be processed in a variety of ways. Pork ham, sausage, meatballs, and bacon are some of the processed, consumer-friendly pork products. The products of the processed pork are a source of rich proteins, vitamins, and minerals.To know about the Research Methodology :- Request Free Sample Report The poultry segment is expected to grow at the fastest rate, with a CAGR of 4.1 percent during the forecast period. The cheaper pricing of segments compared to other cattle, pigs, and muttons has contributed to their growth.

North America Processed Meat Market Regional Analysis

In 2020, the US recorded over 61.0 percent of its revenues. The US is one of the world's biggest beef and beef producers. It produces about 11.4 million tons of beef per year and imports considerable quantities, according to the USDA, from countries including Canada, Australia, Mexico, and New Zealand. In 2020, Canada had an important proportion of its revenue in the North American market. Canada was one of the top producers of pork and beef in 2019 and witnesses both considerable exports and local demand, the Organization for Economic Co-operation and Development (OCED). According to the organization. In addition, the country's high consumption and expenditure stimulated market growth. The Mexican market is predicted to develop at a CAGR of 5.9 percent over the projected period. Meat is an essential part of Mexican traditional food. The fast growth of domestic slaughterhouses and processing plants has increased Mexico's accessibility. The industrial distribution network was developed and market growth in the country was reinforced by the improved supply chain and transport infrastructure. The objective of the report is to present a comprehensive analysis of the North America Processed Meat Market to the stakeholders in the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding North America Processed Meat Market dynamics, structure by analyzing the market segments and project the North America Processed Meat Market size. Clear representation of competitive analysis of key players By Application, price, financial position, product portfolio, growth strategies, and regional presence in the North America Processed Meat Market make the report investor’s guide.North America Processed Meat Market Scope: Inquire before buying

North America Processed Meat Market Key Players

• Tyson Foods, Inc • Conagra Brands, Inc • Sysco Corporation • Smithfield Foods, Inc • Perdue Farms • Cargill, Incorporated • JBS USA • Hormel Foods Corporation • National Beef Packing Company, LLC • OSI Group • Hormel Foods Corporation (United States) • Conagra Brands Inc. (United States) • Foster Farms (United States) • JBS S.A. (Brazil) • Tyson Foods Inc. (United States)

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Processed Meat Market Size, by Market Value (US$ Bn) 3.1. North America Market Segmentation 3.2. Geographical Snapshot of the Processed Meat Market 3.3. Geographical Snapshot of the Processed Meat Market, By Manufacturer share 4. North America Processed Meat Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the North America Processed Meat Market 5. Supply Side and Demand Side Indicators 6. North America Processed Meat Market Analysis and Forecast, 2019-2026 6.1. North America Processed Meat Market Size & Y-o-Y Growth Analysis. 7. North America Processed Meat Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Mn) Estimates & Forecast By Product, 2019-2026 7.1.1. Chilled 7.1.2. Frozen 7.1.3. Canned 7.1.4. Dry & Fermented 7.2. Market Size (Mn) Estimates & Forecast By Meat Type, 2019-2026 7.2.1. Poultry 7.2.2. Beef 7.2.3. Pork 7.2.4. Mutton 8. North America Processed Meat Market Analysis and Forecasts, By Country 8.1. Market Size (Mn) Estimates & Forecast By Country, 2019-2026 8.1.1. Germany 8.1.2. France 8.1.3. Italy 8.1.4. U.K 9. U.S. Processed Meat Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Mn) Estimates & Forecast By Product, 2019-2026 9.2. Market Size (Mn) Estimates & Forecast By Meat Type, 2019-2026 10. Canada Processed Meat Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Mn) Estimates & Forecast By Product, 2019-2026 10.2. Market Size (Mn) Estimates & Forecast By Meat Type, 2019-2026 11. Mexico Processed Meat Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Mn) Estimates & Forecast By Product, 2019-2026 11.2. Market Size (Mn) Estimates & Forecast By Meat Type, 2019-2026 12. Competitive Landscape 12.1. Geographic Footprint of Major Players in the North America Processed Meat Market 12.2. Competition Matrix 12.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 12.2.2. New Product Launches and Product Enhancements 12.2.3. Market Consolidation 12.2.3.1. M&A by Regions, Investment and Applications 12.2.3.2. M&A Key Players, Forward Integration and Backward Integration 12.3. Company Profile : Key Players 12.3.1. JBS USA 12.3.1.1. Company Overview 12.3.1.2. Financial Overview 12.3.1.3. Geographic Footprint 12.3.1.4. Product Portfolio 12.3.1.5. Business Strategy 12.3.1.6. Recent Developments 12.4 Tyson Foods, Inc 12.5 Conagra Brands, Inc 12.6 Sysco Corporation 12.7 Smithfield Foods, Inc 12.8 Perdue Farms 12.9 Cargill, Incorporated 12.10 JBS USA 12.11 Hormel Foods Corporation 12.12 National Beef Packing Company, LLC 12.13 OSI Group 12.14 Hormel Foods Corporation (United States) 12.15 Conagra Brands Inc. (United States) 12.16 Foster Farms (United States) 12.17 JBS S.A. (Brazil) 12.18 Tyson Foods Inc. (United States) 13.Primary Key Insights