Microbial Fermentation Technology Market size was valued at USD 19.68 Billion in 2023 and the Microbial Fermentation Technology Market revenue is expected to reach USD 34.1 Billion by 2030, at a CAGR of 6.2 % over the forecast period.Microbial Fermentation Technology Market Overview

Microbial fermentation technology is a cutting-edge area that produces valuable compounds by fermenting microorganisms. Fungi, bacteria, and eukaryotic cells such as insect cells and CHO cells are still being studied for their potential use in the chemical, pharmaceutical, energy, material, and food industries. Fermentation involves the participation of microorganisms such as bacteria, yeasts, fungus, and their enzymes. The biotechnology program selects bacteria strains for fermentation based on DNA sequences.To know about the Research Methodology :- Request Free Sample Report Microbial Fermentation technologies are not limited to a specific geographical region. The Microbial Fermentation Technology Market has a global presence, with consumers across different continents showing interest in these supplements. This Microbial Fermentation Technology Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Microbial Fermentation Technology Market report showcases the Microbial Fermentation Technology market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.

Microbial Fermentation Technology Market Dynamics

The global microbial fermentation technology market is expanding due to the widespread usage of fermentation technology-generated chemicals in a variety of sectors throughout the world due to its natural structure, cheap cost, and higher production. Furthermore, expanding research and development efforts in various domains of fermentation technology, technical innovation, increasing product awareness, and new product introduction are some of the factors that will drive the microbial fermentation technology market shortly. Rising gasoline prices, as well as the depletion of fossil fuel supplies, have increased the need for alternative goods in the chemical sector such as alcohols, alkaloids, amino acids, and enzymes. These items may be obtained by utilizing solutions from the global microbial fermentation technology market. This trend is expected to drive the market during the forecast period. Solutions in the global microbial fermentation technology market are used in a wide range of industries, including energy, materials, food and drinks, pharmaceuticals, and chemicals. Ethanol, citric acid, and acetic acid are some of the primary products obtained from the use of solutions in the global microbial fermentation technology market. The global microbial fermentation technology market uses fermentation by microorganisms such as bacteria and fungi, as well as eukaryotic cells such as CHO cells and insect cells, to generate valuable goods for humans. The fermentation process is divided into four sub-segments in the worldwide microbial fermentation technology market: production of extracellular metabolites, synthesis of intracellular components, biomass generation, and substrate transformation using molds, plant cells, or algae. Solutions in the global microbial fermentation technology market are used to manufacture valuable goods for humans through fermentation by microorganisms such as bacteria and fungus, as well as eukaryotic cells such as CHO cells and insect cells. The fermentation process is classified into four sub-segments in the global microbial fermentation technology market: production of extracellular metabolites, production of intracellular components, biomass generation, and substrate transformation using molds, plant cells, or algae.Microbial Fermentation Technology Market Segment Analysis

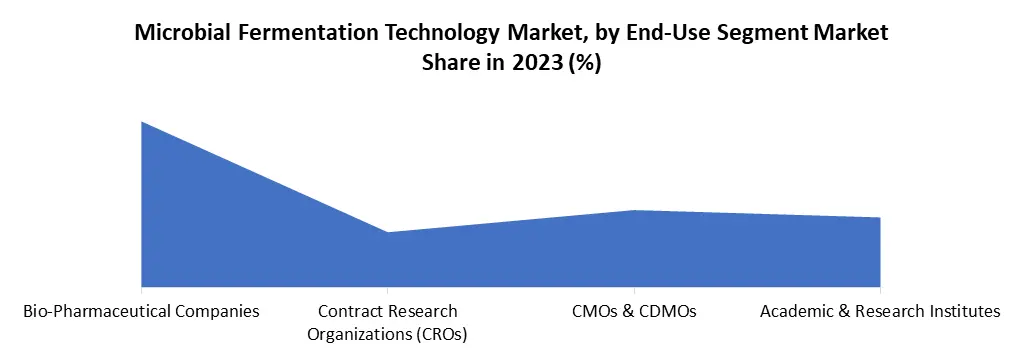

By Application: Antibiotics remain a cornerstone in the pharmaceutical industry, vital for combating bacterial infections. With the rise of antibiotic resistance, research and development efforts focus on novel formulations and combination therapies to address evolving challenges. The growing awareness of gut health and its impact on overall well-being propels the demand for probiotic supplements. Manufacturers are innovating to deliver diverse strains and formulations catering to specific health concerns, driving market expansion. Monoclonal antibodies (mAbs) continue to revolutionize treatment across various disease areas, including cancer and autoimmune disorders. Advancements in biotechnology and targeted therapies fuel the development of novel mAbs with enhanced efficacy and reduced side effects. Recombinant proteins play a crucial role in biopharmaceuticals, serving as therapeutics, diagnostics, and research tools. Increasing applications in personalized medicine and biotechnology drive the demand for recombinant protein production platforms and technologies. Biosimilars offer cost-effective alternatives to biologic drugs, driving market penetration and competition. Regulatory pathways and market acceptance continue to evolve, shaping the landscape for biosimilar development and commercialization. Vaccines play a pivotal role in public health, preventing infectious diseases and reducing healthcare burdens. Ongoing research focuses on developing novel vaccines against emerging pathogens and improving vaccine efficacy and safety profiles. Enzymes find diverse applications in pharmaceutical manufacturing, from drug synthesis to biocatalysis. Demand for specialty enzymes for bioprocessing and green chemistry drives market growth, with a focus on enzyme engineering and optimization. Small molecule drugs remain essential therapeutics across various disease areas, owing to their versatility and oral bioavailability. Research efforts concentrate on rational drug design and repurposing strategies to enhance efficacy and reduce adverse effects. This segment encompasses various niche applications and emerging trends in the pharmaceutical industry, including cell and gene therapies, nanomedicine, and digital health solutions, reflecting the dynamic nature of pharmaceutical innovation and diversification.By End Use: Bio-pharmaceutical companies lead the innovation and commercialization of biologic and small molecule drugs, driving R&D investments and market competition. Strategic collaborations and acquisitions enable companies to expand pipelines and strengthen market positions. CROs play a crucial role in drug development, offering a range of services from preclinical research to clinical trials management. Outsourcing to CROs accelerates drug development timelines and reduces costs, fostering industry growth and efficiency. Contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) provide essential manufacturing and development services to pharmaceutical companies. The outsourcing trend towards CMOs and CDMOs enables flexibility, scalability, and access to specialized expertise, driving market expansion. Academic and research institutes contribute to pharmaceutical innovation through basic and translational research, drug discovery, and preclinical studies. Collaborations between academia and industry facilitate knowledge exchange and technology transfer, fostering a vibrant ecosystem for drug development and innovation.

Microbial Fermentation Technology Market Regional Analysis

The United States is expected to dominate the global microbial fermentation technology market, with an estimated market share of around 30% during the forecast period. The technological advancements in bioprocessing and the development of new microbial strains for the production of rare compounds are some of the key trends driving growth in this region. In addition, the use of CRISPR-Cas9 technology for microbial strain modification is expected to revolutionize the industry. Germany is expected to hold an estimated market share of around 20% during the forecast period. Germany is one of the leading countries in the market, with a strong focus on biopharmaceutical production and regulatory compliance. The country's expertise in fermentation technology and its high-quality standards for production have made it an attractive destination for pharmaceutical companies. The trend toward personalized medicine and the growing demand for biologics is expected to drive the growth of the microbial fermentation technology market in Germany. Japan's microbial fermentation technology industry is expected to hold a share of around 10% during the forecast period. Japan is a significant player in the global market, with a strong focus on food and beverage production. The country's aging population has led to a growing demand for functional foods and nutraceuticals, driving growth in this industry. The trend towards natural and organic products and the use of high-throughput screening techniques for microbial strain discovery are expected to drive further growth in this region.Microbial Fermentation Technology Market Scope: Inquire before buying

Global Microbial Fermentation Technology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 19.68 Bn. Forecast Period 2024 to 2030 CAGR: 6.2% Market Size in 2030: US $ 34.1 Bn. Segments Covered: by Application Antibiotics Probiotics Supplements Monoclonal Antibodies Recombinant Proteins Biosimilars Vaccines Enzymes Small Molecules Others by End Use Bio-Pharmaceutical Companies Contract Research Organizations (CROs) CMOs & CDMOs Academic & Research Institutes Microbial Fermentation Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Microbial Fermentation Technology Key Players Include

1. F. Hoffmann-La Roche AG 2. Koninklijke DSM NV 3. Lonza Group AG 4. Danone Ltd. 5. Amyris Inc. 6. Biocon Ltd. 7. TerraVia Holdings Inc. 8. BioVectra Inc. 9. United Breweries Ltd 10. BASF (Germany) 11. Ajinomoto Company Incorporation (Japan) 12. The Dow Chemical Company (US) 13. Amano Enzyme Inc. (Japan) 14. AB Enzymes (Germany) 15. Archer Daniels Midland Company (US) 16. Du Pont Danisco A/S (Denmark) 17. Cargill Inc. (US) 18. Novozymes A/S (Denmark) 19. Evonik Industries AG (Germany) 20. BIOZEEN Frequently Asked Questions and Answers in the Market: 1. How big is the Microbial Fermentation Technology market? Ans: The global Microbial Fermentation Technology market size was estimated at USD 19.68 Billion in 2023. 2. What is the market growth? Ans: The global market is expected to grow at a compound annual growth rate of 6.2 % from 2024 to 2030 to reach USD 34.1 Billion by 2030. 3. Which segment accounted for the largest market share? Ans: In 2023, The United States is expected to dominate the global market by holding a 30% market share. 4. Who are the key players in the Microbial Fermentation Technology market? Ans: Some key market players are F. Hoffmann-La Roche AG, Koninklijke DSM NV, Lonza Group AG, Danone Ltd. and Others. 5. What are the factors driving the market? Ans: The Microbial Fermentation Technology market is experiencing robust growth, driven by the widespread usage of fermentation technology-generated chemicals in a variety of sectors.

1. Microbial Fermentation Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Microbial Fermentation Technology Market: Dynamics 2.1. Microbial Fermentation Technology Market Trends by Region 2.1.1. North America Microbial Fermentation Technology Market Trends 2.1.2. Europe Microbial Fermentation Technology Market Trends 2.1.3. Asia Pacific Microbial Fermentation Technology Market Trends 2.1.4. Middle East and Africa Microbial Fermentation Technology Market Trends 2.1.5. South America Microbial Fermentation Technology Market Trends 2.2. Microbial Fermentation Technology Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Microbial Fermentation Technology Market Drivers 2.2.1.2. North America Microbial Fermentation Technology Market Restraints 2.2.1.3. North America Microbial Fermentation Technology Market Opportunities 2.2.1.4. North America Microbial Fermentation Technology Market Challenges 2.2.2. Europe 2.2.2.1. Europe Microbial Fermentation Technology Market Drivers 2.2.2.2. Europe Microbial Fermentation Technology Market Restraints 2.2.2.3. Europe Microbial Fermentation Technology Market Opportunities 2.2.2.4. Europe Microbial Fermentation Technology Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Microbial Fermentation Technology Market Drivers 2.2.3.2. Asia Pacific Microbial Fermentation Technology Market Restraints 2.2.3.3. Asia Pacific Microbial Fermentation Technology Market Opportunities 2.2.3.4. Asia Pacific Microbial Fermentation Technology Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Microbial Fermentation Technology Market Drivers 2.2.4.2. Middle East and Africa Microbial Fermentation Technology Market Restraints 2.2.4.3. Middle East and Africa Microbial Fermentation Technology Market Opportunities 2.2.4.4. Middle East and Africa Microbial Fermentation Technology Market Challenges 2.2.5. South America 2.2.5.1. South America Microbial Fermentation Technology Market Drivers 2.2.5.2. South America Microbial Fermentation Technology Market Restraints 2.2.5.3. South America Microbial Fermentation Technology Market Opportunities 2.2.5.4. South America Microbial Fermentation Technology Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Microbial Fermentation Technology Industry 2.8. Analysis of Government Schemes and Initiatives For Microbial Fermentation Technology Industry 2.9. Microbial Fermentation Technology Market Trade Analysis 2.10. The Global Pandemic Impact on Microbial Fermentation Technology Market 3. Microbial Fermentation Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 3.1.1. Antibiotics 3.1.2. Probiotics Supplements 3.1.3. Monoclonal Antibodies 3.1.4. Recombinant Proteins 3.1.5. Biosimilars 3.1.6. Vaccines 3.1.7. Enzymes 3.1.8. Small Molecules 3.1.9. Others 3.2. Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 3.2.1. Bio-Pharmaceutical Companies 3.2.2. Contract Research Organizations (CROs) 3.2.3. CMOs & CDMOs 3.2.4. Academic & Research Institutes 3.3. Microbial Fermentation Technology Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Microbial Fermentation Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 4.1.1. Antibiotics 4.1.2. Probiotics Supplements 4.1.3. Monoclonal Antibodies 4.1.4. Recombinant Proteins 4.1.5. Biosimilars 4.1.6. Vaccines 4.1.7. Enzymes 4.1.8. Small Molecules 4.1.9. Others 4.2. North America Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 4.2.1. Bio-Pharmaceutical Companies 4.2.2. Contract Research Organizations (CROs) 4.2.3. CMOs & CDMOs 4.2.4. Academic & Research Institutes 4.3. North America Microbial Fermentation Technology Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Antibiotics 4.3.1.1.2. Probiotics Supplements 4.3.1.1.3. Monoclonal Antibodies 4.3.1.1.4. Recombinant Proteins 4.3.1.1.5. Biosimilars 4.3.1.1.6. Vaccines 4.3.1.1.7. Enzymes 4.3.1.1.8. Small Molecules 4.3.1.1.9. Others 4.3.1.2. United States Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 4.3.1.2.1. Bio-Pharmaceutical Companies 4.3.1.2.2. Contract Research Organizations (CROs) 4.3.1.2.3. CMOs & CDMOs 4.3.1.2.4. Academic & Research Institutes 4.3.2. Canada 4.3.2.1. Canada Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Antibiotics 4.3.2.1.2. Probiotics Supplements 4.3.2.1.3. Monoclonal Antibodies 4.3.2.1.4. Recombinant Proteins 4.3.2.1.5. Biosimilars 4.3.2.1.6. Vaccines 4.3.2.1.7. Enzymes 4.3.2.1.8. Small Molecules 4.3.2.1.9. Others 4.3.2.2. Canada Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 4.3.2.2.1. Bio-Pharmaceutical Companies 4.3.2.2.2. Contract Research Organizations (CROs) 4.3.2.2.3. CMOs & CDMOs 4.3.2.2.4. Academic & Research Institutes 4.3.3. Mexico 4.3.3.1. Mexico Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Antibiotics 4.3.3.1.2. Probiotics Supplements 4.3.3.1.3. Monoclonal Antibodies 4.3.3.1.4. Recombinant Proteins 4.3.3.1.5. Biosimilars 4.3.3.1.6. Vaccines 4.3.3.1.7. Enzymes 4.3.3.1.8. Small Molecules 4.3.3.1.9. Others 4.3.3.2. Mexico Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 4.3.3.2.1. Bio-Pharmaceutical Companies 4.3.3.2.2. Contract Research Organizations (CROs) 4.3.3.2.3. CMOs & CDMOs 4.3.3.2.4. Academic & Research Institutes 5. Europe Microbial Fermentation Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.2. Europe Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3. Europe Microbial Fermentation Technology Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Microbial Fermentation Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Microbial Fermentation Technology Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Microbial Fermentation Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Microbial Fermentation Technology Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 8. South America Microbial Fermentation Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 8.2. South America Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 8.3. South America Microbial Fermentation Technology Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Microbial Fermentation Technology Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Microbial Fermentation Technology Market Size and Forecast, by End User (2023-2030) 9. Global Microbial Fermentation Technology Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Microbial Fermentation Technology Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. F. Hoffmann-La Roche AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Koninklijke DSM NV 10.3. Lonza Group AG 10.4. Danone Ltd. 10.5. Amyris Inc. 10.6. Biocon Ltd. 10.7. TerraVia Holdings Inc. 10.8. BioVectra Inc. 10.9. United Breweries Ltd 10.10. BASF (Germany) 10.11. Ajinomoto Company Incorporation (Japan) 10.12. The Dow Chemical Company (US) 10.13. Amano Enzyme Inc. (Japan) 10.14. AB Enzymes (Germany) 10.15. Archer Daniels Midland Company (US) 10.16. Du Pont Danisco A/S (Denmark) 10.17. Cargill Inc. (US) 10.18. Novozymes A/S (Denmark) 10.19. Evonik Industries AG (Germany) 10.20. BIOZEEN 11. Key Findings 12. Industry Recommendations 13. Microbial Fermentation Technology Market: Research Methodology 14. Terms and Glossary