The Wind Turbine Forging Market size was valued at USD 7.35 billion in 2022 and the total Wind Turbine Forging Market revenue is expected to grow at a CAGR of 7.5 % from 2023 to 2029, reaching nearly USD 12.19 billion. The wind turbine forging market plays a pivotal role in the renewable energy sector, providing essential components for wind turbines that harness wind energy to generate electricity. The increasing demand for clean energy sources is as countries worldwide seek to reduce carbon emissions and transition to sustainable power generation. The expansion of onshore and offshore wind farms, particularly in Europe and Asia, has fueled the demand for wind turbine components, including forgings. Advancements in wind turbine technology, such as larger and more efficient designs, have led to the need for specialized, high-strength components that withstand the stress and forces involved in energy generation. Recent developments in the wind turbine forging market include strategic initiatives by key players to expand their capabilities and reach. For instance, in 2021, Siemens Gamesa, a leading player in the wind energy industry, announced its plans to invest in a new offshore wind turbine blade manufacturing facility in the UK.To know about the Research Methodology :- Request Free Sample Report This move highlighted the industry's commitment to local production and supply chain resilience, contributing to the growth of the forging market. Sustainability and environmental considerations play a significant role, with manufacturers increasingly adopting green practices in the forging process and exploring advanced materials to reduce the carbon footprint associated with wind turbine production. Challenges also exist in the wind turbine forging market, including supply chain disruptions, raw material price fluctuations, and the need for continuous innovation to meet the evolving requirements of wind turbine designs. These challenges were further exacerbated by the impacts of the COVID-19 pandemic, which disrupted manufacturing and supply chains in the renewable energy sector. The wind turbine forging market is experiencing growth as the global shift towards renewable energy sources accelerated. Key players in the industry were investing in expanding their manufacturing capabilities and adopting sustainable practices to meet the increasing demand for wind turbine components.

Wind Turbine Forging Market Scope and Research Methodology:

The Wind Turbine Forging Market encompasses a comprehensive scope that includes the manufacturing and supply of forged components for wind turbines, catering to both onshore and offshore applications. These forged components encompass a range of parts critical to wind turbine assemblies, such as shafts, gears, flanges, blades, bearings, and other associated components. Research methodology in the Wind Turbine Forging Market involves a multifaceted approach. It begins with data collection from primary and secondary sources. Secondary research involves collecting data from a wide range of reputable sources, including industry reports, market studies, government publications, and academic journals. These sources are critical for market trend analysis, competitive assessments, and understanding the regulatory environment impacting the wind turbine forging market. Quantitative data analysis involves numerical assessments of market size, growth rates, and statistical trends. Qualitative analysis focuses on understanding market dynamics, key drivers, restraints, and opportunities through expert opinions and industry knowledge. Competitive analysis is also a crucial aspect of the research methodology. This includes profiling key players in the wind turbine forging market and understanding their product portfolios, market strategies, and recent developments. This analysis aids in evaluating market competition, innovation, and key players' contributions to the industry. The research methodology for the Wind Turbine Forging Market involves a comprehensive and robust approach, encompassing data collection from primary and secondary sources, rigorous analysis, market segmentation, and competitive assessments. This methodology ensures the accuracy and relevance of the insights and information provided in understanding the dynamics of the wind turbine forging market.Market Dynamics:

Offshore Wind Expansion Boosts Need for Durable Forged Components: The increasing global focus on reducing carbon emissions and transitioning to clean energy sources is driving the growth of the wind turbine forging market. For example, the European Union's ambitious renewable energy targets have led to a surge in wind energy projects, bolstering the demand for forged wind turbine components. Ongoing advancements in wind turbine technology, including larger and more efficient turbine designs, require specialized, high-strength components. For instance, the development of larger offshore wind turbines like GE's Haliade-X demands robust forgings to withstand the challenging offshore conditions, driving the market's growth. The rapid expansion of offshore wind farms in regions like Europe, the United States, and Asia is a significant driver. Offshore turbines, often subjected to harsh marine environments, require durable forged components. A prime example is the growth of the offshore wind sector in the North Sea, driving the demand for specialized forgings. Supportive government policies, incentives, and subsidies for renewable energy projects encourage wind energy investments. Governments worldwide, like the Production Tax Credit and Investment Tax Credit in the United States, promote wind energy development, boosting the forging market. The increasing emphasis on sustainability and environmental responsibility is driving demand for green energy sources like wind. Wind turbine manufacturers are investing in environmentally friendly forging processes and materials to align with these principles. Emerging economies in Asia, Latin America, and Africa are witnessing significant wind energy expansion. For example, India and China have ambitious wind energy targets, stimulating the demand for forged wind turbine components. Ongoing R&D efforts to enhance forging techniques and develop advanced materials play a pivotal role. Innovations like 3D printing of turbine components and carbon-fiber-reinforced forgings are driving market growth. Manufacturers are investing in localizing supply chains to ensure a steady flow of forged components, driving market expansion. The integration of energy storage solutions with wind farms to stabilize energy supply boosts the market. For example, wind farms in California are incorporating energy storage systems, increasing the need for forging components in hybrid systems. Building the necessary infrastructure for wind energy, including grid connections and transmission lines, supports the market. The construction of new wind farms and their integration into the power grid drives demand for forged components. These growth drivers collectively foster the expansion of the wind turbine forging market, as wind energy continues to gain prominence as a clean and sustainable source of power.Largest Wind Power Farms Worldwide Based On Installed Capacity As Of January 2023(in Megawatts)

Competition with Other Energy Sources Influences Wind Forging Demand: The wind turbine forging industry relies on raw materials like steel, and fluctuations in material prices impact manufacturing costs. For instance, sudden spikes in steel prices strain profit margins, as experienced in the steel market in 2021. Setting up or expanding forging facilities requires substantial capital investment, limiting the entry of new players and potentially slowing market growth. For example, building a state-of-the-art forging plant requires significant financial resources. Wind turbine components must adhere to stringent quality and safety standards. Meeting these standards is challenging and costly for manufacturers, particularly small ones without extensive resources. A shortage of skilled labor with expertise in forging and metallurgy hinders the industry's growth. Skilled personnel are essential for maintaining quality and efficiency in the forging process. Wind energy competes with other renewable and non-renewable energy sources. Economic fluctuations impact investment decisions and reduce demand for wind turbine forging. For instance, a sudden drop in oil prices affects the attractiveness of wind energy investments. Obtaining land for wind turbine installations and adhering to environmental regulations is challenging. In regions with stringent permitting processes, wind projects may face delays and added costs. The integration of advanced materials or forging techniques faces challenges in terms of compatibility with existing wind turbine designs and manufacturing processes, affecting adoption rates. Wind turbine components are often large and heavy, requiring specialized transportation. Delays in logistics and the need for infrastructure development pose challenges. For example, transporting oversized turbine components to remote wind farm locations is complex and costly. As wind turbines age, maintenance and replacement needs grow. Manufacturers may face challenges in providing replacement forgings for older turbine models that may be out of production, impacting the aftermarket sector.

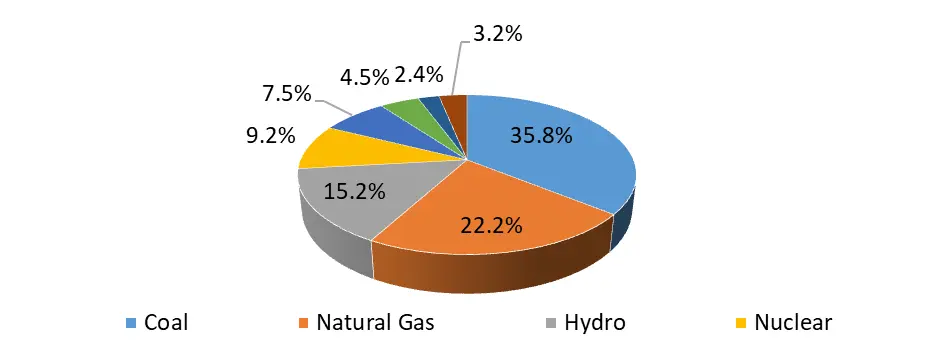

World Electricity Generation By Source 2022, (%)

Offshore Wind Expansion Spurs Demand for Specialized Forgings:

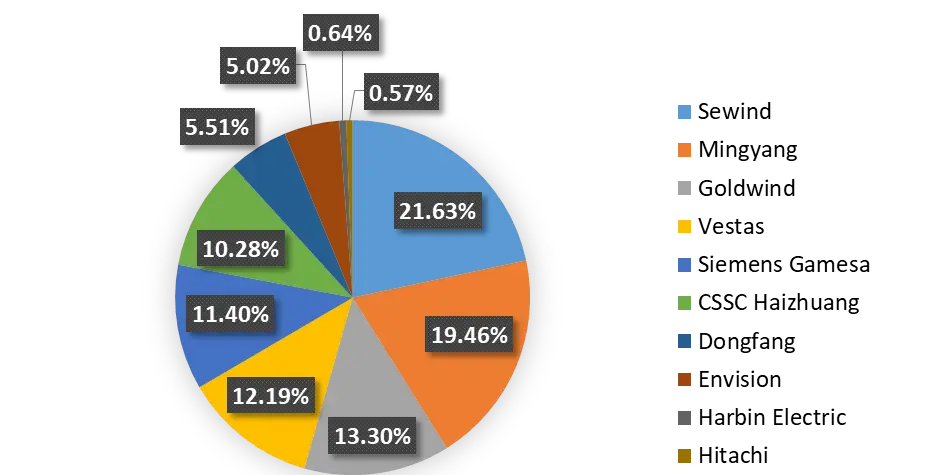

The shift towards renewable energy sources presents a significant growth opportunity for the wind turbine forging market. As countries commit to reducing carbon emissions, the demand for wind energy continues to rise. The integration of energy storage solutions with wind farms enhances grid stability and energy supply reliability. This trend offers opportunities for forging components used in energy storage systems, such as hybrid wind-solar farms with battery storage, like the Hornsdale Power Reserve in Australia. Offshore wind farms, due to their higher energy output potential, are expanding rapidly. The development of larger offshore turbines, as seen with the Haliade-X by GE Renewables, requires specialized forged components, presenting growth potential. Research into advanced materials, such as carbon-fiber-reinforced composites, offers opportunities for lighter and more durable forged components. Innovations in material science can drive the development of next-generation wind turbine components. The emphasis on sustainable practices and the circular economy encourages the recycling and reuse of wind turbine components. For example, the Repowering program in Denmark aims to repurpose older wind turbines, providing opportunities for remanufacturing and re-forging. Emerging markets in Asia, Latin America, and Africa are increasing their wind energy investments. As these regions embrace wind power, they offer growth opportunities for both wind energy projects and the forging market. The implementation of digital twin technology and predictive maintenance in wind farms enhances operational efficiency. Forged components equipped with sensors and monitoring capabilities can support these technological advancements. Green and sustainable forging techniques, such as closed-die forging using recycled materials, align with the renewable energy sector's environmental goals. Manufacturers adopting such practices can gain a competitive edge. Establishing localized forging facilities closer to wind farm sites can reduce transportation costs and delays, creating growth opportunities for regional forging companies.Top Offshore Wind Turbine Suppliers’ Annual Installed Capacity 2021

Wind Turbine Forging Market Segment Analysis:

Based on the Component, Flanges play an essential role in connecting various wind turbine components, including the tower, gearbox, and generator. They are critical for ensuring the structural integrity and stability of wind turbines. Flanges find extensive adoption in both onshore and offshore wind turbines. Offshore wind farms, which require components that can withstand harsh marine conditions, often rely on heavy-duty, specially forged flanges to ensure the turbines' stability and longevity. The demand for flanges is expected to grow in parallel with the increasing deployment of wind turbines in both onshore and offshore applications. Gears are integral components in wind turbine gearboxes, responsible for converting the low rotational speed of the wind turbine rotor into the high-speed rotation needed by the generator to produce electricity. Gears are widely adopted in both onshore and offshore wind turbines. As wind turbine designs evolve to include larger and more efficient turbines, the demand for high-strength, precision-forged gears has surged. The adoption of advanced materials and forging techniques for gears has become crucial in ensuring the optimal performance and energy output of modern wind turbines. Shafts are fundamental components that transmit rotational energy from the wind turbine rotor to the generator. These forged components are universally adopted in wind turbines, whether onshore or offshore. The growing demand for larger wind turbines, such as the Haliade-X by GE Renewables, necessitates longer and sturdier shafts to accommodate the increased turbine size and energy production capacity. Consequently, shaft forging remains a critical and continually evolving sector of the wind turbine forging market. Wind turbine blades are vital for capturing wind energy and converting it into rotational power. Blades are universally adopted in the wind energy sector, from onshore to offshore applications. As wind turbines become larger and more efficient, the need for longer, lighter, and aerodynamically advanced blades has intensified. Forging plays a pivotal role in producing blade components with the required strength, flexibility, and durability to withstand the dynamic forces they encounter. Bearings are essential in facilitating the rotation of wind turbine components, such as the rotor and gearbox. They find widespread adoption in both onshore and offshore wind turbines. Given their critical role in ensuring the smooth and efficient operation of wind turbines, the demand for precision-forged bearings remains consistently high. Offshore wind farms, in particular, rely on specialized bearings designed to withstand corrosive marine conditions, thus presenting opportunities for forging companies to cater to this specific application. The wind turbine forging market's component segment analysis reveals that each component, from flanges to bearings, serves a unique purpose in wind turbine manufacturing. While some components, such as blades and shafts, enjoy universal adoption across onshore and offshore applications, others like flanges and bearings are more specific to offshore wind farms due to their harsh operating conditions. The adoption of advanced materials and forging techniques is pivotal in meeting the evolving demands of the wind turbine industry, where larger and more efficient turbines are becoming the norm. As the wind energy sector continues to grow and mature,Wind Turbine Forging Market Regional Insights:

Europe stands as a large producing region, with countries like Germany, Denmark, and Spain leading in wind turbine manufacturing. Europe's ambitious renewable energy targets have driven substantial domestic production, emphasizing the importance of the wind energy sector in the region. Simultaneously, Europe is a substantial consumer of wind turbine forgings, primarily due to its significant investment in onshore and offshore wind projects. North America, particularly the United States, is a prominent consumer of wind turbine components. Government incentives like the Production Tax Credit and Investment Tax Credit have fueled a robust domestic wind energy market. The U.S. wind industry relies on forgings, leading to considerable imports of these components from forging manufacturers in Europe and Asia. Asia is a multifaceted region, with China emerging as a dominant producer of wind turbines. China's commitment to renewable energy, as seen in its extensive wind energy installations, stimulates both domestic production and consumption of wind turbine forgings. In parallel, China's role as an exporter of forgings to global markets, including the U.S., underlines its significance in the international wind turbine forging trade. The wind turbine forging market is characterized by the dual dynamics of production hubs, such as Europe, and consumption centers, including North America and the Asia-Pacific region. As the global transition to clean energy intensifies, these regional insights are instrumental in understanding the distribution of manufacturing and consumption in this vital sector of the renewable energy industry.Competitive Landscape

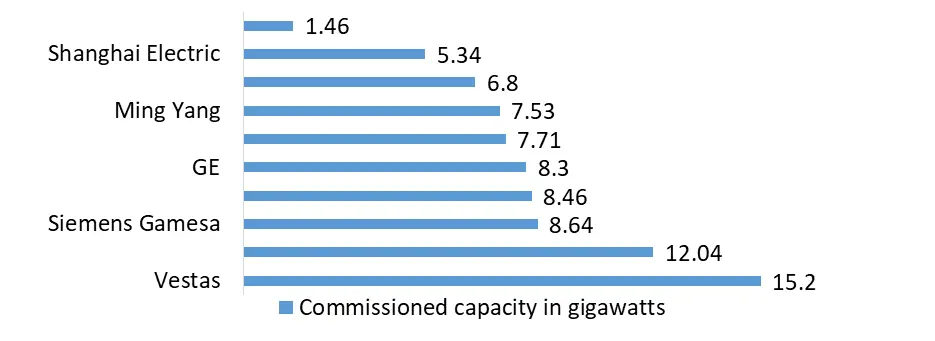

Key Players of the Wind Turbine Forging Market profiled in the report are Bharat Forge Limited, Broadwind Energy Inc, Bruck GmbH, Celsa Armeringsstal AS, CIE Automotive S.A., Euskalforging Group, Farinia Group, Frisa Industrias SA de CV., Gerdau Summit Aços Fundidos e Forjados SA, GKN Aerospace (Melrose Industries), Iraeta Energy Equipment Co., Ltd., Jiangyin Zenkung Forging Co., Luoyang Yujie Industry & Trade Co. Ltd, Nippon Steel Corporation, R&M Forge and Fittings, Saarschmiede GmbH Freiformschmiede, Schaeffler Technologies AG & Co. KG, Scot Forge Co. This provides huge opportunities to serve many End-users and customers and expand the Wind Turbine Forging Market. In 2022, Frisa, a prominent Mexico-based manufacturer, partnered with a leading forging supplier to unveil a comprehensive range of open die forgings and seamless rolled rings. This collaboration aimed to enhance the quality, durability, and value of their offerings, particularly for customers operating in challenging and demanding environments.Leading Wind Turbine Manufacturers Based On Commissioned Capacity Worldwide In 2021(in Gigawatts)

Wind Turbine Forging Market Scope: Inquire Before Buying

Global Wind Turbine Forging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 7.35 Bn. Forecast Period 2023 to 2029 CAGR: 7.5% Market Size in 2029: US $ 12.19 Bn. Segments Covered: by Type Open Die Forging Closed Die Forging Seamless Rolled Ring by Component Flanges Gears Shafts Blades Bearings Others by Application Onshore Installations Offshore Installations Wind Turbine Forging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Wind Turbine Forging Market Key Players:

1. Bharat Forge Limited 2. Broadwind Energy Inc 3. Bruck GmbH, 4. Celsa Armeringsstal AS 5. CIE Automotive S.A. 6. Euskalforging Group 7. Farinia Group 8. Frisa Industrias SA de CV. 9. Finkl & Sons Steel 10. Gerdau Summit Aços Fundidos e Forjados SA, 11. GKN Aerospace (Melrose Industries) 12. Iraeta Energy Equipment Co., Ltd. 13. Jiangyin Zenkung Forging Co. 14. Luoyang Yujie Industry & Trade Co. Ltd 15. Nippon Steel Corporation 16. R&M Forge and Fittings 17. Saarschmiede GmbH Freiformschmiede, 18. Schaeffler Technologies AG & Co. KG, 19. Scot Forge Co, 20. Shanxi Huanjie Petroleum Drilling 21. Sheffield Forgemasters International Ltd. 22. Sinomach Heavy Industry Corporation 23. Specialty Ring Products Inc, 24. Suzhou Tianyuan Equipment Technology Co., Ltd. 25. Synergy Heavy Industry (Jiangsu) Co., Ltd. 26. Tongyu Heavy Industry Co Ltd 27. Tools Co., Ltd. 28. ULMA Forja S Coop 29. Western Machine Works Inc.FAQs:

1. What are the growth drivers for the Wind Turbine Forging Market? Ans. Offshore Wind Expansion Boosts the Need for Durable Forged Components and is expected to be the major driver for the Wind Turbine Forging Market. 2. What is the major Opportunity for the Wind Turbine Forging Market growth? Ans. Offshore Wind Expansion Spurs Demand for Specialized Forgings is expected to be the major Opportunity in the Wind Turbine Forging Market. 3. Which country is expected to lead the global Wind Turbine Forging Market during the forecast period? Ans. Europe is expected to lead the Wind Turbine Forging Market during the forecast period. 4. What is the projected market size and growth rate of the Wind Turbine Forging Market? Ans. The Wind Turbine Forging Market size was valued at USD 7.35 billion in 2022 and the total Wind Turbine Forging Market revenue is expected to grow at a CAGR of 7.5 % from 2023 to 2029, reaching nearly USD 12.19 billion. 5. What segments are covered in the Wind Turbine Forging Market report? Ans. The segments covered in the Wind Turbine Forging Market report are by Type, Component, Application, and Region.

1. Wind Turbine Forging Market: Research Methodology 2. Wind Turbine Forging Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Wind Turbine Forging Market: Dynamics 3.1 Wind Turbine Forging Market Trends by Region 3.1.1 North America Wind Turbine Forging Market Trends 3.1.2 Europe Wind Turbine Forging Market Trends 3.1.3 Asia Pacific Wind Turbine Forging Market Trends 3.1.4 Middle East and Africa Wind Turbine Forging Market Trends 3.1.5 South America Wind Turbine Forging Market Trends 3.2 Wind Turbine Forging Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Wind Turbine Forging Market Drivers 3.2.1.2 North America Wind Turbine Forging Market Restraints 3.2.1.3 North America Wind Turbine Forging Market Opportunities 3.2.1.4 North America Wind Turbine Forging Market Challenges 3.2.2 Europe 3.2.2.1 Europe Wind Turbine Forging Market Drivers 3.2.2.2 Europe Wind Turbine Forging Market Restraints 3.2.2.3 Europe Wind Turbine Forging Market Opportunities 3.2.2.4 Europe Wind Turbine Forging Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Wind Turbine Forging Market Drivers 3.2.3.2 Asia Pacific Wind Turbine Forging Market Restraints 3.2.3.3 Asia Pacific Wind Turbine Forging Market Opportunities 3.2.3.4 Asia Pacific Wind Turbine Forging Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Wind Turbine Forging Market Drivers 3.2.4.2 Middle East and Africa Wind Turbine Forging Market Restraints 3.2.4.3 Middle East and Africa Wind Turbine Forging Market Opportunities 3.2.4.4 Middle East and Africa Wind Turbine Forging Market Challenges 3.2.5 South America 3.2.5.1 South America Wind Turbine Forging Market Drivers 3.2.5.2 South America Wind Turbine Forging Market Restraints 3.2.5.3 South America Wind Turbine Forging Market Opportunities 3.2.5.4 South America Wind Turbine Forging Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Wind Turbine Forging Industry 3.8 The Global Pandemic and Redefining of The Wind Turbine Forging Industry Landscape 3.9 Technological Road Map 4. Global Wind Turbine Forging Market: Global Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 4.1 Global Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 4.1.1 Open Die Forging 4.1.2 Closed Die Forging 4.1.3 Seamless Rolled Ring 4.2 Global Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 4.2.1 Flanges 4.2.2 Gears 4.2.3 Shafts 4.2.4 Blades 4.2.5 Bearings 4.2.6 Others 4.3 Global Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 4.3.1 Onshore Installations 4.3.2 Offshore Installations 4.4 Global Wind Turbine Forging Market Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Wind Turbine Forging Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 5.1 North America Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 5.1.1 Open Die Forging 5.1.2 Closed Die Forging 5.1.3 Seamless Rolled Ring 5.2 North America Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 5.2.1 Flanges 5.2.2 Gears 5.2.3 Shafts 5.2.4 Blades 5.2.5 Bearings 5.2.6 Others 5.3 North America Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 5.3.1 Onshore Installations 5.3.2 Offshore Installations 5.4 North America Wind Turbine Forging Market Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 5.4.1.1.1 Open Die Forging 5.4.1.1.2 Closed Die Forging 5.4.1.1.3 Seamless Rolled Ring 5.4.1.2 United States Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 5.4.1.2.1 Flanges 5.4.1.2.2 Gears 5.4.1.2.3 Shafts 5.4.1.2.4 Blades 5.4.1.2.5 Bearings 5.4.1.2.6 Others 5.4.1.3 United States Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 5.4.1.3.1 Onshore Installations 5.4.1.3.2 Offshore Installations 5.4.2 Canada 5.4.2.1 Canada Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 5.4.2.1.1 Open Die Forging 5.4.2.1.2 Closed Die Forging 5.4.2.1.3 Seamless Rolled Ring 5.4.2.2 Canada Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 5.4.2.2.1 Flanges 5.4.2.2.2 Gears 5.4.2.2.3 Shafts 5.4.2.2.4 Blades 5.4.2.2.5 Bearings 5.4.2.2.6 Others 5.4.2.3 Canada Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 5.4.2.3.1 Onshore Installations 5.4.2.3.2 Offshore Installations 5.4.3 Mexico 5.4.3.1 Mexico Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 5.4.3.1.1 Open Die Forging 5.4.3.1.2 Closed Die Forging 5.4.3.1.3 Seamless Rolled Ring 5.4.3.2 Mexico Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 5.4.3.2.1 Flanges 5.4.3.2.2 Gears 5.4.3.2.3 Shafts 5.4.3.2.4 Blades 5.4.3.2.5 Bearings 5.4.3.2.6 Others 5.4.3.3 Mexico Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 5.4.3.3.1 Onshore Installations 5.4.3.3.2 Offshore Installations 6. Europe Wind Turbine Forging Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 6.1 Europe Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.2 Europe Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.3 Europe Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4 Europe Wind Turbine Forging Market Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.1.2 United Kingdom Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.1.3 United Kingdom Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.2 France 6.4.2.1 France Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.2.2 France Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.2.3 France Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.3.2 Germany Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.3.3 Germany Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.4.2 Italy Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.4.3 Italy Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.5.2 Spain Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.5.3 Spain Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.6.2 Sweden Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.6.3 Sweden Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.7.2 Austria Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 6.4.7.3 Austria Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 6.4.8.2 Rest of Europe Wind Turbine Forging Market Size and Forecast, By Component (2022-2029). 6.4.8.3 Rest of Europe Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7. Asia Pacific Wind Turbine Forging Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 7.1 Asia Pacific Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.2 Asia Pacific Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.3 Asia Pacific Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4 Asia Pacific Wind Turbine Forging Market Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.1.2 China Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.1.3 China Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.2.2 S Korea Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.2.3 S Korea Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.3.2 Japan Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.3.3 Japan Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.4 India 7.4.4.1 India Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.4.2 India Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.4.3 India Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.5.2 Australia Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.5.3 Australia Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.6.2 Indonesia Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.6.3 Indonesia Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.7.2 Malaysia Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.7.3 Malaysia Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.8.2 Vietnam Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.8.3 Vietnam Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.9.2 Taiwan Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.9.3 Taiwan Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.10.2 Bangladesh Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.10.3 Bangladesh Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.11.2 Pakistan Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.11.3 Pakistan Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 7.4.12.2 Rest of Asia Pacific Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 7.4.12.3 Rest of Asia Pacific Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Wind Turbine Forging Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 8.1 Middle East and Africa Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.2 Middle East and Africa Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.3 Middle East and Africa Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8.4 Middle East and Africa Wind Turbine Forging Market Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.4.1.2 South Africa Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.4.1.3 South Africa Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.4.2.2 GCC Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.4.2.3 GCC Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.4.3.2 Egypt Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.4.3.3 Egypt Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.4.4.2 Nigeria Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.4.4.3 Nigeria Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 8.4.5.2 Rest of ME&A Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 8.4.5.3 Rest of ME&A Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 9. South America Wind Turbine Forging Market Size and Forecast by Segmentation (Value and Volume) (2022-2029) 9.1 South America Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 9.2 South America Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 9.3 South America Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 9.4 South America Wind Turbine Forging Market Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 9.4.1.2 Brazil Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 9.4.1.3 Brazil Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 9.4.2.2 Argentina Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 9.4.2.3 Argentina Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Wind Turbine Forging Market Size and Forecast, By Type (2022-2029) 9.4.3.2 Rest Of South America Wind Turbine Forging Market Size and Forecast, By Component (2022-2029) 9.4.3.3 Rest Of South America Wind Turbine Forging Market Size and Forecast, By Application (2022-2029) 10. Global Wind Turbine Forging Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Wind Turbine Forging Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Bharat Forge Limited. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Broadwind Energy Inc 11.3 Bruck GmbH, 11.4 Celsa Armeringsstal AS 11.5 CIE Automotive S.A. 11.6 Euskalforging Group 11.7 Farinia Group 11.8 Frisa Industrias SA de CV. 11.9 Gerdau Summit Aços Fundidos e Forjados SA, 11.10 GKN Aerospace (Melrose Industries) 11.11 Iraeta Energy Equipment Co., Ltd. 11.12 Jiangyin Zenkung Forging Co. 11.13 Luoyang Yujie Industry & Trade Co. Ltd 11.14 Nippon Steel Corporation 11.15 R&M Forge and Fittings 11.16 Saarschmiede GmbH Freiformschmiede, 11.17 Schaeffler Technologies AG & Co. KG, 11.18 Scot Forge Co, 11.19 Shanxi Huanjie Petroleum Drilling 11.20 Sheffield Forgemasters International Ltd. 11.21 Sinomach Heavy Industry Corporation 11.22 Specialty Ring Products Inc, 11.23 Suzhou Tianyuan Equipment Technology Co., Ltd. 11.24 Synergy Heavy Industry (Jiangsu) Co., Ltd. 11.25 Tongyu Heavy Industry Co Ltd 11.26 Tools Co., Ltd. 11.27 ULMA Forja S Coop 11.28 Western Machine Works Inc. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary