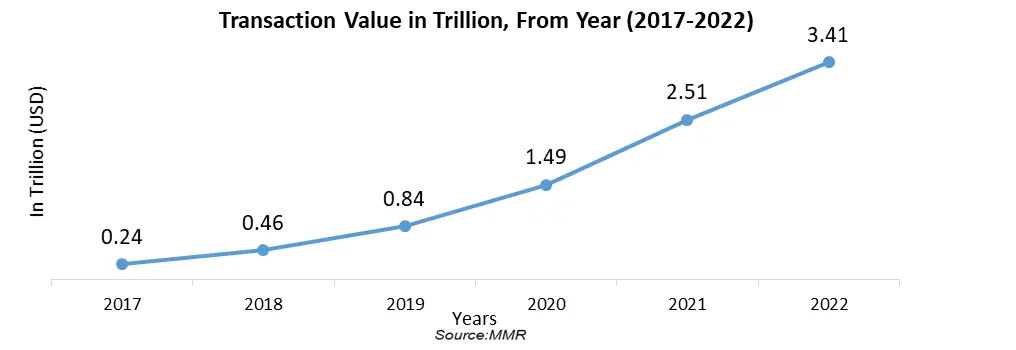

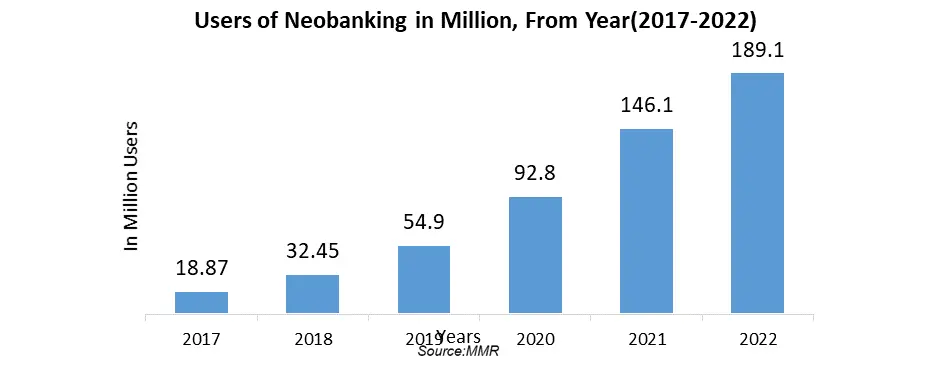

Global Neobanking Market size was valued at USD 68.29 Bn. in 2022 and the total Neobanking revenue is expected to grow by 52.71 % from 2023 to 2029, reaching nearly USD 1322.60 Bn.Neobanking Market Overview:

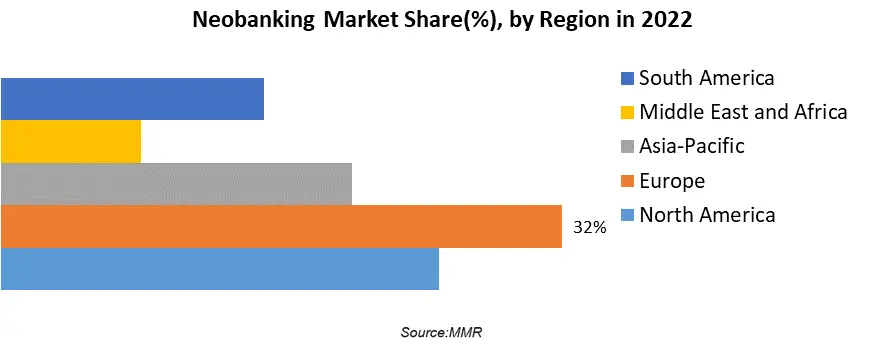

A neobank is a digital-only challenger bank, distinct from traditional banks, operating exclusively in the digital realm. Unlike established conventional banks, neobanks are newly established entities that operate without physical branches, delivering their services through mobile or desktop platforms. Clients are typically onboarded digitally, often through smartphone applications. Neobanks can be categorized into two types those possessing a banking license and those without. Neobanks operate exclusively in the digital space, providing users with the convenience of managing their finances anytime, anywhere. The ability to conduct transactions, check balances, and access a range of financial services through mobile apps or online platforms aligns with the digital lifestyle embraced by many individuals. Europe region dominated the market in the year 2022, whereas the enterprise segment dominated the application segment for the neobanking market. Major market key players such as Chime, Atom Bank PLC, KakaoBank, Monzo, Revolut, Cash App, etc. offer features like real-time spending alerts and budgeting tools, providing various financial services through its mobile platform, and innovative digital banking solutions.To know about the Research Methodology :- Request Free Sample Report Cost Efficiency, Digital Transformation, and Technological Advancements drive the growth of the market Neobanks thrives in the era of digital transformation, offering seamless online and mobile banking experiences, and attracting customers seeking convenience and efficiency. Neobanks often have lower operating costs compared to traditional banks due to their lack of physical branches. This allows them to offer competitive fees or even free services, attracting cost-conscious consumers. The Neobanking market benefits from constant innovation and technological advancements. Features like AI-driven financial insights, real-time transaction tracking, and automated savings tools attract tech-savvy customers. Neobanks are not burdened by legacy systems, enabling them to adapt quickly to market trends and customer needs. This agility is a significant driver in attracting customers seeking modern, flexible financial solutions. Hence, these are the factors that drive the growth of the neobanking market.

Restraints

Security issues, privacy concerns, and Regulatory Challenges can hamper the market Security is the main concern associated with BPO implementation. The growth of the market can be hampered due to a lack of awareness among banks regarding sharing account information and confidential data online. Illegal access to the accounts of users via hacked login credentials creates huge security and privacy concerns among banks. Building trust is crucial in banking, and traditional banks often have a long-established reputation. Neobanks often face regulatory hurdles, as they operate in a tightly regulated financial industry, and face challenges in convincing customers of their reliability and security, especially if they lack a physical presence. While neobanks attract customers with low fees or free services, they must find sustainable ways to monetize their business. Balancing profitability with customer acquisition and retention is a delicate challenge. As a result, these are the reasons that deter the growth of the new banking market.Neobanking Market Opportunity

Partnerships and Ecosystems, Financial Inclusion, and Personalized Services create an opportunity. Neobanks have the opportunity to expand globally without the need for a physical presence in each market. This scalability allows them to reach a broader customer base and diversify their offerings. Collaborations with fintech companies and other non-banking entities offer neobanks the chance to create comprehensive financial ecosystems. By integrating various services, they can enhance customer experience and loyalty. Neobanks play a crucial role in promoting financial inclusion by offering services to unbanked populations. The digital-first approach of neobanking also provides access to financial services for individuals who may not have easy access to traditional banking. Leveraging data analytics and AI, neobanks can offer highly personalized financial advice and services. Tailoring solutions to individual customer needs can enhance customer satisfaction and loyalty. As a result, there is a good opportunity for new entrants and businesses in the neobanking market.

Neobanking Market Segment Analysis

Based on the Service Type, The Mobile Banking segment dominated the Neobanking Market share in the year 2022 accounting for 47% and is expected to dominate the market during the forecast period. The increasing adoption of smartphones and the growing demand for convenient and accessible banking services. The emphasis on digital convenience and accessibility has contributed to the popularity of mobile banking within the neobanking space. Loans segment is rising demand for online lending solutions, particularly among younger generations, is driving this growth. While neobanks primarily focus on deposit and transaction accounts, some have expanded their services to include personal loans, consumer credit, or small business loans. A savings account is also to witness growth during the forecast period. The popularity of digital savings tools is increasing and the need for financial security. typically focus on offering competitive interest rates, low fees, and streamlined account management through digital platforms. Neobanks attract users looking for straightforward and cost-effective solutions for day-to-day banking needs.Based on the Applications, The enterprise segment dominated the market with more than 53.0% market share of the global revenue. The enterprise-related services are asset management, credit management, and transaction management. Several neobank service providers for small and medium enterprises are making efforts to enhance product portfolios through acquisitions aimed at providing a better customer experience. The personal application segment is expected to witness the fastest growth throughout the forecast period. The rate of penetration is high for smartphones which has enabled customers to broadly choose for neobanking services owing to convenience and ease of use. The services are offered using mobile application interfaces, which enable money transfers and payments through the app. The convenience of opening and operating accounts effectively is anticipated to fuel the adoption of neobanking.

Neobanking Market Regional Insights:

The European region dominated the Neobanking Market in the year 2022 with a share of 32.0% of the global revenue. The high rate of smartphone penetration provides a strong foundation for mobile-first neobanks to reach a large customer base. The early adoption of new technologies and the development of multiple innovative technologies contributed to the regional market growth. Companies are strengthing their position in a market by launching product platforms and entering into partnerships. In Europe, traditional banks are frequently seen as slow and to fill this gap neobanks offer innovative and personalized banking products and services, leaving many consumers looking for more easy, convenient, and user-friendly alternatives. North America is the region that is expected to arise as the growing regional market over the forecast period. Technological progression and innovation in this region have increased the growth of the market. Asia-Pacific region is also on the surge of gaining traction. The Easy and convenient banking services and the rise in digital-only banks across countries including Japan, India, and China, are expected to contribute to the regional market growth. The younger generation of the region is expected to be an additional benefit from the adoption of neobanks.

Competitive Landscape

Chime is a neobank that provides online banking services, including fee-free checking and savings accounts. Chime differentiates itself by offering no hidden fees, early direct deposit features, and a user-friendly mobile app, catering to individuals seeking a straightforward banking experience. Monzo is a UK-based neobank known for its mobile banking app, offering features like real-time spending alerts and budgeting tools. Monzo's appeal lies in its user-friendly app, transparent fee structures, and a strong community-driven approach to product development. KakaoBank is a South Korean neobank that operates entirely online, providing various financial services through its mobile platform. KakaoBank leverages its integration with the popular KakaoTalk messaging app, facilitating seamless transactions and creating a comprehensive financial ecosystem. Atom Bank is a digital-only bank based in the United Kingdom, offering a range of banking services through mobile applications. Atom Bank distinguishes itself with innovative digital banking solutions, personalized customer experiences, and a commitment to technological advancements in financial services.The objective of the report is to present a comprehensive analysis of the Neobanking Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors By Region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Neobanking Market dynamics, and structure by analyzing the market segments and projecting the Neobanking Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Neobanking Market makes the report investor’s guide.

Neobanking Market Scope: Inquiry Before Buying

Neobanking Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 68.29 Bn. Forecast Period 2023 to 2029 CAGR: 52.71% Market Size in 2029: US $ 1322.6 Bn. Segments Covered: by Account Type Business Account Saving Account by Service Type Loans Mobile Banking Checking Saving Account Payments and Money Transfer Others by Application Enterprises Personal Neobanking Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Neobanking Market Key Players

1. Cash App [United States] 2. Chime [United States] 3. Atom Bank PLC [United Kingdom] 4. KakaoBank [South Korea] 5. Monzo [United Kingdom] 6. Nubank [Brazil] 7. Revolut [United Kingdom] 8. Starling Bank [United Kingdom] 9. Stocard [Germany] 10. Tinkoff [Russia] 11. Venmo [United States] 12. Fidor Bank Ag [Germany] 13. Monzo Bank Limited [United Kingdom] 14. Movencorp Inc. [United States] 15. Mybank [China] 16. N26 [Germany] 17. Simple Finance Technology Corporation [United States] 18. Ubank Limited [Australia] 19. Webank, Inc. [China] 20. Pockit Ltd [United Kingdom] 21. PRETA S.A.S. [France]Frequently Asked Questions:

1] What segments are covered in the Global Neobanking Market report? Ans. The segments covered in the Neobanking Market report are based on Account Type, Service Type, Application and Region. 2] Which region is expected to hold the highest share of the Global Neobanking Market? Ans. The European region is expected to hold the highest share of the Neobanking Market. The United Kingdom, Germany, and Italy are providing a strong foundation as the rate of smartphone penetration is high. 3] What is the market size of the Global Neobanking Market by 2029? Ans. The market size of the Neobanking Market by 2029 is expected to reach US$ 1322.60 Bn. 4] What is the forecast period for the Global Neobanking Market? Ans. The forecast period for the Neobanking Market is 2023-2029. 5] What was the market size of the Global Neobanking Market in 2022? Ans. The market size of the Neobanking Market in 2022 was valued at US$ 68.29 Bn.

1. Neobanking Market: Research Methodology 2. Neobanking Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Neobanking Market: Dynamics 3.1. Neobanking Market Trends By Region 3.1.1. North America Neobanking Market Trends 3.1.2. Europe Neobanking Market Trends 3.1.3. Asia Pacific Neobanking Market Trends 3.1.4. Middle East and Africa Neobanking Market Trends 3.1.5. South America Neobanking Market Trends 3.2. Neobanking Market Dynamics By Region 3.2.1. North America 3.2.1.1. North America Neobanking Market Drivers 3.2.1.2. North America Neobanking Market Restraints 3.2.1.3. North America Neobanking Market Opportunities 3.2.1.4. North America Neobanking Market Challenges 3.2.2. Europe 3.2.2.1. Europe Neobanking Market Drivers 3.2.2.2. Europe Neobanking Market Restraints 3.2.2.3. Europe Neobanking Market Opportunities 3.2.2.4. Europe Neobanking Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Neobanking Market Drivers 3.2.3.2. Asia Pacific Neobanking Market Restraints 3.2.3.3. Asia Pacific Neobanking Market Opportunities 3.2.3.4. Asia Pacific Neobanking Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Neobanking Market Drivers 3.2.4.2. Middle East and Africa Neobanking Market Restraints 3.2.4.3. Middle East and Africa Neobanking Market Opportunities 3.2.4.4. Middle East and Africa Neobanking Market Challenges 3.2.5. South America 3.2.5.1. South America Neobanking Market Drivers 3.2.5.2. South America Neobanking Market Restraints 3.2.5.3. South America Neobanking Market Opportunities 3.2.5.4. South America Neobanking Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape By Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Analysis of Government Schemes and Initiatives For the Neobanking Market 3.8. The Global Pandemic Impact on the Neobanking Market 4. Neobanking Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Neobanking Market Size and Forecast, By Account Type (2022-2029) 4.1.1. Business Account 4.1.2. Saving Account 4.2. Neobanking Market Size and Forecast, By Service Type (2022-2029) 4.2.1. Loans 4.2.2. Mobile Banking 4.2.3. Checking Saving Account 4.2.4. Payments and Money Transfer 4.2.5. Others 4.3. Neobanking Market Size and Forecast, By Application (2022-2029) 4.3.1. Enterprises 4.3.2. Personal 4.4. Neobanking Market Size and Forecast, By Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Neobanking Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Neobanking Market Size and Forecast, By Account Type (2022-2029) 5.1.1. Business Account 5.1.2. Saving Account 5.2. North America Neobanking Market Size and Forecast, By Service Type (2022-2029) 5.2.1. Loans 5.2.2. Mobile Banking 5.2.3. Checking Saving Account 5.2.4. Payments and Money Transfer 5.2.5. Others 5.3. North America Neobanking Market Size and Forecast, By Application (2022-2029) 5.3.1. Enterprises 5.3.2. Personal 5.4. North America Neobanking Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Neobanking Market Size and Forecast, By Account Type (2022-2029) 5.4.1.1.1. Business Account 5.4.1.1.2. Saving Account 5.4.1.2. United States Neobanking Market Size and Forecast, By Service Type (2022-2029) 5.4.1.2.1. Loans 5.4.1.2.2. Mobile Banking 5.4.1.2.3. Checking Saving Account 5.4.1.2.4. Payments and Money Transfer 5.4.1.2.5. Others 5.4.1.3. United States Neobanking Market Size and Forecast, By Application (2022-2029) 5.4.1.3.1. Enterprises 5.4.1.3.2. Personal 5.4.2. Canada 5.4.2.1. Canada Neobanking Market Size and Forecast, By Account Type (2022-2029) 5.4.2.1.1. Business Account 5.4.2.1.2. Saving Account 5.4.2.2. Canada Neobanking Market Size and Forecast, By Service Type (2022-2029) 5.4.2.2.1. Loans 5.4.2.2.2. Mobile Banking 5.4.2.2.3. Checking Saving Account 5.4.2.2.4. Payments and Money Transfer 5.4.2.2.5. Others 5.4.2.3. Canada Neobanking Market Size and Forecast, By Application (2022-2029) 5.4.2.3.1. Enterprises 5.4.2.3.2. Personal 5.4.3. Mexico 5.4.3.1. Mexico Neobanking Market Size and Forecast, By Account Type (2022-2029) 5.4.3.1.1. Business Account 5.4.3.1.2. Saving Account 5.4.3.2. Mexico Neobanking Market Size and Forecast, By Service Type (2022-2029) 5.4.3.2.1. Loans 5.4.3.2.2. Mobile Banking 5.4.3.2.3. Checking Saving Account 5.4.3.2.4. Payments and Money Transfer 5.4.3.2.5. Others 5.4.3.3. Mexico Neobanking Market Size and Forecast, By Application (2022-2029) 5.4.3.3.1. Enterprises 5.4.3.3.2. Personal 6. Europe Neobanking Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Europe Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.2. Europe Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.3. Europe Neobanking Market Size and Forecast, By Application (2022-2029) 6.4. Europe Neobanking Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.1.2. United Kingdom Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.1.3. United Kingdom Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.2. France 6.4.2.1. France Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.2.2. France Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.2.3. France Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.3.2. Germany Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.3.3. Germany Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.4.2. Italy Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.4.3. Italy Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.5.2. Spain Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.5.3. Spain Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.6.2. Sweden Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.6.3. Sweden Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.7.2. Austria Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.7.3. Austria Neobanking Market Size and Forecast, By Application (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Neobanking Market Size and Forecast, By Account Type (2022-2029) 6.4.8.2. Rest of Europe Neobanking Market Size and Forecast, By Service Type (2022-2029) 6.4.8.3. Rest of Europe Neobanking Market Size and Forecast, By Application (2022-2029) 7. Asia Pacific Neobanking Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.2. Asia Pacific Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.3. Asia Pacific Neobanking Market Size and Forecast, By Application (2022-2029) 7.4. Asia Pacific Neobanking Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.1.2. China Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.1.3. China Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.2.2. S Korea Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.2.3. S Korea Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.3.2. Japan Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.3.3. Japan Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.4. India 7.4.4.1. India Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.4.2. India Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.4.3. India Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.5.2. Australia Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.5.3. Australia Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.6.2. Indonesia Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.6.3. Indonesia Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.7.2. Malaysia Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.7.3. Malaysia Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.8.2. Vietnam Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.8.3. Vietnam Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.9.2. Taiwan Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.9.3. Taiwan Neobanking Market Size and Forecast, By Application (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Neobanking Market Size and Forecast, By Account Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Neobanking Market Size and Forecast, By Service Type (2022-2029) 7.4.10.3. Rest of Asia Pacific Neobanking Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Neobanking Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. Middle East and Africa Neobanking Market Size and Forecast, By Account Type (2022-2029) 8.2. Middle East and Africa Neobanking Market Size and Forecast, By Service Type (2022-2029) 8.3. Middle East and Africa Neobanking Market Size and Forecast, By Application (2022-2029) 8.4. Middle East and Africa Neobanking Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Neobanking Market Size and Forecast, By Account Type (2022-2029) 8.4.1.2. South Africa Neobanking Market Size and Forecast, By Service Type (2022-2029) 8.4.1.3. South Africa Neobanking Market Size and Forecast, By Application (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Neobanking Market Size and Forecast, By Account Type (2022-2029) 8.4.2.2. GCC Neobanking Market Size and Forecast, By Service Type (2022-2029) 8.4.2.3. GCC Neobanking Market Size and Forecast, By Application (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Neobanking Market Size and Forecast, By Account Type (2022-2029) 8.4.3.2. Nigeria Neobanking Market Size and Forecast, By Service Type (2022-2029) 8.4.3.3. Nigeria Neobanking Market Size and Forecast, By Application (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Neobanking Market Size and Forecast, By Account Type (2022-2029) 8.4.4.2. Rest of ME&A Neobanking Market Size and Forecast, By Service Type (2022-2029) 8.4.4.3. Rest of ME&A Neobanking Market Size and Forecast, By Application (2022-2029) 9. South America Neobanking Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 9.1. South America Neobanking Market Size and Forecast, By Account Type (2022-2029) 9.2. South America Neobanking Market Size and Forecast, By Service Type (2022-2029) 9.3. South America Neobanking Market Size and Forecast, By Application (2022-2029) 9.4. South America Neobanking Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Neobanking Market Size and Forecast, By Account Type (2022-2029) 9.4.1.2. Brazil Neobanking Market Size and Forecast, By Service Type (2022-2029) 9.4.1.3. Brazil Neobanking Market Size and Forecast, By Application (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Neobanking Market Size and Forecast, By Account Type (2022-2029) 9.4.2.2. Argentina Neobanking Market Size and Forecast, By Service Type (2022-2029) 9.4.2.3. Argentina Neobanking Market Size and Forecast, By Application (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Neobanking Market Size and Forecast, By Account Type (2022-2029) 9.4.3.2. Rest Of South America Neobanking Market Size and Forecast, By Service Type (2022-2029) 9.4.3.3. Rest Of South America Neobanking Market Size and Forecast, By Application (2022-2029) 10. Global Neobanking Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Neobanking Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Cash App [United States] 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Chime [United States] 11.3. Atom Bank PLC [United Kingdom] 11.4. KakaoBank [South Korea] 11.5. Monzo [United Kingdom] 11.6. Nubank [Brazil] 11.7. Revolut [United Kingdom] 11.8. Starling Bank [United Kingdom] 11.9. Stocard [Germany] 11.10. Tinkoff [Russia] 11.11. Venmo [United States] 11.12. Fidor Bank Ag [Germany] 11.13. Monzo Bank Limited [United Kingdom] 11.14. Movencorp Inc. [United States] 11.15. Mybank [China] 11.16. N26 [Germany] 11.17. Simple Finance Technology Corporation [United States] 11.18. Ubank Limited [Australia] 11.19. Webank, Inc. [China] 11.20. Pockit Ltd [United Kingdom] 11.21. PRETA S.A.S. [France] 12. Key Findings 13. Industry Recommendations