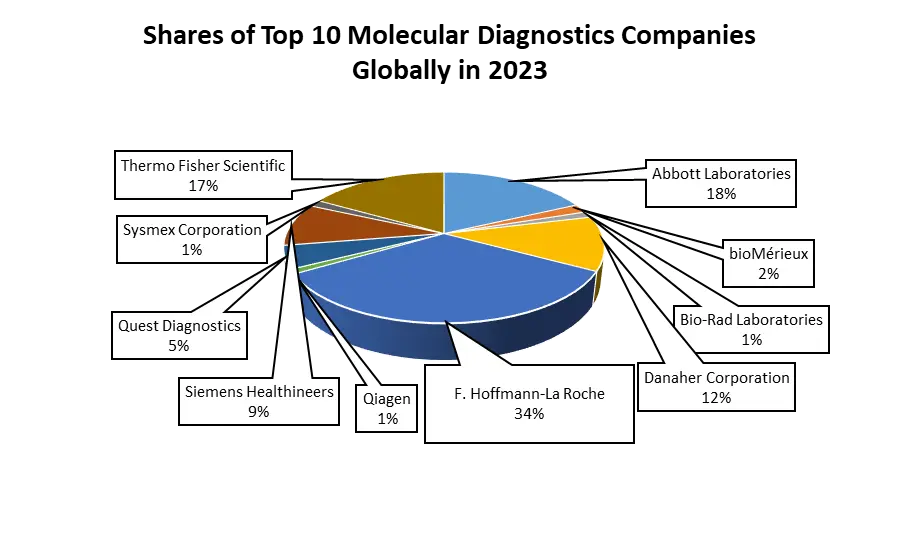

The Molecular Diagnostics Market size was valued at USD 25.17 Billion in 2023 and the total Molecular Diagnostics revenue is expected to grow at a CAGR of 7.14 % from 2024 to 2030, reaching nearly USD 40.79 Billion by 2030. The Molecular Diagnostics Market revolves around the utilization of genetic and proteomic information to detect, diagnose, classify, prognosis, and monitor response to therapy. It integrates molecular biology techniques into medical diagnostics, focusing on genetic polymorphisms and biomarkers in the genome and proteome, assessing gene expression through protein analysis in cells. This field employs powerful methodologies such as PCR-based techniques for bacterial gene detection and quantification of infection-specific proteins using ELISA and proteomics, marking a significant advancement. The Molecular Diagnostics Market leaders such as Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, and Siemens Healthineers have spearheaded recent developments, showcasing innovations in highly sensitive and accurate diagnostic platforms. Rising incidence of infectious diseases and cancers, augmented understanding and acceptance of personalized treatments, and continual advancements in biomarker discovery are major factors which drives the growth of The Molecular Diagnostics Market. Stringent regulatory hurdles for new molecular diagnostic techniques may impede The Molecular Diagnostics Market growth. The Molecular Diagnostics industry is expected a shift toward increased adoption of molecular diagnostics in emerging economies, offering promising prospects for market growth. Recent developments by key players involve the launch of novel platforms and technologies enhancing the scope, accuracy, and applicability of molecular diagnostics across various disease categories, underlining its pivotal role in modern healthcare.To know about the Research Methodology :- Request Free Sample Report

Molecular Diagnostics Market Dynamics:

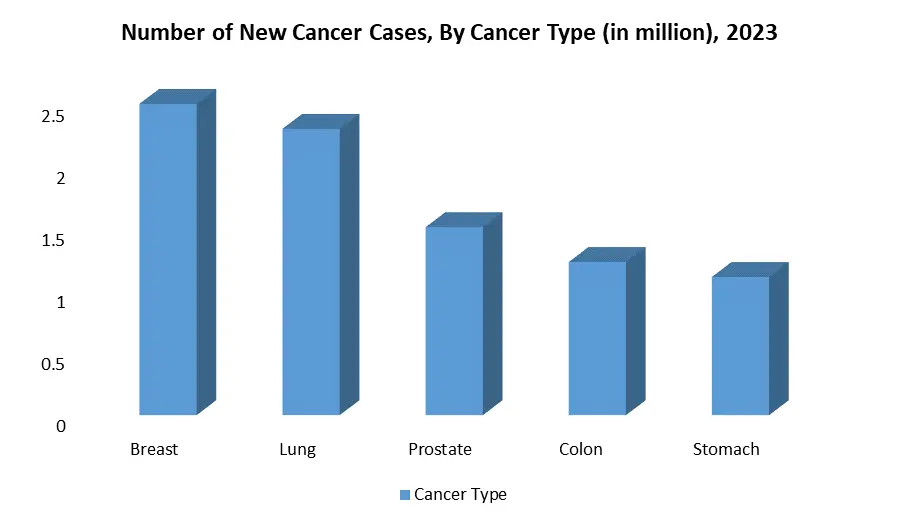

Major Epidemics of the Modern Era as Market Drivers Rising Need for Point-of-Care Diagnostics: The rising demand for Point-of-Care Diagnostics serves as a significant growth driver for the Molecular Diagnostics Market, driven by the increasing frequency of global bacterial and viral epidemics. This rise necessitates rapid and easily accessible diagnostic solutions. For instance, the COVID-19 pandemic catalyzed the need for swift and on-the-spot testing. Technologies such as rapid antigen tests and PCR-based diagnostics emerged as vital tools for immediate disease identification, treatment initiation, and containment efforts, showcasing the Molecular Diagnostics Market response to urgent healthcare needs. Impact of Tuberculosis and Cancer Prevalence: The prevalence of diseases such as Tuberculosis (TB) and cancer, affecting 10.5 million individuals globally in 2023, primarily in countries such as India and China, has boosted the Molecular Diagnostics Market growth. The accuracy and speed of these diagnostic tools are crucial in identifying TB strains, aiding in medication sensitivity analysis, and enabling prompt treatment decisions. The growing global cancer incidence, expected to reach 28 million cases by 2040, underscores the necessity for precise microorganism identification and characterization. Molecular diagnostics, with advancements such as liquid biopsy techniques, play a pivotal role in early cancer detection and personalized treatment strategies, further solidifying its position as an indispensable healthcare tool and driving force behind Molecular Diagnostics Market growth. Better testing detects the organism's strain and medication sensitivity more rapidly, minimizing the time it takes to locate the proper antibiotic. Technological advances, such as polymerase chain reaction (PCR), have also enabled the identification of antibiotic resistance genes and the provision of public health information, such as strain characterization via genotyping. As a result of the aforementioned reasons, the Molecular Diagnostics Market is expected to increase significantly during the forecast period.Understanding Emerging and Re-emerging Infectious Diseases Global epidemics of severe infectious illnesses caused by harmful microorganisms have substantially spurred researchers to create speedy and accurate pathogen detection technologies. Culture-based approaches have traditionally been regarded as gold standards for pathogen detection; however, the lengthy turnaround time associated with these procedures owing to overnight culturing and pathogen isolation limits their use to some extent. The discovery Product & Services of molecular diagnostic tools have sparked a revolution in the diagnosis and surveillance of infectious illnesses in recent years. Initial investments and ongoing expenses pose financial barriers to accessing molecular diagnostics Stringent regulatory requirements hampers the growth of Molecular Diagnostics Market, exemplified by the FDA's rigorous validation procedures during the COVID-19 pandemic, caused delays in approving crucial diagnostic tests such as Ellume's at-home PCR test. These prolonged processes hindered rapid deployment, undermining the market's potential growth despite the tests' effectiveness. Financial barriers, comprising significant initial investments and ongoing expenses, hinder accessibility to molecular diagnostics. For instance, next-generation sequencing (NGS) platforms by Illumina require high initial costs, limiting access for smaller laboratories. Inadequate reimbursement policies further stymie Molecular Diagnostics Market growth. Reimbursement challenges faced by liquid biopsy tests, such as Guardant Health's assays, due to insufficient coverage by insurers, hamper patient access to advanced cancer diagnostics.

The complexity of molecular diagnostic technologies presents a steep learning curve, impeding their widespread implementation. Interpreting genomic data, as seen in Foundation Medicine's comprehensive genomic profiling for precision medicine, demands specialized expertise, restricting routine clinical adoption. Ethical concerns surrounding genetic data misuse, for instance, privacy debates from the unauthorized use of DNA databases such as GEDmatch in criminal investigations, erode patient trust and potentially challenge Molecular Diagnostics Market growth. Understanding the clinical significance of genetic variations identified through whole-genome sequencing, as demonstrated by Genomics England in rare genetic disorder analysis, requires substantial expertise, limiting broader adoption. Fragmentation within the Molecular Diagnostics Market, arising from diverse molecular diagnostic platforms and techniques, hinders standardization and compatibility, impeding seamless integration and interoperability.

Financial Barrier Description High Initial Investment Illumina's Next-Generation Sequencing (NGS) platform costs between $500,000 to $1,000,000, hindering smaller laboratories' affordability. Ongoing Operational Costs Annual expenses for maintaining NGS equipment, estimated at $200,000 - $500,000, adding to financial burden. Skilled Personnel Costs Average annual salary for a molecular diagnostics expert, ranging from $80,000 to $150,000, contributing to high operational costs. Reagent Expenses Annual reagent costs for NGS procedures, estimated at $50,000 - $100,000, adding to the overall financial burden. Training and Education Costs Expenses for specialized training programs in molecular diagnostics, averaging $5,000 - $10,000 per participant, increasing initial investment. Capital Budget Constraints Limited capital budgets allocated for molecular diagnostics, with an average annual budget of $1,000,000 for equipment and resources. Affordability for Smaller Labs Percentage of smaller laboratories unable to afford NGS platforms due to high initial costs, estimated at 40%. Impact on Research Funding Reduction in research grants for molecular diagnostics projects, with a decrease of 20% in funding allocation over the past five years. Cost-Prohibitive Technology Percentage of healthcare institutions limiting adoption due to high costs, with 30% unable to afford advanced molecular diagnostics. Impact on Market Growth Financial barriers leading to a projected 15% decrease in market growth for molecular diagnostics over the next three years. Molecular Diagnostics Market Segment Analysis:

Based on Product & Service, In 2023, the reagents & kits category had the most revenue share of the molecular diagnostics market. It is expected to continue its dominance over the forecast years as a result of its widespread use in research and therapeutic settings. Standard reagents aid in producing efficient and precise outcomes. Standardized outcomes, increased efficiency, and cost-effectiveness are expected to drive market growth. The increased usage of devices to detect coronavirus, which was previously developed for other infectious disorders, is expected to drive market growth. For example, Roche Diagnostics extended its Covid RT-PCR assays offering to the new Cobas 5800 system in countries that obtained the CE mark clearance in February 2022. Based on Test Type, the lab tests category held the greatest proportion of the molecular diagnostics market share. The growing requirement for automation, as well as the increased occurrence of numerous infectious illnesses, are driving the growth of this category. Control is one of the advantages of laboratory testing. Conducting distribution testing in a laboratory setting allows for managing the test intensity level, as well as ensuring regulatory compliance, repeatability, and impartiality. Cost reductions, real-time monitoring, and a shorter time to market. All these factors are expected to drive the growth of lab tests during the forecast period. Based on Technology, the polymerase chain reaction (PCR) category generated the largest revenue in molecular diagnostics. This is due to its Test Type in the diagnosis of COVID-19 and other infectious disorders. The growing use of high-throughput PCR technology to diagnose viral and genetic illnesses boost market growth. DNA sequencing methods and new NGS technologies such as sequencing platforms and RNA sequencing are examples of sequencing technologies for the molecular diagnostics sector. Medication discovery, innovative drug development, and customized treatment are all inextricably related to DNA sequencing technology. Companies are developing novel NGS-based assays for early illness detection. For example, Biodesix announced the launch of its GeneStrat NGSTM Test, a blood-based tumor profiling test, in January 2022, to help clinicians treat advanced lung cancer based on mutations.Based on Application, the Infectious Disease Diagnostics category had the most revenue share of the molecular diagnostics market. The growing use of molecular, particularly PCR assays, for the diagnosis of COVID-19 is the primary cause of this segment's dominance. Traditional testing's shortcomings, such as long turnaround times, poor in vitro kinetic development, difficulties cultivating organisms in manually produced culture medium, and lack of sensitivity, have been mitigated by technology advances such as PCR and ISH. During the forecast period, the oncology segment is predicted to develop at a rapid CAGR. According to WHO, an estimated 19.3 million new cancer cases would be diagnosed globally in 2020, with around 10.0 million cancer deaths. Cancer is predicted to be the second leading cause of mortality in the United States. In January 2022, the British In Vitro Diagnostics Association called for NHS England to create a commissioning framework for molecular diagnostics in cancer. This is done to increase the use and accessibility of cancer molecular diagnostics.

Molecular Diagnostics Market Regional Insights:

North America's Dominance in the Molecular Diagnostics Market North America holds a commanding position in the Molecular Diagnostics market and is expected to maintain its lead in the forecast period. The region's supremacy is attributed to several factors, including significant outbreaks of bacterial and viral diseases, a burgeoning need for point-of-care diagnostics, rapid technological advancements, and the presence of key Molecular Diagnostics market players. During the COVID-19 pandemic, the United States, under the guidance of the Centers for Disease Control and Prevention (CDC), employed advanced diagnostic methods, such as one-step PCR techniques, for COVID-19 diagnosis. The adoption of molecular diagnostics in the United States has transformed disease diagnostics, ensuring timely identification and accurate treatment for critically ill patients. Factors such as increased healthcare spending per capita, advancements in healthcare infrastructure, and a rising incidence of infectious diseases and cancer have boosted a shift towards molecular diagnostics from traditional methods. In Canada, the prevalence of chronic illnesses, especially among the elderly population, is expected to drive the demand for molecular diagnostic testing. Statistics from the Canadian government indicate a significant percentage of the population grappling with prevalent chronic disorders, signaling a growing need for advanced diagnostic solutions. Meanwhile, Europe, while being a significant consumer, actively imports mplecular diagnostic tools to supplement its healthcare capabilities. As for the Asia-Pacific (APAC) region, it stands at the forefront of emerging markets, showcasing rapid growth in molecular diagnostics driven by increasing healthcare expenditure, growing awareness, and a rising demand for advanced healthcare solutions. This regional landscape indicates a symbiotic relationship between North America's production prowess, Europe's consumption patterns, and APAC's emerging market dynamics, fostering a global exchange of expertise and technologies that drive the evolution of molecular diagnostics on a worldwide scale.Molecular Diagnostics Market Competitive Landscapes:

The Molecular Diagnostics Market is highly competitive characterized by dynamic strategies adopted by Molecular Diagnostics key players, focusing on collaborations, acquisitions, product launches, and expansions to drive market growth, especially within the instruments segment. Mylab Discovery Solutions and Hemex Health forged a strategic partnership aimed at developing next-generation diagnostic solutions for Point-of-Care (POC) testing. Hemex's Gazelle POC testing platform combined with Mylab's assay design expertise is poised to bolster the POC molecular diagnostics market, indicating a trend towards innovative partnerships driving segment growth. Similarly, Cepheid's establishment of direct operations in Canada signifies a strategic move to expand its market presence, aiming to augment molecular diagnostic testing adoption in the region, particularly within North America. Pioneering product launches have been instrumental in shaping the competitive landscape. Roche introduced the Cobas 5800 System, enhancing testing accessibility and patient care, particularly in regions accepting the CE mark. Hologic, Inc.'s rollout of the Novodiag Molecular Diagnostic System in Europe signifies a significant advancement in on-demand molecular testing, integrating real-time PCR and DNA microarray capabilities for efficient pathogen identification. Government initiatives have also played a pivotal role, as demonstrated by the US Department of Defense's substantial investment in Qiagen for scaling up COVID-19 Test Kit and Reagent manufacturing, underlining the strategic partnerships between public bodies and industry players to meet crucial testing demands. Strategic acquisitions have also shaped Molecular Diagnostics market dynamics, for instance, Hologic, Inc.'s acquisition of Biotheranostics Inc., a move aimed at broadening their molecular diagnostics portfolio. Partnerships such as Bio-Rad Laboratories Inc.'s collaboration with Seegene Inc., focusing on developing and commercializing infectious disease molecular diagnostic products in the United States, underscore the industry's concerted efforts towards innovation and diversification to address evolving healthcare needs. These multifaceted strategies underscore the competitive landscape's vibrancy, emphasizing a mix of collaborations, product innovations, acquisitions, and partnership to advance molecular diagnostics market globally.

Molecular Diagnostics Market Scope: Inquire before buying

Global Molecular Diagnostics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 25.17 Bn. Forecast Period 2024 to 2030 CAGR: 7.14% Market Size in 2030: US $ 40.12 Bn. Segments Covered: by Product & Service Reagents & Kits Instruments Services & Software by Test Type Lab Tests PoC Tests by Technology Polymerase Chain Reaction (PCR) Isothermal Nucleic Acid Amplification Technology (INAAT) DNA Sequencing & Next- generation Sequencing (NGS) In Situ Hybridization (ISH) DNA Microarrays Other Technologies by Application Infectious Diseases Diagnostics Oncology Testing Genetic Testing Other Test Types by End User Diagnostic Laboratories Hospitals & Clinics Other Molecular Diagnostics Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Molecular Diagnostics Market Key Players:

North America: 1. Abbott Laboratories, Illinois, United States 2. Danaher Corporation, Washington, United States 3. Quest Diagnostics, New Jersey, United States 4. Hologic, Inc., Massachusetts, United States 5. Thermo Fisher Scientific, Massachusetts, United States Europe: 1. bioMérieux, Lyon, France 2. Roche Diagnostics, Basel, Switzerland 3. Siemens Healthineers, Erlangen, Germany 4. QIAGEN, Hilden, Germany Asia-Pacific: 1. Sysmex Corporation, Kobe, Japan 2. BGI Group, Shenzhen, China 3. Biocon, Bangalore, India 4. Mylab Discovery Solutions, Pune, India 5. Trivitron Healthcare, Chennai, India 6. XCyton Diagnostics, Bangalore, India 7. HLL Lifecare Limited, Thiruvananthapuram, IndiaFAQs:

1] What segments are covered in the Global Molecular Diagnostics Market report? Ans. The segments covered in the Molecular Diagnostics Market report are based on Product & Service, Test Type, Technology, Application, End User and Region. 2] Which region is expected to hold the highest share in the Global Molecular Diagnostics Market? Ans. North America region is expected to hold the highest share in the Molecular Diagnostics market. 3] What is the market size of the Global Molecular Diagnostics Market by 2030? Ans. The market size of the Molecular Diagnostics Market by 2030 is expected to reach US$ 40.79 Bn. 4] What is the forecast period for the Global Molecular Diagnostics Market? Ans. The forecast period for the Molecular Diagnostics Market is 2024-2030. 5] What was the market size of the Global Molecular Diagnostics Market in 2023? Ans. The market size of the Molecular Diagnostics Market in 2023 was valued at US$ 25.17 Bn.

1. Molecular Diagnostics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Molecular Diagnostics Market: Dynamics 2.1. Molecular Diagnostics Market Trends by Region 2.1.1. North America Molecular Diagnostics Market Trends 2.1.2. Europe Molecular Diagnostics Market Trends 2.1.3. Asia Pacific Molecular Diagnostics Market Trends 2.1.4. Middle East and Africa Molecular Diagnostics Market Trends 2.1.5. South America Molecular Diagnostics Market Trends 2.2. Molecular Diagnostics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Molecular Diagnostics Market Drivers 2.2.1.2. North America Molecular Diagnostics Market Restraints 2.2.1.3. North America Molecular Diagnostics Market Opportunities 2.2.1.4. North America Molecular Diagnostics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Molecular Diagnostics Market Drivers 2.2.2.2. Europe Molecular Diagnostics Market Restraints 2.2.2.3. Europe Molecular Diagnostics Market Opportunities 2.2.2.4. Europe Molecular Diagnostics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Molecular Diagnostics Market Drivers 2.2.3.2. Asia Pacific Molecular Diagnostics Market Restraints 2.2.3.3. Asia Pacific Molecular Diagnostics Market Opportunities 2.2.3.4. Asia Pacific Molecular Diagnostics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Molecular Diagnostics Market Drivers 2.2.4.2. Middle East and Africa Molecular Diagnostics Market Restraints 2.2.4.3. Middle East and Africa Molecular Diagnostics Market Opportunities 2.2.4.4. Middle East and Africa Molecular Diagnostics Market Challenges 2.2.5. South America 2.2.5.1. South America Molecular Diagnostics Market Drivers 2.2.5.2. South America Molecular Diagnostics Market Restraints 2.2.5.3. South America Molecular Diagnostics Market Opportunities 2.2.5.4. South America Molecular Diagnostics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis for the Molecular Diagnostics Industry 2.8. Analysis of Government Schemes and Initiatives for Molecular Diagnostics Industry 2.9. The Global Pandemic Impact on Molecular Diagnostics Market 3. Molecular Diagnostics Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 3.1.1. Human growth hormone 3.1.2. Erythropoietin 3.1.3. Monoclonal antibodies 3.1.4. Insulin 3.1.5. Granulocyte-colony stimulating factor 3.1.6. Others 3.2. Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 3.2.1. Oncology 3.2.2. Inflammatory 3.2.3. Autoimmune diseases 3.2.4. Chronic diseases 3.2.5. Blood disorders 3.2.6. Growth hormone deficiency 3.2.7. Infectious diseases 3.2.8. Other 3.3. Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 3.3.1. Recombinant DNA Technology 3.3.2. Monoclonal Antibodies (MAb) Technology 3.4. Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospital Pharmacies 3.4.2. Retail Pharmacies 3.4.3. Online Pharmacies 3.5. Molecular Diagnostics Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Molecular Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 4.1.1. Human growth hormone 4.1.2. Erythropoietin 4.1.3. Monoclonal antibodies 4.1.4. Insulin 4.1.5. Granulocyte-colony stimulating factor 4.1.6. Others 4.2. North America Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 4.2.1. Oncology 4.2.2. Inflammatory 4.2.3. Autoimmune diseases 4.2.4. Chronic diseases 4.2.5. Blood disorders 4.2.6. Growth hormone deficiency 4.2.7. Infectious diseases 4.2.8. Other 4.3. North America Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.3.1. Recombinant DNA Technology 4.3.2. Monoclonal Antibodies (MAb) Technology 4.4. North America Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospital Pharmacies 4.4.2. Retail Pharmacies 4.4.3. Online Pharmacies 4.5. North America Molecular Diagnostics Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Human growth hormone 4.5.1.1.2. Erythropoietin 4.5.1.1.3. Monoclonal antibodies 4.5.1.1.4. Insulin 4.5.1.1.5. Granulocyte-colony stimulating factor 4.5.1.1.6. Others 4.5.1.2. United States Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Oncology 4.5.1.2.2. Inflammatory 4.5.1.2.3. Autoimmune diseases 4.5.1.2.4. Chronic diseases 4.5.1.2.5. Blood disorders 4.5.1.2.6. Growth hormone deficiency 4.5.1.2.7. Infectious diseases 4.5.1.2.8. Other 4.5.1.3. United States Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. Recombinant DNA Technology 4.5.1.3.2. Monoclonal Antibodies (MAb) Technology 4.5.1.4. United States Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospital Pharmacies 4.5.1.4.2. Retail Pharmacies 4.5.1.4.3. Online Pharmacies 4.5.2. Canada 4.5.2.1. Canada Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Human growth hormone 4.5.2.1.2. Erythropoietin 4.5.2.1.3. Monoclonal antibodies 4.5.2.1.4. Insulin 4.5.2.1.5. Granulocyte-colony stimulating factor 4.5.2.1.6. Others 4.5.2.2. Canada Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Oncology 4.5.2.2.2. Inflammatory 4.5.2.2.3. Autoimmune diseases 4.5.2.2.4. Chronic diseases 4.5.2.2.5. Blood disorders 4.5.2.2.6. Growth hormone deficiency 4.5.2.2.7. Infectious diseases 4.5.2.2.8. Other 4.5.2.3. Canada Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. Recombinant DNA Technology 4.5.2.3.2. Monoclonal Antibodies (MAb) Technology 4.5.2.4. Canada Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospital Pharmacies 4.5.2.4.2. Retail Pharmacies 4.5.2.4.3. Online Pharmacies 4.5.3. Mexico 4.5.3.1. Mexico Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Human growth hormone 4.5.3.1.2. Erythropoietin 4.5.3.1.3. Monoclonal antibodies 4.5.3.1.4. Insulin 4.5.3.1.5. Granulocyte-colony stimulating factor 4.5.3.1.6. Others 4.5.3.2. Mexico Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Oncology 4.5.3.2.2. Inflammatory 4.5.3.2.3. Autoimmune diseases 4.5.3.2.4. Chronic diseases 4.5.3.2.5. Blood disorders 4.5.3.2.6. Growth hormone deficiency 4.5.3.2.7. Infectious diseases 4.5.3.2.8. Other 4.5.3.3. Mexico Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. Recombinant DNA Technology 4.5.3.3.2. Monoclonal Antibodies (MAb) Technology 4.5.3.4. Mexico Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospital Pharmacies 4.5.3.4.2. Retail Pharmacies 4.5.3.4.3. Online Pharmacies 5. Europe Molecular Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.2. Europe Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.3. Europe Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5. Europe Molecular Diagnostics Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Molecular Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Molecular Diagnostics Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.2. China Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) S Korea 6.5.2.1. S Korea Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Molecular Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Molecular Diagnostics Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.5.2. South Africa Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) GCC 7.5.2.1. GCC Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 8. South America Molecular Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 8.2. South America Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 8.3. South America Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.4. South America Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 8.5. South America Molecular Diagnostics Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil Molecular Diagnostics Market Size and Forecast, by End User (2023-2030)8.5.2. Argentina 8.5.2.1. Argentina Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Molecular Diagnostics Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Molecular Diagnostics Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America Molecular Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America Molecular Diagnostics Market Size and Forecast, by End User (2023-2030) 9. Global Molecular Diagnostics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Molecular Diagnostics Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories, Illinois, United States. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Danaher Corporation, Washington, United States 10.3. Quest Diagnostics, New Jersey, United States 10.4. Hologic, Inc., Massachusetts, United States 10.5. Thermo Fisher Scientific, Massachusetts, United States 10.6. bioMérieux, Lyon, France 10.7. Roche Diagnostics, Basel, Switzerland 10.8. Siemens Healthineers, Erlangen, Germany 10.9. QIAGEN, Hilden, Germany 10.10. Sysmex Corporation, Kobe, Japan 10.11. BGI Group, Shenzhen, China 10.12. Biocon, Bangalore, India 10.13. Mylab Discovery Solutions, Pune, India 10.14. Trivitron Healthcare, Chennai, India 10.15. XCyton Diagnostics, Bangalore, India 10.16. HLL Lifecare Limited, Thiruvananthapuram, India 11. Key Findings 12. Industry Recommendations 13. Molecular Diagnostics Market: Research Methodology