The Molded Case Circuit Breakers Market size was valued at USD 10.64 Billion in 2024 and the total Molded Case Circuit Breakers revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 17.22 Billion.Molded Case Circuit Breakers Market Overview

Molded Case Circuit Breakers are used in power distribution system design primarily to protect low-voltage electrical equipment and circuits. Safe applications requires an understanding of Molded Case Circuit Breakers performance and ratings. Applications of these devices ensure continuity of power during system disturbances. Molded Circuit Breakers are used to protect electrical circuits from over currents and short circuits. Molded Circuit Breakers current rating list includes 16A, 20A, 25A, 32A, 40A, 50A, 63A, 80A, 100A. The main components of Molded Circuit Breakers are the Molding case, Terminals, Operating Apparatus, Trip Unit, and Arc Chamber.To know about the Research Methodology :- Request Free Sample Report

Molded Case Circuit Breakers Market Dynamics

Growing demand for electricity to boost the market growth The demand for electricity continues to increase globally, due to growing need for reliable and safe power distribution systems. Molded Case Circuit Breakers help protect electrical systems from overloads, short circuits, and ground faults, making them an essential component of power distribution systems and this factor is expected to influence the market growth. The need for modern and efficient infrastructure in developing economies is driving the demand for Molded Case Circuit Breakers Market. The construction of new buildings, industrial facilities, and power plants require the installation of MCCBs to ensure the safety and efficiency of electrical systems. Governments and regulatory bodies across the world are implementing stringent safety regulations for electrical systems Molded Case Circuit Breakers play a critical role in ensuring compliance with these regulations, making them an essential component in the construction and maintenance of electrical systems. Technological advancements have led to the development of more efficient and reliable MCCBs. Smart Molded Case Circuit Breakers with digital sensors and communication capabilities are becoming increasingly popular due to their ability to provide real-time information on the status of electrical systems. Increasing demand from end-use industries, including commercial, industrial, and residential sectors and also urbanization and industrialization, is expected to fuel the market growth. Molded Case Circuit Breakers Market Restraints Molded Case Circuit Breakers are more expensive than traditional circuit breakers, which can deter some customers from investing in them and this reason is expected to restrain the market growth. The production of MCCBs requires various raw materials such as copper, aluminum, and plastics. The limited availability of these materials result in increased production costs, which is expected to limit market growth. MCCBs are essential components of power distribution systems, they face competition from other circuit breaker types, such as miniature circuit breakers and air circuit breakers. Despite their importance in power distribution systems, there is limited awareness among end-users, particularly in developing economies, about the benefits of Molded Case Circuit Breakers over other types of circuit breakers. The installation and maintenance of MCCBs require skilled personnel, which can be a challenge in regions where there is a shortage of qualified electrical engineers and technicians and all these factors is expected to hamper the Molded Case Circuit Breakers market growth.Molded Case Circuit Breakers Market Segment Analysis

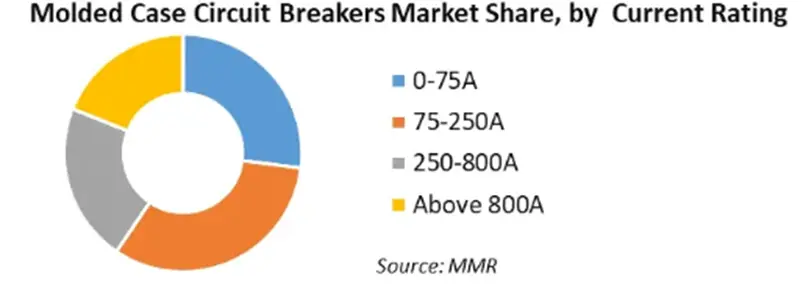

Based on Current Rating, the market is segmented into 0-75A, 75-250A, 250-800A, and above 800A. 0-75A to 75-250A segment dominated the market in 2024 and is expected to continue the dominance over the forecast period. Molded case circuit breakers are mostly used heavy current circuits. The circuits are used in heavy-duty industrial applications. The presence of manufacturers across the globe to produce chemical and electronic products is expected to fuel the demand for Molded Case Circuit Breakers market share. Manufacturers ensure that the circuits are designed and tested to meet various quality, performance, and reference standards & certifications, which helps to increase the market share.

Molded Case Circuit Breakers Market Regional Insight

The Asia Pacific region dominated the market in 2024 and is expected to continue the dominance over the forecast period. The Asia Pacific Molded Case Circuit Breakers Market is a growing market that includes countries such as China, India, Japan, Australia, and others. The market for Molded Case Circuit Breakers in the Asia Pacific region is driven by various factors such as rapid industrialization, urbanization, and the growing demand for electricity. The increasing need for reliable power distribution systems, safety, and efficiency has led to the adoption of Molded Case Circuit Breakers in various applications, including commercial, residential, and industrial sectors and is expected to boost the Molded Case Circuit Breakers market growth. China is the largest market for Molded Case Circuit Breakers in the Asia Pacific region, due to growing economy, and increasing infrastructure development. India is also a significant market for MCCBs, as the country is investing heavily in its power sector to meet the growing demand for electricity. The Asia Pacific Market is expected to continue growing due to the increasing demand for electricity and the need for safe and efficient power distribution systems. The North America Molded Case Circuit Breakers market is a mature market that includes the United States and Canada. MCCBs are electrical protection devices used to protect electrical systems from overloads, short circuits, and ground faults. The market in North America is expected to be driven by factors such as increasing demand for power distribution systems, the need for reliable and safe electrical infrastructure, and the modernization of existing infrastructure. Rise in construction activities in the region, particularly in the commercial and residential sectors, is expected to boost the market growth in the region. The United States is the largest market North America, due to presence of a well-developed infrastructure. Canada is also a significant market for MCCBs, driven by increasing investments in its power sector and the modernization and its well-developed infrastructure. Molded Case Circuit Breakers Market Competitive Landscape Molded Case Circuit Breakers key players are innovating new skills and ideas to acquire the Molded Case Circuit Breakers Market trends over the forecast period. To maintain the competitive edge, the Molded Case Circuit Breakers industry participants are implementing various growth strategies. Innovations, M&A, collaborations, and partnerships are adopted by the key players to thrive in the competitive market and to enhance the Molded Case Circuit Breakers industry penetration to rise the sales of molded case circuit breakers in coming years. Some major key players of the market are Fuji Electric India, Eaton, ABB, C&S Electric, Maxge Electric Technology Co., Ltd, and Tac Automation Pvt. Ltd. Schneider Electric ranges of Molded Case Circuit Breaker devices for industrial applications provide unique and customized solutions depending on the requirement of load. These companies are investing in research and development to improve their product offerings and stay ahead of the competition. In August , Siemens launches new 3VA UL large frame Molded Case Circuit Breaker. They developed a highly flexible MCCB for high current applications to address the need of switchgear manufacturers and panel builders in an environment increasing digitalization. Circuit breaker data is recorded with an accuracy of +/-1% and is transmitted to higher level systems.Molded Case Circuit Breakers Market Scope: Inquire before buying

Molded Case Circuit Breakers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.64 Bn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 17.22 Bn. Segments Covered: by Product Type Miniature Molded-Case by Current Rating 0A-20A 0-75A 75-250A 250-800A Above 800A by End User Power Utilities Industrial Residential Commercial Others Molded Case Circuit Breakers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Molded Case Circuit Breakers key players include

1. Fuji Electric India 2. Eaton 3. ABB 4. C&S Electric 5. Maxge Electric Technology Co., Ltd 6. Tac Automation Pvt. Ltd. 7. Rockwell Automation 8. Chint Group 9. Schneider Electric 10. WEG 11. TERASAKI ELECTRIC CO., LTD. 12. Hitachi Industrial Equipment Systems 13. Maxguard 14. Mitsubishi Electric Corporation 15. Noark Electric 16. GEYA Electrical Equipment Supply 17. JJ Enterprises 18. Nader Circuit Breaker 19. L & T 20. Havells 21. Siemens Frequently Asked Questions: 1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 6.2% over the forecast period. 2] Which region is expected to dominate the Global Molded Case Circuit Breakers Market? Ans. Asia Pacific region is expected to dominate the Market over the forecast period. 3] What is the expected Global Molded Case Circuit Breakers Market size by 2032? Ans. The market size of the Market is expected to reach USD 17.22 Bn by 2032. 4] Who are the top players in the Global Molded Case Circuit Breakers Industry? Ans. The major key players in the Global Molded Case Circuit Breakers Market are Fuji Electric India, Eaton, ABB, C&S Electric, and Maxge Electric Technology Co., Ltd. 5] What was the Global Molded Case Circuit Breakers Market size in 2024? Ans: The Global Molded Case Circuit Breakers Market size was USD 10.64 Billion in 2024.

1. Molded Case Circuit Breakers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Molded Case Circuit Breakers Market: Dynamics 2.1. Molded Case Circuit Breakers Market Trends by Region 2.1.1. North America Molded Case Circuit Breakers Market Trends 2.1.2. Europe Molded Case Circuit Breakers Market Trends 2.1.3. Asia Pacific Molded Case Circuit Breakers Market Trends 2.1.4. Middle East and Africa Molded Case Circuit Breakers Market Trends 2.1.5. South America Molded Case Circuit Breakers Market Trends 2.2. Molded Case Circuit Breakers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Molded Case Circuit Breakers Market Drivers 2.2.1.2. North America Molded Case Circuit Breakers Market Restraints 2.2.1.3. North America Molded Case Circuit Breakers Market Opportunities 2.2.1.4. North America Molded Case Circuit Breakers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Molded Case Circuit Breakers Market Drivers 2.2.2.2. Europe Molded Case Circuit Breakers Market Restraints 2.2.2.3. Europe Molded Case Circuit Breakers Market Opportunities 2.2.2.4. Europe Molded Case Circuit Breakers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Molded Case Circuit Breakers Market Drivers 2.2.3.2. Asia Pacific Molded Case Circuit Breakers Market Restraints 2.2.3.3. Asia Pacific Molded Case Circuit Breakers Market Opportunities 2.2.3.4. Asia Pacific Molded Case Circuit Breakers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Molded Case Circuit Breakers Market Drivers 2.2.4.2. Middle East and Africa Molded Case Circuit Breakers Market Restraints 2.2.4.3. Middle East and Africa Molded Case Circuit Breakers Market Opportunities 2.2.4.4. Middle East and Africa Molded Case Circuit Breakers Market Challenges 2.2.5. South America 2.2.5.1. South America Molded Case Circuit Breakers Market Drivers 2.2.5.2. South America Molded Case Circuit Breakers Market Restraints 2.2.5.3. South America Molded Case Circuit Breakers Market Opportunities 2.2.5.4. South America Molded Case Circuit Breakers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Molded Case Circuit Breakers Industry 2.8. Analysis of Government Schemes and Initiatives For Molded Case Circuit Breakers Industry 2.9. Molded Case Circuit Breakers Market Trade Analysis 2.10. The Global Pandemic Impact on Molded Case Circuit Breakers Market 3. Molded Case Circuit Breakers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Miniature 3.1.2. Molded-Case 3.2. Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 3.2.1. 0A-20A 0-75A 3.2.2. 75-250A 3.2.3. 250-800A 3.2.4. Above 800A 3.3. Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 3.3.1. Power Utilities 3.3.2. Industrial 3.3.3. Residential 3.3.4. Commercial 3.3.5. Others 3.4. Molded Case Circuit Breakers Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Molded Case Circuit Breakers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Miniature 4.1.2. Molded-Case 4.2. North America Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 4.2.1. 0A-20A 0-75A 4.2.2. 75-250A 4.2.3. 250-800A 4.2.4. Above 800A 4.3. North America Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 4.3.1. Power Utilities 4.3.2. Industrial 4.3.3. Residential 4.3.4. Commercial 4.3.5. Others 4.4. North America Molded Case Circuit Breakers Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 4.4.1.1.1. Miniature 4.4.1.1.2. Molded-Case 4.4.1.2. United States Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 4.4.1.2.1. 0A-20A 0-75A 4.4.1.2.2. 75-250A 4.4.1.2.3. 250-800A 4.4.1.2.4. Above 800A 4.4.1.3. United States Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 4.4.1.3.1. Power Utilities 4.4.1.3.2. Industrial 4.4.1.3.3. Residential 4.4.1.3.4. Commercial 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 4.4.2.1.1. Miniature 4.4.2.1.2. Molded-Case 4.4.2.2. Canada Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 4.4.2.2.1. 0A-20A 0-75A 4.4.2.2.2. 75-250A 4.4.2.2.3. 250-800A 4.4.2.2.4. Above 800A 4.4.2.3. Canada Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 4.4.2.3.1. Power Utilities 4.4.2.3.2. Industrial 4.4.2.3.3. Residential 4.4.2.3.4. Commercial 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 4.4.3.1.1. Miniature 4.4.3.1.2. Molded-Case 4.4.3.2. Mexico Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 4.4.3.2.1. 0A-20A 0-75A 4.4.3.2.2. 75-250A 4.4.3.2.3. 250-800A 4.4.3.2.4. Above 800A 4.4.3.3. Mexico Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 4.4.3.3.1. Power Utilities 4.4.3.3.2. Industrial 4.4.3.3.3. Residential 4.4.3.3.4. Commercial 4.4.3.3.5. Others 5. Europe Molded Case Circuit Breakers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.3. Europe Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4. Europe Molded Case Circuit Breakers Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.1.2. United Kingdom Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.1.3. United Kingdom Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.2. France 5.4.2.1. France Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.2.2. France Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.2.3. France Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.3.2. Germany Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.3.3. Germany Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.4.2. Italy Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.4.3. Italy Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.5.2. Spain Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.5.3. Spain Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.6.2. Sweden Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.6.3. Sweden Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.7.2. Austria Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.7.3. Austria Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 5.4.8.2. Rest of Europe Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 5.4.8.3. Rest of Europe Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6. Asia Pacific Molded Case Circuit Breakers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.3. Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4. Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. China Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.1.3. China Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. S Korea Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.2.3. S Korea Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Japan Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.3.3. Japan Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.4. India 6.4.4.1. India Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. India Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.4.3. India Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Australia Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.5.3. Australia Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Indonesia Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.6.3. Indonesia Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Malaysia Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.7.3. Malaysia Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Vietnam Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.8.3. Vietnam Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.9.2. Taiwan Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.9.3. Taiwan Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 6.4.10.3. Rest of Asia Pacific Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 7. Middle East and Africa Molded Case Circuit Breakers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 7.3. Middle East and Africa Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 7.4. Middle East and Africa Molded Case Circuit Breakers Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. South Africa Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 7.4.1.3. South Africa Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. GCC Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 7.4.2.3. GCC Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Nigeria Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 7.4.3.3. Nigeria Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. Rest of ME&A Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 7.4.4.3. Rest of ME&A Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 8. South America Molded Case Circuit Breakers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 8.3. South America Molded Case Circuit Breakers Market Size and Forecast, by End User(2024-2032) 8.4. South America Molded Case Circuit Breakers Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. Brazil Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 8.4.1.3. Brazil Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. Argentina Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 8.4.2.3. Argentina Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Molded Case Circuit Breakers Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Rest Of South America Molded Case Circuit Breakers Market Size and Forecast, by Current Rating (2024-2032) 8.4.3.3. Rest Of South America Molded Case Circuit Breakers Market Size and Forecast, by End User (2024-2032) 9. Global Molded Case Circuit Breakers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Molded Case Circuit Breakers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Fuji Electric India 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Eaton 10.3. ABB 10.4. C&S Electric 10.5. Maxge Electric Technology Co., Ltd 10.6. Tac Automation Pvt. Ltd. 10.7. Rockwell Automation 10.8. Chint Group 10.9. Schneider Electric 10.10. WEG 10.11. TERASAKI ELECTRIC CO., LTD. 10.12. Hitachi Industrial Equipment Systems 10.13. Maxguard 10.14. Mitsubishi Electric Corporation 10.15. Noark Electric 10.16. GEYA Electrical Equipment Supply 10.17. JJ Enterprises 10.18. Nader Circuit Breaker 10.19. L & T 10.20. Havells 10.21. Siemens 11. Key Findings 12. Industry Recommendations 13. Molded Case Circuit Breakers Market: Research Methodology 14. Terms and Glossary