Global Copper Trolley Wires Market size was valued at USD 182.8 Bn in 2022 and is expected to reach USD 370.05 Bn by 2029, at a CAGR of 10.5 %.Copper Trolley Wires Market Overview

Copper Trolley Wires are an important component of electrified transportation systems including electric buses and light rail systems. It is also known as overhead wires. Copper Trolley Wires has been enormous electrical conductivity and resistance to corrosion and thus it is widely used components. It provides an efficient means of electricity transmission to the power of vehicles. The increasing use of Copper Trolley Wires for several applications and increasing investment in infrastructure development boosts Copper Trolley Wires Market growth. For a deeper knowledge of Copper Trolley Wires market penetration, competitive structure, pricing and demand analysis are included in the report The report includes historical data, present and future trends, competitive environment of the Copper Trolley Wires industry. The bottom-up approach was used to estimate the market size.To know about the Research Methodology :- Request Free Sample Report

Copper Trolley Wires Market Dynamics

Increasing use of the Copper Trolley Wires for several applications to boosts the market growth The Copper Trolley Wires are resistant to heat that are eliminated the issues related to overloading and thus they are used in machinery with heavy electrical circuits. Copper is the ductile metal used to produce wires of any thickness and the wires are easily bent or twisted in accordance with the requirements. Due to producing thick as well as thin copper wires, these are used in the electric cable as well as in headphones. The copper trolley wire has high strength and excellent electrical conductivity. Since these are largely preferable for the systems of overhead electrification and support to the Copper Trolley Wires Market growth. For the transmission and distribution of energy, copper is essential in wind turbines due to its malleability and durability properties. Copper trolley wires are used in the healthcare industry in the applications such as surgical closures, endoscopic, orthodontics, orthopedics and surgical instruments and vascular. Professionals in the healthcare sector use copper wire for electrical, cabling mechanical, uses and device/instrument components. As a result, the growing use of Copper Trolley Wires for several applications such as Electric Buses, Railways, Wind Power, Electric Power and Medical Imaging to fuel the Copper Trolley Wires Market growth. Rapid Urbanization, increasing investment and development of the Infrastructure to fuel the market growth The increasing population leads to an increase in the demand for transportation systems such as electric vehicles. With increasing awareness about the advantages of electric vehicles people have been transporting by electric vehicles. Peoples tend to use more environmentally friendly modes of transportation, urbanization has affected how individuals give preference to use electric vehicles. The development of the infrastructure in the electricity, railway systems and automotive sectors. The increasing investment in the expansion of the urban rail networks by many countries resulted in an increasing Copper Trolley Wires Market demand in the railway systems. For example. Indian government plans to set up an effective innovation ecosystem including a free flow of technology to build resilient systems. In June 2022, Minister of Railways, Mr. Ashwini Vaishnaw, launched the Indian Railway Innovation Policy- “Start-ups for Railways”. The ministry aims to know the problems with Indian Railways' dependability, quality and maintenance. With rapid urbanization, growing investment and development of Infrastructure resulted in to increase in the demand for Copper Trolley Wires for electricity and railway systems. Thus, all the factors boost the Copper Trolley Wires Market growth. Copper Trolley Wires Market Trends Increasing shift toward renewable energy sources The growing adoption of renewable energy sources leads to an increase in the integration of the generation of renewable energy with electricity transportation systems. This resulted in developing the hybrid systems where the copper trolley wires are enriching the wind energy. Copper trolley wires are used to ground wind turbines from lightning strikes. Thus wind farms are located in wide-open areas, particularly vulnerable to storms. The rotating blades are used for static electricity build-up. Rising Integration of Smart Technologies The integration of smart technologies including data analytics and sensors supports the enhancements of the maintenance of the systems of the copper trolley wire. This has been used to detect faults, optimize the maintenance schedules and improve the complete system efficiency of the copper trolley wire. For charging and supplying power to an electrically actuated LHD is used to towing the cable system and trolley wire overhead electric supply system. Copper Trolley Wires Market restraints Fluctuations in the copper prices Copper Price is at a current level of 8217.47 and down from 8809.42 months of May 2023 and down from 9377.15 one year ago. This is a change of -6.72% from the months of May 2023 and -12.37% from one year ago. The volatility in copper prices affects the profitability of Copper Trolley Wires manufacturers. The price of copper is majorly influenced by the health of the global economy. This is due to the wide use of Copper Trolley Wires in several sectors of the economy including power generation and transmission. Thus, fluctuation in copper prices restrains the Copper Trolley Wires Market share. The unfavorable impact of the Copper Trolley Wires on the Environment The mining and extraction process of copper has several impacts on environmental sustainability. The procedure of smelting copper produces large volumes of low-concentration sulfur dioxide which is not useful for processing for the elimination of the sulfur. Acid rain happening from the `mixture of SO2 and rain has been causing damage to crops, trees and buildings. Additionally, Respiratory disorders such as asthma and tuberculosis are caused due to inhalation of the silica dust particles during the process of mining as well as extraction of copper.Copper Trolley Wires Market Regional Insights

Technological advancements to boost the Copper Trolley Wires Market share in Asia Pacific Asia Pacific dominated the Copper Trolley Wires Market share in 2022 and is expected to maintain its dominance over the forecast period. The technological advancements in electrification solutions and smart grids support the Market growth. In smart grids, copper trolley wires are largely used due to their high strength and durability. The vehicle grid integration transfers unused power from the vehicle into the smart grid and for the transmission of the power the Copper Trolley Wires are preferable to use. As a result, technhnolocal advancement fuels regional market growth. The regional Copper Trolley Wires market share is also boosted due to the increasing use of Copper Trolley Wires in electric buses, wind power, rapid industrialization and urbanization, growing population and increasing awareness about renewable energy sources. The rising government initiatives in electric mobility due to the growing adoption of electric vehicles in developing economies such as China, India and Japan and increasing investment in the electric transportation infrastructure are also influencing factors for the regional market growth. North America is expected to have significant growth for the Copper Trolley Wires Market during the forecast period. The increasing government initiatives in transportation solutions, infrastructure development, integration in renewable energy and strict safety regulation for the transportation infrastructure are the growth drivers for the regional market.Copper Trolley Wires Market Segment Analysis

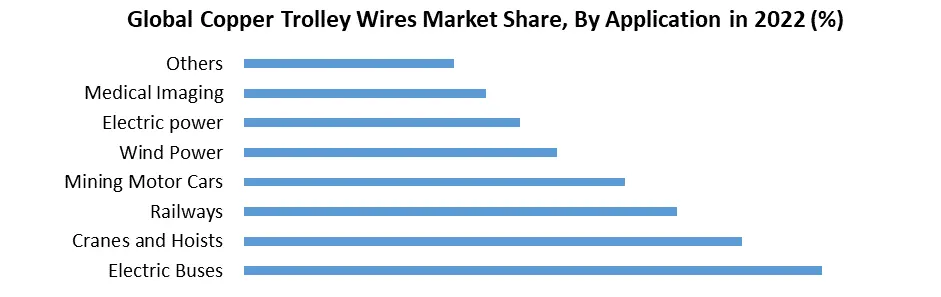

Based on the Type, the Copper Trolley Wires market is categorized into Solid Copper Wire, Stranded Copper Wire, Copper-Clad Copper Wire and Copper-Nickel Copper Wire. Solid Copper wires held the market in 2022 with the highest CAGR. Solid Copper Wire is a heavier and thicker product as compared to standard copper wire. It has weather resistant, strong, anti-corrosive and inexpensive. It is used for the grounding and solid cable wire is used for the home electrical wiring and wiring for breadboards. Solid cables are good electrical conductors which provide stable electrical characteristics. It is largely used in outdoor applications where the requirement in the building is due to its high current capacity and durability. The increasing demand for solid copper wire for electrical wiring, plumbing, roofing and industrial machines drives the segment growth.On the basis of the Applications, the Copper Trolley Wires market is segmented into Electric Buses, Cranes and Hoists, Railways, Mining Motor Cars, Wind Power, Electric power, Medical Imaging and Others. The electric buses segment dominated the market in 2022 and is expected to continue its dominance over the forecast period. The copper Trolley Wires are used to provide electric streetcars and power to buses. The copper trolley wires are used to transmit the electricity from the power grid to the electric buses and these wires are environment friendly. The increase in the use of copper Trolley Wires offers efficient as well as reliable power to vehicles and reduces pollution. All the factors contributing the segment growth.

Copper Trolley Wires Market Competitive Landscape

The report offers Competitive benchmarking of the Copper Trolley Wires industry through Copper Trolley Wires Market revenue, share and size of the key players. The report provides such type of competitive landscape of all Copper Trolley Wires Key Players to assist new market entrants. It also gives information about the analysis of the Competitive Landscape in the Copper Trolley Wires Market structure, highlighting the key players and their strategies. Some of the key players are Service Wire Co., Prysmian Group, Fujikura Ltd, Sumitomo Electric, southern company LLC, The Furukawa electric co. ltd, Bolden Inc., KEI industries, International Wire, cords cable industries ltd, Amphenol and others. Many of the key players conducted research and development activities to enhance their product portfolio. South Wire’s SCR systems offer more than half of the copper rod continuous-casting capacity in the world. The equipment manufacturer produces electrolytic tough pitch (ETP) copper rods. From the very beginning, they have been improving their systems for lower-cost production, high reliability and simplified operation - and sharing that knowledge with our customers. Lamisil has developed a continuous casting process to provide pre-material for high-performance conductors, meeting NEMA WC 67, AS22759, AS29606, MIL-DTL-25038 and CW106C standards. The high-performance conductors need high flex life, 92 percent IACS conductivity, high tensile strength in soft conditions (Rm=414 Mpa), 6% elongation and high thermal stability. The high-performance conductors were particularly developed for aviation, and they have found their way to other markets including medical applications, robotics, electronics and defenses.Copper Trolley Wires Market Scope: Inquire before buying

Copper Trolley Wires Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 182.8 Bn. Forecast Period 2023 to 2029 CAGR: 10.5% Market Size in 2029: US $ 370.05 Bn. Segments Covered: by Type 1. Solid Copper Wire 2. Stranded Copper Wire 3. Copper-Clad Copper Wire 4. Copper-Nickel Copper Wire by Application 1. Electric Buses 2. Cranes and Hoists 3. Railways 4. Mining Motor Cars 5. Wind Power 6. Electric power 7. Medical Imaging 8. Others by End-Use 1. Automotive 2. Aerospace/Aviation 3. Energy 4. pharmaceuticals 5. Others Copper Trolley Wires Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Copper Trolley Wires Key players

1. Service Wire Co. 2. Prysmian Group 3. Fujikura ltd 4. Sumitomo Electric 5. southern company llc 6. The Furukawa electric co. ltd 7. Bolden Inc. 8. KEI industries 9. International Wire 10. cords cable industries ltd 11. Amphenol 12. Siemens AG 13. Nexans SA 14. Lamifil NV 15. Watteredge LLC 16. Alfanar Group 17. OthersFrequently Asked Questions:

1] What is the growth rate of the Global Copper Trolley Wires Market? Ans. The Global Copper Trolley Wires Market is growing at a significant rate of 10.5 % during the forecast period. 2] Which region is expected to dominate the Global Copper Trolley Wires Market? Ans. North America is expected to dominate the Copper Trolley Wires Market during the forecast period. 3] What is the expected Global Copper Trolley Wires Market size by 2029? Ans. The Copper Trolley Wires Market size is expected to reach USD 370.05 Bn by 2029. 4] Which are the top players in the Global Copper Trolley Wires Market? Ans. The major top players in the Global Copper Trolley Wires Market are Service Wire Co., Prysmian Group, Fujikura Ltd, Sumitomo Electric, southern company LLC, The Furukawa electric co. ltd, Bolden Inc., KEI industries, International Wire, cords cable industries ltd, Amphenol and others. 5] What are the factors driving the Global Copper Trolley Wires Market growth? Ans. Increasing use of Copper Trolley Wires for several applications and rapid urbanization and industrialization are expected to drive market growth during the forecast period.

1. Copper Trolley Wires Market: Research Methodology 2. Copper Trolley Wires Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Copper Trolley Wires Market: Dynamics 3.1 Copper Trolley Wires Market Trends by Region 3.1.1 Global Copper Trolley Wires Market Trends 3.1.2 North America Copper Trolley Wires Market Trends 3.1.3 Europe Copper Trolley Wires Market Trends 3.1.4 Asia Pacific Copper Trolley Wires Market Trends 3.1.5 Middle East and Africa Copper Trolley Wires Market Trends 3.1.6 South America Copper Trolley Wires Market Trends 3.2 Copper Trolley Wires Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Copper Trolley Wires Market Drivers 3.2.1.2 North America Copper Trolley Wires Market Restraints 3.2.1.3 North America Copper Trolley Wires Market Opportunities 3.2.1.4 North America Copper Trolley Wires Market Challenges 3.2.2 Europe 3.2.2.1 Europe Copper Trolley Wires Market Drivers 3.2.2.2 Europe Copper Trolley Wires Market Restraints 3.2.2.3 Europe Copper Trolley Wires Market Opportunities 3.2.2.4 Europe Copper Trolley Wires Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Copper Trolley Wires Market Market Drivers 3.2.3.2 Asia Pacific Copper Trolley Wires Market Restraints 3.2.3.3 Asia Pacific Copper Trolley Wires Market Opportunities 3.2.3.4 Asia Pacific Copper Trolley Wires Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Copper Trolley Wires Market Drivers 3.2.4.2 Middle East and Africa Copper Trolley Wires Market Restraints 3.2.4.3 Middle East and Africa Copper Trolley Wires Market Opportunities 3.2.4.4 Middle East and Africa Copper Trolley Wires Market Challenges 3.2.5 South America 3.2.5.1 South America Copper Trolley Wires Market Drivers 3.2.5.2 South America Copper Trolley Wires Market Restraints 3.2.5.3 South America Copper Trolley Wires Market Opportunities 3.2.5.4 South America Copper Trolley Wires Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Copper Trolley Wires Industry 3.8 The Global Pandemic and Redefining of The Copper Trolley Wires Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Copper Trolley Wires Trade Analysis (2017-2022) 3.11.1 Global Import of Copper Trolley Wires 3.11.2 Global Export of Copper Trolley Wires 3.12 Global Copper Trolley Wires Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Copper Trolley Wires Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Copper Trolley Wires Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 4.1.1 Solid Copper Wire 4.1.2 Stranded Copper Wire 4.1.3 Copper-Clad Copper Wire 4.1.4 Copper-Nickel Copper Wire 4.2 Global Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 4.2.1 Electric Buses 4.2.2 Cranes and Hoists 4.2.3 Railways 4.2.4 Mining Motor Cars 4.2.5 Wind Power 4.2.6 Electric power 4.2.7 Medical Imaging 4.2.8 Others 4.3 Global Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 4.3.1 Automotive 4.3.2 Aerospace/Aviation 4.3.3 Energy 4.3.4 pharmaceuticals 4.3.5 Others 4.4 Global Copper Trolley Wires Market Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Copper Trolley Wires Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 5.1.1 Solid Copper Wire 5.1.2 Stranded Copper Wire 5.1.3 Copper-Clad Copper Wire 5.1.4 Copper-Nickel Copper Wire 5.2 North America Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 5.2.1 Electric Buses 5.2.2 Cranes and Hoists 5.2.3 Railways 5.2.4 Mining Motor Cars 5.2.5 Wind Power 5.2.6 Electric power 5.2.7 Medical Imaging 5.2.8 Others 5.3 North America Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 5.3.1 Automotive 5.3.2 Aerospace/Aviation 5.3.3 Energy 5.3.4 pharmaceuticals 5.3.5 Others 5.4 North America Copper Trolley Wires Market Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 5.4.1.1.1 Solid Copper Wire 5.4.1.1.2 Stranded Copper Wire 5.4.1.1.3 Copper-Clad Copper Wire 5.4.1.1.4 Copper-Nickel Copper Wire 5.4.1.2 United States Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 5.4.1.2.1 Electric Buses 5.4.1.2.2 Cranes and Hoists 5.4.1.2.3 Railways 5.4.1.2.4 Mining Motor Cars 5.4.1.2.5 Wind Power 5.4.1.2.6 Electric power 5.4.1.2.7 Medical Imaging 5.4.1.2.8 Others 5.4.1.3 United States Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 5.4.1.3.1 Automotive 5.4.1.3.2 Aerospace/Aviation 5.4.1.3.3 Energy 5.4.1.3.4 pharmaceuticals 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 5.4.2.1.1 Solid Copper Wire 5.4.2.1.2 Stranded Copper Wire 5.4.2.1.3 Copper-Clad Copper Wire 5.4.2.1.4 Copper-Nickel Copper Wire 5.4.2.2 Canada Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 5.4.2.2.1 Electric Buses 5.4.2.2.2 Cranes and Hoists 5.4.2.2.3 Railways 5.4.2.2.4 Mining Motor Cars 5.4.2.2.5 Wind Power 5.4.2.2.6 Electric power 5.4.2.2.7 Medical Imaging 5.4.2.2.8 Others 5.4.2.3 Canada Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 5.4.2.3.1 Automotive 5.4.2.3.2 Aerospace/Aviation 5.4.2.3.3 Energy 5.4.2.3.4 pharmaceuticals 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 5.4.3.1.1 Solid Copper Wire 5.4.3.1.2 Stranded Copper Wire 5.4.3.1.3 Copper-Clad Copper Wire 5.4.3.1.4 Copper-Nickel Copper Wire 5.4.3.2 Mexico Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 5.4.3.2.1 Electric Buses 5.4.3.2.2 Cranes and Hoists 5.4.3.2.3 Railways 5.4.3.2.4 Mining Motor Cars 5.4.3.2.5 Wind Power 5.4.3.2.6 Electric power 5.4.3.2.7 Medical Imaging 5.4.3.2.8 Others 5.4.3.3 Mexico Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 5.4.3.3.1 Automotive 5.4.3.3.2 Aerospace/Aviation 5.4.3.3.3 Energy 5.4.3.3.4 pharmaceuticals 5.4.3.3.5 Others 6. Europe Copper Trolley Wires Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.2 Europe Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.3 Europe Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4 Europe Copper Trolley Wires Market Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.1.2 United Kingdom Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.1.3 United Kingdom Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.2 France 6.4.2.1 France Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.2.2 France Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.2.3 France Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.3.2 Germany Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.3.3 Germany Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.4.2 Italy Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.4.3 Italy Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.5.2 Spain Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.5.3 Spain Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.6.2 Sweden Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.6.3 Sweden Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.7.2 Austria Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 6.4.7.3 Austria Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 6.4.8.2 Rest of Europe Copper Trolley Wires Market Size and Forecast, By Application (2022-2029). 6.4.8.3 Rest of Europe Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7. Asia Pacific Copper Trolley Wires Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.2 Asia Pacific Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.3 Asia Pacific Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4 Asia Pacific Copper Trolley Wires Market Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.1.2 China Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.1.3 China Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.2.2 S Korea Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.2.3 S Korea Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.3.2 Japan Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.3.3 Japan Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.4 India 7.4.4.1 India Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.4.2 India Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.4.3 India Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.5.2 Australia Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.5.3 Australia Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.6.2 Indonesia Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.6.3 Indonesia Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.7.2 Malaysia Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.7.3 Malaysia Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.8.2 Vietnam Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.8.3 Vietnam Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.9.2 Taiwan Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.9.3 Taiwan Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.10.2 Bangladesh Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.10.3 Bangladesh Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.11.2 Pakistan Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.11.3 Pakistan Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 7.4.12.2 Rest of Asia PacificCopper Trolley Wires Market Size and Forecast, By Application (2022-2029) 7.4.12.3 Rest of Asia Pacific Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8. Middle East and Africa Copper Trolley Wires Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.2 Middle East and Africa Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.3 Middle East and Africa Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8.4 Middle East and Africa Copper Trolley Wires Market Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.4.1.2 South Africa Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.4.1.3 South Africa Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.4.2.2 GCC Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.4.2.3 GCC Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.4.3.2 Egypt Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.4.3.3 Egypt Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.4.4.2 Nigeria Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.4.4.3 Nigeria Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 8.4.5.2 Rest of ME&A Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 8.4.5.3 Rest of ME&A Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 9. South America Copper Trolley Wires Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 9.2 South America Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 9.3 South America Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 9.4 South America Copper Trolley Wires Market Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 9.4.1.2 Brazil Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 9.4.1.3 Brazil Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 9.4.2.2 Argentina Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 9.4.2.3 Argentina Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Copper Trolley Wires Market Size and Forecast, By Type (2022-2029) 9.4.3.2 Rest Of South America Copper Trolley Wires Market Size and Forecast, By Application (2022-2029) 9.4.3.3 Rest Of South America Copper Trolley Wires Market Size and Forecast, By End-Use (2022-2029) 10. Global Copper Trolley Wires Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Copper Trolley Wires Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Service Wire Co. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Prysmian Group 11.3 Fujikura ltd 11.4 Sumitomo Electric 11.5 southern company llc 11.6 The Furukawa electric co. ltd 11.7 Bolden Inc. 11.8 KEI industries 11.9 International Wire 11.10 cords cable industries ltd 11.11 Amphenol 11.12 Siemens AG 11.13 Nexans SA 11.14 Lamifil NV 11.15 Watteredge LLC 11.16 Alfanar Group 11.17 Others 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary