Medical Ceramics Market was valued at US$ 19.45 Bn. in 2022. The global Medical Ceramics Market size is expected to grow at a CAGR of 5.3 % through the forecast period.Medical Ceramics Market Overview:

An alternative name for ceramics is inorganic non-metallic materials. Ceramics can be used in a variety of ways. Medical ceramics is one of them. Human body components can be repaired or rebuilt primarily using medical bio-ceramics. Such substances come in powder, coating, and bulk form. The two families of bio-ceramics—bioinert and bioactive—are commonly used to categorize them. The property of time-dependent etc., alteration of the surface upon implantation is a feature shared by all medicinal ceramics. Additionally, it has a predisposition to naturally generate a biologically functional carbonate hydroxyapatite layer, which acts as a strong bonding layer for the living tissue.To know about the Research Methodology :- Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023-2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. The past five years' trends are considered while forecasting the market through 2029. 2022 is a year of exception and analysis, especially with the impact of lockdown by region.

Medical ceramics Market Dynamics:

Renewed attention to implantable technology: Artificial devices known as medical implants are used to replace missing or damaged biological components. In a variety of uses, implants aid in the delivery of medication, the monitoring of bodily processes, and the support of organs and tissues (such as dental, orthopedic, and cardiovascular). The market for medical implants is propelled by the aging population's increasing healthcare needs, technological developments in the medical field, and the rise in chronic illnesses such as osteoarthritis, cardiovascular disease, neuropathic diseases, and congenital disorders, among others. Dental implants (enamels, fillings, prosthetics, and orthodontics), cardiovascular implants (heart valves, pacemakers, catheters, grafts, and stents orthoperiodic implants (artificial hips, knees, shoulders, wrists, fracture fixation, and bone grafts), and hearing implants are among the many implantable devices that utilize medical ceramics as essential components (cochlear implants). The use of medical ceramics is likely to rise in the upcoming years due to the rising need for implantable devices across many industries (such as cardiovascular, dentistry, and orthopedics) ]Stringent clinical & regulatory processes: Clinical trials are costly and time-consuming processes involved in the development of medical ceramic goods. These goods must meet ISO biocompatibility testing requirements and be biocompatible because they will be put inside of people. Companies and investors are wary of investing in this market since it is challenging to predict biocompatibility until the later stages of clinical studies. Additionally, the clearance process for medical ceramic goods is difficult, expensive, and time-consuming due to regulatory procedures that are complex, constrictive, and dependent on the composition of ceramics and their intended applications. These elements are expected to limit the market for medical ceramics' growth to some extent. Emerging market: The healthcare sector is growing quickly in emerging regions, which presents the potential for manufacturers of medical ceramics. The BRICS countries—Brazil, Russia, India, China, and South Africa—have some of the quickest economies in the world. By 2020, the World Economic Forum predicts that these developing nations would pay for almost one-third of all medical expenses. The demand for medical facilities and equipment in these nations will expand due to the growing elderly population, which is expected to fuel the growth of the medical ceramics market. Additionally, the development of these markets can be largely ascribed to the low cost of dental care in these nations when compared to rich economies and the advancement of their infrastructure. Dental crowns, for instance, are USD 2,000 in the US and USD 1,000 in the UK. Issuing with process and recycling: There are too many Challenges with processes for recycling and reparability in medical ceramic structures that are challenging to discover faults. The components of the ceramic matrix are also exceedingly difficult to inspect for interior cracks or wear and strain. The problem of reparability is further highlighted by the lack of skilled labor/ force and appropriate repair methods. Although they have a lengthy lifespan, medical ceramics cannot be recycled. The varied composites used in various end-use applications encounter issues with recyclability and reparability because of the longest life span and various mechanical and optical qualities of medical ceramics.Medical ceramics Market Segment Analysis:

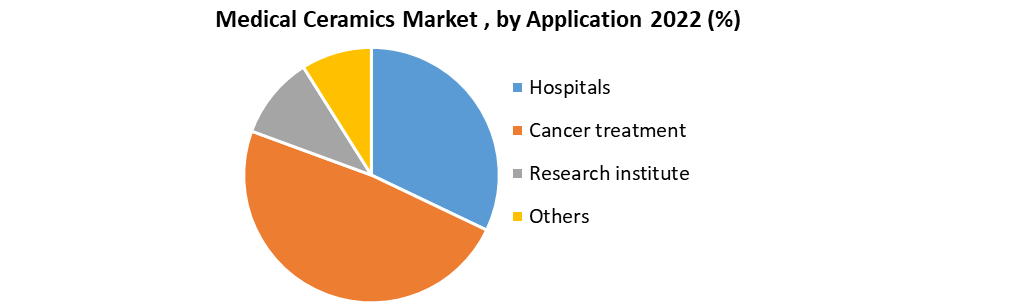

Based on Type: Natural Medical ceramics The market for medical ceramics can be further divided into brazing alloys, bio-active ceramics (tricalcium phosphate, hydroxyapatite, calcium phosphate), bio-Inert ceramics (silicon nitride, zirconia, alumina, pyrolytic carbon, and others), piezo ceramics, bioresorbable, and other categories based on the type of material used. The segment with the biggest share in 2022 was bioinert ceramics. Due to their exceptional chemical stability, these materials are being used more frequently to restore damaged tissues or organs in patients' bodies. The durability, biocompatibility, and corrosion control, on the other hand, are impressive. Due to their extreme strength and a broad range of uses, zirconia ceramics outperform other materials. It is frequently utilized in dental procedures Based on the Application, The Application of medical ceramics can be further divided into hospitals, cancer treatment centers, ASCs, research institutes, and others based on the end-user. In 2022, the hospital sector had the largest proportion. Hospitals serve as peoples' initial point of contact, therefore the need for in-hospital surgical treatments is growing as a result of the enormous rise in cardiovascular illnesses and musculoskeletal difficulties. Hospitals are thought of as highly developed medical facilities that offer comprehensive care. Additionally, the availability of top-tier doctors guarantees that patients will receive safe therapies. Similar to this, the hospital segment is likely to develop at the fastest rate, with a CAGR of 6.8% from 2022 to 2029.

Regional Insights:

Asia Pacific market registers the highest growth for the medical ceramics market with 58.7% market share in 2022. the APAC medical ceramics market is likely to expand quickly during the period. In consideration of the growth of the healthcare market in the area, China, South Korea, and Japan are the region's top three medical ceramics buyers. Huge growth prospects exist for Hap makers in the area as a result of the region's aging population, rising disposable income, technical advancements, and expanding awareness of viable therapies. The fact that China and India have sizable aging populations as well as the fact that Japan has the second-largest healthcare market in the world all contribute to the possibility for medical ceramics makers. South Korea's reputation as the world's center for plastic surgery also presents chances for market participants. The objective of the report is to present a comprehensive analysis of the global Medical Ceramics Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Medical Ceramics Market dynamic, and structure by analyzing the market segments and projecting the Medical Ceramics Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Medical Ceramics Market make the report investor’s guide.Medical ceramics Market Scope: Inquiry Before Buying

Medical ceramics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 19.45 Bn. Forecast Period 2023 to 2029 CAGR: 5.3% Market Size in 2029: US$ 27.93 Bn. Segments Covered: by Type Brazing alloys Bio-active ceramics Bio inert ceramics Piezo ceramics by Application Hospitals Cancer treatment Research institute Others Medical ceramics market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. 3M Company 2. CeramTec GmbH 3. CoorsTek, Inc. 4. DePuy Synthes 5. H.C. Starck GmbH 6. Koninklijke DSM NV 7. Kyocera Corporation 8. Morgan Advanced Materials PLC 9. Ingredion 10. NGK Spark Plug Co., Ltd. 11. Rauschert GmbH & Co., 12. Straumann 13. 3M Health Care 14. Dental Services Group 15. Ceram tec gmbh 16. Tosoh 17. Johnson & Johnson 18. Royal DSM 19. Zimmer Biomat Frequently Asked Questions: 1] What segments are covered in the Global Medical ceramics Market report? Ans. The segments covered in the Global Medical ceramics Market report are based on Product Type and application. 2] Which region is expected to hold the highest share in the Global Medical Ceramics Market? Ans. The Asia Pacific region is expected to hold the highest share in the Global Medical Ceramics Market. 3] What is the market size of the Global Medical ceramics Market by 2029? Ans. The market size of the Global Medical ceramics Market by 2029 is expected to reach US$ 27.93 Bn. 4] What is the forecast period for the Global Medical Ceramics Market? Ans. The forecast period for the Global Medical Ceramics Market is 2023-2029. 5] What was the market size of the Global Medical ceramics Market in 2022? Ans. The market size of the Global Medical ceramics Market in 2022 was valued at US$ 19.45 Bn.

1. Global Medical ceramics market Size: Research Methodology 2. Global Medical ceramics market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Medical ceramics market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Medical ceramics market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • The Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Medical ceramics Market Size Segmentation 4.1. Global Medical ceramics Market Size, by Type (2022-2029) • Brazing alloys • Bio-active ceramics • bio-inert ceramics • Piezo ceramics 4.2. Global Medical ceramics Market Size, by Application (2022-2029) • Hospitals • Cancer treatment • Research institute • Others 5. North America Medical ceramics market (2022-2029) 5.1. North America Medical Ceramics Market Size, by Type (2022-2029) 5.1.1. Brazing alloys 5.1.2. Bio-active ceramics 5.1.3. bio-inert ceramics 5.1.4. Piezo ceramics 5.2. North America Medical Ceramics Market Size, by Application (2022-2029) 5.2.1. Hospitals 5.2.2. Cancer treatment 5.2.3. Research institute 5.2.4. Others 5.3. North America Semiconductor Memory Market, by Country (2022-2029) • The United States • Canada • Mexico 6. Europe Medical ceramics market (2022-2029) 6.1. Europe Medical ceramics market, by Type (2022-2029) 6.2. Europe Medical ceramics market, by Application (2022-2029) 6.3. Europe Medical ceramics market, by Country (2022-2029) • The UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Medical ceramics market (2022-2029) 7.1. Asia Pacific Medical ceramics market, by Type (2022-2029) 7.2. Asia Pacific Medical ceramics market, by Application (2022-2029) 7.3. Asia Pacific Medical ceramics market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASIAN • Rest Of APAC 8. The Middle East and Africa Medical ceramics market (2022-2029) 8.1. The Middle East and Africa Medical ceramics market, by Type (2022-2029) 8.2. The Middle East and Africa Medical ceramics market, by Application (2022-2029) 8.3. The Middle East and Africa Medical ceramics market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Medical ceramics market (2022-2029) 9.1. South America Medical ceramics market, by Type (2022-2029) 9.2. South America Medical ceramics market, by Application (2022-2029) 9.3. South America Medical ceramics market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. 3M company 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. CeramTec GmbH 10.3. CoorsTek, Inc. 10.4. DePuy Synthes 10.5. H.C. Starck GmbH 10.6. Koninklijke DSM NV 10.7. Kyocera Corporation 10.8. Morgan Advanced Materials PLC 10.9. Ingredion 10.10. NGK Spark Plug Co., Ltd. 10.11. Rauschert GmbH & Co., 10.12. Straumann 10.13. 3M Health Care 10.14. Dental Services Group 10.15. Ceram tec gmbh 10.16. Tosoh 10.17. Johnson & Johnson 10.18. Royal DSM 10.19. Zimmer Biomat