The Mayonnaise Market size was valued at USD 11.50 Billion in 2022 and the total Mayonnaise revenue is expected to grow at a CAGR of 14.5% from 2023 to 2029, reaching nearly USD 15.34 Billion.Mayonnaise Market Overview

Mayonnaise, a blend including vegetable oil, acidifying agents, and eggs, stands as a widely consumed staple globally. Recent trends indicate a shift towards innovative formulations, substituting eggs with plant-based components and replacing conventional vegetable oils with healthier alternatives. This shift has spurred the exploration of various ingredients and their properties for the production of plant-based mayonnaise market. These innovative mayonnaises offer improved nutritional and functional qualities, supporting the surging demand for healthier, plant-based alternatives, and reflecting the growing appeal of these products within the food industry.To know about the Research Methodology :- Request Free Sample Report The mayonnaise market constitutes a versatile segment within the condiment industry, defined by its texture and taste, commonly used in various cuisines worldwide. The growth of the market is influence includes a surge in health-conscious consumer trends, spurring demand for healthier alternatives such as low-fat, organic, and natural ingredient-based mayonnaises. Additionally, flavor innovations and diverse product offerings, including herb-infused, spicy, or specialty variants, contribute to market growth by catering to evolving consumer tastes. Asia-Pacific regions are witnessing a rapid rise in the mayonnaise market, driven by an increased adoption of mayonnaise in diverse cuisines, and South America, experiencing a growing preference for traditional mayonnaise variants infused with local flavors. The mayonnaise market continues to expand globally, driven by a convergence of health-conscious consumer preferences, flavor diversification, and increasing adoption in the mayonnaise Market.

Mayonnaise Market Dynamics:

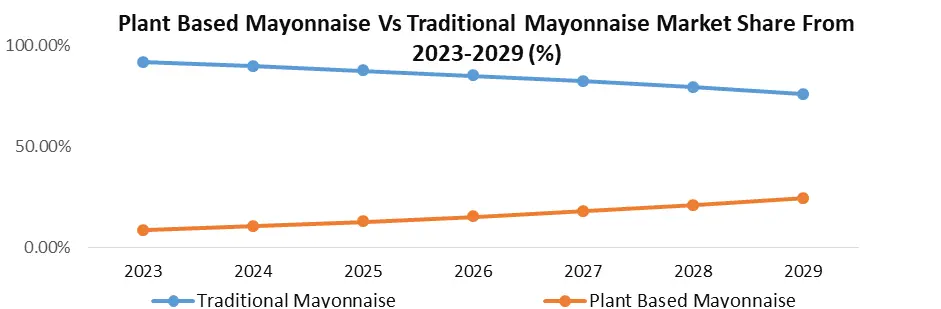

Increasing Adoption of Fat-Free Content and Technological Advancements The increasing demand for healthier and more convenient food options has significantly impacted the mayonnaise market. Consumers now seek mayonnaise products that not only maintain the beloved taste and texture but also align with their health-conscious preferences and busy lifestyles. As a result, there's a growing interest in reduced-fat or fat-free mayonnaise variants that offer lower calorie content without compromising flavor. Additionally, consumers are seeking mayonnaise options made from natural, clean-label ingredients, often preferring those without artificial additives or preservatives. Portability and convenience also play a crucial role, leading to the popularity of single-serve or portable packaging options that cater to on-the-go consumption. Manufacturers are responding to this demand by innovating with formulations that reduce fat content, incorporate healthier ingredients, and provide convenient packaging solutions, thereby meeting the evolving needs of health-conscious and time-strapped consumers in the mayonnaise market.The mayonnaise market is witnessing a surge in demand for sustainable and fat-free alternatives, encouraging severe exploration by food technologists and companies to innovate while preserving taste and texture. Various pioneering technologies have emerged to address this endeavor. High-pressure processing (HPP) plays a pivotal role in modifying ingredient structure and creating lower-fat mayonnaise. Many Industry market players are using high-pressure processing for fat-free content to stand out, leveraging elevated pressures and creating lower-fat mayonnaise while ensuring the desired texture and taste. These innovations hold promise, prompting continuous modifications by companies to offer healthier alternatives that maintain the taste and texture of traditional mayonnaise. Growing Demand For Plant-Based Mayonnaise The trend toward increased demand for plant-based mayonnaise is reshaping the landscape of the market. This surge is driven by shifting consumer preferences towards more sustainable and plant-centric diets. Plant-based mayonnaise offerings cater to a diverse range of dietary needs, appealing to vegans, vegetarians, and those seeking alternatives to traditional egg-based mayonnaise. The rising awareness of environmental sustainability and ethical considerations further propels this trend, prompting consumers to opt for plant-derived ingredients over animal-based ones. Manufacturers are responding to this demand by innovating with a variety of plant sources such as soy, pea protein, avocado oil, or aquafaba (chickpea brine), creating flavorful and creamy plant-based mayonnaise options that not only meet dietary preferences but also offer a healthier alternative to conventional mayonnaise. As this trend gains momentum, it signifies a significant shift in consumer choices and a growing emphasis on sustainable, plant-forward options within the mayonnaise market. Traditional mayonnaise is expected to maintain its dominant position despite the rising popularity of plant-based alternatives. While traditional mayonnaise will likely retain a significant market share, plant-based mayonnaise is forecasted to experience continuous and robust growth.

Mayonnaise Market Segment Analysis:

By Type, the Flavored mayonnaise segment dominated the global Mayonnaise market with the highest market share of 43% in 2022. The segment is further expected to grow at a CAGR of 4.3% and maintain its dominance during the forecast period. Thanks to its diverse properties range of mayonnaises infused with various flavors, including garlic, herb, spicy, and specialty blends are widely adopted to cater to evolving consumer preferences for unique taste experiences, and diverse culinary applications are driving a substantial increase in the demand for flavoured moyonnaise, thereby driving segment growth. Their ability to promote healthier food options and the rising cost of traditional mayonnaise drives the segment's growth. With customization options and a promising future in the food and beverages industry, the flavored segment is expected to continue to increase the Mayonnaise market growth during the forecast period. The unflavoured mayonnaise segment is expected to grow at a significant CAGR and offer lucrative growth opportunities for the Mayonnaise market players during the forecast period. Unflavoured mayonnaise is characterized by its unique blend of properties, including its classic appeal, neutral taste, and foundational ingredient across diverse culinary applications. This versatility makes it a go-to choice for consumers and professional chefs, offering a black canvas for various flavor enhancements that are gaining traction in the mayonnaise industry. The increasing awareness of its versatile applications and the ongoing technological advancement are expected to be the major factors driving the segment's growth.The flavored segment encapsulates a vibrant spectrum of mayonnaises infused with diverse tastes, ranging from zesty herbs to piquant spices, catering to the evolving palates of consumers seeking unique culinary experiences. Meanwhile, the unflavored segment encompasses the classic mayonnaise variant, valued for its neutrality and versatility. Acting as a culinary chameleon, unflavored mayonnaise serves as a foundational ingredient adaptable to various flavor enhancements or as a standalone condiment, appealing to those seeking a traditional, multi-purpose condiment. These two segments offer consumers a choice between the adventurous and the timeless, catering to diverse tastes and culinary preferences.

Mayonnaise Market Regional Insights:

The North American region led the global Mayonnaise market with the highest market share of 42% in 2022. The region is further expected to grow at a CAGR of 4.6% during the forecast period and maintain its dominance by 2029. The increasing demand for a variety of mayonnaise products, shaped by evolving consumer preferences and a focus on health-conscious choices expected to be the major factor driving the North American mayonnaise Market. The United States is expected to be the key region for the Mayonnaise Market. Mayonnaise holds a significant place in American cuisine, widely used in sandwiches, salads, dips, and various recipes. Traditionally, the market has been dominated by established brands offering classic mayonnaise variants. According to the MMR analysis, there has been a shift in consumer preferences toward healthier options, and cleaner-label products with natural ingredients witnessed robust growth in the region from 2021 to 2029.Canada, further expected to be a significant player in the North American mayonnaise market, also contributes to the regional growth of the Mayonnaise market. The Canadian Food industry is marked by a diversified and export-oriented sector, which manufactures a wide range of historically favored classic mayonnaise variants. This sector thrives on continuous product innovations and draws upon organic options leading to increased demand for healthier alternatives, further driving Canada’s Mayonnaise market growth. The Europe region, with countries like Germany, France, and the United Kingdom is emerging as a vital player in the Mayonnaise market. Rapid urbanization, rising disposable incomes, and changing consumer preferences are expected to be the major factors driving the demand for the mayonnaise market. Supermarkets and Hypermarkets are witnessing substantial growth thanks to increasing demand for flavored and unflavored mayonnaise market. Germany in particular, is becoming a hub for Mayonnaise production due to its large population base and low manufacturing costs, thereby supporting market growth. Mayonnaise Market Competitive Landscapes: The Global Mayonnaise market is expected to be highly competitive with the active presence of numerous small and large market players. Major companies are striving to introduce product differentiation and advanced technological innovative products to meet the increasing demand, consequently fostering overall market growth. In addition, the Mayonnaise industry's growth is significantly influenced by research and development of products and technological advancements. A list of manufacturers in the mayonnaise industry is adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Mayonnaise market. For instance, 1. Unilever acquired Sir Kensington’s, a US-based producer of premium mayonnaise products in 2022. This acquisition will help Unilever expand its presence in the US premium mayonnaise market. 2.J.M. Smucker acquired Auguste’s, a Canadian producer of artisanal mayonnaise products in 2022. This acquisition will help J.M.Smucker expand its presence in the Canadian market and broaden its product portfolio. 3.In 2021, Kraft Heinz announced a partnership with Unilever to develop a new line of sustainable mayonnaise products. The two companies use their combined expertise to develop products that are made with recycled materials and have a reduced environmental impact. 4. Conagra Brands announced a partnership with J.M. Smucker to develop a new line of organic products in 2020. The two companies leverage their combined resources to develop products that meet the growing demand for organic food products.

Mayonnaise Market Scope: Inquire Before Buying

Global Mayonnaise Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 11.50 Bn. Forecast Period 2023 to 2029 CAGR: 4.2% Market Size in 2029: US $ 15.34 Bn. Segments Covered: by Type Flavoured UnFlavored by Packaging Type Bottles Pouches Others by Distribution Channel Supermarkets and Hypermarkets Convenience stores Online Retailers Others Mayonnaise Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Mayonnaise Market Key Players:

1. Nestlé SA 2. Ajinomoto Co., Inc. 3. McCormick & Company, Inc. 4. Kraft Heinz Company 5. Unilever PLC 6. Dr. Oetker 7. American Garden 8. Cibona Foods 9. Del Monte 10. Duke'S 11. Kenko Mayonnaise 12. Ken'S Foods 13. Mrs. Bector'S Cremica 14. Oasis Foods 15. Remia International 16. Scandic Food India 17. Stokes Sauces 18. Tina 19. C.F. Sauer Company (Duke’s) 20. EFKO Group 21. AAK Foodservice 22. Ros Agro Group 23. Kewpie Corp. 24. Cremica Food 25. Essen Production AG FAQs: 1. What are the growth drivers for the Mayonnaise market? Ans. The rising demand for technological advancement, with a particular focus on organic, fat-free, and plant-based is expected to be the major driver for the Mayonnaise market. 2. What is the major restraint on the Mayonnaise market growth? Ans. High Cost of Production is expected to be the major restraining factor for the Mayonnaise market growth. 3. Which region is expected to lead the global Mayonnaise market during the forecast period? Ans. North America is expected to lead the global Mayonnaise market during the forecast period. 4. What is the projected market size & and growth rate of the Mayonnaise Market? Ans. The Mayonnaise Market size was valued at USD 11.50 Billion in 2022 and the total Mayonnaise revenue is expected to grow at a CAGR of 4.2% from 2023 to 2029, reaching nearly USD 15.34 Billion. 5. What segments are covered in the Mayonnaise Market report? Ans. The segments covered in the Mayonnaise market report are Type, Packaging Type, Distribution Channel and Region.

1. Mayonnaise Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Mayonnaise Market: Dynamics 2.1. Preference Analysis 2.2. Mayonnaise Market Trends by Region 2.2.1. North America Mayonnaise Market Trends 2.2.2. Europe Mayonnaise Market Trends 2.2.3. Asia Pacific Mayonnaise Market Trends 2.2.4. Middle East and Africa Mayonnaise Market Trends 2.2.5. South America Mayonnaise Market Trends 2.3. Mayonnaise Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Mayonnaise Market Drivers 2.3.1.2. North America Mayonnaise Market Restraints 2.3.1.3. North America Mayonnaise Market Opportunities 2.3.1.4. North America Mayonnaise Market Challenges 2.3.2. Europe 2.3.2.1. Europe Mayonnaise Market Drivers 2.3.2.2. Europe Mayonnaise Market Restraints 2.3.2.3. Europe Mayonnaise Market Opportunities 2.3.2.4. Europe Mayonnaise Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Mayonnaise Market Drivers 2.3.3.2. Asia Pacific Mayonnaise Market Restraints 2.3.3.3. Asia Pacific Mayonnaise Market Opportunities 2.3.3.4. Asia Pacific Mayonnaise Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Mayonnaise Market Drivers 2.3.4.2. Middle East and Africa Mayonnaise Market Restraints 2.3.4.3. Middle East and Africa Mayonnaise Market Opportunities 2.3.4.4. Middle East and Africa Mayonnaise Market Challenges 2.3.5. South America 2.3.5.1. South America Mayonnaise Market Drivers 2.3.5.2. South America Mayonnaise Market Restraints 2.3.5.3. South America Mayonnaise Market Opportunities 2.3.5.4. South America Mayonnaise Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Value Chain - Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For the Mayonnaise Industry 2.9. Analysis of Government Schemes and Initiatives For the Mayonnaise Industry 2.10. The Global Pandemic's Impact on Mayonnaise Market 2.11. Mayonnaise Price Trend Analysis (2021-22) 3. Mayonnaise Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2022-2029) 3.1. Mayonnaise Market Size and Forecast, by Type (2022-2029) 3.1.1. Flavoured 3.1.2. UnFlavored 3.2. Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 3.2.1. Bottles 3.2.2. Pouches 3.2.3. Others 3.3. Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Supermarkets and Hypermarkets 3.3.2. Convenience stores 3.3.3. Online Retailers 3.3.4. Others 3.4. Mayonnaise Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Mayonnaise Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 4.1. North America Mayonnaise Market Size and Forecast, by Type (2022-2029) 4.1.1. Flavoured 4.1.2. UnFlavored 4.2. North America Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 4.2.1. Bottles 4.2.2. Pouches 4.2.3. Others 4.3. North America Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Supermarkets and Hypermarkets 4.3.2. Convenience stores 4.3.3. Online Retailers 4.3.4. Others 4.4. North America Mayonnaise Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Mayonnaise Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Flavoured 4.4.1.1.2. UnFlavored 4.4.1.2. United States Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 4.4.1.2.1. Bottles 4.4.1.2.2. Pouches 4.4.1.2.3. Others 4.4.1.3. United States Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Supermarkets and Hypermarkets 4.4.1.3.2. Convenience stores 4.4.1.3.3. Online Retailers 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Mayonnaise Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Flavoured 4.4.2.1.2. UnFlavored 4.4.2.2. Canada Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 4.4.2.2.1. Bottles 4.4.2.2.2. Pouches 4.4.2.2.3. Others 4.4.2.3. Canada Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Supermarkets and Hypermarkets 4.4.2.3.2. Convenience stores 4.4.2.3.3. Online Retailers 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Mayonnaise Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Flavoured 4.4.3.1.2. UnFlavored 4.4.3.2. Mexico Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 4.4.3.2.1. Bottles 4.4.3.2.2. Pouches 4.4.3.2.3. Others 4.4.3.3. Mexico Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Supermarkets and Hypermarkets 4.4.3.3.2. Convenience stores 4.4.3.3.3. Online Retailers 4.4.3.3.4. Others 5. Europe Mayonnaise Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 5.1. Europe Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.2. Europe Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.3. Europe Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Mayonnaise Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.1.3. United Kingdom Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.2.3. France Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.3.3. Germany Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.4.3. Italy Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.5.3. Spain Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.6.3. Sweden Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.7.3. Austria Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Mayonnaise Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 5.4.8.3. Rest of Europe Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Mayonnaise Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 6.1. Asia Pacific Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.3. Asia Pacific Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Mayonnaise Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.1.3. China Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.2.3. S Korea Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.3.3. Japan Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.4.3. India Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.5.3. Australia Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.6.3. Indonesia Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.7.3. Malaysia Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.8.3. Vietnam Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8.4. Vietnam Mayonnaise Market Size and Forecast, by Industry Vertical(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.9.3. Taiwan Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Mayonnaise Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Mayonnaise Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 7.1. Middle East and Africa Mayonnaise Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 7.3. Middle East and Africa Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Mayonnaise Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Mayonnaise Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 7.4.1.3. South Africa Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Mayonnaise Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 7.4.2.3. GCC Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Mayonnaise Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 7.4.3.3. Nigeria Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Mayonnaise Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 7.4.4.3. Rest of ME&A Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Mayonnaise Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029 8.1. South America Mayonnaise Market Size and Forecast, by Type (2022-2029) 8.2. South America Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 8.3. South America Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. South America Mayonnaise Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Mayonnaise Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 8.4.1.3. Brazil Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Mayonnaise Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 8.4.2.3. Argentina Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Mayonnaise Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Mayonnaise Market Size and Forecast, Packaging Type (2022-2029) 8.4.3.3. Rest Of South America Mayonnaise Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Mayonnaise Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Mayonnaise Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nestlé SA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ajinomoto Co., Inc. 10.3. McCormick & Company, Inc. 10.4. Kraft Heinz Company 10.5. Unilever PLC 10.6. Dr. Oetker 10.7. American Garden 10.8. Cibona 10.9. Del Monte 10.10. Duke'S 10.11. Kenko Mayonnaise 10.12. Ken'S Foods 10.13. Mrs. Bector'S Cremica 10.14. Oasis Foods 10.15. Remia 10.16. Scandic Food India 10.17. Stokes Sauces 11. Key Findings 12. Industry Recommendations 13. Mayonnaise Market: Research Methodology