The Global Marine Lubricants Market was valued at USD 6.42 billion in 2022 and is projected to reach USD 8.02 billion by 2029, growing at a CAGR of 3.2% from 2023 to 2029.Overview and Scope

The marine lubricants market is expanding due to increased demand for effective lubrication solutions in the maritime sector. Marine lubricants are essential for optimal performance and longevity of marine equipment and engines by reducing friction, wear and corrosion. Market research report on marine lubricants covering production, distribution, consumption and growth potential. Market analysis of global trade, fleet growth, regulations and technology. The market report covers overview, trends, opportunities and challenges. Marine lubricants market grows due to demand for high-performance, eco-friendly lubricants that boost fuel efficiency. Eco-friendly lubricants that reduce emissions and promote sustainability are a top priority for consumers, while also improving operational efficiency. Market researchers are developing new formulations, fuel compatibility and lubricant solutions to improve equipment performance in the marine industry. Analyse marine lubricants market trends, growth projections, industry segmentation and competitive landscape for a complete understanding. Evaluates strategies, products, market shares and M&A potential of leading manufacturers. Considers global economy and regulations impacting market dynamics. Report on marine lubricants market analysis with emphasis on sustainability, innovation and consumer preferences. Assists stakeholders in making informed decisions and maintaining competitiveness. Evaluates adoption of eco-friendly practises in the industry such as waste reduction, recycling and renewable resource utilisation. Report assesses consumer demand for ethical and cruelty-free lubricants and responsible consumption. Market trends and consumer preferences shape strategies, products and branding for eco-conscious consumers. Market analysis informs stakeholders' decisions. Report aids stakeholders in comprehending market dynamics and devising sustainable growth strategies by examining trends, drivers, challenges and opportunities. This study analyses market segmentation, competition, regional regulations and emerging trends. Enables stakeholders to capitalise on opportunities, improve market presence and foster innovation in marine lubricants. Global marine lubricants market report analysing sustainability, innovation and consumer preferences. Industry stakeholders can gain valuable insights on market trends, growth projections, competitive landscape and regulatory dynamics from this resource. Analysis drives growth and success in marine lubricants market.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics

Marine lubricants market expands due to diverse factors. Increased demand for lubrication solutions in maritime industry is crucial. Marine lubricants need improvement to enhance equipment performance, reliability and reduce friction, wear and corrosion due to increased shipping and tech advancements. Eco-friendly lubricants are in demand due to regulations on emissions and fuel efficiency. Marine lubricants market is being shaped by key trends. Eco-lubricants are becoming more popular. Researching bio-based lubricants from renewable sources with better biodegradability and lower toxicity than petroleum-based lubricants. Market trend: Innovative products to address industry demands (e.g., lubricants for new engines, alternative fuels, environmental regulations). Market has various drivers and opportunities. Increased international trade and shipping fuel demand for lubricants in container ships, tankers and bulk carriers. New opportunities for lubricant manufacturers with offshore wind farms and cruise industry expansion. Increased ship tech adoption and demand for improved equipment reliability and performance fuel market expansion. Challenges face the marine lubricants industry. Complying with changing environmental regulations is a major challenge. Special lubricants needed to meet emission control areas and sulphur limits while maintaining performance. Challenges stem from costly R&D, testing and certifications. Product differentiation and customer relationships are crucial in a competitive market. Marine lubricants market has growth potential despite challenges. Collaborating with shipyards, distributors and online platforms can expand market reach and accessibility. Bio-based lubricants and eco-friendly practises can give companies a competitive edge by meeting the demand for sustainable products. Innovative products and value-added services drive market growth. Offerings include customised lubricants, eco-friendly fuels, technical assistance and maintenance services. The global marine lubricants market is propelled by the need for effective lubrication solutions in the maritime sector and adherence to environmental regulations. Top trends: sustainability, innovation and compliance with industry standards. Regulatory complexities and intense competition pose challenges. Possible business opportunities: broaden distribution, create sustainable products, customise offerings to meet industry needs. Manufacturers must adapt to regulations, differentiate from competitors and provide excellent customer service to succeed.Global Marine Lubricants Market Segment Analysis

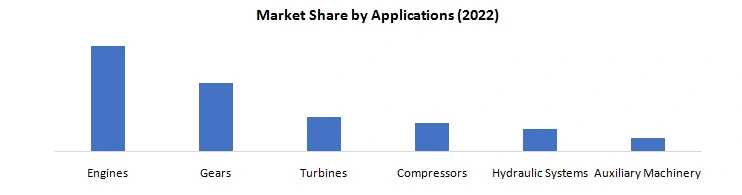

Marine lubricants market segmentation is crucial for comprehending consumer preferences and regional disparities. Segments: lubricant, application, vessel, channel, end-user and region. Segmentation helps manufacturers tailor their offerings and strategies to the market. Marine lubricants are categorised into mineral oil-based, synthetic and bio-based types. Various types have distinct properties and uses, meeting diverse needs in the maritime sector. Marine lubricants are used in various applications such as engines, gears, turbines, compressors, hydraulic systems and auxiliary machinery. Vessels require different lubricants based on their specs and operating conditions. Types of ships include containers, tankers, bulk carriers, offshore support vessels and cruise ships. Distribution channels are crucial in the marine lubricants market. Distribution channel market segments: direct sales, distributors, online platforms, shipyards. Understanding user preferences and convenience is vital for effective lubricant distribution and availability. Market segments for marine lubricants include commercial shipping, offshore industries, fishing vessels, navy and recreational boating. Segment-specific lubricants optimise performance, reliability and regulatory compliance.Geographical segmentation is important due to regional variations in demand, regulations and market dynamics. Marine lubricant market segments: North America, Europe, Asia-Pacific, South America, Middle East and Africa. Regional variances affect demand for marine lubricants. Segmentation analysis aids in creating targeted marketing, customised products and efficient distribution for manufacturers. Manufacturers customise products to meet specific needs by understanding diverse preferences in different segments and regions. Customised lubricants may be necessary for specific applications, vessels, or clients. Customised packaging and branding meet consumer demands for convenience and sustainability. Regional adaptation and segment-specific alignment are key to penetrating the marine lubricants industry. Segmentation analysis enhance manufacturers' competitiveness in a changing market. Segment-specific customization of products, packaging, marketing and distribution strategies is critical for long-term success in the marine lubricants market.

Regional Analysis

Regional factors impact marine lubricants market. Regional preferences are important for manufacturers to meet market demands. NA is a growing market for marine lubricants due to health concerns and eco-friendly options. Increased demand for eco-lubricants in the US due to strict environmental regulations. Demand for eco-friendly marine lubricants is high in the region due to a focus on sustainability and clean technologies. Europe leads global marine lubricants market with focus on sustainability and regulations. Top countries promoting eco-friendly lubricants and alternative fuels: Germany, Netherlands, Norway. High demand for modern marine lubricants due to strong maritime industry and eco-friendly focus. High growth potential for marine lubricants market in Asia Pacific. Urbanisation, maritime trade and new shipbuilding hubs drive demand for quality lubricants. Japan's advanced shipping industry requires specialised lubricants for optimal performance and fuel efficiency. MEA's marine lubricants market has distinct challenges and opportunities. Lubricants needed for shipping hub in extreme conditions. Top markets in the area: UAE, Saudi Arabia, South Africa. Increased investments in port infrastructure and offshore industries are boosting the marine lubricants market.Potential growth for marine lubricants in South America. Growing maritime trade and offshore activities in Brazil, Mexico and Chile drive demand for specialised lubricants in the region. Growing demand for eco-friendly marine lubricants in the region due to sustainability and compliance with global environmental norms. Regional analysis helps manufacturers with marketing, product portfolio and distribution. Manufacturers need to comprehend regional requirements and preferences to tailor their products. Developing versatile lubricants for different settings and regulations is the objective. Aftersales services and tech support are offered. Analysing regional trends, cultural nuances and market demands is crucial for manufacturers to identify growth opportunities and establish a strong presence in the marine lubricants industry. Aligning strategies with regional dynamics can drive success and growth in marine lubricants.

Global Marine Lubricants Market Competitive Analysis

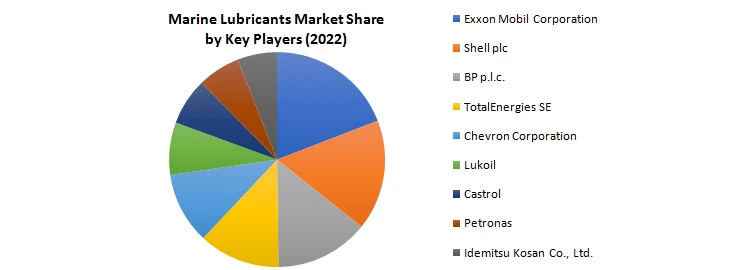

Competitive marine lubricants market with established and new players vying for share. Key players in the industry are ExxonMobil, Chevron, Shell, TotalEnergies and BP. Global reach, varied offerings and strong brand recognition are crucial for market leadership. Local players impact regional and segment-specific marine lubricant markets. Companies like Klüber Lubrication, Gulf Oil Marine, Idemitsu Kosan and JX Nippon Oil have an edge because of their understanding of regional dynamics and ability to serve local customers. Quality and differentiation are crucial for competitiveness in marine lubricants. Top brands prioritise high-performance lubricants for modern marine engines and equipment. Investing in R&D yields innovative lubricants with enhanced performance, longer service intervals and improved fuel efficiency.Distribution networks and partnerships are crucial for companies to expand market reach and ensure efficient product delivery. Partnering with shipyards, distributors and service providers allows companies to provide complete lubrication solutions and tech support to clients. Enhancing customer relationships and offering value-added services increases competitiveness. Marketing is crucial for brand recognition and customer engagement in marine lubricants. Businesses use different channels for product promotion such as trade shows, industry publications, online platforms and social media. Platforms showcase expertise, highlight product features and benefits and connect with global customers. SEO and targeted ads increase online visibility and attract customers. Researching marine lubricants market competition uncovers trends, technology and customer preferences. Data helps firms identify market opportunities, create tailored strategies and stand out from competitors. Invest in R&D, expand distribution networks and implement effective marketing campaigns to remain competitive and achieve sustainable growth in the marine lubricants market.Marine Lubricants Market Scope: Inquire before buying

Global Marine Lubricants Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 6.42 Bn. Forecast Period 2023 to 2029 CAGR: 3.2 % Market Size in 2029: US $ 8.02 Bn. Segments Covered: by Vessel Type Container Ships Tankers Bulk Carriers Offshore Support Vessels Cruise Ships by Lubricants Type Mineral Oil-Based Lubricants Synthetic Lubricants Bio-Based Lubricants by Application Engines Gears Turbines Compressors Hydraulic Systems Auxiliary Machinery by End-User Commercial Shipping Companies Offshore Industries Fishing Vessels Navy Recreational Boating by Distribution channel Direct Sales Distributors Online Platforms Shipyards Marine Lubricants Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

The captured list of leading manufacturers of Marine Lubricants industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, a competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company inthe market fromlocaland global perspectives. 1. Exxon Mobil Corporation 2. Shell plc 3. BP p.l.c. 4. TotalEnergies SE 5. Chevron Corporation 6. Lukoil 7. Castrol 8. Petronas 9. Idemitsu Kosan Co., Ltd. 10. ENEOS Holdings, Inc. 11. China Petroleum & Chemical Corporation (Sinopec) 12. Gazprom Neft 13. Repsol S.A. 14. Croda International Plc 15. AvinOil S.A. 16. CEPSA 17. Gulf Oil Marine 18. Wartsila Corporation 19. Bel-Ray Company 20. Lubrizol Corporation 21. Amsoil Corporation 22. Wynn's 23. Valvoline 24. Royal Purple 25. LIQUI MOLY FAQs 1. What is the role of Marine lubricants in the maritime industry? Ans. Marine lubricants are oils and greases used to lubricate ships and marine equipment. Lubricants are essential for reducing friction, preventing wear and corrosion, and ensuring the smooth operation and longevity of machinery onboard vessels. 2. How do varieties of marine lubricants differ? Ans. Various marine lubricants are available, such as engine oils, hydraulic oils, gear oils, and greases. Lubricants have different compositions, viscosities, and additives for specific applications and equipment needs. Engine oils are made for high temperatures and optimal engine performance, while gear oils handle heavy loads and extreme pressures. 3. Are there environmental regulations affecting the marine lubricants market? Ans. Environmental regulations affect the marine lubricants market. IMO's sulfur emission limits for ships led to low-sulfur and ultra-low-sulfur lubricant development. Growing demand for eco-friendly lubricants that are biodegradable, less toxic and have minimal impact on marine ecosystems. 4. How do companies ensure the compatibility of marine lubricants with specific equipment? Ans. Companies conduct extensive testing and collaborate with equipment manufacturers to ensure the compatibility of their lubricants with specific machinery. This involves evaluating factors such as viscosity requirements, thermal stability, and the ability to resist water contamination. Lubricant manufacturers often provide guidelines and specifications to help ship operators select the appropriate lubricants for their equipment. 5. What factors should be considered when choosing marine lubricants? Ans. When choosing marine lubricants, it's important to consider equipment specs, operating conditions (temp/load), environmental rules, and service intervals. Select lubricants meeting OEM approvals and industry standards for optimal performance, equipment protection, and environmental compliance. Oil analysis and maintenance impact lubricant selection and equipment health.

Table of Contents 1. Marine Lubricants Market: Research Methodology 2. Marine Lubricants Market: Executive Summary 3. Marine Lubricants Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Marine Lubricants Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Marine Lubricants Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Marine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 5.1.1. Mineral Oil-Based Lubricants 5.1.2. Synthetic Lubricants 5.1.3. Bio-Based Lubricants 5.2. Marine Lubricants Market Size and Forecast, by Applications(2022-2029) 5.2.1. Engines 5.2.2. Gears 5.2.3. Turbines 5.2.4. Compressors 5.2.5. Hydraulic Systems 5.2.6. Auxiliary Machinery 5.3. Marine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 5.3.1. Container Ships 5.3.2. Tankers 5.3.3. Bulk Carriers 5.3.4. Offshore Support Vessels 5.3.5. Cruise Ships 5.4. Marine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1. Direct Sales 5.4.2. Distributors 5.4.3. Online Platforms 5.4.4. Shipyards 5.5. Marine Lubricants Market Size and Forecast, by End-User (2022-2029) 5.5.1. Commercial Shipping Companies 5.5.2. Offshore Industries 5.5.3. Fishing Vessels 5.5.4. Navy 5.5.5. Recreational Boating 5.6. Marine Lubricants Market Size and Forecast, by Region (2022-2029) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Marine Lubricants Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Marine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 6.1.1. Mineral Oil-Based Lubricants 6.1.2. Synthetic Lubricants 6.1.3. Bio-Based Lubricants 6.2. North America Marine Lubricants Market Size and Forecast, by Applications(2022-2029) 6.2.1. Engines 6.2.2. Gears 6.2.3. Turbines 6.2.4. Compressors 6.2.5. Hydraulic Systems 6.2.6. Auxiliary Machinery 6.3. North America North America Marine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 6.3.1. Container Ships 6.3.2. Tankers 6.3.3. Bulk Carriers 6.3.4. Offshore Support Vessels 6.3.5. Cruise Ships 6.4. North America Marine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.1. Direct Sales 6.4.2. Distributors 6.4.3. Online Platforms 6.4.4. Shipyards 6.5. North AmericaMarine Lubricants Market Size and Forecast, by End-User (2022-2029) 6.5.1. Commercial Shipping Companies 6.5.2. Offshore Industries 6.5.3. Fishing Vessels 6.5.4. Navy 6.5.5. Recreational Boating 6.6. North America Marine Lubricants Market Size and Forecast, by Country (2022-2029) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Marine Lubricants Market Size and Forecast (by Value USD and Volume Units) 7.1. EuropeMarine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 7.1.1. Mineral Oil-Based Lubricants 7.1.2. Synthetic Lubricants 7.1.3. Bio-Based Lubricants 7.2. EuropeMarine Lubricants Market Size and Forecast, by Applications(2022-2029) 7.2.1. Engines 7.2.2. Gears 7.2.3. Turbines 7.2.4. Compressors 7.2.5. Hydraulic Systems 7.2.6. Auxiliary Machinery 7.3. EuropeMarine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 7.3.1. Container Ships 7.3.2. Tankers 7.3.3. Bulk Carriers 7.3.4. Offshore Support Vessels 7.3.5. Cruise Ships 7.4. EuropeMarine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.1. Direct Sales 7.4.2. Distributors 7.4.3. Online Platforms 7.4.4. Shipyards 7.5. EuropeMarine Lubricants Market Size and Forecast, by End-User (2022-2029) 7.5.1. Commercial Shipping Companies 7.5.2. Offshore Industries 7.5.3. Fishing Vessels 7.5.4. Navy 7.5.5. Recreational Boating 7.6. Europe Marine Lubricants Market Size and Forecast, by Country (2022-2029) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Marine Lubricants Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Marine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 8.1.1. Mineral Oil-Based Lubricants 8.1.2. Synthetic Lubricants 8.1.3. Bio-Based Lubricants 8.2. Asia PacificMarine Lubricants Market Size and Forecast, by Applications(2022-2029) 8.2.1. Engines 8.2.2. Gears 8.2.3. Turbines 8.2.4. Compressors 8.2.5. Hydraulic Systems 8.2.6. Auxiliary Machinery 8.3. Asia PacificMarine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 8.3.1. Container Ships 8.3.2. Tankers 8.3.3. Bulk Carriers 8.3.4. Offshore Support Vessels 8.3.5. Cruise Ships 8.4. Asia PacificMarine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.1. Direct Sales 8.4.2. Distributors 8.4.3. Online Platforms 8.4.4. Shipyards 8.5. Asia PacificMarine Lubricants Market Size and Forecast, by End-User (2022-2029) 8.5.1. Commercial Shipping Companies 8.5.2. Offshore Industries 8.5.3. Fishing Vessels 8.5.4. Navy 8.5.5. Recreational Boating 8.6. Asia Pacific Marine Lubricants Market Size and Forecast, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Marine Lubricants Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Marine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 9.1.1. Mineral Oil-Based Lubricants 9.1.2. Synthetic Lubricants 9.1.3. Bio-Based Lubricants 9.2. Middle East and AfricaMarine Lubricants Market Size and Forecast, by Applications(2022-2029) 9.2.1. Engines 9.2.2. Gears 9.2.3. Turbines 9.2.4. Compressors 9.2.5. Hydraulic Systems 9.2.6. Auxiliary Machinery 9.3. Middle East and AfricaMarine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 9.3.1. Container Ships 9.3.2. Tankers 9.3.3. Bulk Carriers 9.3.4. Offshore Support Vessels 9.3.5. Cruise Ships 9.4. Middle East and AfricaMarine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.1. Direct Sales 9.4.2. Distributors 9.4.3. Online Platforms 9.4.4. Shipyards 9.5. Middle East and Africa Marine Lubricants Market Size and Forecast, by End-User (2022-2029) 9.5.1. Commercial Shipping Companies 9.5.2. Offshore Industries 9.5.3. Fishing Vessels 9.5.4. Navy 9.5.5. Recreational Boating 9.6. Middle East and Africa Marine Lubricants Market Size and Forecast, by Country (2022-2029) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Marine Lubricants Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Marine Lubricants Market Size and Forecast, by Lubricant Type(2022-2029) 10.1.1. Mineral Oil-Based Lubricants 10.1.2. Synthetic Lubricants 10.1.3. Bio-Based Lubricants 10.2. South AmericaMarine Lubricants Market Size and Forecast, by Applications(2022-2029) 10.2.1. Engines 10.2.2. Gears 10.2.3. Turbines 10.2.4. Compressors 10.2.5. Hydraulic Systems 10.2.6. Auxiliary Machinery 10.3. South AmericaMarine Lubricants Market Size and Forecast, by Vessel Type (2022-2029) 10.3.1. Container Ships 10.3.2. Tankers 10.3.3. Bulk Carriers 10.3.4. Offshore Support Vessels 10.3.5. Cruise Ships 10.4. South AmericaMarine Lubricants Market Size and Forecast, by Distribution Channel (2022-2029) 10.4.1. Direct Sales 10.4.2. Distributors 10.4.3. Online Platforms 10.4.4. Shipyards 10.5. South America Marine Lubricants Market Size and Forecast, by End-User (2022-2029) 10.5.1. Commercial Shipping Companies 10.5.2. Offshore Industries 10.5.3. Fishing Vessels 10.5.4. Navy 10.5.5. Recreational Boating 10.6. South America Marine Lubricants Market Size and Forecast, by Country (2022-2029) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Exxon Mobil Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Shell plc 11.3. BP p.l.c. 11.4. TotalEnergies SE 11.5. Chevron Corporation 11.6. Lukoil 11.7. Castrol 11.8. Petronas 11.9. Idemitsu Kosan Co., Ltd. 11.10. ENEOS Holdings, Inc. 11.11. China Petroleum & Chemical Corporation (Sinopec) 11.12. Gazprom Neft 11.13. Repsol S.A. 11.14. Croda International Plc 11.15. AvinOil S.A. 11.16. CEPSA 11.17. Gulf Oil Marine 11.18. Wartsila Corporation 11.19. Bel-Ray Company 11.20. Lubrizol Corporation 11.21. Amsoil Corporation 11.22. Wynn's 11.23. Valvoline 11.24. Royal Purple 11.25. LIQUI MOLY 12. Key Findings 13. Industry Recommendation