The Bentonite Market size was valued at USD 1.89 Billion in 2023 and the total Bentonite Market revenue is expected to grow at a CAGR of 8.1 % from 2024 to 2030, reaching nearly USD 3.26 Billion. The Bentonite market is a dynamic and versatile sector, driven by the unique properties and wide-ranging applications of this soft plastic clay. Bentonite, primarily composed of montmorillonite, a hydrous aluminum silicate, is a key member of the smectite group and is mainly formed through the alteration of volcanic ash and rocks after extensive contact with water. Its most notable characteristics include swelling, water absorption, viscosity, and thixotropy, making it a valuable mineral with diverse uses. Bentonite's applications are high in demand in various industries, and one prominent player in this market is Imerys, known as 'the mineral with a thousand uses.' Its high swelling capacity and viscosity are critical in stabilizing boreholes, controlling water seepage, and removing drilling cuttings in the oil and gas sector. Environmental applications benefit from Bentonite's ability to seal landfills, ponds, and containment structures, creating impermeable barriers and aiding in the remediation of contaminated soil and groundwater.To know about the Research Methodology :- Request Free Sample Report In foundry and metal casting, the Bentonite market is high in demand due to its bonding agent, which enhances mold strength and dimensional stability. Civil engineering projects, such as tunneling and dam construction, employ Bentonite to manage groundwater flow and prevent soil collapse. It's also a common ingredient in clumping cat litter, owing to its exceptional absorbent properties, making it easy to clean. In the cosmetics and personal care industry, Bentonite is used in skincare and cosmetic products for its absorbing and thickening properties. Furthermore, it serves as an excipient in pharmaceutical formulations to improve medication stability and texture. The wine and beverage industry employs Bentonite for clarification, removing suspended particles and proteins. In industrial cleaning, Bentonite-based agents are used to eliminate impurities, oil, and contaminants from surfaces and industrial equipment. Its ability to swell and absorb water, coupled with its natural abundance, positions the Bentonite market as a versatile and valuable material across various industrial and commercial applications. In terms of international trade, in 2021, the top exporters of Bentonite included the United States ($192M), China ($162M), Turkey ($122M), India ($79.3M), and the Netherlands ($71M). Meanwhile, the top importers of Bentonite were Germany ($102M), Canada ($64.2M), the Netherlands ($61.1M), Japan ($39.1M), and Indonesia ($37.9M).

To stay competitive in the global Bentonite market, companies are focusing on mergers and acquisitions and implementing new strategies. 1.For example, Minerals Technologies Inc., through its subsidiary American Colloid Company, increased prices due to rising input and logistics costs. They also acquired Normerica Inc., expanding their presence in the pet care industry, particularly in bentonite-based cat litter products. Additionally, companies like Wyo Ben Inc. are investing significantly in research and development to gain a competitive edge and boost sales revenue. 2.Recent market developments include Bosnian firm Bentoproduct's takeover bid for local mining organization Nematali and the acquisition of Tri-State Construction by Minerals Technologies Inc., signifying the industry's continuous evolution and growth. These developments highlight the ever-expanding Bentonite market and the strategies companies employ to stay at the forefront of this dynamic sector. Bentonite market report covered the detailed analysis of major as well as local industry players with their competitive benchmarking, completion matrix, investment plans key strategies, recent development market trends expansion plans. Bentonite Market Price Trend Analysis: The price of sodium bentonite can vary depending on several factors, including the type, quantity, and shipping costs. Here's a price trend analysis for different purchase options: Price Ranges for Sodium Bentonite (Approximate): 1. Truckload (22.5 tons): $90-$100 per ton, plus freight charges. 2. Large Load (2500lb super sack bags): Approximately $300 per bag. 3. Small Load (50lb bags): Around $8 per bag. It's important to note that these prices are subject to fluctuations based on market conditions and regional differences. In India, the price range for bentonite varies as follows: 1. Rs 750 - Rs 1300: 11% of products 2. Rs 1300 - Rs 2200: 20% of products 3. Rs 2200 - Rs 3800: 27% of products 4. Rs 3800 - Rs 6500: 13% of products The United States is the largest producer and consumer of bentonite, with significant market concentration in Wyoming. Key manufacturers include Amcol, Bentonite Performance Minerals LLC (BPM), Wyo-Ben Inc, Black Hills Bentonite, and Tolsa Group.

Bentonite is an essential material in the construction industry, and its prices can be influenced by various factors, including oil prices and global market conditions. Here is a brief price trend analysis for bitumen:

Price Trends (Based on FOB Middle East USD/MT):

1.Bentonite prices saw a significant drop in April 2020, attributed to a drop in oil prices and the global impact of the COVID-19 pandemic. 2.Iran, a key bitumen producer, decreased prices, with FOB prices dropping to $175-$185 USD per metric ton. 3.China also experienced price drops, with bitumen prices reaching 2032 CNY/MT by the last week of April 2020. The bitumen market is highly influenced by oil prices, global economic conditions, and regional production. The report covered a detailed analysis of the bitumen market price trend and the factors that impact on prices.

MONTH / WEEK WEEK 1 WEEK 2 WEEK 3 WEEK 4 APRIL 220 USD 210 USD 210 USD 185 USD MARCH 260 USD 265 USD 265 USD 260 USD FEBRUARY 280 USD 285 USD 280 USD 280 USD JANUARY 290 USD 290 USD 285 USD 290 USD Bentonite Market Dynamics:

Increasing demand for natural cosmetic products to boost market growth The remarkable skincare properties of bentonite clay, particularly its effectiveness in addressing acne-related issues due to its anti-microbial properties, are significant Bentonite market drivers. Bentonite clay, also known as montmorillonite clay, is a fine, powdery volcanic ash with a pale grey appearance and a fine, powdery texture. Its rich mineral composition, which includes essential minerals like calcium, magnesium, and iron, distinguishes it and provides a variety of skin benefits. Bentonite clay is a popular choice in skincare products, such as soaps and face masks, for various reasons. In soap, it serves as a cleansing agent, removing impurities and offering a spectrum of nourishing minerals that support the skin's natural healing processes. When applied in face masks, it acts as a magnet for excess oils and toxins, drawing them out from the pores. After drying, the mask can be rinsed off, revealing cleaner, more radiant skin.Moreover, bentonite clay's cooling effect helps balance natural oil production, shrink pore diameters, and improve skin moisture retention. It also stimulates blood circulation, enhancing hydration and complexion. Anecdotal evidence suggests that the silicon in bentonite clay aids in softening and brightening the skin by promoting nutrient absorption. Regular use of these masks can help reduce skin pigmentation, including that caused by acne scars and blemishes. Increasing demand for the Bentonite market is due to bentonite clay's well-documented antibacterial and antimicrobial properties. By eliminating harmful bacteria in the skin, it reduces the likelihood of acne breakouts, redness, and irritations. Additionally, bentonite clay can aid in reducing wrinkles and fine lines by repairing damaged skin cells and boosting collagen production. As human bodies produce less collagen with age, this decline is a primary contributor to the aging process, affecting skin elasticity and hydration. The clay can also minimize pore size, giving the appearance of tighter skin. Beyond its application in skin care, bentonite clay is used in the cosmetics industry as a texturizer, filler, thickener, and pigment binder, thanks to its versatility and binding qualities. When mixed with water, it demonstrates remarkable skin-healing capabilities, soothing the skin and facilitating the removal of pollutants. Excess sebum and toxins are absorbed and the clay delivers its vitamins and minerals for the skin to benefit from, making it an excellent component for purifying the skin of impurities, such as excess oils and congested pores. The numerous benefits of bentonite clay in the bentonite market for skin, including its antimicrobial properties, moisture-balancing abilities, collagen-boosting potential, and versatility in skincare and cosmetics, make it a driving force in the skincare industry, appealing to consumers seeking natural and effective solutions for their skincare needs. Many bentonite market manufacturers are also investing in new product launches to expand their product portfolio. The top key players in the market are Minerals Technologies (Amcol), Swell Well Minechem, Ningcheng Tianyu, RT Vanderbilt Company, HOJUN, Huawei Bentonite, and others. Minerals Technologies (Amcol) is the largest player of cosmetic-grade bentonite. Bentonite Clay Transforming Construction industry for a Stronger Future The vital role that the bentonite market plays in the construction industry, the growing demand for Bentonite particularly in excavation and foundation works—is a major factor propelling the bentonite market. Bentonite is a special kind of clay that, when dissolved in water, has the amazing capacity to swell and gel. Because of this feature, it is an essential part of many construction applications. It is regarded as a highly plastic clay because montmorillonite, a clay mineral, makes up more than 85% of its composition. Bentonites come in two main varieties: swelling-type (sodium bentonite) and non-swelling-type (calcium bentonite). Sodium bentonite is the type of bentonite that is most frequently referred to as just "bentonite." The commercial significance of bentonite relies on its physicochemical properties rather than its chemical composition. It offers excellent plasticity, lubricity, high dry-bonding strength, impressive shear and compressive strength, low permeability, and low compressibility. These characteristics make bentonite a commercially viable choice for various construction applications, which drive the Bentonite market demand globally. It plays a vital role in foundry sand binding, drilling mud for the oil and gas industry, and iron ore, and serves as a waterproofing and sealing agent in civil engineering works. One of the noteworthy uses of bentonite in construction is in the form of a fluidic mixture commonly referred to as "bentonite slurry." This is primarily due to its unique rheological properties, which affect how it behaves when mixed with water. However, it's important to note that the awareness and recognition of bentonite as an essential construction element are still evolving. Many construction activities and foundations are executed without utilizing bentonite, resulting in higher costs through the use of cast iron or steel liners. The potential for bentonite to significantly optimize construction processes, reduce expenses, and enhance the performance and durability of structures is yet to be fully realized in the civil engineering industry. As this awareness continues to grow, the utilization of bentonite in construction is expected to become more prevalent, driving its demand in the bentonite market.

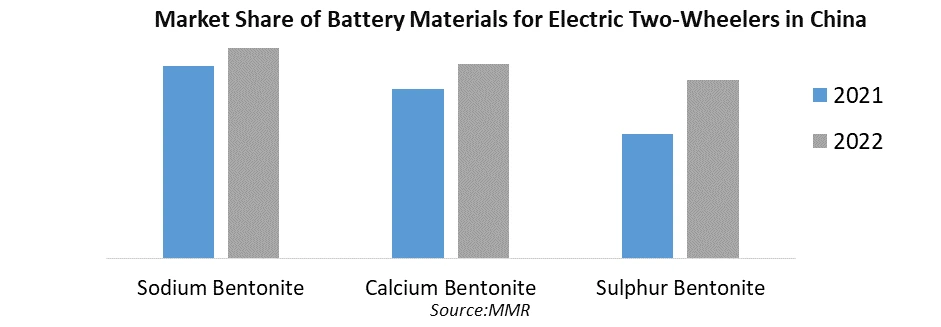

By Product type, Based on the market segments market is segmented into Sodium Bentonite, Calcium Bentonite, and Sulphur Bentonite. Sodium Bentonite is expected to dominate the Bentonite market during the forecast period. Sodium Bentonite is high in demand due to its versatility and high efficiency, sodium bentonite, is a mineral clay renowned for its exceptional water absorption capacity and rapid swelling properties, making it an indispensable sealant with a multitude of applications across various industries. Often referred to as the "mineral of a thousand uses," sodium bentonite finds its role in several critical applications. One of its widely recognized applications is as a pond sealer, although its utility extends beyond just ponds. It serves as an effective sealer for any structure that necessitates water containment or exclusion, including sewage lagoons and landfills, ensuring that contaminants are securely confined within designated areas. In some cases, state governments have mandated its use in water treatment plants to safeguard against leaks into the underground and surrounding areas. Sodium bentonite is also employed for well plugging, preventing the reopening of wells, and it serves as a reliable pond liner for various water bodies, such as farm ponds, wildlife ponds, fish ponds, ranch ponds, artificial lakes, and natural swimming pools. In cases of localized water leaks, sodium bentonite is expertly applied to rectify the affected areas, making it an effective sealant for dams or dam areas to drive the Bentonite market growth. Moreover, sodium bentonite plays a pivotal role in the pet industry, particularly as an anti-odor agent in cat litter. Its ability to absorb water quickly and form easy-to-handle clumps makes it a preferred choice for maintaining feline hygiene. In wastewater treatment, sodium bentonite is a crucial component in biofiltration processes, aiding in the removal of over 90% of unwanted liquids and suspended solids. The bentonite market is growing due to versatile clay is also a staple in various industrial settings, including corrugated cardboard manufacturing, ink production, laundries, mechanical workshops, farms, and food and beverage processing plants, offering efficient solutions for solid-liquid separation. In the oil and gas industry, sodium bentonite serves as an efficient viscosifier in drilling mud, supporting the drilling of oil and gas wells, deepwater wells, and horizontal directional drilling. It enhances the fluid's viscosity, reducing filtration in freshwater drilling fluids, facilitating hole cleaning, and stabilizing poorly blended areas. One of the standout advantages of sodium bentonite is its environmental friendliness, being a 100% natural clay that does not disrupt the ecology of its applications. In addition to its low cost, sodium bentonite stands out in the long run due to minimal maintenance costs and virtually no risk of puncture or tear, making it a reliable and cost-effective choice for pond liners and sealers. Its remarkable effectiveness in various industries positions sodium bentonite as a formidable competitor, as its initial investment is comparable to alternative materials, yet its long-term efficiency sets it apart and propels its demand in the Bentonite industry.

Bentonite Market Regional Insights:

Asia Pacific is an emerging region in the Bentonite market due to the market is expected to experience growth in the foreseeable future, driven by the rising demand from the personal care and cosmetics sector. Bentonite, with its remarkable attributes such as water absorption capacity, detoxification capabilities, and efficacy in acne treatment, has found a valuable place in various personal care and cosmetics products. It is employed in the formulation of sunscreen, hair cleansers, and softeners, and serves as a versatile ingredient, taking on roles as a thickener, absorbent, filler, texturizer, and binder in an array of skincare and hair care products, as well as color cosmetics.Furthermore, the increasing trend toward organic and environmentally friendly products is pushing personal care product manufacturers to embrace natural, chemical-free alternatives that maintain their effectiveness. Bentonite stands out as an ideal choice due to its natural absorbent properties and the absence of severe health-related side effects. Given the eco-friendly nature of bentonite and its suitability for use in personal care products, the market is witnessing a surge in its application within this industry. This is expected to be a significant driving factor for the Bentonite market in recent years.

Bentonite Market Scope: Inquire before buying

Bentonite Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 1.89 Bn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US$ 3.26 Bn. Segments Covered: by Product Type Sodium Bentonite Calcium Bentonite Sulphur Bentonite by Application Foundry Sands Cat Litter Iron Ore Pelletizing Refining Drilling Muds Civil Engineering by End Use Pharmaceuticals Construction Oil & gas Food and Beverages Others Bentonite Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. Black Hills Bentonite - Wyoming, USA 2. Halliburton Co. - Texas, USA 3. Kemira OYJ - Helsinki, Finland 4. Charles B Chrystal Co. Inc. - New York, USA 5. Mineral Technologies Inc. - Pennsylvania, USA 6. Clariant AG - Muttenz, Switzerland 7. Alfa Aesar - Massachusetts, USA 8. Kutch Minerals - Gujarat, India 9. Kunimine Industries Co. Ltd. - Tokyo, Japan 10. Ashapura Group of Companies - Mumbai, India 11. Wyo-Ben Inc. - Montana, USA 12. AMCOL International - Illinois, USA 13. MidPoint Chemicals Company - Georgia, USA 14. M-I SWACO - Texas, USA 15. Volclay International - Mississippi, USA 16. Cimbar - Georgia, USA 17. Amsyn Inc. - New Jersey, USA FAQs: 1. What are the growth drivers for the Bentonite Market? Ans. Growing popularity for eco-friendly chemicles is to be the major driver for the Bentonite Market. 2. What is the major restraint for the Bentonite Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Bentonite Market growth. 3. Which Region is expected to lead the global Bentonite Market during the forecast period? Ans. Asia Pacific is expected to lead the global Bentonite Market during the forecast period. 4. What is the projected Europe Bentonite Market size & growth rate of the Bentonite Market? Ans. The Bentonite Market size was valued at USD 1.89 Billion in 2023 and the total Anime revenue is expected to grow at a CAGR of 8.1% from 2024 to 2030, reaching nearly USD 3.26 Billion. 5. What segments are covered in the Bentonite Market report? Ans. The segments covered in the Bentonite Market report are Product Type, Application, End Use and region

1. Bentonite Market: Research Methodology 2. Bentonite Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Bentonite Market: Dynamics 3.1 Bentonite Market Trends 3.2 Bentonite Market Dynamics 3.2.1 Bentonite Market Drivers 3.2.2 Bentonite Market Restraints 3.2.3 Bentonite Market Opportunities 3.2.4 Bentonite Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Bentonite Industry 3.8 The Global Pandemic and Redefining of The Bentonite Industry Landscape 3.9 Price Trend Analysis 4. Global Bentonite Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Bentonite Market Size and Forecast, by Product Type (2023-2030) 4.1.1 Reagent Product Type 4.1.2 Industrial Product Type 4.2 Global Bentonite Market Size and Forecast, by Application (2023-2030) 4.2.1 More than 98% 4.2.2 Less than 98% 4.3 Global Bentonite Market Size and Forecast, by End-Use (2023-2030) 4.3.1 Synthetic Bentonite 4.3.2 Renewable Bentonite 4.4 Global Bentonite Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Bentonite Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Bentonite Market Size and Forecast, by Product Type (2023-2030) 5.1.1 Reagent Product Type 5.1.2 Industrial Product Type 5.2 North America Bentonite Market Size and Forecast, by Application (2023-2030) 5.2.1 More than 98% 5.2.2 Less than 98% 5.3 North America Bentonite Market Size and Forecast, by End-Use (2023-2030) 5.3.1 Synthetic Bentonite 5.3.2 Renewable Bentonite 5.4 North America Bentonite Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Bentonite Market Size and Forecast, by Product Type (2023-2030) 5.4.1.1.1 Reagent Product Type 5.4.1.1.2 Industrial Product Type 5.4.1.2 United States Bentonite Market Size and Forecast, by Application (2023-2030) 5.4.1.2.1 More than 98% 5.4.1.2.2 Less than 98% 5.4.1.3 United States Bentonite Market Size and Forecast, by End-Use (2023-2030) 5.4.1.3.1 Synthetic Bentonite 5.4.1.3.2 Renewable Bentonite 5.4.2 Canada 5.4.2.1 Canada Bentonite Market Size and Forecast, by Product Type (2023-2030) 5.4.2.1.1 Reagent Product Type 5.4.2.1.2 Industrial Product Type 5.4.2.2 Canada Bentonite Market Size and Forecast, by Application (2023-2030) 5.4.2.2.1 More than 98% 5.4.2.2.2 Less than 98% 5.4.2.3 Canada Bentonite Market Size and Forecast, by End-Use (2023-2030) 5.4.2.3.1 Synthetic Bentonite 5.4.2.3.2 Renewable Bentonite 5.4.3 Mexico 5.4.3.1 Mexico Bentonite Market Size and Forecast, by Product Type (2023-2030) 5.4.3.1.1 Reagent Product Type 5.4.3.1.2 Industrial Product Type 5.4.3.2 Mexico Bentonite Market Size and Forecast, by Application (2023-2030) 5.4.3.2.1 More than 98% 5.4.3.2.2 Less than 98% 5.4.3.3 Mexico Bentonite Market Size and Forecast, by End-Use (2023-2030) 5.4.3.3.1 Synthetic Bentonite 5.4.3.3.2 Renewable Bentonite 6. Europe Bentonite Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.2 Europe Bentonite Market Size and Forecast, by Application (2023-2030) 6.3 Europe Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4 Europe Bentonite Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2 United Kingdom Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.1.3 United Kingdom Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.2 France 6.4.2.1 France Bentonite Market Size and Forecast, by Product (2023-2030) 6.4.2.2 France Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.2.3 France Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2 Germany Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.3.3 Germany Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2 Italy Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.4.3 Italy Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2 Spain Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.5.3 Spain Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2 Sweden Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.6.3 Sweden Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2 Austria Bentonite Market Size and Forecast, by Application (2023-2030) 6.4.7.3 Austria Bentonite Market Size and Forecast, by End-Use (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Bentonite Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2 Rest of Europe Bentonite Market Size and Forecast, by Application (2023-2030). 6.4.8.3 Rest of Europe Bentonite Market Size and Forecast, by End-Use (2023-2030) 7. Asia Pacific Bentonite Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.2 Asia Pacific Bentonite Market Size and Forecast, by Application (2023-2030) 7.3 Asia Pacific Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4 Asia Pacific Bentonite Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2 China Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.1.3 China Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2 S Korea Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.2.3 S Korea Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2 Japan Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.3.3 Japan Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.4 India 7.4.4.1 India Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2 India Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.4.3 India Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.5.2 Australia Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.5.3 Australia Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.6.2 Indonesia Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.6.3 Indonesia Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.7.2 Malaysia Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.7.3 Malaysia Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.8.2 Vietnam Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.8.3 Vietnam Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.9.2 Taiwan Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.9.3 Taiwan Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.10.2 Bangladesh Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.10.3 Bangladesh Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.11.2 Pakistan Bentonite Market Size and Forecast, by Application (2023-2030) 7.4.11.3 Pakistan Bentonite Market Size and Forecast, by End-Use (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Bentonite Market Size and Forecast, by Product Type (2023-2030) 7.4.12.2 Rest of Asia PacificBentonite Market Size and Forecast, by Application (2023-2030) 7.4.12.3 Rest of Asia Pacific Bentonite Market Size and Forecast, by End-Use (2023-2030) 8. Middle East and Africa Bentonite Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.2 Middle East and Africa Bentonite Market Size and Forecast, by Application (2023-2030) 8.3 Middle East and Africa Bentonite Market Size and Forecast, by End-Use (2023-2030) 8.4 Middle East and Africa Bentonite Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2 South Africa Bentonite Market Size and Forecast, by Application (2023-2030) 8.4.1.3 South Africa Bentonite Market Size and Forecast, by End-Use (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2 GCC Bentonite Market Size and Forecast, by Application (2023-2030) 8.4.2.3 GCC Bentonite Market Size and Forecast, by End-Use (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2 Egypt Bentonite Market Size and Forecast, by Application (2023-2030) 8.4.3.3 Egypt Bentonite Market Size and Forecast, by End-Use (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.4.4.2 Nigeria Bentonite Market Size and Forecast, by Application (2023-2030) 8.4.4.3 Nigeria Bentonite Market Size and Forecast, by End-Use (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Bentonite Market Size and Forecast, by Product Type (2023-2030) 8.4.5.2 Rest of ME&A Bentonite Market Size and Forecast, by Application (2023-2030) 8.4.5.3 Rest of ME&A Bentonite Market Size and Forecast, by End-Use (2023-2030) 9. South America Bentonite Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Bentonite Market Size and Forecast, by Product Type (2023-2030) 9.2 South America Bentonite Market Size and Forecast, by Application (2023-2030) 9.3 South America Bentonite Market Size and Forecast, by End-Use (2023-2030) 9.4 South America Bentonite Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Bentonite Market Size and Forecast, by Product Type (2023-2030) 9.4.1.2 Brazil Bentonite Market Size and Forecast, by Application (2023-2030) 9.4.1.3 Brazil Bentonite Market Size and Forecast, by End-Use (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Bentonite Market Size and Forecast, by Product Type (2023-2030) 9.4.2.2 Argentina Bentonite Market Size and Forecast, by Application (2023-2030) 9.4.2.3 Argentina Bentonite Market Size and Forecast, by End-Use (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Bentonite Market Size and Forecast, by Product Type (2023-2030) 9.4.3.2 Rest Of South America Bentonite Market Size and Forecast, by Application (2023-2030) 9.4.3.3 Rest Of South America Bentonite Market Size and Forecast, by End-Use (2023-2030) 10. Global Bentonite Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Bentonite Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Black Hills Bentonite - Wyoming, USA 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Halliburton Co. - Texas, USA 11.3 Kemira OYJ - Helsinki, Finland 11.4 Charles B Chrystal Co. Inc. - New York, USA 11.5 Mineral Technologies Inc. - Pennsylvania, USA 11.6 Clariant AG - Muttenz, Switzerland 11.7 Alfa Aesar - Massachusetts, USA 11.8 Kutch Minerals - Gujarat, India 11.9 Kunimine Industries Co. Ltd. - Tokyo, Japan 11.10 Ashapura Group of Companies - Mumbai, India 11.11 Wyo-Ben Inc. - Montana, USA 11.12 AMCOL International - Illinois, USA 11.13 MidPoint Chemicals Company - Georgia, USA 11.14 M-I SWACO - Texas, USA 11.15 Volclay International - Mississippi, USA 11.16 Cimbar - Georgia, USA 11.17 Amsyn Inc. - New Jersey, USA 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary