Global Maize Bran Market expected to hit 11.79 Mn tons by 2029 from 9.14 Mn tons in 2022 at a CAGR of 3.7% during the forecast periodMaize Bran Market Overview

Maize bran is a fiber obtained from maize through a process of grinding, separation and stabilization. Maize Bran is a by-product of various maize processing industries, which includes starch and ethanol production and the production of maize-based products. The growing health consciousness and increasing demand for healthy food are expected to drive the Maize Bran Market. According to the report, the maize bran contains 22 percent cellulose. 10 to 13 percent protein, 9 to 22 percent starch and 5 percent phenolic and 2 percent ash and 2 to 3 percent lipid.To know about the Research Methodology :- Request Free Sample Report

Maize Bran Market Dynamics

Market Drivers Nutritional and Health Benefits in Humans to Grow the Maize Bran Market Maize corn is full of fiber and regular intake of fiber in the body supports healthy digestive functions and eliminates the problem of constipation. Soluble fibers such as maize bran, barley, nuts, seeds, lentils, peas and some fruits help to lower the low-density lipoprotein (LDL) and reduce the risk of stroke and heart attack. Large populations across the world started including the brans in daily diets due to their health benefits, which is expected to drive the Maize Bran Market. The by-products of maize are considered as low-calorie and rich in nutrition, which is expected to increase the rate of Maize Bran Penetration in major geographic regions such as North America, South America, Europe, Asia Pacific and the Middle East and Africa. The Maize bran contains various nutritional ingredients such as protein, iron, zinc, magnesium and B-complex vitamins. The global export of maize bran is grown at a 6.3 percent rate against 2021 figures. The data shows the growing rate of Maize Bran Penetration worldwide. The Market growth is also supported by the increasing demand from the food industry for bakery products, snacks and confectionery. Some nutritional benefits of maize bran ingredients, which are expected to drive the Maize Bran Industry globally are: • The protein ingredients facilitate the repair of tissues, cells and muscles and provide structural support for the body and boost immunity. • Vitamin B enhances the body’s immune system and supports the function of the nervous system as well as muscular functions. • Iron is helpful in the formation of white blood cells, which act as antibodies and some cereals contain as much iron as Maize Bran Cereal. • Maize bran contains zinc that prevents infections, reduces the risk of prostate cancer and maintains vitamin E supply in the body. Growing Demand for Barn in Biofuel Production is expected to Boost the Market Growth Maize is a key candidate for ethanol production commonly derived from biological feedstocks utilizing fermentation processes. The potential for ethanol from maize lies not only in converting grain to ethanol but in applying cellulose conversion technology to the pericarp that covers the grain. Companies such as Bajaj Hindustan Ltd., Balarampur Chinni Mills Ltd and others and some plants in the U.S. are producing ethanol as a biofuel from maize. All these factors are expected to drive the Maize Bran Market during the forecast period. Maize Bran Market Trends Increasing Demand for Gluten-free Products: As per the MMR report, Maize Bran Products also known as gluten-free products have increased from 173,500 tonnes in 2015 to approximately 391,000 tonnes in 2022. The beverage industry is also expected to increase the Maize Bran Market Share as many are replacing malt with maize as a cost-effective alternative. The Maize Bran industry Growth is supported by the growing trend of snackification. The working-class population popularly known as time-poor consumers strongly demand convenient, tasty and healthy foods that fit into busy schedules. Traditional and new maize-based products are not just practical but also meet modern consumer tastes and serve well-being. Higher Yields and Changing Food Safety Standards: The exponential growth and increased yields have had an impact on the market and increased the number of Maize Bran Key Competitors in the Maize Bran Industry. The Buhler AG, a Switzerland-based company has expertise in maize processing and offers technical solutions to answer increased demand, efficiently process a broad spectrum of product varieties with specific operating parameters and manage quality challenges. Also, the environmental aspects and food safety standards are an area of focus in the Maize Bran Market. In recent years aflatoxin contamination of maize, which has been linked to global warming, has increased significantly. Traditional color sorters that remove discolored grains tend to impact yield by removing more grain than necessary. Buhler’s LumoVision system accurately detects infected grains providing a safe and efficient solution to a growing global problem. Adoption of Sustainable Solutions in the Grinding Process of Maize: Maize is cooked in water for multiple hours before the grinding process to develop a taste. The process requires 1,500 liters of water to process 1,000 kilograms into nixtamalized maize flour. This water contains a lot of fiber and starch and needs to be treated before releasing into the environment. These factors regarding environmental concerns are expected to drive the demand for sustainable solutions in the Maize Bran Market. Market Restraints Uncertainties in the prices of raw materials such as maize and wheat in the production of maize bran and the strict regulations in the manufacturing of maize bran and these regulations are kept varying from region to region and are expected to limit the growth of the Maize Bran Market. The report analyzes the Maize Bran Industry data through SWOT analysis and PORTER’s five force model, which includes growth drivers, opportunities and regional insights and restraints to assist new Maize Bran Companies. Also, the competition from maize bran substitutes, high transportation costs and the seasonal nature of the product are expected to limit the growth of the market.Maize Bran Market Regional Insights

North America held the largest share of the Maize Bran Market in 2022 and produced 354.16 million tonnes. The United States is a major exporter of maize bran in the world, which was nearly 28 percent of total exports. The presence of top manufacturers and suppliers in the USA has made the U.S. the world’s largest producer of ethanol fuel. Further MMR research states that the U.S. ethanol production reached nearly 7 billion gallons, in response to the Energy Act in the USA, while the demand was 4.85 billion gallons. On account of it, the region’s Market is expected to grow significantly. Middle East and Africa are expected to grow in the Maize Bran Market during the forecast period. The increasing demand for good quality gluten-free ready-to-eat breakfast cereals such as maize bran and the shift in consumer preference for organic and non-genetically modified products are expected to boost the region’s Maize Bran Industry. The major Maize Bran Key Companies are investing in these developing regions to increase their Maize Bran Market Share globally. Asia Pacific is expected to emerge as a new market to invest in and create a lucrative opportunity for Maize Bran Key Players. The Maize Bran Market Value increased at an annual rate of 2.6 percent over the last eight years. Recently, on February 22, Vietnam and the Federation of Indian Export Organizations (FIEO) held a meeting for boosting trade in agriculture and processed food. Maize Bran Penetration is expected to be highest in the region to fulfill the need of a large population for good quality protein food. Also, these trade policies between the two economies are anticipated to propel the growth of the Asia Pacific Maize Bran Market.

Maize Bran Market Competitive Landscape

The report provides a detailed analysis of the market through Maize Bran Market Competitive Benchmarking, which includes recent developments of Maize Bran Companies, regulations in major geographic regions and mergers and acquisitions. Cargill, Incorporated, Grain Processing Corporation, Grain Millers, Inc. and AGRANA Beteiligungs-AG are some major Maize Bran Key Players. Among them, Grain Millers got the certification that consumers are looking for organic, gluten-free and non-GMO products. This is expected to drive the global Market growth potential. Also, the latest agricultural trade alliance between ASEAN countries and India’s attempts at crop diversification are expected to get a boost as the country plans to tap substantial quantities of maize for producing ethanol for its fuel blending programme, which is expected to mix 20 percent ethanol with motor spirit by 2025-26. These developments are boosting the Maize Bran Industry and products related to it.Maize Bran Market Segment Analysis

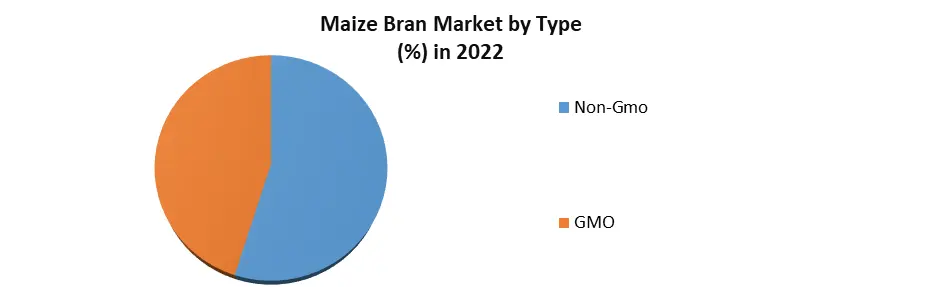

Based on Type The rising health awareness and to avoid the degradation of soil consumers and farmers demand non-genetically modified food products and crops due to their benefits for the human body such as getting peak nutritional value from proteins like lentils, Quinoa, Chia Seeds, Maize Bran, Oats, Chickpeas and Other beans. Whereas, genetically modified crops or products give higher yield production but are expected to erode the soil quality in the long term. Hence, the non-GMO segment holds the largest share of the Maize Bran Market. Based on Industry Vertical The human food segment held the largest revenue share in the Maize Bran Industry. The major Maize Bran Key Competitors are producing different types of Maize Bran Products, which gained popularity as healthy ready-to-eat food across the world. Animal food segment is also expected to hold a significant revenue share in the Maize Bran Market since maize bran has a lucrative demand due to its high protein and fiber ingredients that increases the production of milk and other dairy products. Maize is also used in the production of ethanol that emerging as a biofuel alternative to the existing oil options. The biofuel industry segment is expected to grow rapidly since major Maize Bran Key Companies are also focusing on the production of ethanol.Maize Bran Market Scope: Inquire before buying

Maize Bran Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: 9.14 Mn tons Forecast Period 2023 to 2029 CAGR: 3.7% Market Size in 2029: 11.79 Mn tons Segments Covered: by Type 1.Non-Gmo 2.GMO by Nature 1.Conventional 2.Organic by Distribution Channel 1.Hypermarkets 2.Supermarkets 3.Convenience stores 4.Specialty stores 5.Online stores by Industry Vertical 1.Animal Food 2.Human Food 3.Edible Oil Industry 4.Biofuel Industry Maize Bran Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Maize Bran Key Players include:

1.Cargill, Incorporated. 2.Grain Processing Corporation 3. Didion, Inc. 4. Sunflakes Food Products Pvt. Ltd. 5.Grain Millers, Inc. 6.AGRANA Beteiligungs-AG 7.Bunge North America Inc. 8. Lifeline Foods LLC 9. Prorich Agro Foods 10. Semo Milling LLC. Frequently Asked Questions: 1] What is the growth rate of the Maize Bran Market? Ans. The Maize Bran Market is growing at a CAGR of 3.7% during the forecast period. 2] Which region is expected to dominate the Maize Bran Market? Ans. North America is expected to dominate the Maize Bran Market during the forecast period from 2023 to 2029. 3] What is the expected Maize Bran Market size by 2029? Ans. The size of the Maize Bran Market by 2029 is expected to reach 11.79 Mn tons. 4] Who are the top players in the Maize Bran Market? Ans. The major key players in the Maize Bran Market are Grain Millers, Inc., Lifeline Foods LLC, Cargill Inc and Grain Processing Corporation. 5] Which factors contributed to the growth of the Maize Bran Market in 2022? Ans. The Maize Bran Market is expected to grow due to the rising demand for high protein ready-to-eat cereals across the world.

1. Maize Bran Market: Research Methodology 2. Maize Bran Market: Executive Summary 3. Maize Bran Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Maize Bran Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Maize Bran Market: Segmentation (by Value USD and Volume Units) 5.1. Maize Bran Market, by Type (2022-2029) 5.1.1. Non-Gmo 5.1.2. GMO 5.2. Maize Bran Market, by Nature (2022-2029) 5.2.1. Conventional 5.2.2. Organic 5.3. Maize Bran Market, by Distribution Channel (2022-2029) 5.3.1. Hypermarkets 5.3.2. Supermarkets 5.3.3. Convenience stores 5.3.4. Specialty stores 5.3.5. Online stores 5.4. Market, by Industry Vertical (2022-2029) 5.4.1. Animal Food 5.4.2. Human Food 5.4.3. Edible Oil Industry 5.4.4. Biofuel Industry 5.5. Maize Bran Market, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Maize Bran Market (by Value USD and Volume Units) 6.1. North America Maize Bran Market, by Type (2022-2029) 6.1.1. Non-Gmo 6.1.2. GMO 6.2. North America Maize Bran Market, by Nature (2022-2029) 6.2.1. Conventional 6.2.2. Organic 6.3. North America Maize Bran Market, by Distribution Channel (2022-2029) 6.3.1. Hypermarkets 6.3.2. Supermarkets 6.3.3. Convenience stores 6.3.4. Specialty stores 6.3.5. Online stores 6.4. North America Maize Bran Market, by Industry Vertical (2022-2029) 6.4.1. Animal Food 6.4.2. Human Food 6.4.3. Edible Oil Industry 6.4.4. Biofuel Industry 6.5. North America Maize Bran Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Maize Bran Market (by Value USD and Volume Units) 7.1. Europe Maize Bran Market, by Type (2022-2029) 7.2. Europe Maize Bran Market, by Nature (2022-2029) 7.3. Europe Maize Bran Market, by Distribution Channel (2022-2029) 7.4. Europe Maize Bran Market, by Industry Vertical (2022-2029) 7.5. Europe Maize Bran Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Maize Bran Market (by Value USD and Volume Units) 8.1. Asia Pacific Maize Bran Market, by Type (2022-2029) 8.2. Asia Pacific Maize Bran Market, by Nature (2022-2029) 8.3. Asia Pacific Maize Bran Market, by Distribution Channel (2022-2029) 8.4. Asia Pacific Maize Bran Market, by Industry Vertical (2022-2029) 8.5. Asia Pacific Maize Bran Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Maize Bran Market (by Value USD and Volume Units) 9.1. Middle East and Africa Maize Bran Market, by Type (2022-2029) 9.2. Middle East and Africa Maize Bran Market, by Nature (2022-2029) 9.3. Middle East and Africa Maize Bran Market, by Distribution Channel (2022-2029) 9.4. Middle East and Africa Maize Bran Market, by Industry Vertical (2022-2029) 9.5. Middle East and Africa Maize Bran Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Maize Bran Market (by Value USD and Volume Units) 10.1. South America Maize Bran Market, by Type (2022-2029) 10.2. South America Maize Bran Market, by Nature (2022-2029) 10.3. South America Maize Bran Market, by Distribution Channel (2022-2029) 10.4. South America Maize Bran Market, by Industry Vertical (2022-2029) 10.5. South America Maize Bran Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Cargill, Incorporated. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Grain Processing Corporation 11.3. Didion, Inc. 11.4. Sunflakes Food Products Pvt. Ltd. 11.5. Grain Millers, Inc. 11.6. AGRANA Beteiligungs-AG 11.7. Bunge North America Inc. 11.8. Lifeline Foods LLC 11.9. Prorich Agro Foods 11.10. Semo Milling LLC. 12. Key Findings 13. Industry Recommendation