The Global Large Scale LNG Terminal Market size was valued at USD 2.70 Billion in 2023 and the total Large Scale LNG Terminal revenue is expected to grow at a CAGR of 5.6% from 2024 to 2030, reaching nearly USD 3.95 Billion.Large Scale LNG Terminal Market Overview

The Large Scale LNG Terminal Market is experiencing substantial growth, primarily fuelled by the rising demand for cleaner energy sources. This demand is particularly evident in power generation, transportation, and residential heating industries. LNG terminals are pivotal in the energy supply chain, as they receive, store, and regasify LNG before distributing it to end-users. The market is expected to continue growing steadily, driven by the global transition towards cleaner fuels. This transition is supported by the lower carbon footprint of natural gas compared to coal and oil. Furthermore, the development of new LNG export facilities, particularly in regions like the United States and Australia, is further propelling market expansion.To know about the Research Methodology :- Request Free Sample Report Several trends are influencing the Large Scale LNG terminal market. Notably, there is a significant emphasis on integrating advanced technologies to enhance terminal efficiency and safety. Automation, digitalization, and remote monitoring are increasingly being adopted to streamline LNG terminal operations. Additionally, the industry is witnessing a growing trend of utilizing floating LNG Terminal (FLNG) to access remote offshore gas reserves economically. Key manufacturers such as Linde AG, Royal Dutch Shell plc, Exxon Mobil Corporation, and Chevron Corporation are actively expanding their LNG terminal capacity to meet the rising demand. These companies also invest in technology and infrastructure to improve terminal operations and remain competitive in the market.

Large Scale LNG Terminal Market Dynamics:

Accelerated Natural Gas Infrastructure Investment Boosting Market Dynamics The rising consumption of natural gas, driven by its availability and environmental advantages, is fueling the expansion of infrastructure to collect and deliver gas from wells to end-users. This includes Large Scale LNG Terminal, where LNG is stored and transported to distant areas. Manufacturers are developing large LNG plants due to increased infrastructure expenditure, expanding the market for Large Scale LNG Terminal. This expansion is supported by consumer demand for affordable, low-emission transportation and environmental concerns driving a shift towards LNG. These trends are increasing the demand for Large Scale LNG Terminal, crucial for storing natural gas for heavy-duty commercial vehicles. Advancements in technology and design are improving the cost-production efficiency of these terminals, positively impacting profit margins. Overall, the combination of increased natural gas consumption, infrastructure investment, and consumer demand is driving market growth for Large Scale LNG Terminal, benefiting both producers and consumers. 1. In 2021, the market was controlled by China, South Korea, Japan, and Spain due to their enormous LNG regasification terminal capacities. Japan has the largest LNG regasification capacity in the world, at 211.4 million metric tons annually as of 2021. 2. As of March 2024, spot Asia LNG prices have eased by a quarter since the beginning of the year. This has led to an increase in spot purchases, which is expected to boost demand for Asia LNG 3. India expects companies to invest $4.95 billion (410 billion rupees) to build natural gas pipelines in its northeastern states and northern federal territories of Kashmir and Ladakh. 4. According to Global Energy Monitor (GEM), Globally, more than $720 billion is to be spent on gas pipelines under construction or planned, and an additional $190 billion is to be put on facilities to handle liquefied natural gas (LNG) imports, Volatility of the Market and Prices The market for Large Scale LNG Terminal is severely constrained by price and market instability. These high prices made LNG unaffordable fuel for many emerging economies, which saw power cuts and fuel switching. Supply-demand mismatches, regulatory changes, and geopolitical events are among the many of the variables that cause market volatility. Because of this volatility, it becomes difficult for businesses to forecast market trends and schedule long-term LNG terminal investments. Furthermore, the high initial expenses and intricate regulatory restrictions limit market penetration by acting as obstacles to new firms' entry. Uncertainty about price and market circumstances could slow the expansion of the Large Scale LNG terminal industry, potentially discouraging potential investors. 1. India, a net gas importer, also saw a decline in LNG demand. The LNG import volume decreased by 15% in fiscal year (FY) 2022-23 versus FY2021-22, even as the value increased by a whopping 27%, indicating import priciness. 2. In 2022, 31.2 million tonnes per annum (MTPA) of new import or regasification capacity came online, taking the total import capacity to 970.6 MTPA as of April 2023.Integration of Digital Technologies for Efficiency and Safety Integrating digital technology for increased efficiency and safety presents a promising potential for the Large Scale LNG terminal business. Automation, AI, and the Internet of Things (IoT) are examples of technologies that may transform terminal operations by streamlining workflows and cutting expenses. For instance, real-time equipment performance monitoring using automated systems allows for predictive maintenance and reduces downtime. Digital technologies may also increase safety by strengthening emergency response skills and providing early warnings of possible threats. The sector has a strong opportunity as a result of the combination of these technologies, which raise safety requirements and increase LNG terminal efficiency. Table 1: LNG Exporting Countries and Their Natural Gas Production

Table 2: LNG Importing Countries and Their Natural Gas Consumption

Country LNG Export (MT) Natural Gas Production (MT) US 80.50 744.80 Australia 80.90 117.15 Russia 33.00 510.12 Malaysia 27.30 56.10 Indonesia 15.70 41.82

Country LNG Import (MT) Natural Gas Production (MT) Japan 72.60 72.90 China 63.24 273.23 South Korea 48.10 44.56 France 25.63 27.81 Spain 21.42 24.15 India 19.45 42.23 Large Scale LNG Terminal Market Segment Analysis:

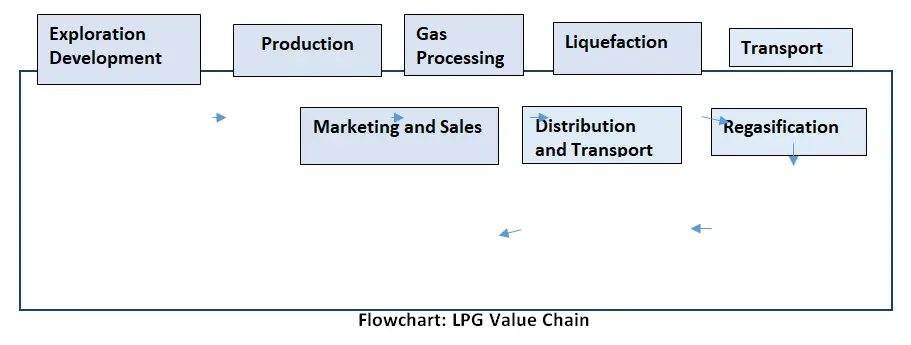

Segmenting the Large Scale LNG Terminal Market by operation, liquefaction emerges as the leading segment, driving market growth with its critical role in converting natural gas into LNG for storage and transportation. The liquefaction segment benefits from the increasing demand for LNG as a cleaner alternative fuel, particularly in power generation and transportation. Moreover, new liquefaction projects in regions rich in natural gas reserves, such as North America and Australia, are propelling market expansion. The liquefaction segment enjoys cost benefits and efficiency in the supply chain, contributing significantly to its leading position in the market. On the other hand, the regasification segment plays a supporting role in market dynamics, facing challenges such as higher operational costs and complexity in the supply chain. However, regasification Terminals are crucial for meeting the rising demand for natural gas in importing regions, diversifying energy sources, and reducing reliance on traditional fuels. The expansion of regasification infrastructure, especially in emerging markets, supports market growth, although to a lesser extent compared to the liquefaction segment. Liquefaction plants are being optimized through the integration of advanced control systems, automation, and digitalization. Real-time monitoring, data analytics, and predictive maintenance are contributing to the reliability and safety of these facilities. The industry is adopting Industry 4.0 principles, making them more responsive to market demands and operational challenges. The liquefaction segment is characterized by regional dynamics, with the US, Russia, Australia, and Qatar being major players in LNG production. Liquefaction facilities are strategically located to cater to both domestic and international demand, and the development of projects near natural gas reserves enhances competitiveness.

Large Scale LNG Terminal Market Regional Analysis:

Asia Pacific is expected to have the highest share of the Large Scale LNG Terminal market from 2023 to 2031, according to the most recent market study. It has been forecast that a rise in consumer preference for natural gas over conventional fuels is going to boost the region's worldwide market share. The rising need for liquefied gas ( LNG ) in Asia Pacific has been driven by the accessible supply of natural gas and the rise in health concerns related to air and water pollution. Natural gas production in the Asia-Pacific region is increasing owing to the region's natural resource base. According to the BP World Energy Review, due to urbanization and economic expansion, Asia Pacific accounted for 72% of the world's LNG import capacity. Countries like China and India are investing heavily in LNG Terminal to meet their energy needs and reduce dependence on coal and oil. Furthermore, the region's strategic location allows for easy access to LNG supply from major exporting countries, facilitating trade and market growth. 1. In 2023, China became the world's largest buyer of LNG, surpassing Japan. 2. In 2022, around 73% of total European re-exports remained within the region; however, in 2023, this dropped to around 35% staying within Europe. Almost 38% of the exports were directed to other Asian markets, primarily to mainland China. 3. In 2022, about 73% of all European re-exports in 2022 in the area; by 2023, just about 35% did. The major destination of over 38% of the exports was mainland China, with the remainder going to other Asian markets. 4. Around 73% of all European re-exports in 2022 stayed in the area; by 2023, that percentage had decreased to roughly 35%. The majority of the exports nearly 38% went to mainland China and other Asian markets. After Asia, Europe is the market leader for Large Scale LNG Terminal. The region's dedication to cutting emissions of greenhouse gases and switching to greener energy sources is what propels its growth. LNG Terminal and pipelines, among other well-developed infrastructure, are essential to Europe's LNG business. Nations that are increasing the capacity of their LNG Terminal include France, Germany, Spain, and the UK. Europe serves as a center for LNG distribution due to its proximity to significant LNG exporters, which promotes commerce. All things considered, Europe's established infrastructure and dedication to greener energy make it a major participant in the Large Scale LNG terminal market. 1. In 2023, the EU's ability to import LNG climbed by 40 billion cubic meters (bcm), and in 2024, a further 30 bcm is expected to become available. Competitive Landscape of Large Scale LNG Terminal Market: Major companies investing in liquefaction and regasification Terminal include Shell, ExxonMobil, and Chevron in the competitive Large Scale LNG terminal industry. Project management and technical services are provided by EPC companies such as TechnipFMC and Bechtel. Operations are managed by terminal operators such as Cheniere Power and Sempra Energy, while production and export operations by national oil firms such as Qatar Petroleum Company and Petronas impact the global market. LNG infrastructure, such as pipelines and storage facilities, is developed by infrastructure firms like Kinder Morgan and Enbridge. Because of the dynamic nature of the market, businesses are always adapting to new circumstances. 1. On 4th August 2023, Crown LNG Holdings, a company that creates liquefied natural gas Terminals that endure severe weather, confirmed on Thursday that it will merge with a blank check company to go public in New York. The acquisition is valued at $685 million for the combined business. 2. A completely owned subsidiary of Shell plc (Shell), Shell Petroleum NV, has successfully acquired all of the assets of Nature Energy Biogas A/S (Nature Energy). 3. On 23rd March 2023, the previously disclosed acquisition of Volta Inc. (Volta) by Shell USA, Inc., a Shell plc subsidiary, was finalized in an all-cash deal estimated to be for $169 million. With this purchase, 4. In 2023, Linde purchased the remaining portion of nexAir, a sizable independent US distributor of packaged gas. 5. On 23rd October 2023, in an all-stock deal valued at $53 billion, or $171 per share based on Chevron's closing price on October 20, 2023, Chevron Corporation and Hess Corporation finalized their agreement to buy all of Hess's outstanding shares. The objective of the report is to present a comprehensive analysis of the Large Scale LNG Terminal to the stakeholders in the industry. The past and current status of the industry with the forecasted Market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include Market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Large Scale LNG Terminal dynamics, and structure by analysing the Market segments and projecting the Large Scale LNG Terminal size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Large Scale LNG Terminal make the report an investor’s guide.Large-scale LNG Terminals Market Scope: Inquire before Buying

Large Scale LNG Terminals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.70 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 3.95 Bn. Segments Covered: by Operations Liquifaction Regasification by Location of Deployment Onshore Offshore by Application Residential Commercial Industrial Large-scale LNG Terminals Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Large Scale LNG Terminal Market Key Players:

North America 1. Linde Engineering (Germany) 2. Royal Dutch Shell plc (Netherlands/UK) 3. Exxon Mobil Corporation (USA) 4. Chevron Corporation (USA) 5. Cameron LNG (USA) 6. Gulfstream LNG 7. Plaquemines LNG 8. Cameron LNG 9. Commonwealth LNG Europe: 1. Linde AG (Germany) 2. Royal Dutch Shell plc (Netherlands/UK) 3. Statoil ASA (Norway) 4. Elba Island LNG Asia Pacific 1. Linde AG (Germany) 2. Shell (India) 3. PETROLIAM NASIONAL BERHAD (PETRONAS) (Malaysia) 4. Nippon Gas Co. (Japan) 5. PETRONAS (Malaysia) 6. Chiyoda Cooperation (Japan) 7. ASaP FAQs: 1. What are the growth drivers for the Large Scale LNG Terminal Market? Ans. Accelerated natural gas infrastructure investment driving the Large Scale LNG Terminal Market. 2. What are the major restraining factors for the Large Scale LNG Terminal Market growth? Ans. Volatility of Price and market is a restraining factor of the Large Scale LNG Terminal Market. 3. Which region is expected to lead the Global Large Scale LNG Terminal Market during the forecast period? Ans. Asia Pacific is expected to lead the Global Large Scale LNG Terminal Market during the forecast period 4. What is the projected market size and growth rate of the Large Scale LNG Terminal Market? Ans. The Global Large Scale LNG Terminal Market size was valued at USD 2.70 Billion in 2022 and the total Large Scale LNG Terminal revenue is expected to grow at a CAGR of 5.6% from 2023 to 2029, reaching nearly USD 3.95 Billion. 5. What segments are covered in the Large Scale LNG Terminal Market report? Ans. The segments covered in the Large Scale LNG Terminal Market report are Operations, Location of Deployment, Application and Region.

1. Large Scale LNG Terminal Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Large Scale LNG Terminal Market: Dynamics 2.1. Large Scale LNG Terminal Market Trends by Region 2.1.1. North America Large Scale LNG Terminal Market Trends 2.1.2. Europe Large Scale LNG Terminal Market Trends 2.1.3. Asia Pacific Large Scale LNG Terminal Market Trends 2.1.4. Middle East and Africa Large Scale LNG Terminal Market Trends 2.1.5. South America Large Scale LNG Terminal Market Trends 2.2. Large Scale LNG Terminal Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Large Scale LNG Terminal Market Drivers 2.2.1.2. North America Large Scale LNG Terminal Market Restraints 2.2.1.3. North America Large Scale LNG Terminal Market Opportunities 2.2.1.4. North America Large Scale LNG Terminal Market Challenges 2.2.2. Europe 2.2.2.1. Europe Large Scale LNG Terminal Market Drivers 2.2.2.2. Europe Large Scale LNG Terminal Market Restraints 2.2.2.3. Europe Large Scale LNG Terminal Market Opportunities 2.2.2.4. Europe Large Scale LNG Terminal Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Large Scale LNG Terminal Market Drivers 2.2.3.2. Asia Pacific Large Scale LNG Terminal Market Restraints 2.2.3.3. Asia Pacific Large Scale LNG Terminal Market Opportunities 2.2.3.4. Asia Pacific Large Scale LNG Terminal Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Large Scale LNG Terminal Market Drivers 2.2.4.2. Middle East and Africa Large Scale LNG Terminal Market Restraints 2.2.4.3. Middle East and Africa Large Scale LNG Terminal Market Opportunities 2.2.4.4. Middle East and Africa Large Scale LNG Terminal Market Challenges 2.2.5. South America 2.2.5.1. South America Large Scale LNG Terminal Market Drivers 2.2.5.2. South America Large Scale LNG Terminal Market Restraints 2.2.5.3. South America Large Scale LNG Terminal Market Opportunities 2.2.5.4. South America Large Scale LNG Terminal Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Large Scale LNG Terminal Industry 2.8. Analysis of Government Schemes and Initiatives For Large Scale LNG Terminal Industry 2.9. Large Scale LNG Terminal Market Trade Analysis 2.10. The Global Pandemic Impact on Large Scale LNG Terminal Market 3. Large Scale LNG Terminal Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 3.1.1. Liquefaction 3.1.2. Regasification 3.2. Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 3.2.1. Onshore 3.2.2. Offshore 3.3. Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 3.3.1. Residential 3.3.2. Commercial 3.3.3. Industrial 3.4. Large Scale LNG Terminal Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Large Scale LNG Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 4.1.1. Liquefaction 4.1.2. Regasification 4.2. North America Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 4.2.1. Onshore 4.2.2. Offshore 4.3. North America Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. North America Large Scale LNG Terminal Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 4.4.1.1.1. Liquefaction 4.4.1.1.2. Regasification 4.4.1.2. United States Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 4.4.1.2.1. Onshore 4.4.1.2.2. Offshore 4.4.1.3. United States Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Residential 4.4.1.3.2. Commercial 4.4.1.3.3. Industrial 4.4.2. Canada 4.4.2.1. Canada Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 4.4.2.1.1. Liquefaction 4.4.2.1.2. Regasification 4.4.2.2. Canada Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 4.4.2.2.1. Onshore 4.4.2.2.2. Offshore 4.4.2.3. Canada Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Residential 4.4.2.3.2. Commercial 4.4.2.3.3. Industrial 4.4.3. Mexico 4.4.3.1. Mexico Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 4.4.3.1.1. Liquefaction 4.4.3.1.2. Regasification 4.4.3.2. Mexico Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 4.4.3.2.1. Onshore 4.4.3.2.2. Offshore 4.4.3.3. Mexico Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Residential 4.4.3.3.2. Commercial 4.4.3.3.3. Industrial 5. Europe Large Scale LNG Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.2. Europe Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.3. Europe Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4. Europe Large Scale LNG Terminal Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.1.2. United Kingdom Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.1.3. United Kingdom Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.2.2. France Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.2.3. France Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.3.2. Germany Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.3.3. Germany Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.4.2. Italy Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.4.3. Italy Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.5.2. Spain Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.5.3. Spain Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.6.2. Sweden Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.6.3. Sweden Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.7.2. Austria Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.7.3. Austria Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 5.4.8.2. Rest of Europe Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 5.4.8.3. Rest of Europe Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Large Scale LNG Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.2. Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.3. Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.1.2. China Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.1.3. China Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.2.2. S Korea Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.2.3. S Korea Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.3.2. Japan Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.3.3. Japan Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.4.2. India Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.4.3. India Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.5.2. Australia Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.5.3. Australia Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.6.2. Indonesia Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.6.3. Indonesia Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.7.2. Malaysia Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.7.3. Malaysia Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.8.2. Vietnam Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.8.3. Vietnam Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.9.2. Taiwan Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.9.3. Taiwan Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 6.4.10.2. Rest of Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 6.4.10.3. Rest of Asia Pacific Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Large Scale LNG Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 7.2. Middle East and Africa Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 7.3. Middle East and Africa Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Large Scale LNG Terminal Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 7.4.1.2. South Africa Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 7.4.1.3. South Africa Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 7.4.2.2. GCC Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 7.4.2.3. GCC Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 7.4.3.2. Nigeria Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 7.4.3.3. Nigeria Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 7.4.4.2. Rest of ME&A Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 7.4.4.3. Rest of ME&A Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 8. South America Large Scale LNG Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 8.2. South America Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 8.3. South America Large Scale LNG Terminal Market Size and Forecast, by Application(2023-2030) 8.4. South America Large Scale LNG Terminal Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 8.4.1.2. Brazil Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 8.4.1.3. Brazil Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 8.4.2.2. Argentina Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 8.4.2.3. Argentina Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Large Scale LNG Terminal Market Size and Forecast, by Operations (2023-2030) 8.4.3.2. Rest Of South America Large Scale LNG Terminal Market Size and Forecast, by Location of Deployment (2023-2030) 8.4.3.3. Rest Of South America Large Scale LNG Terminal Market Size and Forecast, by Application (2023-2030) 9. Global Large Scale LNG Terminal Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Large Scale LNG Terminal Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Linde Engineering (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Royal Dutch Shell plc (Netherlands/UK) 10.3. Exxon Mobil Corporation (USA) 10.4. Chevron Corporation (USA) 10.5. Cameron LNG (USA) 10.6. Gulfstream LNG 10.7. Plaquemines LNG 10.8. Cameron LNG 10.9. Commonwealth LNG 10.10. Linde AG (Germany) 10.11. Royal Dutch Shell plc (Netherlands/UK) 10.12. Statoil ASA (Norway) 10.13. Elba Island LNG 10.14. Linde AG (Germany) 10.15. Shell (India) 10.16. PETROLIAM NASIONAL BERHAD (PETRONAS) (Malaysia) 10.17. Nippon Gas Co. (Japan) 10.18. PETRONAS (Malaysia) 10.19. Chiyoda Cooperation (Japan) 10.20. ASaP 11. Key Findings 12. Industry Recommendations 13. Large Scale LNG Terminal Market: Research Methodology 14. Terms and Glossary