The Smart Solar Market size was valued at USD 23.60 Billion in 2024 and the total Smart Solar revenue is expected to grow at a CAGR of 15.9% from 2025 to 2032, reaching nearly USD 76.86 Billion.Smart Solar Market Overview:

A smart solar device is a piece of machinery that aids in solar energy extraction at a very high conversion efficiency. Solar energy applications can be used to meet a variety of energy needs. The devices are being created to function in a smart environment as a result of technological advancement. In order to harness the available energy and increase device efficiency, smart solar devices help to reduce energy waste and make the greatest use of the power that is available. This report focuses on the different segments of the Smart Solar market (Product, Device, Solution, Application, End-Use Industry, and Region). In-depth analysis of the leading industry participants and regions is provided in this report (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It offers a thorough examination of the numerous sectors' explosive modern-era growth. Through numbers, visuals, and presentations, the core data analysis from 2019 to 2024 is highlighted. The market drivers, restraints, opportunities, and challenges for Smart Solar are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the Smart Solar market.To know about the Research Methodology :- Request Free Sample Report

Smart Solar Market Dynamics:

Smart solar technologies are becoming more popular as a result of governments throughout the world looking for economical solutions and motivating people to convert to environmentally friendly ones by offering subsidies. Controlling energy usage and switching to cleaner, more efficient energy-producing sources are now necessary due to the ever-increasing energy demand from end users in the residential and industrial sectors as well as the depletion of natural resources. Governments all over the world are looking for economical alternatives and are motivating the people to convert to environmentally friendly solutions by offering subsidies, which is boosting the use of intelligent solar solutions. For instance, MNRE has implemented a variety of legislative steps to help India reach its 2024 solar ambitions. Provisions for renewable generation obligations and renewable purchase obligations have been included to the National Tariff Policy. By 2024, state-owned power distribution companies must purchase 8% of their energy from solar sources, and owners of thermal power plants must incorporate a predetermined percentage of renewable energy sources into every new capacity addition. Additionally, solar energy makes a substantial contribution to reducing carbon emissions and securing a sustainable energy future. It can be used for transportation, power generating, lighting, cooling, heating, and even environmental remediation. Global installed solar capacity increased from 227 GW in 2015 to 305 GW in 2016, mostly as a result of growth in the United States and China. The need for higher start-up costs and maintenance costs. The growth of the smart solar market is being hampered by the requirement for higher starting expenses and higher maintenance costs. Smart solar systems, which are largely digital, have the capability of tracking the weather and using that information to project the solar system in accordance with requirements. Data management problems and the need to replace devices are two of the problems hampering the market's growth. Solar power plants need a large amount of land to be installed, but solar PV systems cannot be placed on land that is already developed, forested, or used for agriculture. The major barrier to the market's growth is unstable terrain because solar PV systems cannot be installed there. Device replacement and the possibility of cyber-attacks are expected to hamper the market growth. The use of colocation solutions and services is still in its infancy in developing countries like MEA and Latin America. Due to the early start-up costs, many businesses in these regions are unable to employ smart solar solutions and services. The growth of the smart solar market is significantly hampered by this. The high cost of initial deployment as well as ongoing maintenance is one of the main factors limiting the market for smart solar growth. In addition, the risk of cyber-attacks and the replacement of devices limit market growth. Although installing solar panels may have significant long-term advantages, the upfront costs may be prohibitively great. Without the support of manufacturing businesses, estimating the overall cost of installation is significantly more challenging. Some nations have offered tax breaks and subsidies to entice more people to install solar panels, but the price may be too expensive without money put aside for this reason.Smart Solar Market Segment Analysis:

The Smart Solar Market is segmented by Product, Device, Solution, Application, and End-Use Industry. Based on the Solution, the market is segmented into Asset Management, Network Monitoring, Meter Data Management, Analytics, Supervisory Control and Data Acquisition (SCADA), Remote Metering, and Outage Management. Meter Data Management segment is expected to hold the largest market share of xx% by 2032. The most significant growth in metre data management (MDM) is expected when smart grids and smart metres are deployed more broadly. Software that saves and manages massive volumes of data produced over time by smart metering devices is known as metre data management (MDM). In systems that manage data collection, such as advanced metering infrastructure (AMI) or automatic metre reading (AMR), this data mostly consists of user statistics and events imported from the head-end servers. MDM is a part of the smart grid technology used by utility companies. The analysis of data produced by electric smart metres, which track energy use, may also be included in this. The growth of the Meter Data Management solution has also been facilitated by technological advancement, which has increased the Meter Data Management solution's capacity to support more business operations throughout the utility value chain, such as customer billing, credit management, and metre asset management. As part of its efforts to help Kenya become carbon neutral, Huawei, a Chinese telecommunications corporation, launched an integrated solar energy solution for Kenyan households in August 2022. Based on the Application, the market is segmented into Commercial and Residential (C&I), and Residential. Commercial and Residential (C&I) segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. Since the initial cost of establishing smart solar solutions and services is substantial and limits their applicability in investor-owned utilities, the C&I market is experiencing higher acceptance than residential applications. Commercial uses such schools, hospitals, hotels, retail centres, movie theatres, universities, factories, banks, offices of the government, corporate headquarters, and gas stations can all benefit financially and environmentally from using solar energy. Any commercial building uses more energy than a homeowner does. Electricity is needed every day to operate energy-intensive gadgets like computers, machines, and lighting fixtures. Despite the fact that traditional solar solutions have a significant market share in the residential segment, customers are reluctant to engage in smart solar solutions due to financial restrictions. Zunroof, a manufacturer of solar rooftop systems, announced the consumer launch of a new line of "zunpulse" smart gadgets in September 2020. A single app will control all of the devices. More than 36% of the nation's energy production is used by the commercial sector. Similar to this, more than 26% of total electricity is generated by the industrial sector. There is a higher need for smart solar solutions in commercial and industrial applications due to the rising demand for electricity in these sectors. Based on the Product, the market is segmented into Photovoltaic Cells, Photovoltaic Panels, Inverters, Generators, and Others. Photovoltaic Cells segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. PV can power standalone appliances, tools, and metres in urban or rural settings. Parking metres, temporary traffic signs, emergency phones, radio transmitters, water irrigation pumps, stream-flow gauges, remote guard posts, roadway lights, and other devices can all be powered by PV. Solar power has long been a main source of energy for Earth-orbiting satellites. High-efficiency PV will continue to be a crucial component of planetary and space exploration. It has provided electricity for projects like the International Space Station and surface rovers on the Moon and Mars. Vehicles like cars and boats can use solar energy as an additional power source. Vehicle sunroofs may have PV to charge batteries slowly or provide onboard power. In order to power high-altitude aeroplanes, lightweight PV may also adapt to the curvature of an aeroplane wing. Utility-scale power, ranging from tens of megawatts to more than a gigawatt, can be produced by many acres of PV panels. These substantial systems deliver power into local or regional grids utilizing fixed or solar-tracking panels.

Regional Insights:

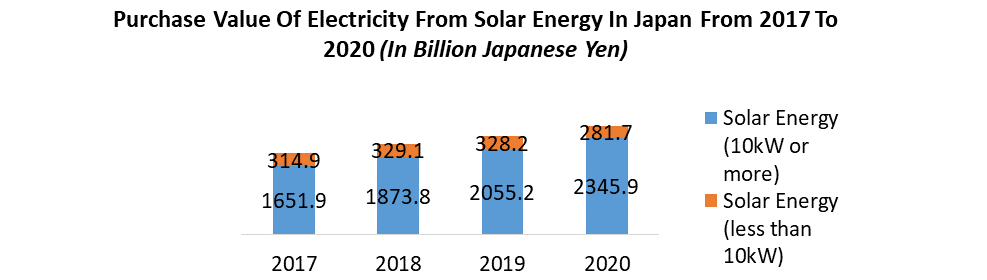

The Asia Pacific region is expected to dominate the Smart Solar Market during the forecast period 2025-2032. The Asia Pacific region is expected to hold the largest market share of xx% by 2032. Japan's Smart Solar Market is growing as a result of stricter government regulation, including the FIT programme. Additionally, the idea of grid automation gives smart solar systems more value. When installed and planned properly, off-grid systems are extremely cost-effective. Through the reductions in energy usage, the user can recover the initial investment expenses within five years of installation. The Energy and Resources Institute (TERI), one of India's premier energy and environmental organisations, introduced a programme named "Indian Solar Market Aggregation for Rooftops" (I-SMART). For the aforementioned programme, TERI had also partnered with the American company Cadmus Group, which offers technical and strategic consulting services. The goal of this aggregation scheme is to make rooftop solar installation easier for Indian users, both personal and commercial. Four states and two Union Territories are expected to see an increase in demand for rooftop solar systems with a 1 GW capacity as a result of the programme. The objective of the report is to present a comprehensive analysis of the Global Smart Solar Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Smart Solar Market dynamic and structure by analyzing the market segments and projecting the Global Smart Solar Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Smart Solar Market make the report investor’s guide.Smart Solar Market Scope: Inquire before buying

Smart Solar Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 23.60 Bn. Forecast Period 2025 to 2032 CAGR: 15.9% Market Size in 2032: USD 76.86 Bn. Segments Covered: by Product Photovoltaic Cells Photovoltaic Panels Inverters Generators Others by Device Smart Solar Meters Intelligrid RFID by Solution Asset Management Network Monitoring Meter Data Management Analytics Supervisory Control and Data Acquisition (SCADA) Remote Metering Outage Management by Application Commercial and Residential (C&I) Residential by End-Use Industry Government Utilities Healthcare Construction Education Agriculture Others Smart Solar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Smart Solar Key Players:

1. ABB 2. GE Power 3. Itron Inc. 4. Schneider Electric 5. Echelon Corporation 6. Silver Spring Networks Inc. 7. Landis+GYR AG 8. Urban Green Energy (UGE) International 9. HCL Technologies 10. Siemens AG 11. Sensus USA Inc. 12. Calico Energy Services 13. Aclara Technologies LLC 14. Smart Solar Solutions LLC 15. Intergraph Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Smart Solar Market? Ans. The Asia Pacific region is expected to hold the highest share in the Smart Solar Market. 2] Who are the top key players in the Smart Solar Market? Ans. ABB, GE Power, Itron Inc., Schneider Electric, Echelon Corporation, Silver Spring Networks Inc., and Landis+GYR AG are the top key players in the Smart Solar Market. 3] Which segment is expected to hold the largest market share in the Smart Solar Market by 2032? Ans. Meter Data Management Solution segment is expected to hold the largest market share in the Smart Solar Market by 2032. 4] What is the market size of the Smart Solar Market by 2032? Ans. The market size of the Smart Solar Market is expected to reach USD 76.86 Bn. by 2032. 5]. What was the Global Smart Solar Market size in 2024? Ans: The Global Smart Solar Market size was USD 23.60 Billion in 2024.

1. Global Smart Solar Market: Research Methodology 2. Global Smart Solar Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to the Global Smart Solar Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Smart Solar Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region 3.12 COVID-19 Impact 4. Global Smart Solar Market Segmentation 4.1 Global Smart Solar Market, by Product (2024-2032) 4.2 Global Smart Solar Market, by Device (2024-2032) 4.3 Global Smart Solar Market, by Solution (2024-2032) 4.4 Global Smart Solar Market, by Application (2024-2032) 4.5 Global Smart Solar Market, by End-Use Industry (2024-2032) 5. North America Smart Solar Market (2024-2032) 5.1 North America Smart Solar Market, by Product (2024-2032) 5.2 North America Smart Solar Market, by Device (2024-2032) 5.3 North America Smart Solar Market, by Solution (2024-2032) 5.4 North America Smart Solar Market, by Application (2024-2032) 5.5 North America Smart Solar Market, by End-Use Industry (2024-2032) 5.6 North America Smart Solar Market, by Country (2024-2032) 6. Europe Smart Solar Market (2024-2032) 6.1. Europe Smart Solar Market, by Product (2024-2032) 6.2. Europe Smart Solar Market, by Device (2024-2032) 6.3. Europe Smart Solar Market, by Solution (2024-2032) 6.4. Europe Smart Solar Market, by Application (2024-2032) 6.5. Europe Smart Solar Market, by End-Use Industry (2024-2032) 6.6. Europe Smart Solar Market, by Country (2024-2032) 7. Asia Pacific Smart Solar Market (2024-2032) 7.1. Asia Pacific Smart Solar Market, by Product (2024-2032) 7.2. Asia Pacific Smart Solar Market, by Device (2024-2032) 7.3. Asia Pacific Smart Solar Market, by Solution (2024-2032) 7.4. Asia Pacific Smart Solar Market, by Application (2024-2032) 7.5. Asia Pacific Smart Solar Market, by End-Use Industry (2024-2032) 7.6. Asia Pacific Smart Solar Market, by Country (2024-2032) 8. South America Smart Solar Market (2024-2032) 8.1. South America Smart Solar Market, by Product (2024-2032) 8.2. South America Smart Solar Market, by Device (2024-2032) 8.3. South America Smart Solar Market, by Solution (2024-2032) 8.4. South America Smart Solar Market, by Application (2024-2032) 8.5. South America Smart Solar Market, by End-Use Industry (2024-2032) 8.6. South America Smart Solar Market, by Country (2024-2032) 9. Middle East and Africa Smart Solar Market (2024-2032) 9.1 Middle East and Africa Smart Solar Market, by Product (2024-2032) 9.2. Middle East and Africa Smart Solar Market, by Device (2024-2032) 9.3. Middle East and Africa Smart Solar Market, by Solution (2024-2032) 9.4. Middle East and Africa Smart Solar Market, by Application (2024-2032) 9.5. Middle East and Africa Smart Solar Market, by End-Use Industry (2024-2032) 9.6. Middle East and Africa Smart Solar Market, by Country (2024-2032) 10. Company Profile: Key players 10.1 ABB 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 GE Power 10.3 Itron Inc. 10.4 Schneider Electric 10.5 Echelon Corporation 10.6 Silver Spring Networks Inc. 10.7 Landis+GYR AG 10.8 Urban Green Energy (UGE) International 10.9 HCL Technologies 10.10 Siemens AG 10.11 Sensus USA Inc. 10.12 Calico Energy Services 10.13 Aclara Technologies LLC 10.14 Smart Solar Solutions LLC 10.15 Intergraph