The Kratom Market size was valued at USD 2.56 Billion in 2025 and the total Kratom revenue is expected to grow at a CAGR of 17.2% from 2025 to 2032, reaching nearly USD 7.79 Billion by 2032.Kratom Market Overview

Kratom is an herbal substance that produces opioid- and stimulant-like effects. It is primarily sourced from Southeast Asian countries where it grows naturally. In several countries, regulatory agencies consider or implement measures to regulate or restrict the sale and use of Kratom due to safety concerns. Kratom is not an FDA-approved medication and kratom products are also not regulated well. Some U.S. states and other countries have made it illegal to purchase or consume. Kratom and kratom products are legal and accessible in many countries. People use kratom to manage drug withdrawal symptoms and cravings, pain, fatigue and mental health problems. The National Institute on Drug Abuse (NIDA) supports and conducts research to evaluate medicinal uses for kratom and related chemical compounds. The market has seen fluctuations in demand and supply mainly because of changing regulations and public perception.To know about the Research Methodology :- Request Free Sample Report

Kratom Market Dynamics

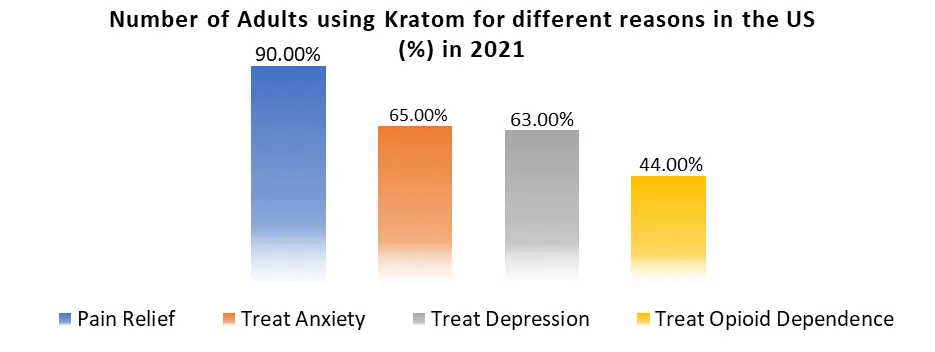

Consumer Demand for Natural and Herbal Products The use of leaves of the Kratom tree to make herbal supplements is gaining popularity. Indigenous communities have been using kratom leaves for medicinal and recreational purposes for centuries. In recent years, kratom is increasingly gaining popularity in the Western world, with an increase in its consumption for various reasons. In 2020, American Kratom Association (AKA), a consumer advocacy group, estimated that in the US, 10-16 million people use kratom by eating its ground leaves in food or brewing them in tea. The demand for natural products is increasing because of the growing wellness and self-care trends. The potential of kratom to provide relaxation, stress relief, and mood improvement aligns with these trends. Kratom is used as part of a holistic health lifestyle because it is seen as a natural way for the improvement of health and well-being. The rising interest of people in holistic health, because it offers a more natural and integrative approach to health and wellness, is highly increasing demand for kratom products. Consumers are learning about herbal products such as kratom through the internet, which has increased access to the internet. Online resources that provide information about the effects, dosages, and safety of kratom are empowering consumers to make informed choices. These factors are highly driving the kratom market growth. Potential Alternative to Opioids Kratom users claim that kratom eases the symptoms of opioid withdrawal as well as treats pain, increases energy, decreases anxiety, and enhances mood. The global market is majorly driven by its increasing use as a natural pain management solution. In recent years, kratom has become popular in the world, especially in North America. The opioid crisis, which is characterized by the widespread misuse and addiction to prescription opioids and illicit drugs, has increased awareness of the need for safer alternatives. kratom is a natural option that some people are turning to for pain relief and opioid withdrawal. Kratom is also considered as a harm-reduction strategy by some for individuals struggling with opioid addiction. Kratom contains alkaloids that interact with opioid receptors in the brain, which provides pain relief without the risk of addiction or respiratory depression associated with traditional opioids.Side Effects Associated with the Use of Kratom Kratom affects differently based on dosing. At higher doses (5 to 15 g), it has been described to have sedative opioid-like effects and at lower doses (1 to 5 g), cocaine-like stimulant effects. At higher doses, there are high chances of toxidrome to occur with diaphoresis, dizziness, and nausea, which gives way to euphoria. Kratom has also been found to be tolerance- and addiction-forming. There are adverse effects associated both with acute overdose/toxicity and with chronic use. Chronic users also suffer tremors, frequent urination, anorexia, weight loss, seizures or psychosis. They suffer from withdrawal symptoms ranging from aggression to insomnia. Acute toxicity results in seizure, hepatotoxicity, and possibly death. Recently, the concern is rising of an emerging epidemic of kratom, as its opioid-like properties are leading to a resurgence in use in the context of the opioid crisis of America. All these side effects associated with the use of kratom are expected to hamper the growth of the global kratom market during the forecast period. In the past few years, the United States (US) and a few European countries have expressed their rising concern that kratom, while having no recognized therapeutic use, could pose a serious risk to public health and society. Kratom use was introduced in these countries only relatively recently and therefore lacks it the cultural and social significance it has acquired in Southeast Asia. In the US and Europe, many kratom products are sold as processed food supplements, some of which contain high contents of isolated mitragynine and other alkaloids, in contrast with kratom leaves in their natural form as they are consumed in Southeast Asian countries. A number of lethal overdoses and severe intoxications, presumably due to kratom, have been reported in the past few years. Blood analysis and other medical investigations revealed that in almost every instance, other psychoactive substances were involved in the overdoses, which made it difficult to establish causality. Thus, the demand for kratom products is expected to reduce in the future, affecting the growth of the market.

Region Demand for Kratom for Medical Purposes North America 600% increase over the past five years Europe 200% increase over the past three years Australia 400% increase over the past five years Southeast Asia 100% increase over the past five years

Kratom Market Regional Insights

Asia Pacific Kratom Market dominated the global market in 2025. Kratom trees are commonly found in southern Thailand, Malaysia, Indonesia, Papua New Guinea, the Philippines and southern Myanmar. In Asia Pacific, where the kratom has been widely used, people use it in small doses as an energy and mood booster, which is similar to coffee use in the West. They use larger amounts for pain, or recreationally like beer and wine. Therefore, Southeast Asian countries, especially Indonesia and Malaysia are the key kratom producers. In the region, kratom has been used for centuries by indigenous populations living across Southeast Asia and it has been used as a traditional medicine to treat several health conditions, including diarrhea, diabetes, fever and pain. The region mainly exports kratom products to other countries, which also includes the US and European nations. In the recent years, the increasing demand for kratom in the Western countries is resulting to a growth in production and export. The North American Kratom Market held the major share of the global market and is expected to grow during the forecast period due to in part to the opioid crisis. This led people to seek out safer alternatives to prescription opioids. Currently, an estimated 5.5 million people in the US use kratom. In the country, kratom is mainly available for purchase online and in head shops, gas stations, vaping establishments and corner stores. It is inexpensive, selling for nine to twenty dollars per ounce on the Internet. Kratom has witnessed an increase in popularity in the region due to its purported benefits over the past few years. Many individuals are shifting to kratom as an alternative to prescription painkillers, seeking natural pain relief or help with opioid withdrawal symptoms. Alabama, Arkansas, Indiana, Rhode Island, Vermont, and Wisconsin are the six states, where the use of kratom is illegal. In 2019, the three states in the region passed the Kratom Consumer Protection Act (or something similar to it). These states are Arizona, Nevada, and Utah. Three states in the region have established age restrictions for kratom products. Those are Tennessee (21), Minnesota (18), and Illinois (18). As per 2024, New Jersey is the latest state to consider regulation of kratom that includes making it illegal to sell to anyone under 21.

Kratom Market Segment Analysis

Based on Form: The market is divided into Processed Kratom and Raw Kratom Leaves. The Processed Kratom segment held the major kratom market share in 2025 and is expected to grow rapidly during the forecast period. This is attributed to the high demand for processed kratom because it offers convenience and precise dosing. Many kratom users prefer a processed form of kratom because they are easy to measure, ingest, and use in their daily routines. Based on Product Type: The market is divided into Powdered Kratom, Kratom Extracts, Kratom Capsules and Tablets and Kratom Tinctures. The Powdered Kratom segment held the largest kratom market share in 2025. Powdered kratom is the most popular and widely consumed form of kratom. The Kratom Capsules and Tablets segment is expected to grow rapidly during the forecast period. Kratom Capsules and Tablets offer a convenient way to consume kratom. They provide precise dosing, which makes them popular among users who want to monitor their intake closely. They are highly preferred by newcomers to kratom as they eliminate the need for measuring and handling loose powder. The Kratom Tinctures segment is also expected to grow at a high rate during the forecast period. Kratom Tinctures, a liquid extract of kratom, is known for rapid absorption, which provides a faster onset of effects compared to other forms. Tinctures are convenient for on-the-go use and travel because of their compact size. This is making them popular among kratom enthusiasts. Based on Distribution Channel: The market is divided into Online and Offline. The Offline segment dominated the global market in 2025. The Online segment is expected to grow rapidly during the forecast period. The online purchase of kratom is mainly increasing due to the convenience and accessibility of e-commerce platforms. To cater to customer base across the world, many kratom vendors are establishing their online stores.Kratom Market Competitive Landscape

The kratom market is relatively fragmented, with a large number of small and medium businesses operating both online and in physical stores. There are regulatory requirements for kratom sales and the products are obtained from various sources including Southeast Asia and the United States so it is easy to start a kratom business. The competition on price is high mainly because of the huge number of competitors and low barriers to entry. This makes it difficult for businesses to generate profits. The demand for kratom products is increasing due to its rising popularity among consumers, which has resulted in an increase in competition in the market, as businesses struggle to attract new customers and increase their presence in the market.Further, this section of the kratom Market report provides a detailed analysis of the competitors and information provided by the competitors. A secondary research method was used to provide detailed information on kratom key competitors while the primary research method included interviews with the market players. The investments by key players in research and development, revenue, sales, production capacities and company overview are all included in the report. SWOT analysis was used to provide the strengths and weaknesses of the key players in the kratom industry.

Kratom Market Scope: Inquiry Before Buying

Kratom Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 2.56 Bn. Forecast Period 2026 to 2032 CAGR: 17.2% Market Size in 2032: USD 7.79 Bn. Segments Covered: by Form Processed Kratom Raw Kratom Leaves by Product Type Powdered Kratom Kratom Extracts Kratom Capsules and Tablets Kratom Tinctures by Application Pain Management Mood Enhancement Energy and Focus Relaxation and Anxiety Relief by Distribution Channel Online Offline Kratom Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Kratom Key Players

1. Kraken Kratom 2. Happy Hippo Herbals 3. PurKratom 4. Kats Botanicals 5. Coastline Kratom 6. Mitragaia 7. Phytoextractum 8. Herbal RVA 9. Super Speciosa 10. Kratom Spot 11. New Dawn Kratom 12. Kratom Krush 13. Your Kratom 14. Oties Botanicals 15. Kona Kratom 16. Golden Monk 17. Kats Botanicals 18. Kratom Source USA 19. Bulk Kratom Now Frequently Asked Questions 1] What is the expected CAGR of the Global Kratom Market during the forecast period? Ans. During the forecast period, the Global Kratom Market is expected to grow at a CAGR of 3.4 percent. 2] What was the Global Kratom Market size in 2025? Ans: The Global Kratom Market size was USD 2.56 Billion in 2025. 3] What is the expected Kratom Market size by 2032? Ans. USD 7.80 Bn is the expected Kratom Market size by 2032. 4] What are the major Kratom Market segments? Ans. The market is divided by Form, Product Type, Application and Distribution Channel. 5] Which regional Kratom Market is expected to grow at a high rate during the forecast period? Ans. North America Kratom Market is expected to grow at a high rate during the forecast period.

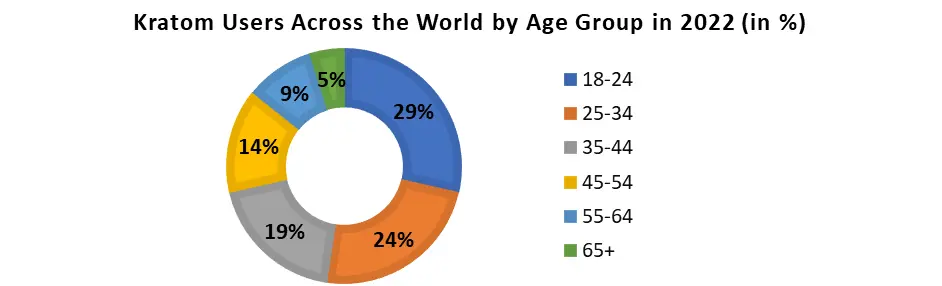

1. Kratom Market: Market Introduction 1.1. Executive Summary 1.2. Market Size (2023) & Forecast (2025-2032) 1.3. Market Size (USD) and Market Share (%) 1.3.1. By Segments 1.3.2. By Regions 1.3.3. By Country 2. Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Product Segment 2.2.3. End-User Segment 2.2.4. Revenue (2023) 2.2.5. Market Share (%) 2.2.6. Headquarter 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 2.5. Overview of local versus global competition 2.6. Emerging small-scale brands and niche players targeting unique demographics 3. Kratom Market Dynamics 3.1. Kratom Market Trends 3.2. Kratom Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Asia Pacific 3.5.3. Europe 3.5.4. Middle East and Africa 3.5.5. South America 3.5.6. Analysis of international regulations and legislative shifts in key markets 3.5.6.1. U.S. 3.5.6.2. Southeast Asia 3.5.6.3. Europe 3.5.7. Compliance challenges and legal restrictions impacting global trade 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for the Industry 4. Macroeconomic Analysis 4.1. Regional Economic Health by Key Markets 4.2. Economic Growth 4.3. Consumption Pattern by Product Type (2023) 4.3.1. Powdered Kratom 4.3.2. Kratom Extracts 4.3.3. Kratom Capsules and Tablets 4.3.4. Kratom Tinctures 5. Overview of Kratom as a Natural Alternative in the Drug Market 5.1. Drug Demand by Region/Country 5.2. Impact of Consumer Awareness on Prescription Drug Demand 5.3. Role of Social Media and Digital Platforms in Shaping Kratom and Drug Industry Dynamics 5.4. Top kratom-producing countries 5.4.1. Indonesia 5.4.2. Thailand 5.4.3. Malaysia 5.4.4. Myanmar 5.4.5. Cambodia 5.4.6. Papua New Guinea 5.4.7. Laos 5.4.8. Vietnam 5.4.9. Philippines 6. Consumer Insights and Behavior 6.1. Buyer Demographics and Consumption Patterns 6.1.1. Age 6.1.2. Gender 6.1.3. Health Awareness 6.1.4. Cultural Receptivity 6.2. Consumer Pain Points and Satisfaction Metrics 6.2.1. Product Quality 6.2.2. Safety 6.2.3. Availability 6.2.4. Pricing 6.3. Role of E-commerce Growth and Digital Marketplaces 7. Cost Structure Analysis 7.1. Raw Material Costs, Processing, Packaging, and Distribution 7.2. Key Cost Factors That Affect Kratom Price 7.3. Kratom Price by Region 8. Kratom Market: Global Kratom Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 8.1. Global Kratom Market Size and Forecast, By Form 8.1.1. Processed Kratom 8.1.2. Raw Kratom Leaves 8.2. Global Kratom Market Size and Forecast, By Product Type 8.2.1. Powdered Kratom 8.2.2. Kratom Extracts 8.2.3. Kratom Capsules and Tablets 8.2.4. Kratom Tinctures 8.3. Global Kratom Market Size and Forecast, By Application 8.3.1. Pain Management 8.3.2. Mood Enhancement 8.3.3. Energy and Focus 8.3.4. Relaxation and Anxiety Relief 8.4. Global Kratom Market Size and Forecast, By Distribution Channel 8.4.1. Online 8.4.2. Offline 8.5. Global Kratom Market Size and Forecast, by Region 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 9. North America Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 9.1. North America Market Size and Forecast, By Form 9.2. North America Market Size and Forecast, By Product Type 9.3. North America Market Size and Forecast, By Application 9.4. North America Market Size and Forecast, By Distribution Channel 9.5. North America Market Size and Forecast, by Country 9.5.1. United States 9.5.1.1. United States Market Size and Forecast, By Form 9.5.1.2. United States Market Size and Forecast, By Product 9.5.1.3. United States Market Size and Forecast, By Application 9.5.1.4. United States Market Size and Forecast, By Distribution Channel 9.5.2. Canada 9.5.3. Mexico 10. Europe Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 10.1. Europe Market Size and Forecast, By Form 10.2. Europe Market Size and Forecast, By Product Type 10.3. Europe Market Size and Forecast, By Application 10.4. Europe Market Size and Forecast, By Distribution Channel 10.5. Europe Market Size and Forecast, by Country 10.5.1. France 10.5.2. Germany 10.5.3. Italy 10.5.4. Spain 10.5.5. Sweden 10.5.6. Russia 10.5.7. Rest of Europe 11. Asia Pacific Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 11.1. Asia Pacific Market Size and Forecast, By Form 11.2. Asia Pacific Market Size and Forecast, By Product Type 11.3. Asia Pacific Market Size and Forecast, By Application 11.4. Asia Pacific Market Size and Forecast, By Distribution Channel 11.5. Asia Pacific Market Size and Forecast, by Country 11.5.1. China 11.5.2. South Korea 11.5.3. Japan 11.5.4. India 11.5.5. Australia 11.5.6. Indonesia 11.5.7. Philippines 11.5.8. Malaysia 11.5.9. Vietnam 11.5.10. Thailand 11.5.11. Rest of Asia Pacific 12. Middle East and Africa Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 12.1. Middle East and Africa Market Size and Forecast, By Form 12.2. Middle East and Africa Market Size and Forecast, By Product Type 12.3. Middle East and Africa Market Size and Forecast, By Application 12.4. Middle East and Africa Market Size and Forecast, By Distribution Channel 12.5. Middle East and Africa Market Size and Forecast, by Country 12.5.1. South Africa 12.5.2. GCC 12.5.3. Egypt 12.5.4. Nigeria 12.5.5. Rest of ME&A 13. South America Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 13.1. South America Market Size and Forecast, By Form 13.2. South America Market Size and Forecast, By Product Type 13.3. South America Market Size and Forecast, By Application 13.4. South America Market Size and Forecast, By Distribution Channel 13.5. South America Market Size and Forecast, by Country 13.5.1. Brazil 13.5.2. Argentina 13.5.3. Chile 13.5.4. Colombia 13.5.5. Rest of South America 14. Company Profile: Key Players 14.1. Kratom King 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. Mystic Island Kratom 14.3. PurKratom 14.4. Supernatural Botanicals 14.5. The Kratom Company 14.6. Kratom Exchange 14.7. Kraken Kratom 14.8. Herbal Salvation 14.9. Golden Monk 14.10. Kats Botanicals 14.11. Coastline Kratom 14.12. Phytoextractum 14.13. Kratom Spot 14.14. Kratom Krush 14.15. Kingdom Kratom 14.16. Green Leaf Kratom 14.17. Mitragaia 14.18. Happy Go Leafy 14.19. MIT45 14.20. K-Tropix 15. Key Findings 16. Analyst Recommendations 17. Kratom Market: Research Methodology