Intelligent Traffic Management Market size was valued at USD 12499.71 Mn. in 2023 and the total Intelligent Traffic Management System revenue is expected to grow by 12.87 % from 2024 to 2030, reaching nearly USD 29170.89 Mn.Intelligent Traffic Management Market Overview:

Continuously increasing traffic flow causes traffic congestion and jams, increasing transportation costs and impacting people's daily lives. An intelligent traffic management system enables users to be better informed and to use transportation networks in a safer, more coordinated, efficient, and smarter manner. Intelligent Traffic Management System (ITMS) applies communication and information technology to the management of traffic, vehicles, users, and road infrastructure. To increase the effectiveness of road transportation and traffic management, ITMS offers a helpful interface with other modes of transportation, which increases demand for the Intelligent Traffic Management Market. ITMS involves road surveillance, a crucial necessity in the realm of internal security, interest in the ITMS market is growing quickly as concerns about internal security grow. In emergencies like natural disasters, fires, riots, or terrorist attacks, ITMS is playing a significant role in offering a quick mass evacuation method that is effective and efficient, which drives the Intelligent Traffic Management Market. The solution is to adopt ITMS, which leverages advanced technology and intelligent solutions. This system is able to track traffic flow and speed, in order to provide real-time traffic control that is more dynamic and flexible in shifting traffic density reports covering detailed, analyses of market trends, key benchmarking, and emerging market strategies for Intelligent Traffic Management Market.To know about the Research Methodology :- Request Free Sample Report

Competitive landscape

The intelligent traffic management market had strong development during the forecast period, with a CAGR of 12.87%. The COVID-19 pandemic caused the automobile sector to start shrinking, which significantly affects new car manufacturing. GDP growth and sales of passenger cars in India and other major nations. India saw a 10% rise in passenger automobile sales when compared to other countries. With more than 20 million automobiles sold in China in 2020, compared to 17.5 million in the US, China is the market leader. India is expected to see exceptional GDP growth, traffic congestion would be a major problem. The most apparent option seems to be to increase the road network by building flyovers or extending existing routes. However, research shows that after 5 years, traffic will use up 90% of the extra capacity. The government's increased investment in smart cities may provide a solution through sensor-assisted integrated traffic management. This report explains the most recent strategies and advancements implemented by the leading industry participants in the Intelligent Traffic Management Market. To lead the market and participate in the process of market growth, a company must collaborate with the top market leaders, acquire comparatively weaker companies, provide new goods and services to the market, and upgrade current software. According to analyses, the biggest cause of traffic jams is automobile drivers hunting for parking spaces. To aid with traffic congestion, newer technologies like vehicle-to-vehicle communication enable automobiles to speak with each other and with objects along the route. Government and manufacturers might collaborate closely to test out such ideas. Additionally, it is expected that more intelligent systems implemented to prevent traffic deaths, giving the market for intelligent traffic management systems a significant boost. Currently, more than 1 billion people die each year as a result of automotive accidents. Therefore, avoiding it has made the significance of adopting intelligent traffic management systems more apparent. These will create an opportunity for market players.Intelligent Traffic Management Market Dynamics:

Smart Cities are Setting the Standard for Advanced Intelligent Traffic Manegment Systems. The global smart city market is rapidly growing. It is expected to grow from $410.8 billion in 2020 to more than $820 billion in 2025. Smart cities make choices using big data, and the automotive IoT revolution is allowing the collection and sharing of such data. Transportation is a significant component influencing urban areas and a fundamental use case for smart cities. Intelligent Traffic Management Markets, which frequently use a traffic management center to monitor and coordinate a broad network of sensors, are discovering new methods to reduce traffic congestion and increase urban mobility. In recent years, there has been increased investment in the Intelligent Traffic Management Market, with a $12 billion budget for transportation development in 2018. This significant cost is mostly attributable to linked infrastructure equipped with sensors for traffic control and preventative maintenance. The city, on the other hand, is focused on linked cars, with ambitions to debut driverless buses as early as 2022. KPMG has ranked the city #1 in terms of autonomous vehicle preparedness. Singapore's data-rich intelligent transportation system, which can provide real-time traffic advisories to the public, has helped to make the city one of the least congested in the world.Cybersecurity is a major concern in Intelligent traffic management system Traffic signal operations have a significant influence on the safety and efficiency of traffic flow for all road users, with over 400,000 traffic lights distributed throughout the United States. Recent cybersecurity threats have made the Intelligent Traffic Management Market more conscious of the potential harm that such threats can hamper the market growth. Present traffic light systems are not correctly protected, they may be easily hacked. For example, unencrypted communication between a central traffic control management system and field traffic signal control units is sometimes employed, allowing an attacker to easily manipulate traffic signal indications. Another example is wireless detectors, which might be modified to provide fake information to traffic control systems and cause them to operate incorrectly. More details about threats and their affect on the market are covered in the report.

City Investment in Smart mobility with ITMS New York City New York City has already been investing in connected infrastructure and adaptive signals, installing cameras and sensors at over 10,000 city intersections. The municipality is also innovating using connected cars, deploying a Connected Vehicle Pilot Program to collect and analyze data from connected vehicles for a variety of technologies and applications. The program will use connected vehicle hardware and software to implement V2X initiatives to improve safety and traffic management in real-time. Singapore The city has been named by KPMG as the first in readiness for automated vehicles. Singapore’s data-rich intelligent transportation system, with its ability to deliver real-time traffic alerts to the public, has made the city one of the least congested in the world. London London is taking its infrastructure into the future by leading the way in 5G infrastructure. The Smart Mobility Living Lab in London (SMLL) is deploying the world’s most advanced urban testbed to provide 5G connectivity for connected and autonomous vehicles. The city will test V2I and V2V capabilities in a real-world environment, taking advantage of high-speed 5G. O2, the mobile operator enabling SMLL reported that the value of 5G for road management systems could reduce the time for motorists stuck in traffic by 10 percent, save the economy £880 million a year, and reduce CO2 emissions by 370,000 metric tons per year. Paris Paris is also focusing on road safety and traffic management, decreasing traffic fatalities by 40%. It is advancing its already established intelligent transportation system and will invest €100M to adapt infrastructure to facilitate mass deployment of connected and autonomous vehicles. Beijing The city is also focusing on expanding the presence of electric vehicles and has launched BeMobility, a program with a projected budget of over €9B with the goal of deploying e-carsharing and EV fleets, as well as increasing the number of charging stations in the city. The following companies are currently participating in the Custom Software Development Services Market: BoTree Technologies, Fingent, ELEKS, BairsDev, SumatoSoft, and Iflexion.

Intelligent Traffic Management Market Segment Analysis:

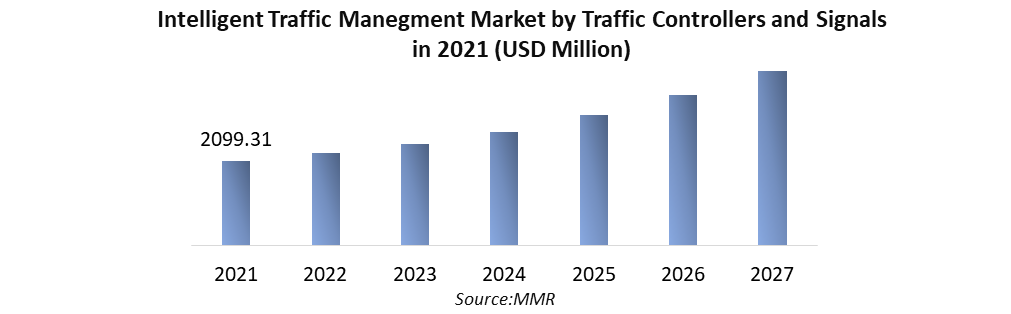

Based on Product Type, the Intelligent Traffic Management Market is segmented into Integrated Urban Traffic Control Systems, Variable / Dynamic Message Signs, Emergency Response Systems, Border Control Systems, Electronic Toll Collection Systems, Parking Management Systems, Violation and Measurement Systems, Freeway Management Systems, and others. Integrated Urban Traffic Control System held the largest market share in 2021. UTC systems are a type of traffic management that integrates and coordinates traffic signal control across a wide area in order to regulate traffic flows on the road network. Integrating and coordinating neighboring traffic signals involves developing a strategy based on the frequency and length of individual signal features, as well as the time offsets between them, and implementing a system to electrically connect the signals. A traffic-responsive signal control system is a method of altering traffic signal settings (cycles, green splits, and offsets) in real-time to optimize a particular goal function, such as minimizing travel time or pauses, depending on the traffic situation, thanks to these factors increases demand of UTC in Intelligent Traffic Management Market.Based on the Component- Traffic Controllers and Signals are expected to dominate the market with 13.37% of CAGR during the forecast period. The market's growth is driven by growing demand for real-time traffic information from passengers and drivers, as well as an increase in the number of cars on the road. Poor infrastructure and expanding government measures for improved traffic management are other major drivers of the growing Intelligent Traffic Management Market. The industry is expected to gain a great pace over the duration of 2022, although growth will be irregular irrespective of the pandemic outbreak. While demand is not expected to drop completely, due to project delays and adjustments in different product groups. The Intelligent Traffic Management Market grows throughout the forecast period as traffic effectiveness improves. As a result, the post-pandemic era is expected to provide attractive development possibilities for Intelligent Traffic Management Market (ITMS) incumbents.

Intelligent Traffic Management Market Regional Insights:

The European Intelligent Traffic Management Market is expected to develop at a 12.53% CAGR during the forecast period. The German market dominated the Europe Intelligent Traffic Management Market in 2023 and is predicted to remain dominant through 2030, generating a market value of $ 1668.39 Million by 2030. The UK market is expected to grow at a CAGR of 11.48% during the forecast period (2024-2030). Furthermore, the French market is predicted to grow at a CAGR of 11.94% during (2024-2030). The rate of technological and system developments is increasing throughout the region. En 302 637 3 is the name of a new ITS standard that was introduced by the European Commission. This standard offers a description of the Decentralized environmental notification basic service and related road danger warnings. The decentralized environmental notification provides information on future traffic circumstances, such as the location and nature of road danger. In addition, they can assist in adjusting traffic lights in an emergency to offer a clear way to the needed destination. Finally, this innovative technology improves road safety and security. Across the region, the rate of progress in numerous technologies and systems is accelerating, which drives the Intelligent Traffic Management Market.Intelligent Traffic Management Market Scope: Inquiry Before Buying

Global Intelligent Traffic Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 12499.71 Mn. Forecast Period 2024 to 2030 CAGR: 12.87% Market Size in 2030: US $ 29170.89 Mn. Segments Covered: by Product Type Integrated Urban Traffic Control System Variable / Dynamic Message Signs Emergency Response Systems Border Control System Electronic Toll Collection System Parking Management System Violation And Measurement Systems Tunnel Management System Freeway Management System by Components Traffic Controllers And Signals Surveillance Cameras Video Walls Server 3D Simulators GUI Workstation Detectors & Sensors Other Components by Spender Type Infrastructure Enterprises & Ppps Federal And Provincial Government Industries & Commercial Enterprise Intelligent Traffic Management Market Key Players are:

1. Cubic Corporation (US) 2. IBM Corporation (US) 3. General Electric Company (US) 4. TransCore (US) 5. Econolite Control Products, Inc. (US) 6. Iteris Inc (US) 7. Cisco Systems, Inc (US) 8. Teledyne FLIR LLC (US) 9. Chevron Corporation (US) 10.SNC-Lavalin Group (Canada) 11.Quarterhill Inc (Canada) 12.Siemens AG (Germany) 13.PTV GmbH (Germany) 14.Thales Group (France) 15.Alstom (France) 16.SICE (Spain) 17.Kapsch TrafficCom (Austria) 18.SWARCO (Austria) 19.TomTom International BV (Netherlands) 20.Baumer Holding AG. (Switzerland) 21.Q-Free ASA (Norway) 22.Zhejiang Dahua Technology Co., Ltd. (China) 23.Huawei Technologies Co., Ltd. (China) 24.Fujitsu (Japan) Frequently Asked Questions: 1] What segments are covered in the Global Intelligent Traffic Management Market report? Ans. The segments covered in the Intelligent Traffic Management Market report are based on Product, Age group, End-use, and Region. 2] Which region is expected to hold the highest share in the Global Intelligent Traffic Management Market? Ans. The Europe region is expected to hold the highest share in the Intelligent Traffic Management Market. 3] What is the market size of the Global Intelligent Traffic Management Market by 2030? Ans. The market size of the Intelligent Traffic Management Market by 2030 is expected to reach US$ 29170.89 Mn. 4] What is the forecast period for the Global Intelligent Traffic Management Market? Ans. The forecast period for the Intelligent Traffic Management Market is 2024-2030. 5] What was the market size of the Global Intelligent Traffic Management Market in 2023? Ans. The market size of the Intelligent Traffic Management Market in 2023 was valued at US$ 12499.71 Mn.

1. Intelligent Traffic Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Intelligent Traffic Management Market: Dynamics 2.1. Intelligent Traffic Management Market Trends by Region 2.1.1. North America Intelligent Traffic Management Market Trends 2.1.2. Europe Intelligent Traffic Management Market Trends 2.1.3. Asia Pacific Intelligent Traffic Management Market Trends 2.1.4. Middle East and Africa Intelligent Traffic Management Market Trends 2.1.5. South America Intelligent Traffic Management Market Trends 2.2. Intelligent Traffic Management Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Intelligent Traffic Management Market Drivers 2.2.1.2. North America Intelligent Traffic Management Market Restraints 2.2.1.3. North America Intelligent Traffic Management Market Opportunities 2.2.1.4. North America Intelligent Traffic Management Market Challenges 2.2.2. Europe 2.2.2.1. Europe Intelligent Traffic Management Market Drivers 2.2.2.2. Europe Intelligent Traffic Management Market Restraints 2.2.2.3. Europe Intelligent Traffic Management Market Opportunities 2.2.2.4. Europe Intelligent Traffic Management Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Intelligent Traffic Management Market Drivers 2.2.3.2. Asia Pacific Intelligent Traffic Management Market Restraints 2.2.3.3. Asia Pacific Intelligent Traffic Management Market Opportunities 2.2.3.4. Asia Pacific Intelligent Traffic Management Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Intelligent Traffic Management Market Drivers 2.2.4.2. Middle East and Africa Intelligent Traffic Management Market Restraints 2.2.4.3. Middle East and Africa Intelligent Traffic Management Market Opportunities 2.2.4.4. Middle East and Africa Intelligent Traffic Management Market Challenges 2.2.5. South America 2.2.5.1. South America Intelligent Traffic Management Market Drivers 2.2.5.2. South America Intelligent Traffic Management Market Restraints 2.2.5.3. South America Intelligent Traffic Management Market Opportunities 2.2.5.4. South America Intelligent Traffic Management Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Intelligent Traffic Management Industry 2.8. Analysis of Government Schemes and Initiatives For Intelligent Traffic Management Industry 2.9. Intelligent Traffic Management Market Trade Analysis 2.10. The Global Pandemic Impact on Intelligent Traffic Management Market 3. Intelligent Traffic Management Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Integrated Urban Traffic Control System 3.1.2. Variable / Dynamic Message Signs 3.1.3. Emergency Response Systems 3.1.4. Border Control System 3.1.5. Electronic Toll Collection System 3.1.6. Parking Management System 3.1.7. Violation And Measurement Systems 3.1.8. Tunnel Management System 3.1.9. Freeway Management System 3.2. Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 3.2.1. Traffic Controllers And Signals 3.2.2. Surveillance Cameras 3.2.3. Video Walls 3.2.4. Server 3.2.5. 3D Simulators 3.2.6. GUI Workstation 3.2.7. Detectors & Sensors 3.2.8. Other Components 3.3. Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 3.3.1. Infrastructure Enterprises & Ppps 3.3.2. Federal And Provincial Government 3.3.3. Industries & Commercial Enterprise 3.4. Intelligent Traffic Management Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Intelligent Traffic Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Integrated Urban Traffic Control System 4.1.2. Variable / Dynamic Message Signs 4.1.3. Emergency Response Systems 4.1.4. Border Control System 4.1.5. Electronic Toll Collection System 4.1.6. Parking Management System 4.1.7. Violation And Measurement Systems 4.1.8. Tunnel Management System 4.1.9. Freeway Management System 4.2. North America Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 4.2.1. Traffic Controllers And Signals 4.2.2. Surveillance Cameras 4.2.3. Video Walls 4.2.4. Server 4.2.5. 3D Simulators 4.2.6. GUI Workstation 4.2.7. Detectors & Sensors 4.2.8. Other Components 4.3. North America Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 4.3.1. Infrastructure Enterprises & Ppps 4.3.2. Federal And Provincial Government 4.3.3. Industries & Commercial Enterprise 4.4. North America Intelligent Traffic Management Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Integrated Urban Traffic Control System 4.4.1.1.2. Variable / Dynamic Message Signs 4.4.1.1.3. Emergency Response Systems 4.4.1.1.4. Border Control System 4.4.1.1.5. Electronic Toll Collection System 4.4.1.1.6. Parking Management System 4.4.1.1.7. Violation And Measurement Systems 4.4.1.1.8. Tunnel Management System 4.4.1.1.9. Freeway Management System 4.4.1.2. United States Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 4.4.1.2.1. Traffic Controllers And Signals 4.4.1.2.2. Surveillance Cameras 4.4.1.2.3. Video Walls 4.4.1.2.4. Server 4.4.1.2.5. 3D Simulators 4.4.1.2.6. GUI Workstation 4.4.1.2.7. Detectors & Sensors 4.4.1.2.8. Other Components 4.4.1.3. United States Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 4.4.1.3.1. Infrastructure Enterprises & Ppps 4.4.1.3.2. Federal And Provincial Government 4.4.1.3.3. Industries & Commercial Enterprise 4.4.2. Canada 4.4.2.1. Canada Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Integrated Urban Traffic Control System 4.4.2.1.2. Variable / Dynamic Message Signs 4.4.2.1.3. Emergency Response Systems 4.4.2.1.4. Border Control System 4.4.2.1.5. Electronic Toll Collection System 4.4.2.1.6. Parking Management System 4.4.2.1.7. Violation And Measurement Systems 4.4.2.1.8. Tunnel Management System 4.4.2.1.9. Freeway Management System 4.4.2.2. Canada Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 4.4.2.2.1. Traffic Controllers And Signals 4.4.2.2.2. Surveillance Cameras 4.4.2.2.3. Video Walls 4.4.2.2.4. Server 4.4.2.2.5. 3D Simulators 4.4.2.2.6. GUI Workstation 4.4.2.2.7. Detectors & Sensors 4.4.2.2.8. Other Components 4.4.2.3. Canada Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 4.4.2.3.1. Infrastructure Enterprises & Ppps 4.4.2.3.2. Federal And Provincial Government 4.4.2.3.3. Industries & Commercial Enterprise 4.4.3. Mexico 4.4.3.1. Mexico Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Integrated Urban Traffic Control System 4.4.3.1.2. Variable / Dynamic Message Signs 4.4.3.1.3. Emergency Response Systems 4.4.3.1.4. Border Control System 4.4.3.1.5. Electronic Toll Collection System 4.4.3.1.6. Parking Management System 4.4.3.1.7. Violation And Measurement Systems 4.4.3.1.8. Tunnel Management System 4.4.3.1.9. Freeway Management System 4.4.3.2. Mexico Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 4.4.3.2.1. Traffic Controllers And Signals 4.4.3.2.2. Surveillance Cameras 4.4.3.2.3. Video Walls 4.4.3.2.4. Server 4.4.3.2.5. 3D Simulators 4.4.3.2.6. GUI Workstation 4.4.3.2.7. Detectors & Sensors 4.4.3.2.8. Other Components 4.4.3.3. Mexico Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 4.4.3.3.1. Infrastructure Enterprises & Ppps 4.4.3.3.2. Federal And Provincial Government 4.4.3.3.3. Industries & Commercial Enterprise 5. Europe Intelligent Traffic Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.3. Europe Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 5.4. Europe Intelligent Traffic Management Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.1.3. United Kingdom Intelligent Traffic Management Market Size and Forecast, by Spender Type(2023-2030) 5.4.2. France 5.4.2.1. France Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.2.3. France Intelligent Traffic Management Market Size and Forecast, by Spender Type(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.3.3. Germany Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.4.3. Italy Intelligent Traffic Management Market Size and Forecast, by Spender Type(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.5.3. Spain Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.6.3. Sweden Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.7.3. Austria Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 5.4.8.3. Rest of Europe Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6. Asia Pacific Intelligent Traffic Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.3. Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4. Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.1.3. China Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.2.3. S Korea Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.3.3. Japan Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.4. India 6.4.4.1. India Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.4.3. India Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.5.3. Australia Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.6.3. Indonesia Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.7.3. Malaysia Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.8.3. Vietnam Intelligent Traffic Management Market Size and Forecast, by Spender Type(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.9.3. Taiwan Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 6.4.10.3. Rest of Asia Pacific Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 7. Middle East and Africa Intelligent Traffic Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 7.3. Middle East and Africa Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 7.4. Middle East and Africa Intelligent Traffic Management Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 7.4.1.3. South Africa Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 7.4.2.3. GCC Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 7.4.3.3. Nigeria Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 7.4.4.3. Rest of ME&A Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 8. South America Intelligent Traffic Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 8.3. South America Intelligent Traffic Management Market Size and Forecast, by Spender Type(2023-2030) 8.4. South America Intelligent Traffic Management Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 8.4.1.3. Brazil Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 8.4.2.3. Argentina Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Intelligent Traffic Management Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Intelligent Traffic Management Market Size and Forecast, by Components (2023-2030) 8.4.3.3. Rest Of South America Intelligent Traffic Management Market Size and Forecast, by Spender Type (2023-2030) 9. Global Intelligent Traffic Management Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Intelligent Traffic Management Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cubic Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. IBM Corporation (US) 10.3. General Electric Company (US) 10.4. TransCore (US) 10.5. Econolite Control Products, Inc. (US) 10.6. Iteris Inc (US) 10.7. Cisco Systems, Inc (US) 10.8. Teledyne FLIR LLC (US) 10.9. Chevron Corporation (US) 10.10. SNC-Lavalin Group (Canada) 10.11. Quarterhill Inc (Canada) 10.12. Siemens AG (Germany) 10.13. PTV GmbH (Germany) 10.14. Thales Group (France) 10.15. Alstom (France) 10.16. SICE (Spain) 10.17. Kapsch TrafficCom (Austria) 10.18. SWARCO (Austria) 10.19. TomTom International BV (Netherlands) 10.20. Baumer Holding AG. (Switzerland) 10.21. Q-Free ASA (Norway) 10.22. Zhejiang Dahua Technology Co., Ltd. (China) 10.23. Huawei Technologies Co., Ltd. (China) 10.24. Fujitsu (Japan) 11. Key Findings 12. Industry Recommendations 13. Intelligent Traffic Management Market: Research Methodology 14. Terms and Glossary