Global Data Governance Market size was valued at USD 3.84 Bn in 2023 and is expected to reach USD 15.73 Bn by 2030, at a CAGR of 22.32 % over the forecast period.Data Governance Market Overview

Data Governance is a principled approach to manage data during its life cycle, from acquisition to use to disposal. Ensure that data is accurate, consistent, complete, and reliable. This involves defining data quality standards and implementing processes to monitor and improve data quality over time. Effective data governance is essential for organizations to derive value from their data while minimizing risks and ensuring compliance. It helps maintain data integrity, supports informed decision-making, and fosters trust in an organization's data assets. The data governance market featured a variety of vendors offering solutions, including Informatica, Collibra, IBM, SAP, Talend, Alation, SAS, and others. These vendors provided tools and platforms for data governance, metadata management, data cataloging, and related services. The market is expected to continue evolving with trends such as the integration of artificial intelligence and machine learning into Data Governance Solutions Market, increased adoption of cloud-based data governance platforms, and a focus on data democratization.To know about the Research Methodology :- Request Free Sample Report

Data Governance Market Dynamics

Data Quality and Accuracy to boost the Data Governance Market growth High-quality data is the lifeblood of effective decision-making and operational efficiency. Data governance plays a pivotal role in maintaining data quality by enforcing standards for data accuracy, consistency, completeness, and reliability. The data governance market is experiencing significant growth and evolution, driven by a multitude of factors that highlight its pivotal role in modern organizations. Data governance has become increasingly critical as data volumes expand, regulatory pressures intensify, and organizations recognize the value of high-quality, well-managed data. The relentless pursuit of digital transformation requires organizations to harness data effectively. Data governance serves as the bedrock of these initiatives, ensuring data is efficiently managed, integrated, and leveraged for advanced technologies like analytics, artificial intelligence, and automation. Businesses increasingly recognize the inherent value of their data assets. Data governance enables organizations to monetize their data by selling it, sharing it with partners, or leveraging it to create new revenue streams and business models. Effective data governance solution also helps business address data privacy and security issues that are increasingly taking center stage with rising data breaches over the past years. Data governance tools are used to make data governance planning easier with definitions. Effective data governance solution also helps business address data privacy and security issues that are increasingly taking center stage with rising data breaches over the forecast period in the worldwide big data governance market. Organizations are navigating increasingly complex data ecosystems, including diverse data sources, cloud-based solutions, and data lakes. Effective data governance is essential to maintain control, visibility, and governance over data assets in these intricate environments. The exponential growth of data, including structured and unstructured data, necessitates the adoption of data governance practices. Without these practices, organizations struggle to manage, analyze, and derive value from the deluge of data generated daily. Customers expect organizations to handle their data responsibly and securely. Demonstrating robust data governance practices enhance customer trust and loyalty, especially in an era where data breaches are headline news, which is expected to increase the Data Governance Market share. Data governance enables organizations to identify and mitigate data-related risks, including data breaches, data loss, and regulatory non-compliance. Proactive risk management is a crucial aspect of data governance.Lack of Awareness and Education to restraint the Data Governance Market growth A fundamental challenge is the lack of awareness and understanding of data governance principles among business leaders and employees in the Data Governance Software. Without proper education and buy-in, it is challenging to garner support for data governance initiatives. Employees resist data governance initiatives because they perceive them as disruptive or as additional work. Resistance to change is a significant barrier to successful implementation in the Data Governance Market. Data governance aims to break down data silos and promote data sharing and collaboration. However, organizations often struggle with entrenched data silos, making it difficult to create a unified data governance framework software industry. An organization's culture hinders data governance efforts within the Data Governance Market. A culture that does not prioritize data quality, transparency, or accountability can undermine data governance initiatives. Identifying data owners and stewards is crucial for data governance, but organizations struggle to define clear lines of responsibility in the Data Governance Software industry. This leads to confusion and hinders effective governance, which is expected to limit the Data Governance Software Market growth. The sheer volume and diversity of data generated in today's digital age overwhelm data governance efforts, particularly in Data Governance Implementation. Unstructured data, big data, and data from various sources add complexity. Older legacy systems may not be equipped to support modern data governance practices. Organizations with legacy systems face challenges in integrating them into a data governance framework in Data Governance Implementation. Without standardized data definitions, formats, and naming conventions, data governance efforts are inefficient. Achieving standardization across the organization is a formidable task in Data Governance Implementation. While data governance helps with regulatory compliance, it also places additional compliance burdens on organizations. Meeting the requirements of multiple data privacy regulations is challenging for the Data Governance industry growth in Data Governance Implementation. Benefits of Data Governance Enhanced Data Trustworthiness: When data is governed effectively, it becomes more trustworthy. This increased trust in data encourages employees to rely on it for critical business decisions, which leads to better overall performance and helps to boost the Data Governance Market growth. Data Security: Implementing data governance practices enhances data security by defining access controls, encryption methods, and data protection measures. This safeguards sensitive information and minimizes the risk of data breaches. Data Transparency: Data governance often involves creating data catalogs and metadata management, making it easier for users to find and understand available data resources. This transparency encourages collaboration and knowledge sharing. Accountability: Data governance assigns data stewards or data owners who are responsible for specific datasets. This accountability ensures that there is someone responsible for data quality and usage, reducing confusion and errors. Competitive Advantage: Organizations with strong data governance practices gain a competitive edge by leveraging their data assets more effectively, spotting market trends faster, and responding to customer needs more efficiently.

Data Governance Market Segment Analysis

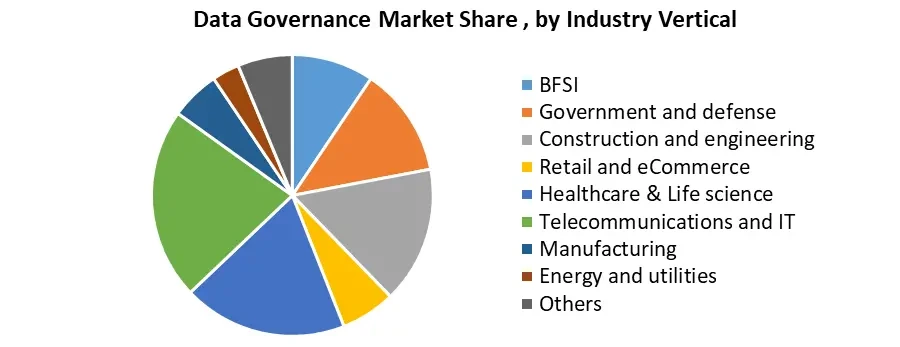

Based on Component, the market is segmented into Solutions, and Services. The solution segment held the largest Data Governance market share in 2023 and is expected to dominate the market over the forecast period. The "solution segment" in the data governance market refers to the various types of software and tools that are designed to help organizations establish and maintain effective data governance practices. These solutions are essential for implementing data governance frameworks, enforcing data policies, and ensuring data quality, security, and compliance. The solution segment typically encompasses a range of software products and platforms tailored to address specific aspects of data governance. Metadata management solutions and Data Governance Solutions Market focus on capturing, storing, and managing metadata, which provides valuable information about data assets. This includes details about data sources, data definitions, data lineage, data owners, and more. Effective metadata management is critical for understanding and governing data effectively, which is expected to boost the segment growth in the Data Governance market. Based on Organization Size, the market is segmented into Small & Medium Enterprises, and Large Enterprises. The small & Medium Enterprises segment dominated the market in 2023 and is expected to hold the largest market share over the forecast period. The Small and Medium Enterprises (SMEs) segment in the data governance market refers to businesses that fall within the category of small and medium-sized enterprises. These organizations are characterized by their relatively smaller size and operational scale compared to large enterprises. Data governance solutions tailored for SMEs are designed to address the specific needs, challenges, and resource constraints that SMEs typically face when implementing data governance initiatives. SMEs typically have less complex data ecosystems with fewer data sources, data types, and data volumes compared to large enterprises. Their data governance needs are often less intricate, which significantly contribute for the Data Governance market growth. SMEs are known for their agility and ability to make quick decisions. They require data governance solutions that align with their need for efficiency and responsiveness. Based on Deployment Model, the market is segmented into On-premises and Cloud. On-premises segment held the largest market share in 2023 and is expected to dominate the market over the forecast period. This is a widely utilized method of giving businesses the ability to manage risks, industry policies, business processes, and compliance. Organizations that opt for on-premises data governance maintain and manage their data centers or server rooms to host the data governance software and related infrastructure. This gives them complete control over their data environment. On-premises data governance typically involves the use of physical servers, storage devices, and networking equipment that are owned and maintained by the organization. These resources are dedicated to running the Data Governance Software Market. Data privacy regulations often require organizations to have a high level of control over sensitive data. On-premises solutions provide a way to ensure data privacy and compliance by keeping data within the organization's physical boundaries, which is expected to boost the Data Governance Market growth. Based on Industry Vertical, the market is segmented into BFSI, Government and defense, Construction and engineering, Retail and eCommerce, Healthcare & life science, Telecommunications and IT, Manufacturing, Energy and utilities, and others. The healthcare & life science segment held the largest Data Governance Market Share in 2023 and is expected to continue the dominance over the forecast period. Healthcare and life science organizations deal with highly sensitive patient health data, clinical trial data, research data, and genomic information. Accurate and high-quality data is crucial for patient care, clinical research, and drug development. Data governance practices aim to maintain data accuracy, completeness, and consistency. Healthcare and life science organizations often use diverse systems and formats for data storage and management. Data governance helps bridge interoperability gaps, ensuring that data can be exchanged and used effectively across different systems and platforms. Collaboration is vital in healthcare research and patient care. Data governance supports secure data sharing and collaboration among healthcare providers, researchers, pharmaceutical companies, and regulatory bodies. Data governance is essential for managing the vast amounts of data generated during clinical trials, from patient enrolment and data collection to analysis and reporting, which is expected to boost the segment growth in the Data Governance market.

Data Governance Market Regional Analysis

Data Security Concerns to boost the Asia Pacific Data Governance Market growth Asia Pacific dominated the Data Governance Market in 2023 and is expected to hold the largest Data Governance Market share over the forecast period. Growing technology expenses in Australia, Singapore, India, and China, SMEs' demand for cost-effective data management and governance services and Data Governance Solutions Market, heavy infrastructure development upgrades, growing need for cloud-based remedies, growing size of SMEs, companies operating in the region providing various solutions based on organization size and needs, the region being the world's center of digital innovation. The rising number of data breaches and cyberattacks in the APAC region has heightened concerns about data security, which is expected to boost the Data Governance Market growth in the region. Data governance solutions help organizations establish robust data protection measures and access controls. Data is the cornerstone of decision-making, and organizations are increasingly focused on data quality and trustworthiness. Data governance ensures data accuracy, consistency, and reliability, fostering trust in data assets. Several APAC governments have launched initiatives to promote data-driven innovation and the development of data ecosystems. These initiatives often emphasize the importance of data governance to ensure data is used responsibly. With the global nature of business, managing data across borders is a key consideration. Data governance helps organizations navigate the complexities of cross-border data flow while complying with regional and international regulations. Integration of artificial intelligence and automation into data governance processes to enhance efficiency and decision-making. North America held the 2nd largest market share in 2023. Massive interest in cloud-based arrangements, the presence of numerous players, constant developments, early recognition of innovative technologies, data-driven culture, substantial adoption of data governance and management solutions, the presence of a large number of vendors in the US, enterprises with well-established processes, high levels of technology awareness, high risk and data management capacity of organizations in other regions.Data Governance Market Competitive Landscape

The competitive landscape of the data governance market is dynamic and includes a mix of established players, emerging vendors, and niche specialists. Larger players often acquire niche vendors to expand their data governance portfolios. This led to consolidation and increased competition. Vendors form strategic partnerships and alliances to offer integrated data governance solutions that cover a broader spectrum of data management challenges. The shift toward cloud-based data governance solutions is gaining momentum, with cloud providers playing a significant role in the market. Some vendors specialize in specific industry verticals, offering tailored solutions to address industry-specific data governance requirements. Informatics (US) is recognized as one of the leading Data Governance Key players in the market. Many solutions related to data management and big data such as data quality, data security, integration, and cloud solutions are provided by the company.Data Governance Market Scope: Inquiry Before Buying

Data Governance Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.84 Bn. Forecast Period 2024 to 2030 CAGR: 22.32% Market Size in 2030: US $ 15.73 Bn. Segments Covered: by Component Solutions Services by Application Incident management Process management Compliance management Risk management Audit management Data quality and security management Others by Organization Size Small & Medium Enterprises Large Enterprises by Deployment Model On-premises Cloud by Industry Vertical BFSI Government and defense Construction and engineering Retail and eCommerce Healthcare & Life science Telecommunications and IT Manufacturing Energy and utilities Others Data Governance Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Data Governance Key Players Include

North America: 1. Informatica 2. Oracle Corporation 3. TIBCO Software 4. Infogix 5. Varonis Systems 6. Collibra 7. IBM 8. Talend 9. SAS Institute 10. Alation 11. Informatica 12. TIBCO Software 13. Erwin 14. Datameer 15. Collibra 16. Reltio 17. Denodo Technologies 18. Quest Europe: 19. Ataccama 20. Datumize 21. erwin, Inc. 22. Varonis 23. TopQuadrant 24. IRI Asia-Pacific: 25. Alation 26. Gimmal 27. China National Offshore Oil Corporation Latin America: 28. Datameer 29. Infogix 30. IDERA Frequently Asked Questions: 1] What is the growth rate of the Global Data Governance Market? Ans. The Global Data Governance Market is growing at a significant rate of 22.32 % over the forecast period. 2] Which region is expected to dominate the Global Data Governance Market during the forecast period? Ans. Asia Pacific region is expected to dominate the Data Governance Market over the forecast period. 3] What is the expected Global Data Governance Market size by 2030? Ans. The market size of the Data Governance Market is expected to reach USD 15.73 Bn by 2030. 4] Who are the top players in the Global Data Governance Industry? Ans. The major key players in the Global Data Governance Market are Informatica, Oracle Corporation, TIBCO Software, and Infogix. 5] Which factors are expected to drive the Global Data Governance Market growth by 2030? Ans. Data Quality and Accuracy drive the Data Governance Market growth over the forecast period (2024-2030).

1. Data Governance Market: Research Methodology 2. Data Governance Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Data Governance Market: Dynamics 3.1. Data Governance Market Trends by Region 3.1.1. North America Data Governance Market Trends 3.1.2. Europe Data Governance Market Trends 3.1.3. Asia Pacific Data Governance Market Trends 3.1.4. Middle East and Africa Data Governance Market Trends 3.1.5. South America Data Governance Market Trends 3.2. Data Governance Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Data Governance Market Drivers 3.2.1.2. North America Data Governance Market Restraints 3.2.1.3. North America Data Governance Market Opportunities 3.2.1.4. North America Data Governance Market Challenges 3.2.2. Europe 3.2.2.1. Europe Data Governance Market Drivers 3.2.2.2. Europe Data Governance Market Restraints 3.2.2.3. Europe Data Governance Market Opportunities 3.2.2.4. Europe Data Governance Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Data Governance Market Drivers 3.2.3.2. Asia Pacific Data Governance Market Restraints 3.2.3.3. Asia Pacific Data Governance Market Opportunities 3.2.3.4. Asia Pacific Data Governance Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Data Governance Market Drivers 3.2.4.2. Middle East and Africa Data Governance Market Restraints 3.2.4.3. Middle East and Africa Data Governance Market Opportunities 3.2.4.4. Middle East and Africa Data Governance Market Challenges 3.2.5. South America 3.2.5.1. South America Data Governance Market Drivers 3.2.5.2. South America Data Governance Market Restraints 3.2.5.3. South America Data Governance Market Opportunities 3.2.5.4. South America Data Governance Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Data Governance Industry 3.8. Analysis of Government Schemes and Initiatives For Data Governance Industry 3.9. The Global Pandemic Impact on Data Governance Market 4. Data Governance Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Data Governance Market Size and Forecast, by Component (2023-2030) 4.1.1. Solutions 4.1.2. Services 4.2. Data Governance Market Size and Forecast, by Application (2023-2030) 4.2.1. Incident management 4.2.2. Process management 4.2.3. Compliance management 4.2.4. Risk management 4.2.5. Audit management 4.2.6. Data quality and security management 4.2.7. Others 4.3. Data Governance Market Size and Forecast, by Organization Size (2023-2030) 4.3.1. Small & Medium Enterprises 4.3.2. Large Enterprises 4.4. Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 4.4.1. On-premises 4.4.2. Cloud 4.5. Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.1. BFSI 4.5.2. Government and defense 4.5.3. Construction and engineering 4.5.4. Retail and eCommerce 4.5.5. Healthcare & Life science 4.5.6. Telecommunications and IT 4.5.7. Manufacturing 4.5.8. Energy and utilities 4.5.9. Others 4.6. Data Governance Market Size and Forecast, by Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Data Governance Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Data Governance Market Size and Forecast, by Component (2023-2030) 5.1.1. Solutions 5.1.2. Services 5.2. North America Data Governance Market Size and Forecast, by Application (2023-2030) 5.2.1. Incident management 5.2.2. Process management 5.2.3. Compliance management 5.2.4. Risk management 5.2.5. Audit management 5.2.6. Data quality and security management 5.2.7. Others 5.3. North America Data Governance Market Size and Forecast, by Organization Size (2023-2030) 5.3.1. Small & Medium Enterprises 5.3.2. Large Enterprises 5.4. North America Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 5.4.1. On-premises 5.4.2. Cloud 5.5. North America Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.1. BFSI 5.5.2. Government and defense 5.5.3. Construction and engineering 5.5.4. Retail and eCommerce 5.5.5. Healthcare & Life science 5.5.6. Telecommunications and IT 5.5.7. Manufacturing 5.5.8. Energy and utilities 5.5.9. Others 5.6. North America Data Governance Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States Data Governance Market Size and Forecast, by Component (2023-2030) 5.6.1.1.1. Solutions 5.6.1.1.2. Services 5.6.1.2. United States Data Governance Market Size and Forecast, by Application (2023-2030) 5.6.1.2.1. Incident management 5.6.1.2.2. Process management 5.6.1.2.3. Compliance management 5.6.1.2.4. Risk management 5.6.1.2.5. Audit management 5.6.1.2.6. Data quality and security management 5.6.1.2.7. Others 5.6.1.3. United States Data Governance Market Size and Forecast, by Organization Size (2023-2030) 5.6.1.3.1. Small & Medium Enterprises 5.6.1.3.2. Large Enterprises 5.6.1.4. United States Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 5.6.1.4.1. On-premises 5.6.1.4.2. Cloud 5.6.1.5. United States Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 5.6.1.5.1. BFSI 5.6.1.5.2. Government and defense 5.6.1.5.3. Construction and engineering 5.6.1.5.4. Retail and eCommerce 5.6.1.5.5. Healthcare & Life science 5.6.1.5.6. Telecommunications and IT 5.6.1.5.7. Manufacturing 5.6.1.5.8. Energy and utilities 5.6.1.5.9. Others 5.6.2. Canada 5.6.2.1. Canada Data Governance Market Size and Forecast, by Component (2023-2030) 5.6.2.1.1. Solutions 5.6.2.1.2. Services 5.6.2.2. Canada Data Governance Market Size and Forecast, by Application (2023-2030) 5.6.2.2.1. Incident management 5.6.2.2.2. Process management 5.6.2.2.3. Compliance management 5.6.2.2.4. Risk management 5.6.2.2.5. Audit management 5.6.2.2.6. Data quality and security management 5.6.2.2.7. Others 5.6.2.3. Canada Data Governance Market Size and Forecast, by Organization Size (2023-2030) 5.6.2.3.1. Small & Medium Enterprises 5.6.2.3.2. Large Enterprises 5.6.2.4. Canada Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 5.6.2.4.1. On-premises 5.6.2.4.2. Cloud 5.6.2.5. Canada Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 5.6.2.5.1. BFSI 5.6.2.5.2. Government and defense 5.6.2.5.3. Construction and engineering 5.6.2.5.4. Retail and eCommerce 5.6.2.5.5. Healthcare & Life science 5.6.2.5.6. Telecommunications and IT 5.6.2.5.7. Manufacturing 5.6.2.5.8. Energy and utilities 5.6.2.5.9. Others 5.6.3. Mexico 5.6.3.1. Mexico Data Governance Market Size and Forecast, by Component (2023-2030) 5.6.3.1.1. Solutions 5.6.3.1.2. Services 5.6.3.2. Mexico Data Governance Market Size and Forecast, by Application (2023-2030) 5.6.3.2.1. Incident management 5.6.3.2.2. Process management 5.6.3.2.3. Compliance management 5.6.3.2.4. Risk management 5.6.3.2.5. Audit management 5.6.3.2.6. Data quality and security management 5.6.3.2.7. Others 5.6.3.3. Mexico Data Governance Market Size and Forecast, by Organization Size (2023-2030) 5.6.3.3.1. Small & Medium Enterprises 5.6.3.3.2. Large Enterprises 5.6.3.4. Mexico Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 5.6.3.4.1. On-premises 5.6.3.4.2. Cloud 5.6.3.5. Mexico Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 5.6.3.5.1. BFSI 5.6.3.5.2. Government and defense 5.6.3.5.3. Construction and engineering 5.6.3.5.4. Retail and eCommerce 5.6.3.5.5. Healthcare & Life science 5.6.3.5.6. Telecommunications and IT 5.6.3.5.7. Manufacturing 5.6.3.5.8. Energy and utilities 5.6.3.5.9. Others 6. Europe Data Governance Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Data Governance Market Size and Forecast, by Component (2023-2030) 6.2. Europe Data Governance Market Size and Forecast, by Application (2023-2030) 6.3. Europe Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.4. Europe Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.5. Europe Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6. Europe Data Governance Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.1.2. United Kingdom Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.1.3. United Kingdom Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.1.4. United Kingdom Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.1.5. United Kingdom Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.2. France 6.6.2.1. France Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.2.2. France Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.2.3. France Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.2.4. France Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.2.5. France Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.3. Germany 6.6.3.1. Germany Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.3.2. Germany Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.3.3. Germany Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.3.4. Germany Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.3.5. Germany Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.4. Italy 6.6.4.1. Italy Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.4.2. Italy Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.4.3. Italy Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.4.4. Italy Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.4.5. Italy Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.5. Spain 6.6.5.1. Spain Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.5.2. Spain Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.5.3. Spain Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.5.4. Spain Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.5.5. Spain Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.6.2. Sweden Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.6.3. Sweden Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.6.4. Sweden Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.6.5. Sweden Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.7. Austria 6.6.7.1. Austria Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.7.2. Austria Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.7.3. Austria Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.7.4. Austria Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.7.5. Austria Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Data Governance Market Size and Forecast, by Component (2023-2030) 6.6.8.2. Rest of Europe Data Governance Market Size and Forecast, by Application (2023-2030) 6.6.8.3. Rest of Europe Data Governance Market Size and Forecast, by Organization Size (2023-2030) 6.6.8.4. Rest of Europe Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 6.6.8.5. Rest of Europe Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7. Asia Pacific Data Governance Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Data Governance Market Size and Forecast, by Component (2023-2030) 7.2. Asia Pacific Data Governance Market Size and Forecast, by Application (2023-2030) 7.3. Asia Pacific Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.4. Asia Pacific Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.5. Asia Pacific Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6. Asia Pacific Data Governance Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.1.2. China Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.1.3. China Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.1.4. China Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.1.5. China Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.2.2. S Korea Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.2.3. S Korea Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.2.4. S Korea Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.2.5. S Korea Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.3. Japan 7.6.3.1. Japan Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.3.2. Japan Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.3.3. Japan Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.3.4. Japan Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.3.5. Japan Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.4. India 7.6.4.1. India Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.4.2. India Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.4.3. India Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.4.4. India Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.4.5. India Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.5. Australia 7.6.5.1. Australia Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.5.2. Australia Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.5.3. Australia Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.5.4. Australia Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.5.5. Australia Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.6.2. Indonesia Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.6.3. Indonesia Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.6.4. Indonesia Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.6.5. Indonesia Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.7.2. Malaysia Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.7.3. Malaysia Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.7.4. Malaysia Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.7.5. Malaysia Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.8.2. Vietnam Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.8.3. Vietnam Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.8.4. Vietnam Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.8.5. Vietnam Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.9.2. Taiwan Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.9.3. Taiwan Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.9.4. Taiwan Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.9.5. Taiwan Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Data Governance Market Size and Forecast, by Component (2023-2030) 7.6.10.2. Rest of Asia Pacific Data Governance Market Size and Forecast, by Application (2023-2030) 7.6.10.3. Rest of Asia Pacific Data Governance Market Size and Forecast, by Organization Size (2023-2030) 7.6.10.4. Rest of Asia Pacific Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 7.6.10.5. Rest of Asia Pacific Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 8. Middle East and Africa Data Governance Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Data Governance Market Size and Forecast, by Component (2023-2030) 8.2. Middle East and Africa Data Governance Market Size and Forecast, by Application (2023-2030) 8.3. Middle East and Africa Data Governance Market Size and Forecast, by Organization Size (2023-2030) 8.4. Middle East and Africa Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 8.5. Middle East and Africa Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 8.6. Middle East and Africa Data Governance Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa Data Governance Market Size and Forecast, by Component (2023-2030) 8.6.1.2. South Africa Data Governance Market Size and Forecast, by Application (2023-2030) 8.6.1.3. South Africa Data Governance Market Size and Forecast, by Organization Size (2023-2030) 8.6.1.4. South Africa Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 8.6.1.5. South Africa Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 8.6.2. GCC 8.6.2.1. GCC Data Governance Market Size and Forecast, by Component (2023-2030) 8.6.2.2. GCC Data Governance Market Size and Forecast, by Application (2023-2030) 8.6.2.3. GCC Data Governance Market Size and Forecast, by Organization Size (2023-2030) 8.6.2.4. GCC Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 8.6.2.5. GCC Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 8.6.3. Nigeria 8.6.3.1. Nigeria Data Governance Market Size and Forecast, by Component (2023-2030) 8.6.3.2. Nigeria Data Governance Market Size and Forecast, by Application (2023-2030) 8.6.3.3. Nigeria Data Governance Market Size and Forecast, by Organization Size (2023-2030) 8.6.3.4. Nigeria Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 8.6.3.5. Nigeria Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Data Governance Market Size and Forecast, by Component (2023-2030) 8.6.4.2. Rest of ME&A Data Governance Market Size and Forecast, by Application (2023-2030) 8.6.4.3. Rest of ME&A Data Governance Market Size and Forecast, by Organization Size (2023-2030) 8.6.4.4. Rest of ME&A Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 8.6.4.5. Rest of ME&A Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 9. South America Data Governance Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Data Governance Market Size and Forecast, by Component (2023-2030) 9.2. South America Data Governance Market Size and Forecast, by Application (2023-2030) 9.3. South America Data Governance Market Size and Forecast, by Organization Size (2023-2030) 9.4. South America Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 9.5. South America Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 9.6. South America Data Governance Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil Data Governance Market Size and Forecast, by Component (2023-2030) 9.6.1.2. Brazil Data Governance Market Size and Forecast, by Application (2023-2030) 9.6.1.3. Brazil Data Governance Market Size and Forecast, by Organization Size (2023-2030) 9.6.1.4. Brazil Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 9.6.1.5. Brazil Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina Data Governance Market Size and Forecast, by Component (2023-2030) 9.6.2.2. Argentina Data Governance Market Size and Forecast, by Application (2023-2030) 9.6.2.3. Argentina Data Governance Market Size and Forecast, by Organization Size (2023-2030) 9.6.2.4. Argentina Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 9.6.2.5. Argentina Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Data Governance Market Size and Forecast, by Component (2023-2030) 9.6.3.2. Rest Of South America Data Governance Market Size and Forecast, by Application (2023-2030) 9.6.3.3. Rest Of South America Data Governance Market Size and Forecast, by Organization Size (2023-2030) 9.6.3.4. Rest Of South America Data Governance Market Size and Forecast, by Deployment Model (2023-2030) 9.6.3.5. Rest Of South America Data Governance Market Size and Forecast, by Industry Vertical (2023-2030) 10. Global Data Governance Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Data Governance Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Informatica 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Oracle Corporation 11.3. TIBCO Software 11.4. Infogix 11.5. Varonis Systems 11.6. Collibra 11.7. IBM 11.8. Talend 11.9. SAS Institute 11.10. Alation 11.11. Informatica 11.12. TIBCO Software 11.13. Erwin 11.14. Datameer 11.15. Collibra 11.16. Reltio 11.17. Denodo Technologies 11.18. Quest 11.19. Ataccama 11.20. Datumize 11.21. erwin, Inc. 11.22. Varonis 11.23. TopQuadrant 11.24. IRI 11.25. Alation 11.26. Gimmal 11.27. China National Offshore Oil Corporation 11.28. Datameer 11.29. Infogix 11.30. IDERA 12. Key Findings 13. Industry Recommendations 14.Terms and Glossary