Global Industrial Automation Oil and Gas Market to reach USD 23.54 Bn by 2032 from USD 17.07 Bn in 2025 at 4.7 % CAGRIndustrial Automation Oil and Gas Market Overview:

The industrial automation oil & gas market has evolved from a cost-saving tool into a strategic backbone for navigating supply volatility, regulatory pressures, and operational complexity. As global oil demand reached 103.84 million barrels per day (mb/d) in 2024, fueled by Non-OECD Asia, China, India, the Middle East, Africa, and Latin America, the pressure to optimize operations and protect margins intensified. Simultaneously, global oil supply is projected to rise by 3.0 mb/d in 2025 and 2.4 mb/d in 2026, emphasizing the critical role of automation, AI-driven analytics, and predictive maintenance in maximizing asset efficiency.Industrial Automation Oil & Gas Market Key Highlights

• 89% of oil & gas companies invest in data analytics to improve production efficiency. • Operational efficiency has increased by an average of 25% across global oil operations due to automation. • The AI in oil & gas market is projected to reach USD 5.28 billion by 2030. • 80% of offshore platforms operate with digital automation systems, enhancing safety and reliability. • Integration of Industrial Automation: SCADA systems, DCS, PLC, IIoT, robotics, digital twins, and AI-powered monitoring are now integral across upstream, midstream, and downstream oil & gas operations. • Digital Transformation in Oil & Gas: By 2024, 78% of oil & gas companies had implemented digital transformation strategies. • Focus on Asset Management: 70% of oil & gas companies are focusing on asset management and maintenance, emphasizing automation's role in reducing unplanned downtime and optimizing production. • Impact on Operations: Automation is helping extend equipment life and optimize production across the sector. • Global Reach: Automation investments are reshaping operations from offshore platforms in Saudi Arabia and Brazil to refineries in India, China, the US, and South Korea. • Real-Time Monitoring & Predictive Maintenance: Automation enables real-time monitoring, predictive maintenance, and energy-efficient production optimization, enhancing operational efficiency.

To know about the Research Methodology :- Request Free Sample Report

Industrial Automation Oil and Gas Market Dynamics

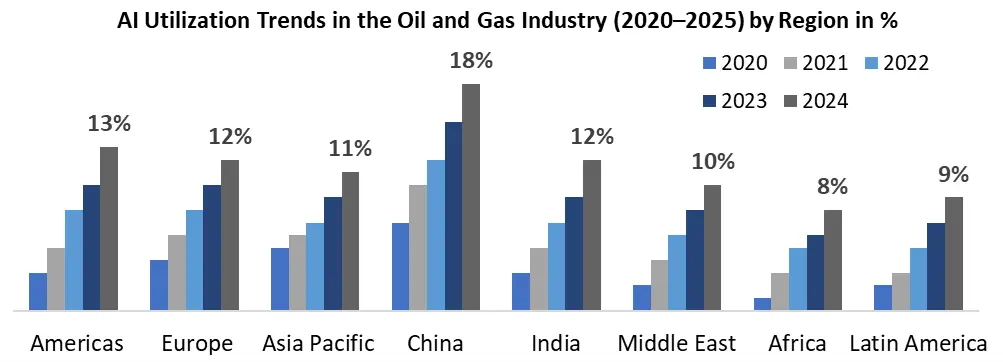

Operational Efficiency Under Price Pressure boost the market growth: With Brent crude averaging USD 63–65/bbl in late 2025, oil companies face ongoing margin pressure. Industrial automation, predictive maintenance, and AI-enabled monitoring reduce maintenance costs by up to 20% and extend equipment lifespan by 18%, enabling reliable and cost-efficient operations across upstream, midstream, and downstream segments. Integration and Change Management Failures limit the Industrial Automation Oil & Gas industry growth: Despite automation’s high ROI potential, nearly 30% of digital transformation initiatives fail due to poor system integration, workforce resistance, and cybersecurity gaps, particularly in legacy infrastructures in Russia, Africa, and Latin America. Overcoming these barriers is critical for realizing full automation benefits. Autonomous Operations and AI Adoption create lucrative growth opportunities to Industrial Automation Oil & Gas Market: Autonomous Operations and AI Adoption By 2026, 60% of oil companies plan to deploy AI-driven exploration, drilling, and production optimization solutions. Emerging markets such as India, China, and the Middle East are increasingly adopting digital-by-design facilities, creating opportunities for enhanced decision-making, reduced downtime, and higher asset utilization.

Industrial Automation Oil and Gas Market segment analysis

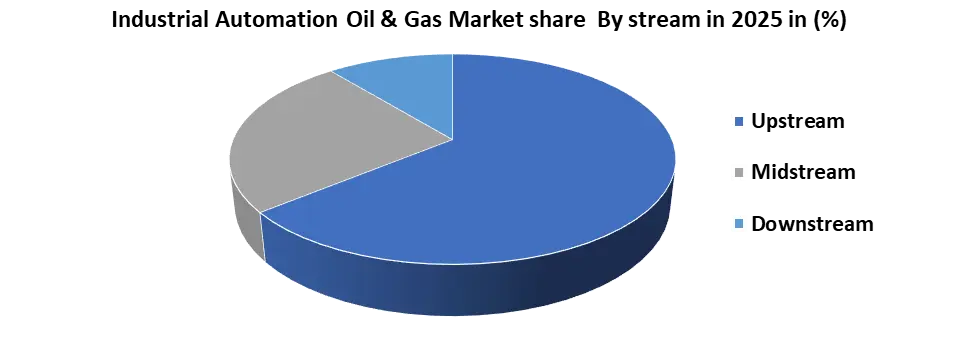

By Stream: The upstream segment leads the market in 2025 due to high capital intensity, operational complexity, and safety risks in exploration and production. Automation technologies optimize drilling, reservoir monitoring, and predictive maintenance, delivering higher production and operational safety. While midstream focuses on pipeline monitoring and transport efficiency, and downstream leverages automation for refining, terminal operations, and energy efficiency, upstream continues to lead in investment and technology penetration, driven by the demand for cost reduction and operational reliability.

Industrial Automation Oil and Gas Market Regional Analysis

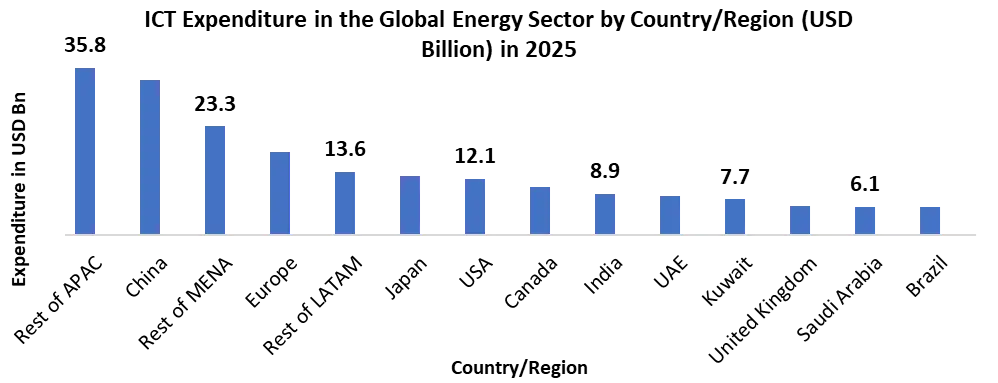

Asia-Pacific was led the market in 2025 due to refinery expansions, rapid oil consumption growth, and large-scale digitalization initiatives. China built 58 million barrels of crude stocks in 2024, while India continues expanding refining capacity. Investments in smart refineries and energy-efficient operations are key growth drivers. • North America: The US leads in upstream automation, digital drilling, and LNG terminal automation, while Canada and Mexico modernize aging assets through cloud SCADA and predictive maintenance. • Middle East: With OPEC crude production at 28.99 mb/d in November 2025, countries like Saudi Arabia are heavily investing in AI-driven production optimization and advanced control systems to maintain cost leadership. • Europe: Tightening regulations and weaker demand push operators toward automation-driven efficiency, emissions monitoring, and compliance systems. • Africa & South America: Nations like Nigeria, Angola, Brazil, Venezuela, and Colombia implement remote monitoring, mobile SCADA, and centralized control rooms to manage production volatility and infrastructure challenges.

Industrial Automation Oil and Gas Market: Competitive Landscape and Strategic Growth

The global Industrial Automation Oil & Gas Market was dominated by key industrial technology leaders investing in AI, digital twins, cloud SCADA, and predictive maintenance to enhance operational efficiency, safety, and sustainability. Over the past five years, Emerson Electric, Siemens, Schneider Electric, Honeywell, and ABB have achieved high single-digit annual growth, driven by digital oilfield adoption and innovative automation solutions.Key Players and Strategic Highlights:

• Emerson Electric – DeltaV DCS and redesigned SaaS SCADA mobile app enabling remote operations, route-based inspections, and alarm management. • Siemens – AI-driven analytics, digital twins, and cybersecurity for LNG and refining automation in Europe, Middle East, and Asia. • Schneider Electric – EcoStruxure platform integrating energy management and decarbonization. • Honeywell – Experion and Forge platforms for predictive maintenance and autonomous operations. • ABB – Robotics, electrification, and advanced control systems for offshore and subsea assets.Major Countries in Oil and Gas:

Case studies show ADNOC (UAE) generated USD 500 million via AI, while drone inspections reduced safety incidents for offshore operators.

Producers Exporters Importers US Saudi Arabia China Saudi Arabia Russia India Russia Iraq Japan UAE UAE South Korea Iraq Kuwait OECD Europe Canada Nigeria US Brazil Top 5 Countries by Proven Natural oil & Gas Reserves (2024)

Industrial Automation Oil and Gas Market Scope: Inquiry Before Buying

Industrial Automation Oil and Gas Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 17.07 Bn. Forecast Period 2026 to 2032 CAGR: 4.7% Market Size in 2032: USD 23.54 Bn. Segments Covered: by Component Industrial Robots Control Valves Field Instruments HMI (Human Machine Interface) Industrial PC Process Analyzer Intelligent Pigging Vibration Monitoring by Solutions SCADA (Supervisory Control and Data Acquisition) PLC (Programmable Logic Controller) DCS (Distributed Control System) MES (Manufacturing Execution System) Functional Safety PAM (Plant Asset Management) by Stream Upstream Midstream Downstream by Application Drilling Production Refining Pipeline Monitoring Industrial Automation Oil and Gas key players

1. Schneider Electric SE 2. Siemens AG 3. ABB Ltd. 4. Honeywell International Inc. 5. Emerson Electric Co. 6. Rockwell Automation Inc. 7. Yokogawa Electric Corporation 8. General Electric Company (GE Digital) 9. Mitsubishi Electric Corporation 10. Endress+Hauser Group 11. National Oilwell Varco (NOV) 12. Schlumberger Limited 13. Baker Hughes Company 14. Weatherford International plc 15. TechnipFMC plc 16. Cameron International (Schlumberger) 17. Omron Corporation 18. Fanuc Corporation 19. Kongsberg Gruppen ASA 20. Eaton Corporation 21. Robert Bosch GmbH 22. Hitachi, Ltd. 23. Thermo Fisher Scientific Inc. 24. KROHNE Messtechnik GmbH 25. VEGA Grieshaber KG 26. Cisco Systems, Inc. 27. AVEVA Group plc 28. Aspen Technology, Inc. 29. Metso Corporation 30. SMC CorporationFAQ

1)What is Industrial Automation in the Oil & Gas industry? Ans: It refers to using technologies like SCADA, DCS, PLCs, IIoT, AI, and robotics to monitor, control, and optimize operations across upstream, midstream, and downstream segments. 2)Why is Industrial Automation important for Oil & Gas companies? Ans: Automation improves operational efficiency, safety, predictive maintenance, and asset reliability, reducing costs and minimizing unplanned downtime. 3)What is the market size and growth forecast? Ans: The market is projected to grow from USD 17.07 billion in 2025 to USD 23.54 billion by 2032, at a CAGR of 4.7%, driven by AI and digital transformation adoption. 4.) Which segments dominate the market? Ans: The upstream segment leads due to high capital intensity, operational complexity, and safety risks, while midstream and downstream focus on pipeline and refining efficiency. 5)Who are the key players in the Industrial Automation Oil & Gas Market? Ans: Top companies include Schneider Electric, Siemens, ABB, Honeywell, Emerson Electric, Rockwell Automation, Yokogawa, and GE Digital.

1. Industrial Automation Oil and Gas Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industrial Automation Oil and Gas Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. End-User 2.3.5. Total Company Revenue (2025) 2.3.6. Certifications 2.3.7. Global Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Recent Developments 2.7. Market Positioning & Share Analysis 2.7.1. Company Revenue, Industrial Automation Oil and Gas Revenue, and Market Share (%) 2.7.2. MMR Competitive Positioning 2.8. Strategic Developments & Partnerships 2.8.1. Mergers, acquisitions, and joint ventures 2.8.2. Expansion into emerging markets 2.8.3. Strategic alliances with OEMs or system integrators 2.8.4. Investments in new production facilities 2.8.5. Sustainability initiatives and green product launches 3. Industrial Automation Oil and Gas Market: Dynamics 3.1. Industrial Automation Oil and Gas Market Trends 3.2. Industrial Automation Oil and Gas Market Dynamics 3.2.1. North America 3.2.2. Europe 3.2.3. Asia Pacific 3.2.4. Middle East and Africa 3.2.5. South America 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 4. Pricing and Cost Structure Analysis (2025) 4.1. Hardware Pricing Trends and Cost Comparisons 4.2. Software Licensing Models and Subscription Costs 4.3. Service Fee Benchmarking and Contract Analysis 4.4. Total Cost of Ownership for Automation Systems 4.5. ROI Analysis for Industrial Automation Investments 5. Value Chain and Supply Chain Analysis 5.1. Raw Material Sourcing for Industrial Automation Equipment 5.2. Manufacturing and Assembly Processes for Automation Components 5.3. Distribution Channels and Logistics for Oil & Gas 5.4. Aftermarket Services and Spare Parts Availability 5.5. Supplier Landscape and Strategic Partnerships Overview 6. Regulatory and Compliance Landscape 6.1. International Standards Applicable to Industrial Automation 6.2. Safety Regulations Compliance Including API and IEC 6.3. Environmental Compliance Requirements for Oil & Gas Industry 6.4. Data Privacy and Security Policies for Industrial Systems 6.5. Certification and Accreditation Requirements for Market Players 7. Technology Trends and Innovations 7.1. Artificial Intelligence and Machine Learning in Automation 7.2. Digital Twin Platforms for Simulation and Operational Insight 7.3. Augmented Reality and Virtual Reality Applications 7.4. Blockchain Technology in Supply Chain Monitoring 7.5. Robotics Advancements for Operational Efficiency 8. Sustainability Initiatives and Impact 8.1. Net-Zero Carbon Targets and Industry Response 8.2. Emissions Monitoring and Automation Solutions Implementation 8.3. Energy Efficiency Automation Solutions for Operational Savings 8.4. Renewable Energy Integration with Industrial Automation 8.5. Carbon Capture Technologies and Environmental Compliance 9. Risk Management Frameworks 9.1. Operational Risk Assessment and Mitigation Strategies 9.2. Cybersecurity Risk Management for Industrial Systems 9.3. Health and Safety Risk Reduction Solutions 9.4. Project Delivery Risks and Contingency Planning 9.5. Financial and Market Risk Analysis for Companies 10. Case Studies 10.1. Upstream Automation Case Study for Drilling Optimization 10.2. Midstream Digitalization Case Study for Pipeline Control 10.3. Downstream Control System Upgrade Case Study Insights 10.4. Predictive Maintenance Implementation Case Study 10.5. Cost Optimization Success Stories Across Segments 11. Strategic Recommendations 11.1. Short-Term Strategies for Immediate Market Growth 11.2. Mid-Term Priorities for Technology Adoption and ROI 11.3. Long-Term Roadmap for Market Expansion Plans 11.4. Technology Adoption Matrix for Industrial Automation 11.5. Investment Opportunities for Global Market Players 12. Industrial Automation Oil and Gas Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 12.1. Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 12.1.1. Industrial Robots 12.1.2. Control Valves 12.1.3. Field Instruments 12.1.4. HMI (Human Machine Interface) 12.1.5. Industrial PC 12.1.6. Process Analyzer 12.1.7. Intelligent Pigging 12.1.8. Vibration Monitoring 12.2. Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 12.2.1. SCADA (Supervisory Control and Data Acquisition) 12.2.2. PLC (Programmable Logic Controller) 12.2.3. DCS (Distributed Control System) 12.2.4. MES (Manufacturing Execution System) 12.2.5. Functional Safety 12.2.6. PAM (Plant Asset Management) 12.3. Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 12.3.1. Upstream 12.3.2. Midstream 12.3.3. Downstream 12.4. Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 12.4.1. Drilling 12.4.2. Production 12.4.3. Refining 12.4.4. Pipeline Monitoring 12.5. Industrial Automation Oil and Gas Market Size and Forecast, by Region (2025-2032) 12.5.1. North America 12.5.2. Europe 12.5.3. Asia Pacific 12.5.4. Middle East and Africa 12.5.5. South America 13. North America Industrial Automation Oil and Gas Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 13.1. North America Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 13.2. North America Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 13.3. North America Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 13.4. North America Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 13.5. North America Industrial Automation Oil and Gas Market Size and Forecast, by Country (2025-2032) 13.5.1. United States 13.5.2. Canada 13.5.3. Mexico 14. Europe Industrial Automation Oil and Gas Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 14.1. Europe Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 14.2. Europe Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 14.3. Europe Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 14.4. Europe Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 14.5. Europe Industrial Automation Oil and Gas Market Size and Forecast, by Country (2025-2032) 14.5.1. United Kingdom 14.5.2. France 14.5.3. Germany 14.5.4. Italy 14.5.5. Spain 14.5.6. Sweden 14.5.7. Austria 14.5.8. Rest of Europe 15. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 15.1. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 15.2. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 15.3. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 15.4. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 15.5. Asia Pacific Industrial Automation Oil and Gas Market Size and Forecast, by Country (2025-2032) 15.5.1. China 15.5.2. S Korea 15.5.3. Japan 15.5.4. India 15.5.5. Australia 15.5.6. Indonesia 15.5.7. Malaysia 15.5.8. Vietnam 15.5.9. Taiwan 15.5.10. Rest of Asia Pacific 16. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 16.1. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 16.2. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 16.3. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 16.4. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 16.5. Middle East and Africa Industrial Automation Oil and Gas Market Size and Forecast, by Country (2025-2032) 16.5.1. South Africa 16.5.2. GCC 16.5.3. Egypt 16.5.4. Nigeria 16.5.5. Rest of ME&A 17. South America Industrial Automation Oil and Gas Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 17.1. South America Industrial Automation Oil and Gas Market Size and Forecast, by Component (2025-2032) 17.2. South America Industrial Automation Oil and Gas Market Size and Forecast, by Solutions (2025-2032) 17.3. South America Industrial Automation Oil and Gas Market Size and Forecast, by Stream (2025-2032) 17.4. South America Industrial Automation Oil and Gas Market Size and Forecast, by End-Use (2025-2032) 17.5. South America Industrial Automation Oil and Gas Market Size and Forecast, by Country (2025-2032) 17.5.1. Brazil 17.5.2. Argentina 17.5.3. Chile 17.5.4. Colombia 17.5.5. Rest Of South America 18. Company Profile: Key Players 18.1. Schneider Electric SE 18.1.1. Company Overview 18.1.2. Business Portfolio 18.1.3. Financial Overview 18.1.4. SWOT Analysis 18.1.5. Strategic Analysis 18.1.6. Recent Developments 18.2. Siemens AG 18.3. ABB Ltd. 18.4. Honeywell International Inc. 18.5. Emerson Electric Co. 18.6. Rockwell Automation Inc. 18.7. Yokogawa Electric Corporation 18.8. General Electric Company (GE Digital) 18.9. Mitsubishi Electric Corporation 18.10. Endress+Hauser Group 18.11. National Oilwell Varco (NOV) 18.12. Schlumberger Limited 18.13. Baker Hughes Company 18.14. Weatherford International plc 18.15. TechnipFMC plc 18.16. Cameron International (Schlumberger) 18.17. Omron Corporation 18.18. Fanuc Corporation 18.19. Kongsberg Gruppen ASA 18.20. Eaton Corporation 18.21. Robert Bosch GmbH 18.22. Hitachi, Ltd. 18.23. Thermo Fisher Scientific Inc. 18.24. KROHNE Messtechnik GmbH 18.25. VEGA Grieshaber KG 18.26. Cisco Systems, Inc. 18.27. AVEVA Group plc 18.28. Aspen Technology, Inc. 18.29. Metso Corporation 18.30. SMC Corporation 19. Key Findings 20. Industry Recommendations 21. Industrial Automation Oil and Gas Market: Research Methodology