India Power Bank Market was worth US$ 10.51 Bn in 2022 and overall revenue is anticipated to rise at a rate of 8.1% from 2023 to 2029, reaching almost US$ 18.14 Bn in 2029.India Power Bank Market Overview:

The India Power Bank Market is expected to grow at a significant rate. Smartphone users around the world could be potential customers for power battery packs or power banks. Persuading smartphone users to purchase power banks will depend on their lifestyle. The expansion of smartphones and multimedia devices, according to a recent study by Persistence Market Research, acts as a strong distribution network for power bank goods. The power battery pack market, which is presently valued at US$ 6.3 billion, is expected to rise at a CAGR of % to reach US$ 13.7 billion by the end of 2024, according to the analysisTo know about the Research Methodology :- Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the market through 2029. 2020 is a year of exception and analyzed specially with the impact of lockdown by region.

India Power Bank Market Dynamics:

Increasing electronic gadgets holder and falling price of power bank are the key drivers of the India power bank market. Rising disposable income, growing urbanization and increasing penetration of smartphones, tablets and compact electronic devices are other major factors that positively impact on the India’s power bank market during the forecast. Increase in energy consumption by the electronic gadgets coupled with the use of these devices has significantly increased in recent years, due to the availability of internet-based application and games. Power banks have gained enormous popularity across the urban areas. In case of outage or an unstable electricity supply, power banks are most helpful. Low quality force banks can cause overheating, decrease a telephone's battery life, and in the most noticeably awful situation, may even detonate. These are for the most part evaluated low to draw in purchasers. A couple of producers utilize reused batteries, which, thusly, increment the danger of blast. In this manner, low quality force banks can impede the development of the market.India Power Bank Market Segment Analysis:

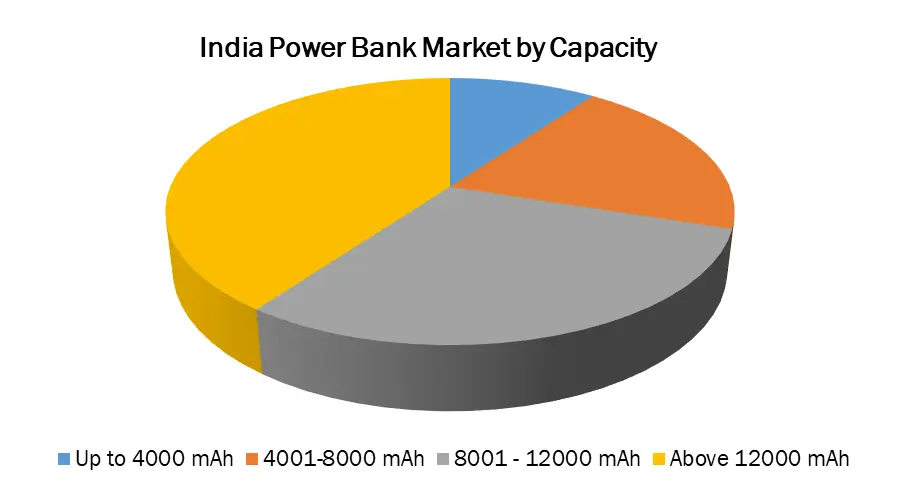

India Power Bank Market segment into Capacity, Application and Distribution channel. Based on Capacity, the market is sub-segmented into the Up to 4000 mAh, 4001 - 8000 mAh, 8001 - 12000 mAh and Above 12000 mAh. The above 12000 mAh segment is dominated in the market. These power banks offer high output efficiency and a long battery life, as well as LEDs or LCDs that show the battery level. Consumers choose these power banks because they are less expensive than power banks with capacity of more than 15,000 mAh. These power banks are big and have a lot of extra capabilities like DC output connections for charging laptops, USB Type C ports, and Quick charge functionality. Due to salary cuts, the COVID-19 pandemic has resulted in a significant slowdown in economic growth and a decrease in per capita income for the population.

India Power Bank Market: Competition Landscape

A power bank has four main components - lithium ion cells, control PCB, moldings and USB connectors and cables. The government’s decision to classify power banks and to bring the import duty to zero on raw materials for lithium ion cells, which go into that accessory, which create Rs 18,000-crore industry and generate up to 80,000 jobs by 2025. India Cellular and Electronic Association of India (ICEA), announced more than 250 factories for assembly can come up by 2025 and added that this year itself, there would be a value. In India, there are about 430 million smartphone users currently who use about 33 million power banks a year worth Rs 2,000 crore. Currently most of the power banks are imported and can easily be substituted by those made in India. India Power Bank Market has the presence of a large number of players. Major players in the India Power Bank Market are concentrating on developing new technologies to facilitate the industry with lowest time and low expenditure consuming technologies. In recent years there are many discoveries in the field of technologies with regards to India Power Bank Market, which in turn will help the industry to grow resulting in boost to the competition. The Indian e-commerce website like are sold in this festival likewise, power bank are also sold in Rs XXX crore worth. Amazon and Flipkart and many more are predicted to sale 5 billion value products in coming festivals and seasons. Every year around Rs 750 crore worth premium smartphones The objective of the report is to present a comprehensive analysis of the India Power Bank Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Power Bank Market dynamics, structure by analyzing the market segments and project the market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.India Power Bank Market Scope: Inquire before buying

India Power Bank Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 10.51 Bn. Forecast Period 2023 to 2029 CAGR: 8.1% Market Size in 2029: US$ 18.14 Bn. Segments Covered: by Capacity Range Up to 4000 mAh 4001 - 8000 mAh 8001 - 12000 mAh Above 12000 mAh by Application Smartphone Tablet by Distribution Channel Online Offline India Power Bank Market Key Players

1. Anker Technology Co. Limited 2. Mophie Inc. 3. Panasonic Corporation 4. Rav Power 5. Samsung Electronics Co. 6. Sony Corporation 7. Xtorm BV 8. Apacer Technologies Inc. 9. Braven 10. LC-INCIPIO Technologies Inc. 11. Goal Zero Corporation 12. GP Batteries International Ltd 13. IEC Technology LLC 14. Maxell Holdings Ltd 15. MiPow Limited 16. Intex Technologies (India) Ltd. 17. Portronics Digital Private Limited 18. Best IT World (India) Private Limited 19. Zebronics India Pvt. 20. Lapguard 21. SSK GroupFrequently Asked Questions:

1] What was the market size of India Power Bank Market 2022? Ans – India Power Bank Market was worth US$ 10.51 Bn in 2022. 2] What is the market segment of India Power Bank Market? Ans -The market segments are based on Capacity, Application and Distribution channel. 3] What is forecast period consider for India Power Bank Market? Ans -The forecast period for Walnut Market 2023 to 2029. 4] Which sub-segment is dominated in Capacity segment? Ans - The above 12000 mAh segment is dominated in the market. 5] What was the market size of India Power Bank Market 2029? Ans - India Power Bank Market is estimated at worth US$ 18.14 Bn in 2029.

India Power Bank Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 1.4. Key Questions Answered 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations Used 2.3. Research Methodology 3. Executive Summary 3.1. India Power Bank Market Size, By Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.3. Drivers and Restraints Snapshot Analysis 4.3.1. Drivers 4.3.2. Restraints 4.3.3. Opportunities 4.3.4. Porter’s Analysis 4.3.5. Value Chain Analysis 4.3.6. SWOT Analysis 5. India Power Bank Market Analysis and Forecast 5.1. India Power Bank Market Analysis and Forecast 5.2. India Power Bank Market Size & Y-o-Y Growth Analysis 6. India Power Bank Market Analysis and Forecast, By Capacity Range Type 6.1. Introduction and Definition 6.2. Key Findings 6.3. India Power Bank Market Value Share Analysis, By Capacity Range Type 6.4. India Power Bank Market Size (US$ Mn) Forecast, By Capacity Range Type 6.5. India Power Bank Market Analysis, By Capacity Range Type 6.6. India Power Bank Market Attractiveness Analysis, By Capacity Range Type 6.6.1. Up to 4000 mAh 6.6.2. 4001 - 8000 mAh 6.6.3. 8001 - 12000 mAh 6.6.4. Above 12000 mAh 7. India Power Bank Market Analysis and Forecast, By Distribution Channel Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. India Power Bank Market Value Share Analysis, By Distribution Channel Type 7.4. India Power Bank Market Size (US$ Mn) Forecast, By Distribution Channel Type 7.5. India Power Bank Market Analysis, By Distribution Channel Type 7.6. India Power Bank Market Attractiveness Analysis, By Distribution Channel Type 7.6.1. Online 7.6.2. Offline 8. India Power Bank Market Analysis and Forecast, By Application Type 8.1. Introduction and Definition 8.2. Key Findings 8.3. India Power Bank Market Value Share Analysis, By Application Type 8.4. India Power Bank Market Size (US$ Mn) Forecast, By Application Type 8.5. India Power Bank Market Analysis, By Application Type 8.6. India Power Bank Market Attractiveness Analysis, By Application Type 8.6.1. Smartphone 8.6.2. Tablet 8.6.3. Other 9. PEST Analysis 10. Company Profiles 10.1. Market Share Analysis, By Company 10.2. Competition Matrix 10.3. Company Profiles: Key Player 10.4. Sony Corporation 10.4.1. Company Overview 10.4.2. Financial Overview 10.4.3. Business Strategy 10.4.4. Recent Developments 10.4.5. Manufacturing Footprint 10.5. Anker Technology Co. Limited 10.6. Mophie Inc. 10.7. Panasonic Corporation 10.8. Rav Power 10.9. Samsung Electronics Co. 10.10. Xtorm BV 10.11. Apacer Technologies Inc. 10.12. Braven 10.13. LC-INCIPIO Technologies Inc. 10.14. Goal Zero Corporation 10.15. GP Batteries International Ltd 10.16. IEC Technology LLC 10.17. Maxell Holdings Ltd 10.18. MiPow Limited 10.19. Intex Technologies (India) Ltd. 10.20. Portronics Digital Private Limited 10.21. Best IT World (India) Private Limited 10.22. Zebronics India Pvt. 10.23. Lapguard 10.24. SSK Group 11. Primary Key Insights