Global Lithium-sulfur Battery Market size was valued at USD 0.390 Billion in 2023 and the total Lithium-sulfur Battery Market revenue is expected to grow at 31.8% through 2024 to 2030, reaching nearly USD 2.69 Billion.Lithium-sulfur Battery Market Overview:

The lithium-sulfur (Li-S) battery is a rechargeable battery. The lightweight nature resulting from lithium's low atomic weight and sulfur's moderate atomic weight, these batteries possess a weight profile parallel to water's density. An authentication to their capabilities, Li-S batteries powered the Zephyr 6, marking the longest and highest-altitude flight for an unmanned solar-powered aircraft back in August 2008. Recent advancements in battery technology are custom-made to meet the demands of diverse sectors, especially in electro-mobility and stationary applications. Electric vehicles like Battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs), in that lithium-sulfur batteries play an important role. These EVs force a range of charging set-ups, from traditional to rapid systems. In stationary settings, lithium-sulfur batteries are gaining traction for regulating power in micro and smart grids, serving as crucial transient energy storage solutions. The rising demand for electric vehicles (EVs) and government initiatives towards achieving zero carbon goals are driving the lithium-sulfur battery market growth in the forecast period. The lithium-sulfur battery plays a key role in various aerospace applications, satellites, high-altitude aircraft, and other space vehicle which helps to drive the lithium-sulfur battery market. Within the aerospace field, these batteries be categorized as either primary (one-time use) or secondary (rechargeable), lithium-sulfur batteries intended for aerospace use, especially in equipment on board transported by aircraft. The aerospace sector dominates the lithium-sulfur battery market moving toward lower emission sources. The aerospace industry is progressively adopting lithium-sulfur batteries due to their superior energy density requirements which drives the lithium-sulfur battery market growth. Rising global temperatures have prompted both developed and developing countries like Asia Pacific, North America, Europe, and others to transition away from thermal power plants in support of renewable energy alternatives. In North America, the Aerospace sector is dominant in the lithium-sulfur battery market due to the usage of lithium-sulfur batteries in high-range aircraft, and drones, these batteries offer extended and potent energy storage capabilities, making them increasingly favored in the Lithium-sulfur Battery Market.To know about the Research Methodology :- Request Free Sample Report

Lithium-sulfur Battery market Dynamics:

Energy Density of Lithium-sulfur Battery Lithium-sulfur batteries have higher energy density compared to local lithium-ion batteries, making them attractive for applications and demanding extended battery life. The competitiveness of Lithium-sulfur Battery Market, especially in the Energy Density, serves as a driving factor in the AESB (automotive and stationary energy storage battery) market. Advancements aiming for improved volumetric efficiency drive their appeal and adoption. Shifting to cost-effective anode materials like silicon and graphite help manage expenses, although slightly compromise battery energy densities. Cost-Effectiveness driving the growth of Lithium-sulfur Battery Higher energy density and the low heavy metals, lithium-sulfur batteries are lighter, making them ideal for aerospace and electric vehicle applications and also other automotive industries. The research and manufacturing processes advance, the cost of producing lithium-sulfur batteries is probable to reduce, boosting their Lithium-sulfur Battery Market adoption. The general availability, favorable geographic range, and environmentally-friendly nature of sulfur position Lithium-sulfur batteries as an eco-friendly and cost-effective alternative. Efficient management and minimal consumption of electrolytes contribute to cost savings. Environmental Concerns affecting Lithium-sulfur Battery A growing prominence on sustainability, the lower environmental impact of lithium-sulfur batteries, especially reduced the use of rare earth metals, is drive their Lithium-sulfur battery market growth. The transition from a liquid to a solid arrangement seems to be a capable strategy for safer Lithium-sulfur battery. In May 2023, the Environmental Protection Agency (EPA) Regulations (EPA) issued a memo to clarify how these regulations apply to lithium-ion batteries. Lithium- sulfur batteries are regulated as hazardous materials under the DOT's Hazardous Materials Regulations (HMR)Lithium-sulfur Battery Market Challenges

The increasing prominence of fuel cell, which harness electricity finished electrochemical reactions using hydrogen and oxygen, shows a competitive challenge. Fuel cells have advantages like longer flight times for drones and are gaining traction in sectors like automotive and energy storage. The increasing adoption of fuel cells, especially in automotive and energy storage applications, is intensifying the competition for the Lithium-sulfur Battery Market, especially in forecast period. While drones have become more affordable and accessible in technological developments, their typical flight duration remains constrained frequently. Constraint be overcome using fuel cells, which extend the operational time to around an hour.Opportunities in Lithium-sulfur Battery Market

The growth of the global micro grids market drive the growth of the global Lithium-sulfur Battery market as micro grids essentially use Li-ion and lead-acid batteries and are capable of constant use in a partial-state-of-charge (PSoC) when the availability of solar power is limited. Hence, boosting the growth of the Lithium-sulfur Battery market in focus during the forecast period.Lithium-sulfur Battery Market Segment Analysis:

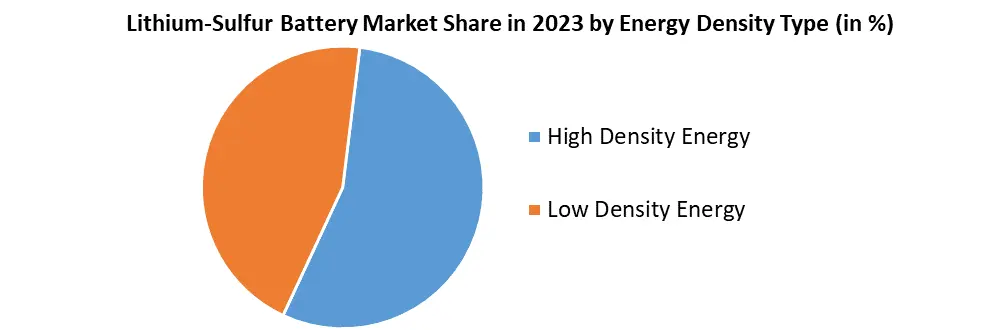

By Energy Density, The high energy density segment have significant growth in the forecast period. Batteries with high energy density offer extended operational durations relative to their size. When compared to low energy density counterparts, these batteries deliver equivalent power outputs but occupy less space. Efficiency not only facilitates cost-effective grid integration and utility-scale energy storage but also enables electric vehicles (EVs) to achieve extended driving ranges. Given that high-energy-density lithium-sulfur batteries are predominantly favored for EV applications, a specific segment within the lithium-sulfur battery market is expected to experience growth in the forecast period.By Power Capacity, Lithium-sulfur batteries, characterized by their compactness and lightness with capacities under 0-500 mAh, are increasing demand in Lithium-sulfur Battery Market, power solutions for short electronic gadgets like wearable’s, medical tools, and wireless communication devices. Their standout features a superior energy density coupled with an extended operational lifespan, ensuring sustained and effective performance for these devices. The surge in demand for such lithium-sulfur batteries, especially within the sub-500 mAh capacity bracket, is driven in Lithium-sulfur Battery Market by the prevailing shift towards miniaturizing electronic components and a growing focus on energy conservation. Given that devices in these categories demand batteries that are both diminutive and offer potent power output, the global adoption of these trends is poised to fuel significant Lithium-sulfur Battery Market growth for 0-500 mAh lithium-sulfur batteries in the forecast period.

Lithium-sulfur Battery Market Regional Insights:

Asia Pacific holds the dominant position in the Lithium-sulfur Battery market and expected to dominate the market in forecast period. Key countries including China, Japan, and South Korea, play pivotal roles in fostering Lithium-sulfur Battery Market growth. Countries like Australia, India, and Vietnam have outlined initiatives to establish lithium-sulfur battery production units within their territories in the forecast period. The lithium-sulfur battery market is actively striving to provide technical advantages of lithium-sulfur batteries, including superior energy density and storage capacity, integrated energy storage solutions using these batteries are growing acceptance. In April 2023, the South Korean government collaborated with three major battery firms LG Energy Solution Ltd, Samsung SDI Co., Ltd, and SK on Co., Ltd to declare a collective investment of USD 15.1 billion by 2030. The initiative aims to develop advanced battery technologies and focus on solid-state batteries into the Lithium-sulfur Battery Market. In Japan, governmental efforts to boost electronic vehicle adoption are expected to drive the demand for lithium-sulfur batteries. North America region emerge as rapidly growing Lithium-sulfur battery market in 2023, driven by its rapid advancements in energy storage solutions and monitoring equipment. U.S. is significant country which invest in the military sector, which expected at enhancing soldier comfort in challenging environments. The U.S. increasingly integrates renewable energy sources into its energy matrix, there's a heightened demand for efficient energy storage solutions, especially for optimizing long-distance energy transmission and conversion processes. State initiatives promoting electric vehicles, coupled with the presence of industry leaders like Tesla, have intensified the demand for reliable, cost-effective battery solutions. For instance, a companies like Google, Microsoft, and Apple, which play a pivotal role in shaping the digital landscape like Smart devices ranging from computers and smartphones to wearable like smart bands, watches, and glasses offers promising avenues for the adoption of lithium-sulfur batteries in forecast period, amplify the need for energy backup solutions, for server infrastructures.Lithium-sulfur Battery Market Competitive Landscapes:

In 2023, a German based company Theion, launched lithium-sulfur batteries for mobile devices, having high capacity, rapid charging capabilities, and cost-effectiveness. Also unveiling batteries for automotive applications by 2024, setting their leadership in their lithium-sulfur battery market. In October 2023, Zeta Energy engineers batteries that potentially outperform their lithium-sulfur battery market counterparts. These metrics place Zeta Energy at the forefront of innovation, challenging and setting new standards for lithium-sulfur batteries. Zeta Energy's recent advancements and verifications highlight their leadership in the lithium-sulfur battery market. As competitors try to establish themselves, Zeta Energy's achievements demonstrate the company's commitment to advancing battery technology, promoting transparency, and influencing the future of energy storage solutions. In June 2023, Lyten marked a significant milestone with the initiation of a pilot their lithium-sulfur battery production in San Jose, also Lyten Company open its new headquarter in Luxembourg, Europe. Provides easy access to major European markets with regional standards and benefiting from EU's supportive policies for sustainable energy solutions.Lithium-sulfur Battery Market Scope: Inquiry Before Buying

Lithium-sulfur Battery Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 0.39 Bn. Forecast Period 2024 to 2030 CAGR: 31.8% Market Size in 2030: US $ 2.69 Bn. Segments Covered: by Energy Density Type High energy density Low energy density by Type Liquid Semi-Solid Solid by Power Capacity 0-500 mAh, 501-1000 mAh, Above 1000 mAh by Application Aviation Automotive Electronics Other Applications by vehicle Type Two wheeler Four wheeler Light commercial vehicle Heavy Commercial vehicle Others Lithium-sulfur Battery Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Lithium-sulfur Battery Key Players:

1. Bettergy Corp. (Peekskill, New York.) 2. TRU Group Inc. (Tucson, Arizona, United States) 3. Zeta Energy LLC (Houston, Texas ) 4. CIC energiGUNE (Vitoria, Álava.) 5. Giner Inc. (Newton, Massachusetts, US.) 6. Gelion Technologies Pty Ltd. (Australasia) 7. Theion (Germany) 8. Ilika PLC (UK ) 9. Poly Plus Battery Co. (Berkeley, CA,) 10. Iolitec Ionic Liquids Technologies GmbH (Germany) 11. Lyten Inc. (San Jose, California) 12. Merck KGaA (Darmstadt, Germany.) 13. LG Chem Ltd. (Seoul, South Korea.) 14. Rechargion Energy Pvt. Ltd. (Pune, Maharashtra.) 15. Shenzhen Uscender Industrial Co. Ltd. (China) 16. Sion Power Corp. (United States) 17. Solid State PLC (Redditch, UK) 18. VTC Power Co. Ltd. (shenzhen) 19. Guang Dong Fullriver Industry Co. Ltd. (Guangdong) 20. NexTech Batteries (Carson City, Nevada) 21. Li-S Energy Ltd.FAQs:

1. What are the growth drivers for the Lithium-sulfur Battery Market? Ans. Energy saving, Recued weight, Cost effectiveness, Environmental concerns and Research and development are the major driver for the market. 2. What is the major segment for the Lithium-sulfur Battery Market growth? Ans. Electronics and Aerospace Application segment are expected to be the major segment factor for the Surface disinfectant growth. 3. Which region is expected to lead the global Surface disinfectant during the forecast period? Ans. Asia pacific region is expected to lead the global Surface disinfectant during the forecast period. 4. What is the expected market size & growth rate of the Lithium-sulfur Battery Market? Ans. Lithium-sulfur Battery Market size was valued at USD 0.390 Billion in 2023 and the total market revenue is expected to grow at 31.8% through 2024 to 2030, reaching nearly USD 2.69 Billion. 5. What segments are covered in the Lithium-sulfur Battery Market report? Ans. The segments covered in the Surface disinfectant report are Type, Applications, End-use, and Region.

1. Lithium-sulfur Battery Market: Research Methodology 2. Lithium-sulfur Battery Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Lithium-sulfur Battery Market: Dynamics 3.1 Lithium-sulfur Battery Market Trends by Region 3.1.1 Global Lithium-sulfur Battery Market Trends 3.1.2 North America Lithium-sulfur Battery Market Trends 3.1.3 Europe Lithium-sulfur Battery Market Trends 3.1.4 Asia Pacific Lithium-sulfur Battery Market Trends 3.1.5 Middle East and Africa Lithium-sulfur Battery Market Trends 3.1.6 South America Lithium-sulfur Battery Market Trends 3.2 Lithium-sulfur Battery Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Lithium-sulfur Battery Market Drivers 3.2.1.2 North America Lithium-sulfur Battery Market Restraints 3.2.1.3 North America Lithium-sulfur Battery Market Opportunities 3.2.1.4 North America Lithium-sulfur Battery Market Challenges 3.2.2 Europe 3.2.2.1 Europe Lithium-sulfur Battery Market Drivers 3.2.2.2 Europe Lithium-sulfur Battery Market Restraints 3.2.2.3 Europe Lithium-sulfur Battery Market Opportunities 3.2.2.4 Europe Lithium-sulfur Battery Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Lithium-sulfur Battery Market Drivers 3.2.3.2 Asia Pacific Lithium-sulfur Battery Market Restraints 3.2.3.3 Asia Pacific Lithium-sulfur Battery Market Opportunities 3.2.3.4 Asia Pacific Lithium-sulfur Battery Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Lithium-sulfur Battery Market Drivers 3.2.4.2 Middle East and Africa Lithium-sulfur Battery Market Restraints 3.2.4.3 Middle East and Africa Lithium-sulfur Battery Market Opportunities 3.2.4.4 Middle East and Africa Lithium-sulfur Battery Market Challenges 3.2.5 South America 3.2.5.1 South America Lithium-sulfur Battery Market Drivers 3.2.5.2 South America Lithium-sulfur Battery Market Restraints 3.2.5.3 South America Lithium-sulfur Battery Market Opportunities 3.2.5.4 South America Lithium-sulfur Battery Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 By Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Lithium-sulfur Battery Industry 3.8 The Global Pandemic and Redefining of The Lithium-sulfur Battery Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Lithium-sulfur Battery Trade Analysis (2018-2023) 3.11.1 Global Import of Lithium-sulfur Battery 3.11.2 Global Export of Lithium-sulfur Battery 4. Global Lithium-sulfur Battery Market: Global Market Size and Forecast by Segmentation (By Value) (2024-2030) 4.1 Global Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 4.1.1 High energy density 4.1.2 Low energy density 4.2 Global Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 4.2.1 Liquid 4.2.2 Semi-Solid 4.2.3 Solid 4.3 Global Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 4.3.1 0-500 mAh, 4.3.2 501-1000 mAh, 4.3.3 Above 1000 mAh 4.4 Global Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 4.4.1 Aviation 4.4.2 Automotive 4.4.3 Electronics 4.4.4 Other Applications 4.5 Global Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 4.5.1 Two wheeler 4.5.2 Four wheeler 4.5.3 Light commercial vehicle 4.5.4 Heavy Commercial vehicle 4.5.5 Others 4.6 Global Lithium-sulfur Battery Market Size and Forecast, by Region (2024-2030) 4.6.1 North America 4.6.2 Europe 4.6.3 Asia Pacific 4.6.4 Middle East and Africa 4.6.5 South America 5. North America Lithium-sulfur Battery Market Size and Forecast by Segmentation (By Value) (2024-2030) 5.1 North America Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 5.1.1 High energy density 5.1.2 Low energy density 5.2 North America Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 5.2.1 Liquid 5.2.2 Semi-Solid 5.2.3 Solid 5.3 North America Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 5.3.1 0-500 mAh, 5.3.2 501-1000 mAh, 5.3.3 Above 1000 mAh 5.4 North America Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 5.4.1 Aviation 5.4.2 Automotive 5.4.3 Electronics 5.4.4 Other Applications 5.5 North America Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 5.5.1 Two wheeler 5.5.2 Four wheeler 5.5.3 Light commercial vehicle 5.5.4 Heavy Commercial vehicle 5.5.5 Others 5.6 North America Lithium-sulfur Battery Market Size and Forecast, by Country (2024-2030) 5.6.1 United States 5.6.1.1 United States Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 5.6.1.1.1 High energy density 5.6.1.1.2 Low energy density 5.6.1.2 United States Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 5.6.1.2.1 Liquid 5.6.1.2.2 Semi-Solid 5.6.1.2.3 Solid 5.6.1.2.4 5.6.1.3 United States Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 5.6.1.3.1 0-500 mAh, 5.6.1.3.2 501-1000 mAh, 5.6.1.3.3 Above 1000 mAh 5.6.1.4 United States Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 5.6.1.4.1 Aviation 5.6.1.4.2 Automotive 5.6.1.4.3 Electronics 5.6.1.4.4 Other Applications 5.6.1.5 United States Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 5.6.1.5.1 Retail Stores 5.6.1.5.2 E-commerce 5.6.1.5.3 Direct Sales 5.6.2 Canada 5.6.2.1 Canada Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 5.6.2.1.1 High energy density 5.6.2.1.2 Low energy density 5.6.2.2 Canada Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 5.6.2.2.1 Liquid 5.6.2.2.2 Semi-Solid 5.6.2.2.3 Solid 5.6.2.2.4 Spicy 5.6.2.3 Canada Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 5.6.2.3.1 0-500 mAh, 5.6.2.3.2 501-1000 mAh, 5.6.2.3.3 Above 1000 mAh 5.6.2.4 Canada Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 5.6.2.4.1 Aviation 5.6.2.4.2 Automotive 5.6.2.4.3 Electronics 5.6.2.4.4 Other Applications 5.6.2.5 Canada Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 5.6.2.5.1 Two wheeler 5.6.2.5.2 Four wheeler 5.6.2.5.3 Light commercial vehicle 5.6.2.5.4 Heavy Commercial vehicle 5.6.2.5.5 Others 5.6.3 Mexico 5.6.3.1 Mexico Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 5.6.3.1.1 High energy density 5.6.3.1.2 Low energy density 5.6.3.2 Mexico Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 5.6.3.2.1 Liquid 5.6.3.2.2 Semi-Solid 5.6.3.2.3 Solid 5.6.3.3 Mexico Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 5.6.3.3.1 0-500 mAh, 5.6.3.3.2 501-1000 mAh, 5.6.3.3.3 Above 1000 mAh 5.6.3.4 Mexico Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 5.6.3.4.1 Aviation 5.6.3.4.2 Automotive 5.6.3.4.3 Electronics 5.6.3.4.4 Other Applications 5.6.3.5 Mexico Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 5.6.3.5.1 Two wheeler 5.6.3.5.2 Four wheeler 5.6.3.5.3 Light commercial vehicle 5.6.3.5.4 Heavy Commercial vehicle 5.6.3.5.5 Others 6. Europe Lithium-sulfur Battery Market Size and Forecast by Segmentation (By Value) (2024-2030) 6.1 Europe Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.2 Europe Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.3 Europe Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.4 Europe Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.5 Europe Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6 Europe Lithium-sulfur Battery Market Size and Forecast, by Country (2024-2030) 6.6.1 United Kingdom 6.6.1.1 United Kingdom Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.1.2 United Kingdom Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.1.3 United Kingdom Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.1.4 United Kingdom Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.1.5 United Kingdom Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.2 France 6.6.2.1 France Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.2.2 France Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.2.3 France Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.2.4 France Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.2.5 France Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.3 Germany 6.6.3.1 Germany Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.3.2 Germany Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.3.3 Germany Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.3.4 Germany Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.3.5 Germany Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.4 Italy 6.6.4.1 Italy Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.4.2 Italy Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.4.3 Italy Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.4.4 Italy Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.4.5 Italy Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.5 Spain 6.6.5.1 Spain Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.5.2 Spain Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.5.3 Spain Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.5.4 Spain Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.5.5 Spain Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.6 Sweden 6.6.6.1 Sweden Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.6.2 Sweden Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.6.3 Sweden Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.6.4 Sweden Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.6.5 Sweden Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.7 Austria 6.6.7.1 Austria Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.7.2 Austria Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 6.6.7.3 Austria Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.7.4 Austria Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.7.5 Austria Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 6.6.8 Rest of Europe 6.6.8.1 Rest of Europe Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 6.6.8.2 Rest of Europe Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030). 6.6.8.3 Rest of Europe Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 6.6.8.4 Rest of Europe Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 6.6.8.5 Rest of Europe Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7. Asia Pacific Lithium-sulfur Battery Market Size and Forecast by Segmentation (By Value) (2024-2030) 7.1 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.2 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.3 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.4 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.5 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6 Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Country (2024-2030) 7.6.1 China 7.6.1.1 China Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.1.2 China Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.1.3 China Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.1.4 China Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.1.5 China Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.2 South Korea 7.6.2.1 S Korea Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.2.2 S Korea Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.2.3 S Korea Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.2.4 S Korea Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.2.5 S Korea Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.3 Japan 7.6.3.1 Japan Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.3.2 Japan Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.3.3 Japan Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.3.4 Japan Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.3.5 Japan Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.4 India 7.6.4.1 India Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.4.2 India Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.4.3 India Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.4.4 India Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.4.5 India Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.5 Australia 7.6.5.1 Australia Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.5.2 Australia Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.5.3 Australia Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.5.4 Australia Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.5.5 Australia Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.6 Indonesia 7.6.6.1 Indonesia Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.6.2 Indonesia Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.6.3 Indonesia Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.6.4 Indonesia Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.6.5 Indonesia Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.7 Malaysia 7.6.7.1 Malaysia Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.7.2 Malaysia Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.7.3 Malaysia Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.7.4 Malaysia Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.7.5 Malaysia Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.8 Vietnam 7.6.8.1 Vietnam Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.8.2 Vietnam Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.8.3 Vietnam Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.8.4 Vietnam Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.8.5 Vietnam Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.9 Taiwan 7.6.9.1 Taiwan Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.9.2 Taiwan Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.9.3 Taiwan Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.9.4 Taiwan Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.9.5 Taiwan Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.10 Bangladesh 7.6.10.1 Bangladesh Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.10.2 Bangladesh Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.10.3 Bangladesh Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.10.4 Bangladesh Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.10.5 Bangladesh Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.11 Pakistan 7.6.11.1 Pakistan Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.11.2 Pakistan Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.11.3 Pakistan Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.11.4 Pakistan Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.11.5 Pakistan Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 7.6.12 Rest of Asia Pacific 7.6.12.1 Rest of Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 7.6.12.2 Rest of Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 7.6.12.3 Rest of Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 7.6.12.4 Rest of Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 7.6.12.5 Rest of Asia Pacific Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8. Middle East and Africa Lithium-sulfur Battery Market Size and Forecast by Segmentation (By Value) (2024-2030) 8.1 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.2 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.3 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.4 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.5 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8.6 Middle East and Africa Lithium-sulfur Battery Market Size and Forecast, by Country (2024-2030) 8.6.1 South Africa 8.6.1.1 South Africa Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.6.1.2 South Africa Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.6.1.3 South Africa Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.6.1.4 South Africa Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.6.1.5 South Africa Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8.6.2 GCC 8.6.2.1 GCC Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.6.2.2 GCC Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.6.2.3 GCC Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.6.2.4 GCC Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.6.2.5 GCC Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8.6.3 Egypt 8.6.3.1 Egypt Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.6.3.2 Egypt Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.6.3.3 Egypt Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.6.3.4 Egypt Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.6.3.5 Egypt Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8.6.4 Nigeria 8.6.4.1 Nigeria Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.6.4.2 Nigeria Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.6.4.3 Nigeria Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.6.4.4 Nigeria Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.6.4.5 Nigeria Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 8.6.5 Rest of ME&A 8.6.5.1 Rest of ME&A Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 8.6.5.2 Rest of ME&A Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 8.6.5.3 Rest of ME&A Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 8.6.5.4 Rest of ME&A Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 8.6.5.5 Rest of ME&A Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 9. South America Lithium-sulfur Battery Market Size and Forecast by Segmentation (By Value) (2024-2030) 9.1 South America Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 9.2 South America Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 9.3 South America Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 9.4 South America Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 9.5 South America Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 9.6 South America Lithium-sulfur Battery Market Size and Forecast, by Country (2024-2030) 9.6.1 Brazil 9.6.1.1 Brazil Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 9.6.1.2 Brazil Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 9.6.1.3 Brazil Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 9.6.1.4 Brazil Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 9.6.1.5 Brazil Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 9.6.2 Argentina 9.6.2.1 Argentina Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 9.6.2.2 Argentina Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 9.6.2.3 Argentina Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 9.6.2.4 Argentina Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 9.6.2.5 Argentina Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 9.6.3 Rest Of South America 9.6.3.1 Rest Of South America Lithium-sulfur Battery Market Size and Forecast, by Energy Density Type (2024-2030) 9.6.3.2 Rest Of South America Lithium-sulfur Battery Market Size and Forecast, by Type (2024-2030) 9.6.3.3 Rest Of South America Lithium-sulfur Battery Market Size and Forecast, by Power Capacity (2024-2030) 9.6.3.4 Rest Of South America Lithium-sulfur Battery Market Size and Forecast, by Application (2024-2030) 9.6.3.5 Rest Of South America Lithium-sulfur Battery Market Size and Forecast, by Vehicle Type (2024-2030) 10. Global Lithium-sulfur Battery Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 Vehicle Type Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Lithium-sulfur Battery Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Zeta Energy LLC 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Details on Partnership 11.1.7 Regulatory Accreditations and Certifications Received by Them 11.1.8 Awards Received by the Firm 11.1.9 Recent Developments 11.2 Bettergy Corp. 11.3 CIC energiGUNE 11.4 Gelion Technologies Pty Ltd. 11.5 Giner Inc. 11.6 Guang Dong Fullriver Industry Co. Ltd. 11.7 Theion 11.8 Ilika PLC 11.9 Poly Plus Battery Co. 11.10 Iolitec Ionic Liquids Technologies GmbH 11.11 LG Chem Ltd. 11.12 Li-S Energy Ltd. 11.13 Lyten Inc. 11.14 Merck KGaA 11.15 NexTech Batteries 11.16 Rechargion Energy Pvt. Ltd. 11.17 Shenzhen Uscender Industrial Co. Ltd. 11.18 Sion Power Corp. 11.19 Solid State PLC 11.20 TRU Group Inc. 11.21 VTC Power Co. Ltd. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary