The India Hydrogen Market reached a value of US $ 72.14 Mn. in 2023. India Hydrogen Market size is estimated to grow at a CAGR of 6.3%.India Hydrogen Market Overview:

Hydrogen with the chemical formula ‘H2’ is a colourless, odourless, flammable substance chemical element. Hydrogen is the most abundant element in the world and accounted for 0.14% of the earth’s crust by weight. Hydrogen is three times abundant as helium, which is also widely available in nature. Hydrogen has a wide range of benefits such as being cost-effective, efficient, and environmentally friendly, as a result, hydrogen usage grows in the refining of petroleum, the treatment of metals, the production of fertilisers, and the processing of food goods. In 2019, Hydrogen was the 322nd most traded product across the globe, and trade in Hydrogen represents 0.055% of total global trade. In 2019, India exported hydrogen by a value of US $ 276 Mn. while imported hydrogen by a value of US $ 10.4 Mn.To know about the Research Methodology :- Request Free Sample Report

India Hydrogen Market Dynamics:

Hydrogen is obtained from fossil fuels and biomass, as well as water and a combination of the two. Natural gas is the most common source of Hydrogen, accounting for three-quarters of the total dedicated hydrogen production of around 70 million metric tonnes per year. This accounts for around 6% of global natural gas consumption. The growing production and consumption are expected to boost the hydrogen market growth across the globe along with India. The rising environmental concerns along with growing energy demand are driving the necessity for sustainable energy sources like hydrogen. In addition, governments of India are enacting strict rules and regulations to lower the carbon emissions from the automobile industry, which is driving up EV sales across the country. The widespread use of hydrogen as a coolant in power plant generators is boosting the India Hydrogen Market growth across the country. The high potential for hydrogen to reduce carbon emissions in India is positively impacting on hydrogen market. According to TERI, India’s demand for hydrogen is continuously growing, which is accounted for 6 million tonnes (MT) per annum, with most of the consumption coming from fertiliser plants and refineries. The growing demand is expected to grow to go up to 28 MT by 2050 and 40 MT by 2060. India has increased its demand for hydrogen and is expected to cover 4%, which is accounted for13 million metric tonnes of hydrogen consumption. Hydrogen plays a role in resolving a number of pressing energy issues. It proposes ways to decarbonize a variety of industries, including long-haul transportation, chemicals, and iron and steel, in which major emissions reductions are proving challenging. It also contributes to the improvement of air quality and increased energy security. Hydrogen contains more energy about 130 megajoules per kg (MJ/Kg) as compared to petrol and diesel, which contain energy between 45 to 46 megajoules per kg (MJ/kg). These factors are expected to boost the hydrogen market growth across the country. As per the MMR study, a car consumes 1 liter of hydrogen to cover 28 kilometres, while petrol consumes 1 liter of petrol to cover 18 kilometres. However, the current price of hydrogen in India is valued at Rs 880 per kg, which increases the fuel cost. In addition, the lack of hydrogen-dispensing stations is expected to hamper the India hydrogen market growth during the forecast period.Future Insight of India Hydrogen Market:

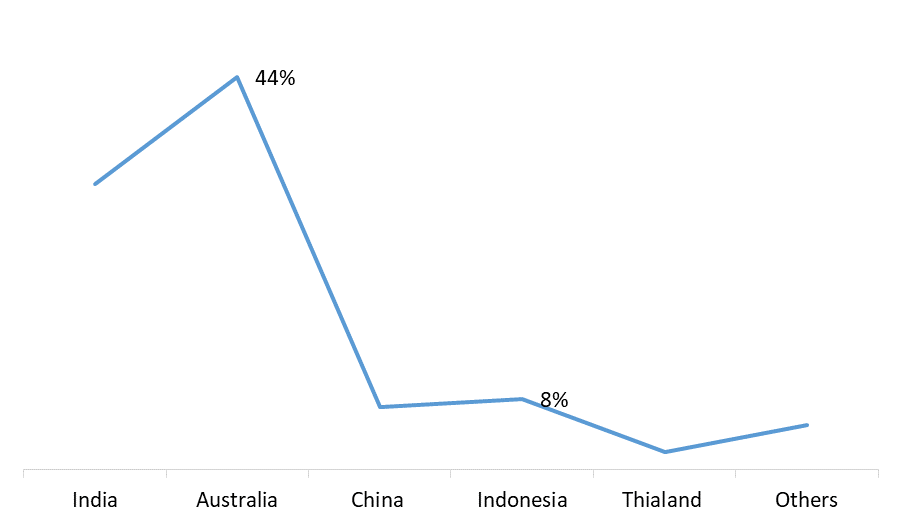

At present, the India’s total production of hydrogen comes from fossil fuels. By 2050, three-fourth of all hydrogen is expected to be green. India produces 6 million metric tonnes of grey hydrogen each year, accounting for about 8.5% of global demand. Increased hydrogen usage in the country's energy mix is expected to increase energy self-sufficiency. In addition, having a focus on green hydrogen is expected to help India to fulfill its climate change commitments by reducing carbon emissions. In the short term, a sensible strategy is expected to boost hydrogen's share over grey, blue, and green. The country's largest private sector in the oil and gas industry, Reliance Industries Ltd (RIL), announced its intention to become carbon-neutral by 2035. Its goal is to use green energy and hydrogen to replace fossil fuels in transportation. The company announced that it will invest the US $ 750000 million in renewable energy during the forecast period. The growing investment and increasing focus towards the hydrogen market from the Indian government are expected to drive the India hydrogen market growth during the forecast period. For Instance, Prime Minister Narendra Modi announced the commencement of a National Hydrogen Mission on August 15, 2021, and stated countries intention to turn India into a global center for green hydrogen production and export.Hydrogen supply Potential by countries of Asia Pacific Region:

India Hydrogen Market Segment Analysis:

Based on the Type, the India Hydrogen Market is segmented into Merchant and Captive. The Merchant segment held the largest market share, accounting for 58% in 2023. Merchant hydrogen is produced using water electrolysis and natural gas methods, reducing the need for fuel transportation and the installation of new hydrogen infrastructure. The merchant Hydrogen cost conveyance and distribution of hydrogen are boosting the India Hydrogen Market growth during the forecast period. Based on the Application, the India Hydrogen Market is segmented into Petroleum and Refinery, Ammonia and Methanol Production, Transportation, Power Generation, and Others. The Ammonia and Methanol production segment held the largest market share, accounting for 31% in 2023. Ammonia plants use a substantial portion of the hydrogen produced. Hydrogen is usually produced on-site in ammonia plants with fossil fuel as a feedstock. With its growing use and its low cost, along with an increasing huge consumer base, ammonia is used extensively in the fertiliser manufacturing process. The Transportation segment is expected to grow at a CAGR of 7.2% during the forecast period. The segment growth is attributed to the significant rise in demand for Fuel Cell Electric Vehicles (FCEV) across the country. Hydrogen is used in various types of transportation, including buses, trains, and fuel cell electric vehicles. Hydrogen is more fuel-efficient than traditional internal combustion engines along it releases no exhaust pollution. In March 2019, the Ministry of Economy, Trade, and Industry (METI) India updated the national hydrogen strategy to place 200000 FCEV units by 2025, and 800000 units by 2030. The objective of the report is to present a comprehensive analysis of the India Hydrogen Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the India Hydrogen Market dynamic, structure by analyzing the market segments and projecting the India Hydrogen Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the India Hydrogen Market make the report investor’s guide.India Hydrogen Market Scope: Inquire before buying

India Hydrogen Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 72.14 Mn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 110.64 Mn. Segments Covered: by Type Merchant Captive by Technology Steam Methane Reforming Coal Gasification by Application Petroleum and Refinery Ammonia and Methanol Production Transportation Power Generation Others India Hydrogen Market by Region

• North India • South India • East India • West IndiaIndia Hydrogen Market Key Players

1. Reliance Industries Limited 2. Indian Oil Corporation Ltd. 3. GAIL (India) Limited 4. Ballard Power System 5. Air Liquide 6. Air Products 7. Thyssenkrupp 8. KBR/Johnson Matthey 9. Cummins 10. Fuel Cell Energy 11. Plug Power 12. Bloom Energy 13. Linde 14. INOX Air 15. DCW Limited 16. TATA Chemicals 17. Bhoruka Gas 18. Air Water 19. Grasim Industries 20. Adani EnterprisesFrequently Asked Questions:

1] What segments are covered in the India Hydrogen Market report? Ans. The segments covered in the India Hydrogen Market report are based on Type, Technology and Application. 2] Which region is expected to hold the highest share in the India Hydrogen Market? Ans. The West India region is expected to hold the highest share in the India Hydrogen Market. 3] What is the market size of the India Hydrogen Market by 2030? Ans. The market size of the India Hydrogen Market by 2030 is US $ 110.64 Mn. 4] What is the forecast period for the India Hydrogen Market? Ans. The Forecast period for the India Hydrogen Market is 2024-2030. 5] What was the market size of the India Hydrogen Market in 2023? Ans. The market size of the India Hydrogen Market in 2023 was US $ 72.14 Mn.

1. India Hydrogen Market Size: Research Methodology 2. India Hydrogen Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global India Hydrogen Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. India Hydrogen Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by Country 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region 3.12. COVID-19 Impact 4. India Hydrogen Market Size Segmentation 4.1. India Hydrogen Market Size, by Type (2023-2030) • Merchant • Captive 4.2. India Hydrogen Market Size, by Technology (2023-2030) • Steam Methane Reforming • Coal Gasification 4.3. India Hydrogen Market Size, by Application (2023-2030) • Petroleum and Refinery • Ammonia and Methanol Production • Transportation • Power Generation • Others 5. North India Hydrogen Market (2023-2030) 5.1. India Hydrogen Market Size, by Type (2023-2030) • Merchant • Captive 5.2. India Hydrogen Market Size, by Technology (2023-2030) • Steam Methane Reforming • Coal Gasification 5.3. India Hydrogen Market Size, by Application (2023-2030) • Petroleum and Refinery • Ammonia and Methanol Production • Transportation • Power Generation • Others 5.4. North India Hydrogen Market, by States (2023-2030) • Delhi • Uttar Pradesh • Haryana 6. South India Hydrogen Market (2023-2030) 6.1. South India Hydrogen Market, by Type (2023-2030) 6.2. South India Hydrogen Market, by Technology (2023-2030) 6.3. South India Hydrogen Market, by Application (2023-2030) 6.4. South India Hydrogen Market, by States (2023-2030) 7. East India Hydrogen Market (2023-2030) 7.1. East India Hydrogen Market, by Type (2023-2030) 7.2. East India Hydrogen Market, by Technology (2023-2030) 7.3. East India Hydrogen Market, by Application (2023-2030) 7.4. East India Hydrogen Market, by States (2023-2030) 8. West India Hydrogen Market (2023-2030) 8.1. West India Hydrogen Market, by Type (2023-2030) 8.2. West India Hydrogen Market, by Technology (2023-2030) 8.3. West India Hydrogen Market, by Application (2023-2030) 8.4. West India Hydrogen Market, by States (2023-2030) 9. Company Profile: Key players 9.1. Reliance Industries Limited 9.1.1. Company Overview 9.1.2. Financial Overview 9.1.3. Global Presence 9.1.4. Capacity Portfolio 9.1.5. Business Strategy 9.1.6. Recent Developments 9.2. Indian Oil Corporation Ltd. 9.3. GAIL (India) Limited 9.4. Ballard Power System 9.5. Air Liquide 9.6. Air Products 9.7. Thyssenkrupp 9.8. KBR/Johnson Matthey 9.9. Cummins 9.10. Fuel Cell Energy 9.11. Plug Power 9.12. Bloom Energy 9.13. Linde 9.14. INOX Air 9.15. DCW Limited 9.16. TATA Chemicals 9.17. Bhoruka Gas 9.18. Air Water 9.19. Grasim Industries 9.20. Adani Enterprises