India Digital Banking Platforms Market size Volume was USD 779.79 Mn. in 2022 and the total India Digital Banking Platforms volume is expected to grow by 9.44% from 2023 to 2029, reaching nearly USD 1604.67 Mn.India Digital Banking Platforms Market Overview:

The digital banking platforms market is achieving traction owing to rising demand among banks for providing improved customer experience & growing acceptance of cloud-based solutions by financial organizations. As India’s banking sector experiences key disruption & modification, the country’s banks are transmuting. They are capitalizing heavily on digital tools to catch up with top global players proposing wide-ranging & urbane services. The Indian government has set itself on a track to intensely digitize India’s populace across areas counting social facility supplies, transfers & transactions, & official banking. The nation’s rapidly rising digital community is gradually demanding that India’s banks not only preserve pace with global top practices, but leapfrog far beyond them by developing new, uniquely Indian products, services, and business models.To know about the Research Methodology :- Request Free Sample Report

India Digital Banking Platforms Market Dynamics

Country’s digital drive With a fast-expanding digital economy, banks in countries that have not spent pointedly on digitization currently have a huge incentive to do so, sideways with growing government outlooks that sufficiently help the rising digital community. This digital revolution also provides increased facility, decreases cost, & builds loyalty & promise among an ever-more inconsistent banking consumer base and this experience is not distinctive to India. The track to digital maturity for Country’s banking sector Across the world, bankers spot the risk of disruption, many are compelling to policies that would have been measured ridiculous in the banking sector as newly as a decade ago. Looking for visions about how banking players plan to power digital skills in their new development plans, the IBV in partnership with Oxford Economics measured more than 2,000 banking players through 31 nations, with 150 from India. The vision from India The country’s economy has also been a source of financial facilities and inventions over the past few years. Many FinTech start-up trades have formed, covering the banking and financial markets business. In addition, the Country’s banking sector has also seen industry connection with trades from other industries trailing new banking occasions. According to the MMR report study, India’s banking administrators are gradually concentrating on signing big data & and analytics tools. The survey also discloses that 67 % of them are leading their establishments to increase the engagement and experience of their consumers, associated with only 51 % of global banking administrators. Other zones of the banking revolution also rank highly among the country’s banking leaders, 57% percent are watching to increase employee efficiency and 47 % are looking to expand the quality of trade decision-making within their administrations. Consumer-centric answers enable banks to increase consumer loyalty by providing boosted services and fast determinations to consumer queries. Banks are concentrated on adopting consumer retention strategies and drawing new consumers by efficiently communicating with them. A digital banking stage’s Omnichannel abilities support banks in facilitating personalized conversations through several channels, including voice, web, and mobile. It allows banks to involve consumers through all touchpoints. Scuh advancements are expected to drive the growth of the India Digital Banking Platforms Market over the forecast period. Checking end-to-end consumer journeys and tracing all actions help to make a complete view for every consumer. Digital banking permits personalization at the scale of 5 and 15 percent revenue development for firms in the financial facilities area. Customers expect fast speed and prompt transactions, which is making digital banking stages more reliable and well-organized to use this propels the Contactless Payment Solutions India Market. Absence of digital knowledge in the country Many developing nations still lack digital literacy, which hampers the extensive scale adoption of online and mobile payments. This harmfully influences the market development of digital banking stages. Digital literacy includes an extensive range of skills, like the ability to read & and make sense of technical information, which supports folks operating and making the usage of digital skills. Most nations in India have a low digital literacy rate; hence, folks cannot exploit the possibility of digital technologies. Technology sellers are also tentative about making investments owing to the small number of digital transactions. Hence, a lower literacy rate in the country is anticipated to slow down the development of the digital banking platforms market. Usage of digital banking and biometrics India’s civic digital infrastructure which is a big online establishment in many ways, acts as an outlier for the principle of the effect of technology in a short time span. The work was written off in a small time period, it has organized technology at the grass-roots, tapping into the nation’s huge local potential. India is now prepared to share its knowledge with the emerging world which is expected to boost the Virtual Banking Platforms India Market. The system constructed on a distinctive twelve-digit ID code for every Indian resident has considerably enhanced financial presence, access to civic documents and services, tax obedience, retail payments, and the administration of government grants. The solution has been the Adhar card, Adhar Card was launched in the year 2009 by the government of India. To track the program, he linked in Nandan Nilekani, an expert in Infosys, the nation’s homegrown technology giant. It was a determined try to reach and automatically establish the more than 1.3 Bn individuals living in India’s sprawling, diverse, and sometimes unreachable territory. While queries were raised about confidentiality matters, Adhar was approved by the Indian Supreme Court for opt-in usage in the year 2018; a superior bench of judges confirmed the decision in January 2021. Nowadays, most of India has selected to join the biometric data system: there are 1.26 Bn. People formally registered in Adhar. Adhar became the pillar of India’s community digital infrastructure in the year 2014 when PM Narendra Modi shared it with his administration’s Jan Dhan initiative, a fiscal presence program for India’s enormous number of unbanked households. These new accounts were related to both mobile numbers and Adhar, making the Jan Dhan-Adhar mobile. Today more than 80 percent of Indians have opened their account in banks which results into increasing the Online Account Management India Market.India Digital Banking Platforms Market Segment Analysis

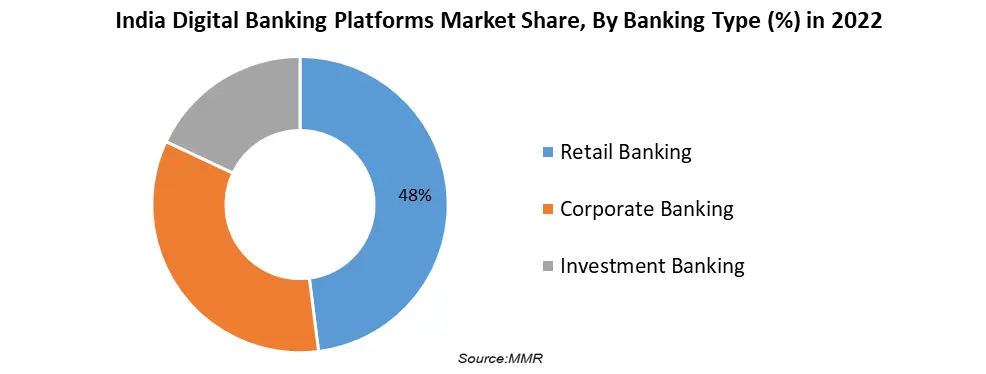

Based on the Banking Mode, India's digital banking platform market is segmented into two categories, online banking and mobile banking. The mobile banking segment dominated the market in the year 2022 and accounts for the largest market share as there is an increasing number of smartphones in India. Many customers prefer instant gratification and demand one-click solutions for everything, such as payments and the services of other banking, which is driving the growth of mobile banking across the country. Mobile banking provides a variety of services such as bill payment, instant transfer of funds, access to transaction history, etc., which is very beneficial, particularly for (SMEs) small and medium-sized businesses. Therefore, the popularity of mobile banking is increasing favoring the growth of Mobile Banking Solutions India Market. Online banking is also gaining popularity as it is an easier way to do transactions by mobile or net banking and can send money to different locations as well hence the demand for Online Banking Platforms India Market is increasing.Based on the Banking Type, The market is segmented into 3 categories i.e. retail banking, corporate banking, and investment banking. The retail banking sector dominates the market and holds the largest market share because of the increasing internet accessibility among customers along with the increasing penetration of digital banking services amongst the general public because of higher security and better convenience which leads to a boost in the Digital Payment Services India Market. On the other side, the corporate banking segment is also expected to reach at an ample rate due to the increasing adoption of digital banking platforms among small and medium-sized enterprises for improving business efficiency. Hence, the demand for the Fintech Solutions India Market is increasing.

India Digital Banking Platforms Market States Insights:

The regions in the Indian digital banking platform market are segmented into North India, South India, East India, and West India. The western region in the country, especially Mumbai city is the financial capital of India. Population of the Mumbai city is over 20 million which is a big factor as the adoption of smartphones is also high. Therefore, these factors dominate the Indian digital banking platform market in this region and hence there is an increasing dependency on digital banking platforms in this region. Moreover, states like Maharashtra and Gujarat are developing and the growth of the small and medium-sized businesses are the major driving forces for Digital Wallet Platforms India Market and its development.The objective of the report is to present a comprehensive analysis of the Indian Forklift Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Indian Forklift Market dynamics, and structure by analyzing the market segments and projecting the Indian Forklift Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Indian Forklift Market make the report investor’s guide.

India Digital Banking Platforms Market Scope: Inquiry Before Buying

India Digital Banking Platforms Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 779.79 Mn. Forecast Period 2023 to 2029 CAGR: 9.44% Market Size in 2029: US $ 1604.67 Mn. Segments Covered: by Banking Mode Online Banking Mobile Banking by Banking Type Retail Banking Corporate Banking Investment Banking India Digital Banking Platforms Market, by Region

North India South India East India West IndiaIndia Digital Banking Platforms Market Key Players

1. TCS [India] 2. EdgeVerve Finacle. 3. Oracle FLEXCUBE Core Banking. 4. Wipro Core Banking As-a-Service. 5. SAP Banking and Financial Services. [Germany] 6. Temenos T24 Transact 7. C-Edge Technologies Ltd. 8. NCR Corporation digital banking solutions. 9. Finastra Fusion core banking software. 10. Fiserv banking platforms. 11. Finacus Solutions Pvt. Ltd. 12. TrustBankCBS. 13. 3i Infotech.Frequently Asked Questions:

1] What segments are covered in the India Digital Banking Platforms Market report? Ans. The segments covered in the India Digital Banking Platforms Market report are based on Banking Mode, Banking Type and Region. 2] Which region is expected to hold the highest share in the India Digital Banking Platforms Market? Ans. The Western region is expected to hold the largest share of the India Digital Banking Platforms Market. Mumbai city is the financial capital of the country which 3] What is the market size of the India Digital Banking Platforms Market by 2029? Ans. The market size of the India Digital Banking Platforms Market by 2029 is expected to reach USD 1604.67 Mn. 4] What is the forecast period for the India Digital Banking Platforms Market? Ans. The forecast period for the India Digital Banking Platforms Market is 2023-2029. 5] What was the market size of the India Digital Banking Platforms Market in 2022? Ans. The market size of the India Digital Banking Platforms Market in 2022 was value at USD 779.79 Mn.

1. India Digital Banking Platforms Market: Research Methodology 2. India Digital Banking Platforms Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. India Digital Banking Platforms Market: Dynamics 3.1. India Digital Banking Platforms Market Trends by Region 3.2. India Digital Banking Platforms Market Dynamics by Region 3.2.1. India 3.2.1.1. India Digital Banking Platforms Market Drivers 3.2.1.2. India Digital Banking Platforms Market Restraints 3.2.1.3. India Digital Banking Platforms Market Opportunities 3.2.1.4. India Digital Banking Platforms Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 3.7. Key Opinion Leader Analysis For the India Digital Banking Platforms Market 3.8. Analysis of Government Schemes and Initiatives For the India Digital Banking Platforms Market 3.9. The Global Pandemic Impact on the India Digital Banking Platforms Market 4. India Digital Banking Platforms Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. India Digital Banking Platforms Market Size and Forecast, By Banking Mode (2022-2029) 4.1.1. Online Banking 4.1.2. Mobile Banking 4.2. India Digital Banking Platforms Market Size and Forecast, By Banking Type (2022-2029) 4.2.1. Retail Banking 4.2.2. Corporate Banking 4.2.3. Investment Banking 4.3. India Digital Banking Platforms Market Size and Forecast, by Region (2022-2029) 4.3.1.1. North India Digital Banking Platforms Market Size and Forecast, By Banking Mode (2022-2029) 4.3.1.1.1. Online Banking 4.3.1.1.2. Mobile Banking 4.3.1.2. North India Digital Banking Platforms Market Size and Forecast, By Banking Type (2022-2029) 4.3.1.2.1. Retail Banking 4.3.1.2.2. Corporate Banking 4.3.1.2.3. Investment Banking 5. India Digital Banking Platforms Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2022) 5.3.5. Company Locations 5.4. Leading India Digital Banking Platforms Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. TCS 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. EdgeVerve Finacle. 6.3. Oracle FLEXCUBE Core Banking. 6.4. Wipro Core Banking As-a-Service. 6.5. SAP Banking and Financial Services. [Germany] 6.6. Temenos T24 Transact 6.7. C-Edge Technologies Ltd. 6.8. NCR Corporation digital banking solutions. 6.9. Finastra Fusion core banking software. 6.10. Fiserv banking platforms. 6.11. Finacus Solutions Pvt. Ltd. 6.12. TrustBankCBS. 6.13. 3i Infotech. 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary