India Artificial Meat Market size is expected to reach nearly US$ 14.11 Mn by 2026 with the CAGR of 5.4% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

India Artificial Meat Market Overview:

The global production of meat is estimated to double from 230M metric tons in the year 2000 to 465M metric tons by 2050. Its bad impact on water and energy utilization, nitrogen creation means that people can no longer stick to the conservative way of killing animals to eat meat. The meat industry uses a 3rd of the world’s freshwater directly or indirectly which places tremendous stress on fast depleting water resources. According to the MMR study report here is the amount of water compulsory to produce the following things:Beef consumption stays a prominent threat to the earth. A cow releases up to 500L of methane per day & contributes more to greenhouse emissions than cars. The animal agri industry accounts for 18 percent of all greenhouse gas emissions worldwide. In terms of land, animal feed production takes up nearly 33 percent of total arable land. In comparison, meat substitute creates 1/10th greenhouse emissions. Plant-based meat uses 47–99 percent less land, releases 30–90 percent fewer greenhouse gases, & uses 72–99 percent less water.

India Artificial Meat Market Size:

India stays at a nascent platform in the artificial meat market in terms of market size but is picking up fast. According to Good Dot, which is the key competitor in the market now, it sells about 12–15K units of the product daily. With an avg. family size of four, it means about 50–60K people consume such products.India Artificial Meat Market Trends:

Major impact of Corona Virus: The animal protein supply chain has been harshly strained in the corona virus pandemic. The market size of India’s poultry industry is at USD 14 Billion & is dropping an astounding $200M-$275M everyday while chicken prices have dropped by as much as 70 percent. Income Transition during the forecast period: India will become the maximum populated country by the end of 2030. Consumption outlines will change as go from lower middle income class to a middle-income class, to replicate a higher protein-based consumption. Consumption of processed chickens is growing at 15–20 percent annually.Demographic Shifts:

Majority of people are non-veg: 71 percent of Indian people more than 15 years old report that they are non-vegetarian. There are also noticeable regional differences. While 25 percent of persons are non-vegetarians in Rajasthan, around 99 percent are non-vegetarian in West Bengal and Telangana. According to MMR report in 2018, chicken accounted for 50 percent of India’s meat market by volume tracked by beef & buffalo meat at 25 percent & mutton & lamb at ~20 percent. Absence of protein in an Indian’s food: In the Global Hunger Index 2019, India ranks 102nd out of 117 nations. Data from MMR reports only 10 percent of babies between 6–23 months are fed sufficiently. Absence of satisfactory nutrition leads to as much as 40 percent of children under age 5 to be underdeveloped. Vitamin A deficiency in playgroup children is 62 percent owing to malnutrition & poor protein consumption. An astounding 60 percent of children aged 6 months to 5 years, more than 50 percent of women between 15–49 years, & 1 in 4 men suffer from anemia. Improved receptiveness to trying out alt meat: According to MMR report of artificial meat & clean meat, 63 percent of Indians reported that they were very likely to purchase artificial meat. This is even more than the established economies of the United States & China. Another 32 percent said they were somewhat likely. While the survey model was skewed to well-educated high-income city based people the consequences do look promising.India & Meat-Free Food:

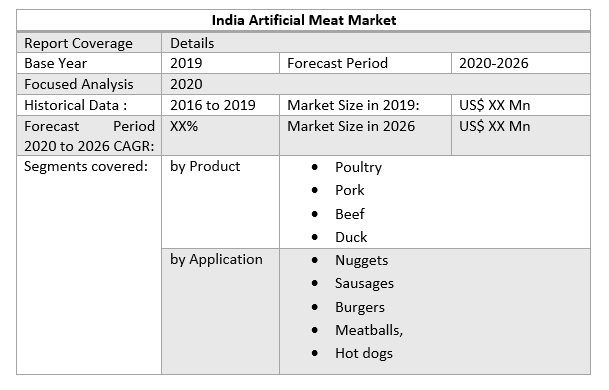

Approximately 80% of individuals in India practice Hinduism; the religion doesn’t need meat-free living, but vegetarianism is observed as “highly meritorious. But in the past few years, the demand for meat in country has increased. A 2018 study exposed that 71 % of Indian people over the age of 15 are non-vegetarian. According to MMR survey in 2019, over 60 percent of Indian people need to purchase plant-based meat regularly. An increasing middle-class, improved awareness of global trends, & the requirement for protein transitions for human & planetary health, & deep-seated cultural opinions on meat consumption within India’s varied population make plant-based foods ideally placed to cut through sociocultural divides. The report covers Poultry, Pork, Beef, Duck with detailed analysis India Artificial Meat Market industry with the classifications of the market on the, Product, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled fifteen key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the India Artificial Meat Market: Inquire before buying

India Artificial Meat Market Key Players

• MosaMeat • Just, Inc • SuperMeat • Aleph Farms Ltd • Finless Foods Inc • Integriculture • Balletic Foods • Future Meat Technologies Ltd • Avant Meats Company Limited • Higher Steaks • Appleton Meats • Fork & Goode • Biofood Systems LTD • Mission Barns • BlueNalu, Inc. • Mutable

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: India Artificial Meat Market Size, by Market Value (US$ Mn) 3.1. India Market Segmentation 3.2. India Market Segmentation Share Analysis, 2019 3.2.1. India 3.2.2. By Region (North India, South India, East India, Western India) 3.3. Geographical Snapshot of the Artificial Meat Market 3.4. Geographical Snapshot of the Artificial Meat Market, By Manufacturer share 4. India Artificial Meat Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. India 4.1.1.2. By Region (North India, South India, East India, Western India) 4.1.2. Restraints 4.1.2.1. India 4.1.2.2. By Region (North India, South India, East India, Western India) 4.1.3. Opportunities 4.1.3.1. India 4.1.3.2. By Region (North India, South India, East India, Western India) 4.1.4. Challenges 4.1.4.1. India 4.1.4.2. By Region (North India, South India, East India, Western India) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the India Artificial Meat Market 5. Supply Side and Demand Side Indicators 6. India Artificial Meat Market Analysis and Forecast, 2019-2026 6.1. India Artificial Meat Market Size & Y-o-Y Growth Analysis. 7. India Artificial Meat Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 7.1.1. Poultry 7.1.2. Pork 7.1.3. Beef 7.1.4. Duck 7.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.2.1. Nuggets 7.2.2. Sausages 7.2.3. Burgers 7.2.4. Meatballs, 7.2.5. Hot dogs 8. India Artificial Meat Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North India 8.1.2. Western India 8.1.3. East India 8.1.4. South India 9. East India Artificial Meat Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 9.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 10. Western India Artificial Meat Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 10.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 11. South India Artificial Meat Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 12. North India Artificial Meat Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 13. Competitive Landscape 13.1. Geographic Footprint of Major Players in the India Artificial Meat Market 13.2. Competition Matrix 13.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 13.2.2. New Product Launches and Product Enhancements 13.2.3. Market Consolidation 13.2.3.1. M&A by Regions, Investment and Verticals 13.2.3.2. M&A, Forward Integration and Backward Integration 13.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 13.3. Company Profile : Key Players 13.3.1. MosaMeat. 13.3.1.1. Company Overview 13.3.1.2. Financial Overview 13.3.1.3. Geographic Footprint 13.3.1.4. Product Portfolio 13.3.1.5. Business Strategy 13.3.1.6. Recent Developments 13.3.2. Just, Inc 13.3.3. SuperMeat 13.3.4. Aleph Farms Ltd 13.3.5. Finless Foods Inc 13.3.6. Integriculture 13.3.7. Balletic Foods 13.3.8. Future Meat Technologies Ltd 13.3.9. Avant Meats Company Limited 13.3.10. Higher Steaks 13.3.11. Appleton Meats 13.3.12. Fork & Goode 13.3.13. Biofood Systems LTD 13.3.14. Mission Barns 13.3.15. BlueNalu, Inc. 13.3.16. Mutable 13.3.17. Seafuture Sustainable Biotech 13.3.18. Shiok Meats 13.3.19. Wild Type 13.3.20. Lab farm Foods 13.3.21. Kiran Meats 13.3.22. Cubiq Foods 13.3.23. Cell Farm FOOD Tech 13.3.24. Granjua Celular S.A. 14. Primary Key Insights