Global Hydrodynamic Bearing Market was valued at US$ 4.78 Bn. in 2022 and the total revenue is expected to grow at 6.15% CAGR through 2023 to 2029, reaching US$ 7.27 Bn.Hydrodynamic Bearing Market Overview:

Hydrodynamic bearing is also called fluid dynamic bearing, which is based on the principle of lubrication. The bearing consists of a rotating journal inside the bore or a sleeve. These bearings are widely used in machines, engines, Power plants, turbines, gearbox, compressors, and defense & aerospace equipment. The growing demand from machine tools, power plants, and engine and gearbox markets is expected to drive the market in the forecast period. Each demand driver segment is analysed in the report by region to give the growth and restraint analysis of the Hydrodynamic Bearing in the forecast period.To know about the Research Methodology :- Request Free Sample Report There has been a rise in demand for hydrodynamic bearing with low maintenance requirements higher efficiency, longer service life and damping that can significantly reduce vibrations. The report has covered the Hydrodynamic Bearing market’s size and demand by different segments, segments include by products, applications and by regions. Key data analysis is presented in the form of statistics, info graphics, and presentations. The study discusses the Hydrodynamic bearing market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the Global Hydrodynamic bearing market situation. The data were gathered through primary interviews and secondary research. Manufacturers, suppliers, and dealers/distributors make up a large portion of the interviewees in order to learn more about value chains, the demand-supply situation, and to assess the market environment. Secondary data has been collected from reliable sources, such as official databases in each country, annual reports of manufacturers, and contributions from global as well as local players. Special focus is given to the un-organized sector to understand the contribution of local players and their impact on a local market in the total market share.

Market Dynamics:

Hydrodynamic bearing can bear large loads without compromising accuracy and position making it one of the key drivers in demand. The selection of bearing is dependent on basis of stiffness requirement and load carrying capacity. Hydrodynamic bearing is considered to have infinite life they are designed to operate within a certain speed range and they are capable to carry a high load in a given speed range with accurate positioning. Gearbox with attractive features is another key driver of the hydrodynamic bearing market To ensure high gearbox output, the oil flow and efficiency region are important. The bulk of turbo machinery equipment and gearbox producers strongly prefer hydrodynamic journal bearings. These gearboxes have some attractive features, such as strong dynamic damping for the rotor and high efficiency which are contributing factors in driving the market growth during the forecast period. The hydrodynamic bearing has been facing challenges due to multiple types of bearings in the market Other types of bearings that can support loads coming from either direction could pose a threat to the industry. Hydrodynamic bearings cannot sustain radial loads, but they are likely to get damaged because they cannot withstand axial stress. However, the continuous transformation from internal combustion engines to electric cars still poses a big obstacle because electric motors would take the place of IC engines and need less bearing.Hydrodynamic Bearing Market Segment Analysis:

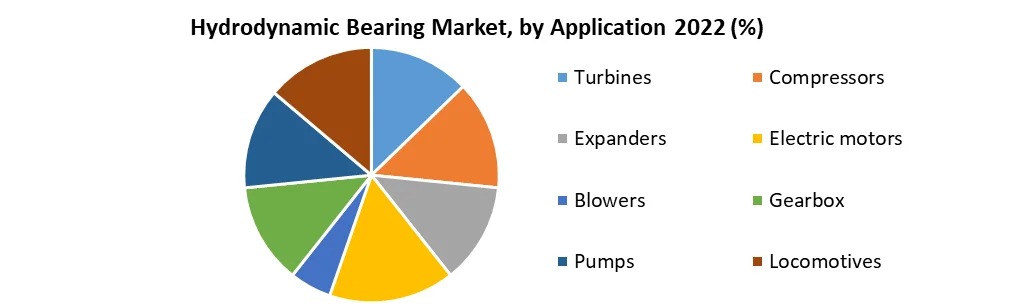

By product type, In high-speed rotating machinery, elliptical journal bearings are used. The direct search technique and iterative programming are efficiently used in the hybrid optimization strategy to discover the best solutions. The weighted sum of the maximum averaged oil film temperature rise, the leakage flow rate, and the inversion of vibration onset speed of the journal under many constraints is the objective function that is minimised in the design and optimization of elliptical journal bearings. Design variables such as vertical and horizontal radial clearances, bearing length-to-diameter ratio, and bearing orientation angle are determined to minimise the objective function. For a variety of journal rotational speeds, the findings are presented graphically. The efficiency of the design is evaluated by contrasting the optimised operational characteristics with those derived from the randomly chosen design variables. By applications, In 2022, turbine market segment had the largest market share. Hydrodynamic bearings are used for larger, faster and stronger rotating equipment that requires stronger support for the rotating parts. These include steam turbines, gas turbines, marine shafts, pumps and motors that run on speeds higher than 3000 RPM, or machinery running over 500 HP. Hydrodynamic bearings provide support for turbo machinery with a longer lifetime than ball bearing or roller bearings from the lubrication that prevents contact between the rotating parts of the bearings. In addition, hydrodynamic bearings can operate through the critical speed while maintaining optimum stability and suppressing vibration while reducing noise. Applications of our hydrodynamic bearings include gas turbines, steam turbines, generators, heavy machinery rotary shafts with high-speed requirements, hydroelectric turbines, large and heavy pumps, compressors, large engines, etc.

Regional Insights:

Japan held the largest market share in 2022 with a share of almost 45%. Japan is home to the majority of animation studios worldwide. Around 622 animation studios work to create animated content in Japan, with 542 Hydrodynamic Bearing studios located in Tokyo alone. The objective of the report is to present a comprehensive analysis of the Hydrodynamic Bearing Marketto the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Hydrodynamic Bearing Market dynamics, and structure by analyzing the market segments and projecting the Hydrodynamic Bearing Marketsize. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Hydrodynamic Bearing Market make the report investor’s guide.Hydrodynamic Bearing Market Scope: Inquire before buying

Hydrodynamic Bearing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.78 Bn. Forecast Period 2023 to 2029 CAGR: 6.15% Market Size in 2029: US $ 7.27 Bn. Segments Covered: by Product Cylindrical Elliptical Symmetrical Other by Application Turbines Compressors Expanders Electric motors Blowers Gearbox Pumps Locomotives Hydrodynamic Bearing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Hydrodynamic Bearing Market Key Players are:

1. GTW BEARINGS s.r.o. 2. HENTEC OY AB 3. KC Engineering Bearings Ltd. 4. Kingsbury, Inc. 5. Lignum Vitae 6. Luoyang Bearing Science & Technology Co.,Ltd. 7. Miba AG 8. Motion Industries, Inc., 9. Nelson Air 10.NSK Ltd. 11.US Korea Hotlink by LPR 12.Waukesha Bearings Corporation 13.SKF. Frequently Asked Questions: 1. What is the forecast period considered for the Hydrodynamic Bearing Market report? Ans. The forecast period for the Hydrodynamic Bearing Market is 2023-2029. 2. Which key factors are hindering the growth of the Hydrodynamic Bearing Market? Ans. The hydrodynamic bearing facing challenges and restraints due to multiple types of bearings are available in market 3. What is the compound annual growth rate (CAGR) of the Hydrodynamic Bearing Market for the forecast period? Ans. 6.15% is the annual growth rate of the hydrodynamic bearing market for the forecast period 4. What are the key factors driving the growth of the Hydrodynamic Bearing Market? Ans. Hydrodynamic bearing market growth drivers are they can bear large lodes and still it can be accurate in positioning and long life. 5. Which are the worldwide major key players covered for the Hydrodynamic Bearing Market report? Ans. GTW BEARINGS s.r.o., HENTEC OY AB,KC Engineering Bearings Ltd.,Kingsbury, Inc.,and Lignum Vitae are the major key players covered inthe hydrodynamic bearing market report.

1. Hydrodynamic Bearing Market: Research Methodology 2. Hydrodynamic Bearing Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Hydrodynamic Bearing Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Hydrodynamic Bearing Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Hydrodynamic Bearing Market Segmentation 4.1.Hydrodynamic Bearing Market, by Product (2022-2029) • Cylindrical • Elliptical • Symmetrical • Other 4.2. Hydrodynamic Bearing Market, By Application (2022-2029) • Turbines • Compressors • Expanders • Electric motors • Blowers • Gearbox • Pumps • Locomotives 5. North America Hydrodynamic Bearing Market (2022-2029) 5.1 North American Hydrodynamic Bearing Market, By Product (2022-2029) • Cylindrical • Elliptical • Symmetrical • Other 5.2 North America Hydrodynamic Bearing Market, By Application(2022-2029) • Turbines • Compressors • Expanders • Electric motors • Blowers • Gearbox • Pumps • Locomotives 5.3 North America Hydrodynamic Bearing Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Hydrodynamic Bearing Market(2022-2029) 6.1. European Hydrodynamic Bearing Market, By Product (2022-2029) 6.2. European Hydrodynamic Bearing Market, By Application (2022-2029) 6.3 European Hydrodynamic Bearing Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Hydrodynamic Bearing Market(2022-2029) 7.1. Asia Pacific Hydrodynamic Bearing Market, By Product (2022-2029) 7.2. Asia Pacific Hydrodynamic Bearing Market, By Application (2022-2029) 7.3. Asia Pacific Hydrodynamic Bearing Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Hydrodynamic Bearing Market(2022-2029) 8.1. Middle East and Africa Hydrodynamic Bearing Market, By Product (2022-2029) 8.2. Middle East and Africa Hydrodynamic Bearing Market, By Application (2022-2029) 8.3. Middle East and Africa Hydrodynamic Bearing Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Hydrodynamic Bearing Market(2022-2029) 9.1. South America Hydrodynamic Bearing Market, By Product (2022-2029) 9.2. South America Hydrodynamic Bearing Market, By Application (2022-2029) 9.3 South America Hydrodynamic Bearing Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 GTW BEARINGS s.r.o. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 HENTEC OY AB 10.3 KC Engineering Bearings Ltd. 10.4 Kingsbury, Inc. 10.5 Lignum Vitae 10.6 Luoyang Bearing Science & Technology Co.,Ltd. 10.7 Miba AG 10.8 Motion Industries, Inc 10.9 Nelson Air 10.10 NSK Ltd. 10.11 US Korea Hotlink by LPR 10.12 Waukesha Bearings Corporation 10.13 SKF.