Home Automation Market size was valued at USD 50.60 Bn in 2024, and the Home Automation revenue is growing at a CAGR of 5.8% from 2025 to 2032, reaching USD 79.44 Bn by 2032.Home Automation Market Overview

The global home automation market encompasses a wide range of smart devices and systems that facilitate increased convenience, energy efficiency, and security in residential settings. Some of the main categories of products include smart lighting, smart thermostats, smart locks, smart video surveillance systems, smart entertainment systems, and smart energy management systems. The industry has been divided by technology (wired, wireless, or hybrid), control interface (smartphone apps, voice assistants, central hubs, etc.), and the various connectivity standards (Wi-Fi, ZigBee, Z-Wave, Bluetooth, Matter) used by the solutions. There is a clear trend towards AI-enabled, IoT-enabled, and interoperable platforms, given the introduction of smart home products and the growing sustainability movement. The main drivers propelling the market forward are increased urbanization, increased connected devices, and consumer preferences for a safer, efficient, and personalized living experience. North America is expected to be the biggest market due to higher disposable incomes and much higher connectivity and IoT penetration. Europe is expected to be the second-largest market, propelled by energy efficiency regulations and package programs. Some of the market leaders in the global home automation industry include Honeywell, Schneider Electric, Johnson Controls, Siemens, and Control4, driving innovation through AI and system interoperability. Emerging opportunities for growth in the home automation industry include energy optimization, elder care automation, home healthcare, and electric vehicle charging integration, which will continue to drive strong growth in the global market.To know about the Research Methodology :- Request Free Sample Report

Home Automation Market Dynamics

Growing Adoption of Smart Homes and IoT Integration to drive Home Automation Market Growth The home automation market is fuelled by the increasing adoption of smart home technologies, driven by rising consumer demand for convenience, security, and energy efficiency. The integration of IoT, AI, and voice-enabled assistants (like Alexa, Google Assistant, and Siri) enhances seamless connectivity and remote control of appliances, lighting, HVAC, and security systems. Urbanization, rising disposable incomes, and government initiatives promoting energy-efficient housing are further boosting demand. Additionally, the expansion of 5G and high-speed internet infrastructure enables real-time monitoring and interoperability among connected devices, thereby accelerating market penetration worldwide. High Installation and Integration Costs to restrain Home Automation Market Expansion A major restraint in the home automation market is the high initial cost of installation and integration of smart devices and systems. Comprehensive automation solutions often require professional installation, wiring, and compatibility with existing home infrastructure, which raises costs significantly. In addition, lack of standardized communication protocols across devices from different manufacturers can lead to interoperability issues, discouraging adoption among cost-sensitive consumers. Concerns regarding data privacy and cybersecurity risks with connected devices also create hesitation, particularly in developing regions where awareness of secure digital infrastructure is limited. Energy-Efficient Smart Solutions to boost Home Automation Market Growth The home automation market offers strong opportunities through the growing demand for AI-powered, intuitive, and sustainable solutions. Advancements in predictive analytics and machine learning are enabling smart systems that can adapt to user behavior, optimize energy usage, and enhance comfort. Increasing adoption of renewable energy and integration of home automation with smart grids create opportunities for energy-efficient and eco-friendly solutions. Rising urban smart city projects, coupled with expanding middle-class consumer bases in emerging economies, further amplify growth potential. Moreover, subscription-based services, aftermarket upgrades, and smart device ecosystems (bundled entertainment, security, and utility management) present recurring revenue opportunities for market players.Home Automation Market Segment Analysis

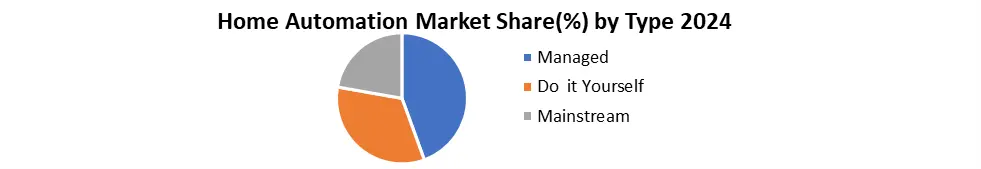

Based on Type, the Home Automation market is segmented into managed, DIY, and Mainstream. Among these, the Managed segment in the home automation market is most dominant in North America, where consumers prefer professionally installed and monitored solutions that ensure reliability, security, and seamless integration. Companies like ADT, Vivint, and Control4 (Snap One) have established a strong presence by offering bundled packages that combine smart security, energy management, and automation with 24/7 monitoring services. The dominance of managed systems in this region is also supported by high disposable incomes, consumer trust in professional service providers, and the demand for advanced security solutions in residential housing. Additionally, the subscription-based model common in North America ensures recurring revenue for providers, further strengthening the growth of this segment.

Home Automation Market Regional Insights

North America emerged as the dominant region in the global Home Automation market in 2024, contributing the largest share of global revenue at XX%, driven by advanced residential infrastructure, high consumer purchasing power, and early adoption of smart technologies across households. The U.S. leads the market, supported by widespread deployment of smart lighting, thermostats, security systems, and voice-controlled devices, while Canada is witnessing rapid growth with rising adoption of energy-efficient housing and connected security solutions. Government regulations promoting energy conservation and sustainable housing, along with incentives for smart energy management, have accelerated adoption, further supported by the presence of key global players such as Google (Nest), Amazon (Alexa), Honeywell, and Control4, as well as a strong ecosystem of IoT startups. North America also benefits from high-speed internet penetration, digitally aware consumers, and well-established distribution networks, enabling seamless integration of AI, IoT, and cloud-based platforms for enhanced personalization, security, and energy optimization. With increasing demand for convenience, sustainability, and connected living, the region is expected to maintain its leadership in the global Home Automation market throughout the forecast period. Home Automation Market Competitive Landscape North American Home Automation market is highly competitive, dominated by major technology giants, established appliance manufacturers, and specialized IoT solution providers. Leading players such as Google (Nest) and Amazon (Alexa) hold significant market share with their expansive ecosystems of smart speakers, thermostats, security devices, and AI-driven voice assistants, while Apple HomeKit attracts premium consumers through secure, privacy-focused solutions integrated across iOS devices. Traditional automation leaders like Honeywell and Control4 (Snap One) strengthen their presence with expertise in energy management, building automation, and customizable whole-home systems. Other key contributors, including Samsung SmartThings, ADT, Vivint Smart Home, and Ecobee, add to the competitive intensity with innovations in connected appliances, security monitoring, and energy optimization. Competition is driven by continuous advancements in AI, IoT, and cloud-based platforms, alongside partnerships with builders, telecom operators, and utility providers to expand adoption. With players differentiating through ecosystem integration, user experience, and data-driven personalization, the market remains dynamic and innovation-driven, ensuring North America’s continued leadership in global home automation. Key Development in the Home Automation Market April 2025, Global – AI-Integrated Smart Home Hubs Gain Momentum Global tech leaders introduced next-generation smart home hubs with built-in AI assistants, seamless multi-device connectivity, and predictive automation features, catering to the rising demand for personalized, energy-efficient, and secure home environments. March 2025, United States – Surge in Smart Security and Energy Management Adoption U.S. households reported accelerated adoption of smart security systems, including AI-driven cameras and smart locks, alongside rapid growth in connected energy management solutions such as thermostats and smart meters, supported by government incentives for sustainable housing. January 2025, Asia-Pacific – Expansion of Affordable IoT-Based Home Automation Solutions Asia-Pacific markets, particularly China and India, witnessed strong demand for affordable IoT-enabled lighting, appliances, and voice-assisted devices, driven by rising urbanization, growing middle-class populations, and expanding broadband penetration. Key Trends of the Home Automation Market AI-Driven Personalization and Security The integration of AI into smart home hubs, security cameras, and connected devices is enabling predictive automation, advanced threat detection, and personalized user experiences, driving adoption in developed markets such as the U.S. and Europe. Sustainability and Energy Optimization Growing emphasis on energy-efficient living is fuelling demand for smart thermostats, energy management systems, and integration of home automation with renewable energy and smart grids, particularly in regions with strong regulatory support like Europe and rising eco-conscious consumer bases globally.Home Automation Market Scope: Inquire before buying

Home Automation Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 50.60 Bn. Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 79.44 Bn. Segments Covered: by Type Managed Do it Yourself (DIY) Mainstream by Component Hardware Software Services by Application Entertainment Safety & Security Lighting Home Automation Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Home Automation Market: Key Players are

North America 1. Snap One (Control4) 2. Crestron Electronics 3. Google 4. Apple 5. Amazon Europe 1. Siemens 2. Schneider Electric 3. ABB 4. Legrand 5. Signify Asia-Pacific 1. Samsung 2. LG 3. Xiaomi 4. Panasonic 5. Tuya SmartFrequently Asked Questions:

1] What segments are covered in the Global Home Automation Market report? Ans. The segments covered in the Home Automation Market report are based on Type, Component, and Application. 2] Which region is expected to hold the highest share in the Global Home Automation Market? Ans. The North America region is expected to hold the highest share in the Home Automation Market. 3] What is the market size of the Global Home Automation Market by 2032? Ans. The market size of the Home Automation Market by 2032 is expected to reach US$ 79.44 Bn. 4] What is the forecast period for the Global Home Automation Market? Ans. The forecast period for the Home Automation Market is 2025-2032. 5] What was the market size of the Global Home Automation Market in 2024? Ans. The market size of the Home Automation Market in 2024 was valued at US$ 50.60 Bn.

1. Home Automation Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Home Automation Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Home Automation Market: 3.1. Region-wise Trends of Home Automation Market 3.1.1. North America Home Automation Market Trends 3.1.2. Europe Home Automation Market Trends 3.1.3. Asia Pacific Home Automation Market Trends 3.1.4. Middle East and Africa Home Automation Market Trends 3.1.5. South America Home Automation Market Trends 3.2. Home Automation Market Dynamics 3.2.1.1. Rising Advancement in Technology for the Home Automation Market 3.2.2. Global Home Automation Market Restraints 3.2.3. Global Home Automation Market Opportunities 3.2.3.1. Rising Demand For Home Automation 3.2.4. Global Home Automation Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political 3.4.2. Economical 3.4.3. Social 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Home Automation Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Home Automation Market Size and Forecast, By Type (2024-2032) 4.1.1. Managed 4.1.2. Do It Yourself 4.1.3. Mainstream 4.2. Home Automation Market Size and Forecast, By Application (2024-2032) 4.2.1. Entertainment 4.2.2. Safety and Security 4.2.3. Lighting 4.3. Home Automation Market Size and Forecast, By Component (2024-2032) 4.3.1. Hardware 4.3.2. Software 4.3.3. Services 4.4. Home Automation Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Home Automation Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Home Automation Market Size and Forecast, By Type (2024-2032) 5.1.1. Managed 5.1.2. Do It Yourself 5.1.3. Mainstream 5.2. North America Home Automation Market Size and Forecast, By Application (2024-2032) 5.2.1. Entertainment 5.2.2. Safety and Security 5.2.3. Lighting 5.3. North America Home Automation Market Size and Forecast, By Component (2024-2032) 5.3.1. Hardware 5.3.2. Software 5.3.3. Services 5.4. North America Home Automation Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Home Automation Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Managed 5.4.1.1.2. Do It Yourself 5.4.1.1.3. Mainstream 5.4.1.2. United States Home Automation Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Entertainment 5.4.1.2.2. Safety and Security 5.4.1.2.3. Lighting 5.4.1.3. Agriculture United States Home Automation Market Size and Forecast, By Component (2024-2032) 5.4.1.3.1. Hardware 5.4.1.3.2. Software 5.4.1.3.3. Service 5.4.2. Canada 5.4.2.1. Canada Home Automation Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Managed 5.4.2.1.2. Do It Yourself 5.4.2.1.3. Mainstream 5.4.2.2. Canada Home Automation Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Entertainment 5.4.2.2.2. Safety and Security 5.4.2.2.3. Lighting 5.4.2.3. Canada Home Automation Market Size and Forecast, By Component (2024-2032) 5.4.2.3.1. Hardware 5.4.2.3.2. Software 5.4.2.3.3. Services 5.4.2.4. Mexico Home Automation Market Size and Forecast, By Type (2024-2032) 5.4.2.4.1. Managed 5.4.2.4.2. Do It Yourself 5.4.2.4.3. Mainstream 5.4.2.5. Mexico Home Automation Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Entertainment 5.4.2.5.2. Safety and Security 5.4.2.5.3. Lighting 5.4.2.6. Mexico Home Automation Market Size and Forecast, By Component (2024-2032) 5.4.2.6.1. Hardware 5.4.2.6.2. Software 5.4.2.6.3. Services 6. Europe Home Automation Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Home Automation Market Size and Forecast, By Type (2024-2032) 6.2. Europe Home Automation Market Size and Forecast, By Application (2024-2032) 6.3. Europe Home Automation Market Size and Forecast, By Component (2024-2032) 6.4. Europe Home Automation Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.2. France 6.4.2.1. France Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Home Automation Market Size and Forecast, By Component (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Home Automation Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Home Automation Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Home Automation Market Size and Forecast, By Component (2024-2032) 7. Asia Pacific Home Automation Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Home Automation Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Home Automation Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Home Automation Market Size and Forecast, By Component (2024-2032) 7.4. Asia Pacific Home Automation Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.4. India 7.4.4.1. India Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Home Automation Market Size and Forecast, By Component (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Home Automation Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Home Automation Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Home Automation Market Size and Forecast, By Component (2024-2032) 8. Middle East and Africa Home Automation Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Home Automation Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Home Automation Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Home Automation Market Size and Forecast, By Component (2024-2032) 8.4. Middle East and Africa Home Automation Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Home Automation Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Home Automation Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Home Automation Market Size and Forecast, By Component (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Home Automation Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Home Automation Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Home Automation Market Size and Forecast, By Component (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Home Automation Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Home Automation Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Home Automation Market Size and Forecast, By Component (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Home Automation Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Home Automation Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Home Automation Market Size and Forecast, By Component (2024-2032) 9. South America Home Automation Market Size and Forecast by Segmentation (by Value in USD Bn..) (2024-2032) 9.1. South America Home Automation Market Size and Forecast, By Type (2024-2032) 9.2. South America Home Automation Market Size and Forecast, By Application (2024-2032) 9.3. South America Home Automation Market Size and Forecast, By Component (2024-2032) 9.4. South America Home Automation Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Home Automation Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Home Automation Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Home Automation Market Size and Forecast, By Component (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Home Automation Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Home Automation Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Home Automation Market Size and Forecast, By Component (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Home Automation Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Home Automation Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Home Automation Market Size and Forecast, By Component (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Schneider Electric 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Siemens 10.3. ABB 10.4. Legrand 10.5. Signify 10.6. Samsung Electronics 10.7. Xiaomi 10.8. LG Electronics 10.9. Panasonic 10.10. Tuya Smart 10.11. Amazon 10.12. Google 10.13. Apple 10.14. Crestron 10.15. Snap One 11. Key Findings 12. Analyst Recommendations 13. Home Automation Market: Research Methodology