The Hydrocracker Market size was valued at USD 68 Billion in 2023 and the total Hydrocracker revenue is expected to grow at a CAGR of 5.5% from 2024 to 2030, reaching nearly USD 98.92 Billion in 2030.Hydrocracker Market Overview

The report aims to provide a comprehensive analysis of the hydrocracker market, examining key trends, challenges, opportunities, and Hydrocracker market dynamics shaping its landscape. The global desire for renewable energy sources is driving the continuous growth of the hydrocracker industry. To meet increasingly strict environmental requirements, refineries are being forced to invest in hydrocracking technologies, especially to reduce the sulfur content of fuels. Also driving growth in the Hydrocracker market are technological developments in hydrocracking, such as increased efficiency and lower emissions. The use of hydrocracking technology is driven by the growing need for cleaner fuels, which is motivated by environmental concerns and regulatory mandates for low-sulfur diesel and gasoline. Technological developments that prioritize increased profitability, decreased emissions, and increased efficiency are propelling market growth through ongoing innovation in hydrocracking procedures. Additionally, the industry's ability to satisfy the rising demand is being strengthened by investments in new hydrocracking units and refinery growth projects, particularly in North America. It indicates a smart reaction to market dynamics and ensures alignment with changing environmental regulations. The Hydrocracker market has a lot of potential for growth because of planned growth, technology developments, and rising consumer demand for cleaner fuels. However, to maintain growth, strategic planning, and innovation are required because of difficulties like fluctuation in feedstock quality and competition from other fuels. The hydrocracker market is expected to be shaped by 2030. Initiatives in research and development, entering new Hydrocracker markets, and implementing sustainable practices.To know about the Research Methodology :- Request Free Sample Report

Hydrocracker Market Dynamics

Growing Demand for Refined Petroleum Products Global demand for premium refined petroleum products, such as diesel, gasoline, and jet fuel, is driving the hydrocracker market. The increase in demand is the result of multiple factors. First off, the need for transportation fuels like gasoline and diesel is driven by the growing global population and urbanization, which is encouraged by a rise in the use of both personal and commercial vehicles. Second, rising economic growth in developing nations drives more energy consumption, especially in the industrial and transportation sectors. Ultimately, the growing need for jet fuel is a result of the aviation sector, particularly in the Asia-Pacific area. Together, these elements drive the hydrocracker market's growth in the face of rising worldwide energy demand. Hydrocrackers are essential for producing premium-grade fuels such as diesel, gasoline, and jet fuel from plentiful and affordable heavy feedstocks. It helps refineries streamline their operations and meet the increasing demand for their products. Refineries are looking for flexible and effective technologies like hydrocrackers to maximize output and boost profitability as the market's thirst for these lighter fuels develops. In addition, strict environmental regulations about fuel sulfur content are driving the Hydrocracker market for cleaner substitutes, such as fuels that have been hydrocracked. Utilizing hydrocracking procedures allows for a significant reduction in sulfur, which guarantees adherence to legal requirements and strengthens the transition to fuels that are more ecologically friendly. Cleaner Fuel Demand The global trend towards cleaner fuels, especially low-sulfur gasoline and diesel, is expected to propel growth in the hydrocracker industry. Many things are driving this tendency. First of all, stricter rules on the amount of sulfur in fuels are a result of growing environmental concerns about air pollution and its harmful impact on both human health and the environment. Second, although comparable laws are emerging for road transportation fuels in various nations, international entities such as the International Maritime Organization (IMO) are imposing restrictions to limit the amount of sulfur content in marine fuels. Finally, the Hydrocracker market for low-sulfur fuels continues to grow because of growing customer preference for cleaner options, which is driving growth in the hydrocracker industry. Hydrocrackers are excellent in producing fuels that are significantly lower in sulfur content and cleaner, meeting consumer demands as well as refineries' stringent adherence to environmental standards. Refineries must either modernize their current infrastructure or adopt cutting-edge technologies like hydrocracking to maintain competitiveness and assure regulatory compliance with the increase in demand for low-sulfur fuels. The ability to produce cleaner fuels with lower sulfur levels is further strengthened by the development of sophisticated catalysts and hydrocracking methods, indicating the essential part that hydrocrackers play in easing the shift to environmentally friendly fuel production.Feedstock Quality Variability One significant difficulty facing the hydrocracker sector is the unpredictability of feedstock quality. The global variety of crude oil sources, each with distinct chemical compositions that influence the characteristics of the hydrocracking feedstock, is the root cause of this problem. Also, the hydrocracking process is negatively impacted by contaminants found in crude oil, such as sulfur, nitrogen, and metals. In addition, refineries frequently have to adjust to different feedstock compositions according to availability and cost, which cause problems with hydrocracking units' smooth functioning. Resolving these issues is essential to keeping hydrocracking operations dependable and effective. Variations in feedstock quality hurt the hydrocracking process by diminishing efficiency and increasing energy consumption. Production is disrupted by operational obstacles such as impurity-induced corrosion of equipment and catalyst deactivation, which lead to increased maintenance requirements and unscheduled downtime. In addition, the dynamic range and responsiveness of hydrocracking machines are restricted by the frequent modifications of operational parameters required to account for different feedstock quality. It is essential to tackle these obstacles to preserve peak efficiency and minimize disturbances in hydrocracking activities.

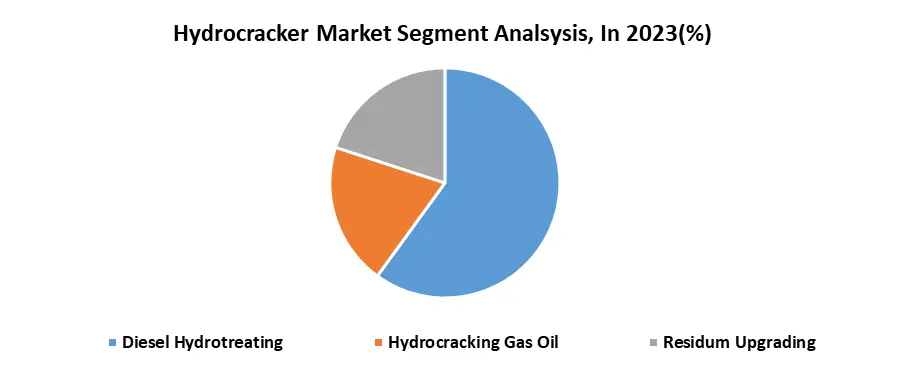

Hydrocracker Market Segment Analysis

By Application, a variety of strategies for diesel hydrotreating, which accounts for 50% of the hydrocracker market, is essential to the growth of the industry. Firstly, a strong demand for diesel hydrotreating has been created by strict environmental rules requiring lower sulfur content in diesel fuel. These laws force refineries to implement hydrocracking technology, which drives Hydrocracker market growth. Second, the necessity of diesel as a fuel for industry and transportation keeps hydrocracking technology relevant. Hydrocracking ensures market competitiveness while meeting continuous demand by allowing refineries to create ecologically friendly fuel. Finally, the Hydrocracker market dominance of diesel hydrotreating encourages ongoing technological advancement. Particularly for diesel hydrotreating applications, manufacturers place a high priority on improving catalyst efficiency, optimizing process parameters, and minimizing environmental effects. These continuous developments drive technological advancement and market competitiveness, which benefits the entire hydrocracker market in addition to increasing the efficiency of diesel generation.

Hydrocracker Market Regional Analysis

North America dominates the global Hydrocracker market, it held XX% of the Hydrocracker market share in 2023. The growing demand for cleaner fuels, driven by tough environmental rules, drives refineries to use hydrocracking to produce low-sulfur diesel and gasoline. The US shale oil development opens up opportunities for hydrocracking, which increases demand in the Hydrocracker market for processing heavier feedstocks. Also, the need to modernize North America's aging refinery infrastructure offers chances to upgrade existing units or build new hydrocracking plants. These developments highlight how important hydrocracking is to achieving new fuel requirements and reviving refinery operations in the face of shifting market conditions. The hydrocracker market has difficulties arising from the variety of feedstock quality because the region's crude oil sources are various. In addition, the demand for refined petroleum products is long-term threatened by competition from alternative fuels including electric cars and renewable energy sources. In 2023, Reuters reported that ExxonMobil had announced plans to grow its refinery in Beaumont, Texas, with a new hydrocracking facility, valued at USD 10 billion. To process heavier crudes, Valero Energy Corporation has also upgraded its refinery in Port Arthur, Texas, adding a new hydrocracking unit. The move reflects the industry's attempts to improve operational capabilities and meet hydrocracker market realities. The US Environmental Protection Agency (EPA) promotes the use of technology like hydrocracking for compliance by enforcing requirements to lower the sulfur content of gasoline and diesel. The goal of Canadian government R&D expenditures is to improve hydrocracking technology's environmental sustainability and efficiency. Because it refine more than Canada or Mexico, the United States has become the leading force in the North American hydrocracking market. Also, the United States' plentiful shale oil reserves fuel the need to upgrade heavier feedstocks, and strict environmental restrictions mandate the use of hydrocracking to produce cleaner gasoline.Hydrocracker Market Competitive Landscape In 2023, ExxonMobil announced a USD XX billion development project in Beaumont, Texas, inclusive of a new hydrocracking unit. The strategic move underscores the company's dedication to meeting the rising demand for cleaner fuels while bolstering its Hydrocracker market position, potentially inspiring other industry players to pursue similar upgrades. In 2022, Honeywell UOP launched its "Honeywell UOP ECO" suite of hydrocracking technologies, focusing on enhanced efficiency, reduced emissions, and improved profitability. The offering aligns with the escalating demand for sustainable solutions in refining, positioning Honeywell UOP as a leader in eco-friendly hydrocracking solutions. Investments in new technologies and development initiatives drive Hydrocracker market growth by increasing capacity and meeting rising demand for greener fuels. Technological advancements incentivize industry participants to compete, which in turn propels innovation and the supply of better solutions, ultimately leading to the sector's continual improvement. Additionally, the development of environmentally friendly technologies encourages sustainable refining methods, which may foster an industry that is more accountable and ecologically sensitive.

Hydrocracker Market Scope: Inquire Before Buying

Global Hydrocracker Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 68 Bn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 98.92 Bn. Segments Covered: by Feedstock Heavy Crude Oil Residues Vacuum Gas Oil by Technology Single-stage Hydrocracking Two-stage Hydrocracking by Application Diesel Hydrotreating Hydrocracking Gas Oil Residuum Upgrading Hydrocracker Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Hydrocracker Market

1. ExxonMobil 2. Axens 3. Honeywell UOP 4. Shell 5. hydrocarbon engineering 6. McDermott 7. KBR 8. Chevron Lummus Global 9. Lianyungang I (China) 10. Sriracha I (Thailand) 11. Vadinar (India) 12. Offshore-technology 13. mogas 14. Reuters 15. Honeywell 16. fuelsandlubes 17. Yokogawa 18. Valv Technologies 19. ogj 20. valmet 21. exxonmobil 22. argusmedia FAQs: 1. What are the primary products of hydrocracking? Ans. The primary products of hydrocracking include diesel, gasoline, jet fuel, and other lighter hydrocarbons, which have lower sulfur content and higher octane ratings compared to the original feedstock. 2. What are the main challenges faced by the hydrocracker market? Ans. The main challenges faced by the hydrocracker market include feedstock quality variability, competition from alternative fuels, and the high initial investment required for building and operating hydrocracking units. 3. What is the projected market size & and growth rate of the Hydrocracker Market? Ans. The Hydrocracker Market size was valued at USD 68 Billion in 2023 and the total Hydrocracker revenue is expected to grow at a CAGR of 5.5% from 2023 to 2030, reaching nearly USD 98.92 Billion in 2030. 4. What segments are covered in the Hydrocracker Market report? Ans. The segments covered in the Hydrocracker market by Feedstock, Technology, and Application

1. Hydrocracker Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hydrocracker Market: Dynamics 2.1. Hydrocracker Market Trends by Region 2.1.1. North America Hydrocracker Market Trends 2.1.2. Europe Hydrocracker Market Trends 2.1.3. Asia Pacific Hydrocracker Market Trends 2.1.4. Middle East and Africa Hydrocracker Market Trends 2.1.5. South America Hydrocracker Market Trends 2.2. Hydrocracker Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hydrocracker Market Drivers 2.2.1.2. North America Hydrocracker Market Restraints 2.2.1.3. North America Hydrocracker Market Opportunities 2.2.1.4. North America Hydrocracker Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hydrocracker Market Drivers 2.2.2.2. Europe Hydrocracker Market Restraints 2.2.2.3. Europe Hydrocracker Market Opportunities 2.2.2.4. Europe Hydrocracker Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hydrocracker Market Drivers 2.2.3.2. Asia Pacific Hydrocracker Market Restraints 2.2.3.3. Asia Pacific Hydrocracker Market Opportunities 2.2.3.4. Asia Pacific Hydrocracker Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hydrocracker Market Drivers 2.2.4.2. Middle East and Africa Hydrocracker Market Restraints 2.2.4.3. Middle East and Africa Hydrocracker Market Opportunities 2.2.4.4. Middle East and Africa Hydrocracker Market Challenges 2.2.5. South America 2.2.5.1. South America Hydrocracker Market Drivers 2.2.5.2. South America Hydrocracker Market Restraints 2.2.5.3. South America Hydrocracker Market Opportunities 2.2.5.4. South America Hydrocracker Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hydrocracker Industry 2.8. Analysis of Government Schemes and Initiatives For Hydrocracker Industry 2.9. Hydrocracker Market Trade Analysis 2.10. The Global Pandemic Impact on Hydrocracker Market 3. Hydrocracker Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 3.1.1. Heavy Crude Oil 3.1.2. Residues 3.1.3. Vacuum Gas Oil 3.2. Hydrocracker Market Size and Forecast, by Technology (2023-2030) 3.2.1. Single-stage Hydrocracking 3.2.2. Two-stage Hydrocracking 3.3. Hydrocracker Market Size and Forecast, by Application (2023-2030) 3.3.1. Diesel Hydrotreating 3.3.2. Hydrocracking Gas Oil 3.3.3. Residuum Upgrading 3.4. Hydrocracker Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Hydrocracker Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 4.1.1. Heavy Crude Oil 4.1.2. Residues 4.1.3. Vacuum Gas Oil 4.2. North America Hydrocracker Market Size and Forecast, by Technology (2023-2030) 4.2.1. Single-stage Hydrocracking 4.2.2. Two-stage Hydrocracking 4.3. North America Hydrocracker Market Size and Forecast, by Application (2023-2030) 4.3.1. Diesel Hydrotreating 4.3.2. Hydrocracking Gas Oil 4.3.3. Residuum Upgrading 4.4. North America Hydrocracker Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 4.4.1.1.1. Heavy Crude Oil 4.4.1.1.2. Residues 4.4.1.1.3. Vacuum Gas Oil 4.4.1.2. United States Hydrocracker Market Size and Forecast, by Technology (2023-2030) 4.4.1.2.1. Single-stage Hydrocracking 4.4.1.2.2. Two-stage Hydrocracking 4.4.1.3. United States Hydrocracker Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Diesel Hydrotreating 4.4.1.3.2. Hydrocracking Gas Oil 4.4.1.3.3. Residuum Upgrading 4.4.2. Canada 4.4.2.1. Canada Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 4.4.2.1.1. Heavy Crude Oil 4.4.2.1.2. Residues 4.4.2.1.3. Vacuum Gas Oil 4.4.2.2. Canada Hydrocracker Market Size and Forecast, by Technology (2023-2030) 4.4.2.2.1. Single-stage Hydrocracking 4.4.2.2.2. Two-stage Hydrocracking 4.4.2.3. Canada Hydrocracker Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Diesel Hydrotreating 4.4.2.3.2. Hydrocracking Gas Oil 4.4.2.3.3. Residuum Upgrading 4.4.3. Mexico 4.4.3.1. Mexico Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 4.4.3.1.1. Heavy Crude Oil 4.4.3.1.2. Residues 4.4.3.1.3. Vacuum Gas Oil 4.4.3.2. Mexico Hydrocracker Market Size and Forecast, by Technology (2023-2030) 4.4.3.2.1. Single-stage Hydrocracking 4.4.3.2.2. Two-stage Hydrocracking 4.4.3.3. Mexico Hydrocracker Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Diesel Hydrotreating 4.4.3.3.2. Hydrocracking Gas Oil 4.4.3.3.3. Residuum Upgrading 5. Europe Hydrocracker Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.2. Europe Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4. Europe Hydrocracker Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.1.2. United Kingdom Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.2.2. France Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.3.2. Germany Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.4.2. Italy Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.5.2. Spain Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.6.2. Sweden Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.7.2. Austria Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Hydrocracker Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 5.4.8.2. Rest of Europe Hydrocracker Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Hydrocracker Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Hydrocracker Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.2. Asia Pacific Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Hydrocracker Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.1.2. China Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.2.2. S Korea Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.3.2. Japan Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.4.2. India Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.5.2. Australia Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.6.2. Indonesia Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.7.2. Malaysia Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.8.2. Vietnam Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.9.2. Taiwan Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Hydrocracker Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 6.4.10.2. Rest of Asia Pacific Hydrocracker Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Hydrocracker Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Hydrocracker Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 7.2. Middle East and Africa Hydrocracker Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Hydrocracker Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Hydrocracker Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 7.4.1.2. South Africa Hydrocracker Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. South Africa Hydrocracker Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 7.4.2.2. GCC Hydrocracker Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. GCC Hydrocracker Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 7.4.3.2. Nigeria Hydrocracker Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Nigeria Hydrocracker Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 7.4.4.2. Rest of ME&A Hydrocracker Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. Rest of ME&A Hydrocracker Market Size and Forecast, by Application (2023-2030) 8. South America Hydrocracker Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 8.2. South America Hydrocracker Market Size and Forecast, by Technology (2023-2030) 8.3. South America Hydrocracker Market Size and Forecast, by Application(2023-2030) 8.4. South America Hydrocracker Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 8.4.1.2. Brazil Hydrocracker Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. Brazil Hydrocracker Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 8.4.2.2. Argentina Hydrocracker Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. Argentina Hydrocracker Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Hydrocracker Market Size and Forecast, by Feedstock (2023-2030) 8.4.3.2. Rest Of South America Hydrocracker Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest Of South America Hydrocracker Market Size and Forecast, by Application (2023-2030) 9. Global Hydrocracker Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hydrocracker Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ExxonMobil 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Axens 10.3. Honeywell UOP 10.4. Shell 10.5. hydrocarbon engineering 10.6. McDermott 10.7. KBR 10.8. Chevron Lummus Global 10.9. Lianyungang I (China) 10.10. Sriracha I (Thailand) 10.11. Vadinar (India) 10.12. Offshore-technology 10.13. mogas 10.14. Reuters 10.15. Honeywell 10.16. fuelsandlubes 10.17. Yokogawa 10.18. Valv Technologies 10.19. ogj 10.20. valmet 10.21. exxonmobil 10.22. argusmedia 11. Key Findings 12. Industry Recommendations 13. Hydrocracker Market: Research Methodology 14. Terms and Glossary