The Global Hot Dog Market size reached USD 20.10 Bn in 2022 and is expected to reach USD 26.81 Bn by 2029, growing at a CAGR of 4.2 % during the forecast period.Hot Dog Market Overview:

Hot dogs are gaining popularity around the world because of their taste, convenience, and variety they offer. Hot dogs are made from ground-up and pureed animal flesh, usually from pigs, cows, or chickens. Hot Dog Manufacturers often add a variety of ingredients such as seasonings, spices, herbs, and binders to enhance the taste and texture of hot dogs. According to MMR Findings, Americans consume a massive 20 billion hot dogs every year, and approx. 96 % of American homes eat hot dogs annually. The financial impact of hot dogs is also significant, with Americans spending over $8.3 billion on hot dogs and sausages in US supermarkets in 2022 alone. This substantial expenditure reflects the demand for hot dogs during the forecast period. The United States has the largest market for hot dogs followed by China, Germany, and Brazil. The market is not limited to the United States. There are hot dog lovers all over the world, and the hot dog market key players are expanding their reach by exporting their products to new markets. Oscar Mayer is a subsidiary of Kraft Heinz and is one of the largest hot dog key players across the world. The Hot Dog market is also gaining popularity in European countries because hot dogs are widely available as street food and quick snack options and have become a familiar and accessible food choice for people of all ages, contributing to the growth of the Hot Dog market in these regions.Top Hot Dog Consuming Cities 2022

1. Los Angeles 2. New York 3. Dallas 4. Chicago 5. Philadelphia 6. Boston 7. Houston 8. Atlanta 9. Miami 10. PhoenixHot Dog Market Report Scope:

The report provides a quantitative analysis of the current Hot Dog market drivers, restraints, trends, estimations, and opportunities of the market to identify the prevailing opportunities in the market during the forecast period. PORTER's five forces analysis shows the ability of buyers and suppliers to make profit-oriented strategic decisions and build their supplier-buyer network. In-depth analysis as well as the market size and segmentation assist in determining the current Hot Dog market potential. Some factors that are supposed to affect the business positively or negatively have been analyzed in this report which will give a clear futuristic view of the industry to the decision-makers. The report presents a comprehensive analysis of the global Hot Dog market to the stakeholders who want to invest in this market. The report includes past and current scenarios of the market with the forecasted market size. The report covers all the aspects of the market with a thorough study of key players that include market leaders, followers, and new entrants. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the internal or local market make the report investor’s guide. They are continuously strategizing on mergers & acquisitions for the expansion of their market share and growth opportunities during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Hot Dog Market Dynamics:

The increasing trend of on-the-go food items to drive Hot Dog Market The growing popularity of hot dogs and the increasing trend of on-the-go food items is expected to propel the growth of the hot dog market during the forecast period. According to MMR Analysis, approx. 10.83% of restaurants offer Hot dogs on their menus. For instance, Sweet Earth manufacturer announced the launch of their first ever Vegan Jumbo Hot Dogs and the new and improved Sweet Earth Awesome Burger 2.0 in the United States to meet the growing consumer demand for Hot Dogs. The opening cost of a hot dog franchise ranges from $100,000 to $500,000, which is significantly lower than the cost of opening a franchise in other sectors such as fast food or retail. The food and beverage sector has been hit hard by the pandemic, as many restaurants, retail partners, and food outlets were forced to close during the peak of the outbreak. In 2022, New Yorkers spent more money on hot dogs around US$ 133.6 million than any other food in this country. Furthermore, the increasing demand for organic hot dogs to avoid the risk of being overweight or obese is expected to boost the growth of the hot dog market during the forecast period. Moreover, increasing demand for hot dogs because of the growing awareness of the high nutritional content of these products is expected to increase the demand in the hot dogs market. For instance, in April 2021, Nathan’s Famous announced its partnership with Meatless Farm to bring consumers the industry’s first gourmet, plant-based hot dog, a product created not just for flexitarian and vegetarian customers, but all who enjoy healthy diets. Preferences for Hot Dog amongst the younger generation in developing economies to Drive the Hot Dog Market The younger generation in developing economies increasingly preferred hot dogs as a convenient and affordable meal option that is flavorful and has a variety of toppings with different flavors, such as spicy or sweet. Furthermore, Hot dogs are a relatively inexpensive food option which makes them a popular choice for young people on a budget. Hot dog manufacturing brands are launching new flavors and varieties of hot dogs that appeal to young people's taste buds. They are using social media to reach out to young people and posting photos and videos of their hot dogs by offering discounts and promotions. Many hot dog market key players are partnering with food delivery services to make it easier for young people to order hot dogs. In Brazil, hot dog brands are sponsoring sporting events and concerts that are popular with young people and also arrange educational programs that teach young people about the history and nutritional value of hot dogs. The above-mentioned factors are expected to increase the demand for Hot Dog market amongst the younger generation during the forecast period. Increasing Technological Advancement in Hot Dogs to Drive the Hot Dog Market The plant-based hot dog market is growing rapidly because of the increasing popularity of veganism and vegetarianism all over the world. Plant-based hot dogs are a convenient and easy-to-prepare food option that is also healthy and affordable. In recent years, plant-based hot dog manufacturers have made significant improvements in the taste and texture of their products, making them more appealing to consumers who are looking for a meat-free alternative. Furthermore, Plant-based hot dogs are now available in a wide variety of retailers, making them more convenient and accessible to consumers. The above factors are expected to drive the Hot Dog market. Hot Dog market restraint: Hot dogs are made from processed meat, which has been linked to a number of health problems such as cancer, heart disease, and obesity. This has led to a growing number of consumers choosing to avoid hot dogs. Furthermore, Hot dogs face competition from other processed foods, such as chicken nuggets, frozen pizzas, and burritos. These foods are often seen as being healthier than hot dogs, and they are also more convenient to prepare. Thus, the market is hampered during the forecast period.Hot Dog Market Segment Analysis:

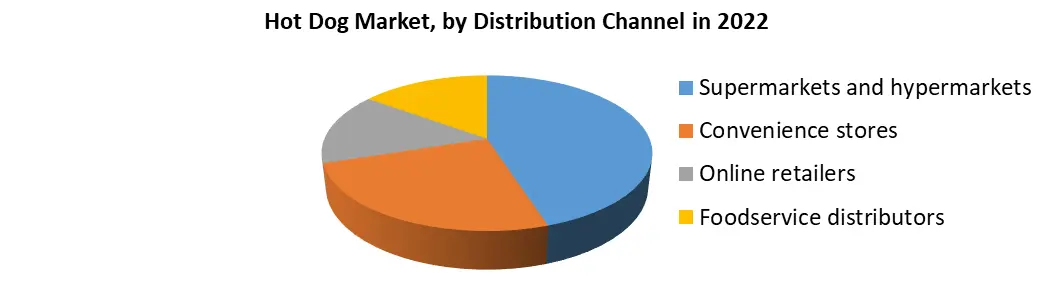

Based on the Type, the Beef Hot Dog segment held the largest revenue share of 8.9 % in 2022 and is expected to grow during the forecast period. Beef hot dogs are known for their rich flavor and juicy texture. The demand for beef hot dogs is growing in developing countries such as Asia Pacific and Latin America because of the Increasing demand for convenient and ready-to-eat food products, growing urbanization, and rising disposable income. Based on the Distribution, the Supermarkets and hypermarket segments are the largest distribution channel for Hot Dog Market, accounting for a significant share of the market. The growth of these segments is attributed to the fact that supermarkets and hypermarkets offer a wide variety of hot dogs, including both national and private-label brands. They also offer a convenient shopping experience for consumers, as they are often located in convenient locations and have extended hours. Thus, the supermarket and hypermarket segment growth has increased the Hot Dog Market demand during the forecast period.

Hot Dog Market Regional Insights

In the North American region, the Hot Dog Market is expected to grow at a CAGR of 10.5% due to the Rising preference for convenience products, Increasing health consciousness, and Growing demand for ready-to-eat meals during the forecast period. The North American market is fragmented, with a large number of small and medium-sized players. The leading players in the Hot Dog market such as Hormel Foods, Tyson Foods, Nestlé, and Bar-S Foods are investing in research and development to develop new and innovative hot dog products. They are also expanding their distribution channels to reach a wider audience. Consumers in the North American region are increasingly looking for convenient and easy-to-prepare food options. Hot dogs are a convenient food option and can be easily cooked and enjoyed at home anytime and popular food choice at sporting events, such as baseball games, football games, and soccer matches. This is because of their affordability, convenience, and portability. Furthermore, Hot dogs are becoming increasingly popular in ethnic cuisines, such as Mexican, Asian, and Italian due to the versatility of hot dogs, which can be easily adapted to different flavors and cultures. The above-mentioned factors driving the growth of the hot dog market.Hot Dog Market Scope: Inquire before buying

Hot Dog Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 20.1 Bn. Forecast Period 2023 to 2029 CAGR: 4.2% Market Size in 2029: US $ 26.81 Bn. Segments Covered: by Type Chicken Beef Pork Plant-Based Others by Distribution Supermarkets/Hypermarkets Convenience Stores Online Channel Food Service Others Hot Dog Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hot Dog Market Key Players

1. Hormel Foods Corp. 2. Nestlé S.A. 3. San Miguel Purefoods Company, Inc. 4. Bar-S Foods (A Sigma Company) 5. Elpozo Alimentacion S.A. 6. Animex Foods Sp 7. Bob Evans Farms, LLC 8. Johnsonville, LLC 9. Atria Plc 10. ALFA SAB DE CV 11. Helen Brownings Organic 12. Kent Quality Foods LLC 13. Kunzler & Co. Inc. 14. NH Foods Ltd. 15. Tyson Foods Inc. 16. Smithfield Foods Inc. 17. WH Group 18. Goodman Fielder Ltd. 19. Nippon Meat Packers Inc. 20. Peoples Food Holdings Ltd.FAQs:

1. Who are the key players in the Hot Dog market? Ans. Hormel Foods Corp., Nestlé S.A., and San Miguel Purefoods Company, Inc. are the major companies operating in the market. 2. Which Type segment dominates the Hot Dog market? Ans. The Beef Hot Dog segment accounted for the largest share of the global Hot Dog market in 2022. 3. How big is the Hot Dog market? Ans. The Global market size reached USD 20.10 Bn in 2022 and is expected to reach USD 26.81 Bn by 2029, growing at a CAGR of 4.2 % during the forecast period. 4. What are the key regions in the global Hot Dog market? Ans. Based On the region, the market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global Hot Dog market. 5. What is the study period of this market? Ans. The Global market is studied from 2022 to 2029.

1. Hot Dog Market: Research Methodology 2. Hot Dog Market: Executive Summary 3. Hot Dog Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Hot Dog Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Hot Dog Market: Segmentation (by Value USD and Volume Units) 5.1. Hot Dog Market, by Type (2022-2029) 5.1.1. Chicken 5.1.2. Beef 5.1.3. Pork 5.1.4. Plant-Based 5.1.5. Others 5.2. Hot Dog Market, by Distribution (2022-2029) 5.2.1. Supermarkets/Hypermarkets 5.2.2. Convenience Stores 5.2.3. Online Channel 5.2.4. Food Service 5.2.5. Others 5.3. Hot Dog Market, by Region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Hot Dog Market (by Value USD and Volume Units) 6.1. North America Hot Dog Market, by Type (2022-2029) 6.1.1. Chicken 6.1.2. Beef 6.1.3. Pork 6.1.4. Plant-Based 6.1.5. Others 6.2. North America Hot Dog Market, by Distribution (2022-2029) 6.2.1. Supermarkets/Hypermarkets 6.2.2. Convenience Stores 6.2.3. Online Channel 6.2.4. Food Service 6.2.5. Others 6.3. North America Hot Dog Market, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Hot Dog Market (by Value USD and Volume Units) 7.1. Europe Hot Dog Market, by Type (2022-2029) 7.2. Europe Hot Dog Market, by Distribution (2022-2029) 7.3. Europe Hot Dog Market, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Hot Dog Market (by Value USD and Volume Units) 8.1. Asia Pacific Hot Dog Market, by Type (2022-2029) 8.2. Asia Pacific Hot Dog Market, by Distribution (2022-2029) 8.3. Asia Pacific Hot Dog Market, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Hot Dog Market (by Value USD and Volume Units) 9.1. Middle East and Africa Hot Dog Market, by Type (2022-2029) 9.2. Middle East and Africa Hot Dog Market, by Distribution (2022-2029) 9.3. Middle East and Africa Hot Dog Market, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Hot Dog Market (by Value USD and Volume Units) 10.1. South America Hot Dog Market, by Type (2022-2029) 10.2. South America Hot Dog Market, by Distribution (2022-2029) 10.3. South America Hot Dog Market, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Hormel Foods Corp. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Nestlé S.A. 11.3. San Miguel Purefoods Company, Inc. 11.4. Bar-S Foods (A Sigma Company) 11.5. Elpozo Alimentacion S.A. 11.6. Animex Foods Sp 11.7. Bob Evans Farms, LLC 11.8. Johnsonville, LLC 11.9. Atria Plc 11.10. ALFA SAB DE CV 11.11. Helen Brownings Organic 11.12. Kent Quality Foods LLC 11.13. Kunzler & Co. Inc. 11.14. NH Foods Ltd. 11.15. Tyson Foods Inc. 11.16. Smithfield Foods Inc. 11.17. WH Group 11.18. Goodman Fielder Ltd. 11.19. Nippon Meat Packers Inc. 11.20. Peoples Food Holdings Ltd. 12. Key Findings 13. Industry Recommendation