Food Colors Market size was valued at US$ 4.64 Bn. in 2022 and the total Food Colors revenue is expected to grow at 5.8% through 2023 to 2029, reaching nearly US$ 6.89 Bn.Food Colors Market Overview:

Food color is any dye, pigment, or substance that adds colour to food and beverages. Food colors come in liquids, powders, gels, and pastes, and are used in meat products, beverages, dairy, bakery & confectionary, processed food & vegetables, and oils & fats. Food coloring does not always indicate that the ingredients are organic; however, in some cases, it indicates that fewer ingredients are used. The fewer the ingredients used, the more natural the food product. The food colors market includes both natural and synthetic colors. Natural food colors are derived from a wide variety of edible natural sources, including vegetables, fruits, plants, minerals, and other edible natural sources. These colors are obtained using physical and/or chemica methods, which result in selective extraction of pigments relative to nutritive or aromatic constituents. Artificial color is a chemical compound, which is used to add taste and improve the appearance to food or enhance the food flavoring characteristics.To know about the Research Methodology:-Request Free Sample Report In this report, the Food Colors market's growth reasons, as well as the market's many segments (Type, Source, Application, Form, Solubility and Region.), are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the Food Colors market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the Global Food Colors market situation.

Food Colors Market Dynamics:

Consumption of processed and packaged foods has increased due to an increase in the number of working professionals and modernization. The increased consumption of processed food products such as ready-to-eat snacks, soft drinks, convenience foods, processed dairy products, and others has resulted in an increase in the use of various food colours. To provide an appealing appearance, these colours are mixed and amalgamated into processed food products and beverages. The appeal of food products is as important to the ingredients used in the production of the food products as it is to the consumers. Pigments and dyes are the most commonly used food colourants in food products, and liquid dyes and gels are used in beverages. These colours are used differently in different products. Colorants are used in greater quantities in soft and carbonated drinks than in food products. The rising consumption of soft drinks in developing countries will allow for rapid growth in the food colors market in the coming years. Consumers are aware of the harmful effects of various synthetic ingredients that are utilized in the food products, which when consumed regularly would lead to various health disorders. Consumption of chemical colors on regular basis leads to various allergic problems. This way the consumers prefer buying products that are prepared using plantbased ingredients. The usage of natural colors and pigments came to the spotlight due to the increase in consumer awareness regarding various health benefits of the same. The rising popularity of natural colors or plant-based colors owing to their health benefits will create market opportunities. It helps reduce the risk of allergies among the consumers, which creates an opportunity for the manufacturers of the natural colors. Some of the innovative ways are listed below: Blue spirulina is utilised as a source to create natural colours; it typically takes the form of a lake. The blue pigment known as natural ultramarine is obtained from the semi-precious stone lapis lazuli. Different hues can be created through the bioconversion of certain components present in bacteria, fungus, and yeasts. Commercial colour extraction uses ingredients from aquatic sources, mainly seaweed and Chilean sea bass. The FDA has categorized titanium dioxide as a safe to use colorant for food applications. Food-grade titanium dioxide used within maximum permissible limits is safe, and no health risks have been observed pertaining to it. Consumers perceive titanium dioxide as a chemical, which can cause life-threatening diseases, such as cancer. However, there are no adequately evident studies available to prove this. Further, misperceptions about the health hazards of titanium dioxide are a key factor creating a significant challenge for the market growth. Colors are water-based, food colours in their synthetic and natural liquid forms are less concentrated than those in powder or gel form. For culinary items that need lighter and more pastel colorings, such as cake icings, sweets, and meat replacements, liquid food colours are employed. They offer constancy in colour and are simple to mix. Poor pigment dispersion issues are also less of a concern with liquid food colours. However, when it comes to scalability and temperature, liquid components are challenging to use. Advantages of liquid coloring are Availability in bulk sizes, Ability to precisely measure the quantity, Easy dispersion with water-based products, Creation of customized colors by combining with other shades. On June 6th 2021, Symrise AG agreed to accept an offer from Oterra to acquire their natural food coloring business. As part of its core business, the firm provides products related to pet food, aquafeed, flavors, nutrition, and health in food. Around 80 Diana Food employees in two France and U.K production facilities will be affected by this acquisition. On 1st February 2021, Kraft launched a bright pink Mac & Cheese for Valentine’s Day. Known for its cheesy KraftMac & Cheese, the firm launches Candy Kraft Mac & Cheese using a candy flavor packet to give it a pink color and a hint of sweet candy flavor to the product. Synthetic food colors exhibit carcinogens and other allergies. To overcome this, there are various stringent regulations imposed by the federation of various countries. Artificial colors such as red 40, yellow 6, and yellow 5 are tested to have harmful carcinogens which can lead to cancer when consumed regularly. A study conducted by the U.K. government concluded that consumption of artificial and synthetic colors by 8-9-year-olds results in hyperactivity. Caffeine, a widely used color in soft drinks may cause heart problems such as palpitations. According to FDA (The Food and Drug Administration), lab testing results on animals show that the synthetic colors Red 40, Yellow 6, Yellow 5, Blue 2, Blue 1, and Green 3 express cancer properties on the lab animals.Food Colors Market Segment Analysis:

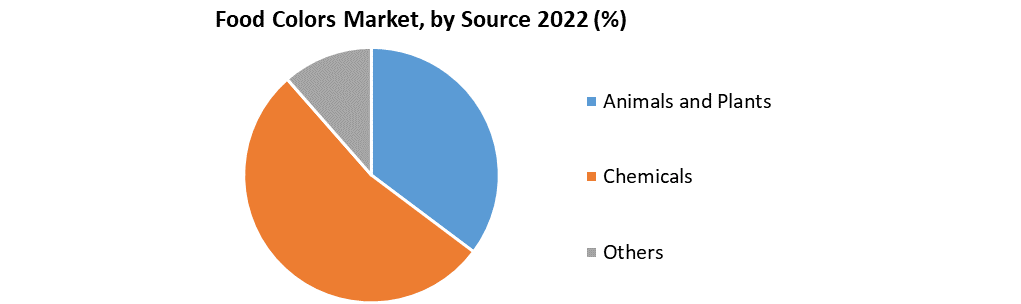

By Type, Because they are more readily available and less expensive than natural hues, synthetic colors dominated the market with 23 % share in 2022. Different kinds of artificial food colouring are used in foods and beverages to enhance its appeal, appetizingness, and attractiveness to customers. Due to numerous strict restrictions and regulations by various federal organisations, the demand for these synthetic chemical hues is expected to develop slowly over time. On the other side, due to a high level of consumer preference for natural components, natural colours are epected to grow at CAGR of 9.67 % through the forecast period. The artificially produced food colours are identical to those found in nature and include the same chemicals. This sort of food colourant has a lower level of consumer awareness, which results in its moderate CAGR increase. For flavour and colour, caramel is frequently used in the production of candies. An important driving force behind the global market's growth is consumer acceptance of different color variants. By Source, Plants and Animal dominated the market with 43 % share in 2022. The increase in consumer awareness of natural colors is expected to create a demand for these plant and animal sources. There are various microorganisms as well which act as a natural food colorant and produce canthaxanthin, astaxanthin, phycocyanin, and others. Natural pigments are used for pharmaceutical purposes as well, as it is safe to consume. The cost of production and the usage of these natural sources colors are on the expensive side, which increases the value of these colorants.

Food Colors Market Regional Insights:

Europe Region dominated the market with 37% share in 2022. The main factors promoting the growth of the food colours market in Germany are the country's strong demand for packaged foods and the expanding bakery, confectionery, dairy, and frozen products markets. Additionally, it is anticipated that investments in cutting-edge technological advancements would promote the creation of novel natural or nature-identical colours for use in applications including processed foods and pharmaceuticals. Food colours are regulated in the European Union as food additives under a comprehensive set of standards for food enhancement professionals. 39 colors have been given the green light by the European Union to be used as colour additives in food. Because of the growing interest in clean label goods and wellbeing mindfulness, the European food colour market continues to grow and dominated the market. Growing hygienic concerns in the UK are pressuring assemblies to acquire clean labels, which has sparked interest in natural colors. The Asia Pacific region is expected to grow at a CAGR of 8.3 % through the forecast period because of components, for example, high production levels in nations such as New Zealand and Australia, expanding interest for standard items and the advancement of a way of life and broadened customer spending on food and drinks within the area. The development of this locale is active by the food business in Japan, India, and China, and by the significant increment in exchange food coloring results of these nations. The objective of the report is to present a comprehensive analysis of the Food Colors market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Food Colors market dynamics, and structure by analyzing the market segments and projecting the Food Colors market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Food Colors market make the report investor’s guide.Food Colors Market Scope: Inquire before buying

Food Colors Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.64 Bn. Forecast Period 2023 to 2029 CAGR: 5.8% Market Size in 2029: US $ 6.89 Bn. Segments Covered: by Type Natural Synthetic Naturally-identical Caramel Others by Source Animals and Plants Chemicals Others by Application Processed Food Products Dairy Products Non- diary Products Beverages Alcoholic Non-Alcoholic Others by Form Liquid Powder Gel by Solubility Dyes Lakes Food Colors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Food Colors Market Key Players are:

1. Dohler Group 2. Archer Daniels Midland 3. Sensient 4. Ingredion, Inc. 5. Sensient Technologies 6. Kalsec, Inc 7. DDW, Inc. 8. Chr. Hansen 9. Koninklijke DSM NV 10.Naturex 11.DSM 12.Florio Colori 13.Lycored 14.The Colour House Corporation 15.Colourkitchen FAQs: 1. What is the market size of the Food Colors Market in 2022? Ans. Food Colors Market size was valued at US$ 4.64 Bn. in 2022. 2. What is the Forecast Period of the Food Colors Market? Ans. Forecast Period for Food Colors Market in 2023-2029. 3. What is the projected market size & growth rate of the Food Colors Market? Ans. Food Colors Market is expected to grow at 5.8% through 2023 to 2029, reaching nearly US$ 6.89 Bn. 4. What segments are covered in the Food Colors Market report? Ans. The segments covered are Type, Source, Application, Form, Solubility, and Region.

1. Global Food Colors Market: Research Methodology 2. Global Food Colors Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Food Colors Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Food Colors Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Food Colors Market Segmentation 4.1 Global Food Colors Market, by Type (2022-2029) • Natural • Synthetic • Naturally-identical • Caramel • Others 4.2 Global Food Colors Market, by Source (2022-2029) • Animals and Plants • Chemicals • Others 4.3 Global Food Colors Market, by Aplication (2022-2029) • Processed Food Products o Dairy Products o Non- diary Products • Beverages o Alcoholic o Non-Alcoholic • Others 4.4 Global Food Colors Market, by Form (2022-2029) • Liquid • Powder • Gel 4.5 Global Food Colors Market, by Solubility (2022-2029) • Dyes • Lakes 5. North America Food Colors Market(2022-2029) 5.1 North America Food Colors Market, by Type (2022-2029) • Natural • Synthetic • Naturally-identical • Caramel • Others 5.2 North America Food Colors Market, by Source (2022-2029) • Animals and Plants • Chemicals • Others 5.3 North America Food Colors Market, by Application (2022-2029) • Processed Food Products o Dairy Products o Non- diary Products • Beverages o Alcoholic o Non-Alcoholic • Others 5.4 North America Food Colors Market, by Form (2022-2029) • Liquid • Powder • Gel 5.5 North America Food Colors Market, by Solubility (2022-2029) • Dyes • Lakes 5.6 North America Food Colors Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Food Colors Market (2022-2029) 6.1. European Food Colors Market, by Type (2022-2029) 6.2. European Food Colors Market, by Source (2022-2029) 6.3. European Food Colors Market, by Application (2022-2029) 6.4. European Food Colors Market, by Form (2022-2029) 6.5. European Food Colors Market, by Solubility (2022-2029) 6.6. European Food Colors Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Food Colors Market (2022-2029) 7.1. Asia Pacific Food Colors Market, by Type (2022-2029) 7.2. Asia Pacific Food Colors Market, by Source (2022-2029) 7.3. Asia Pacific Food Colors Market, by Application (2022-2029) 7.4. Asia Pacific Food Colors Market, by Form (2022-2029) 7.5. Asia Pacific Food Colors Market, by Solubility (2022-2029) 7.6. Asia Pacific Food Colors Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Food Colors Market (2022-2029) 8.1 Middle East and Africa Food Colors Market, by Type (2022-2029) 8.2. Middle East and Africa Food Colors Market, by Source (2022-2029) 8.3. Middle East and Africa Food Colors Market, by Application (2022-2029) 8.4. Middle East and Africa Food Colors Market, by Form (2022-2029) 8.5. Middle East and Africa Food Colors Market, by Solubility (2022-2029) 8.6. Middle East and Africa Food Colors Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Food Colors Market (2022-2029) 9.1. South America Food Colors Market, by Type (2022-2029) 9.2. South America Food Colors Market, by Source (2022-2029) 9.3. South America Food Colors Market, by Application (2022-2029) 9.4. South America Food Colors Market, by Form (2022-2029) 9.5. South America Food Colors Market, by Solubility (2022-2029) 9.6. South America Food Colors Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Texas Instruments Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.3. Dohler Group 10.4. Archer Daniels Midland 10.5. Sensient 10.6. Ingredion, Inc. 10.7. Sensient Technologies 10.8. Kalsec, Inc 10.9. DDW, Inc. 10.10. Chr. Hansen 10.11. Koninklijke DSM NV 10.12. Naturex 10.13. DSM 10.14. Florio Colori 10.15. Lycored 10.16. The Colour House Corporation 10.17. Colourkitchen