The Hepatitis C Market size was valued at USD 54.20 Billion in 2023 and the total Global Hepatitis C Market revenue is expected to grow at a CAGR of 13.90 % from 2024 to 2030, reaching nearly USD 134.79 Billion by 2030Hepatitis C Market Overview

Hepatitis C is a liver infection caused by the hepatitis C virus. Hepatitis C can range from a mild illness lasting a few weeks to a serious, long-term illness. Hepatitis C is often described as acute, meaning a new infection, or chronic, meaning long-term infection. Liver diseases attributed to hepatitis C are a major cause of drug-related deaths, accounting for more than half of the total number of deaths attributed to the use of drugs. Among 4962 patients, 83% of those with positive HCV antibodies were tested for HCV 60% of them were positive and 1002 (40%) initiated treatment. Several other countries are expanding their HCV treatment programs, but the overall progress toward achieving WHO elimination goals by 2030 is slow.To know about the Research Methodology :- Request Free Sample Report The highest burden of disease is in the Eastern and European Regions, with 12 million people chronically infected in each region. In Southeast Asia and the Western Pacific Region, an estimated 10 million people in each region are chronically infected. 9 million people are chronically infected in the African Region and 5 million in the Region of the Americas. India, Egypt, and Pakistan are examples of countries that have committed to scaling up their HCV programs. To accelerate progress towards HCV elimination, countries will need to intensify case-finding efforts. Countries that prioritized patients who were previously diagnosed and awaiting care for HCV treatment will need to focus on active case finding. 1. According to the WHO, Globally an estimated 58 million people have chronic hepatitis C virus infection, with about 1.5 million new infections occurring per year. There are an estimated 3.2 million adolescents and children with chronic hepatitis C infection.

Hepatitis C Market Dynamics

Rising Disease Prevalence to Innovations in Treatment Chronic viral hepatitis is a major public health issue globally and mostly affects countries having limited resources. The surge in Liver diseases has propelled the Hepatitis C Market. Around 71 million people living with chronic Hepatitis C infection. Creating significant opportunities for pharmaceutical companies to develop and market effective therapies to meet the demand for treatment. The key factor influencing the market growth is an increase in healthcare expenditures that helps improve its infrastructure. Rising public & private organizations to spread awareness about hepatitis C. The rising prevalence of hepatitis C virus infection is fuelled by inadequate blood donation strategies. HCV disease prevalence is higher in countries with higher prevalence rates observed in certain parts of the world, including parts of Africa, Asia, and Eastern Europe. Public health campaigns, awareness programs, and initiatives aimed at Hepatitis C prevention, screening, and treatment contribute to market growth by influencing patient behavior, healthcare provider practices, and healthcare policy. New treatments offer the chance to curb the global hepatitis C epidemic. The companies responsible for innovating and producing these drugs can play a central role in achieving important goals.Challenges in the Hepatitis C Market: Addressing Limited Access to Screening, Diagnosis, and Treatment A significant challenge in the Hepatitis C market is the limited access to screening and diagnosis, particularly in low- and middle-income countries. Due to a shortage of healthcare workers, poor medical infrastructures, insufficient screening, and poor access to care and treatment. Approximately 4.5 million new infections are reported globally on an annual basis. HBV is responsible for 620,000 deaths each year. Increase in imperfect vaccine coverage, poor education, poverty, inadequate prevention and, frequent iatrogenic transmission, and, insufficient access to treatment. Poverty and illiteracy have been identified as risk factors for viral hepatitis C transmission and the high cost of antiviral therapies is a limiting factor to access to treatment. The lack of medical infrastructure and laboratories, combined with the shortage of healthcare workers and diagnostic tools, are additional obstacles to developing efficient access to treatment for chronic hepatitis.

Hepatitis C Market Segment Analysis

By Treatment Type, Antiviral Medications hold the highest share of 80% with an increasing CAGR of 14.0%. The National Institutes of Health (NIH) has identified several viral families that have the potential to cause future pandemics. Direct-acting antiviral (DAA) regimens for hepatitis C virus (HCV) rank among the most significant biopharmaceutical advances in medicine. DAA regimens are initially high-cost treatments. Direct-acting antiviral (DAA) regimens for hepatitis C virus (HCV) rank among the most significant biopharmaceutical advances in medicine. DAA regimens were initially high-cost treatments. About 15% to 45% of people infected automatically get rid of the virus within 6 months of infection without any treatment, and the rest of them develop chronic hepatitis C virus infection resulting in growth in the market. According to MMR analysis, no known drugs for several viral families had been approved or were in clinical trials funded by the Department of Health and Human Services (HHS). The United States has been a leader in the adoption of direct-acting antiviral (DAA) medications for treating Hepatitis C. Access to antiviral treatments has improved due to healthcare reforms, increased awareness, and expanded insurance coverage.

Hepatitis C Market Regional Insights

North America holds the largest share of 40.20 % with a growing CAGR of 14.2% during the forecast period. The U.S. has significant growth owing to the high prevalence of the disease and the availability of advanced healthcare infrastructure. Key factors that influence the market are number of diagnosed cases, treatment guidelines, reimbursement policies, and the availability of innovative therapies. 10,000 people are newly infected with viral hepatitis every year in the United States. In 2023, 42 states reported a total of 5,023 acute hepatitis C cases corresponding to 69,800 estimated infections, and 43 states reported a total of 107,540 newly reported chronic hepatitis C cases. The primary transmission route in the UK is injecting drug use where there is sharing of needles or other injecting equipment. The UK government adopted the World Health Assembly’s updated global strategies that support the World Health Organization’s (WHO) ambition to eliminate viral hepatitis by 2030. Europe is the fastest-growing market with a market share of 27.80%. Government initiatives and funding programs aimed at Hepatitis C elimination. The market is expected to grow at a faster rate in Eastern Europe than in Western Europe. Increasing awareness of Hepatitis C and screening programs has propelled the market growth in the region. The Key challenge in the region is the high cost of treatment and lack of access to treatment in some countries of Europe. Germany holds the largest market share of 20%, followed by France, Italy, Spain, and the UK Germany has a high prevalence of Hepatitis C owing to factors like past blood-borne transmission risks and injecting drug use.Hepatitis C Market Competitive Landscape 1. In 2023, Gilead Sciences acquired MiroBio for $ 400 Million, an acquisition aimed to bring MicroBio’s pipeline of small molecule drugs for liver diseases, including Hepatitis C, under Gilead’s leadership in the Hepatitis C market and bolstered their R&D efforts. 2. In 2023, AbbVie acquired Tigelion for $450 Million, Tigelion’s lead asset was a phase 2b drug candidate for Hepatitis C with an opportunity provided AbbVie with an opportunity to diversify its Hepatitis C portfolio beyond protease inhibitors. 3. In 2023, Gilead Sciences partnered with Ichiki & Co Ltd. To develop and commercialize sofosbuvir in Japan. The partnership aimed to expand access to sofosbuvir, a key component of many Hepatitis C treatments, in the Japanese Market. 4. In 2023, Merck & Co. partnered with Arcturus Therapeutics to develop and commercialize RNA interference (RNAi) therapies for Hepatitis C. The Partnership combined Merck’s expertise in viral diseases with Arcturus’ innovative RNAi technology, aiming to develop next-generation treatment for Hepatitis C.

Hepatitis C Market Scope: Inquire before buying

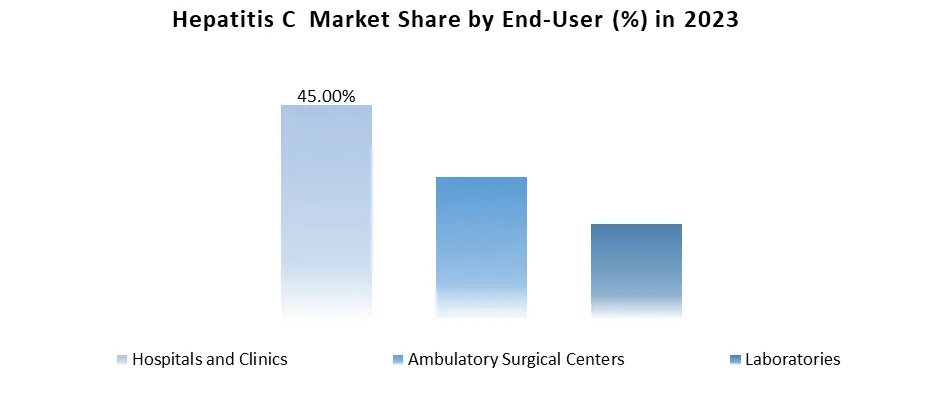

Global Hepatitis C Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 54.20 Bn. Forecast Period 2024 to 2030 CAGR: 13.90% Market Size in 2030: US $ 134.79 Bn. Segments Covered: by Disease Stage Acute Hepatitis C Chronic Hepatitis C by Treatment Type Antiviral Medications Combination Therapy Liver Transplantation by End User Hospitals and Clinics Ambulatory Surgical Centers Laboratories Hepatitis C Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hepatitis C Market Key Players

1. Gilead Sciences, Inc. 2. AbbVie Inc. 3. Merck & Co., Inc. 4. Bristol Myers Squibb 5. Johnson & Johnson 6. F. Hoffmann-La Roche Ltd 7. Novartis International AG 8. GlaxoSmithKline plc 9. Pfizer Inc. 10. AbbVie Inc. 11. Allergan (now part of AbbVie) 12. Mylan N.V. 13. Teva Pharmaceutical Industries Ltd. 14. Biocon Ltd. 15. Cipla Limited 16. Dr. Reddy's Laboratories Ltd. 17. Sun Pharmaceutical Industries Ltd. 18. Lupin Limited 19. Alnylam Pharmaceuticals, Inc. 20. Enanta Pharmaceuticals, Inc. Frequently Asked Questions: 1] What is the projected market size & and growth rate of the Hepatitis C Market? Ans. The Hepatitis C Market size was valued at USD 54.20 Billion in 2023 and the total Global Hepatitis C revenue is expected to grow at a CAGR of 13.90 % from 2024 to 2030, reaching nearly USD 134.79 Billion By 2030 2] What segments are covered in the Hepatitis C Market report? Ans. The segments covered in the Hepatitis C Market report are based on Disease stage, Treatment Type, and End-use. 3] Which region is expected to hold the highest share in the Hepatitis C Market? Ans. The North American region is expected to hold the highest share of the Hepatitis C Market. 4] What are the growth drivers for the Hepatitis C Market? Ans. Innovation in technology, etc. is expected to be the major driver for the Hepatitis C market. 5] What is the forecast period for the Hepatitis C Market? Ans. The forecast period for the Hepatitis C Market is 2024-2030.

1. Hepatitis C Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hepatitis C Market: Dynamics 2.1. Hepatitis C Market Trends by Region 2.1.1. North America Hepatitis C Market Trends 2.1.2. Europe Hepatitis C Market Trends 2.1.3. Asia Pacific Hepatitis C Market Trends 2.1.4. Middle East and Africa Hepatitis C Market Trends 2.1.5. South America Hepatitis C Market Trends 2.2. Hepatitis C Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hepatitis C Market Drivers 2.2.1.2. North America Hepatitis C Market Restraints 2.2.1.3. North America Hepatitis C Market Opportunities 2.2.1.4. North America Hepatitis C Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hepatitis C Market Drivers 2.2.2.2. Europe Hepatitis C Market Restraints 2.2.2.3. Europe Hepatitis C Market Opportunities 2.2.2.4. Europe Hepatitis C Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hepatitis C Market Drivers 2.2.3.2. Asia Pacific Hepatitis C Market Restraints 2.2.3.3. Asia Pacific Hepatitis C Market Opportunities 2.2.3.4. Asia Pacific Hepatitis C Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hepatitis C Market Drivers 2.2.4.2. Middle East and Africa Hepatitis C Market Restraints 2.2.4.3. Middle East and Africa Hepatitis C Market Opportunities 2.2.4.4. Middle East and Africa Hepatitis C Market Challenges 2.2.5. South America 2.2.5.1. South America Hepatitis C Market Drivers 2.2.5.2. South America Hepatitis C Market Restraints 2.2.5.3. South America Hepatitis C Market Opportunities 2.2.5.4. South America Hepatitis C Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hepatitis C Industry 2.8. Analysis of Government Schemes and Initiatives For Hepatitis C Industry 2.9. Hepatitis C Market Trade Analysis 2.10. The Global Pandemic Impact on Hepatitis C Market 3. Hepatitis C Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 3.1.1. Acute Hepatitis C 3.1.2. Chronic Hepatitis C 3.2. Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 3.2.1. Antiviral Medications 3.2.2. Combination Therapy 3.2.3. Liver Transplantation 3.3. Hepatitis C Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals and Clinics 3.3.2. Ambulatory Surgical Centers 3.3.3. Laboratories 3.4. Hepatitis C Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Hepatitis C Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 4.1.1. Acute Hepatitis C 4.1.2. Chronic Hepatitis C 4.2. North America Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 4.2.1. Antiviral Medications 4.2.2. Combination Therapy 4.2.3. Liver Transplantation 4.3. North America Hepatitis C Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals and Clinics 4.3.2. Ambulatory Surgical Centers 4.3.3. Laboratories 4.4. North America Hepatitis C Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 4.4.1.1.1. Acute Hepatitis C 4.4.1.1.2. Chronic Hepatitis C 4.4.1.2. United States Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 4.4.1.2.1. Antiviral Medications 4.4.1.2.2. Combination Therapy 4.4.1.2.3. Liver Transplantation 4.4.1.3. United States Hepatitis C Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospitals and Clinics 4.4.1.3.2. Ambulatory Surgical Centers 4.4.1.3.3. Laboratories 4.4.2. Canada 4.4.2.1. Canada Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 4.4.2.1.1. Acute Hepatitis C 4.4.2.1.2. Chronic Hepatitis C 4.4.2.2. Canada Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 4.4.2.2.1. Antiviral Medications 4.4.2.2.2. Combination Therapy 4.4.2.2.3. Liver Transplantation 4.4.2.3. Canada Hepatitis C Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospitals and Clinics 4.4.2.3.2. Ambulatory Surgical Centers 4.4.2.3.3. Laboratories 4.4.3. Mexico 4.4.3.1. Mexico Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 4.4.3.1.1. Acute Hepatitis C 4.4.3.1.2. Chronic Hepatitis C 4.4.3.2. Mexico Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 4.4.3.2.1. Antiviral Medications 4.4.3.2.2. Combination Therapy 4.4.3.2.3. Liver Transplantation 4.4.3.3. Mexico Hepatitis C Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospitals and Clinics 4.4.3.3.2. Ambulatory Surgical Centers 4.4.3.3.3. Laboratories 5. Europe Hepatitis C Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.2. Europe Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.3. Europe Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4. Europe Hepatitis C Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.1.2. United Kingdom Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.1.3. United Kingdom Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.2.2. France Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.2.3. France Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.3.2. Germany Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.3.3. Germany Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.4.2. Italy Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.4.3. Italy Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.5.2. Spain Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.5.3. Spain Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.6.2. Sweden Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.6.3. Sweden Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.7.2. Austria Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.7.3. Austria Hepatitis C Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 5.4.8.2. Rest of Europe Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 5.4.8.3. Rest of Europe Hepatitis C Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Hepatitis C Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.2. Asia Pacific Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.3. Asia Pacific Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Hepatitis C Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.1.2. China Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.1.3. China Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.2.2. S Korea Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.2.3. S Korea Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.3.2. Japan Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.3.3. Japan Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.4.2. India Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.4.3. India Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.5.2. Australia Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.5.3. Australia Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.6.2. Indonesia Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.6.3. Indonesia Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.7.2. Malaysia Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.7.3. Malaysia Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.8.2. Vietnam Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.8.3. Vietnam Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.9.2. Taiwan Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.9.3. Taiwan Hepatitis C Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 6.4.10.2. Rest of Asia Pacific Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Hepatitis C Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Hepatitis C Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 7.2. Middle East and Africa Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 7.3. Middle East and Africa Hepatitis C Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Hepatitis C Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 7.4.1.2. South Africa Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 7.4.1.3. South Africa Hepatitis C Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 7.4.2.2. GCC Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 7.4.2.3. GCC Hepatitis C Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 7.4.3.2. Nigeria Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 7.4.3.3. Nigeria Hepatitis C Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 7.4.4.2. Rest of ME&A Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 7.4.4.3. Rest of ME&A Hepatitis C Market Size and Forecast, by End User (2023-2030) 8. South America Hepatitis C Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 8.2. South America Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 8.3. South America Hepatitis C Market Size and Forecast, by End User(2023-2030) 8.4. South America Hepatitis C Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 8.4.1.2. Brazil Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 8.4.1.3. Brazil Hepatitis C Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 8.4.2.2. Argentina Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 8.4.2.3. Argentina Hepatitis C Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Hepatitis C Market Size and Forecast, by Disease Stage (2023-2030) 8.4.3.2. Rest Of South America Hepatitis C Market Size and Forecast, by Treatment Type (2023-2030) 8.4.3.3. Rest Of South America Hepatitis C Market Size and Forecast, by End User (2023-2030) 9. Global Hepatitis C Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hepatitis C Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gilead Sciences 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. AbbVie Inc. 10.3. Merck & Co., Inc. 10.4. Bristol Myers Squibb 10.5. Johnson & Johnson 10.6. F. Hoffmann-La Roche Ltd 10.7. Novartis International AG 10.8. GlaxoSmithKline plc 10.9. Pfizer Inc. 10.10. AbbVie Inc. 10.11. Allergan (now part of AbbVie) 10.12. Mylan N.V. 10.13. Teva Pharmaceutical Industries Ltd. 10.14. Biocon Ltd. 10.15. Cipla Limited 10.16. Dr. Reddy's Laboratories Ltd. 10.17. Sun Pharmaceutical Industries Ltd. 10.18. Lupin Limited 10.19. Alnylam Pharmaceuticals, Inc. 10.20. Enanta Pharmaceuticals, Inc. 11. Key Findings 12. Industry Recommendations 13. Hepatitis C Market: Research Methodology 14. Terms and Glossary