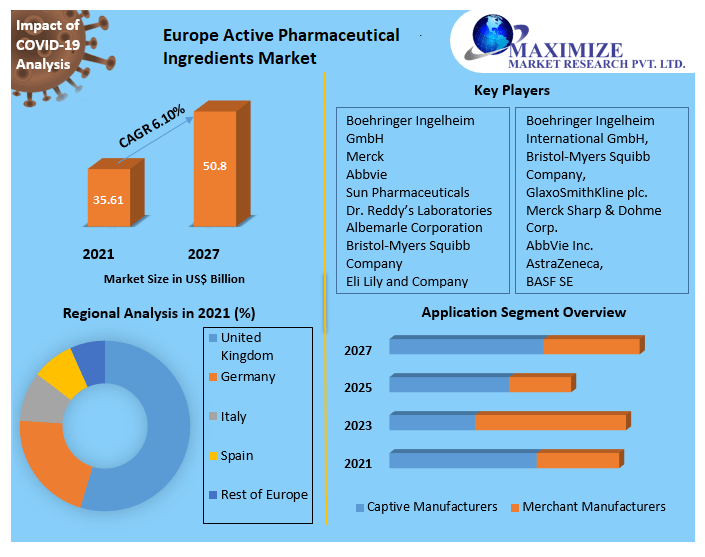

Europe Active Pharmaceutical Ingredients Market is expected to reach US$ 50.8 Bn. at a CAGR of 6.10% during the forecast period 2027. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology :- Request Free Sample Report

Europe Active Pharmaceutical Ingredients Market Dynamics:

The active pharmaceutical ingredient is a drug component, which is responsible for producing medicinal effects on patients. API or active pharmaceutical ingredient and excipient are two key components for drugs that are used by manufacturers. Combination therapies are used by certain drugs that include multiple active ingredients for the treatment of illness symptoms. API forms the central ingredient while the excipient is the substance that covers API and is used for delivering medication inside the human body system. Excipients are chemically inactive substances by composition and do not react with the API. Pharmaceutical companies that are into manufacturing drugs use certain pre-notified standards for determining the API strength of each drug. The standard may vary broadly from one brand to another as companies use different tests manufacturing drugs.Europe Active Pharmaceutical Ingredients Market Segment Analysis:

Europe's active pharmaceuticals market is segmented into drug type, manufacturer type, synthesis type, therapeutic area, and geography. Considering the synthesis type segment, the market for active pharmaceuticals is divided into biotech and synthetic. High R&D for novel biosimilar drugs and the shift in focus of traditional manufacturers towards biological drugs resulted in the biotech segment holding the largest segment. On the basis of drug type, the market has been divided into branded drugs, generic drugs, and over-the-counter (OTC) drugs. Higher spending on R&D activities together with the rise in drug prices have resulted in branded drugs holding the largest segment and has a huge scope of growth as well. By manufacturer type, the market diverges into merchant and captive manufacturers as merchant manufacturers have held one of the fastest-growing. A rise in outsourcing of drug molecule formulation by drug manufacturers is a major factor that has boosted the growth of the merchant manufacturer segment. In addition, drug manufacturers are choosing outsourcing options for eliminating the need of heavy investment in their manufacturing process. This has acted as another major factor to boost the high growth of merchant manufacturers in Europe. Europe is very strict about its medical facilities and rules. This has resulted in manufacturers becoming more stringent about the active pharmaceutical ingredients. The presence of some large pharmaceutical companies that manufacture drugs has resulted in market growth for active pharmaceutical ingredients in Europe. UK, Germany, and France are a few major countries that have resulted in higher demand for API and boosted the overall market growth.Research Methodology:

The market is estimated by triangulation of data points obtained from various sources and feeding them into a simulation model created individually for each market. The data points are obtained from paid and unpaid sources along with paid primary interviews with key opinion leaders (KOLs) in the market. KOLs from both, demand and supply sides were considered while conducting interviews to get an unbiased idea of the market. This exercise was done at a country level to get a fair idea of the market in countries considered for this study. Later this country-specific data was accumulated to come up with regional numbers and then arrive at a market value for European Active Pharmaceutical Ingredients market.Europe Active Pharmaceutical Ingredients Market, Key Highlights:

• Europe Active Pharmaceutical Ingredients Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Europe Active Pharmaceutical Ingredients Market • Europe Active Pharmaceutical Ingredients Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Europe Active Pharmaceutical Ingredients Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Europe Active Pharmaceutical Ingredients Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Europe Active Pharmaceutical Ingredients Market are also profiled.Europe Active Pharmaceutical Ingredients Market Scope: Inquire before buying

Europe Active Pharmaceutical Ingredients Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2027 Historical Data: 2017 to 2021 Market Size in 2021: US $ 35.61 Bn. Forecast Period 2022 to 2027 CAGR: 6.10% Market Size in 2027: US $ 50.8 Bn. Segments Covered: by Synthesis Type • Biotech • Monoclonal Antibodies • Recombinant Proteins • Vaccines • Synthetic by Drug Type • Branded Drugs • Generic Drugs • Over-the-counter (OTC) Drugs by Manufacturer Type • Captive Manufacturers • Merchant Manufacturers by Therapeutic Area • Cardiology • Pulmonology • Oncology • Neurology • Ophthalmology • Orthopedics • Others Active Pharmaceutical Ingredients Market by Region

• Europe • UK • Germany • Italy • France • Russia • Spain • OthersEurope Active Pharmaceutical Ingredients market Key Players

• Boehringer Ingelheim GmbH • Merck • Abbvie • Sun Pharmaceuticals • Dr. Reddy’s Laboratories • Albemarle Corporation • Bristol-Myers Squibb Company • Eli Lily and Company • Vinchem • Corden Pharma • Pfizer Inc., • Novartis AG, • anofi, • Boehringer Ingelheim International GmbH, • Bristol-Myers Squibb Company, • GlaxoSmithKline plc. • Merck Sharp & Dohme Corp. • AbbVie Inc. • AstraZeneca, • BASF SE • Aurobindo Pharma • LUPIN • Mylan N.V. • Sun Pharmaceutical Industries Ltd, • Piramal Pharma Solutions

1. EXECUTIVE SUMMARY 2. RESEARCH METHODOLOGY 2.1. Market Definition 2.2. Market Scope 2.3. Data Sources 3. MARKET VARIABLES & SCOPE 3.1. Market Segmentation & Scope 3.2. Market Driver Analysis 3.3. Market Restraint Analysis 3.4. Penetration &Growth Prospect Mapping 3.5. Market SWOT Analysis, By Factor (political & legal, economic and technological) 3.6. Porter’s Five Forces Industry Analysis 3.7. Market Value Chain Analysis 4. SYNTHESIS TYPE ESTIMATES & TREND ANALYSIS (2021-2027) 4.1. Active Pharmaceutical Ingredients Market: Synthesis Type Movement Analysis 4.2. Biotech 4.2.1. Biotech market, 2021-2027 (USD billion) 4.2.2. Monoclonal antibodies 4.2.2.1. Monoclonal antibodies market, 2021-2027 (USD billion) 4.2.3. Recombinant proteins 4.2.3.1. Recombinant proteins market, 2021-2027 (USD billion) 4.2.4. Vaccines 4.2.4.1. Vaccines market, 2021-2027 (USD billion) 4.3. Synthetic 4.3.1. Synthetic market, 2021-2027 (USD billion) 5. DRUG TYPE ESTIMATES & TREND ANALYSIS (2021-2027) 5.1. Active Pharmaceutical Ingredients Market: Drug Type Movement Analysis 5.2. Branded/Innovative Drugs 5.2.1. Branded/Innovative drugs market, 2021-2027 (USD billion) 5.3. Generic Drugs 5.3.1. Generic drugs market, 2021-2027 (USD billion) 5.4. Over-the-counter (OTC) Drugs 5.4.1. Over-the-counter market, 2021-2027 (USD billion) 6. MANUFACTURER TYPE ESTIMATES & TREND ANALYSIS (2021-2027) 6.1. Active Pharmaceutical Ingredients Market: Manufacturer Type Movement Analysis 6.2. Captive Manufacturers 6.2.1. Captive manufacturers market, 2021-2027 (USD billion) 6.3. Merchant Manufacturers 6.3.1. Merchant manufacturers market, 2021-2027 (USD billion) 7. THERAPEUTIC AREA ESTIMATES & TREND ANALYSIS (2021-2027) 7.1. Active Pharmaceutical Ingredients Market: Therapeutic Area Movement Analysis 7.2. Cardiology 7.2.1. Cardiology market, 2021-2027 (USD billion) 7.3. Pulmonology 7.3.1. Pulmonology market, 2021-2027 (USD billion) 7.4. Oncology 7.4.1. Oncology market, 2021-2027 (USD billion) 7.5. Neurology 7.5.1. Neurology market, 2021-2027 (USD billion) 7.6. Ophthalmology 7.6.1. Ophthalmology market, 2021-2027 (USD billion) 7.7. Orthopedics 7.7.1. Orthopedics market, 2021-2027 (USD billion) 7.8. Others 7.8.1. Others market, 2021-2027 (USD billion) 8. REGIONAL ESTIMATES & TREND ANALYSIS BY SYNTHESIS TYPE, DRUG TYPE, MANUFACTURER TYPE, AND THERAPEUTIC AREA (2021-2027) 8.1. Active Pharmaceutical Ingredients Market Share By Region, 2021-2027 8.2. Europe 8.2.1. Europe active pharmaceutical ingredients market, 2021-2027 (USD billion) 8.2.2. UK 8.2.2.1. UK Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.3. Germany 8.2.3.1. Germany Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.4. Russia 8.2.4.1. Russia Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.5. France 8.2.5.1. France Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.6. Spain 8.2.6.1. Spain Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.7. Italy 8.2.7.1. Italy Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 8.2.8. Others 8.2.8.1. Others Active Pharmaceutical Ingredients market, 2021-2027 (USD billion) 9. MARKET COMPETITION ANALYSIS 9.1. Strategy Framework 9.2. Company Profiles 9.2.1. Eli Lily and Company 9.2.1.1. Company Overview 9.2.1.2. Financial Performance 9.2.1.3. Product Benchmarking 9.2.1.4. Strategic Initiatives 9.2.2. Corden Pharma 9.2.2.1. Company Overview 9.2.2.2. Financial Performance 9.2.2.3. Product Benchmarking 9.2.2.4. Strategic Initiatives 9.2.3. Boehringer Ingelheim GmbH 9.2.3.1. Company Overview 9.2.3.2. Financial Performance 9.2.3.3. Product Benchmarking 9.2.3.4. Strategic Initiatives 9.2.4. Merck & Co., Inc. 9.2.4.1. Company Overview 9.2.4.2. Financial Performance 9.2.4.3. Product Benchmarking 9.2.4.4. Strategic Initiatives 9.2.5. Abbvie 9.2.5.1. Company Overview 9.2.5.2. Financial Performance 9.2.5.3. Product Benchmarking 9.2.5.4. Strategic Initiatives 9.2.6. Vinchem 9.2.6.1. Company Overview 9.2.6.2. Financial Performance 9.2.6.3. Product Benchmarking 9.2.6.4. Strategic Initiatives 9.2.7. Sun Pharmaceuticals 9.2.7.1. Company Overview 9.2.7.2. Financial Performance 9.2.7.3. Product Benchmarking 9.2.7.4. Strategic Initiatives 9.2.8. Albemarle Corporation 9.2.8.1. Company Overview 9.2.8.2. Financial Performance 9.2.8.3. Product Benchmarking 9.2.8.4. Strategic Initiatives 9.2.9. Dr. Reddy’s Laboratories 9.2.9.1. Company Overview 9.2.9.2. Financial Performance 9.2.9.3. Product Benchmarking 9.2.9.4. Strategic Initiatives 9.2.10. Bristol-Myers Squibb Company 9.2.10.1. Company Overview 9.2.10.2. Financial Performance 9.2.10.3. Product Benchmarking 9.2.10.4. Strategic Initiatives 9.2.11. Pfizer Inc., 9.2.12. Novartis AG, 9.2.13. anofi, 9.2.14. Boehringer Ingelheim International GmbH, 9.2.15. Bristol-Myers Squibb Company, 9.2.16. GlaxoSmithKline plc. 9.2.17. Merck Sharp & Dohme Corp. 9.2.18. AbbVie Inc. 9.2.19. AstraZeneca, 9.2.20. BASF SE 9.2.121.Aurobindo Pharma 9.2.22 LUPIN 9.2.23.Mylan N.V. 9.2.24.Sun Pharmaceutical Industries Ltd, 9.2.25.Piramal Pharma Solutions