The Greek Yogurt Market size was valued at USD 15.50 Billion in 2025 and the total Greek Yogurt revenue is expected to grow at a CAGR of 8.71% from 2025 to 2032, reaching nearly USD 27.82 Billion by 2032.Greek Yogurt Market Overview

Yogurt is defined as the “food produced by culturing one or more of the optional dairy ingredients [cream, milk, partially skimmed milk or skimmed milk] with a characterizing bacterial culture that contains the lactic acid-producing bacteria. Yogurts differ according to their chemical composition, method of production, flavor used, and the nature of post-incubation processing. There are substantial differences in the composition of Greek-style yogurts measured in products in different countries. Greek-style yogurt, also known as strained yogurt, concentrated yogurt, or thick yogurt, is a semi-solid fermented milk product derived from yogurt by draining away part of its whey. Greek Yogurt is a frozen dessert typically made from milk or cream that has been flavored with a sweetener, either sugar or an alternative and comes in flavors such as strawberry and vanilla, or with fruit, such as strawberries or peaches. The mixture is cooled below the freezing point of water and stirred to incorporate air spaces and prevent detectable ice crystals from forming. The demand for lactose-free and non-dairy Greek Yogurt has risen in its use due to the lactose-intolerant consumer base. The changing consumer base demand for more innovative flavors of yogurt has forced Greek Yogurt manufacturing companies to invest in technological advancement for new flavors. The use of technological development such as Data analytics is expected to provide valuable insights into consumer behavior, the market trends in the local regional market and increase the sales performance of the company in that region. The Greek Yogurt manufacturer can use data-driven knowledge to improve product development, change marketing strategy, and grow distribution channels.To know about the Research Methodology :- Request Free Sample Report

Greek Yogurt Market Dynamics

Consumer preference for healthy food items The changing consumer preference for better health options and food items is a major and crucial factor shaping and demanding the Greek Yogurt market. With the increasing population, the awareness of health benefits and the conscious consumer base are driving the market growth. The demand for protein-rich foods which is the vital nutrient for our body, is increased and the need for more protein-rich Greek yogurt is increased. Healthier Greek Yogurt considering consumer preference refers to low-sugar and low-fat yogurt which can be used in breakfast, lunch, or as snacks. Rapid urbanization being a global trend is the leading factor for the use of the Western diet, as the Western population is more likely to consume Greek yogurt. Other factors such as growing middle-class consumers with health-conscious and rising disposable income are driving the market growth. Potential Health Concern related to the consumption of Greek Yogurt The rising health consciousness among consumers for the consumption of Greek Yogurt which is manufactured by the use of pasteurized milk is a key restraining factor for the Greek Yogurt market growth. Greek Yogurt is a source of protein and calcium but the use of pasteurized milk and homogenized milk is increasing the health concern among consumers of Greek yogurt. The rise in the price of milk also affects the price of Greek yogurt which directly raises the price of yogurt. The rising price of raw materials for Greek Yogurt production is potentially affecting consumer affordability. Regulatory rules for proper labeling and restrictions on the use of particular ingredients can hamper the growth of the Greek yogurt market. Emerging trends in the Greek Yogurt market Emerging trends such as lactose-free Greek Yogurt is one of the major opportunity for the Greek Yogurt market in the upcoming years. The increasing demand for an alternative to dairy-based Greek Yogurt due to the lactose-intolerant consumer base in countries is a major opportunity in the Greek Yogurt market. Non-dairy Greek yogurt is also gaining popularity in the European region due to the increasing health consciousness among the people. The increasing fitness industry demands protein-rich food products which can help companies to target specific consumer audience groups. Technological development in Greek Yogurt production for developing a wider range of flavors with increased and improved texture is been raising the growth opportunity in the market. Need for Product Innovation in the Greek Yogurt Market The increased competition in the market through the establishment of new local companies has been a key challenge for the growth of the market. The expansion of key companies in emerging markets for their sales of products is a major challenge as the consumer base does not fully trust the new products. This competition has led to rising price wars, and reduced profits by the products. The need for product innovation is new and the existing market is a must to attract a new consumer base. The established brands need to keep focus on the launching of new flavors with a high investment in research and development. Government regulations for the strict labeling of content and ingredient usage or the change in food safety regulations can be a challenge for the Greek yogurt market.Greek Yogurt Market Segment Analysis

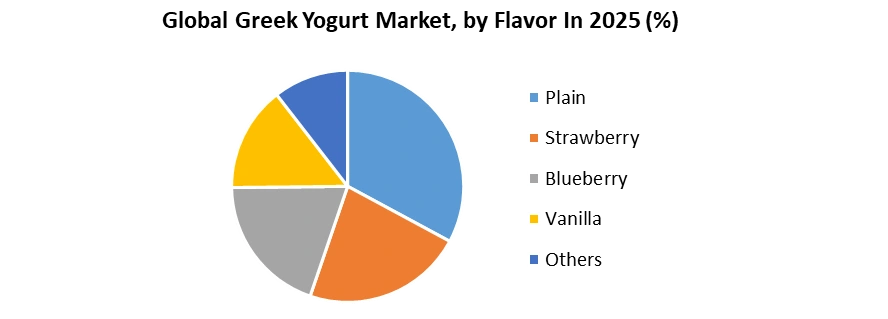

Based on Product, the whole milk segment for the Greek yogurt market was the largest in the year 2025. Whole milk Greek yogurt is the old and traditional type of yogurt. Made from whole milk, this whole milk yogurt is higher in fat content and provides a rich flavor. Whole milk is also recognized as a valuable and good source of calcium and protein with essential minerals and vitamins for our bodies. Consumers increasingly favor and prefer high-protein food sources and Greek yogurt with whole milk is considered to be the best source of protein. The Greek yogurt manufacturing companies are developing new flavors in whole milk Greek yogurt products to spread across a wide range of consumers.The other types of Greek yogurt are low-fat and non-fat yogurt. Low-fat Greek yogurt is the second most consumed type of yogurt and the demand is rising for the health benefits of more low-fat healthy options in food products. A growing consumer base with healthier preferences in food products demands reduced-fat options, low-fat options Greek yogurt options to lose weight. The yogurt manufacturers are increasing in the technological advancement for making low-fat Greek yogurt with added new flavors. Non-fat Greek yogurt is rising in demand which is made of fat-free milk, which gives the product the lowest fat content. These are a very good and rich source of protein and are mostly preferred by professional bodybuilders in the fitness industry, these products are good choices for controlling weight. Based on Flavor, strawberry flavor is the most demanded and used flavor segment in the Greek yogurt market. The Greek yogurt in the strawberry flavor comes with natural ingredients and real pieces of fruit. The rising health-conscious consumer base is aware of the nutrition provided by fruit, demands, and consumes more real fruit-based yogurt. The strawberry Greek yogurt flavors also come in a variety of products such as plain strawberry, sweetened strawberry, strawberry swirl, and strawberry with granola. Greek yogurt manufacturers are focusing on the innovation and development of new strawberry-based Greek yogurt with high protein content. The other flavors such as blueberry and vanilla are rising in use due to the difference and variations in the taste of yogurt. Blueberry being a little bit sour and tangy in taste comes in different levels of sweetness. Vanilla is a classic flavor and vanilla Greek yogurt is rich in flavor and creamy in texture. This vanilla yogurt is used with fruit, nuts, and granola. The strong appeal by consumers for healthy and protein-rich foods is growing the demand for the Greek yogurt market.

Greek Yogurt Market Regional Analysis

North American region has a large consumer base for the Greek Yogurt market and is driven by the rising awareness for health consciousness. The consumers of Greek yogurt are aware of the health benefits that it contains good nutritious content. Yogurt likely arrived in the United States in small, undocumented batches carried by immigrants in the nineteenth century. It made an appearance as a niche health food in the early twentieth century and as a sweet, processed snack around mid-century. Greek Yogurt also comes in many forms, such as traditional, whipped, drinkable, and fruit on the bottom. The demand for Greek yogurt is rising in the fitness industry as Greek yogurt, which has more protein than traditional yogurt, has fueled the growth of the yogurt market. Yogurt consumption in the United States has risen and behind is the other countries such as Canada and Europe. Interest in healthier eating is encouraging many consumers to reduce their sugar intake. This may encourage more protein, fiber, and probiotic-enhanced yogurt products to enter the market. The European region witnessed significant growth in the Greek yogurt market due to the rise in health awareness in the population. The increasing consumer base of Greek yogurt with the awareness of the health benefits that it contains good nutritious content. The rising popularity of vegan trends in Europe is expected to drive the demand and need for non-dairy yogurt products, providing the various health benefits associated with yogurt consumption, such as enhanced digestion, good and improved immunity, and reduced risk of chronic diseases like obesity and cardiovascular heart disease. The addition of Greek yogurt in the post-meal is also one of the factors for the growth of the market. Recognizing this trend, brands like Activia and Actimel in the region are actively addressing the growing interest in probiotic-rich yogurt with unique flavors. In consideration of health concerns, the United Kingdom government's Department of Health and Social Care has implemented regulations stating that yogurt should not be placed alongside high-sugar and high-salt content products on shelves in stores and retail outlets. Competitive Landscape The Greek Yogurt market is fragmented with numerous small and medium-sized players operating in different countries. These players are constantly introducing new flavors, packaging formats, and healthier options to boost sales, which have been declining in developed regions like North America and Western Europe. Nowadays, consumers are increasingly drawn towards the healthier options of food products made with natural ingredients, low calories, and health claims, prompting manufacturers to focus on developing products with these attributes. Nestle the leading company in the production of Greek Yogurt has made various technological advancements in the products. Their products are added with fruit pieces with more thick and creamy texture. Their Greek yogurt is included with PROBIOTICS which are good bacteria, unlike any other bacteria that can survive digestive juices better, reach your intestine, and help improve digestion. General Mills has launched two new products in their list named OUI and YQ, which are a type of French yogurt rich in taste and texture, and has promised new product development in the upcoming years.Greek Yogurt Market Scope : Inquire Before Buying

Global Greek Yogurt Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 15.50 Bn. Forecast Period 2026 to 2032 CAGR: 8.71% Market Size in 2032: USD 27.82 Bn. Segments Covered: by Product Whole milk Low fat Non-fat by Flavor Plain Strawberry Blueberry Vanilla Others by Distribution Channel Supermarkets Convenience stores Online stores Others Greek Yogurt Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Greek Yogurt Market, Key Players are

1. Chobani Holdings LLC 2. Danone 3. Unilever 4. Fage International S.A 5. Nestle S.A 6. General Mills, Inc. 7. Parmalat S.p.A 8. Muller UK & Ireland Group 9. The Kroger Co. 10. Wallaby Yogurt Company 11. The Hain Celestial Group 12. Stonyfield 13. NESTLE S.A. 14. THE KROGER CO. 15. The Hain Celestial Group 16. Chr. Hansen Holding A/S 17. Yakult Honsha Co., Ltd 18. Lallemand Inc. 19. Lonza 20. Winclove Probiotics 21. Probi FAQs: 1. What are the growth drivers for the Greek Yogurt market? Ans. Increasing Health Awareness, Shifting Consumer Preferences, etc. are expected to be the major drivers for the Greek Yogurt market. 2. What is the major restraint for the Greek Yogurt market growth? Ans. Strong Competition and potential health concern for the lactose-intolerant consumer base is expected to be the major restraining factor for the Greek Yogurt market growth. 3. Which region is expected to lead the global Greek Yogurt market during the forecast period? Ans. North America is expected to lead the global Greek Yogurt market during the forecast period. 4. What is the projected market size & and growth rate of the Greek Yogurt Market? Ans. The Greek Yogurt Market size was valued at USD 15.50 Billion in 2025 and the total Greek Yogurt revenue is expected to grow at a CAGR of 8.71% from 2025 to 2032, reaching nearly USD 27.82 Billion by 2032. 5. What segments are covered in the Greek Yogurt Market report? Ans. The segments covered in the Greek Yogurt market report are Product, Flavors, Distribution Channel, and Region.

1. Greek Yogurt Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Greek Yogurt Market: Dynamics 2.1. Preference Analysis 2.2. Greek Yogurt Market Trends by Region 2.2.1. North America Greek Yogurt Market Trends 2.2.2. Europe Greek Yogurt Market Trends 2.2.3. Asia Pacific Greek Yogurt Market Trends 2.2.4. Middle East and Africa Greek Yogurt Market Trends 2.2.5. South America Greek Yogurt Market Trends 2.3. Greek Yogurt Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Greek Yogurt Market Drivers 2.3.1.2. North America Greek Yogurt Market Restraints 2.3.1.3. North America Greek Yogurt Market Opportunities 2.3.1.4. North America Greek Yogurt Market Challenges 2.3.2. Europe 2.3.2.1. Europe Greek Yogurt Market Drivers 2.3.2.2. Europe Greek Yogurt Market Restraints 2.3.2.3. Europe Greek Yogurt Market Opportunities 2.3.2.4. Europe Greek Yogurt Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Greek Yogurt Market Drivers 2.3.3.2. Asia Pacific Greek Yogurt Market Restraints 2.3.3.3. Asia Pacific Greek Yogurt Market Opportunities 2.3.3.4. Asia Pacific Greek Yogurt Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Greek Yogurt Market Drivers 2.3.4.2. Middle East and Africa Greek Yogurt Market Restraints 2.3.4.3. Middle East and Africa Greek Yogurt Market Opportunities 2.3.4.4. Middle East and Africa Greek Yogurt Market Challenges 2.3.5. South America 2.3.5.1. South America Greek Yogurt Market Drivers 2.3.5.2. South America Greek Yogurt Market Restraints 2.3.5.3. South America Greek Yogurt Market Opportunities 2.3.5.4. South America Greek Yogurt Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Greek Yogurt Industry 2.8. Analysis of Government Schemes and Initiatives For the Greek Yogurt Industry 2.9. The Global Pandemic's Impact on Greek Yogurt Market 2.10. Greek Yogurt Price Trend Analysis (2025-2032) 2.11. Global Greek Yogurt Market Trade Analysis (2025-2032) 3. Greek Yogurt Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2025-2032) 3.1. Greek Yogurt Market Size and Forecast, by Product (2025-2032) 3.1.1. Whole milk 3.1.2. Low fat 3.1.3. Non-fat 3.2. Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 3.2.1. Plain 3.2.2. Strawberry 3.2.3. Blueberry 3.2.4. Vanilla 3.2.5. Others 3.3. Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 3.3.1. Supermarket 3.3.2. Convenience stores 3.3.3. Online stores 3.3.4. Others 3.4. Greek Yogurt Market Size and Forecast, by Region (2025-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Greek Yogurt Market Size and Forecast by Segmentation (by Value) (2025-2032) 4.1. North America Greek Yogurt Market Size and Forecast, by Product (2025-2032) 4.1.1. Whole milk 4.1.2. Low fat 4.1.3. Non-fat 4.2. North America Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 4.2.1. Plain 4.2.2. Strawberry 4.2.3. Blueberry 4.2.4. Vanilla 4.2.5. Others 4.3. North America Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 4.3.1. Supermarket 4.3.2. Convenience stores 4.3.3. Online stores 4.3.4. Others 4.4. North America Greek Yogurt Market Size and Forecast, by Country (2025-2032) 4.4.1. United States 4.4.1.1. United States Greek Yogurt Market Size and Forecast, by Product (2025-2032) 4.4.1.1.1. Whole milk 4.4.1.1.2. Low fat 4.4.1.1.3. Non-fat 4.4.1.2. United States Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 4.4.1.2.1. Plain 4.4.1.2.2. Strawberry 4.4.1.2.3. Blueberry 4.4.1.2.4. Vanilla 4.4.1.2.5. Others 4.4.1.3. United States Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.1.3.1. Supermarket 4.4.1.3.2. Convenience stores 4.4.1.3.3. Online stores 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Greek Yogurt Market Size and Forecast, by Product (2025-2032) 4.4.2.1.1. Whole milk 4.4.2.1.2. Low fat 4.4.2.1.3. Non-fat 4.4.2.2. Canada Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 4.4.2.2.1. Plain 4.4.2.2.2. Strawberry 4.4.2.2.3. Blueberry 4.4.2.2.4. Vanilla 4.4.2.2.5. Others 4.4.2.3. Canada Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.2.3.1. Supermarket 4.4.2.3.2. Convenience stores 4.4.2.3.3. Online stores 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Greek Yogurt Market Size and Forecast, by Product (2025-2032) 4.4.3.1.1. Whole milk 4.4.3.1.2. Low fat 4.4.3.1.3. Non-fat 4.4.3.2. Mexico Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 4.4.3.2.1. Plain 4.4.3.2.2. Strawberry 4.4.3.2.3. Blueberry 4.4.3.2.4. Vanilla 4.4.3.2.5. Others 4.4.3.3. Mexico Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.3.3.1. Supermarket 4.4.3.3.2. Convenience stores 4.4.3.3.3. Online stores 4.4.3.3.4. Others 5. Europe Greek Yogurt Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 5.1. Europe Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.2. Europe Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.3. Europe Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4. Europe Greek Yogurt Market Size and Forecast, by Country (2025-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.1.2. United Kingdom Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.1.3. United Kingdom Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.2. France 5.4.2.1. France Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.2.2. France Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.2.3. France Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.3. Germany 5.4.3.1. Germany Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.3.2. Germany Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.3.3. Germany Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.4. Italy 5.4.4.1. Italy Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.4.2. Italy Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.4.3. Italy Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.5. Spain 5.4.5.1. Spain Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.5.2. Spain Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.5.3. Spain Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.6. Sweden 5.4.6.1. Sweden Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.6.2. Sweden Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.6.3. Sweden Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.7. Austria 5.4.7.1. Austria Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.7.2. Austria Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.7.3. Austria Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Greek Yogurt Market Size and Forecast, by Product (2025-2032) 5.4.8.2. Rest of Europe Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 5.4.8.3. Rest of Europe Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6. Asia Pacific Greek Yogurt Market Size and Forecast by Segmentation (by Value) (2025-2032) 6.1. Asia Pacific Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.2. Asia Pacific Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.3. Asia Pacific Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4. Asia Pacific Greek Yogurt Market Size and Forecast, by Country (2025-2032) 6.4.1. China 6.4.1.1. China Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.1.2. China Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.1.3. China Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.2. S Korea 6.4.2.1. S Korea Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.2.2. S Korea Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.2.3. S Korea Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.3. Japan 6.4.3.1. Japan Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.3.2. Japan Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.3.3. Japan Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.4. India 6.4.4.1. India Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.4.2. India Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.4.3. India Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.5. Australia 6.4.5.1. Australia Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.5.2. Australia Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.5.3. Australia Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.6.2. Indonesia Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.6.3. Indonesia Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.7.2. Malaysia Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.7.3. Malaysia Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.8.2. Vietnam Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.8.3. Vietnam Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.9.2. Taiwan Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.9.3. Taiwan Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Greek Yogurt Market Size and Forecast, by Product (2025-2032) 6.4.10.2. Rest of Asia Pacific Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 6.4.10.3. Rest of Asia Pacific Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 7. Middle East and Africa Greek Yogurt Market Size and Forecast by Segmentation (by Value) (2025-2032 7.1. Middle East and Africa Greek Yogurt Market Size and Forecast, by Product (2025-2032) 7.2. Middle East and Africa Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 7.3. Middle East and Africa Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4. Middle East and Africa Greek Yogurt Market Size and Forecast, by Country (2025-2032) 7.4.1. South Africa 7.4.1.1. South Africa Greek Yogurt Market Size and Forecast, by Product (2025-2032) 7.4.1.2. South Africa Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 7.4.1.3. South Africa Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.2. GCC 7.4.2.1. GCC Greek Yogurt Market Size and Forecast, by Product (2025-2032) 7.4.2.2. GCC Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 7.4.2.3. GCC Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Greek Yogurt Market Size and Forecast, by Product (2025-2032) 7.4.3.2. Nigeria Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 7.4.3.3. Nigeria Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Greek Yogurt Market Size and Forecast, by Product (2025-2032) 7.4.4.2. Rest of ME&A Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 7.4.4.3. Rest of ME&A Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 8. South America Greek Yogurt Market Size and Forecast by Segmentation (by Value) (2025-2032) 8.1. South America Greek Yogurt Market Size and Forecast, by Product (2025-2032) 8.2. South America Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 8.3. South America Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4. South America Greek Yogurt Market Size and Forecast, by Country (2025-2032) 8.4.1. Brazil 8.4.1.1. Brazil Greek Yogurt Market Size and Forecast, by Product (2025-2032) 8.4.1.2. Brazil Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 8.4.1.3. Brazil Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.2. Argentina 8.4.2.1. Argentina Greek Yogurt Market Size and Forecast, by Product (2025-2032) 8.4.2.2. Argentina Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 8.4.2.3. Argentina Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Greek Yogurt Market Size and Forecast, by Product (2025-2032) 8.4.3.2. Rest Of South America Greek Yogurt Market Size and Forecast, by Flavors (2025-2032) 8.4.3.3. Rest Of South America Greek Yogurt Market Size and Forecast, by Distribution Channel (2025-2032) 9. Global Greek Yogurt Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Structure 9.4.1. Market Leaders 9.4.2. Market Followers 9.4.3. Emerging Players 9.5. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nestle S.A 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Chobani Holdings LLC 10.3. Danone 10.4. Fage International S.A 10.5. General Mills, Inc. 10.6. Parmalat S.p.A 10.7. Muller UK & Ireland Group 10.8. The Kroger Co. 10.9. Wallaby Yogurt Company 10.10. The Hain Celestial Group 10.11. Stonyfield 10.12. NESTLE S.A. 10.13. THE KROGER CO. 10.14. The Hain Celestial Group 10.15. Chr. Hansen Holding A/S 10.16. Yakult Honsha Co., Ltd 10.17. Lallemand Inc. 10.18. Lonza 10.19. Winclove Probiotics 10.20. Probi 11. Key Findings 12. Industry Recommendations 13. Greek Yogurt Market: Research Methodology